Buying

| Newer Posts | Older Posts |

Will A 6% Mortgage Interest Rate Seem High After A Year Of 6% Rates? |

|

Many (though not all) home buyers in the market today have been shopping for homes for the past three, six or 12 months. As such, when they encounter today's mortgage interest rate of around 6.25% they find it to be high. Quite high! After all, six months ago, the average 30 year fixed rate mortgage interest rate was 4.25%... and a year ago, the average rate was a touch below 3%. So, of course, a 6.25% mortgage rate seems high compared to 4.25% or 3%. But... fast forward a year... if mortgage interest rates have remained around 6% for a full year, will they then stop seeming and feeling high? Clearly, a 6.25% mortgage interest rate a year from now will still result in the same mortgage payment as a 6.25% mortgage interest rate does today... but perhaps that payment (and that interest rate) will no longer be viewed in the context of what could have recently been... at 4.25% or 3%. Of course, I'm hoping mortgage interest rates don't really stay this high (around 6%) for a full year, but if they do, maybe they won't seem quite as high to home buyers a year from now. | |

I Was Going To Upgrade To A Larger Home Until I Saw That Larger Mortgage Payment!?! |

|

In more than a few conversations over the past week I have been chatting with friends and past clients who have shared that they had been recently toying with the idea of upgrading to a larger home. In each of these instances, they bought their home three to eight years ago and are now finding it to be a bit tight in various areas. A new kid (or two) stretching the bedroom usage... working from home part of the time with limited space in which to do so... older kids with friends coming over to hang out and wanting room to lounge, etc., etc. These various "life is changing and house needs are changing" situations prompted each of these homeowners to think about whether they ought to upgrade to a larger home. But... then they started running the numbers. At first, things look good... They bought their current home for $300K, have a mortgage payment of around $1600/month, they still owe $250K and could sell for $415K. Thus, they could walk away with about $140K after settlement. But then, things turn a bit... The larger home would cost them around $540K. They'd put $140K down, so they'd be financing about $400K. At current mortgage rates of around 6%, their monthly payment would be... $2900/month. As you can see from this rough math for this one homeowner's situation, even though their $300K home is now worth $415K, and even though they would be walking away with $140K after selling, and even though they'd only be upgrading from a $415K home to a $540K home... their mortgage payment would be jumping up from $1600/month to $2900/month. The big change here is, of course, the mortgage interest rate. Paying off that 3.25% mortgage and taking out a new 6% mortgage is going to cost ya! What does this mean for homeowners and our local market? I suspect there will be fewer elective home upgrades over the next few years if interest rates remain this high... which has the potential to further limit resale inventory of homes for sale. This story is not everyone's story... so if you're considering an upgrade (or a downgrade) let me know if you'd like to do some rough math together to evaluate the overall financial impact of making the change. | |

The Value Of The Smallest House In The Neighborhood |

|

How much should you be willing to pay for the smallest house in a neighborhood? Especially if it is a good bit smaller than all the other houses in the neighborhood? Let's imagine a neighborhood in Harrisonburg or Rockingham County where homes typically sell for $450K - $500K, with an occasional sale above $500K. All of these homes, however, are 3000 SF homes. There might be a 2800 SF homes that sells from time to time, but almost all are at, above, or well above 3000 SF. So -- when a 2300 SF home comes on the market in the neighborhood, how much should you be willing to pay? A seller might say $440K. After all, you have to pay $450K+ to buy any house in this amazing neighborhood, so even if my house is smaller than most, you'll need to pay pretty close to that floor of $450K. A buyer might say $400K. After all, the 2300 SF home is markedly smaller than just about every other home in the neighborhood, so the sales price should be quite a bit lower as well. If a 3000 SF home sells for $450K, I don't want to pay more than $400K for a 2300 SF home. I might say $420K. I think there is merit in both of the perspectives above, and a blending of those two concepts gets us close to what a buyer should be willing to pay. Keep in mind -- it is also possible that a buyer will come along who just LOVES the neighborhood and doesn't need much space at all. This buyer might just be willing to pay closer to that $440K - $450K price, especially if they are a cash buyer, or moving from a more expensive market, etc. | |

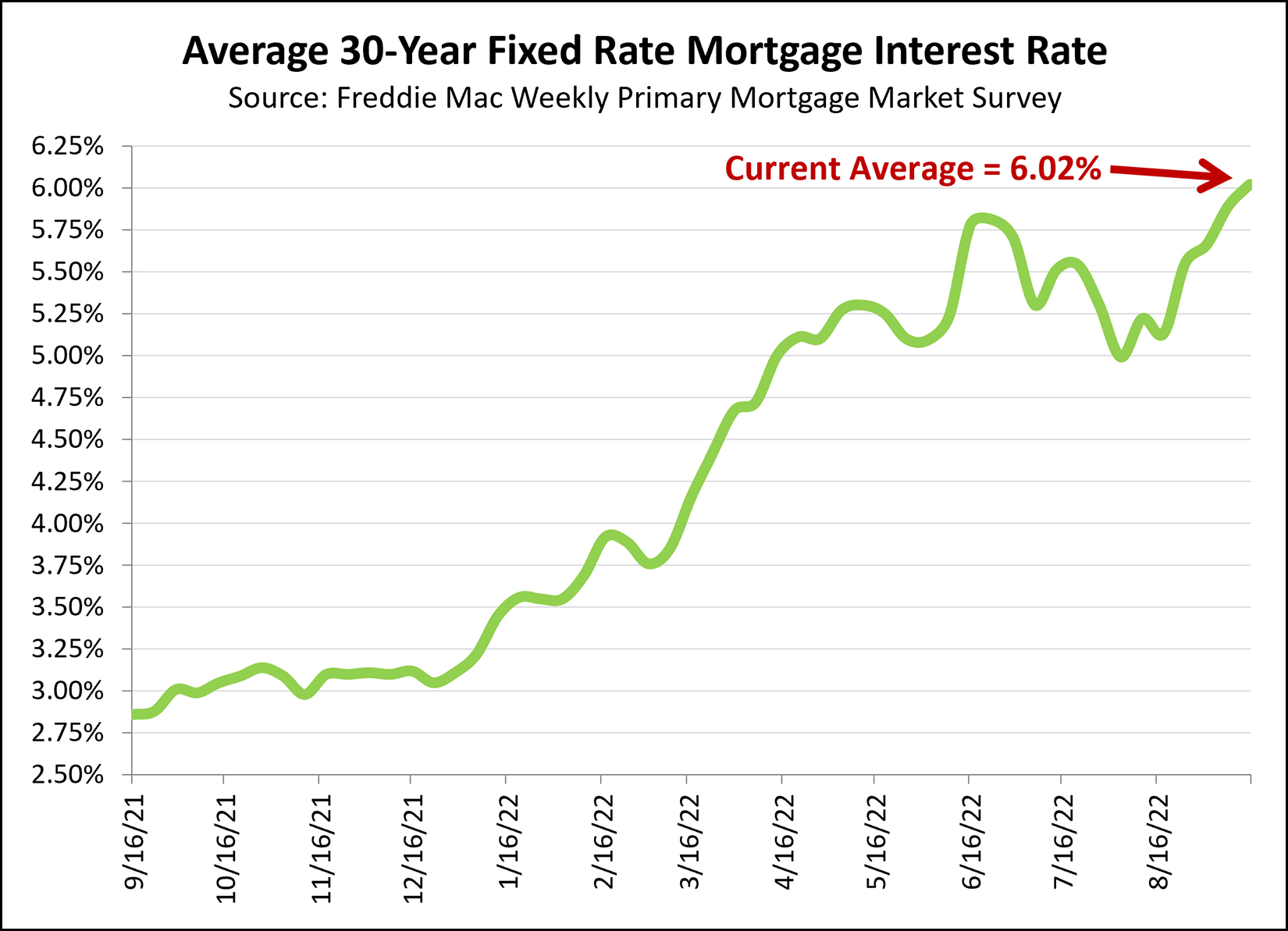

Mortgage Interest Rates Double Within A Single Year |

|

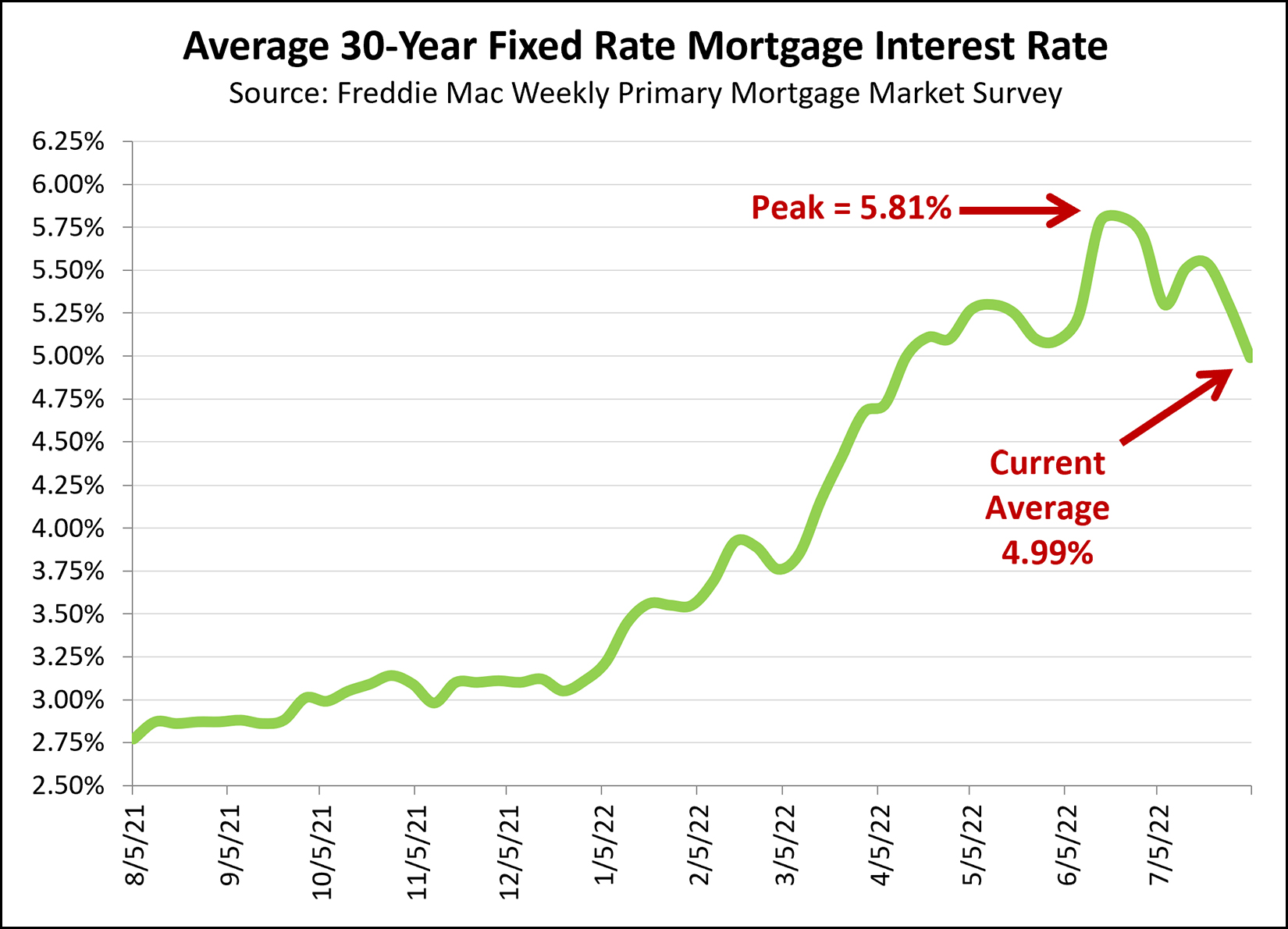

Well, then. A year ago, the average 30 year fixed rate mortgage interest rate was under 3%. Today, the average 30 year fixed rate mortgage interest rate is 6.02%. Yikes. Clearly, this affects mortgage payments rather significantly. Now, to create at least a bit of context... [1] Nobody really thought 3% mortgage interest rates were normal or sustainable. They were great, of course, for home buyers... but I don't think anyone really thought they'd stick around for as long as they did. [2] In some ways a buyer's monthly housing costs were held abnormally low by those abnormally low mortgage interest rates. So, while monthly housing costs have increased significantly over the past year given this shift in interest rates... it wasn't really from "normal" to "high" - it was more of from "low" speedily through "normal" and then to "high" today. [3] The last time this average 30 year fixed rate mortgage rate was above six percent was back in 2008. It's been a bit. Will mortgage interest rates continue to rise? Will they hover around six percent? Will they drop back into the five point something range? Stay tuned to find out. In the meantime, some home buyers today are opting for an adjustable rate mortgage instead of a fixed rate mortgage. The average rate for a 5/1 ARM is currently 4.93%. This type of mortgage product will keep that 4.93% rate for five years and then can adjust once per year thereafter. | |

Which Comes First? Buying Your Next Home Or Selling Your Current Home? |

|

If you are getting ready to sell your home AND buy a home, it can sometimes be difficult to determine where to start... Do you start by finding a house you want to purchase? Or do you start by listing your home for sale? I would suggest that you start with whichever you anticipate will be the most difficult part of the two step process. If it will be difficult to sell your home (because of price, location, layout, features, age, etc.) and it will be at least slight easier to buy the next one (plenty of viable options are listed for sale) then you are likely best off starting with listing your home for sale. Work to get the more difficult half of the transition underway by getting your current home under contract, and then work on the easier side of the transition. If it will be more difficult to buy the next house (because of the specificity of your housing goals, or because of low inventory levels, etc.) and it will be at least slightly easier to sell your current home (because the property type, location or price are in high demand) then you are likely best off focusing first on finding the home to buy -- and then listing your home for sale. There are plenty of nuances we can discuss further to formulate a plan for attempting to simultaneously sell and buy -- but as a general rule of thumb, you'll be best off to start with the harder half of the transaction. | |

If You Are Hoping To Negotiate On Price, An Offer On Day One Might Not Make Sense |

|

Ooooh... an exciting new listing just hit the market! It's in the neighborhood where you hope to live, has just the right amount of space, has the garage you've been hoping for, and... oh wait... ugh... the price is a bit higher than you had hoped. This imaginary (but very exciting) new listing is priced at $425,000. You had been hoping to spend no more than $400,000. So, what to do... If you go see the house, and love it even more in person, do you make an offer of $400K on Day 1? Probably not. A home seller is not likely to accept your offer of $400K on Day 1. They will likely wait for other showing to happen, hoping to have another offer to consider... AND... they will let all other buyers who view the home know that they have an offer... and they won't need to clarify that it's only an offer of $400K. So... if you are hoping to negotiate on price, it probably does not make sense to make an offer on that first day... unless you were really willing to pay the full list price if needed. If you wait a few days, or a week, to make an offer... someone else might make an offer, which could then give you the option to make an offer as well... or if nobody else makes an offer, perhaps you will then be able to negotiate on price. | |

As Time On The Market Increases, Contingencies In Offers Often Increase |

|

Day 1 - If a buyer is interested enough to make on Day 1, and potentially be competing against other highly motivated buyers, there is a good chance they will waive some or many or all contingencies. They might not be proposing a home inspection, a radon test, or an appraisal contingency. Day 7 - If a listing is still available on Day 7, a buyer will likely tentatively feel comfortable proposing some contingencies (home inspection, radon test, appraisal, etc.) but perhaps not all of the above. Day 30 - If a listing is still available on Day 30, a buyer will likely feel comfortable proposing any and all contingencies, including a home inspection, radon test and an appraisal. Home Buyers -- Do you want to wait to make an offer to potentially be in a position to include contingencies that you'd prefer to have as a part of your purchase contract? Even knowing that waiting to make the offer might mean someone else buys the house before you make an offer? | |

Most Conditions Are More Favorable For Buyers Now Than A Year Ago, Though Not Mortgage Interest Rates |

|

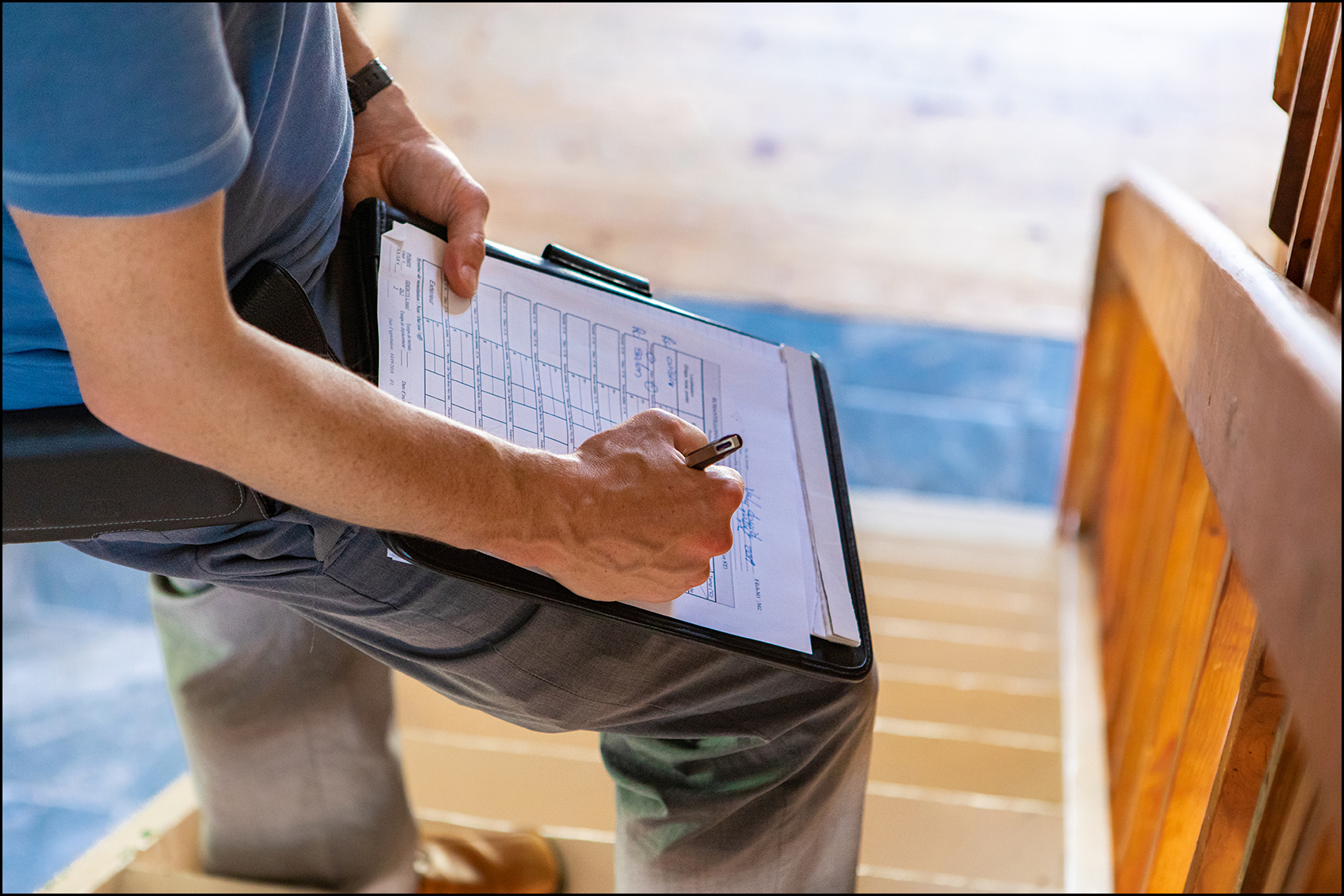

If we ignore mortgage interest rates for a moment (how can we!?) I believe it is accurate to say that home buyers are finding conditions to be more favorable now than a year ago. Here are the main factors making the local real estate market at least a bit more favorable for buyers now compared to a year ago... INVENTORY IS UP - We aren't seeing a massive increase in the number of homes available for sale at any given time, but we are seeing a slow rise in the number of active listings, which gives a buyer slightly more choices at any given time. TIME ON MARKET INCREASING A SMIDGE - It's often hard to back this up with data, but it seems that some new listings are sticking around on the market for a few more days (or even a week - gasp) longer than a year ago. This gives buyers a touch more time to consider whether or not to make an offer. FEWER MULTIPLE OFFER SCENARIOS - Some houses are still seeing multiple offers within the first day or two of being on the market, but quite a few are only seeing one offer. This allows a buyer to think more rationally about the price they are willing to pay, and goes a long way towards curtailing the flurry of escalation clauses causing prices to increase ever higher. INSPECTION CONTINGENCIES ARE OK AGAIN - Some buyers are reintroducing this novel concept of a... home inspection!? What a wonderful world where buyers can spend more than 45 minutes in a house to learn about the house, and even with a trained professional that can give them a much fuller view of the house characteristics and potential deficiencies! APPRAISAL CONTINGENCIES MIGHT MAKE A COMEBACK - We're starting to see appraisal contingencies again on some offers, and why not!? If you're not competing with another offer, why not include an appraisal contingency. It only seems reasonable. So... even if buyers today are finding themselves in what is certainly still a seller's market, the buying environment is indeed marginally better in multiple categories today as compared to a year ago. The two downsides, though, are that mortgage interest rates are MUCH higher now than a year ago, and the price you will pay for any particular house is likely a good bit higher now than a year ago. | |

Are Home Buyers Walking Away From Contracts In Harrisonburg? |

|

You may have read in recent news headlines that home buyers are cancelling their contracts to buy homes left and right. Here is one such news story... Homebuyers are backing out of more deals as high mortgage rates persist and recession fears linger (CNBC) This would cause plenty of people in our local area whether this is also happening locally. Are home buyers walking away from contracts in Harrisonburg? I'm going to say, anecdotally, a strong NO. That phenomenon does not seem to be happening in any significant way in the Harrisonburg and Rockingham County real estate market. Buyers generally seem to know what their mortgage interest rate is going to be before they make an offer (via a conversation with their lender) and are then locking in their interest rate once they are under contract. So, should sellers now wonder if their buyer will really make it to closing or if they might decide to back out of the deal? That does not seem to be a concern a buyer needs to have any more than at other times in the past 10+ years... at least in Harrisonburg and Rockingham County. | |

Plenty Of Properties Likely Sold Above Appraised Value Over The Past Few Years But Fewer Are Likely To Do So Moving Forward |

|

Home buyer attitude towards appraisals has certainly shifted over the past few years! PRE-COVID... Most buyers would include appraisal contingencies in their offers to reserve the right to have a conversation with the seller about the sales price if the appraised value ended up being lower than the contract price. Most sellers were comfortable with these appraisal contingencies and found them to be reasonable. EARLY COVID... Some buyers started to leave appraisal contingencies out of their offers to compete in multiple offer scenarios. These offers were no longer contingent on the property appraising at or above the contract price. IN THE THICK OF COVID... The market just kept heating up over the past few years, during Covid, and eventually, home buyers almost always found themselves competing with multiple (or many, or multitudes) of other offers. Home buyers started adding in specific language to their offers agreeing to proceed with the purchase so long as the appraised value wasn't any lower than $____ below the sales price, or agreeing to proceed with the purchase regardless of the appraised value. These offers would significantly reduce (or eliminate) the possibility of an appraisal disrupting the home sale. Home buyers were willing to go this route to try to compete to secure a contract on a house... and home sellers were delighted! NOW... Some new listings are still having 5+ offers within a few days, but plenty are only having one or two offers. With fewer competing offers, and with a feeling that the market might be slowing a bit, more home buyers are revisiting the topic of whether to include an appraisal contingency. Some buyers are now including appraisal contingencies in their offers once again. Buyers should likely decide whether to include an appraisal contingency based on whether they are competing with other offers, and based on how much they like a particular property. Some sellers find the return of the appraisal contingency to be quite reasonable. Some sellers think it is a terrible thing, and are insistent that they should be able to sell their home for more than an appraised value. Sellers should likely decide whether to accept an appraisal contingency based on how much interest exists in their home, how many offers they have, how long it has been on the market, etc. A shift in the way that home buyers and sellers see appraisal contingencies is normal as we start to see some early signs that the local housing market might be slowing down from a sprint to a fast run. As with all things housing market related right now, the dynamics described above to not equally apply to all property types, price ranges and locations. :-) | |

If High Mortgage Interest Rates Having You Looking At Renting Instead Of Buying, Unfortunately You Will Also Find High Rental Rates!?! |

|

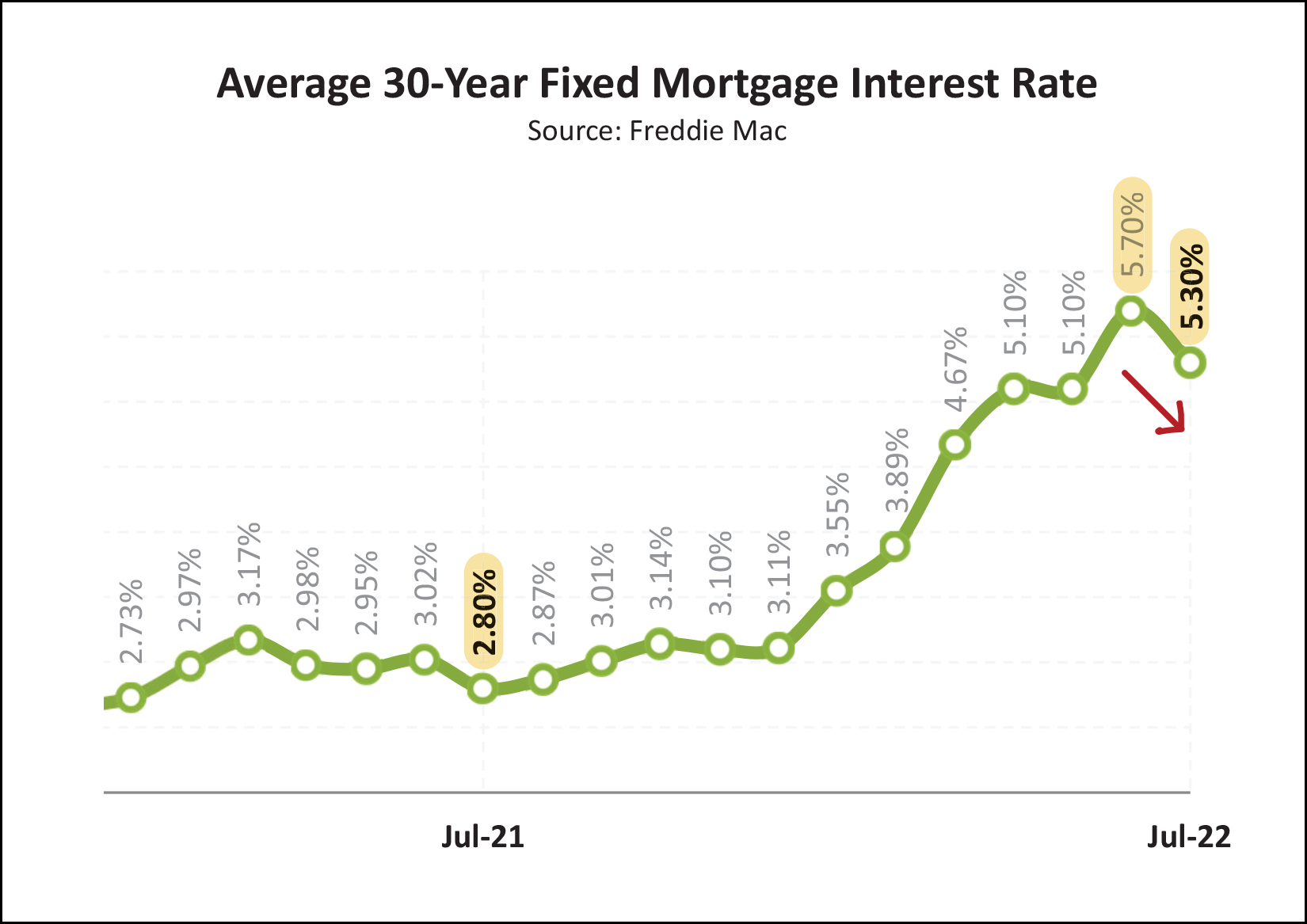

Some (many?) would be home buyers are discovering that mortgage interest rates are making their potential monthly housing costs much higher than anticipated. Just a year ago, the mortgage interest rate was 2.8% for a 30 year fixed rate mortgage and now it's 5.3%. Combine higher mortgage interest rates with higher home values and today's buyers find much higher mortgage payments... A Year Ago... $225,000 = 2021 Median Sales Price of Townhomes, Duplexes and Condos $1,038 = monthly payment assuming 10% downpayment, 2.8% mortgage interest rate Today... $241,767 = 2022 Median Sales Price of Townhomes, Duplexes and Condos $1,431 = monthly payment assuming 10% downpayment, 5.3% mortgage interest rate So, the potential monthly housing cost of buying a median priced townhouse has increased from $1,038 to $1,431 in the past year. This might cause some (many?) would be buyers to explore renting instead. But... rental rates have also increased significantly over the past year! I don't have a large data set to support this statement, but generally speaking, townhouses that might have rented for around $1,100 a year ago are now often renting for $1,350 or more. So, perhaps rental rates aren't increasing as quickly as monthly housing costs if you purchase a townhouse... but these higher rental rates mean that choosing to rent instead buy doesn't provide quite as much relief of your housing costs as you might imagine. | |

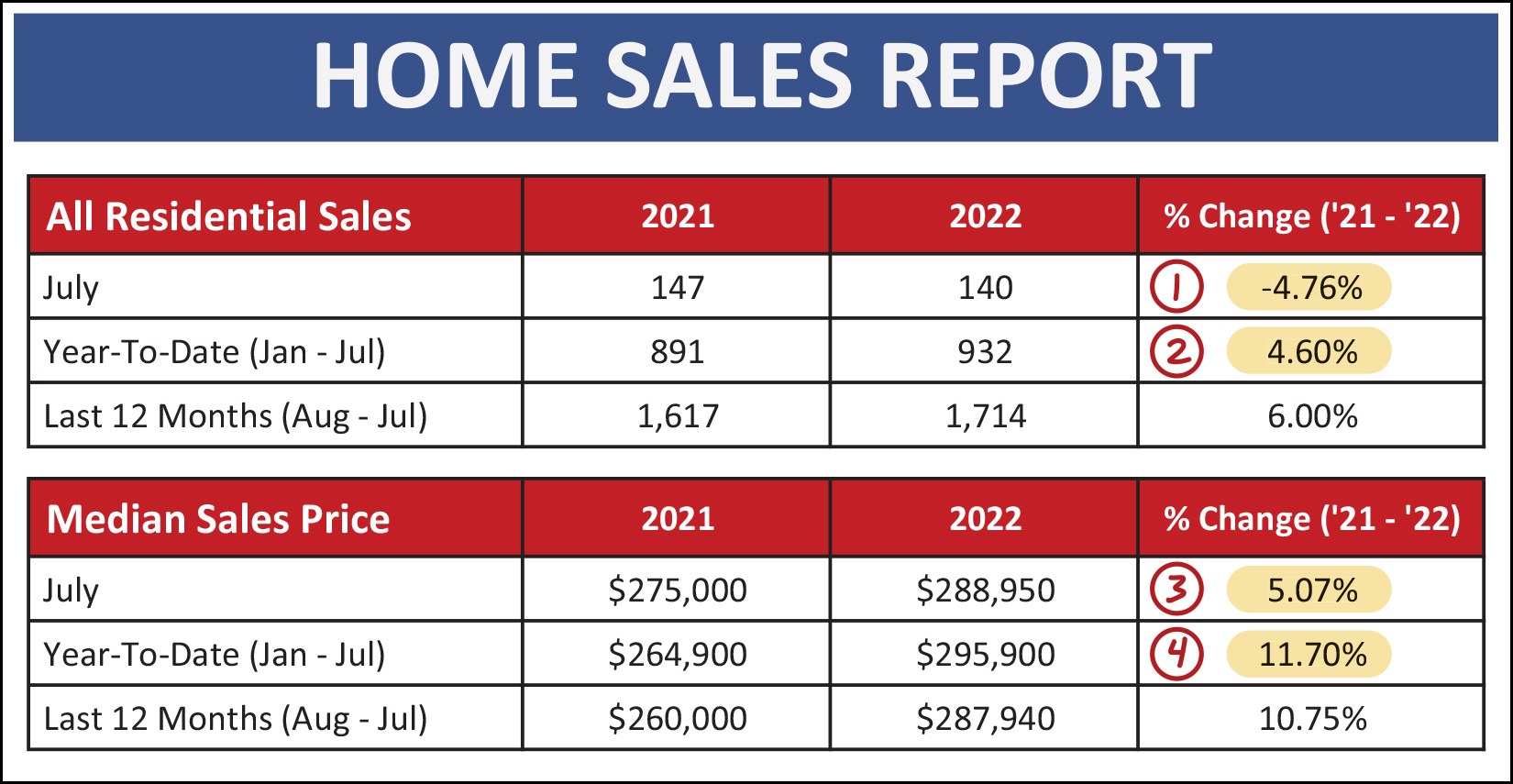

Harrisonburg Housing Market Still Showing Strength Despite Some Signs Of Slowing |

|

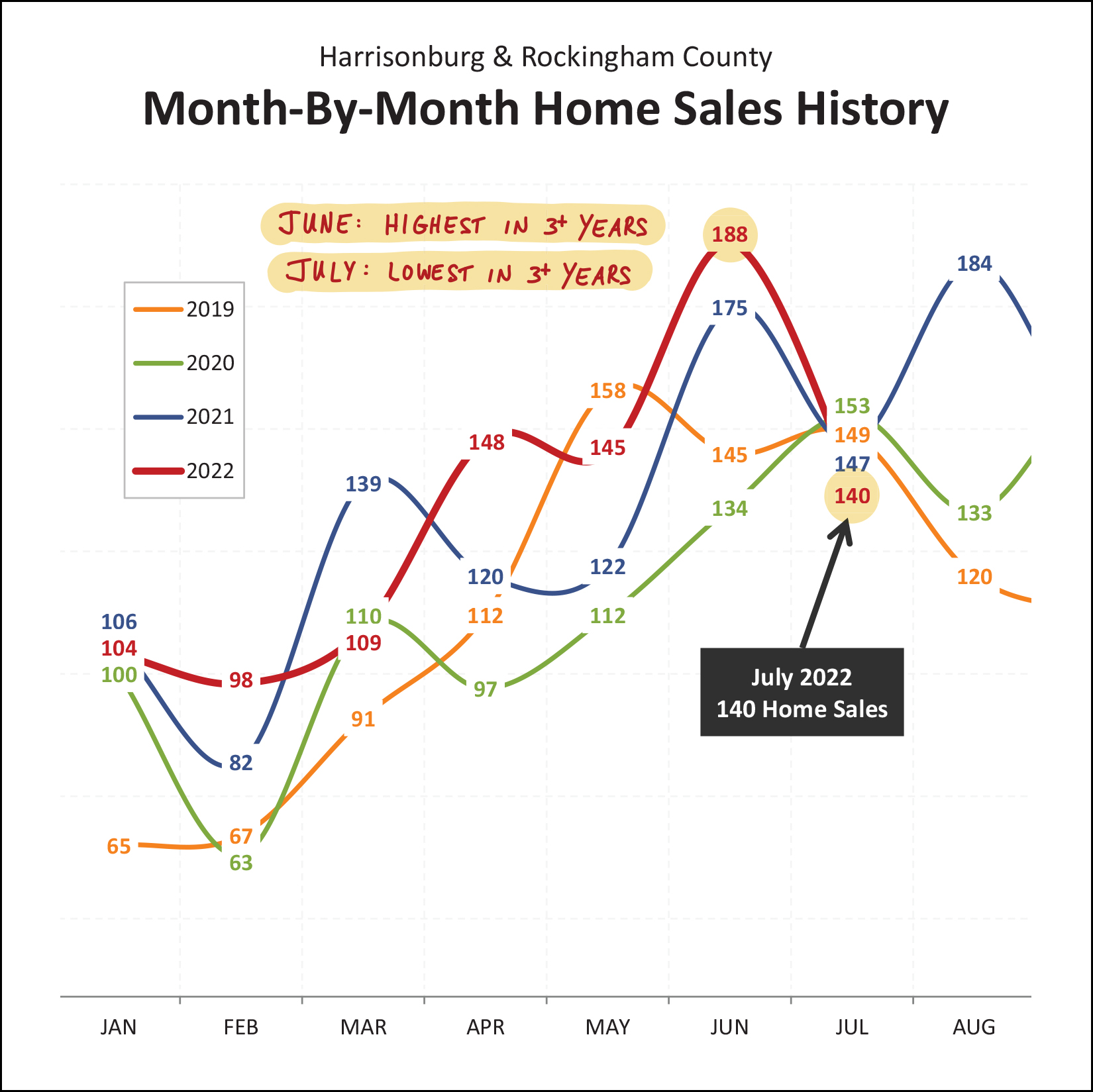

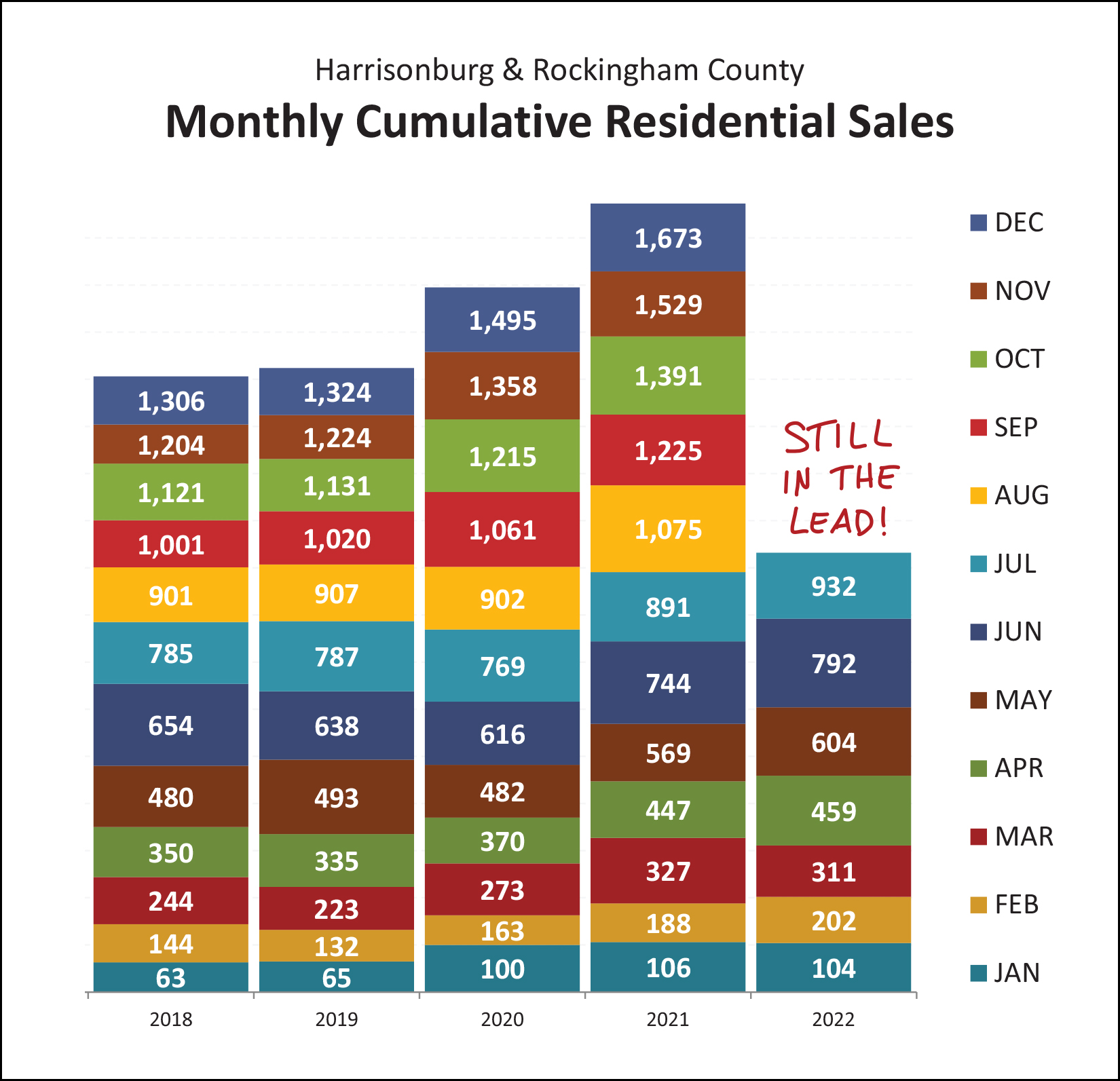

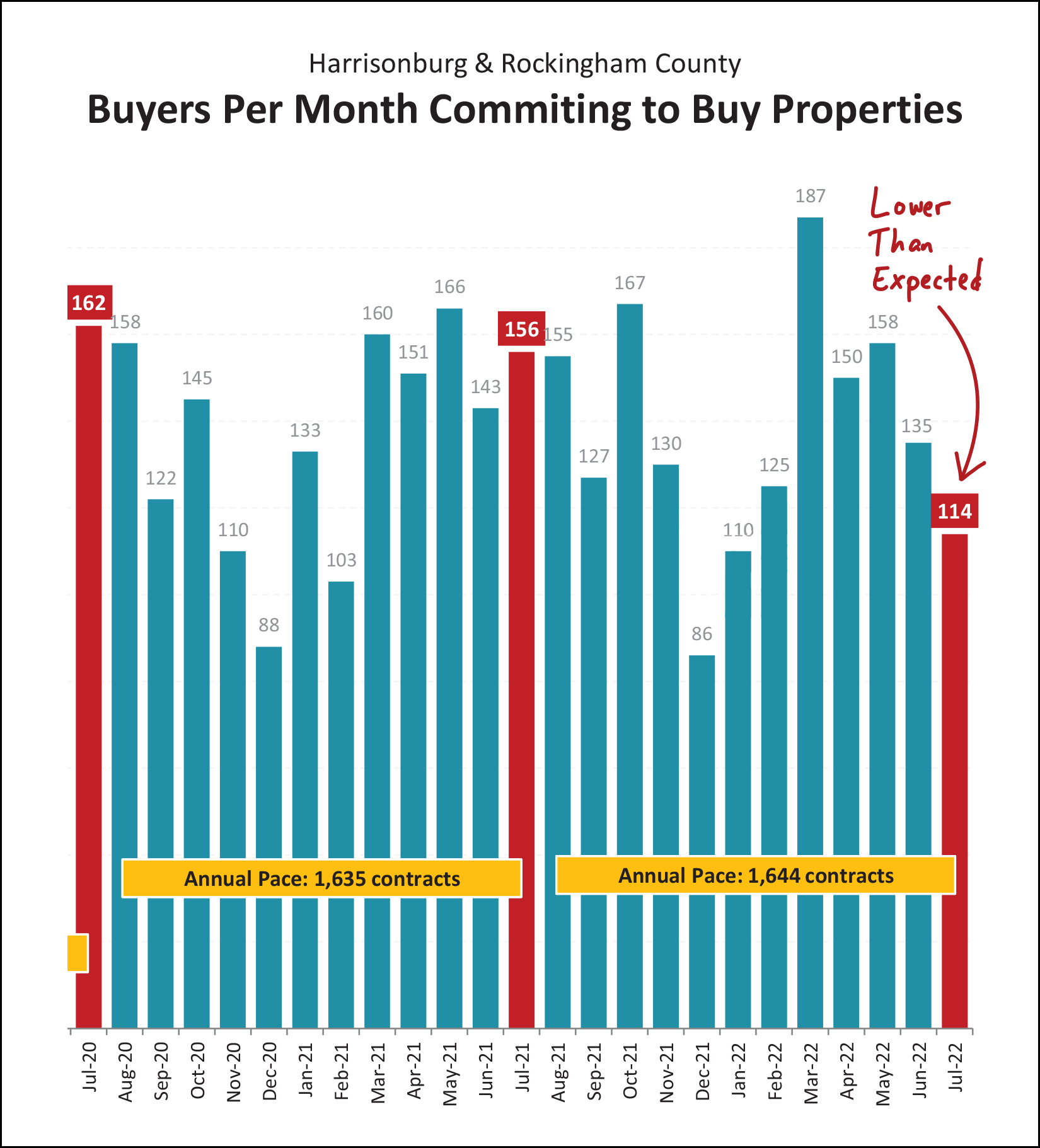

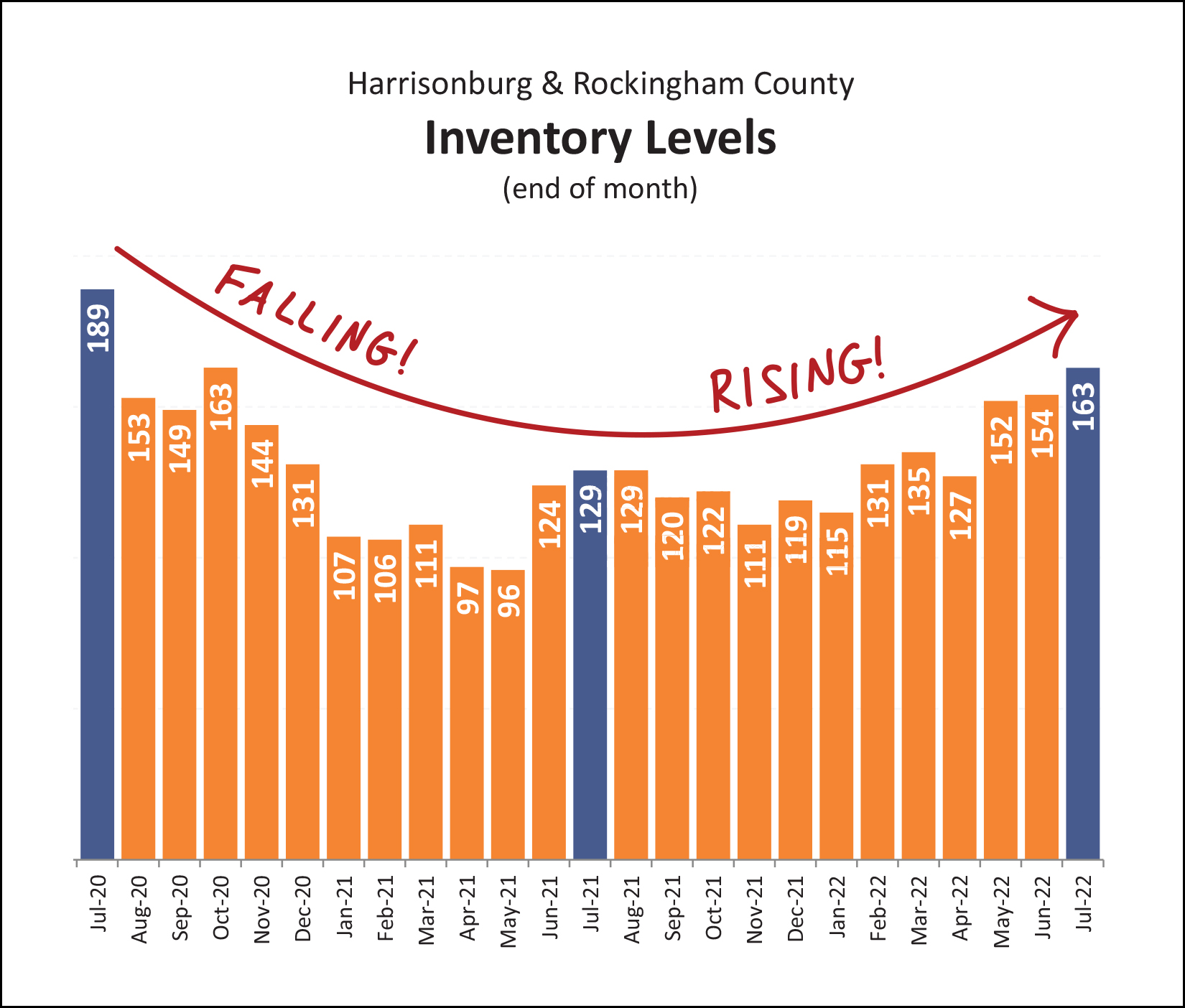

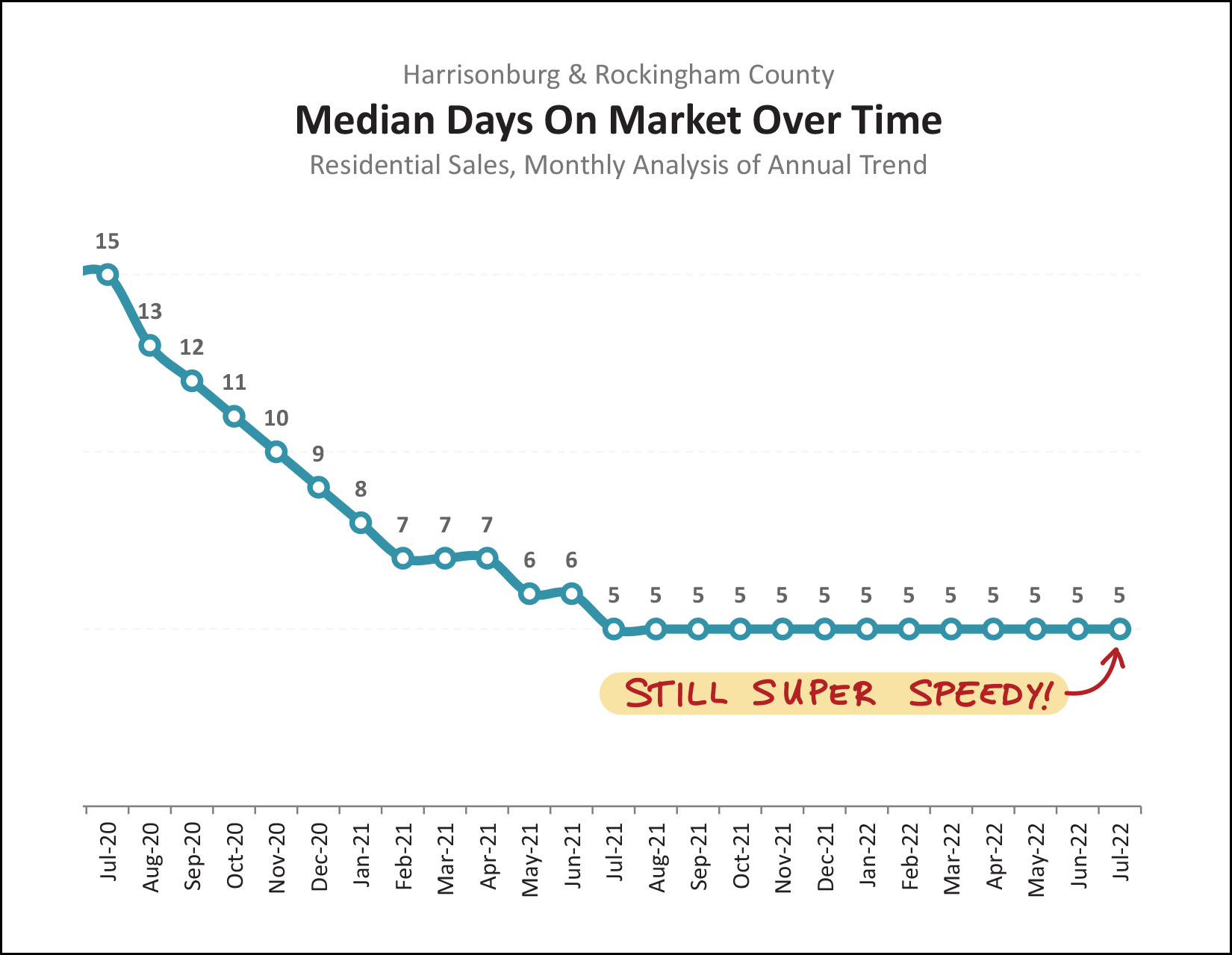

Happy Thursday afternoon, friends! As any student or teacher will tell you, summer is almost over! čśó I hope that you and your family had a wonderful summer and that you had at least one opportunity to sneak away... to the beach, the lake, a tropical island, a music festival, a rural AirBNB, a national forest, a campsite or a new city! One of my favorite spots to sneak away is Deep Creek Lake, MD...  But getting back to business... The beautiful house on the cover of this month's market report is located at 3161 Henry Grant Hill in Preston Lake and you can find out more about this spacious home here. Each month I have a giveaway, of sorts, for readers of this market report. This month's giveaway requires a special sort of market report reader... one who also likes to run... a lot. I enjoy running and frequently participate in races put on by VA Momentum, and thus I was excited to hear they are putting on a half marathon this fall. So... this month, you can enter for a chance to win a free registration to the Harrisonburg Half Marathon, to be held on October 15, 2022! Find out more about the half marathon here. Enter to win the free race registration here. Email me and tell me I'm crazy for thinking you'd run a half marathon here. čśë And now, after all that, let's dig in and see what is happening in our local housing market...  As noted in my headline above, there are some signs that our local real estate market might be slowing down a bit. This very well may mean, though, that it slows down from going 90 MPH in a 60 MPH zone to going 75 MPH in a 60 MPH zone. The latest numbers, as shown above, indicate that... [1] July home sales were slower (140) than last July. We'll see this again on a graph in a moment. [2] Thus far this year we have seen 932 home sales, which is 4.6% more than last year. We had a record number of home sales last year, so a further increase this year is... record breaking. [3] The median sales price in July was 5% higher than last July. [4] When looking at the first seven months of the year, the median sales price has risen 11.7% in Harrisonburg and Rockingham County. So... most of these indicators are quite positive, rosy, exuberant, except the slight slow down in July. This is seen a bit more clearly here...  Above, you'll note that in June 2022 we had an astronomical 188 home sales... higher than any of the past three months of June. But, then, July. In July 2022 we only saw 140 home sales, which is less than any of the past three months of July. Some might point out that looking at a single month of housing data, in a small-ish housing market, can make you think something is happening, when nothing is happening. I agree that can happen. If we smash the two months together, we find that there have been 328 home sales this June and July... compared to 322 home sales last June and July. So... maybe things are "just fine" right now, and maybe things are starting to slow, slightly.  As shown above, if things are starting to slow... they're only just starting to do so, and they're doing so verrrrry slowly. The 932 home sales seen thus far in 2022 is more than we have seen in the first seven months of any of the prior four years. Perhaps when we get another month or two into the year we will see things level out a bit in 2022?  Slicing and dicing the data once more, this graph (above) measures (each month) the number of sales in a 12 month period as shown with an orange line, and the 12-month median sales price (measured each month) shown with the green line. As you can see at the end of the orange line, it's possible that the overall pace of home sales is slowing a bit... but then again, maybe not. We'll need to watch this for a few more months to know for sure. Speaking of the future, our most reliable indicator of future sales is... current contracts...  This one surprised me a bit. We usually see around 150 to 160 contracts signed in any given month of July. But... not this July. There were only 114 contracts signed in July 2022, which is much lower than usual, and likely means we will see a lower than usual month of closed sales in August and/or September. This falls to the category of "things that make you say hmmmm...." and this will definitely be a trend we will need to continue to monitor. Somewhat fewer buyers signing contracts might mean that inventory levels would rise a bit...  Indeed, we are starting to see inventory levels creep up a bit. There are now 163 homes for sale in Harrisonburg and Rockingham County, which is a bit more than the 129 we saw at this time a year ago. It is important to note, though that these "slightly higher" inventory levels are really still VERY, VERY low. Many or most buyers in most price ranges and locations still have very few options of homes to buy right now. So, yes, inventory levels are creeping up a bit, but don't think that's necessarily giving buyers more choices... or giving buyers more leverage... at least not at this point. So... a few fewer sales... fewer contracts... slightly higher inventory levels... that probably means that homes aren't selling as quickly, right!? Well...  Looking at the 12 months of home sales prior to July 2021 (a year ago) the median "days on market" for those sales was only five days. That metric has remained constant for 13 months now... and today, when looking backwards by a year, the median "days on market" is still just five days. Narrowing the focus even more, to just the 114 properties that went under contract in July 2022, we might expect to see a higher "days on market" -- and we do -- but only barely. The median days on market during July 2022 was... six days. So, homes are still going under contract very, very quickly! Finally, maybe this (below) is a contributing factor to the slight slow down over the past 30 to 45 days?  A year ago, the mortgage interest rate was 2.8%. Six months ago it was 3.55%. During June and July it was as high as 5.81%, though it has started to decline now. It is quite possible that these higher mortgage rates have caused some buyers to not be able to buy any longer... or that it has at least partially dampened their enthusiasm. So, there you have it, friends. The housing market in Harrisonburg and Rockingham County is still showing great signs of strength with more sales than ever, at higher prices than ever. But... we might be seeing a slight slow down in home sales (from record high levels) and we might be seeing a slight increase in inventory levels (from record low levels). We'll have to give it a few more months to see how things continue to develop in the local market to know for sure. Until then... If selling a home is on your mind, let's talk sooner rather than later. Before you know it, we'll be halfway through fall and headed into winter. If you are planning to buy a home soon, let's start watching for new listings of interest and going to see them quickly when they hit the market. If I can be of any help with the above (selling, buying) please call/text me at 540-578-0102 or email me here so we can talk about working together to navigate your way through the ever changing Harrisonburg real estate market. | |

Anecdotally, A Smaller Percentage of Showings Seem To Be Resulting In Offers These Days |

|

I don't have any data to back this up, but it seems that a smaller percentage of showings are result in offers right now. A year ago, 20 showings might have resulted in 5 to 10 offers. Today, 20 showings seems to be resulting in 2 to 3 offers. It's hard to know what exactly is driving this change... [1] Home prices are certainly higher now than they were a year ago, and maybe it's harder for buyers who look at houses to get excited about paying today's prices as compared to the prices a year ago? Though, a year ago, prices seemed pretty high to most folks as well... [2] Mortgage interest rates are certainly higher now than they were a year ago, and maybe buyers are excited about Home X at Price Y but when they run the numbers and determine Mortgage Payment Z their excitement cools? Though, they could have known that before they decided to go see the house... [3] The housing market was on fire a year ago with no signs of cooling off, whereas now some markets are seeing sales and/or prices level off or decline slightly. So, maybe buyers are a touch more hesitant to act today as compared to a year ago because there is some small amount of doubt of whether home prices will continue to accelerate upwards over the next few years? Though, a year ago, there was some doubt about whether prices would keep accelerating upwards because they had been increasing so quickly up until that time... So, it's hard to say why, but a somewhat smaller portion of buyers who go to view homes seem to be deciding to make an offer on those homes right now. Does this matter to sellers? Not necessarily. [1] Homes are still selling very quickly. [2] Homes are still selling at prices that are very favorable to sellers. [3] Sellers are still often having more than one offer to consider, even if they don't have ten offers. So, changes are afoot, but they aren't necessarily changes that are affecting the pace of sales or sales prices in our local market. | |

Happy Mortgage Interest Rate News As Average Rate Falls Below 5% Again |

|

Mortgage interest rates have been steadily climbing for most of the past six months -- peaking at 5.81%. But... in a bit of good news for buyers in today's housing market... the average mortgage interest rate (for a 30 year fixed rate mortgage) has fallen below 5% again... barely... to 4.99%. Just over a month ago with rates nearing 6%, some were thinking we were going to see them continue to rise to 6%, 7% or beyond. This moderation in rates is certainly helpful for home buyers looking to buy a home right now! | |

If You Can Buy A Home Without Selling, Get Your Ducks In A Row Sooner Rather Than Later |

|

It's hard to get a home seller to consider a home sale contingency these days. The market is still moving quite briskly, so why would a seller tie up their home in a contract with a buyer... who then has to go and sell their home!? Sometimes, though, a buyer can buy their next home before selling their current home. This allows said buyer to make an offer without a home sale contingency, and thus, have a shot at securing a contract on the home they hope to purchase. But... sometimes... being able to buy a home without selling requires a bit of research or planning or both... RESEARCH - If you are pretty sure you can buy without selling, don't wait to talk to your lender to confirm that until a house of interest comes on the market for sale. Talk to them now! Submit documentation to your lender to get to having a firm understanding of whether you can or cannot buy without selling... and get a copy of your pre-approval letter! PLANNING - Perhaps you have quite a bit of equity in your home... or perhaps it is entirely paid off! One option may be to take out an equity line on your current home to allow you to use those funds for a downpayment on the new house... and then pay off the equity line when you sell your current home. If you're looking for a good lender for getting pre-qualified or for exploring equity line options, let me know... | |

Home Inspections Are Likely To Become A Thing Again, And They Should |

|

Over the past two years I have told countless home sellers something along the following lines as they have made final preparations to sell their home... "That recent listing over in that neighborhood had five offers within the first week and none of those buyers included home inspection contingencies." "That townhouse just went under contract after receiving eight offers, and only one of the eight buyers was asking to be able to conduct a home inspection." As such, many home sellers over the past two years have not had to work their way through home inspection contingencies and the negotiations that sometimes take place after those inspections. And... my point today... most home buyers over the past two years have not had the option of conducting a home inspection during their purchase process. As our local real estate market starts transitioning into a market that is not quite as piping hot of a market as it has been for the past two years, we will very likely start to see more offers with home inspection contingencies. This is great news for buyers! A home purchase is a major financial decision both in the near term and the long term. You are paying a large amount of money for a home in which to live... but that home may very well need some items repaired or need some system maintenance or replacement in the near future. A home inspection allows a buyer to more clearly understand potential home maintenance costs over time by learning more about the condition of the components and systems of the house. As a side note, I am much more of a fan of home inspections being used by buyers to learn about a house and to propose slightly different contract terms if major issues are discovered -- more so than home inspections being used by buyers to try to renegotiate the deal just because they can threaten to walk away from the deal based on the inspection contingency. Home sellers today should be prepared for offers that may include inspection contingencies. Home buyers today should consider including inspection contingencies if they are not competing with multiple other buyers to secure a contract on a hot new listing. | |

Increased Mortgage Interest Rates Can Significantly Decrease Your Home Purchasing Power |

|

If you have $2,000 per month in your budget for your mortgage payment, that budget won't allow you to buy quite the same house now as compared to six months ago. Six Months Ago = 3.22% Mortgage Interest Rate = $451,000 house Six months ago, you could purchase a $451,000 house in the City of Harrisonburg, put 20% down, finance the purchase with a 30 year fixed rate mortgage at 3.22%, pay your tax bill and homeowners insurance all for a smidge less than $2,000. Today = 5.81% Mortgage Interest Rate = $353,000 house Today, you can purchase a $353,000 house in the City of Harrisonburg, put 20% down, finance the purchase with a 30 year fixed rate mortgage at 5.81%, pay your tax bill and homeowners insurance all for slightly less than $2,000. $98,000 of Purchasing Power... Gone! As such, if you have a fixed budget for your housing costs, you have lost $98,000 of purchasing power over the past six months given the increased interest rates. But Remember... Six months ago, plenty of buyers with a $2,000 budget may have been buying $353K houses... not $451K houses... so for some buyers the increased monthly costs are likely painful, but may not change their purchasing decisions. -- This article was inspired by an even more thorough analysis of this dynamic over here. | |

Homes Not In Property Owners Associations Might Still Have Restrictive Covenants |

|

Just because the house you are buying is not located in a Property Owners Association... that does not mean that there are not rules that affect your ownership of the property. Many neighborhoods developed in the past 20 to 30 years do not have Property Owners Associations... but do have Restrictive Covenants. These restrictive covenants often set down guidelines such as... [1] If you want to make exterior changes to your house or add an outbuilding, etc., you may need to first seek approval from an architectural review committee. [2] Non domestic animals (chicken, pigs, goats) are often prohibited. [3] There may be restrictions on parking commercial vehicles, campers, trailers or boats on your property. ...and the list goes on! So, if you are buying a house that is not a part of a Property Owners Association, let's also take a moment to check for any restrictive covenants that may affect your ownership of the property and make sure you are familiar with and comfortable with those restrictions. | |

It Can Be Particularly Challenging For Relocating Home Buyers To Buy Right Now |

|

There have been three instances in the past week where I really wish the fictional private jet shown above existed... ;-) It is particularly challenging for a relocating home buyers to buy houses in Harrisonburg and Rockingham County right now. If you plan to move to the Harrisonburg area at the end of the summer, and you live four hours (or more) away from Harrisonburg, when a new listing of potential interest hits the market, you're often caught in a dilemma. I can "show" you the house virtually via FaceTime, but then, do you... [1] Make an offer without having seen the house yourself, in order to have a chance at having an offer submitted in time for it to be considered. [2] Hop in the car or book a plane ticket to get to Harrisonburg to see the house yourself, the following day, to make a decision about submitting an offer after having seen the house in person. Neither option seems great to relocating home buyers. Many buyers just simply aren't comfortable with buying a house without having seen it themselves, in person, and having walked through it. Understandably. Some buyers are reluctant to hop in the car for an eight (+) hour adventure, or a two day excursion by plane, to see a house in person... perhaps to then either not like it as much as they thought... or to love it even more but then submit an offer that is not accepted. So, what is a relocating home buyer to do? Our company does not currently have plans to purchase a private jet to fly buyers in to see homes... but I'll let you know if we start exploring that possibility. Private jets aside, the options seem to be... [1] Get comfortable with submitting an offer to buy a house without having seen it yourself in person. You might not feel better or worse about this depending on the property, its condition, and how well it fits your needs. [2] Commit to making the trek (by car or plane) to Harrisonburg to see new listings of interest, even though sometimes the trip will not yield a contract on a house. [3] Plan to rent an apartment or townhouse for six months upon arriving in Harrisonburg to then be able to explore houses for sale, in person, quickly, as they hit the market. If the pace of the market were to ever slow down, the dynamic described above could change... but right now that doesn't seem to be happening. | |

The Summer Housing Market Often Provides An Irregular Flow Of New Listings |

|

Starting and stopping and starting again. Home buyers hoping to buy a house in Harrisonburg or Rockingham County over the next month or two might become confused, or frustrated (or both) with the start and stop nature of the market during the summer months. There might be 300 homes listed for sale over the next two months... but there won't be five new listings per day for the next 60 days. Why, you might ask? Mostly because of seller's vacation plans. "I'm going to get the house ready to go on the market on ___. Oh, wait, we're going on vacation just before that, so let's push it back a few weeks." "I'm going to be ready to have the house photographed by ___. Oh, wait, then we leave on vacation immediately after that and I don't want to be out of town when the house is being shown." If you are a home buyer hoping to buy soon... don't get overly discouraged when there is a slow week or so of new listings... that will almost always be followed by a burst of new listings in the following few weeks. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings