Buying

| Newer Posts | Older Posts |

Some Sellers Will Prioritize Certainty Over Price |

|

When a seller signs a contract with a buyer, they want to be as certain as possible that the contract will proceed to settlement. The king of all offers, providing the most certainty to a seller would be a cash offer with no contingencies whatsoever. As each of the contingencies below are added to a contract, the seller's certainty decreases...

It is important, as a buyer, to remember that most sellers are thinking about certainty alongside price. Which of these offers is likely to succeed?

When presented with these three offers I think many or most sellers would choose offer #1 even though it is $1K or $5K lower than the other two offers in hand. Give careful thought to the contingencies you do and do not include in your offer and understand how they affect the seller's view of the certainty that your contract will make it to settlement. | |

If You Are Buying A Home Soon, Consider Starting Your Loan Application Now |

|

Here are the three sequences I see buyers follow most frequently....

As Late As Possible

Incredibly Proactive

A Reasonable Middle Ground

I try to encourage all of my clients to at least be in the "reasonable middle ground" sequence as outlined above. This gives them a firm idea of what they can afford and how a home price will compare to a loan payment. This also allows them to make a stronger offer, already having a pre-qualification letter in hand. I strongly discourage my clients from following the "as late as possible" sequence as outlined above. This doesn't help them make the best decisions about which houses to pursue, how far to negotiate, etc. This also doesn't allow us to make as strong of an offer on a house. Occasionally, one of my clients will fall into the "incredible proactive" sequence as outlined above, and wow, this makes the financing process a joy to work through! These buyers have already done so much of their work with the lender before even thinking about which house to buy -- which then allows them to focus on buying, negotiating, inspecting, etc., rather than be bogged down in the process of securing their mortgage. Let me know if you have questions about how I have described these sequences -- and let me know if you would like a few recommendations for lenders in the Harrisonburg area. | |

Will This House Sell For More Than The Asking Price? |

|

The answer to this question - will a house sell for more than its asking price - does not just relate to how the asking price compares to the market value of the home.

Certainly, if a house is priced too low, or even priced fairly in a competitive market, that will increase the likelihood that it will sell above the asking price... [1] A house worth $350K, listed for $330K, will almost certainly sell for more than the asking price. [2] A house worth $350K, listed for $350K, is likely to sell for more than the asking price in the current market. ... but there are other factors that affect this as well. [1] How many buyers have viewed the home? As the number of showings increases, the likelihood of a house selling for more than the asking price also increases. [2] How many buyers have made an offer? As the number of offers increases, the likelihood of a house selling for more than the asking price also increases. All of this might seem pretty straightforward, but pause to reflect on these dynamics as you are considering an offer on a house recently listed for sale. Consider these two fictional houses that came on the market (not really) yesterday, that we’re walking through today... [1] House listed for $350K, with 18 showings and four offers thus far. This house is very, very likely to sell for more than the asking price. :-) [2] House listed for $350K, with eight showings and one offer thus far. This house might sell for more than the asking price - if another buyer jumps in and makes a second offer. [2] House listed for $350K, with 12 showings and no offers. This house could, possibly, sell for more than the asking price, but it is not seeming very likely given that lots of buyers have looked at it already and there aren’t any offers. [3] House listed for $350K, with one showing and no offers. This house is almost certainly not going to sell for more than the asking price - unless a bit more time passes and several buyers all of a sudden go see the house at the same time and make simultaneous offers and then have to compete with each other to buy the house. So, to answer the question of whether a house is likely to sell for more than its asking price, we really need to start by asking how many showings a house has had and how many offers exist. | |

Harrisonburg Area High End Home Sales Booming In 2021 |

|

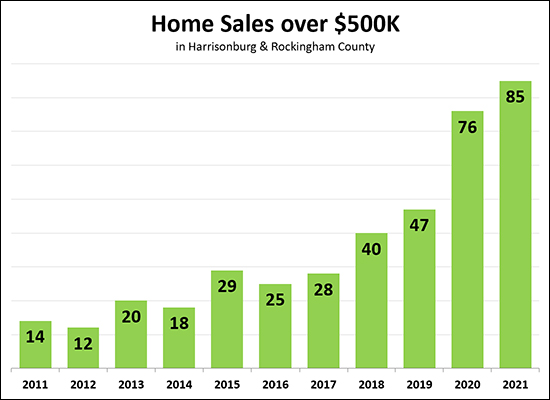

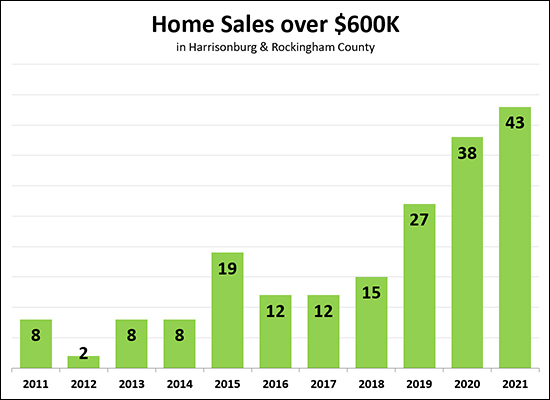

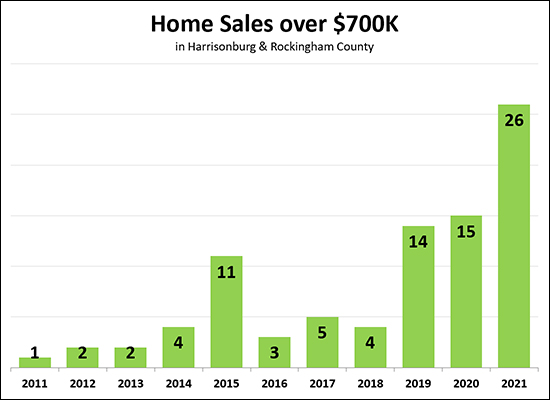

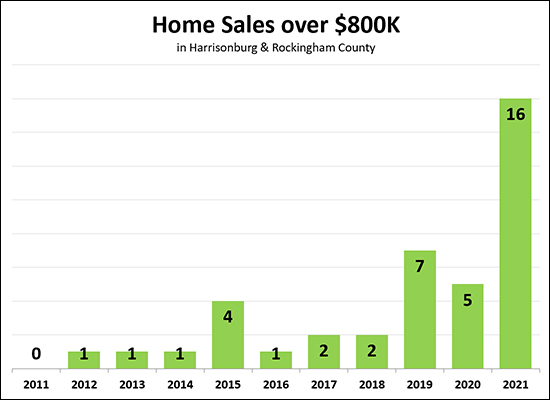

Only 7% of local home buyers spend $500K or more on their home purchase (per sales data over the past 12 months) but this segment of the local housing market has been strong over the past few years. As shown above, there were 76 home sales over $500K last year - which was wellmore than any time in the past decade. This year we have already exceeded that pace of $500K+ home sales even with just the first ninemonths of the year. There have already been 85 home sales over $500K up through October 4, 2020 and there is still time for a more before the end of the year.  We also saw a big jump in the number of home sales over $600K last year Last year was an extraordinarily strong year for home sales over $600K - with 38 such sales - well more than in any other year in the past decade. This year -- we're seeing even more $600K+ home sales, with 43 thus far and still three months to go! Let's keep narrowing our focus, now to sales over $700K...  The number of $700K home sales a year was averaging four sales per year between 2016 and 2018 and then more than tripled in 2019 to 14 sales, followed by another 15 sales in 2020. But this year -- wow! The number of home sales over $700K looks like it will likely double this year as we have already seen 26 such home sales in the first nine months of 2021! And... one more time... let's look at even more expensive homes...  This one surprised me. Well, most of the graphs did, but this one particularly. Before 2019 we were seeing around two sales a year over $800K. In 2019 and 2020 that jumped up to 7 (2019) and 5 (2020) -- but this year -- we have already seen 16 buyers pay over $800K for homes in Harrisonburg and Rockingham County! So -- overall, the high end home sales market is doing extremely well as compared to performance in past years! If you are thinking of selling your high end home (over $500K, $600K, $700K or even $800K) this might be the time to do so! | |

Moving Once Is Hard, But Moving Twice Is Harder |

|

Moving from one house to another is tough work! Even tougher (sometimes) is arranging the timing and logistics to work well for all parties. If you're selling a house in order to buy a house, it's possible that...

The spot for you to be can be somewhat easier -- you could stay at a hotel or with a friend for a night if needed. It's decidedly harder to put all of your belongings in the hotel room or in your friend's house. The options, generally speaking, are...

If none of these are possibilities -- I have even had some clients who had to put everything in storage, just for a few days -- and then move it out of storage into the new house. Again - even moving is tremendously hard - but arranging for it within the tight confines of closing timelines and when you do and do not have access to the old house and new house can make it even more difficult! | |

The Higher The Price Point Of The Home, The More Important The Layout Of The Home |

|

If a buyer is buying a home priced over $400K or $500K, or even over $300K, the layout of the home becomes very important to them. That is not to say that it is unimportant for a $200K buyer -- but someone buying a more expensive home oftentimes plans to stay in it for a longer time frame. If not the #1 feedback, then perhaps the #2 feedback I receive from showings of homes priced over $400K is that the layout just didn't work for the buyers....

| |

You Finally Found THE House, Now, How To Make An Offer |

|

How, you might ask, do we go about getting from the point of wanting to make an offer --- to actually making the offer? Here's a brief overview....

When we get to step seven, above, we will be discussing and deciding on the terms of the offer. Below is a list of the main contract terms we will need to discuss in preparing to make an offer.

Before and after making an offer, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

Buying A Home Before Selling Your Current Home |

|

If you plan to buy a home this fall -- but you already own a home, that you plan to sell -- then one of your first conversations should likely be with your favorite mortgage lender. It's a seller's market, after all, which means that... [1] When you are selling your home, you will likely find yourself able to negotiate favorable terms with most buyers making an offer on your home. ...but... [2] When you are making an offer to buy a home, the seller will likely have the upper hand in negotiations. As such, if you are planning to make an offer to buy a house with any of these scenarios, you are unlikely to be successful...

So, if you want to have a fighting chance at buying a home right now, you will likely want to explore what it would look like to buy before (or independent of) selling your home. Basically, will your lender allow you to buy a new home before selling your current home. If your lender says this is possible -- and if you are comfortable with it -- this will allow you to pursue houses that come on the market and make offers that are not contingent on the sale of your home. But again, all of this starts with a conversation with your lender. So, if you want to buy this fall, but will also need to sell, and you're not sure if you can buy before selling -- talk to a mortgage lender ASAP to find out! If you need recommendations on some great mortgage lenders in this area, feel free to email me. | |

How Close Is Close Enough In A Limited Inventory Market? |

|

This house has soooo much of what I want in a new home... ...I mean -- it checks off almost all of the boxes... ...well, but, except for ___, and I did say that was pretty important... ...but there are so few options for buying right now... ...should I just go ahead and move forward with this mostly perfect house? This is the conversation I have had went LOTS of buyers lately -- they have decided to buy, have seen so few options on the market, finally see a house that is reasonably close to what they want -- and they then need to decide whether that house is close enough. It's a tough call with no one right answer! How close to perfect do you need to get when shopping for a home in a market where there are very few listings on the market at any given time, and when houses often go under contract in days rather than weeks or months? Will you be glad to finally have a contract on a house be done with the frantic search? Are the areas in which the house misses the market for you critical areas or "nice to have, but not essential" areas? Are the ways in which the house is not perfect changeable (condition, finishes) or unchangeable (location) in the future? There is no easy answer -- but I'm happy to talk it all through with you when we find that house that is pretty darn close to what you want to buy -- but not quite perfect. | |

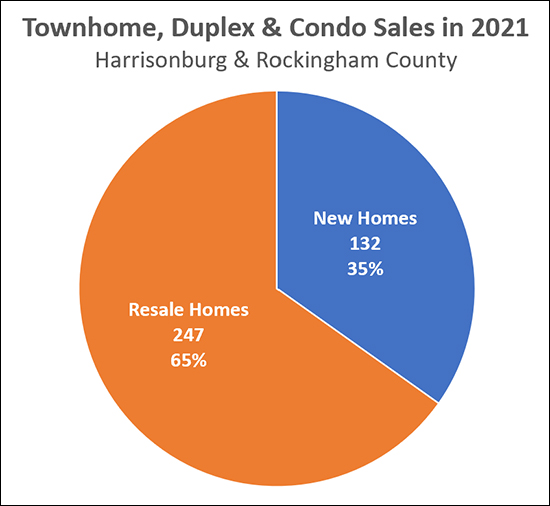

35% Of Townhome, Duplex and Condo Sales Are New Homes! |

|

This stat (illustrated above) might surprise you. It surprised me! Thus far in 2021 there have been 379 sales of townhomes, duplexes and condos in Harrisonburg and Rockingham County as recorded in the HRAR MLS. Of those 379 sales -- 35% of them have been new home sales! I know there have been plenty of new home sales (particular of attached properties) in 2021, but I didn't think it was more than a third of all attached homes that are selling. Here are some of the spots where we have seen the most sales of new townhomes, duplexes and condos thus far in 2021...

| |

Focus Mostly On The Biggest Issues When Requesting Repairs After A Home Inspection |

|

After a home inspection, a buyer knows more about the house than when they agreed to pay $X to purchase the house. In order for them to still want to pay $X for the house, they may ask the seller to address some of the deficiencies found during the home inspection. Imagine a hypothetical scenario where the following deficiencies are found:

So - which items should the buyer ask the seller to repair? Some could say ALL of them - the buyer didn't agree to pay $X for the house with all of these large and small issues. But I'd advise most buyers to only request that the seller address a subset of those issues:

All of the other items (3-7) are minor issues that won't cost too much (in time or money) to repair after you buy the house. But why not ask the seller to repair these items?

| |

Home Buyers Who Desire Home Inspections Might Not Be Able To Pursue All Homes |

|

Here's a dynamic I've observed in our local market over the past six months or so...

So -- if you are buying a house and you would only want to buy with a home inspection contingency (which is very reasonable) then you might not find success in securing a contract on a new listing with multiple offers... but once a house has been on the market for a few days or a week or two it is very likely that a seller will consider an offer with your inspection contingency - especially if they do not have any other offers at the time they receive your offer. So, reasonably cautious buyers who want do conduct a home inspection do not need to despair that they shall never be able to buy a home -- but it will likely mean that you will not be able to successfully pursue some new listings. | |

Finding a Home Into Which You Can Downsize Can Be Difficult In Harrisonburg |

|

There are plenty of large-ish detached homes (2500 - 4000 SF) in Harrisonburg and Rockingham County that are occupied by a parent or parents who have raised their families in those homes but now find themselves with a family sized home without any kids living at home any longer. As you might expect, many of these homeowners would like to downsize. They don't need 3000 or 3500 SF just for themselves and the few times a year when the kids (and possibly kids' families) are back home to visit. But, sometimes downsizing is easier said than done... This homeowner would likely prefer to move into a home that is perhaps 1400 to 2200 SF, depending on how much they want to downsize, and they would likely prefer a home that won't require a lot of maintenance over the coming five to ten years and a home that has everything they need on one floor. There are only so many homes in this area that match this description, and they don't hit the market all that often -- and when they do, they usually sell quickly. Below are some of the popular downsizing destinations where buyers often find themselves in or near Harrisonburg. The links below will take you to a listing of recent sales in each area as this will show you some recent sales prices and because there aren't currently active listings in many of these locations. Popular Downsizing Neighborhoods: If you're in the situation described above, what other locations are you considering when you are looking to downsize? | |

Is A Cash Offer Really That Much Better Than One With Financing? |

|

Many sellers, when receiving a cash offer and one with financing, ask themselves (or their agent) whether a cash offer is really that much better than one with financing. As with many questions in real estate, it depends... First, a $400K cash offer and a $400K offer with financing will both (any other contingencies aside) result in the same amount money going to the seller -- $400K less mortgage payoffs and transaction costs. So, in that way, a cash offer and an offer with financing are pretty similar -- the seller gets the same amount of money. These two offers, though, start to feel pretty different...

In this case (above) the second buyer is likely is not very financially capable and that could mean there would be difficulties in the buyer obtaining financing to complete the home purchase. The fact that the lender is an unknown variable can also give a seller pause as they compare the two offers. These two offers, though, may very well seem pretty similar to a seller...

In this case (above) the second buyer would seem to be very financially capable, in that are putting a sizable deposit down and have a significant amount of funds to use as a down payment. The fact that the lender is a known variable (local, reliable) means that the offer is very likely to proceed quickly and smoothly to closing. So, in the end -- should a seller look at a cash offer as being undoubtedly better than any offer with financing? Not necessarily. An offer that is similar in offer price, with 80% financing, a sizable deposit, and where a buyer is working with a known local lender is just about as strong as a cash offer in almost all circumstances. | |

I Just Sold My House. Should I Buy A House This Year Or Wait Until Next Year? |

|

Let's say you just sold your house -- and you're wondering -- should you go ahead and buy the next house now? Or wait a year? After all, home values seem quite high right now -- maybe you'd be better off waiting a year? Let's check -- from one very narrow scenario... Buying Today for $300K and Financing 80% of the Purchase Price Mortgage Payment = $1,259 per month (2.78% mortgage) $427 per month in principal reduction $832 per month in interest, taxes and insurance A year later you will have paid $15,108 for housing -- but $5,124 of that will have gone towards principal reduction. Thus, you will have "paid" a net of $9,984 during the year. Renting For A Year and Then Buying The Same House We will (generously) assume that interest rates will be the same a year from now. They'll probably actually be higher. We're going to assume you'll pay around $1,200 per month in rent for a year, which won't get you as nice of digs as your $300K purchase, but perhaps you keep the rental budget low to minimize your rental costs. A year later you will have paid $14,400 in rent as compared to $9,984 if you went ahead and bought now. Thus, your housing costs would be $4,416 higher for the coming year if you rented now instead of buying now. Now, let's fold that into how home values might change over the next year... Same Increase In Home Values As The Past Year (+10.9%) The $300K home you did not purchase will now cost you $332,700. As such, you will have paid an extra $4,416 in rent and you'll now pay an extra $32,700 in a purchase price. Ouch. That makes it $37,116 more expensive to wait a year,. This scenario is not necessarily very likely to occur as the 10.9% increase in our local median sales price was well above any long-term norm. Same Increase In Home Values As The Average Of The Past Five Years (+5.8%) The $300K home you did not purchase will now cost you $317,400. As such, you will have paid an extra $4,416 in rent and you'll now pay an extra $17,400 in a purchase price. Still relatively painful. That makes it $21,816 more expensive to wait a year. Same Increase In Home Values As The Average Of The Past Ten Years (+3.2%) The $300K home you did not purchase will now cost you $309,600. As such, you will have paid an extra $4,416 in rent and you'll now pay an extra $9,600 in a purchase price. That makes it $14,016 more expensive to wait a year. No Change In Home Values You pay the same ($300K) price for the same home a year from now and you just lose the $4,416 in extra housing costs that you paid by renting for a year. Home Values Drop 1.5% If home values drop 1.5% over the next year -- then you'd basically break even. You would pay $4,500 less in a purchase price after having paid $4,416 more in rent during the intervening year. Home Values Drop 3% or 5% of 10% If you get above a 1.5% decline in home values over the next year -- then, yes -- it would have made more sense to have waited a year after selling to buy your next house. So, What Do You Conclude? In the end, you'll need to decide which of these scenarios seems the most likely to occur in the next year...

But... don't forget... I'm leaving out a few factors that would probably cause most people to buy now (after selling) rather than waiting a year...

Yes, this analysis had a lot of detail -- but there is plenty of nuance in any scenario where you are thinking about buying or renting. Feel free to touch base with me if you want to think through or talk through your scenario and options. | |

Why In The World Are You Buying A House Without A Home Inspection?? |

|

Yes, sometimes buyers these days are making offers on houses without a home inspection contingency. As Paige asked yesterday... Is everyone else in the world significantly more handy, a better gambler, or just have that much cash laying around? Good question, Paige! :-) Here are some of the reasons why buyers are making offers without home inspection contingencies...

A few more thoughts and observations...

Home buyers have some difficult decisions to make these days as they formulate a plan for pursuing a house in a housing market with very low supply levels. Deciding whether to include a home inspection contingency is just one of those difficult decisions. | |

I Will Offer You ONE MILLION DOLLARS For Your House... Oh, Contingent On An Appraisal... |

|

I've seen buyers use this strategy quite a few times lately... and sellers usually aren't interested, or fooled, or entertained. Here's the scenario... A house is listed for sale, priced at $250,000. Three offers come in, each one higher than the last, as is typical in this market...

Then, the fourth offer comes in. Offer #4 is an offer of $350,000. Contingent on the property appraising at or above the contract price. I'm exaggerating a bit to make my point here -- but not by much. Basically, a buyer offers WAAAAAY above the asking price -- well beyond what anyone would think would be a reasonable offer for the property -- but makes their offer contingent on an appraisal. I suppose the thought is that surely a seller would pick an offer of $350K instead of an offer of $255K, $260K or $265K, right!? Maybe not. I have had the chance to see several sellers respond to these absurdly, unrealistically high offers and again, sellers usually aren't interested, or fooled or entertained by such offers. Almost every seller I know would happily take Offer #3 as described above before they'd even start to entertain Offer #4. Clearly, buyers can attempt to negotiate however they'd wish to do so, but this particular strategy does not seem, to me, to be a winning strategy. | |

Special Saturday Edition: Home Sales, Prices Flying High In Harrisonburg Area |

|

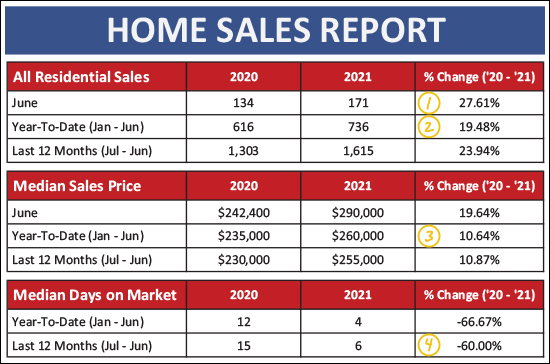

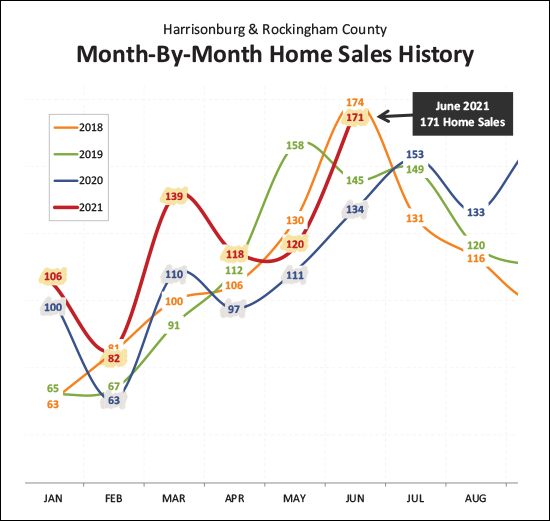

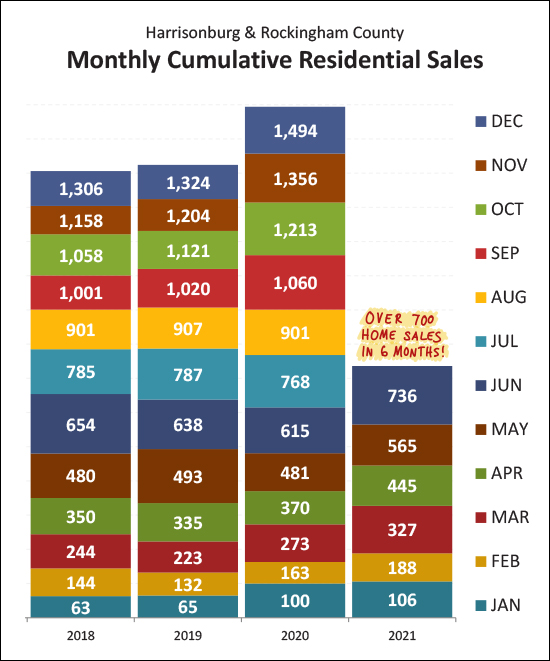

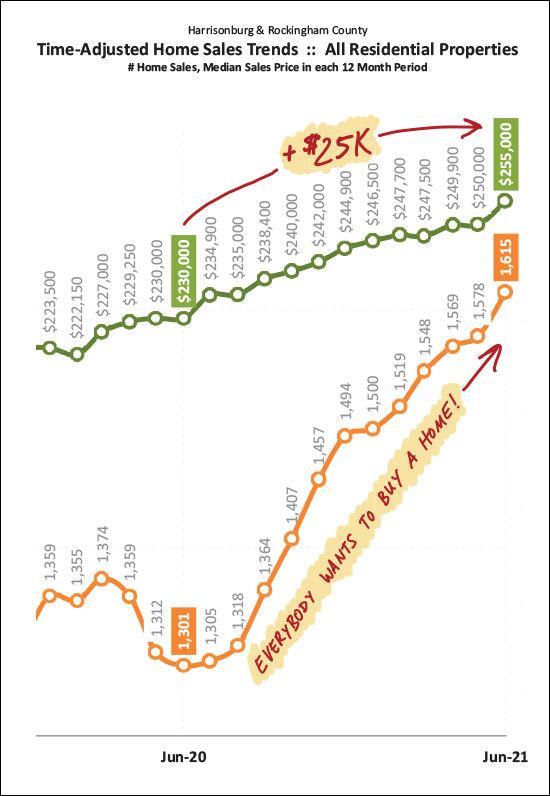

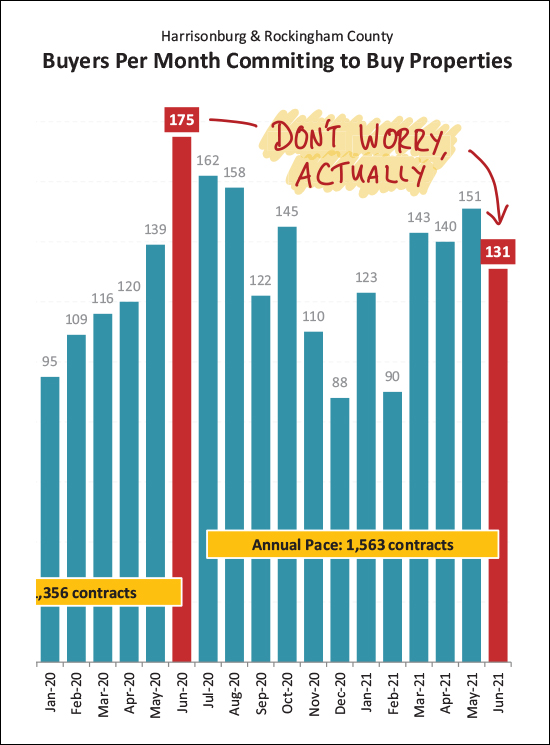

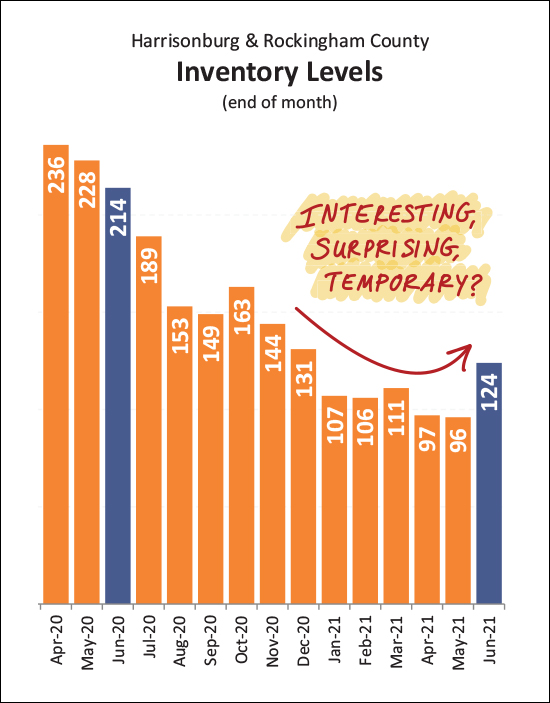

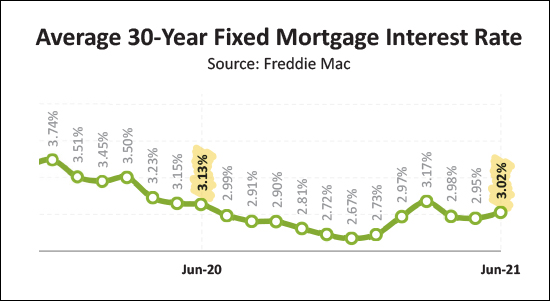

Happy Saturday morning to you! I hope you had a wonderful week. I am still unwinding a bit from a great time at the Red Wing Roots music festival last weekend. I enjoyed seeing many of you there, and if you missed it this year, you should consider attending next year! Back to the here and now, though -- I'm not sure what your weekend looks like -- but thus far mine has involved sipping coffee while my daughter and I have been drawing on our iPads. Admittedly, Emily is creating art, and I'm doodling on graphs and charts as included below - but fun times nonetheless. :-) Regardless of whether your weekend will include relaxing at home, traveling out of state to see family, heading to the beach for a week, or working in the yard -- I hope it is a weekend that includes at least some moments of fun and relaxation. When you get to a few free moments in your weekend, take a look through the remainder of this market update to learn more about what is happening in our quickly moving local real estate market. First, the full PDF of my market report can be found here, second, the featured home shown above is located at 261 5th Street in Broadway and you find details of it here, and now, let's dive in...  Quickly glancing through the numbers above, you might find your eyes opening wider than normal and your eyebrows rising higher than normal. There are some rather surprising things going on in our local housing market. Anyone who is selling their home, or trying to buy their home, knows about these dynamics -- but it's good to put some numbers to it... [1] There were 171 home sales in June 2021, which was 28% more than last June! [2] Thus far this year (we're halfway through it) there have been 736 home sales, which is 19% more than the first half of last year! [3] The median sales price in the first half of this year was $260,000 (!!) which is 11% higher the median sales price during the first half of last year which was only $235,000. [4] Over the past 12 months it has taken a median of six days for houses (that sold) to go under contract -- compared to a median of 15 days during the 12 months before that. So, yeah, lots of homes are selling, at much higher prices than a year ago, and much more quickly! Breaking it down between detached homes and attached (duplexes, townhouses, condos) homes reveals a few other details...  Above you might notice that... [1&3] There have been a 19% increase in the number of detached homes that have sold in Harrisonburg and Rockingham County over the past year -- but a much higher 37% increase in the number of attached homes that have sold! [2&4] The median sales price of detached homes ($285,000) has risen a bit more (14%) over the past year than the median sales price of attached homes ($200,000) which has only (haha) risen 11% over the past year. Those (above) are the long term trends. When we dial in a bit and look at things on a monthly we find that this strong increase in the number of home sales thus far in 2021 has been a month after month after month occurrence...  I have highlighted each of the first six months of 2021 in yellow above, and the corresponding month last year in gray. Now, it certainly bears noting that home sales during some of the months in the first half of last year were likely a bit lower than they would have been otherwise because of Covid, but regardless -- each month of home sales in 2021 has been head and shoulders above the corresponding month of 2020. And now, let's see how this first half of the year stacks up against the first half of the past few years... look for the dark blue bars...  As you can see, with over 700 home sales (736) in the first half of 2021 this year is well ahead of the pace of home sales in the first half of each of the past three years. Looking ahead, it currently seems quite reasonable to think that we would see 1500+ home sales in 2021, with one significant exception. Home sales were tilted towards the second half of the year last year due to Covid, so while we are seeing stronger sales in the first half of 2021 (compared to 2020) things might level out a bit when we get to comparing the second half of 2021 to an abnormally strong second half of 2020. The next visualization is still shocking to me each time I update it with another month of data...  A year ago, 1300-ish buyers were buying homes a year -- now that has risen to 1600+ buyers per year!?! Indeed, it feels like EVERYBODY wants to buy a home... because, keep in mind, this 1600+ per year figure does not include all of the would-be buyers who made offers on houses in the past year but were not successful in securing a contract to buy a house!?! Imagine if there had been enough houses on the market for all of those buyers to have bought as well... The price change (orange line above) over the past year is also somewhat of an eyebrow raiser. The median price has risen $25,000 in the past year. Thus, if you own a home, the value of that property may have very well increased $25,000 over the past year! Admittedly, this varies based on property type, location, price range, etc., -- but suffice it to say -- home values have increased quite a bit in the past year!! Now, just to keep you levelheaded this morning, the next two graphs might make you (and me) say "hmmm..." and "well, let's see what comes next"...  Above, it would appear that the pace of buyers signing contracts has dropped off considerably in June 2021!?!?! ;-) But don't worry too much -- I don't think!? The pace of contract signing in any typical March / April / May is usually quite (!!) active. Last year, buyer activity was significantly suppressed during those normally active months because of Covid -- we didn't know what was happening, what was going to happen, whether the housing market was going to slow down, etc. Then, buyer activity exploded in June of last year and remained quite strong throughout most of the remainder of the year. So, as you look at the decline in June 2021 as compared to June 2020, keep in mind that it was a very unusual June 2020. So, wait and see -- but I don't think June contract numbers mean that our local housing market is slowing down. And now, the second graph to make you say hmmm.....  Inventory levels have risen over the past month -- to the highest level in almost six months! This is somewhat interesting and surprising -- but I do also wonder whether it is temporary. I should also point out that this increase in inventory levels only takes us from super-super-super-super low inventory levels up to super-super-super low inventory levels. In the end, most buyers in most price ranges will still find very few choices of homes on the market at any given time. So, I think this is a wait and see -- as to whether we'll start seeing inventory levels rising again, or if this is a one month blip. Lastly, just to remind everyone of at least one of the reasons why so many buyers would LOVE to buy a house right now -- mortgage interest rates are phenomenally low right now...  Interest rates have been up and down over the past year, falling as low as 2.67% and rising as high as 3.17%. Clearly, though, anything under 4% still has to be described as absurdly low from any sort of a long term perspective. The cost of financing your home purchase will be very, very low if you are fortunate enough to secure a contract to buy a home in 2021. OK, that's all of the charts and graphs I have for you this morning. A few short takeaways from a big picture perspective... BUYERS: Get prequalified now, see new listings quickly, and carefully consider each contract term of your offer to make it as strong as possible. SELLERS: Prepare your home well, price it reasonably, enjoy a short period of time when you have to put up with showings, and enjoy likely being able to select from multiple offers with favorable terms. HOMEOWNERS: Enjoy knowing that your home value is increasing. :-) If you have questions about buying, or selling, or just want to tell me about the exciting plans you have for the weekend ahead -- drop me a line via email or call/text me at 540-578-0102. Otherwise, enjoy the weekend! | |

All The Cool Kids Are Offering To Pay Over Appraised Value These Days |

|

Escalation clauses are so YESTERDAY!?! ;-) Not really -- many/most buyers are still using them -- but they don't matter much if an appraisal is going to rein a sales price back in... Consider these three offers on a fictional home listed for $300K...

Hooray, the house sells for $355K to buyer #3, right? Well, probably... though if it then appraises for $300K, then none of the offer prices over the list price or the escalation clauses really amounted to anything. Thus, these days, many buyers are not only asking themselves how high they are willing to go with an escalation clause -- they are also asking themselves how much above the appraised value they are willing to pay for a house. Consider, then, the following three offers on the same house listed for $300K...

Clearly, a seller would toss out the first offer. Some sellers would then immediately jump to the third offer, since it is $10K higher than the second offer -- but -- that depends on your best guess as to the appraised value of your house. If you listed your home for $300K, presumably you think it should sell for around $300K and thus might appraise for $300K. If that is the case, then the second offer above is likely a better choice for you. That offer would stay at $325K even if the appraisal came in at $300K, whereas the third offer would start off higher at $335K but would then drop to $310K if the appraised value were $300K. So, as a buyer -- consider how much above the appraised value you are willing to pay for a house when you are competing with multiple other offers -- and as a seller, consider how an appraisal will impact each offer that you might accept. | |

Sometimes, Appraisals Are Reining In High Contract Prices, And That Can Keep Sales Prices From Getting Out Of Hand |

|

Let's say there's a house that comes on the market for $300K. Every Realtor and buyer that looks at it agrees that it is worth $300K because three identical houses sold the prior day for $299K, $300K and $301K. ;-) The house immediately has LOTS of interest, LOTS of showings and LOTS of offers. The house ends up going under contract for $335K. Wow! Now, a few things can happen from here...

So -- even if buyers are willing to (per their offers) pay higher and higher and higher prices for houses -- regardless of what other buyers recently paid for similar houses -- the appraisal process is still, often but not always, keeping things in check and preventing prices from skyrocketing too quickly. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings