Market

| Newer Posts | Older Posts |

New Home Construction (For Sale or Rent) Is Likely The Only Path Towards A More Balanced Local Housing Market |

|

Over the past two (to five) years the local real estate market has seen... [1] More and more homes selling. [2] Higher and higher sales prices. [3] Higher and higher rental rates. Over the past six months, mortgage interest rates have increased significantly (from around 3% to nearly 6%) and yet... [1] We're still seeing just about the same number of homes selling. [2] Sales prices keep climbing. [3] Rental rates keep climbing. One conclusion that I keep coming back to in recent weeks and months is that... There are more people who want to live in Harrisonburg and Rockingham County than there is housing in which they can live. Generally speaking, when demand for housing exceeds supply, prices go up... that's what we're been seeing over the past few years. So, what's the answer? If there are 134,000 people living in Harrisonburg and Rockingham County, but there are 140,000 or 150,000 who would like to live here... ...the only path towards a more balanced housing market is to have... ...more homes. So, whether it's new homes being built to be sold... or new homes being built to be rented... that will help bring balance to our local housing market. It's certainly not clear how much more housing is needed, in what locations, or of what property types, sizes, or prices... but overall, more housing needs to be created (built) to account for the ever increasing number of people who would like to live in this area. | |

An Early Look At June 2022 Home Sales |

|

As mortgage interest rates rise, many continue to wonder whether it will significantly slow down the amount of home buying activity we are seeing in our local market. It's a reasonable thing to wonder about. Here's a quick preview of how things went last month (June 2022) compared to the same month a year ago... June 2021 Mortgage Interest Rate at Start of Month = 2.99% Closed Home Sales in Harrisonburg & Rockingham County = 175 Contracts Signed = 143 June 2022 Mortgage Interest Rate at Start of Month = 5.09% Closed Home Sales in Harrisonburg & Rockingham County = 168 Contracts Signed = 129 Conclusions By the numbers... there were 4% fewer home sales this June compared to last June... and 10% fewer contracts. So, maybe (?) things are slowing down, a bit? That said, in many months over the past few years home sales seem to be constrained by the number of sellers willing to sell, and not so much the number of buyers interested in buying. Stay tuned for further updates as I take a fuller look at the market over the coming week. | |

Is The Local Real Estate Market Softening? |

|

Anecdotally, it seems like a maybe the local real estate market is softening... but the data certainly doesn't show it yet. Here are a variety of current market anecdotes for you... [1] Many new listings are still having a flurry of showings and multiple offers and are selling at or above the list price with very few contingencies. [2] Sometimes a hot new listings receives just two offers instead of the five to eight that might have been anticipated. [3] Sometimes, new listings are coming on the market and sitting for a week or so before generating an offer. [4] Sometimes sellers start at one asking price and adjust it down a few weeks later after not having received any offers. And some data... [5] Thus far (Jan - May) in 2022, 4.75% more homes have sold than last year. So... is the market softening? Items 1 and 5 above would indicate... no. Items 2, 3 and 4 would suggest... maybe. I'll keep monitoring the data to see if it starts to show anything different... but for now, I'm leaning more towards believing the story told by the data more than the story told by the occasional anecdote. | |

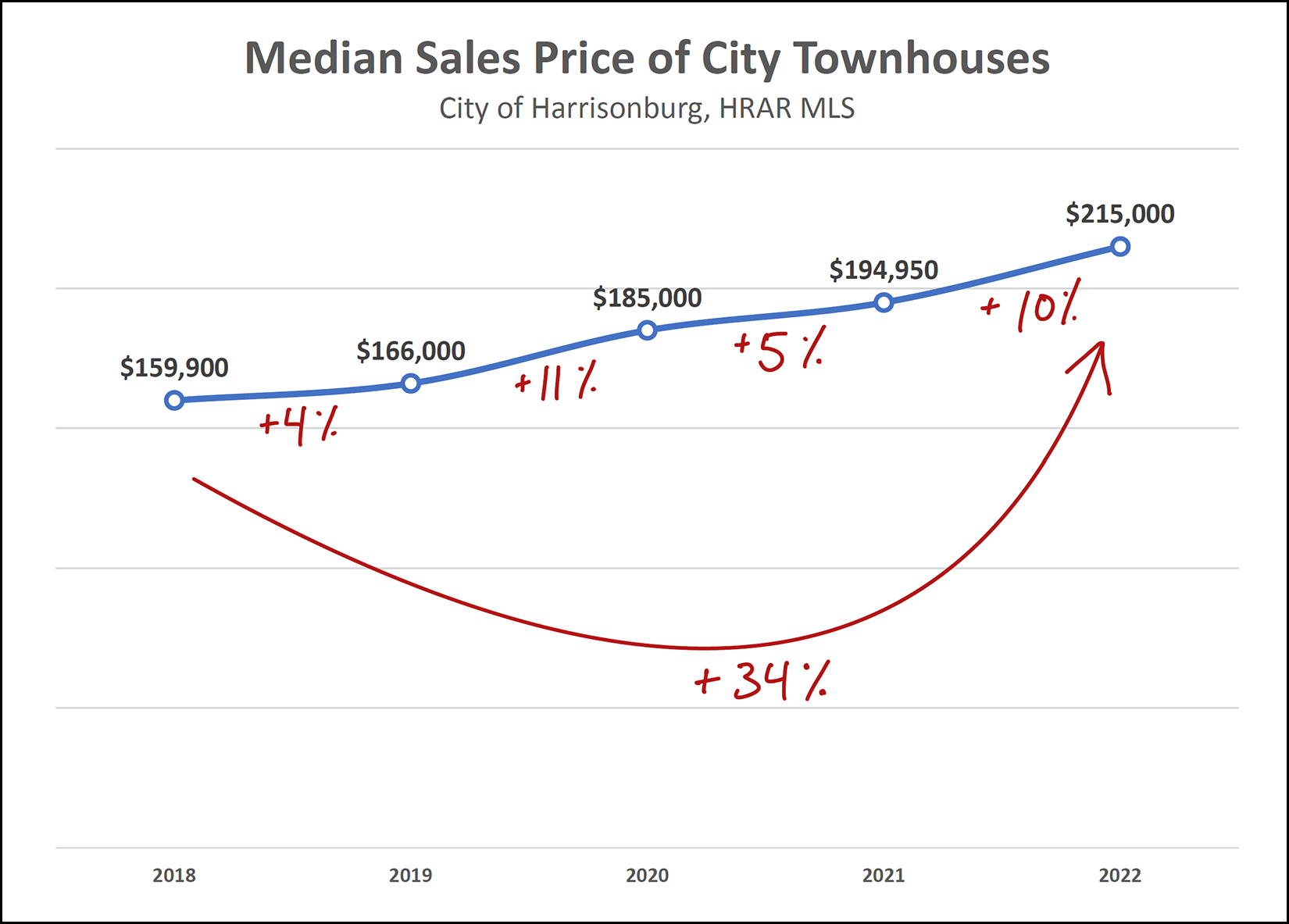

City Townhouse Sales Prices Increase 34% Over Four Years |

|

Townhouse values in the City of Harrisonburg have certainly increased rather quickly over the past few years... As shown above, we have seen a 4% to 11% increase in median sales prices for each of the past four years. There has been an overall 34% increase in the median sales price since 2018. If you happened to buy a townhouse a few years ago, you'll likely be in great shape if you're selling now or soon! Also helping this segment of our local housing market is that most new townhouses are now in the $250K+ price range. | |

If You Expected The Local Housing Market To Slow Down Drastically, This Probably Is Not What You Meant |

|

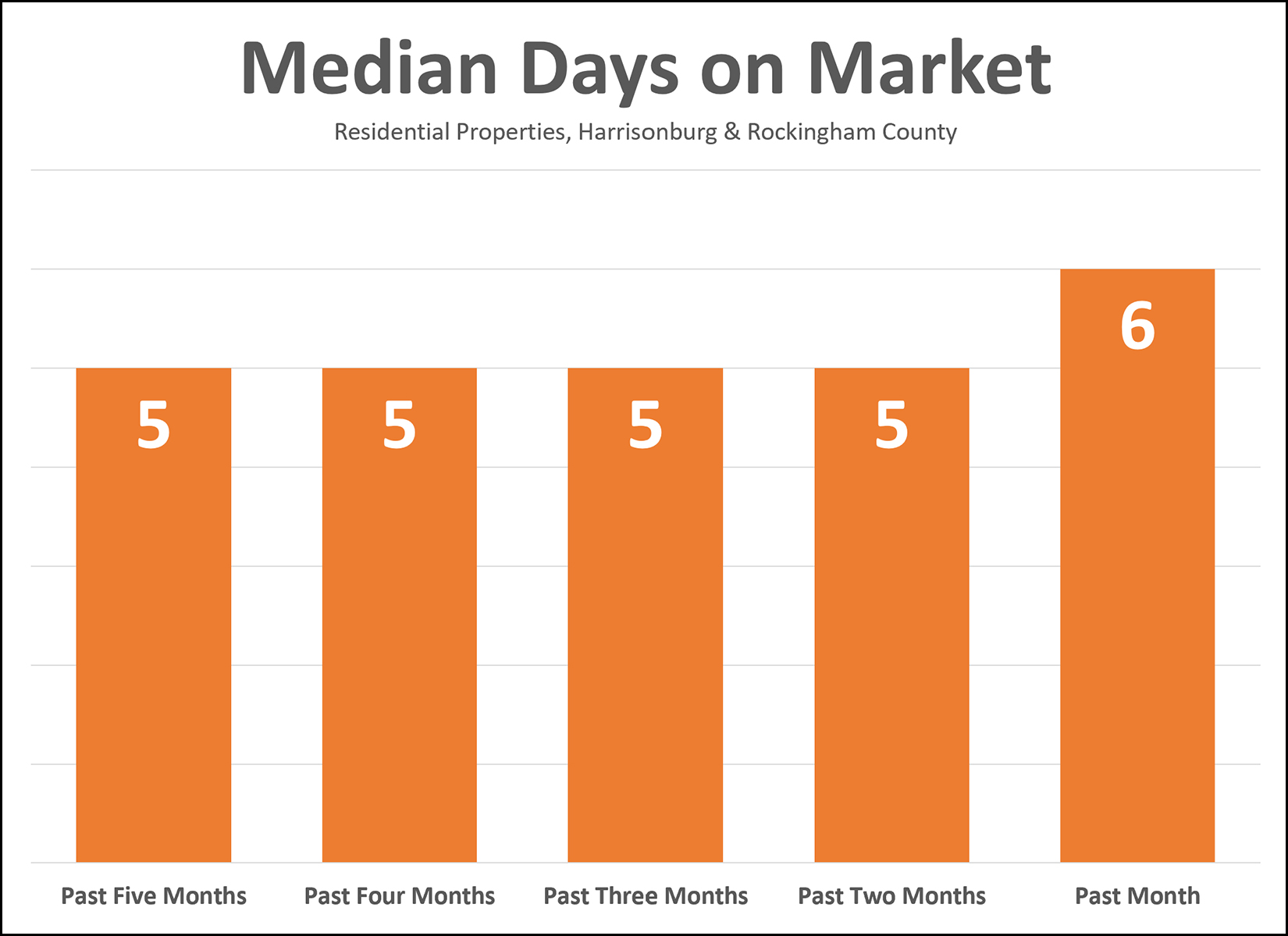

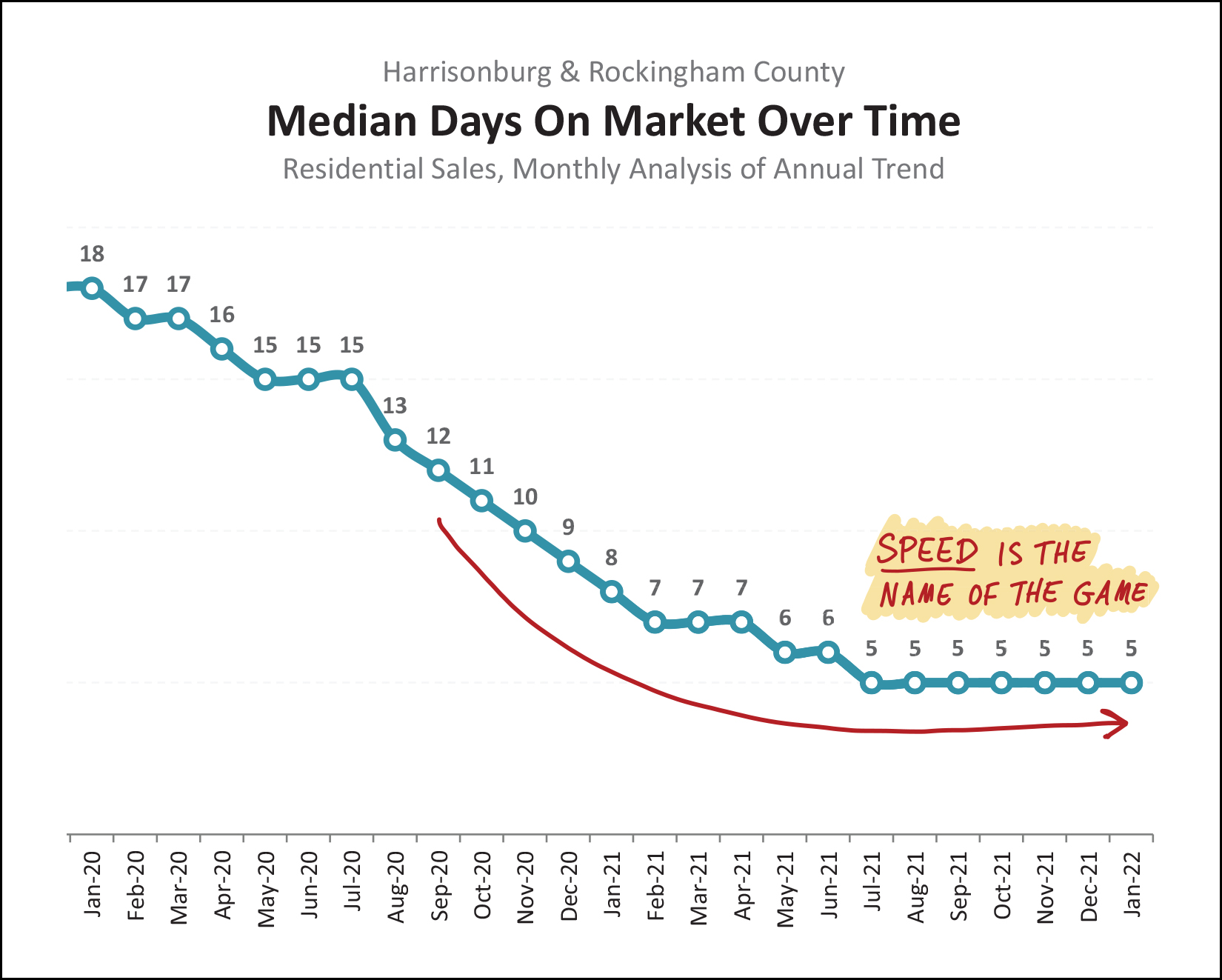

Two years ago the "median days on market" was 15 days in Harrisonburg and Rockingham County. By a year ago, it had dropped to a median of six days on the market. Given that interest rates are rising, I thought perhaps we might be seeing this metric (how quickly homes are going under contract) start to rise in Harrisonburg and Rockingham County. And I was right! Things are SLOWING DOWN! ;-) Wink, wink, nudge, nudge. The graph above starts by looking at the median days on market over the past five months... the median was five days. Then, over just the most recent four months... still a median of five days. Next, over just the past three months, when interest rates started to rise... still a median of five days. Well what about over the past two months... still a median of five days. But, ah ha! I finally found it. The sign the market is really slowing down. The median days on market has increased 20% (!!!!) when we get to that last data point... the median days on market over the past month is... SIX days! :-) So, bottom line, did things go under contract more slowly over the past month than in previous months? Oh, yes, by one day. Is it a sign that the market is slowing? I suppose so. Barely. We'd need to see more of a change than what is described above and shown above to conclude that buyer enthusiasm is measurably declining. Stay tuned to see if that median days on market figure will scrape and claw it's way back up to SEVEN days sometime in the next few months. | |

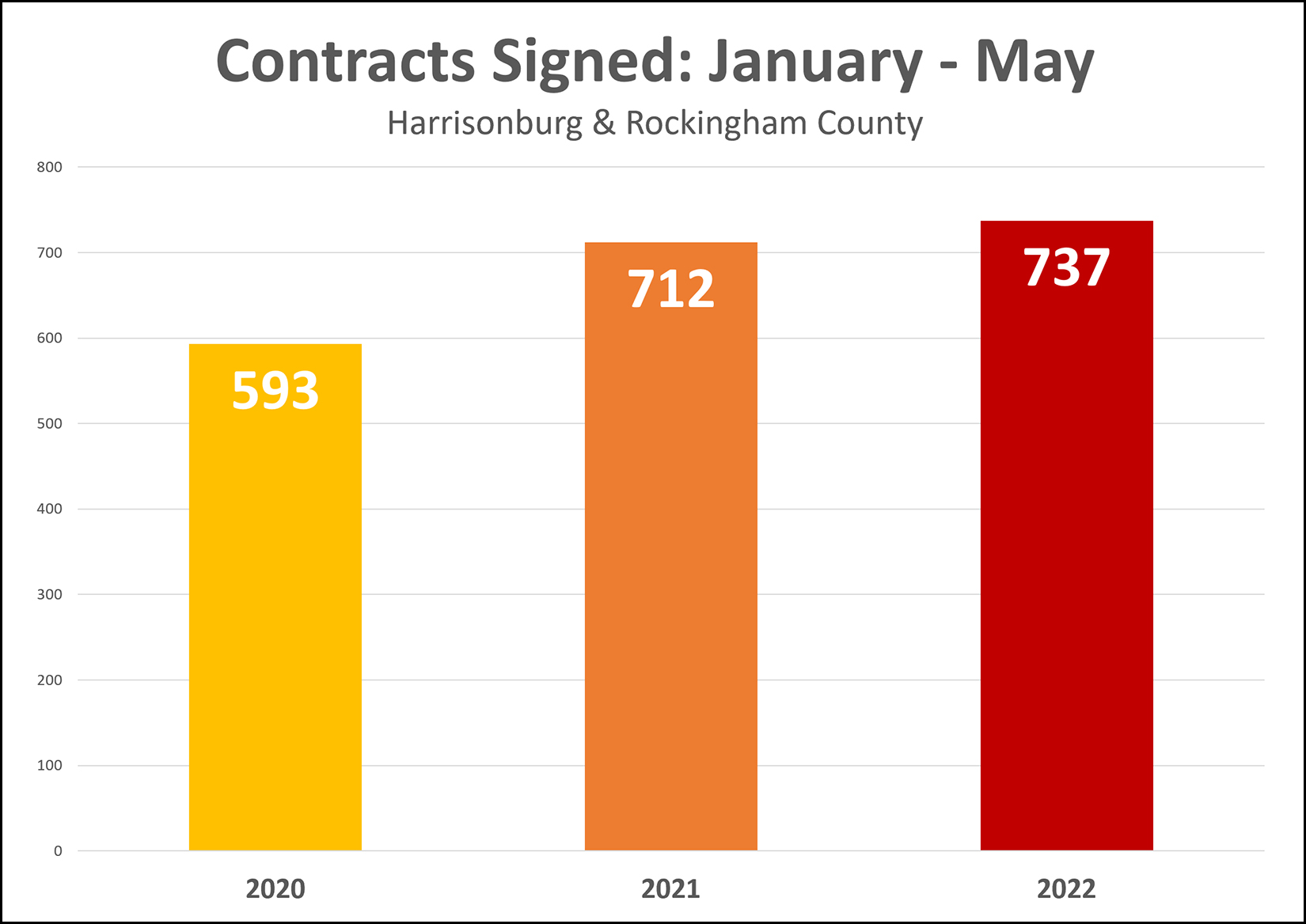

Strong First Five Months of Contract Activity in 2022 |

|

Look out... before you know it, I'll be saying the year is halfway over!? As usual, the months are flying by in 2022 and we are now looking backwards at a full five months of contract (and sales) activity. The graph above illustrates how many buyers (and sellers) have signed contracts to buy (and sell) homes in the first five months of 2020, 2021 and 2022. As you can see, the pace of home buying activity increased quite a bit between 2020 and 2021... and this year, it has increased even further. Higher mortgage interest rates in 2022 might slow down overall home sales activity, but thus far we don't seem to be seeing it here locally. | |

Are We Seeing A Big Slow Down In Home Sales Activity Locally? |

|

If you read much national news you'll see plenty of headlines that say the housing market is slowing down... the housing market peaked... slower times are ahead for housing markets across the country. I'm sure that is all true, generally, nationally, and maybe in many markets. But, real estate is and has also been, local. Will the pace of home sales slow down in our local market? Maybe so. Will prices stop climbing as much as they have been in recent years? Maybe so. Are either of those things happening yet? Are we seeing a big slow down in home sales activity locally? It seems not. Properties going under contract in the past 30-ish days (April 25 - May 24) this year compared to last... Last Year = 170 contracts This Year = 162 contracts If things start changing in our local market, I'll be certain to be writing about it here... but just because you're reading it in the national news doesn't mean it is necessarily happening in Harrisonburg and Rockingham County. | |

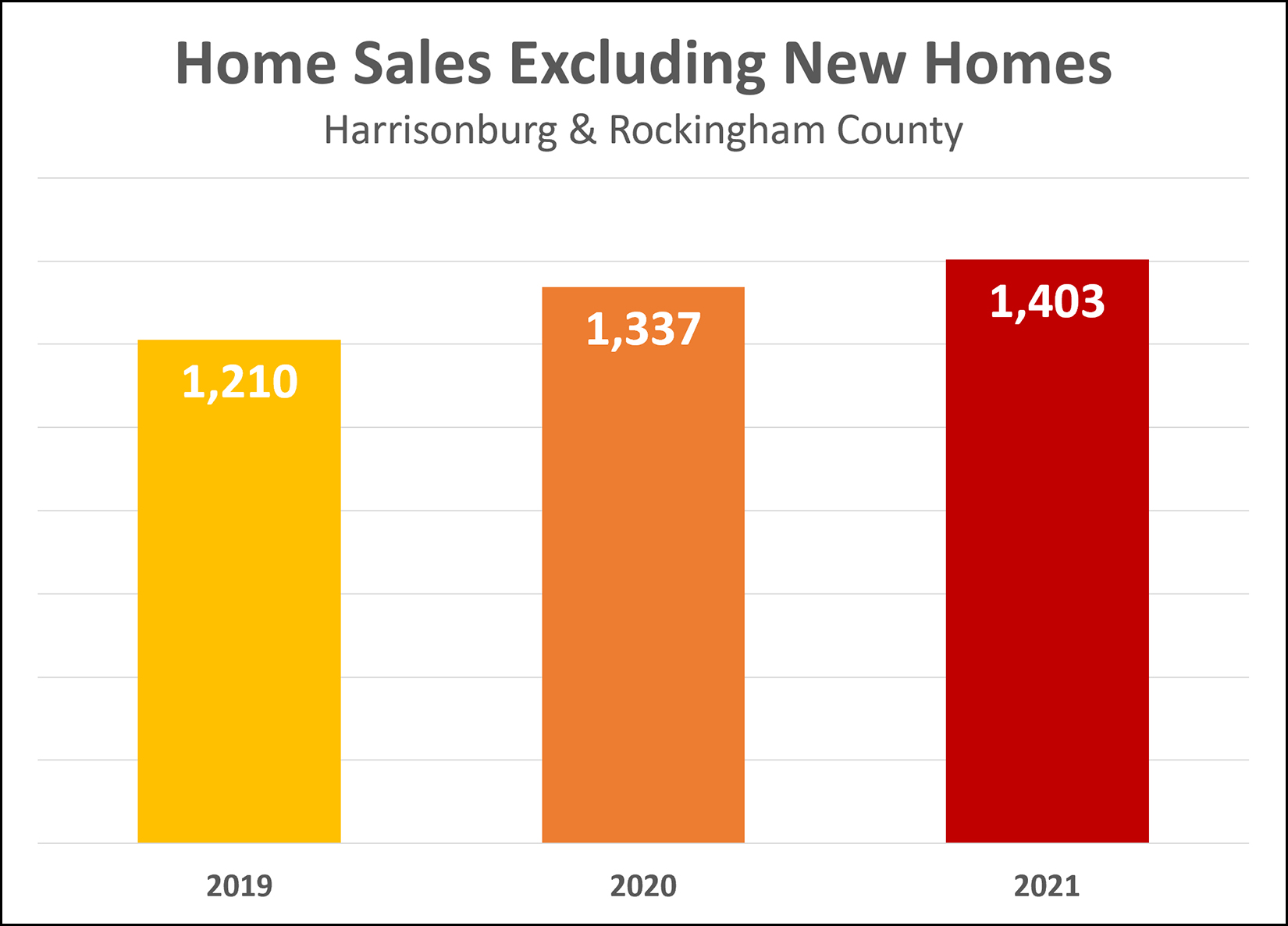

Sales of Not New Homes Are Increasing Too |

|

What do we call homes that are not new homes? Resale homes? Used homes? Existing homes? Previously owned homes? :-) Last week I pointed out that we are seeing a rapid increase in the sale of new homes in our market... a 39% increase in 2020 and a 68% increase in 2021. One might have thus wondered if ALL of the increases in our local area home sales can be attributed to new home sales. Well, the answer seems to be... no. As shown above, sales of not-new homes are increasing as well... a 10% increase in 2020 and a 5% increase in 2021. | |

Reflecting On Large, Fast Changes In Mortgage Interest Rates |

|

For at least the past five years, I have remained convinced that mortgage interest rates would start rising... anytime. But month after month, year after year, interest rates did not rise... instead, they fell. But 2022 has been a bit different. If you had asked me anytime in the past five or ten years what would happen if mortgage interest rates increased from 3% to 5% in the course of just four months, I likely would have told you that the market would likely immediately and significantly slow down... not to a screeching halt... but certainly to a slower pace than before that enormous increase in mortgage interest rates. But, here we are, on the other side of rapidly increasing mortgage interest rates for the past four months, and the market seems to still be, doing pretty similar things to what it was doing before mortgage interest rates started rapidly climbing. Homes are still going under contract very quickly. Buyers are still often competing with multiple offers, including escalation clauses and waiving contingencies. Prices keep climbing. So, have the rising mortgage interest rates had any impact at all on our local housing market? I'd say yes. 1. Some would-be home buyers are no longer able to afford the homes they would like to buy. 2. I think some homes might be receiving two or three offers now instead of six or eight that they might have received before. 3. Some would-be sellers might not be selling after all as they see how their buying budget will be affected by higher mortgage interest rates. So, there have been changes in our local market as a result of these rapidly rising interest rates, they the higher rates have had a much narrower impact than I would have assumed in years gone by. One other point of trivia... the last time the average mortgage interest rate was 5.25% (or higher) was... way back in August 2009... almost 13 years ago! | |

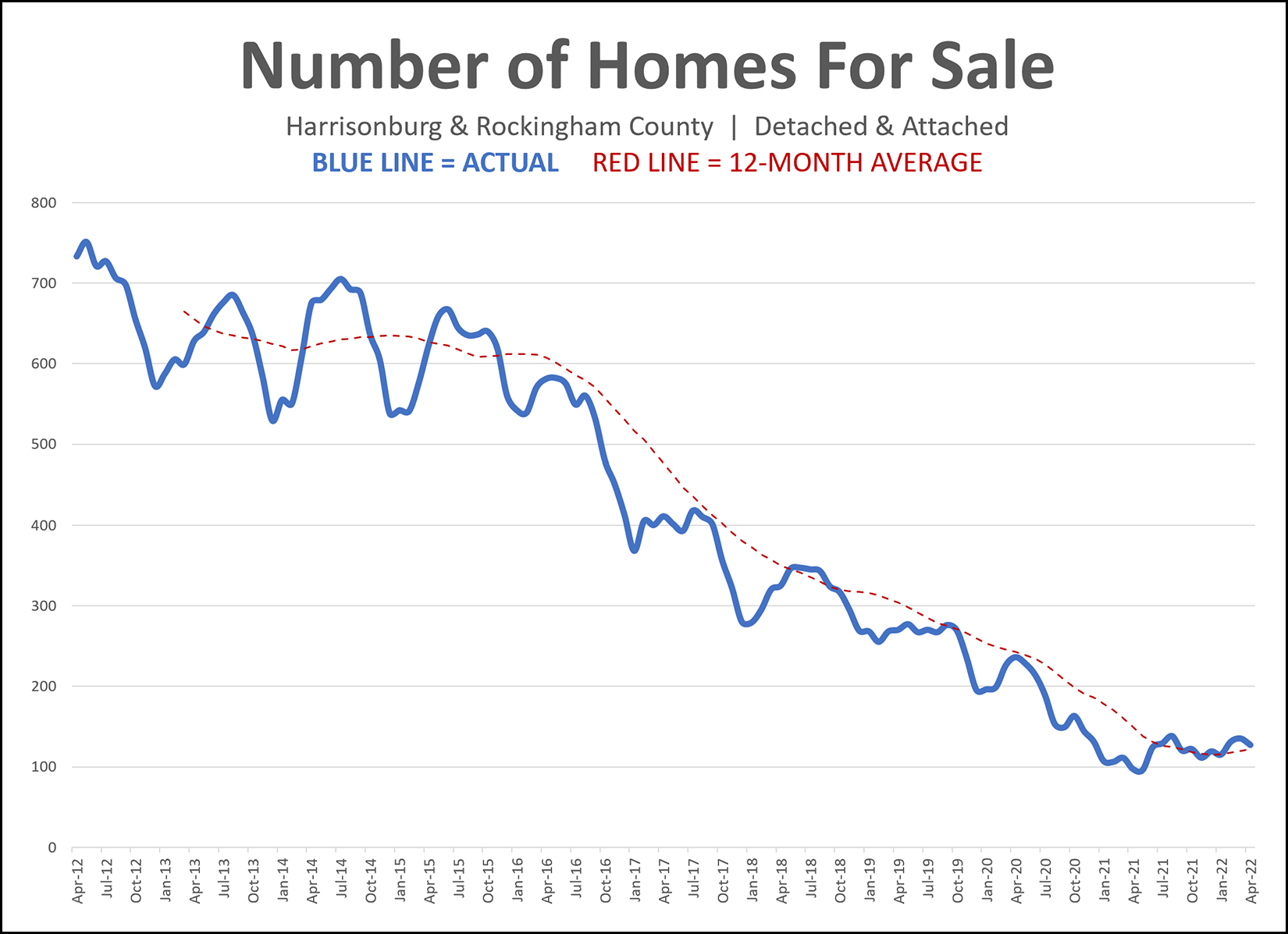

Inventory Levels Have Been Dropping For Almost An Entire Decade |

|

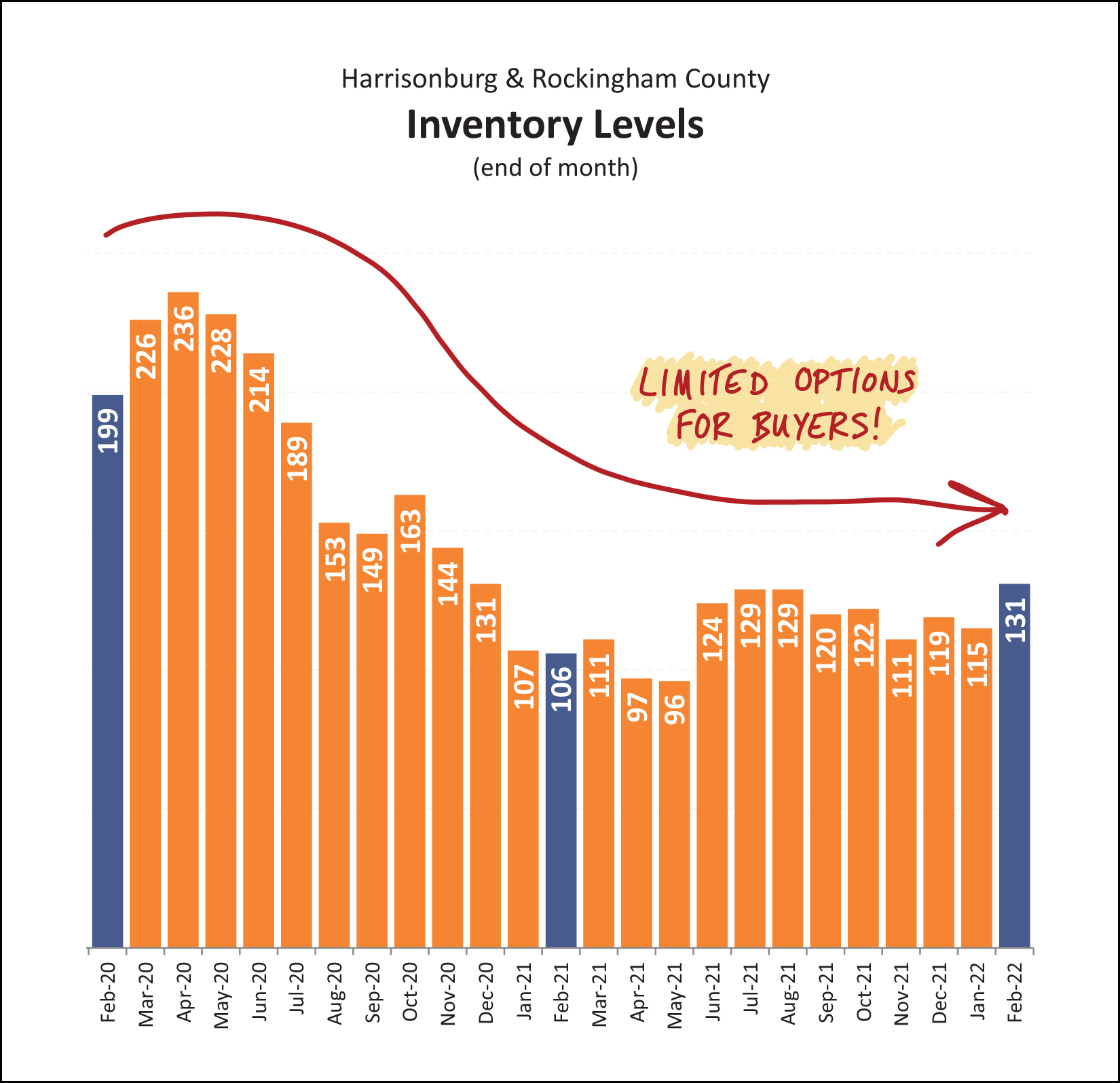

At the end of last month there were only 127 homes for sale in Harrisonburg and Rockingham County. Five years ago, at the end of April 2017, there were 411 homes for sale. Five years before that, at the end of April 2012, there were 733 homes for sale. Home buyers over the past year have had fewer options of what to buy at any given point in time than ever before in the past decade, and possibly ever before, ever. The low inventory levels don't mean fewer buyers are buying -- in fact, more buyers are buying on an annual basis than ever before. The low inventory levels are an indication that there is much more buyer demand than seller supply, so new listings get scooped up (go under contract) within a matter of days -- thus, not contributing to the inventory levels at the end of the month. | |

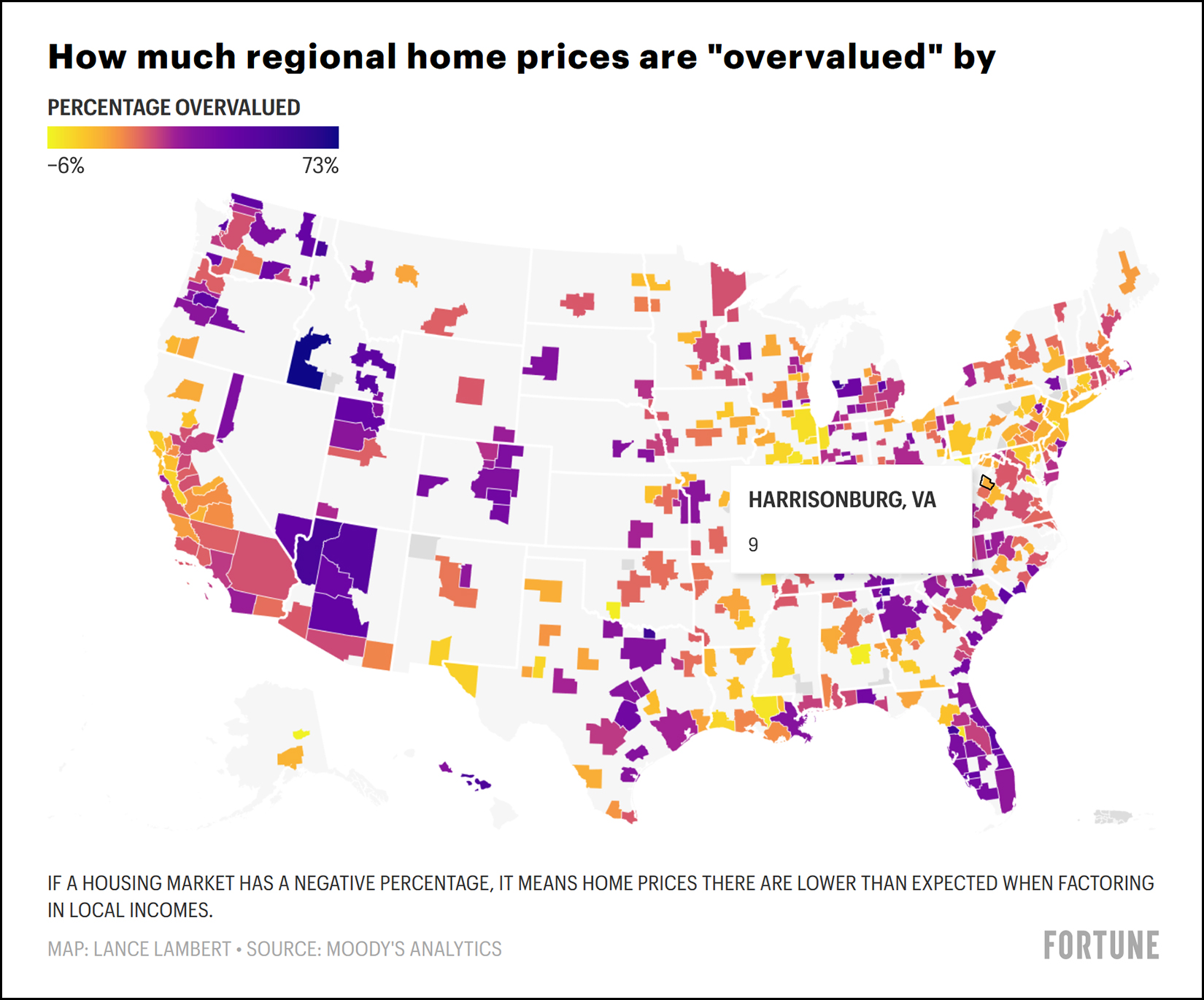

Is The Harrisonburg Housing Market Nine Percent Overvalued? |

|

There's a good article to read over at Fortune from earlier this week... In a nutshell... [1] Moody's Analytics believes the housing boom will wind down in the coming year, perhaps leading to no year-over-year home price growth a year from now. [2] Zandi, chief economist at Moody's, does not think we will see large price corrections, but some markets might. [3] Moody's ran an analysis of local housing markets within the context of local income levels to estimate which markets might be overvalued. [4] Of the 392 metropolitan statistical areas they studied, 149 markets are overvalued by at least 25%... with a high of 73% in Boise. As you can see from the map above (embedded in the article at the link above) the analysis by Moody's indicates that the Harrisonburg market may be 9% overvalued within the context of income. Read the entire article for much more commentary and further insights... | |

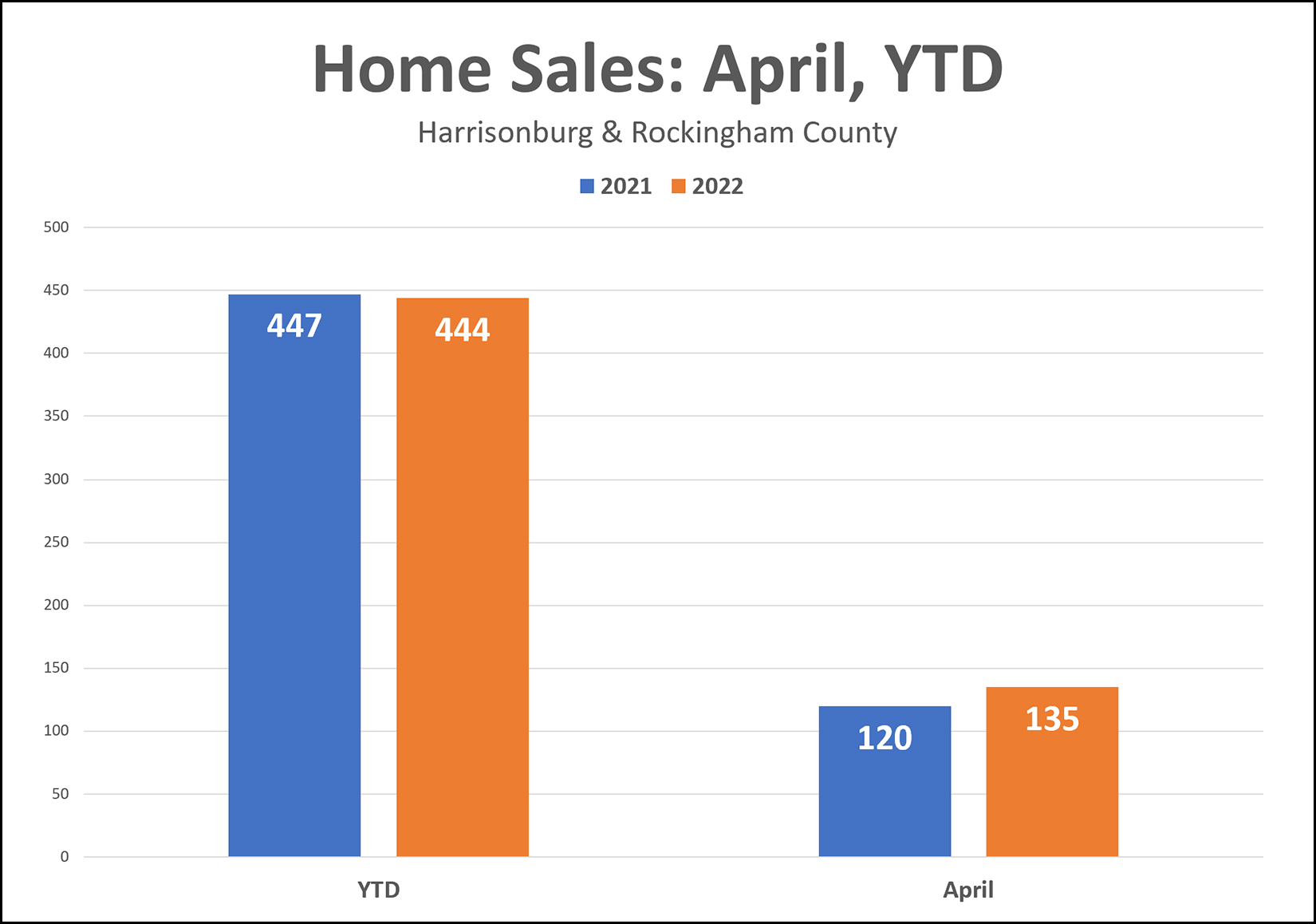

If Home Sales Are Going To Slow, April Did Not Show It |

|

Many wonder or suspect if home sales will slow in 2022 because of rising mortgage interest rates. That is certainly just one of the reasons why home sales could slow -- they could also slow because there aren't enough homeowners willing to sell their homes. Low supply = slow sales. Above, you'll see that we've seen just about the same number of home sales this year as last year during the first four months of the year. Furthermore, home sales this April were stronger than last April!? Finally, there are likely still some April home sales that closed this past Friday that aren't showing up in the MLS yet. So... if home sales are really going to slow down in 2022, it doesn't seem that April sales figures are showing that. Maybe things will slow down in May? Or maybe not! | |

Home Buyer Demand, While Possibly Reduced Due To Higher Interest Rates, Seems To Still Exceed Supply |

|

This is totally anecdotal at this time, so I'll see what the data seems to indicate when I compile my market later this month, but thus far.. Home Buyer Demand, While Reduced Due To Higher Interest Rates, Seems To Still Exceed Supply That is to that I suspect... [1] Buyer demand is decreasing, somewhat, due to higher mortgage interest rates. [2] The amount of buyer demand in the market is still greater than the amount of seller supply. Case in point - the anecdote - would be two very (!!) similar properties that came on the market over the past few months... The first property came on the market when the average 30-year fixed mortgage interest rate was around 4.3%. There were six offers within 72 hours. The second property came on the market when the average 30-year fixed mortgage interest rate was around 5.1%. There were three offers within 72 hours. So... yes, I think higher rates will reduce buyer demand, but that reduced demand might very well continue to exceed available supply for some time to come! | |

Home Price GROWTH Seems Likely To Decline In 2022 |

|

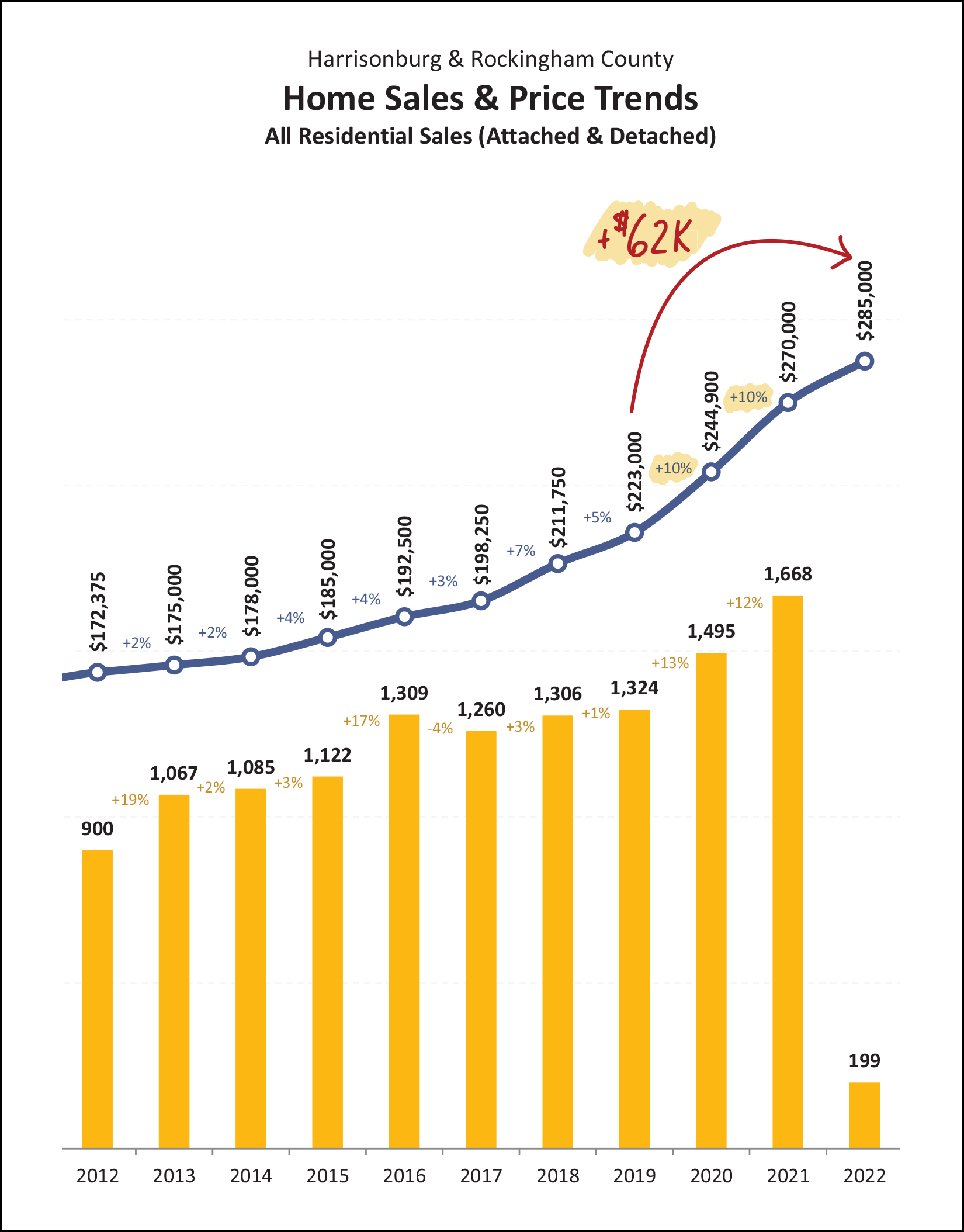

It seems likely that we will see a decline in home price GROWTH in 2022. Here are the changes in the median sales price over the past five years... 2017 = +3% 2018 = +7% 2019 = +5% 2020 = +10% 2021 = +10% While I don't think we will see the median home PRICE decline in 2022... ...I do think we will see the GROWTH in the median home price decline. Given quickly rising mortgage interest rates, it seems more likely than not that we will NOT see another 10% increase in the median sales price of homes in Harrisonburg and Rockingham County this year. I think we are likely to still see the median sales price increase, but perhaps not as quickly as it has over the past two years. | |

Is FOMO Fueling Rising Home Prices? |

|

The Federal Reserve Bank of Dallas indicates that there are signs of a brewing housing bubble... and FOMO (fear of missing out) might be a contributing factor. You'll find the article from the Dallas Fed and some accompanying graphs here... Some summary points from that article... [1] If lots of home buyers believe current, large, housing price increases will continue, further and stronger buying can be fueled by FOMO - the fear of missing out - which can drive prices up even further. [2] The Dallas Fed calls this phenomenon described above "expectations-driven explosive appreciation" or "exuberance" and it seems to be happening in many housing markets right now. [3] The U.S. housing market has shown signs of exuberance for more than five consecutive quarters. [4] Since the beginning of 2020 there has been a divergence between home prices and rental rates... home prices have been going up much more quickly than rental rates. [5] Much of the data the Dallas Fed analyzed shows signs of "abnormal U.S. housing market behavior" -- which probably is not a surprising descriptor for anyone who has been in the market (buying or selling) over the past few years. [6] Factors contributing to the abnormal market behavior seem to include historically low interest rates, pandemic-related fiscal stimulus programs, Covid-19-related supply-chain disruptions among other factors. So, that was most of the worrisome parts of the article, but this little paragraph towards the end is somewhat of a reassuring finale... "Based on present evidence, there is no expectation that fallout from a housing correction would be comparable to the 2007-09 Global Financial Crisis in terms of magnitude or macroeconomic gravity. Among other things, household balance sheets appear in better shape, and excessive borrowing doesn’t appear to be fueling the housing market boom." So... it's possible that there is a housing bubble (though every local market is different and will behave differently) and if there is a bubble, prices could flatten out or decline, but if they do it doesn't seem likely that it will have the same impact as the 2007-09 housing and financial crisis. Happy Monday!? ;-) P.S. Read the actual article yourself... it has some great additional commentary and context... | |

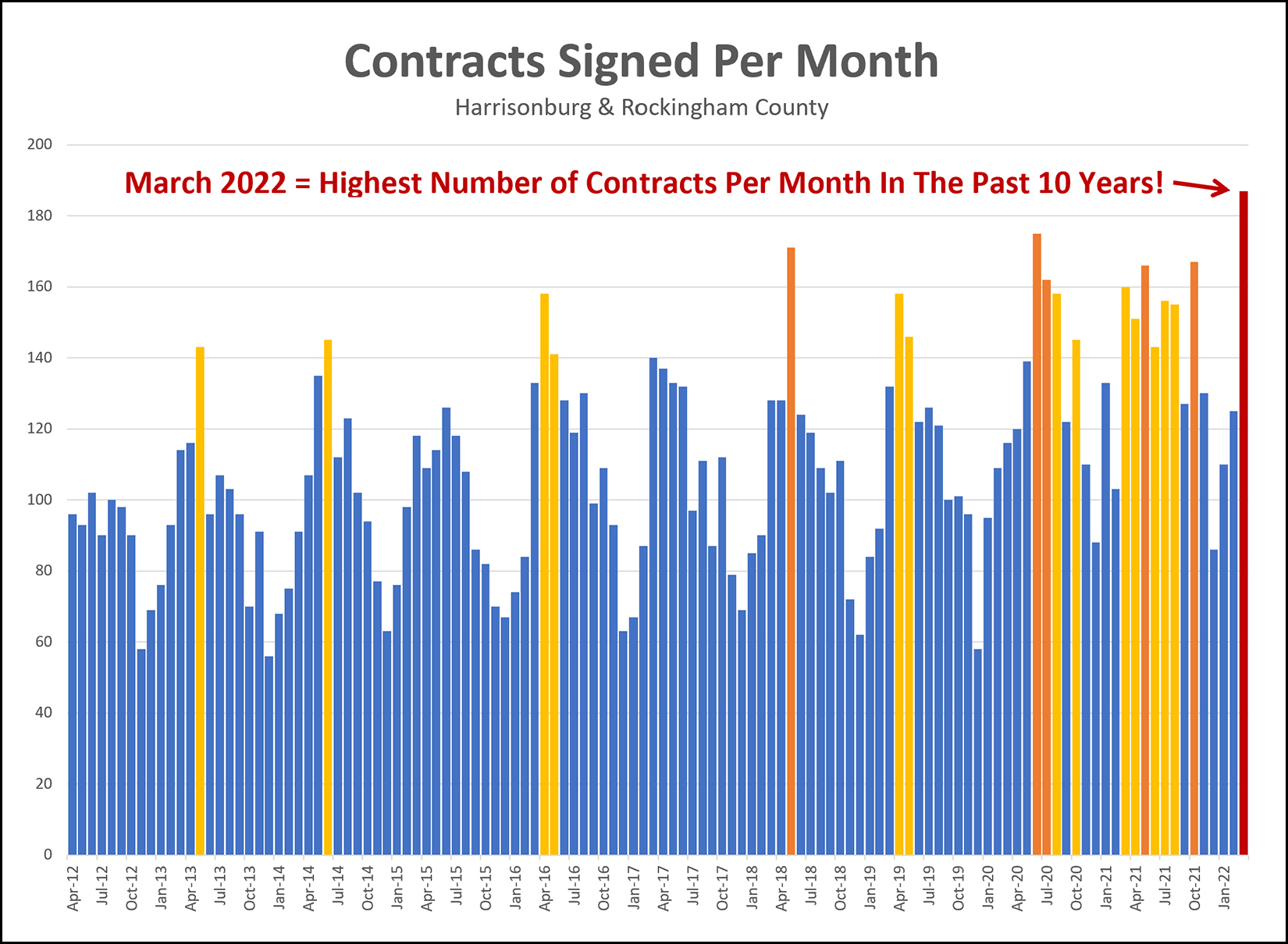

More Contracts Were Signed In March 2022 Than In Any Month In The Past Decade |

|

Wow! I knew that a lot of homes went under contract last month when I compiled my market report but I hadn't yet put it in a larger context. During March 2022, contracts were signed on a total of 186 properties in Harrisonburg and Rockingham County. Looking back an entire decade, there has never been a month when more contracts have been signed! In fact, there have only been a handful of months (five) when more than 160 contracts were signed. So, what gives? Why so much contract activity? [1] The market is strong, silly, sellers are excited to sell, buyers are excited to buy. [2] For some reason, more sellers than usual waited until March to list their homes (instead of January or February) causing an unexpected peak in March 2022. [3] Sellers are buyers are seeing interest rates rising and sellers want to go ahead and sell before rates get too high and buyers want to go ahead and buy before rates get too high. Maybe 1 and 2 and 3? ;-) Whatever the reason, there isn't any doubt that March 2022 was a record setting month for buyer and seller activity in the Harrisonburg and Rockingham County real estate market. | |

If Higher Mortgage Interest Rates Will Cause The Market To Shift, It Does Not Seem To Be Happening Yet |

|

In theory, as mortgage interest rates increase, some buyers will be priced out of considering some homes that they would like to purchase. If enough buyers are priced out of being able to afford their preferred home, maybe we will see fewer offers on homes listed for sale. If there are fewer offers on homes offered for sale, then perhaps buyers won't keep having to pay so much over the asking price. If buyers aren't paying so much over the asking price, maybe the 10% per year increase in median sales price in our area will start to move back to a more reasonable 3% to 4% per year. But, thus far, these are all just theories and possibilities, not actualities. Despite significant increases in mortgage interest rates over the past month (and 3 - 4 months) we don't yet seem to be seeing a decline in the amount of buyer interest in many or most new listings. I'll keep wondering if we will see that shift happening... and I'll keep crunching the numbers to see if there is evidence that it is happening... but if you are holding off on buying a home right now because you are absolutely certain that a shift is coming... it might be a long wait. | |

Homeowners In Harrisonburg, Rockingham County, Likely Improved Their Net Worth By Approximately $25,000 Over The Past Year |

|

This fits into the category of...

The median value of a home sold in Harrisonburg and Rockingham County was $244,900 in 2020. One year later, in 2021, it was $270,000. This marks a $25,000 increase in the value of a median priced home over the course of a single year. So, if you have owned a home in Harrisonburg or Rockingham County over the past year you have likely seen a $25,000 increase in your net worth... or more if you own a home valued above the median sales price... or less if you own a home valued lower than the median sales price. So... Homeowners: Be thankful for the value of your home increasing so heartily over the past year. Would Be Home Buyers: Keep trying. It's a competitive market, but it is worth continuing to try to buy a home. Everybody Else: Some people may not be in a position to buy a home because of their job or income situation, because they are working to pay off debt, because they might need to move within the next few years, or for any number of other reasons. That's OK. But if you haven't bought a home and aren't planning to... but you could afford to do so, and you plan to live here for awhile... maybe we should chat. | |

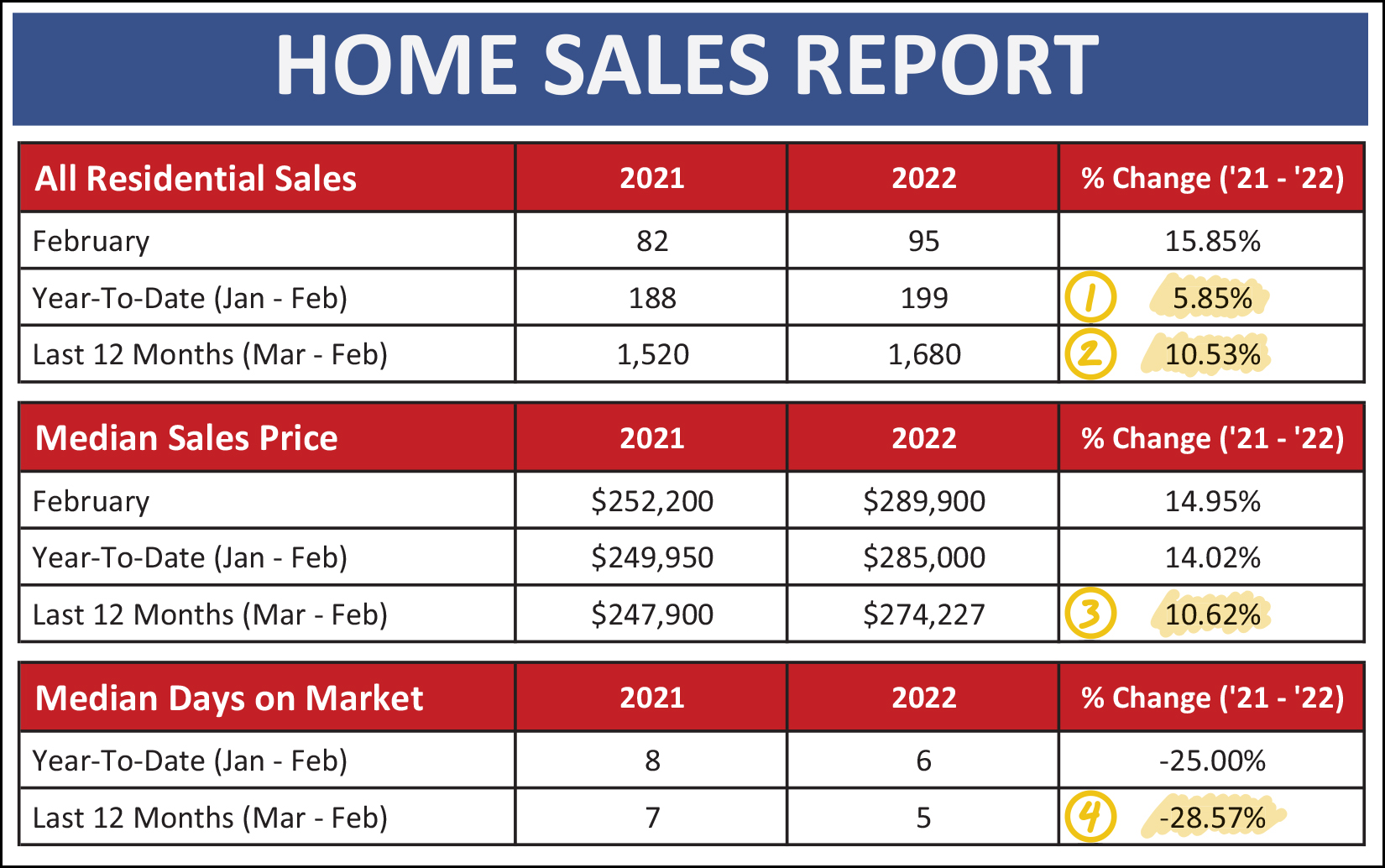

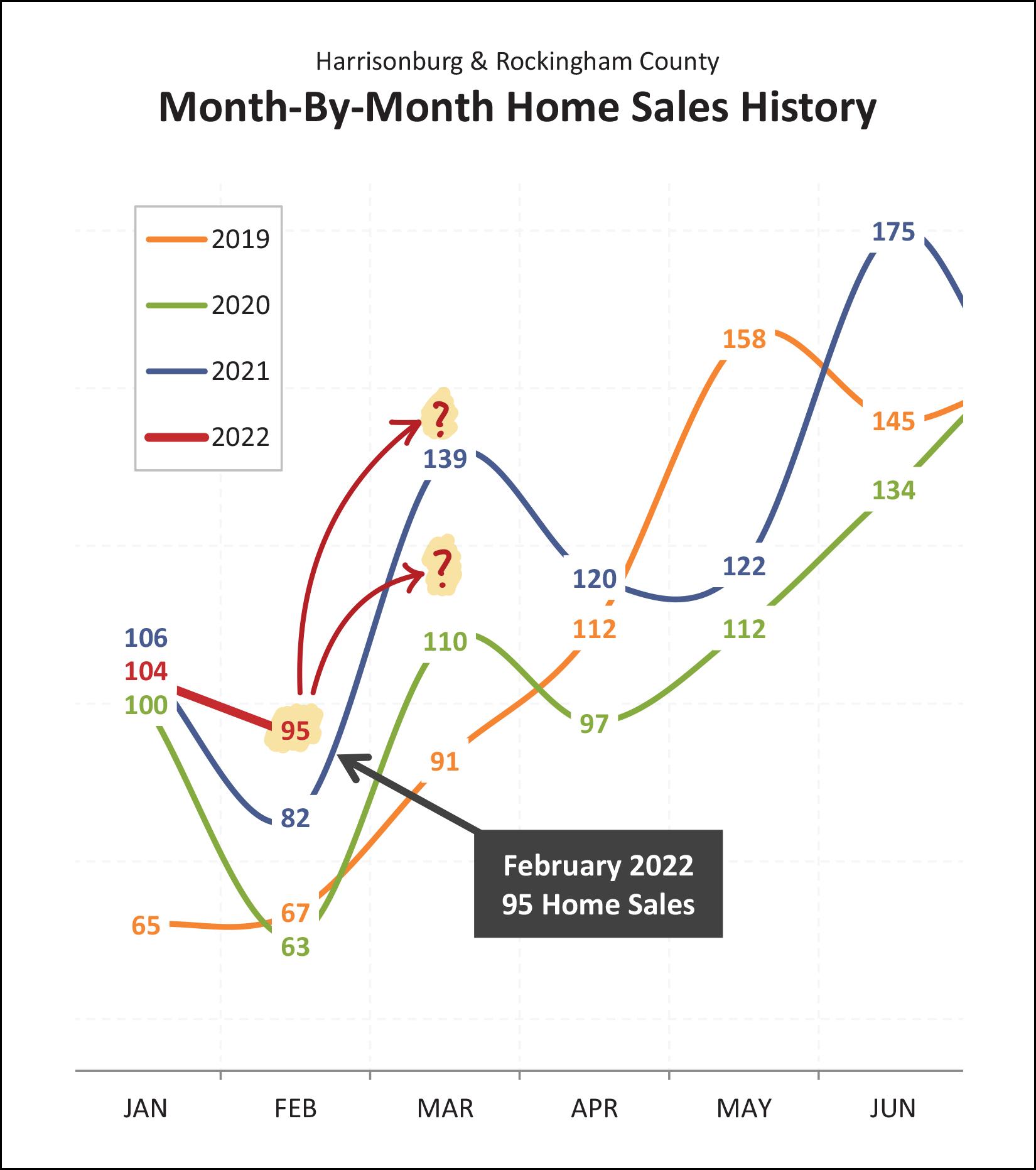

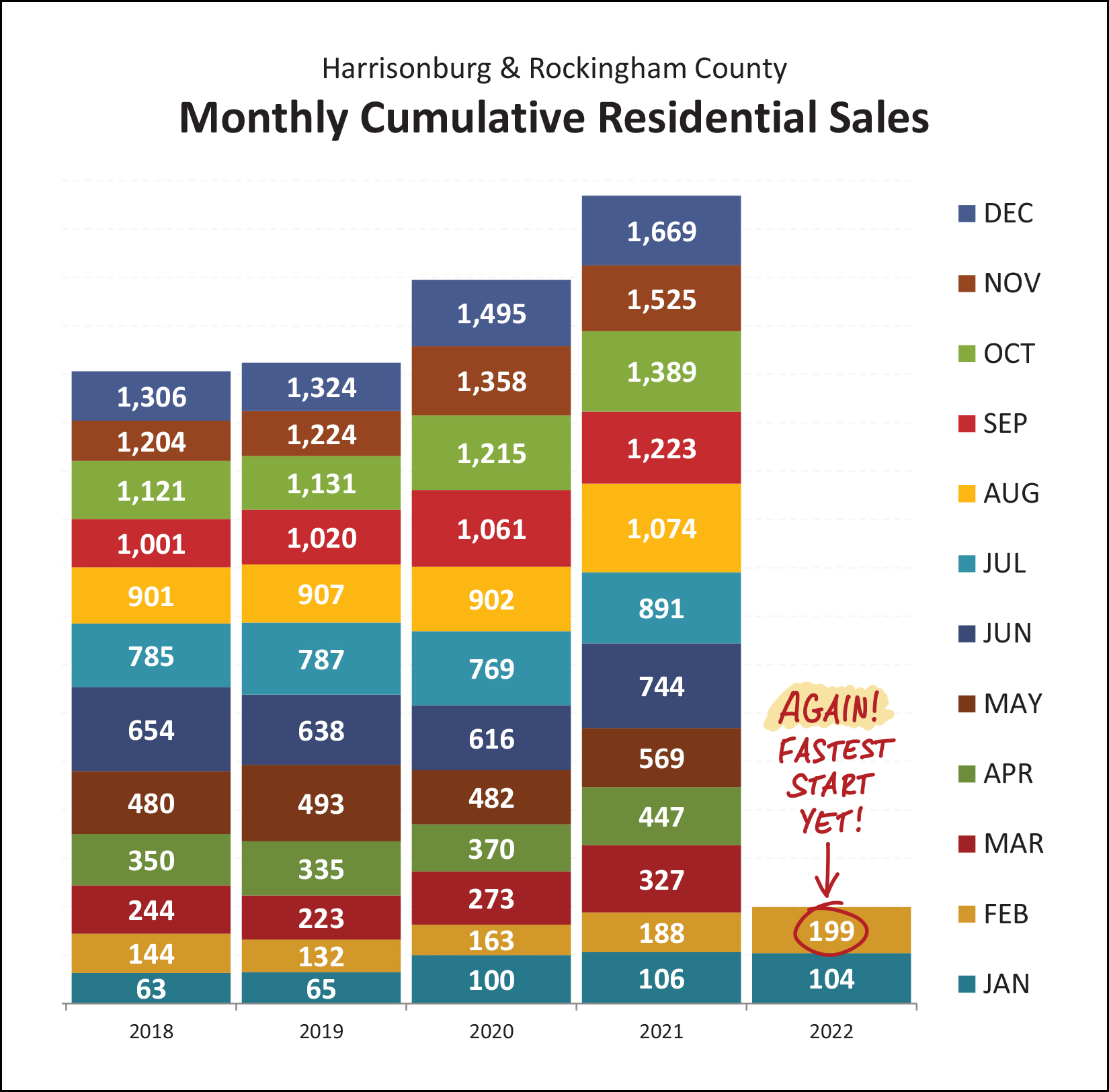

Home Sales Rise Again, Along With Prices, In February 2022 |

|

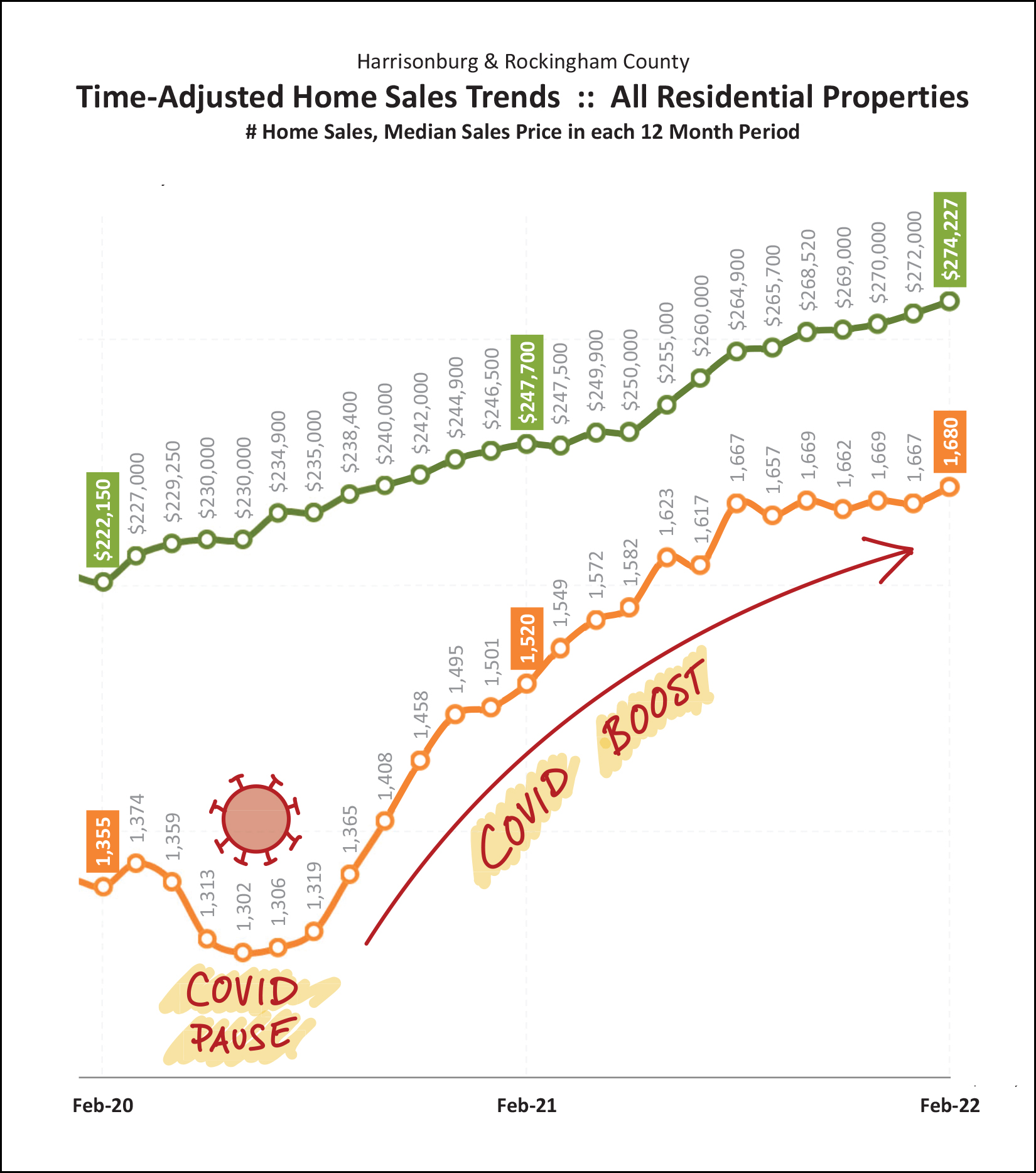

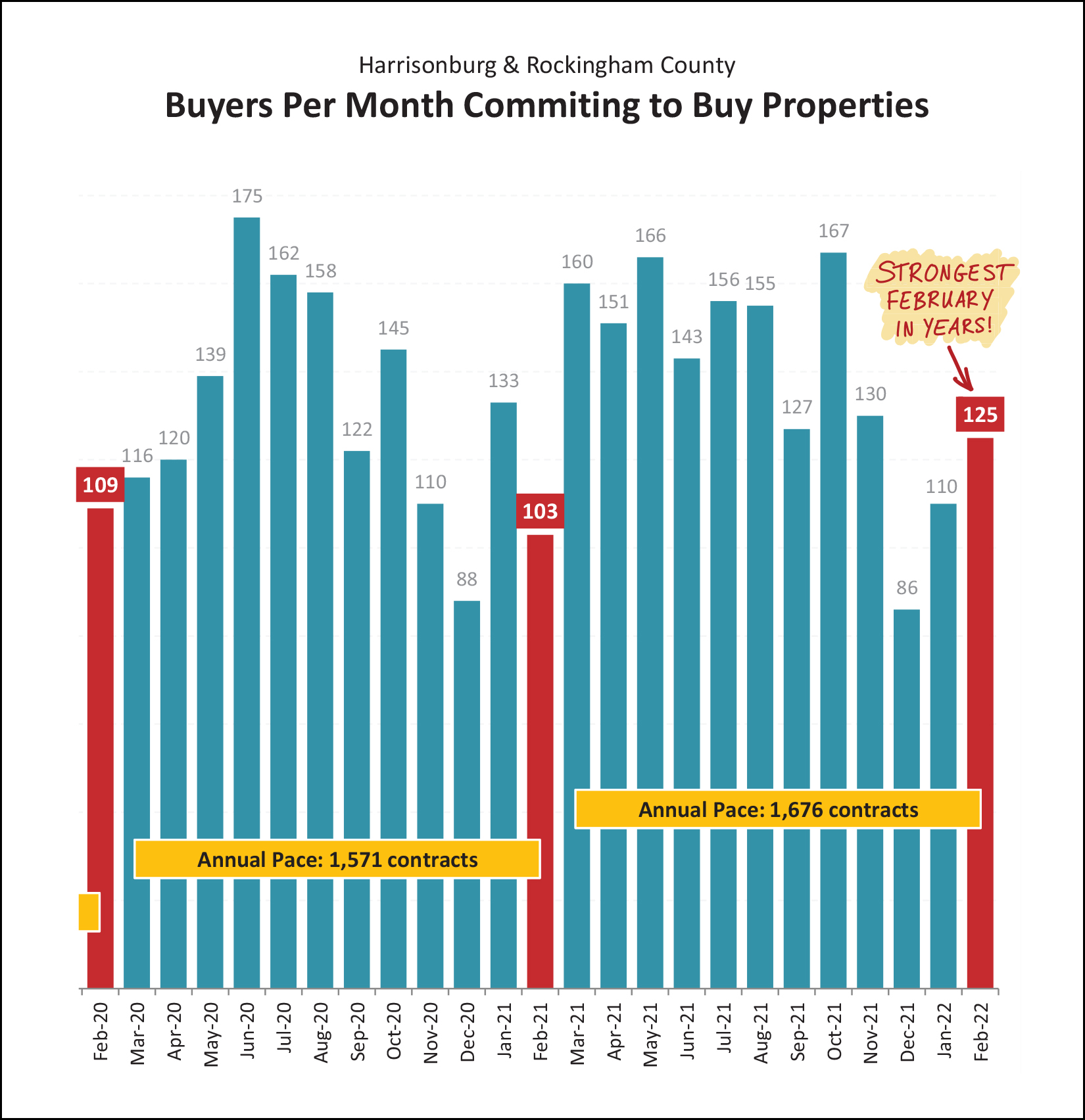

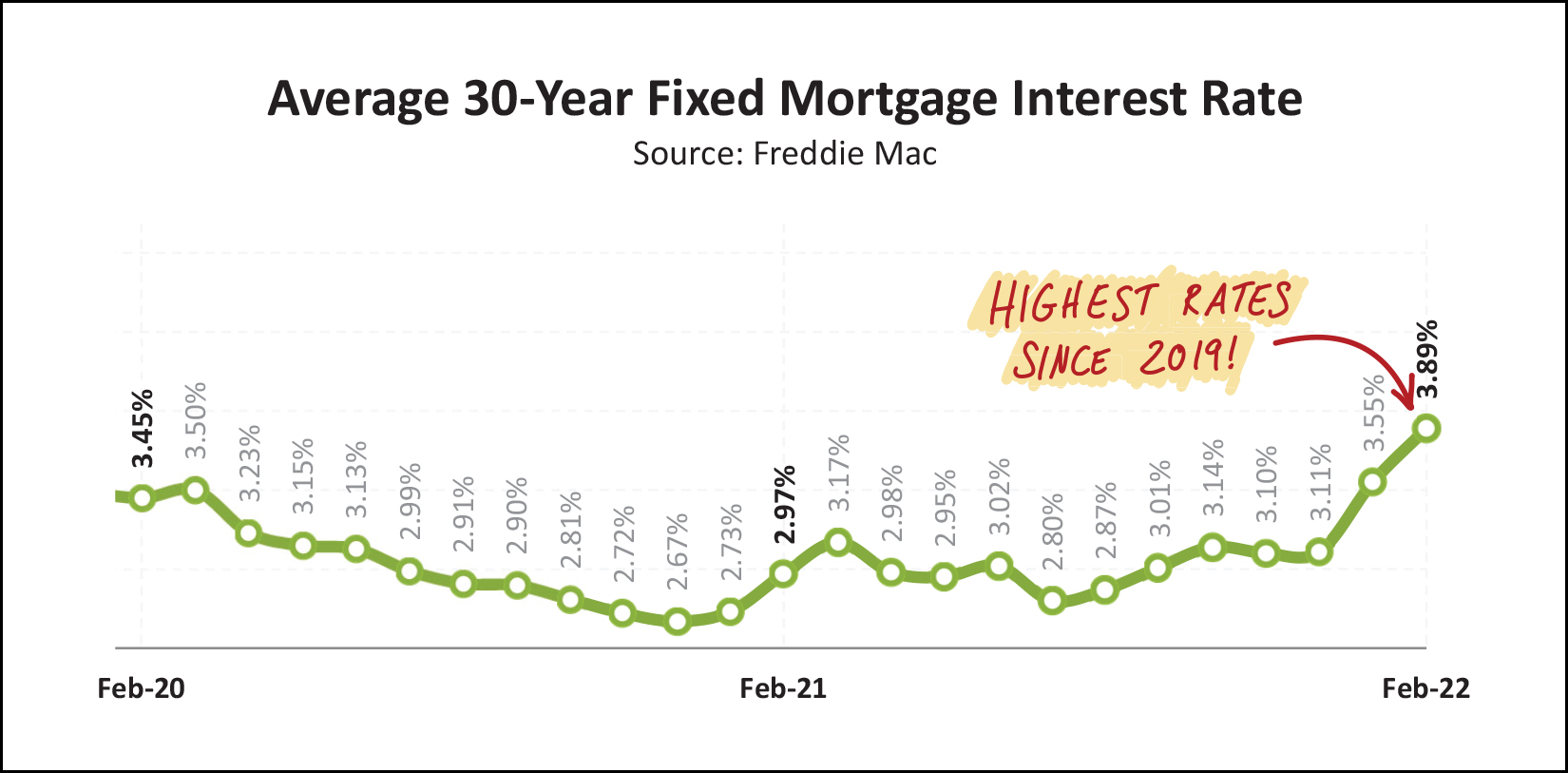

Happy Friday Morning, and for many of you, Happy (end of) Spring Break! I hope your week has gone well, whether you had a break or not. I was able to skip town for part of this week down to Virginia Beach where I was delighted to experience several beautiful sunrises like this one on Monday...  There sure is something relaxing about being near the water... and if the water (and air) were warmer, it probably would have been quite relaxing to be in the water as well! :-) Before I dive into this month's charts and graphs, a few quick notes... Check Out Magpie Diner... Each month in this space I'll be highlighting one of my favorite spots in the 'burg, or surrounding, where I enjoy dining, having a cup of coffee, etc. This month... it's Magpie Diner... a breakfast and lunch restaurant with a diner-inspired menu. If I'm at Magpie, I'll likely be having the french toast of the week with some scrambled eggs and a side of bacon. Yum! Have you checked out Magpie? If not, I highly recommend that you do so sometime this month. To make it even more fun, I'm giving away a $50 gift card to Magpie Diner. Enter your name/email here and I'll pick a winner in about a week. :-) Featured Home... The beautiful home pictured above is a custom built, single level home with amazing views from the top of Crossroads Farm. Check out additional photos and all of the details of this home by visiting 750FrederickRoad.com. Download All The Graphs... Some of you prefer to download the full slide deck of charts and graphs. You can do so here. Now, let's move on to the market data...  As shown above, things started getting busier in February... [1] There have been 199 home sales in Harrisonburg and Rockingham County thus far in 2022... which is a 5.85% increase from the same timeframe last year. [2] When looking at the past 12 months there have been 1,680 home sales in our local market, which is an even larger (10.53%) increase over the prior 12 months. [3] These increase in the quantity of home sales have been accompanied by an 11% increase in the median sales price over the past year. The median sales price of all homes sold in Harrisonburg and Rockingham County increased from $247,900 up to $274,227 in the last year alone! [4] If you thought homes couldn't sell any faster... you (and I) were wrong. The median "days on market" for Harrisonburg and Rockingham County has fallen 29% over the past year... from a median of seven days to a median of five days! But, despite these strong increases across the board... not all property types have seen the same changes over the past year...  As shown above, the "attached" portion of the local market (townhomes, duplexes and condos) have seen a bigger boom over the past year than detached (single family) homes... [1] We have seen 8% more detached home sales in Harrisonburg and Rockingham County over the past year as compared to the prior year, while... [3] We have seen a much larger 17% increase in attached home sales during that same time. [2] The median sales price of detached homes has increased 9% over the past year, while... [4] The median sales price of attached homes has increased by 18% in a single year! So, it has certainly been a good time to sell (and a tough time to buy) a townhouse or duplex lately! Looking at the monthly "play by play" we can see that things started to get a bit spicy in February...  As you might notice, above, the 104 home sales we saw this January fell right in the middle of the pack for what we might have expected in a January. But... February was different. We saw 95 home sales this February which was well and above any other recent month of January. Where do we go from here? We'll know within the next few weeks as we finish out March. Will we be able to surpass last March's very, very active month with 139 home sales? Will we fall somewhere between March 2020 and March 2021? Stay tuned to find out. I know we're only two months into the year, but...  Yes, again, we are setting new records. In 2020, the 163 home sales see in January and February was the fastest start in many years. Then in 2021, I said the same about January and February with 188 home sales. And yet, here we are again, with 199 home sales in the first two months of the year, we seem poised to see another fast paced and highly active year in our local real estate market! Someone asked me recently if Covid had been a real drag on the local housing market. Yes, I said, for a few months...  You'll notice on the graph above that Covid did seem to drag down the annual pace of home sales in early 2020... between April 2020 and September 2020. But then as we kept moving through fall 2020, and then into and through 2021, things just wouldn't let up. We saw month after month (with only a few exceptions) of stronger and stronger home sales. What caused this? At least some of it was, really, Covid. The place and space we call home became even more critical during the pandemic, and many folks found themselves living in homes that didn't work that well when all of a sudden they were working from home or had kids learning from home. So, "home" became even more important than ever -- causing plenty of homeowners to move to a new home. That, plus super low interest rates (to try to stabilize the economy), plus less discretionary spending, plus stimulus funds, all put more money in the bank accounts of would-be buyers, allowing many of them to jump on into the real estate market. Finally, an increasing number of people found themselves able to work from home... causing some folks to relocate to the Shenandoah Valley to work from a much more beautiful and relaxing place than they may have lived previously. As we continue to work our way through this pandemic that might eventually be considered an endemic, will we eventually see a flattening out or a decline in the pace of home sales in Harrisonburg and Rockingham County? I'm not convinced that we will. Alongside all of the factors referenced above, the overall population growth in this area persists based on employers expanding, local college graduates staying in the area, parents of local college graduates retiring to the area, and much more. I think it is relatively likely we will continue to see a similarly active local housing market over the next few years. OK... tangent over... back to the numbers. ;-)  This graph is showing the overall trends in home sales (quantity) and median prices over the past few years. I included it this month to draw out the magnitude of the raw data... we have seen the median sales price increase $62,000 over the past three years! That's great news for sellers, and for homeowners, but certainly is not very welcomed news for home buyers who have not yet bought a home. We saw a 10% increase in the median sales price in 2020 and 2021. I'm not thinking the increase will be as large in 2022, but I do think the median sales price will increase yet again this year.  And where might the market be going from here, you might ask? Well... with a very strong month of contract activity in February (see above) it seems very likely that we'll see a strong month of closed sales in March. So, yes, we're about to enter the busiest time of the year... between March and August. Get ready!  If you are hoping to buy a home soon, you might look at the graph above and get depressed by the low inventory levels. But... scroll back up to the previous graph for a moment and look at all of the contracts we usually see signed between March and August. Those buyers signing contracts (one could be you!) are almost all buyers signing contracts on homes that are listed for sale between March and August. So, while inventory levels at any given moment are not likely to increase over the next six months... there are almost positively going to be lots (and lots) of options of houses for you to buy over the next six months... or at least options of houses for which you can compete against lots of other eager home buyers. :-/  Indeed, the competition is fierce... and the market is moving quickly! The median "days on market" is five days right now... which means you need to go try to see any new listing of interest within the first day or two of when it hits the market for sale -- and you need to be ready to make an offer shortly thereafter if you are interested in buying that exciting new listing. Eventually we might (should?) see this metric start to increase a bit as the market slows... but we are definitely and assuredly not there yet.  Lastly, how about those interest rates? If there is one external factor that has the highest likelihood of affecting home buying activity in 2022... it is rising mortgage interest rates. Just six months ago, the average mortgage interest rate on a 30 year mortgage was 2.87%... and it has risen more than a full percentage point in the past six months to 3.89% at the end of March. As such, not only are today's home buyers paying a higher purchase price for nearly any home that they might purchase -- but their monthly mortgage payment will also be higher now (than it has been in recent months and years) because of rising interest rates. It seems likely that these rates will either level out near 4% or continue to rise even a bit above 4% as we continue through 2022. OK! That makes it to the end of this month's recap of our local housing market. A few reminders for you... [1] Go eat at Magpie Diner. You're certain to love it! :-) [2] Looking to buy soon? Email me so we can chat about what you'd like to buy, and talk to a lender ASAP. Let me know if you'd like some recommendations. [3] Planning to sell soon? Let's meet to talk about your house, any needed improvements or preparations, pricing, timing, the market and more. Email me to set up a time to meet to talk. That's all for now. Be in touch anytime (email me or call/text 540-578-0102) if I can be of help to you or your family, friends, neighbors or colleagues. Hope to talk to you soon! | |

Lots Of Home Buyers Are Still Competing For New Listings |

|

For many new listings, the competition is still quite fierce in Harrisonburg and Rockingham County. Here are three recent examples I've been involved with or heard of in the past 10 days... [1] A townhouse in the City of Harrisonburg under $200K received 12 offers within three days. [2] A duplex in the County in the $300K's received 7 offers within three days. [3] A detached home in the City of Harrisonburg in the $300K's received 16 offers within four days. Wow! Now, this won't be the case for every new listing, in every price range, in every location... there are more buyers in some price ranges and for some locations than others. This also won't hold true independent of how a seller prices their home. A home that ends up selling for $200K will likely have a different number of offers based on whether they priced the property at $195K, $199K, $205K or $225K. But... yes... the market is still quite active, with plenty of buyers ready to buy, and many (to most) new listings being scooped up quite quickly. If you're getting ready to sell this spring, we should talk sooner rather than later about timing, preparations, pricing and more. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings