| Newer Posts | Older Posts |

A Year From Now, Mortgage Interest Rates Seem Unlikely To Be Much Below Six Percent |

|

The current average 30 year fixed mortgage interest rate is 6.82%. If you are waiting to buy a home until mortgage interest rates fall below 6% you might be waiting a while. A compilation of mortgage interest rate projections by Fast Company (here) show the following projected mortgage interest rates for the first and second quarter of 2025... Mortgage Bankers Association: 5.9% in 2025-Q1 5.8% in 2025-Q2 Fannie Mae: 6.3% in 2025-Q1 6.2% in 2025-Q2 Wells Fargo: 6.0% in 2025-Q1 5.9% in 2025-Q2 It seems that mortgage interest rates may very well stay near, at or above 6% for at least the next year. Read more here. | |

How Long Will You Stay In Your Home? |

|

It seems homeowners are staying in their homes much longer now than they did two decades ago... with the median homeowner tenure having risen from 6.5 years in 2006 to 11.9 years today. This analysis of homeowner tenure is thanks to a recent analysis by Redfin... A few reasons for this increase in homeowner tenure seem to include... [1] Older Americans staying in their homes longer. [2] More recently, the sticky-ness of low fixed mortgage interest rates. A few results of this increase in homeowner tenure seem to include... [1] Lower inventory levels of resale homes. [2] Continued increases in home values. When I ask folks that I encounter on a day to day basis how long they will stay in their current homes, I often am told that they will stay in their current homes for a very long time, if not forever. This is largely because... [1] They bought their home when home values were lower or significantly lower than they are now, and they are enjoying a relatively low mortgage balance compared to current home values. [2] They bought their home when mortgage interest rates were below 4%... or they refinanced their mortgage when interest rates were below 4%, and they do not want their housing payments to increase if they obtain a new mortgage above 6%. How long will you stay in your home? I plan to stay in mine for quite a while! | |

Another Buyer May Be Able Or Willing To Pay More Than You |

|

Many homes in many price ranges are still receiving multiple offers. Thus, a variety of questions may run through your mind if you are making an offer on a popular new listing... [1] How much is this home worth? [2] How much am I willing to pay for this house? [3] Will I win the bidding war? The challenge in answering #3 above is often not in the answer to #1 but in other buyer's answer to #2. It's note quite this black and white, but let's pretend that you and the three other buyers who are making an offer all conclude that the home is worth $350K. You love the house but your budget is capped at $360K. You offer to pay up to $360K. The second buyer won't pay a dime over market value, so they offer $350K. The third buyer has a budget that goes up to $500K, so they are willing to pay up to $370K for the house. Depending on the other terms of the offer, the third buyer is likely to secure the contract on the house. As another example... Let's again pretend that the home in question is worth $350K, but it needs some updates. You love the house, but given the need for some updates you are not comfortable paying more than $350K. The second buyer offers $340K because of the need for updates. The third buyer is super handy and will make all of the updates themselves and has plenty of cash to spare for supplies, etc., so they offer to pay up to $360K. Again, depending on the other terms of the offer, the third buyer is likely to secure the contract on the house. In any given multiple offer scenario, you must remember (as a buyer) that other buyers might be able or willing to pay more than you. | |

You Can Change A Lot About A House, But Not The Location Or Neighborhood |

|

That house is PERFECT! It has the right amount of bedrooms, it's the perfect size, I love the flow of the main living spaces, and the exterior siding and landscaping are just what I'm looking for in a home. But... it's not in the neighborhood or location where I'd like to live. Most buyers won't buy the house described above, because they won't be able to change the location or neighborhood of the house. You can finish some basement space to add a bedroom. You can build an addition to create more living space. You can open up some walls or close in some openings to affect the flow of the main living spaces. You can paint or replace exterior siding. You can add, remove or change the landscaping. But... you can't change the location or neighborhood where that house is situated. ** Yes, I understand that technically you could move a house, but it's rather cost prohibitive. ;-) So... if you see a house that you love, but it's in the wrong neighborhood or location... chances are, you won't end up buying it. Buy a house based on the things you cannot change... and be willing to change the things you can. | |

How To Think About The Market Value Of Your Home When There Have been No Recent Sales In Your Neighborhood |

|

I think this is going to be a more common phenomenon over the next few years... In preparing to list your home for sale we start to take a look, together, at recent sales of similar homes to predict the price a buyer will be willing to pay for your home. But... there have been no sales in your neighborhood over the past year... or two years... or three years!?! What does one then do? It's probably best not to focus on sales prices in your neighborhood from more than two or three years ago as they won't be a very accurate indicator of the value of your home in the current market. We'll likely need to work to identify comparable sales outside of your neighborhood that are as similar to your home as possible to potentially include... [1] the same school district [2] a similar size home [3] a similar structure of home (one story vs. two story) [4] a similar age of a home [5] a home with similar interior and exterior materials and finishes We will then make adjustment to the sales prices of each comparable property based on differences in both the neighborhood and the other attributes listed above. It is certainly ideal when there are highly similar comparable sales right in your very own neighborhood to use as reference points when pricing your home -- but that is not always going to be our current context right now given that fewer homeowners are selling from year to year. | |

Home Sellers In Many Price Ranges Still Need To Plan To Be Kicked Out Of Their Houses For A Few Days |

|

Plenty has changed since the times of real estate during a pandemic... [1] Mortgage interest rates are now 6% instead of 3%. [2] Sellers are often receiving a few offers instead of a flurry of offers. [3] Homes are often selling at or just above asking, instead of waaaay above asking. But some things have not changed... Home sellers in many price ranges (and locations and property types) still need to be plan to be kicked out of their homes for a few days when they list them for sale. Is this happening for all new listings? No Are all or most of the showings turning into offers? No Can it get a bit logistically challenging for sellers to have so many showings within the first few days on the market? Yes Do most sellers decide it is worth it? Yes Happy Spring, and let me know if you want to get kicked out of your home for a few days... ;-) | |

Make The Most Of Each New Listing This Spring! |

|

With mortgage interest rates still above 6% and with the vast majority of homeowners having mortgage interest rates below 4%, there will likely be far fewer new listings this spring. Why, after all, would a homeowner want to sell, pay off their mortgage with a 4% interest rate and buy, obtaining a new mortgage above 6%? Certainly, there are still plenty of reasons why homeowners will sell their homes even give the mortgage interest rate dynamic described above. Some may be moving out of the area, or moving to a different neighborhood or school district, or moving to have more space, or to have less maintenance. But the difference in most current mortgage holder's rates and current market rates is likely to continue to suppress the number of new listings we will see hitting the market. As such, if you're looking to buy a home this spring -- because you are moving into the area, or because you are currently renting, or for any other reason -- you should make the most of each new listing. Talk to your mortgage lender to get pre-approved... now. Go see each new listing of potential interest.. .quickly. Be ready to make a decision about an offer... quickly. | |

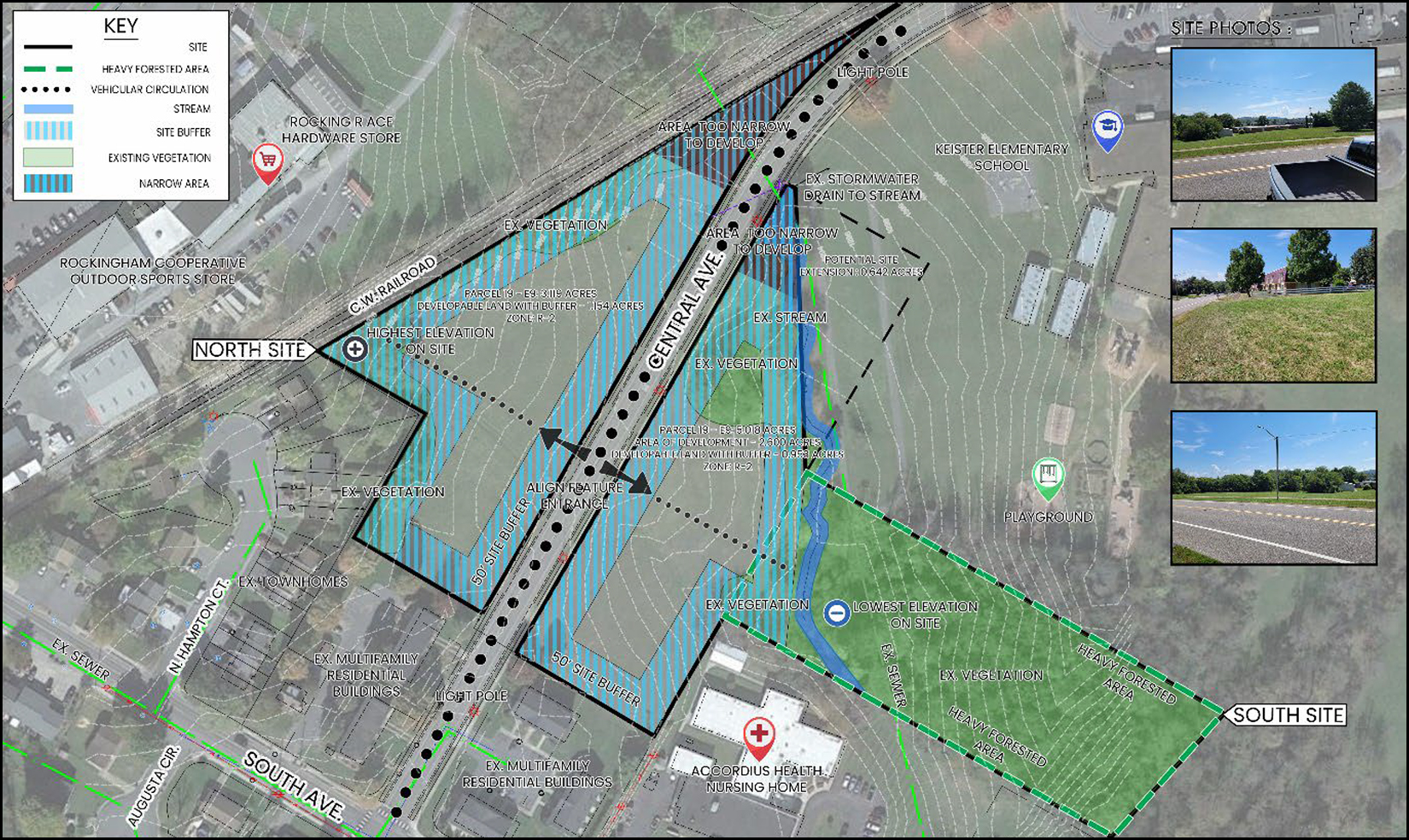

Harrisonburg Explores Options For Developing Housing On City Owned Land |

|

The City of Harrisonburg has been working for the past year on exploring how two City-owned properties might be developed to provide future affordable housing solutions. The first site is an 8.59 acre parcel located on Neff Avenue that would likely allow for the development of either (72) townhomes or up to (200) apartments. Here is an illustration of a potential townhome layout...  The second site is an 8.13 acre parcel on Central Avenue that would likely allow for the development of (36) single family homes, (51) townhomes or up to (133) apartments. Here is an illustration of a potential single family home layout...  Click here to download the full memorandum from Land Planning and Design Associates, Inc. who prepared a detailed technical memorandum outlining opportunities, constraints, possible development solutions and affordable housing solutions. The memorandum also include multiple other renderings of potential development plans for these sites. | |

The Differential Value In Your Escalation Clause Should Likely Vary Based On The Other Terms Of Your Offer |

|

We're still in a housing market where many new listings will have multiple offers within a few days -- not all new listings, and maybe not most -- but many. As such, if you are hoping to buy a home this spring or summer you may find yourself competing against another buyer (or buyers) when you make an offer. If you are making an offer, and competing against one or more other offers, you may find yourself including an escalation clause in your contract. How does an escalation clause work, you might ask? An escalation clause allows you to make an offer at one price but include offer terms that will automatically increase that offer if another offer is at a higher price point. For example... offering $325K... but automatically increasing your offer up to $340K if there is another higher offer. One missing element of the description above is the differential value in your escalation clause. Here are two different versions of the escalation clause above, with differential values... [1] Offer of $325K, automatically increasing to be $1K above other offers, up to a maximum of $340K. [2] Offer of $325K, automatically increasing to be $5K above other offers, up to a maximum of $340K. Let's say, for illustrative purposes, that you are (unbeknownst to you) competing with an offer of $330K. The first escalation clause above [1] would cause your offer to be $331K. The second escalation clause above [2] would cause your offer to be $335K. Why would you include a differential of $1K vs. $5K vs. something even higher? Oftentimes, it depends on the other terms of your offer. If you are making a very clean offer with an 80% financing contingency, no home inspection, no home sale contingency and a speedy proposed settlement... you might just include a $1K differential in your escalation clause. The thought or hope in this instance is that your offer terms (other than price) will be equal to or better than the competing offer, and that your offer being $1K higher is enough of a difference to hopefully cause the seller to accept your offer. If you are making an offer with a smaller downpayment (95% financing), and with an inspection contingency... and if you suspect you are competing against buyers with larger downpayments or without inspection contingencies... you might include a larger differential in your escalation clause. The thought here is that if your offer with an inspection contingency is only $1K higher than a competing offer without an an inspection contingency, the seller will likely accept the other offer... but if you are offering (via the differential in your escalation clause) a price that is $3K (or $5K) higher than the competition, maybe that differential will be enough to cause the seller to still consider your offer despite the inspection contingency. And so on and so on. If you are proposing a delayed settlement date, increase the differential. If you have a home sale contingency as well, increase the differential. You can't know the details of the terms of the offer with which you are competing... but you can be strategic about how you craft the terms of your escalation clause based on the other terms of your offer. | |

Even If You LOVE A House, You Will Probably Only Be Willing To Pay So Much Or Remove So Many Contingencies |

|

Sometimes we end up searching for a home you LOVE for quite a while! Sometimes we never find a house that you completely LOVE but we find one that you like, a LOT. But, yes, sometimes we find a house that you absolutely LOVE!!! And yet... 1. You are probably only willing to pay so much for that house that you love. If a house is priced at $400K and that price is in line with recently sold properties, and it is an absolutely perfect fit for what you want in a home, and like nothing we have seen in over six months of searching... then you might be willing to pay $425K for the house. But you probably wouldn't pay $450K. There is a limit, for most buyers, of how much they'll pay even if it is an absolutely perfect fit. 2. You are probably only willing to remove so many contingencies from your offer. Will you remove an inspection contingency from your offer on an absolutely perfect house? Maybe, maybe not. Will you remove an appraisal contingency for said house? Maybe, maybe not. Will you liquidate assets to pay cash instead of having a financing contingency? Maybe, maybe not. Will you take on the risk of having two mortgages and remove a home sale contingency? Maybe, maybe not. For any given house, even one that you LOVE, we'll have to discuss how far you are willing to go to buy that house -- relative to price, and contingencies. | |

Would You, As A Seller, Turn Down A Solid Offer In Hand For The Possibility Of One To Come? |

|

As usual, context matters, which I'll get to below, but... If you listed your home a few days ago and you have a solid offer... but are being told you might receive another offer in a day or two... would you turn down the solid offer? Or would you go ahead and decide to move forward. Let's add some context that might point us in a few different directions... House #1 - Listed for $750K (upper end of the market), three showings over five days, a full price offer with reasonable contingencies is received on the fifth day, and one of the other buyers that viewed the home says they might make an offer within a day or two, and no other showings are scheduled. Most sellers in this situation would probably go ahead and move forward with the solid offer - even though another offer might materialize. House #2 - Listed for $350K (highly active segment of the market), 15 showings scheduled over the first three days of being on the market, a full price offer with reasonable contingencies is received on the first day, after the third showing, and the buyer is anxious to have a response. Many or most sellers would hold off on responding to that first (solid) offer, for at least a day, given the other showings that are about to take place. These are two examples that are a bit more clear cut than many situations that sellers find themselves in -- having to balance the value of the solid offer in hand compared to the possibility of other offers to (maybe) come along soon. As we think through a response (or no response yet) we'll consider the context of your price range, the size of your market, the number of scheduled showings, the feedback we are getting from the showings, the length of time your house has been on the market and more. But there certainly is always plenty of value in the solid offer in hand! | |

Consider Reverse Buyer Remorse When Deciding Whether To Make An Offer On A New Listing |

|

So, you followed my advice and we went to see that new listing on the first or second day it was listed for sale. Great! Buyers in most price ranges in Harrisonburg and Rockingham County still often need to see a home rather quickly when it hits the market in order to have a chance to make an offer. But now, you don't know what to do. You like the house a lot... but maybe you don't love it. You recognize that it checks off a lot of boxes of what you are looking for in a home... but you weren't immediately convinced that this was "the one" for you. So, what do you do? Do you make an offer? Do you decide not to make an offer? Do you keep thinking about it for a few days even though that might mean you miss out on the chance to buy it? It can often be helpful to think about this decision by considering the concept of reverse buyer's remorse. Buyer's remorse is a feeling of regret after having decided to buy something. It doesn't happen that often with real estate, in my experience, but more often with other purchases of things you don't necessarily need. Reverse buyer's remorse (as I'm using the phrase) is a feeling of regret for NOT having decided to buy something. If you don't make an offer on this house, and someone else buys it, will you be sad to have missed out on it? If you would be sad to have missed out on it, maybe you should make an offer. If you would not be sad to have missed out on it, maybe you shouldn't make an offer. | |

Monetary Policy Enacted By The Fed Contributed To Current Housing Affordability Challenges But Monetary Policy Does Not Seem Likely To Fix The Problem In The Near Future |

|

If you're hoping to understand the current housing affordability challenges (in many or most markets across the US) and how we came to be in the current situation, this article is a good one to read... The Fed won't fix the housing market (Yahoo Finance) Below are a few pertinent excerpts...

Indeed, the drastic rate cuts by the Fed at the start of the pandemic resulted in pandemonium in the housing market with an abnormally high number of buyers seeking to buy a home.

Indeed, both here in the Shenandoah Valley and in many other markets across the country, there is a shortage of housing. And so, what will get us out of this challenging time for housing affordability? It does not seem that the Fed plans to make any rapid or significant monetary policy changes that would impact housing affordability... and, since the Fed doesn't build houses, they won't be creating any further housing inventory. We can likely expect slow interest rate cuts over the next year or two and hopefully we will see continued construction of new residences to house those who already live in the Shenandoah Valley and those who wish to make it their home now or in the future. | |

Home Prices In Harrisonburg, Rockingham County Might Not Shoot Upwards Quickly If Or When Mortgage Interest Rates Fall Because Prices Did Not Drop When Rates Rose |

|

If or as mortgage interest rates drop, will we see home prices shoot upwards? Let's back up a few steps... When mortgage interest rates rose from 3.2% to 7.1% within 10 months (Jan 2022 - Oct 2022) some housing markets saw home prices decline. Understandably, if the mortgage interest rate doubles, a buyer's monthly housing payments will be much higher than the previous year -- directly and immediately affecting housing affordability. Thus, some markets saw prices decline during 2022 at least partially as a result of higher mortgage interest rates. Harrisonburg and Rockingham County, notably, did not see a decline in the median sales price during that (2022) timeframe. Many people in markets (often larger cities) where home prices did decline are now (reasonably) wondering if home prices will spike upwards if or when mortgage interest rates fall. If you are in a market where home prices dropped as interest rates rose... then yes, it is reasonable to think you'll see home prices rise (or rise faster) if or as mortgage interest rates drop. But... back to Harrisonburg and Rockingham County... I am not expecting that we will see an uptick in home prices if or as mortgage rates decline... mainly because we did not see prices drop when rates rose. This is not to say that home prices won't continue to rise in this area -- I think they will -- but I don't think we'll see an increase in home prices specifically related to mortgage rates dropping. | |

If Or As Mortgage Interest Rates Decline, Buyers Will Likely Jump Back In Sooner Than Sellers |

|

Mortgage interest rates peaked this past Fall at 7.79% and have been mostly declining since that time, to current levels of 6.74%. But, 6.74% can still feel high after interest rates were below 5% for 13 years... and below 4% for three years. As mortgage interest rates potentially continue to decline, perhaps back down to 6%, what will we see happening in the market? Will the lower mortgage interest rates spur on more home sales activity? Maybe, but perhaps not as much as you would likely expect. If / when / as mortgage interest rates move back down towards 6% -- or the low 6%'s or the high 5%'s we are likely to see more would be home buyers interested in buying. They will be able to afford higher sales prices and/or their monthly mortgage payment will be lower. But... in order for a home sale to take place... we need both a buyer AND a seller. Many homeowners (would be sellers) have mortgage interest rates below 4%. Quite a few have interest rates below 3%. Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 6% mortgage interest rate? Somewhere between no and probably not? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 5.5% mortgage interest rate? Somewhere between probably not and maybe? Will a homeowner sell, paying off their mortgage that has a 2.75% or 3.5% rate... to then buy another home with a 4.99% mortgage interest rate? Maybe? I expect that as we move through 2024 and 2025, and as mortgage interest rates (likely?) continue to decline (at least somewhat) we are likely to see more buyers jumping back into the market before sellers are doing the same. Which means... that we are likely to still see a competitive market... if buyer demand rises more quickly than seller supply. | |

Planning To Buy A Home? Yes, Talk To Me, But Talk To A Lender Too! |

|

If you are getting ready to buy a home -- whether your first or your last -- you will probably have plenty of questions.

If you're new to home buying, or new to the area, you'll probably have more questions than some other buyers, and that is OK! If you're getting ready to buy your fourth home and have lived in Harrisonburg for decades you might have fewer questions than some other buyers, and that is OK too! I am happy to meet with you to talk through all of this, and much more. We can do that in person, by phone, by Zoom, etc. But another important conversation to be having in parallel is with a mortgage lender. Unless you will be paying cash for your home, you'll need a loan to make your home purchase, and having a conversation with a lender sooner rather than later will serve you well. When meeting with a lender you will be...

So, if you're planning to buy a home this spring... Yes, talk to me... but talk to a lender too! Call/text me at 540-578-0102 or email me here. We can set up a time to meet and I can send you contact information for several qualified, professional and responsive local lenders. | |

How Many More Single Family Detached Homes Will Be Built In The City Of Harrisonburg? |

|

Over the past year this is where single family detached homes were built, as reflected by sales in the HRAR MLS... City of Harrisonburg = 3 homes Rockingham County = 58 homes When looking at development proposals in the City of Harrisonburg here's the breakdown of property types being proposed... Apartments = 74% or 2,747 homes Townhomes or Duplexes = 21% or 771 homes Single Family Detached Homes = 6% or 206 homes So, I suppose it is reasonable to ask or wonder... how many more single family detached homes be built in the City of Harrisonburg? Perhaps the vast majority of single family homes that will ever exist in Harrisonburg have already been built? Perhaps over the next 10, 20 and 30 years, 95% or more of new housing units will be apartments, townhouses or duplexes? After all, the City will eventually run out of land for building more housing. As it currently stands, if you are going to buy a new single family home in the next few years it seems almost certain that it will be in Rockingham County, not the City of Harrisonburg. | |

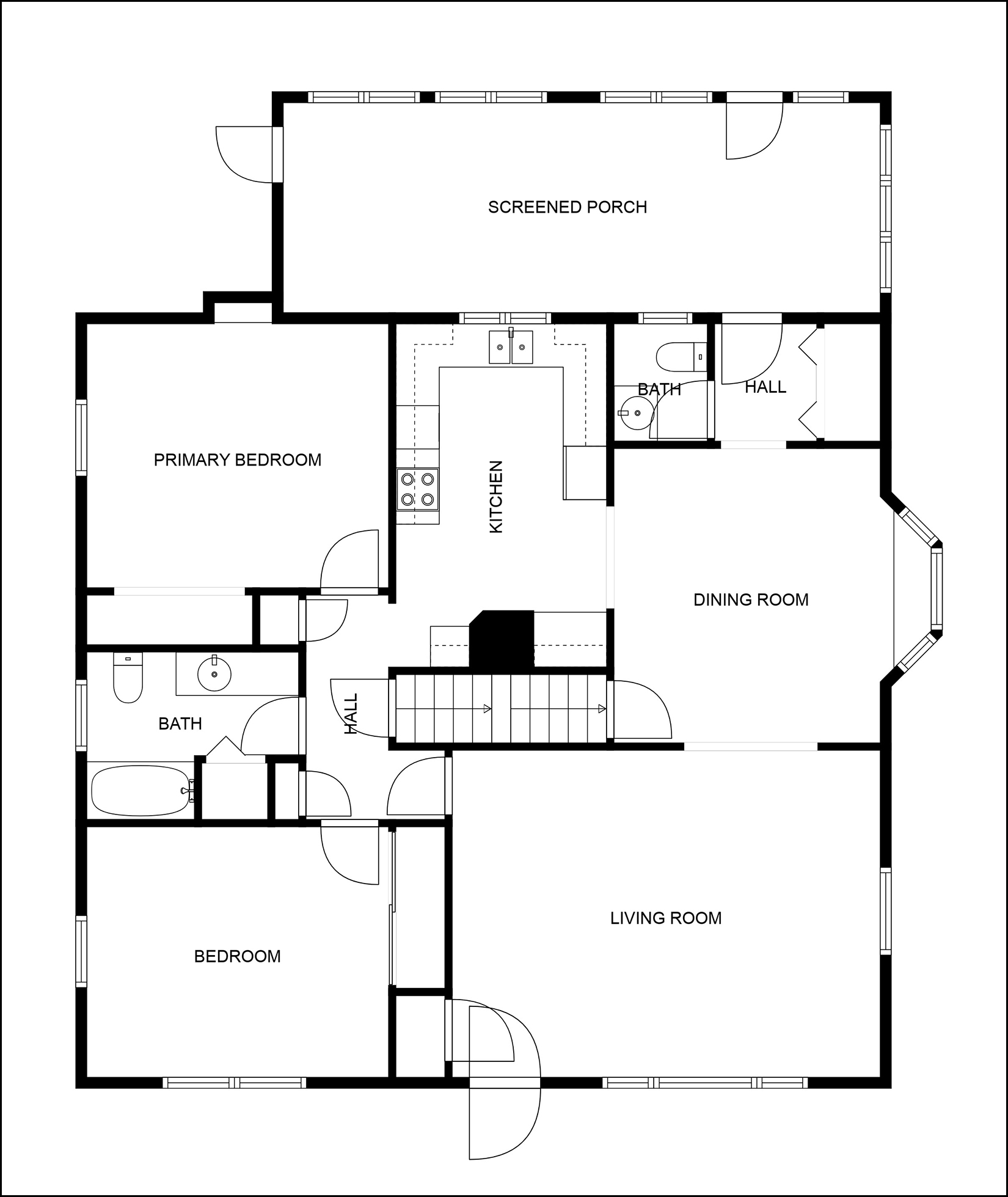

Moving Beyond Photos When Evaluating Homes For Sale |

|

If you're searching for a home these days one of the first things you are likely evaluating when a new listing pops is all of the photos of the house. Thankfully, many or most new listings include great photos of the house, sometimes even including aerial photos. But, the photos only take you so far. Before you even step foot into the home you can often understand the house and its layout a bit more than what the photos might allow by reviewing the floor plan, a 3D walk through or a video of the home. Not all new listings include these additional ways to understand and evaluate the house -- and when they do, this additional information is not always easily accessible on all real estate websites and apps. If you see a new listing of interest, and you like what you see in the photos, but aren't quite sure how all of the spaces in the photos fit together -- feel free to text, email or call me and I can check to see if there are floor plans, a 3D walk through or a video for the listing of interest. We will then, of course, learn the most about the house by walking through it together... but let's start by reviewing as much information as is available to us about each new listing! | |

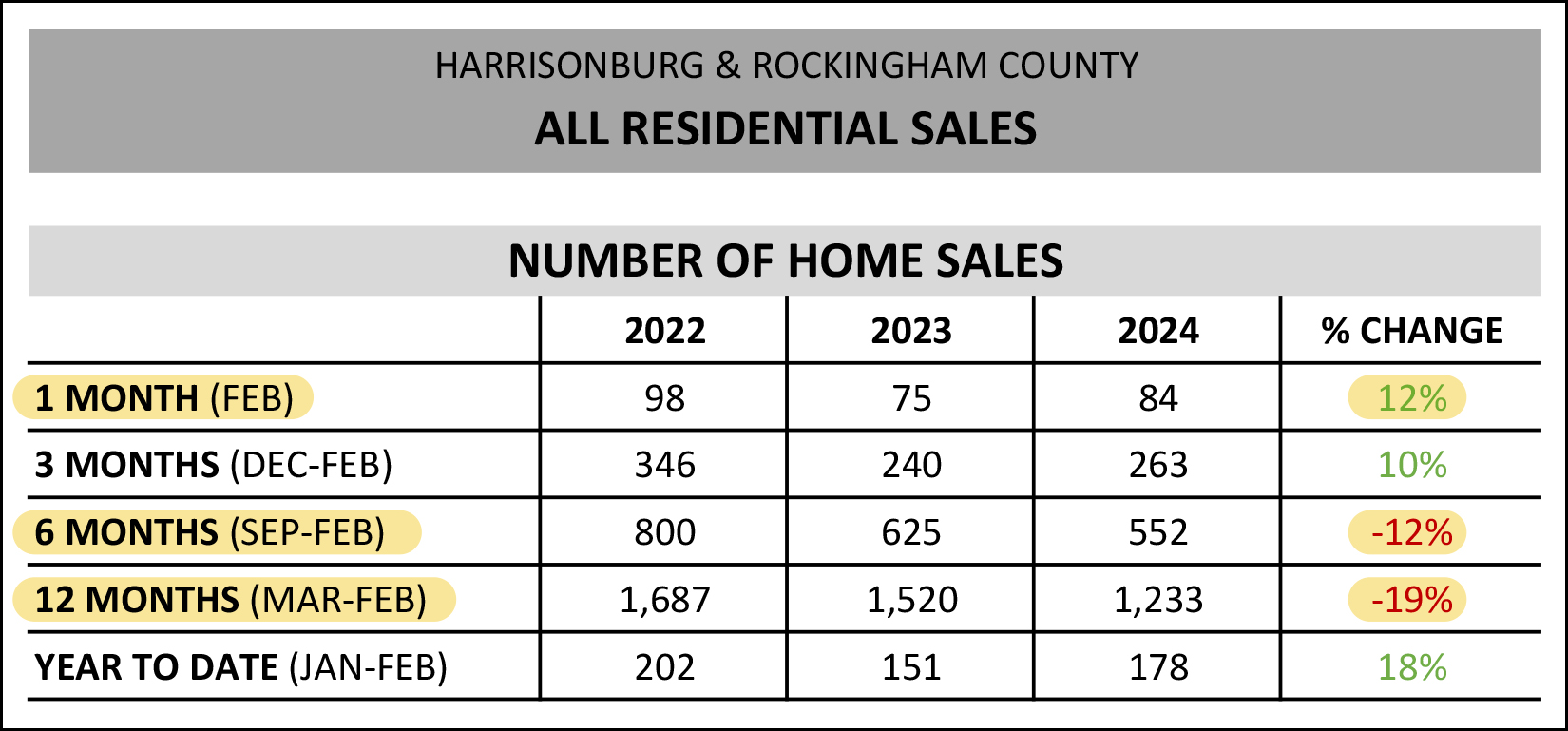

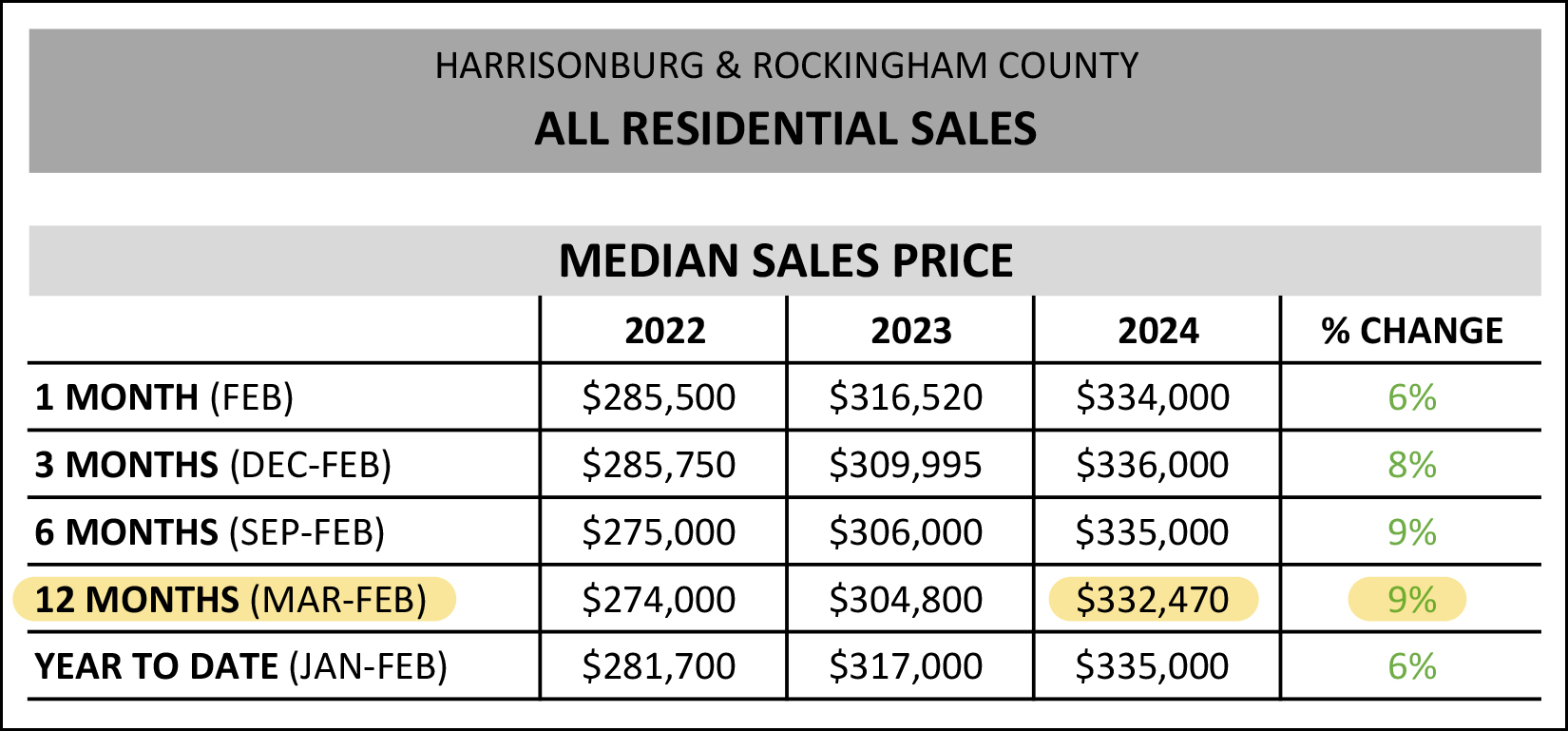

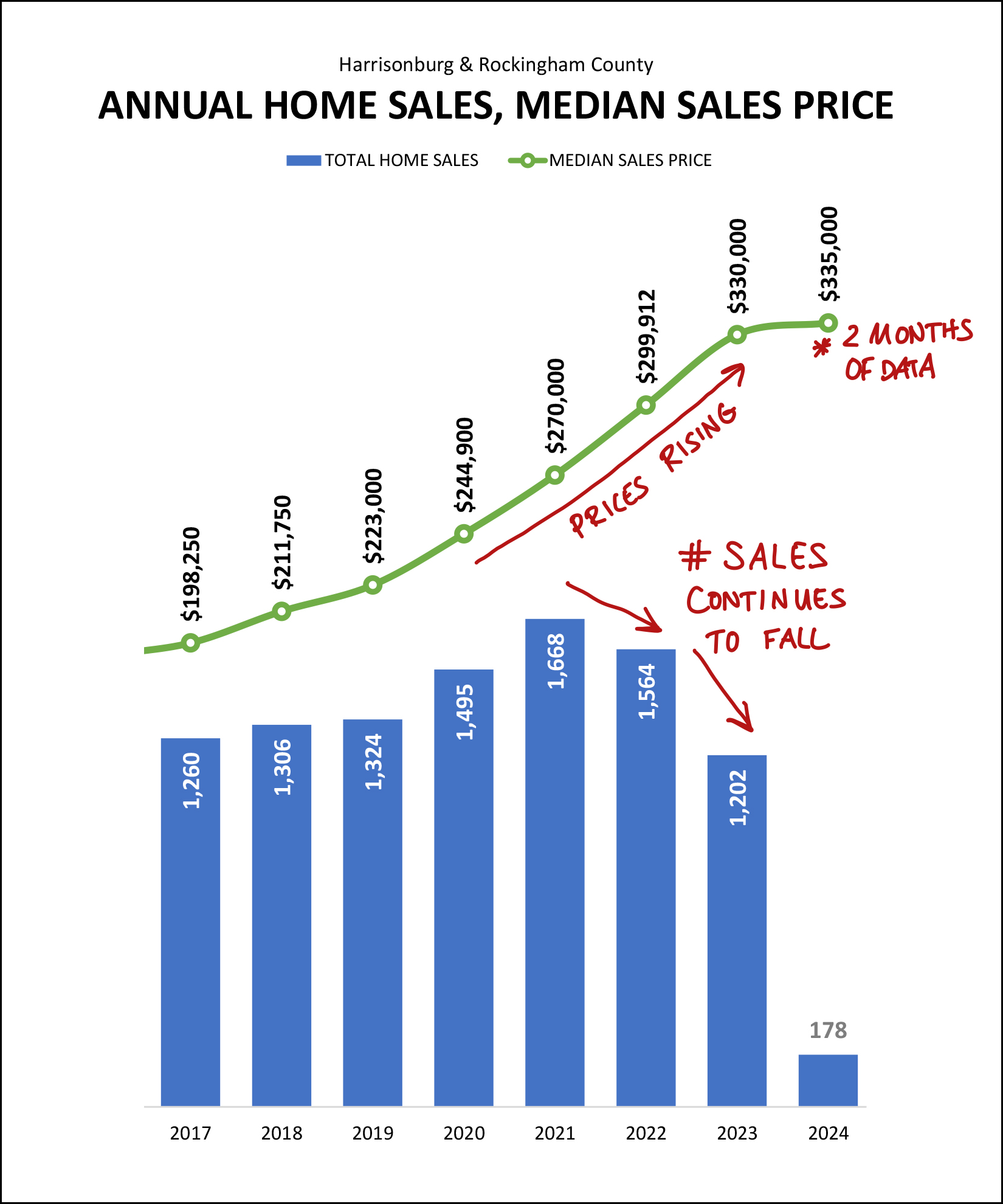

Annual Pace Of Home Sales May Have Started To Increase Again And Median Sales Prices Just Keep On Rising |

|

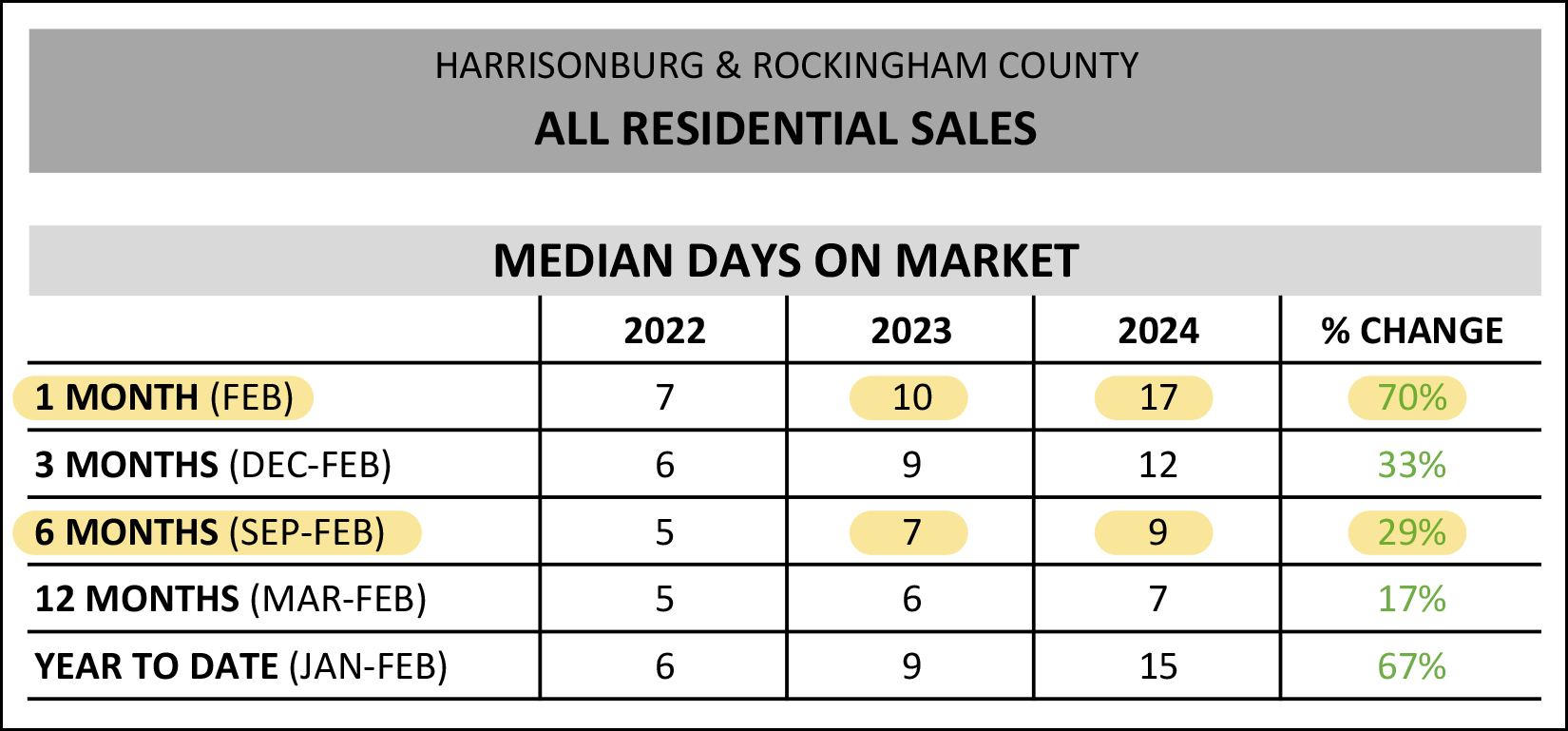

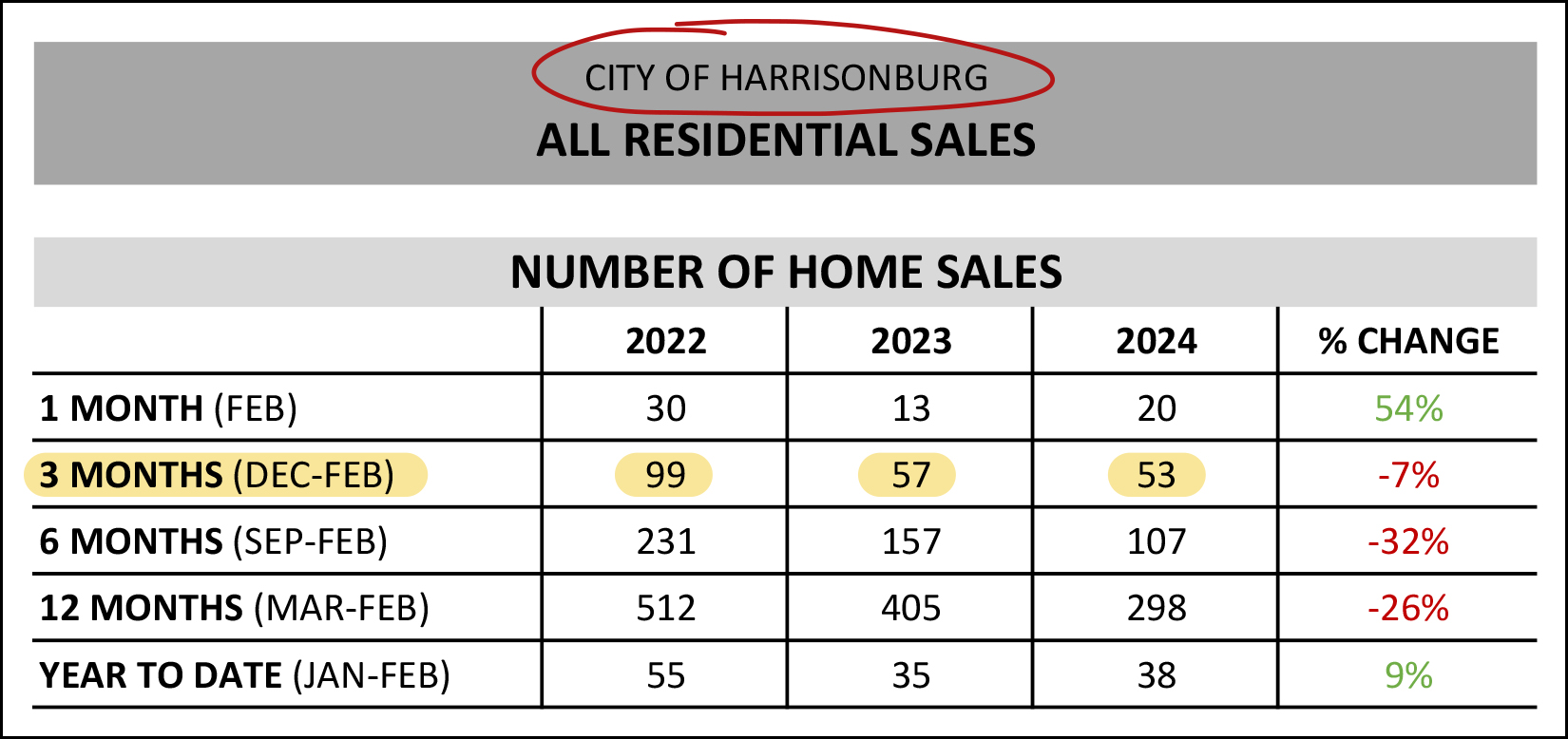

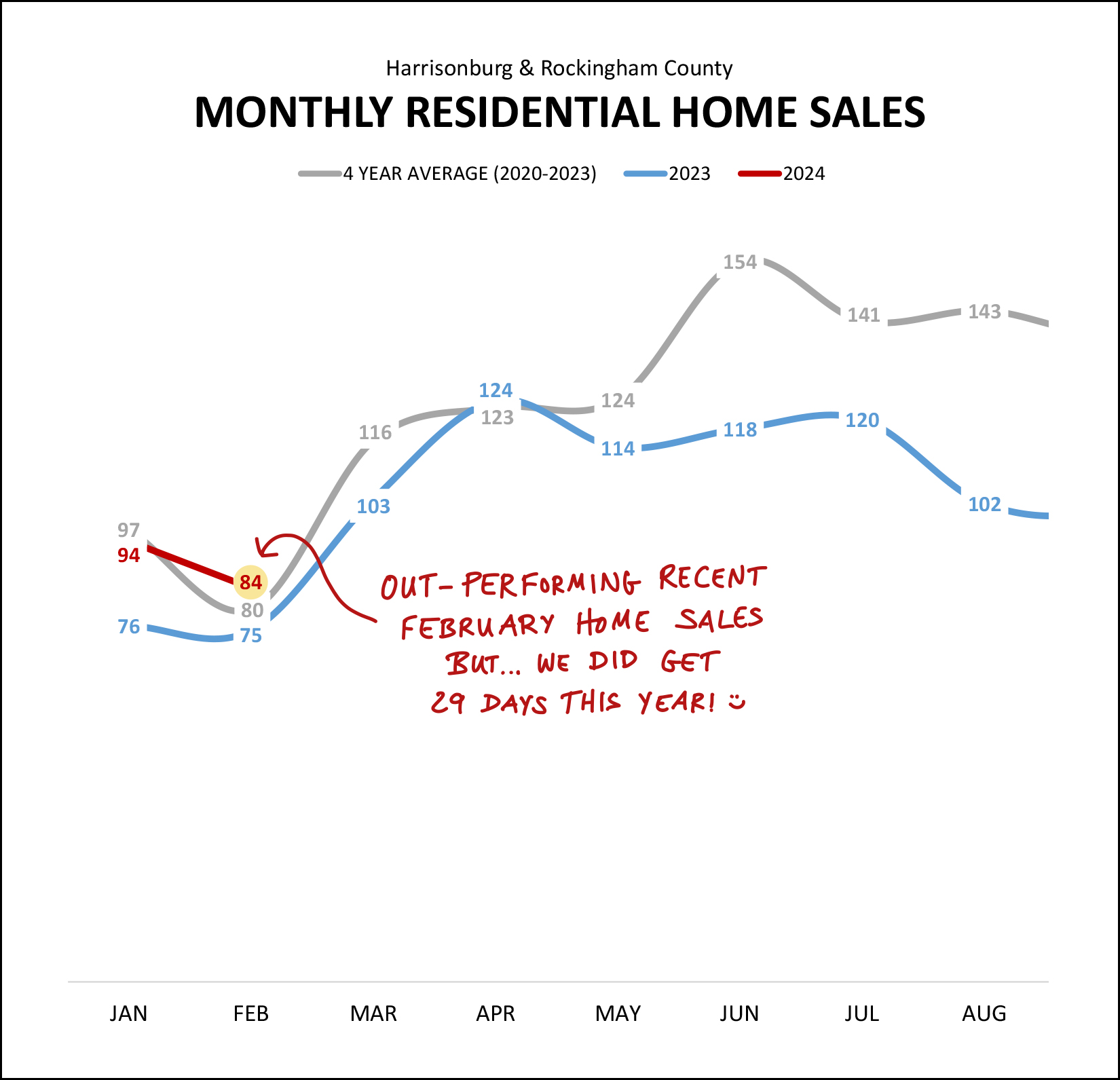

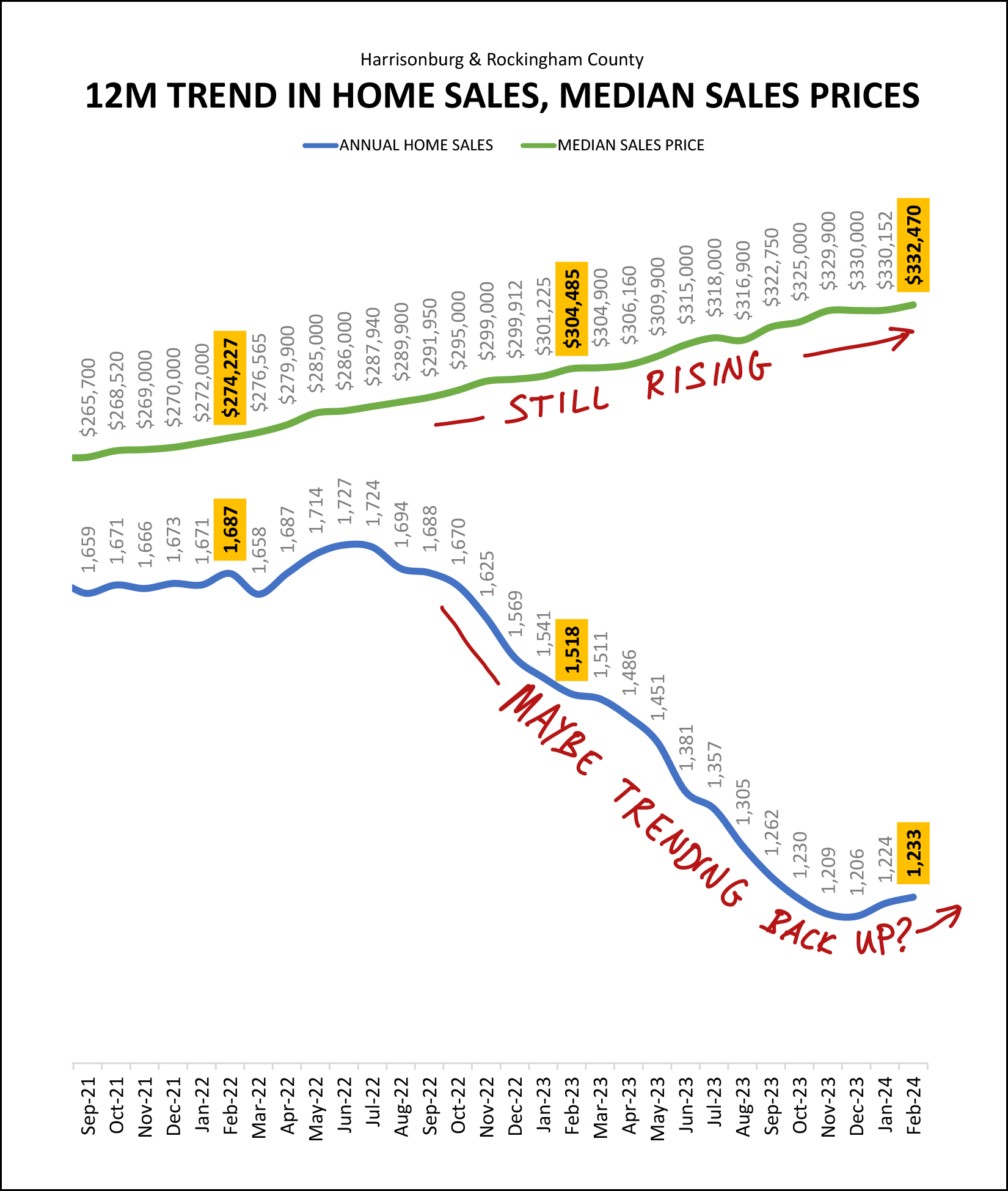

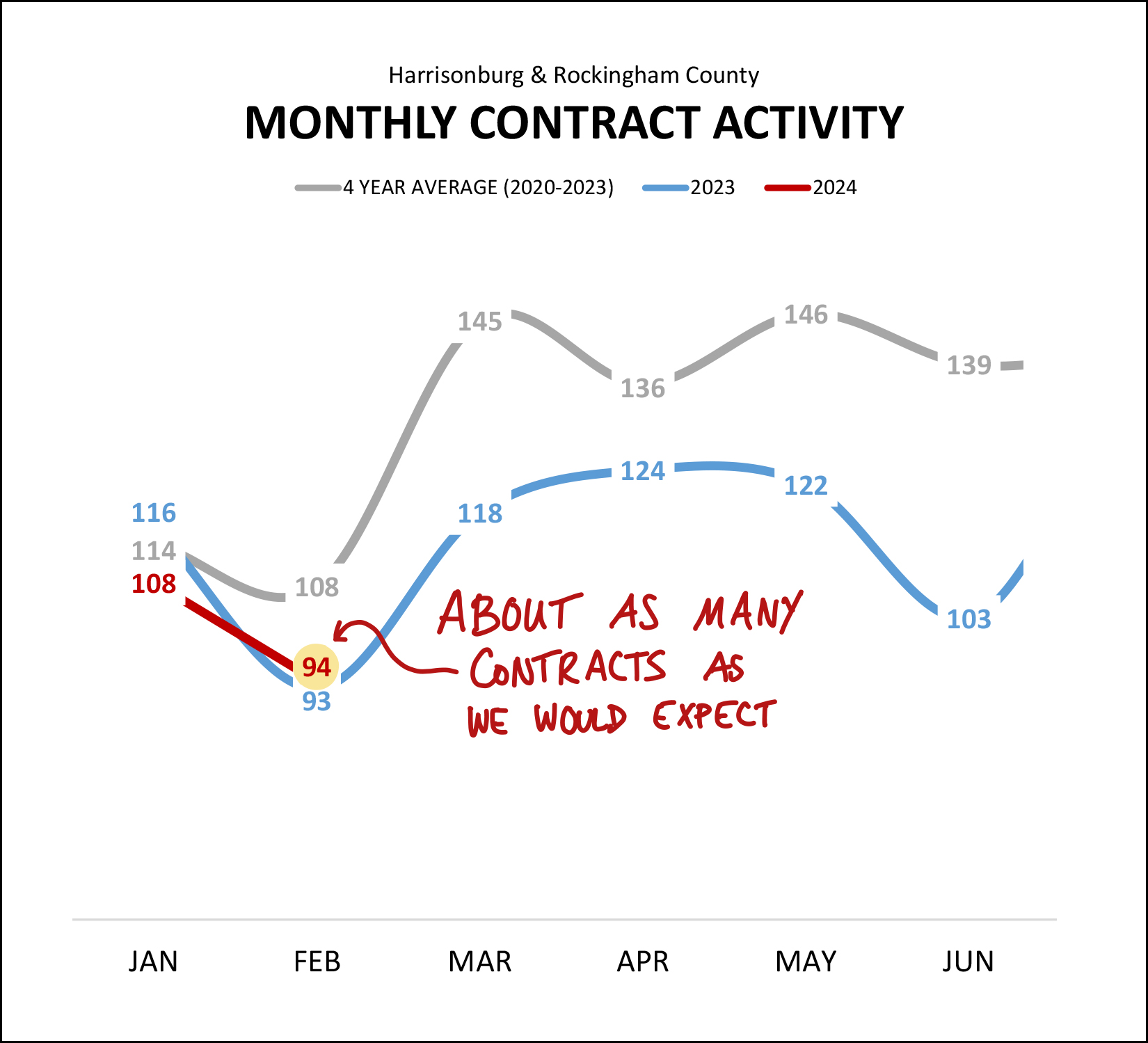

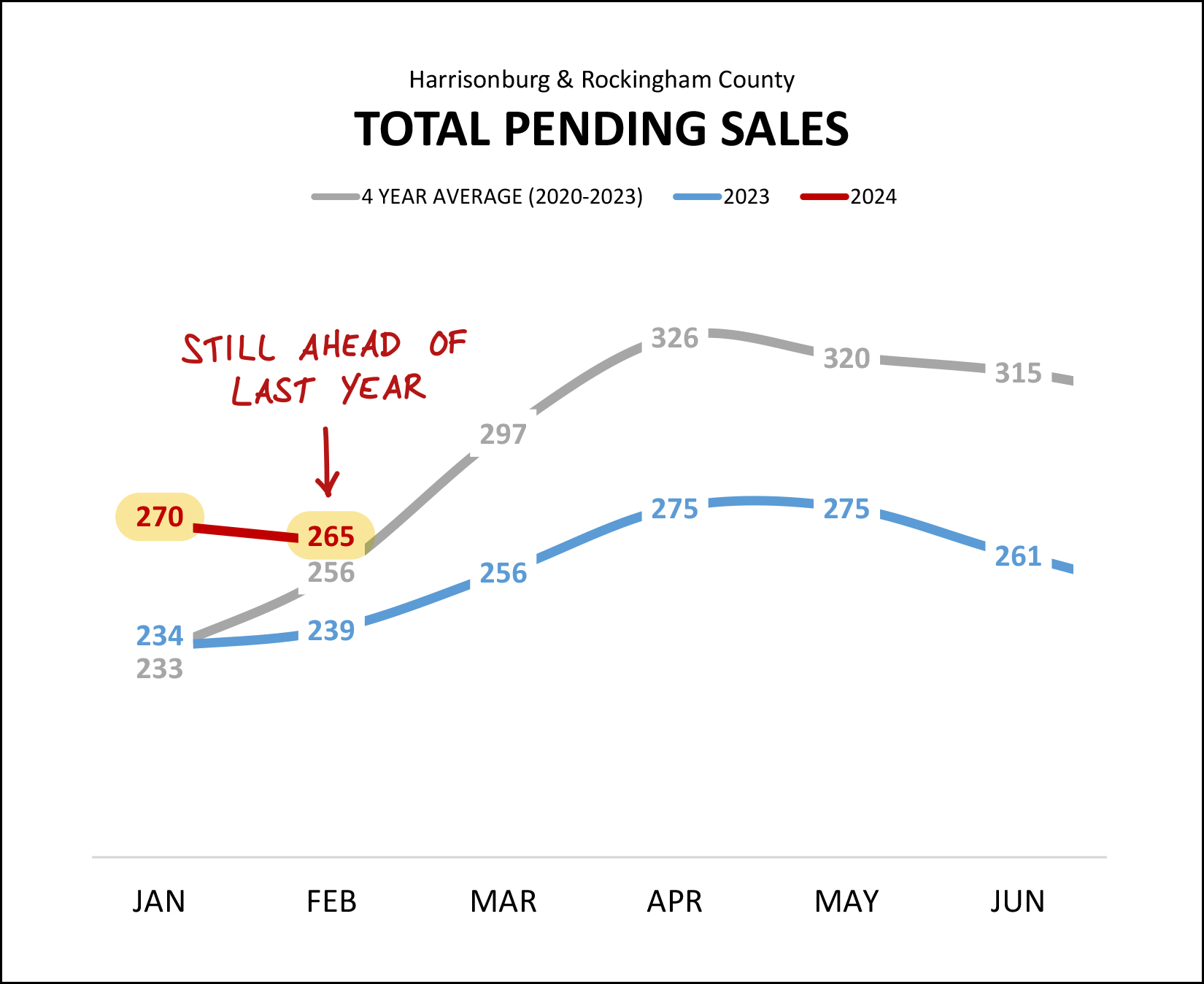

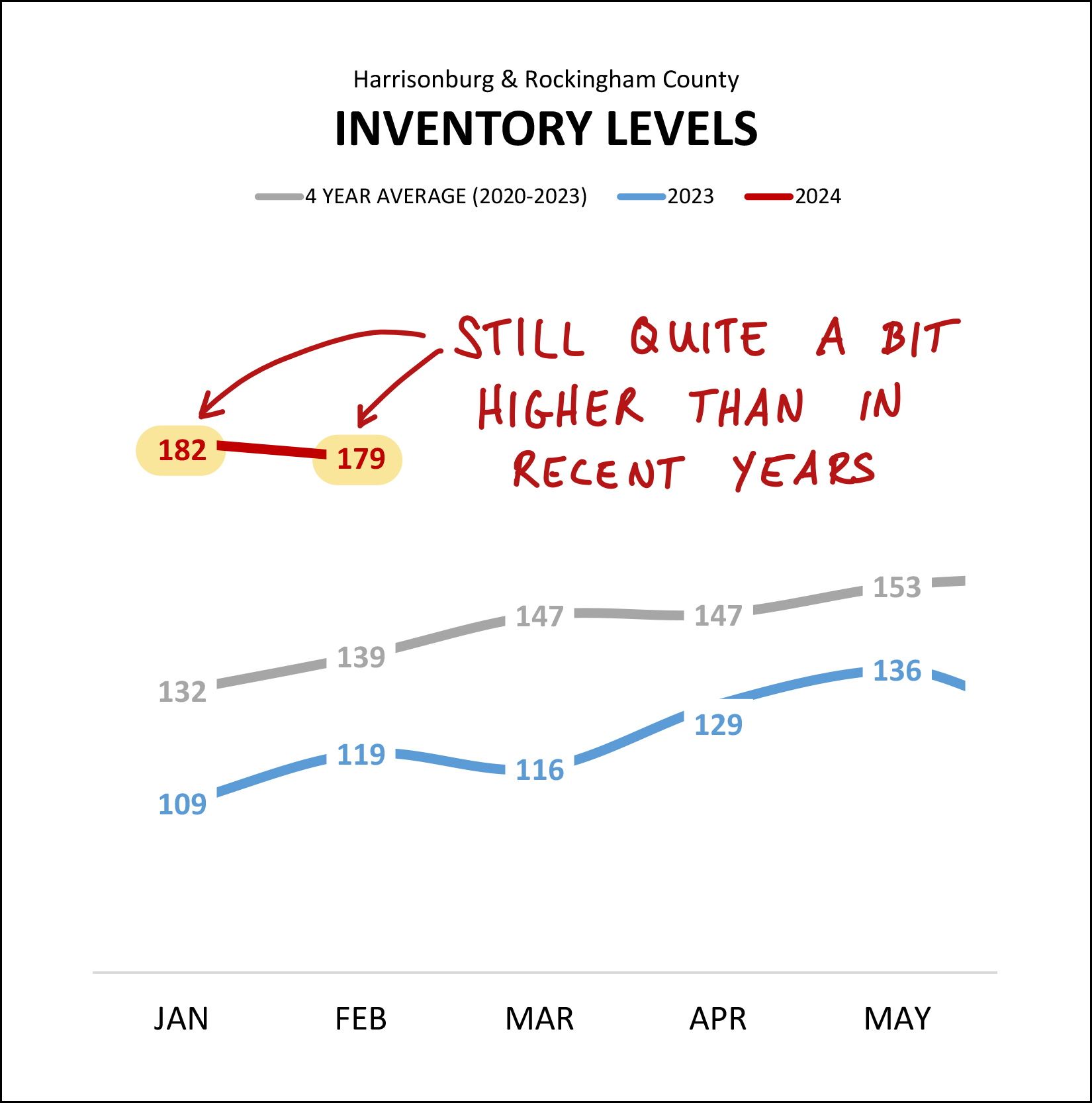

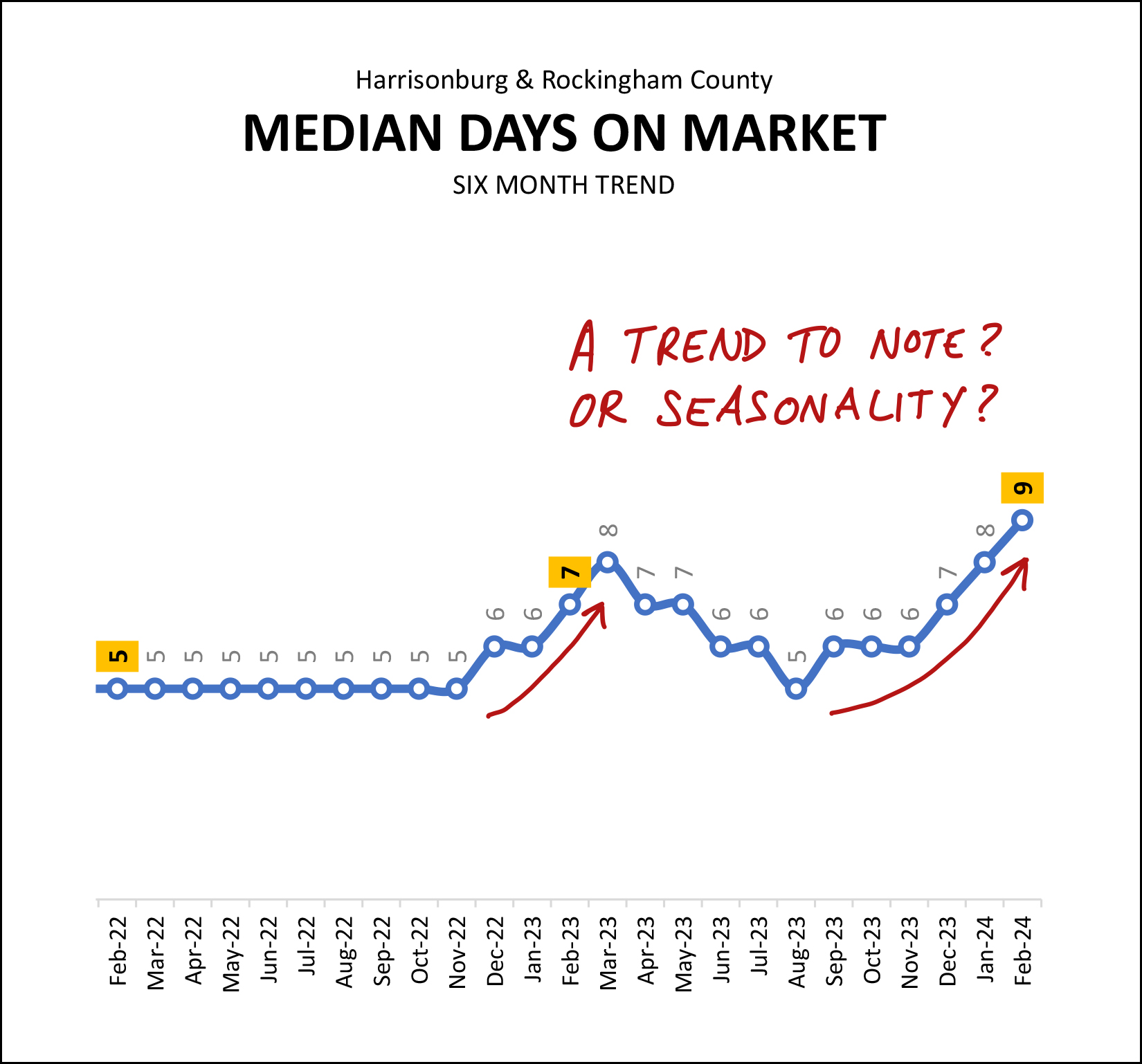

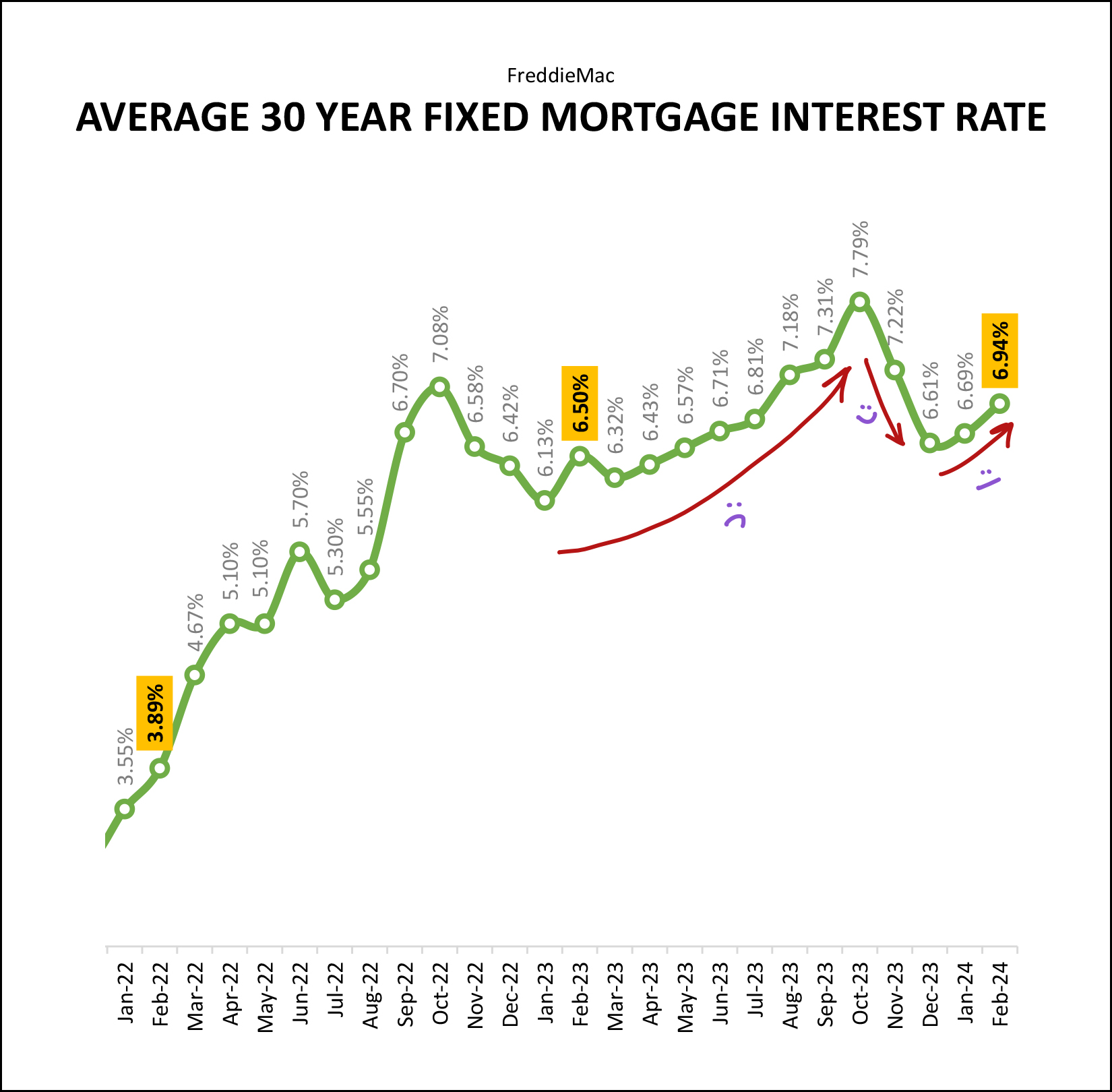

Happy Monday morning, friends! We're about a week away from spring -- as the seasons go -- and the spring real estate market is almost upon us as well! Furthermore, this Thursday (3.14) you'll have a chance to celebrate PI day! Each month I offer a giveaway, of sorts, for readers of my monthly market report. This month you have a chance to win a few pies (pizzas) from Bella Luna. If you find me at Bella Luna I'll likely be enjoying a Caesar Salad and The Don - their meatball pizza. Click here to enter a chance to win a $50 gift certificate to Bella Luna! And now, let's take a look at some of the most recent trends in our local real estate market, starting with how many homes have been selling of late in Harrisonburg and Rockingham County...  Here's what I'm noticing in the chart above... [1] You'll see this on a graph a bit further down, but we saw slightly more home sales this February (84) than last February (75). That said, both of these months of February home sales are well below the 98 home sales we saw two February's ago in 2022. [2] Skipping down to the third highlighted line above, we have seen a 19% decline in home sales in our local market -- but in the past six months (the second highlighted line above) we have only seen a 12% decline in home sales. You'll also see this visually in a graph a bit later, but we may have seen the slowest slow of the recent slowness in our local market -- as it pertains to the number of homes that are selling. That's all (for the moment) about how many homes are selling -- but let's take a look at the prices at which these homes are selling...  Feel free to peruse them all (above) but I'll just focus in on the one highlighted line. The median sales price of homes selling in Harrisonburg and Rockingham County over the past 12 months has been $332,470. This most recent annual median home sales price is 9% higher than it was a year ago when it was $304,800. So... the median sales price is definitely still increasing, quickly, though we saw quite a few months (years) when it was increasing by 10% per year. So, maybe the increase in our local median sales price is slowing, barely. We'll know more over the next 3, 6 and 12 months. And, for another potentially changing trend... how quickly homes are selling...  Two items to note above... [1] I usually hesitate to focus in on just one month of data because it is hard to call anything a trend when looking at such a small data set, but, I will for the moment. Two years ago, homes that went under contract in February did so in a median of 7 days. Last year that was a median of 10 days. This February the homes that went under contract did so in a median of 17 days. So, homes took a good bit longer to sell (go under contract) this February than in recent months of February. [2] Furthermore, looking at the past six months (September through February) it is taking a median of nine days for homes to go under contract and this is up (slightly) from the median of seven days a year ago and the median of five days two years. ago. So, is it taking a bit longer for homes to go under contract now than in recent years? Yes. Does it indicate a change in the market, or something else? I'll explore this a bit more further on in this report. Next up, just a momentary pause to look at home sales only in the City of Harrisonburg...  If you have been trying to buy a home in the City of Harrisonburg for the past few months you might have had a difficult time finding something to buy. As shown above, two years ago there were 99 home sales in the three month period we just finished passing through (December to February) but last year there were only 57 home sales during that timeframe and this year, only 53. This significant drop in the number of homes selling is not a result of lower buyer interest - but more so a result of fewer homeowners being willing to sell. Here's hoping -- for all the would be City home buyers -- that we start to see some homes listed for sale in the City of Harrisonburg this spring and summer! Now, on to some graphs to tell the story a bit more visually, starting with the month by month tracking of home sales in all of Harrisonburg and Rockingham County...  A bit of explanation on the graph above -- the red line shows monthly home sales in 2024, the blue line shows last year (2023) and the grey line shows the average of the past four years (2020-2023) for context. Home sales this February were a good bit higher (+9) than last February -- and also higher than the average of the past four months of February. As noted above, technically we had one extra day (Feb 29) to achieve that this year, but the higher month of home sales is significant nonetheless. Given that January 2024 was a good chunk higher than last year (+18) and February 2024 also outperformed last year (+9) it should come as no surprise that the rolling trend of annual home sales seems to be taking a turn upward...  Annual home sales in Harrisonburg and Rockingham County peaked at 1,727 home sales in a year back in June 2022 and since that time have been mostly declining for about 18 months. But... maybe no longer. As shown above, we have seen increases in the number of annual home sales for each of the past two months. Will this be a trend and will annual home sales continue to rise as we move through 2024 -- quite possibly. Stay tuned to find out as we continue through the year. Here's another look at the year to year of home sales trends for greater context...  As shown above... the number of homes selling each year steadily increased between 2017 and 2021 from 1,260 sales/year up to 1,668 sales a year. After that time, though, we saw declines in the number of annual sales from 2021 to 2022 and again to 2023. Based on January and February data we could see an increase in 2024 -- but we are very early in the year still. The same thing can be said about considering the 2024 median sales price -- we are still early in the year. As pictured in the graph above, the median sales price in our market has steadily increased from 2017 ($198,250) all the way through last year ($330,000). When looking at this year, thus far, the increase in the median sales price has been quite a bit smaller than other recent annual gains -- but we're just two months into the year. A few more months of data will give us a clearer picture of whether sales prices are flattening out at all. I suspect that median price increases are not slowing down as much as the graph above would suggest. Now, to guess at the future a bit, here are the most recent months of contract activity...  Despite more home sales in January and February this year than last, contract activity has not been telling the same story. There were fewer signed contracts this January (108) than last (116) and in February we only saw an increase of one contract between last year (93) and this year (94). If we expect to see home sales activity pick up in 2024 (over and above 2023) we'll need to start seeing more contract activity in the coming months. One slightly different take on this is looking at how many houses are under contract at the end of each month...  There are currently 265 homes under contract in Harrisonburg and Rockingham per the HRAR MLS, which is well above where we were last year at this time when only 239 (blue line) homes were under contract. This trend (more pending listings) is a good sign for those hoping that we will see an increase of some sort in the number of homes that are selling in 2024. So, contract activity is a bit lower, but pending sales are quite a bit higher. Confusing. How about inventory levels, how many homes are available for sale from which buyers can select at any given moment?  As shown above, inventory levels this year are much higher than in any recent year. There are currently 179 homes for sale, which is well above the 119 homes for sale a year ago. Of note, half of the homes currently for sale are new homes -- and the number of new homes for sale can fluctuate quite a bit from year to year as homes are often listed for sale before they are built. I don't (darn) have a record of how many resale homes were listed for sale a year ago, but of the 179 homes currently listed for sale, only 88 of the are resale listings. Next up, how quickly homes are (or are not) going under contract...  A few things can be said about the graph above... [1] We are no longer in the era of homes going under contract at record speeds (median of 5 days) month after month after month after month. That's just not where we are right now. [2] The increase in the median days on market over the past six months might be a sign of a trend -- or it might merely be seasonality. The market might be slowing down (as far as how quickly buyers are contracting to buy homes) or we might start to see this metric increase each winter and then decline again in the spring and summer. The last time we saw the median days on market increase to 7 days (instead of 5) was last winter (Feb 2023) and we saw it again this winter. Let's see if this metric starts to decline again over the next few months. Finally, mortgage interest rates...  What a range of emotions home buyers have felt over the past year and a half... Mortgage interest rates steadily rose from 6.13% in January 2023 to 7.79% in October 2023. Ugh. But then rates fell for several months from 7.79% in October 2023 down to 6.61% in December 2023. Yay. And then... they crept back upward for each of the past two months to 6.94% where they closed out at the end of February. I suspect we will continue to see mortgage interest rates between 6.5% and 7% for much of 2024 -- though perhaps they'll get down closer to 6% by the middle to end of the year. And that, folks, brings us to the end of this month's overview of trends in our local housing market. If you want more (there's more) you can check out an even fuller set of charts and graphs here. Otherwise, let's get ready for SPRING! Home buyers - you will likely see more homes listed for sale over the next few months, hopefully resulting in more and better options for just the right house for you to pursue. Touch base with your lender for an updated preapproval letter if you haven't talked to them recently, and get ready to go see new listings right away when they hit the market. Home sellers - you will likely still find a solid group of interested buyers for your home - depending on your price range and location, and even more importantly, depending on how well you prepare your home, how appropriately you price it, and how thoroughly and professionally we market it. If you are thinking about selling your current home, or finding a home to buy this spring, I'd be happy to help you understand the market and work to accomplish your goals of selling or buying. Touch base anytime so we can set up a time to chat by phone or in person. You can contact me most easily at 540-578-0102 (call/text) or by email here. Happy Pi Day, soon. Happy Spring, soon. | |

Most Homes You Consider Buying Will Not Be A Perfect Fit, So How Much Imperfection Will You Look Past? |

|

I'd love to think that we will find the absolute perfect home for you -- requiring no compromises at all -- perhaps even exceeding your expectations. And certainly, that is possible. But it's not necessarily likely. Most homes that you consider will not be an absolutely perfect fit. You might wish there were a bit more space in this room, or wish that they had updated that part over there, or wish the yard was a bit larger, or wish that the floor plan was a bit more open on the main level. As such, we'll likely see multiple versions of "not quite perfect" through the process of exploring potential homes -- along with at least a few "nowhere even close to perfect" options as well. Your decision as we work through the buying (exploring) process will be to decide how much imperfect you are willing to live with -- and what type(s) of imperfection you will accept. You might decide to purchase an imperfect house that you can make more perfect later through some renovations. You might decide to purchase an imperfect house because its imperfections make it more affordable and keep you in your price range. You might decide to purchase an imperfect because it is the least imperfect one we have seen yet. This is not intended to be a downer -- "you'll never find the perfect house" -- but rather, an encouragement to think about what versions of "not quite perfect" will be acceptable to you. You don't have to decide this up front, and it may change through the course of our exploration of homes to purchase. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings