Negotiations

| Newer Posts | Older Posts |

The Conundrum Of What Price To Offer On A Slightly Overpriced New Listing |

|

Oh, silly sellers, why did you have to make this so difficult!? ;-) There's a fantastic new listing on the market... very likely worth $415K. But... the sellers listed it for sale with a price of $430K. Ugh. You want to make an offer on this house... you want to buy the house... but what do you offer? If the house had been priced at $415K, you would immediately make an offer of $415K. If the house had been priced at $420K, you may very well have made an offer of $420K. But the house is priced at $430K. So do you... [1] Offer $430K, the list price, ignoring the fact that you think this is too much to pay for the house? [2] Offer $415K, the likely value of the house, but $15K lower than the list price? If you offer $430K you are likely paying more for the house than it is worth in the current market. If you offer $415K the seller is almost certainly going to stall in responding to your offer, hoping for another offer that is higher... and is going to alert other interested buyers that they have an offer... which might result in other offers coming in as well. There is no easy answer to this question... it's situational in some ways... and your course of action should be guided by your level of interest in the house and the amount of other early interest in the house. But darn those sellers, pricing the house a bit of market value. ;-) | |

Home Inspections Are Likely To Become A Thing Again, And They Should |

|

Over the past two years I have told countless home sellers something along the following lines as they have made final preparations to sell their home... "That recent listing over in that neighborhood had five offers within the first week and none of those buyers included home inspection contingencies." "That townhouse just went under contract after receiving eight offers, and only one of the eight buyers was asking to be able to conduct a home inspection." As such, many home sellers over the past two years have not had to work their way through home inspection contingencies and the negotiations that sometimes take place after those inspections. And... my point today... most home buyers over the past two years have not had the option of conducting a home inspection during their purchase process. As our local real estate market starts transitioning into a market that is not quite as piping hot of a market as it has been for the past two years, we will very likely start to see more offers with home inspection contingencies. This is great news for buyers! A home purchase is a major financial decision both in the near term and the long term. You are paying a large amount of money for a home in which to live... but that home may very well need some items repaired or need some system maintenance or replacement in the near future. A home inspection allows a buyer to more clearly understand potential home maintenance costs over time by learning more about the condition of the components and systems of the house. As a side note, I am much more of a fan of home inspections being used by buyers to learn about a house and to propose slightly different contract terms if major issues are discovered -- more so than home inspections being used by buyers to try to renegotiate the deal just because they can threaten to walk away from the deal based on the inspection contingency. Home sellers today should be prepared for offers that may include inspection contingencies. Home buyers today should consider including inspection contingencies if they are not competing with multiple other buyers to secure a contract on a hot new listing. | |

How Quickly Will We Plan To Respond To An Offer On My House? |

|

When we receive an offer, how quickly will we plan to respond to that offer? Well, as is often the answer... it depends... We will certainly look at the acceptance deadline on that offer to see when the buyer hopes we will respond... but we might not always respond within that timeframe. Here are a few of the guidelines that will likely inform our response timeline... [1] If the offer is an extremely strong offer with very favorable terms, we will likely respond sooner rather than later. [2] If the offer is OK or good, but not great, we will likely wait until nearly the end of that response timeframe, or possibly even later. [3] If we already have feedback from every other buyer who has viewed the home and none of them plan to make an offer, we will likely respond sooner rather than later. [4] If there were a half dozen showings today and we're still waiting to hear back as to if those buyers will be making offers, we will likely wait a bit to respond to the offer. [5] If we have no other showings scheduled or requested, we will likely respond sooner rather than later. [6] If we have a dozen more showings scheduled and requests coming in beyond that, we will likely wait a bit to respond to the offer. So... as you can see, there isn't one set answer to how quickly we respond to any given offer. It will depend on the context for that offer as informed by the factors noted above, and other factors as well. | |

Even Home Sellers of Newer Or Well Maintained Homes Enjoy Offers Without Inspection Contingencies |

|

So, you're getting ready to make an offer on a super popular new listing. You've heard that there have been 12 showings thus far, and there are already three offers on the table. You're going through the list of contract terms that you'll propose...

Let's arbitrarily and inexactly throw all homes into one of two categories...

Many buyers who are considering properties in the first category (older and/or poorly maintained) are hesitant - reasonably so - to skip the home inspection contingency. Here's where things get interesting, though... Some buyers who are considering properties in the second category (newer and/or well maintained) think that a seller of such a property probably doesn't mind an inspection contingency because, after all, their property is newer and/or well maintained. And yes, that is true. Those property sellers very likely don't mind a home inspection contingency all that much... ...but...

That's not to say that all buyers should be making offers without inspection contingencies as long as a property is newer and/or well maintained... ...but at some point you have to do the calculus of what offer terms are most likely to secure you a contract to actually buy a house. Even if a home sellers has nothing to be worried about in home inspection category, they still enjoy be able to consider an offer without such a contingency! | |

You Might Not Want To Think About This Aspect Of Escalation Clauses. Sorry!? |

|

Escalation clauses are all the rage right now when would-be buyers are competing against multiple other offers on popular, well prepared, well priced, thoroughly marketed new listings. An escalation clause allows you to make an offer at one price, but have that offer price automatically increase to compete against other offers. Yesterday, I pointed out that when it comes to escalation clauses... Today, I'd like to point out that sometimes, your offer with an escalation clause might escalate based on a competing offer that might make you groan when you see it after your offer escalates. Here's the imagined scenario, on a house listed for $400,000... Your Offer = $405,000 contingent on financing 75% of the purchase price, escalating to be $5,000 above any other offer up to $460,000. Offer #2 = $400,000 contingent on financing 80% of the purchase price, escalating to be $1,000 above any other offer up to $410,000. No biggie here -- your offer escalates to $415,000 and that probably seems reasonable. Offer #3 = $400,000 contingent on financing 97% of the purchase price, contingent on a home inspection, contingent on the property appraising at or above the contract price, $500 deposit, contingent on the sale of a property that has not yet been listed for sale, from buyers who have not yet been prequalified, escalating to be $1,000 above any other offer up to $460,000. Oof. Offer #3 is not likely actually an offer that would be accepted by the seller... but it caused your offer to escalate all the way up to $460,000 -- which is $55K above your original offer, and $45K above how far it would have escalated based on Offer #2. Pointing this out is not a recommendation that you make your escalation clause super complicated, as that might overwhelm or turn off the seller... but it is important to realize that competing offers that are extremely weak in almost every way except price might cause your offer to escalate just as much or more as a very strong competing offer would. I suppose, at a minimum, in the situation above, your escalation clause could have at least stated that your offer wouldn't escalate if the competing offer had a home sale contingency? | |

If Your Downpayment Is Small, Your Escalation Clause Differential Should Likely Be Large |

|

Consider these scenarios of multiple offers on a house listed for $400,000... Two offers...

In this scenario, a seller will almost always pick the first offer. Most sellers would be just fine missing out on that final $1,000 being offered by the second buyers because they would rather work with a buyer with a larger downpayment that would appear to be more financially capable, more readily able to cure any appraisal shortages, etc. Interestingly, the second buyer seemed happy to pay $435,000 for the house, but is not likely to get the house because the differential of their escalation clause was only $1,000. Now, then, here is an alternative scenario that the second buyer could have created which might have changed the thought process of the seller...

In this version of the offer situation, the second buyer will at least (likely) get the seller to slow down and give their offer some serious thought. Even if the seller doesn't like the 95% financing situation, and the possible ramifications of that high loan-to-value ratio, to ignore that second offer is potentially leaving $10,000 on the table. So... if you have a small downpayment, you may want to consider a larger differential in your escalation clause... otherwise, you shouldn't be surprised if your offer is not seriously considered by a home seller with multiple strong offers. | |

Many Home Sellers Are Enjoying Working Through Far Fewer Contract Contingencies |

|

I used to tell home sellers that they should expect to that we'll be working through three large, major, serious contingencies between the time that their house is under contract and when it makes it to closing... 1. Home Inspection 2. Financing 3. Appraisal We had to make over each of these hurdles, through each of these gauntlets to successfully make it to settlement. But, now, sellers are enjoying often only working through only two of these contingencies, or even just one of these contingencies. I recently listed a property for sale in the $300K range and we received six offers on the property within 48 hours of being on the market. None of the six buyers included a home inspection contingency. So, many sellers are finding themselves not needing to worry about making it through the home inspection process. On another recent listing six buyers did include an appraisal contingency and two buyers specifically said that they would be willing to pay $___ over the appraised value if the appraisal came in low. So, many sellers don't have to worry about an appraisal contingency at all, or not anywhere near as much as they had in the past. Thus, many sellers are finding the period of time between contract and closing to be much less stressful... and they realize that it is much more certain that they will make it successfully to closing. Buyers, on the other hand, well, yeah... you can imagine from my comments above... they are having to decide on each offer whether to include what used to be typical contingencies (inspection, appraisal) to protect their best interests. It's a bit of a crazy time right now, with a very imbalanced market, and thus far things are not seeming to be slowing down. | |

Using An Escalation Clause To Make Sure You Do Not Pay More Than You Need To Pay For A House |

|

This might sound a bit counterintuitive to suggest in the current market, but I believe an escalation clause can (amidst other appropriate offer terms) be an effective way to make sure you are not paying more than you need to pay for a house.

Here’s the scenario… A lovely house comes on the market… it is **exactly** what you have been looking for… and you manage to snag a showing slot on the first day the house is available for showings. We discover that there are a **lot** of showings on the first two days of showing and we’re already feeling anxious before we get to the house for our showing. We haven’t been inside for more than a few minutes before you realize this is **definitely** the house that you would do anything to be able to purchase. The house is listed for $400,000. You would happily pay $400,000 for the house… or even $405,000 or $410,000… maybe even $420,000 or $425,000. It is, indeed, that perfect. It isn’t until day two that you have an updated lender letter showing you are pre-approved up to $425,000 and you are relieved to find out that the house is still available. We start talking through potential offer terms and then find out that after 48 hours there aren’t any offers on the house. We get the sense that there have been about 20 showings and about 10 of those buyers still haven’t decided whether to make an offer… but at the moment, there aren’t any offers. What to do, what to do. Do we offer $400,000 and ask to be notified if there are other offers… with the plan of revising the offer if we find out that we are in competition with other buyers tomorrow? This is a reasonable plan, but some seller won’t slow down and wait for your revised offer if they get a stronger, acceptable offer after they receive your offer. Do we just offer $415,000 or $420,000 to try to proactively put our offer above any other offers that might come in? This is also a reasonable plan, but you might then be paying $15,000 or $20,000 more than you need to pay if no other offers are made. One strategy for this situation (among many, for sure) is to make an offer at or just above the asking price with an escalation clause to automatically keep your offer a set increment above any other competing offers that come in later. This might be an offer of $402,500 with an escalation clause to automatically make your offer $5,000 higher than any other offer up to $425,000. Doing so (as described above) would give you the advantage of only paying $402,500 if no other offers came in, or if the other offers were right at the list price of $400,000 -- while also allowing your offer to be automatically be higher than any other offer unless they offered $425,000 or higher. So… if you are making an offer… and there aren’t any offers in play yet… consider an offering price at or just above the list price… with an escalation clause to hopefully keep you in first position if or when other competing offers do start rolling in. You will be giving yourself the best chance of actually buying the house, while also doing a decent job of making sure you don’t pay any more than you need to pay based on competing demand. | |

It Can Be Difficult For An Owner Occupant Buyer To Compete With An Aggressive, Motivated, Investor Buyer With Cash |

|

Some properties that hit the market these days -- particularly townhouses -- appeal to two different pools of buyers... Owner Occupants - often first time buyers, hoping to buy the townhouse to move in, put down roots, establish some equity, and more. Investor Buyers - hoping to buy the townhouse to then rent it out to tenants to provide a return on their investment. Sometimes, owner occupants and investor buyers are on relatively equal footing when it comes to negotiations. They might offer similar prices... they might both be financing a part of the purchase price... they might both have inspection or appraisal contingencies, or they might not have either of those contingencies. But sometimes... ...sometimes aggressive, motivated investors with cash, make it *very* difficult for an owner occupant buyer to have a chance at all. Even if an owner occupant's offer price is identical to this aggressive investor' offer price... an investor who is paying cash removes the loan approval as a variable... and more importantly (especially in this market) they remove the appraisal as a variable. Let's say that townhouses in this particular neighborhood have been selling for $200K... but both the owner occupant buyer and cash investor buyer are willing to pay $225K. That $225K offer (times two) is great news for the seller... but... the owner occupant buyer who is financing their purchase will likely need the property to appraise for $225K (in many cases) and thus the investor buyer, paying cash, which will not require an appraisal, becomes a MUCH more compelling offer. And who can blame the seller of the townhouse... even if they would much rather sell their townhouse to an owner occupant buyer, it's hard for such a townhouse seller to choose a path that is objectively much more likely to have issues related to the appraisal. So... if you are a would-be owner occupant buyer making an offer on a townhouse... you better just hope you aren't competing against an aggressive, motivated investor buyer with cash! | |

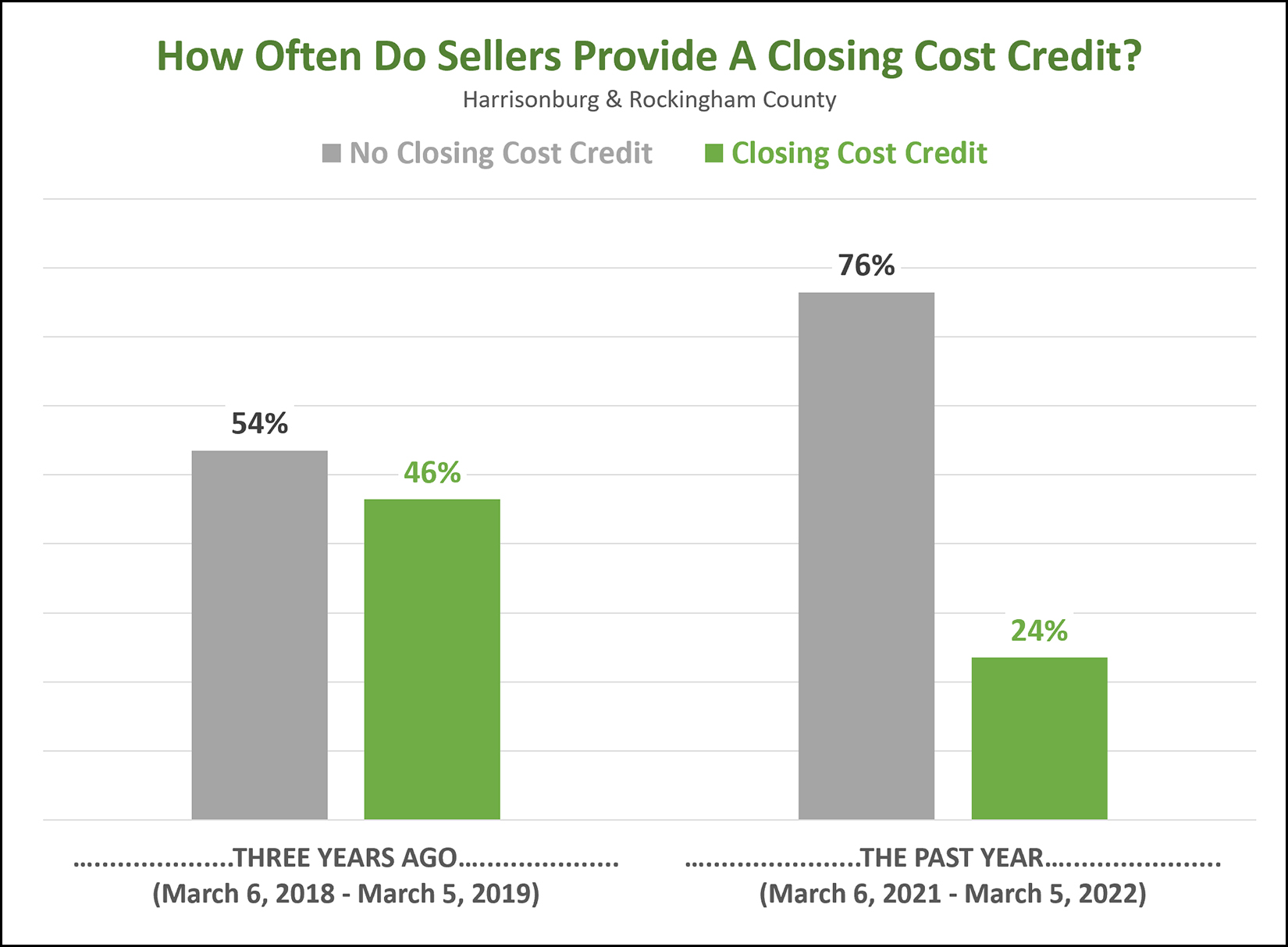

As You Might Expect, Most Home Sellers Are Not Providing Closing Cost Credits These Days |

|

Sometimes a home buyers doesn't have all the cash on hand that they need for both a down payment and the closing costs. In that situation, sometimes a buyer might propose a higher sales price with the seller providing a closing cost credit at settlement. For example... instead of the buyer paying $240K for the house, they could pay $245K and the seller would give them a $5K credit back at closing. But... these days... that isn't happening as often. Three years ago sellers were giving closing cost credits to buyers in nearly half (46%) of all home sales in Harrisonburg and Rockingham County. These days, it is only happening about one in four times. Why might these types of transactions (with closing cost credits) not be happening as frequently right now? First, many or most sellers seem to gravitate towards buyers who have the strongest financial position (largest downpayment) as that is often an indication that they will be more likely to make it successfully through the contract contingencies (inspection, financing, appraisal) to settlement. Second, artificially increasing a contract price in order to have part of your closing costs included in that contract price will most often raise the bar as far as the the price for which the house will need to appraise. If presented with a $240K offer and a $245K less $5K offer, nearly all sellers will choose the $240K offer so that the house only has to appraise for $240K and not $245K. So... if you need a closing cost credit when buying a home... that's fine, it's still happening sometimes... but not nearly as frequently as it was in the recent past. | |

Is Your Escalation Clause Working The Way You Think It Will? |

|

If you are making an offer on a house in 2022 there is a decent chance there will be other offers on the property as well. As such, you may find yourself considering the use of an escalation clause. What is an escalation clause, you might ask? An escalation clause allows you to offer one price but then to effectively increase your offer price to be above any other competing offers. Consider the following scenario on a house listed for $350,000

Offer 2 wins, right? If all the other terms were identical, then probably so. But if the first buyer didn't want to pay more than the asking price if they didn't have to -- but if they would have been willing to pay up to $360,000 -- then things could have worked out differently...

In this situation, Offer 1 becomes an offer of $352,000 and likely is the chosen buyer instead of Offer 2 which is then $1,000 lower. But let's add a layer here -- contingencies...

I see this type of scenario play out quite regularly. In many cases, the seller is will choose to move forward with Offer 2 - even though it is $1,000 less than Offer 1. Buyer #1 might have thought their escalation clause would do the trick and ensure they get to buy the property -- but that is not likely to occur. Why, you might ask? Buyer 2 seems to be better qualified to buy the home, with a larger down payment, plus they do not want to do a home inspection and they won't try to renegotiate after an appraisal. So, if a buyer has some other terms (financing, inspection, timing, etc.) that are possibly or likely to be less favorable to the seller, said buyer might consider leveraging their escalation clause a bit, such as the following...

In this scenario, Offer 1 becomes an offer of $356,000 compared to Offer 2 which is an offer of $351,000. This will cause the seller to think at least a bit longer and harder about whether they really want to go with Offer 2 that is more favorable from a contingency perspective. Think strategically when you are crafting your offer -- and your escalation clause -- knowing that a seller is looking at all of the terms of your offer, not just the offer price. | |

Lots Of Home Buyers Are Still Competing For New Listings |

|

For many new listings, the competition is still quite fierce in Harrisonburg and Rockingham County. Here are three recent examples I've been involved with or heard of in the past 10 days... [1] A townhouse in the City of Harrisonburg under $200K received 12 offers within three days. [2] A duplex in the County in the $300K's received 7 offers within three days. [3] A detached home in the City of Harrisonburg in the $300K's received 16 offers within four days. Wow! Now, this won't be the case for every new listing, in every price range, in every location... there are more buyers in some price ranges and for some locations than others. This also won't hold true independent of how a seller prices their home. A home that ends up selling for $200K will likely have a different number of offers based on whether they priced the property at $195K, $199K, $205K or $225K. But... yes... the market is still quite active, with plenty of buyers ready to buy, and many (to most) new listings being scooped up quite quickly. If you're getting ready to sell this spring, we should talk sooner rather than later about timing, preparations, pricing and more. | |

200 Home Buyers Paid More Than 5% Over Asking Price For Their Homes In The Past Year |

|

Sometimes, you have to be willing to pay the price to get the house... Over the past year-ish (Feb 7, 2021 - Feb 6, 2022) there have been 1,660 home sales in Harrisonburg and Rockingham County. As noted earlier this week, 73% of buyers paid full price or more for their home -- which is 1,229 of those 1,660 home sales. But going a bit further... 200 buyers paid more than 5% over the asking price for the home they purchased in the past year. Looking just at those 200 transactions where buyers paid more than 5% over the asking price... on average, buyers paid $25,561 over the list price! How does that number strike you? It was much higher than I thought it would be... I guess the guy in the photo above is holding out $40,000 of cash -- slightly higher than the average of $25,561 noted above -- sorry for my illustrative exaggeration. ;-) | |

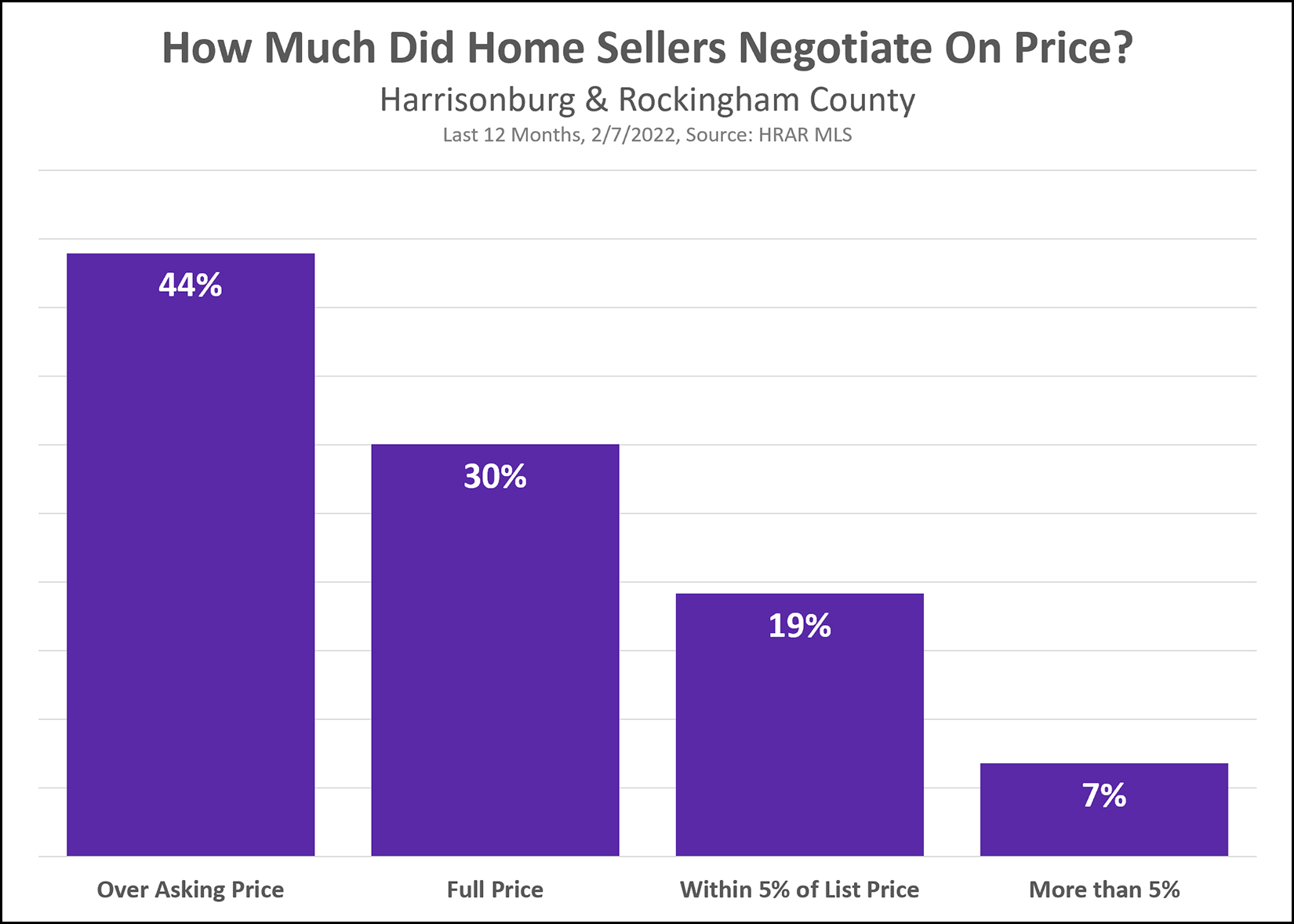

74% of Homes Sold for Full Price or Higher in the Past 12 Months! |

|

A somewhat shockingly high number of homes sold at or above asking price over the past year...

So, what does that mean for you if you are selling or buying in 2022? SELLERS: If you want to sell for $400K, you likely don't need to list your home for $420K in order to leave yourself room to negotiate down on price. Listing it for $400K will likely do the trick, and might result in the house selling for more than $400K. BUYERS: Understand that you are likely to need to pay full price or higher for the house you plan to buy -- though that needs to be put in the context of the value of the home. Certainly, if a $400K house is listed for sale for $475K then you shouldn't pay full price or higher... Understanding the local real estate market is more important than ever for buyers and sellers in 2022! | |

Home Inspection Contingency Modifications |

|

In this competitive real estate market -- when buyers are often finding themselves competing with multiple other buyers for their perfect home -- some buyers find themselves considering whether to make an offer without a home inspection contingency. Certainly, an offer without a home inspection contingency is likely to be seen by the seller as a stronger than an identical offer with an inspection contingency. Of late, I have seen some buyers (or their agents) trying to find space between having a home inspection contingency and not having one. Here are three modifications of home inspection contingencies I have seen lately that don't seem to be all that helpful... Repairs Will Only Be Requested If Total Repair Cost Exceeds $1,000 - I suppose this is intended to communicate that a buyer won't ask the seller to make small or minor repairs, but most sellers still see this as being almost identical to a regular old home inspection contingency. After all, just about every inspection report has enough needed small repairs that they would have a total cost of over $1,000. So, this ends up being some "feel good language" that doesn't actually make an insightful seller feel any better than a contingency without the language. Inspection For Informational Purposes Only - This is usually accompanied by language that allows a buyer to terminate the contract if they do not like what they find during the home inspection, so this modification really just seems to be a promise to terminate the contract instead of asking for repairs if there are issues. This often isn't seen as much stronger than an offer with a regular old home inspection contingency. If There Are Issues, Buyer Will Request Repairs, Not Terminate - Again, I think this is often intended to try to make the seller feel better about the inspection contingency. The buyer is promising not to just give up and walk away -- they will at least request repairs and try to work things out. But, this one is also pretty subjective -- those repairs that are requested (instead of terminating the contract) can be requested in a manner that would make it almost impossible to come to an mutually acceptable resolution -- essentially working a buyer back towards being able to get out of the contract, technically by having required repairs instead of having terminated the contract. I have nothing against a buyer (or buyer's agent) trying to soften the impact of a home inspection contingency -- but most sellers look at things in a bit more of a black and white perspective -- is there an inspection contingency or not? So... instead of spending lots of time and energy trying to fine tune the language of a cleverly crafted modification of an inspection contingency... focus on deciding whether you want the opportunity to reconsider whether you will purchase the property after having gathered additional information during a home inspection. If you do want the chance to reconsider the purchase, then you're going to have an inspection contingency - and regardless of what additional language you add in to try to soften the impact of that contingency - a seller is almost certainly going to see it as being less favorable than an offer without an inspection contingency. | |

Why In The World Are You Buying A House Without A Home Inspection?? |

|

Yes, sometimes buyers these days are making offers on houses without a home inspection contingency. As Paige asked yesterday... Is everyone else in the world significantly more handy, a better gambler, or just have that much cash laying around? Good question, Paige! :-) Here are some of the reasons why buyers are making offers without home inspection contingencies...

A few more thoughts and observations...

Home buyers have some difficult decisions to make these days as they formulate a plan for pursuing a house in a housing market with very low supply levels. Deciding whether to include a home inspection contingency is just one of those difficult decisions. | |

All The Cool Kids Are Offering To Pay Over Appraised Value These Days |

|

Escalation clauses are so YESTERDAY!?! ;-) Not really -- many/most buyers are still using them -- but they don't matter much if an appraisal is going to rein a sales price back in... Consider these three offers on a fictional home listed for $300K...

Hooray, the house sells for $355K to buyer #3, right? Well, probably... though if it then appraises for $300K, then none of the offer prices over the list price or the escalation clauses really amounted to anything. Thus, these days, many buyers are not only asking themselves how high they are willing to go with an escalation clause -- they are also asking themselves how much above the appraised value they are willing to pay for a house. Consider, then, the following three offers on the same house listed for $300K...

Clearly, a seller would toss out the first offer. Some sellers would then immediately jump to the third offer, since it is $10K higher than the second offer -- but -- that depends on your best guess as to the appraised value of your house. If you listed your home for $300K, presumably you think it should sell for around $300K and thus might appraise for $300K. If that is the case, then the second offer above is likely a better choice for you. That offer would stay at $325K even if the appraisal came in at $300K, whereas the third offer would start off higher at $335K but would then drop to $310K if the appraised value were $300K. So, as a buyer -- consider how much above the appraised value you are willing to pay for a house when you are competing with multiple other offers -- and as a seller, consider how an appraisal will impact each offer that you might accept. | |

Several Ways To Think About Appraisal Contingencies |

|

It used to be pretty common for real estate contracts to be contingent on the property appraising at or above the contract price. If a buyer was to be paying $350K for a house -- they wanted to make sure the appraised value was $350K or higher. These days many buyers understand that they might need to be willing (and able) to pay above the appraised value in order to actually buy a home. After all, if a house is listed for $350K and there are six offers on the house, all with escalation clauses and the winning offer is $370K -- that buyer may need to be willing to still pay $370K even if the appraised value ends up being $350K or $360K. Here, then, are a few ways that buyers are thinking about and dealing with appraisal contingencies... Contingent On Appraisal Some buyers are still making offers that are contingent on the appraised value being equal to or greater than the contract price. These offers are often going to be the ones that are least likely to be accepted in a multiple offer scenario if all other terms were the same. It is fine to include this contingency in an offer -- but it greatly reduces the likelihood that the seller will choose to move forward with your offer. An Unspoken But Implied Contingency If you are financing 90% or 95% or 97% or 100% of the purchase price -- even if you don't have an appraisal contingency explicitly included in your contract -- your offer may effectively be contingent on the property appraising at/above the contract price due to the financing contingency. When a buyer is financing 95% of a $250K purchase price -- and the appraisal comes in at $240K, their lender will likely require the buyer to bring extra cash to closing. If the buyer has extra cash -- great. If not, the buyer will not be able to move forward with the purchase as a result of the low appraisal -- even without an appraisal contingency -- because of the financing contingency. A Limited Contingency Perhaps you're offering $310K for a house and you are willing and able to move forward with the purchase so long as the property appraises at or above $300K. As such, you're willing to pay $10K above the asking price. We can make your offer contingent on the property appraising for at least $300K -- which will give the seller more peace of mind because you are willing to pay $10K over the appraised value. Not At All Contingent Maybe you love a house soooo much that you do not even care about the appraised value -- and your financing or cash situation is such that it won't change things if the appraisal comes in slightly or significantly low. In such an instance, we don't need to make the contract contingent on the property appraising at any particular price -- and we might even go so far as to say in the contract that you will proceed with the purchase regardless of the appraised value. In Summary... It's a fast moving market these days and with so many buyers making offers on properties, many buyers are often willing to pay above appraised value for a property that is a great fit for them. It is important to think about and talk about the appraisal process and strategically incorporate (or don't incorporate) whatever contract terms make the most sense given your level of interest in the property, your financing situation, your cash situation, etc. | |

Consider Strategically Crafting An Escalation Clause Based On Your Other Contingencies |

|

So, let's consider this scenario... Offer #1 = $255K Offer #2 = $250K with an escalation clause to increase $1K above all other offers up to $270K Based on this information, buyer #2 wins, right? Their offer is effectively $256K and the first offer is $255K, so the seller would definitely pick offer #2, right? Well -- maybe. What if we had these additional details... Offer #1 = $255K, contingent on the buyer financing 80% of the purchase price, and no home inspection Offer #2 = $250K with an escalation clause to increase $1K above all other offers up to $270K, contingent on the buyer financing 97% of the purchase price and contingent on a home inspection and contingent on the property appraising at/above the contract price I suspect you may see where I'm going with this. In this situation, why would a seller pick offer #2, just for a sales price that is $1K higher, to then voluntarily be subjecting themselves to possible further negotiations related to the home inspection, the appraised value, and with a buyer who would appear to be less financially qualified (3% down payment instead of 20% down payment) than the first buyer? Most sellers would likely pick Offer #1 in this more nuanced scenario. So -- extrapolating from this specific "what if" -- if your offer will include contingencies or terms that are bound to be less favorable to the seller, you may want to consider being willing to pay a higher price compared to other offers. Here's how that might look... Offer #1 = $255K, contingent on the buyer financing 80% of the purchase price, and no home inspection Offer #2 = $250K with an escalation clause to increase $5K above all other offers up to $270K, contingent on the buyer financing 97% of the purchase price and contingent on a home inspection and contingent on the property appraising at/above the contract price Now, the seller has an offer of $255K and an offer of $260K. The higher offer still has more contingencies to work through -- but perhaps they are more willing to do so given that the sales price would be $5K higher in this scenario instead of just $1K higher. So, as you consider that "differential" that you put in your escalation clause -- consider the other terms and contingencies you are including and how they might compare to other competing offers -- and consider adjust that differential accordingly. P.S. No, I'm not an attorney. I'm not offering legal advise. I'm just a Realtor pondering negotiating strategies aloud. Consult with your Realtor about how to draft the most competitive offer on a property based on your situation and that individual property. :-) | |

Strategies For Securing A Contract WITH A Home Inspection Contingency |

|

Some would-be home buyers are, reasonably, not comfortable entering into a contract to purchase a home without an inspection contingency. But...in a competitive market where there are often multiple offers, it is harder to compete as a buyer if one or several of the competing offers does not include an inspection contingency. Of note, we won't really know if competing offers do or do not have inspection contingencies, but when there are multiple competing offers in the current market, it seems that there will often be at least one without an inspection contingency. So, how can a buyer who desires an inspection contingency compete in such an environment? Here are a few ideas... 1. SHORTEN THE TIMELINE Proactively get on a home inspector's schedule so that you can include a shorter timeline in your offer for the inspection contingency to be resolved. 2. REMOVE YOUR OPTION TO TERMINATE The standard home inspection contingency gives you the option to either request repairs or terminate the contract after completing the inspection. Give the seller a bit more peace of mind that you won't just terminate the contract even if the inspection goes reasonably well by removing that second option from your inspection contingency. 3. SACRIFICE YOUR DEPOSIT Consider offering to give the contract deposit to the seller if you cannot work your way through the inspection contingency. This will show that you are committed to making the deal work and successfully getting through the inspection contingency. 4. RAISE THE STAKES If you are including an escalation clause to make your offer $1K above any other offers -- consider raising that threshold, If your escalation clause takes your offer to $276K with an inspection contingency compared to another offer at $275K without an inspection -- the seller will probably choose the offer that is $1K lower without an inspection contingency. But if your escalation clause made your offer $5K higher than other offers, the seller might decide to accept your $280K offer with an inspection contingency instead of the $275K offer without. In the end, it can be a challenging time to secure a contract on a house regardless of the contingencies you want to include -- but including an inspection contingency can make it much more challenging to be successful. If you definitely want that inspection contingency in place, consider any or all of the strategies above to increase your odds of securing a contract to buy a house. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings