| Newer Posts | Older Posts |

Home Inspection Contingency Modifications |

|

In this competitive real estate market -- when buyers are often finding themselves competing with multiple other buyers for their perfect home -- some buyers find themselves considering whether to make an offer without a home inspection contingency. Certainly, an offer without a home inspection contingency is likely to be seen by the seller as a stronger than an identical offer with an inspection contingency. Of late, I have seen some buyers (or their agents) trying to find space between having a home inspection contingency and not having one. Here are three modifications of home inspection contingencies I have seen lately that don't seem to be all that helpful... Repairs Will Only Be Requested If Total Repair Cost Exceeds $1,000 - I suppose this is intended to communicate that a buyer won't ask the seller to make small or minor repairs, but most sellers still see this as being almost identical to a regular old home inspection contingency. After all, just about every inspection report has enough needed small repairs that they would have a total cost of over $1,000. So, this ends up being some "feel good language" that doesn't actually make an insightful seller feel any better than a contingency without the language. Inspection For Informational Purposes Only - This is usually accompanied by language that allows a buyer to terminate the contract if they do not like what they find during the home inspection, so this modification really just seems to be a promise to terminate the contract instead of asking for repairs if there are issues. This often isn't seen as much stronger than an offer with a regular old home inspection contingency. If There Are Issues, Buyer Will Request Repairs, Not Terminate - Again, I think this is often intended to try to make the seller feel better about the inspection contingency. The buyer is promising not to just give up and walk away -- they will at least request repairs and try to work things out. But, this one is also pretty subjective -- those repairs that are requested (instead of terminating the contract) can be requested in a manner that would make it almost impossible to come to an mutually acceptable resolution -- essentially working a buyer back towards being able to get out of the contract, technically by having required repairs instead of having terminated the contract. I have nothing against a buyer (or buyer's agent) trying to soften the impact of a home inspection contingency -- but most sellers look at things in a bit more of a black and white perspective -- is there an inspection contingency or not? So... instead of spending lots of time and energy trying to fine tune the language of a cleverly crafted modification of an inspection contingency... focus on deciding whether you want the opportunity to reconsider whether you will purchase the property after having gathered additional information during a home inspection. If you do want the chance to reconsider the purchase, then you're going to have an inspection contingency - and regardless of what additional language you add in to try to soften the impact of that contingency - a seller is almost certainly going to see it as being less favorable than an offer without an inspection contingency. | |

The Tax Assessment Of A Property Is Most Useful For... Calculating The Real Estate Tax Bill For The Property |

|

Oh, I see that house down the street is for sale! What's the list price? They are asking $400,000 for the house. What is the tax assessment of the property? Why? --- If you want to know the tax assessed value of the house to understand how much an owner of the property pays in real estate taxes - great! Let's go take a look at the tax assessment. --- If you want to know the tax assessed value of the house to evaluate whether the seller's asking price for their home is reasonable -- you likely aren't looking in the right places for indicators of market value. --- Tax assessed values are actually intended to be a good indicator of market value, as the City and County want to be taxing you on the basis of the actual market value of your property... but... oftentimes, the tax assessed value of properties in this area range from low to very low. Part of that is due to timing. Today's tax assessed values may be based on sales data from 12 to 18 to 24 months ago due to the time intensive process of analyzing property values and updating tax assessed values. The median sales price is currently increasing quickly, at a rate of 10% to 12% per year. Thus, when market values are quickly increasing and tax assessed values are based on 12 to 24 month old data, you are likely to see a more significant difference between tax assessments and market values. So, it's fine to look at the tax assessment of a property, but I wouldn't put too much confidence in thinking that it is an indicator of the present market value of the property. | |

Recent Similar Home Sales In The Same Neighborhood Are Often The Best Indicator Of Home Value |

|

What are the top three factors affecting home value? "Location, Location, Location" Or so the saying goes. But, really, the location of a property is key in understanding its value. A home with 1500 SF in one neighborhood in Harrisonburg will not necessarily sell for the same price as a home with 1500 SF in another neighborhood on the other side of town. A townhome built 20 years ago in one neighborhood will not necessarily sell for the same price as a townhome in another neighborhood that was built 20 years ago. As such... Don't be too hasty in drawing conclusions about the value of a house based on the sales price of houses in a completely different location or neighborhood. It is usually best to seek to understand the value of a home by first examining recent sales in the same neighborhood or location of the home in question. | |

Most, But Not All, Home Sellers Optimize For Price |

|

What are you optimizing for?

As a home seller, you are always optimizing for something. PRICE - Maybe you are willing to wait as long as it takes to get the price that you want for your house. Even if it takes months longer than you had hoped and even if it means that you aren't able to continue on with other life transitions that you had planned, at least you go the price you wanted. TIME - Maybe it's important to you that you wrap up your home sale (have the house under contract) within a few weeks or within a month. If so, you might be willing to price your home a bit lower to maximize the possibility that you accomplish your timing goals. CONVENIENCE - Maybe your strategy for when you list your home and your pricing strategy all revolve around making it a seamless transition to your next home. You're willing to be flexible on timing and on pricing so long as it lets you accomplish your goals of buying that perfect next home. | |

The Three Main (Usual) Hurdles To Getting To Closing |

|

While every home sale is different -- with unique contingencies based on the needs and situations of the buyer and seller -- there are three main hurdles that most buyers and the houses they are purchasing must clear to make it to closing. So if you are selling your house -- where is your contract in this process? Have you cleared 1, 2 or 3 of the hurdles, thus far? There will be plenty of other details to attend to, but these are the three main areas of focus. Evaluating the property condition, the property value, and the buyer's finances.... INSPECTION - This is an evaluation, by a home inspector, of the condition of the house. Clearing this hurdle typically involves requesting that the seller make some repairs to the house (or negotiate further on price) based on new information about the property condition discovered during the inspection process. APPRAISAL - This is an evaluation, by an appraiser hired by the purchaser's lender, of the value of the house. If the property appraises for the contract price (or higher), all is well -- otherwise, the buyer and seller may need to renegotiate the contract price based on the appraised value. LOAN APPROVAL - This is an evaluation, by a lender (and their underwriters) of the purchaser's financial situation. The lender must confirm that the buyer has the income to support the mortgage payment required for purchasing the home. Again - there are many other smaller hurdles (for example, a termite inspection) and larger hurdles (for example, a home sale contingency) that may need to be cleared in your purchase (or sale) of a home -- but these three main hurdles (inspection, appraisal, loan approval) are the three main mileposts during the contract-to-closing process that we'll be focused during the transaction. NOW, TECHNICALLY, 2021 IS A BIT DIFFERENT... Some buyers in today's market are skipping a home inspection -- so you might be dealing with two hurdles instead of three... ...and some buyers in today's market are not making their contract contingent on an appraisal -- so you might be dealing with just one hurdle instead of two or three. BUT YOU MIGHT ALSO BE DEALING WITH SIX HURDLES!

Would you rather have three main hurdles to clear, or six? Let's imagine that you receive two offers on your house, which is listed for $250K....

So -- a slightly higher sales price, with a home sale contingency, is not always more valuable to a seller than a slightly lower sales price without a home sale contingency. Selling your home can be quite straight forward and a very smooth process -- but we typically have one, two, three or even six significant hurdles to clear before we successfully make it to closing. | |

Is That Bedroom Really A Bedroom? |

|

You don't have to be a math major to count bedrooms, right? Well, technically, that's true -- but counting bedrooms for real estate purposes can become a bit nuanced. Now -- the National Appraiser Roster has all sorts of nuances surrounding this topic....

Wow. OK. Lots to consider there. So -- the short answer is that you can count your bedrooms based on whether they have windows and closets -- but it may require a bit more thought and analysis before we decide how many bedrooms we'll say that your home has when we put it on the market. Oh, and two final notes....

| |

How Much Will Your Housing Costs Increase When You Sell Your Home And Buy A New One? |

|

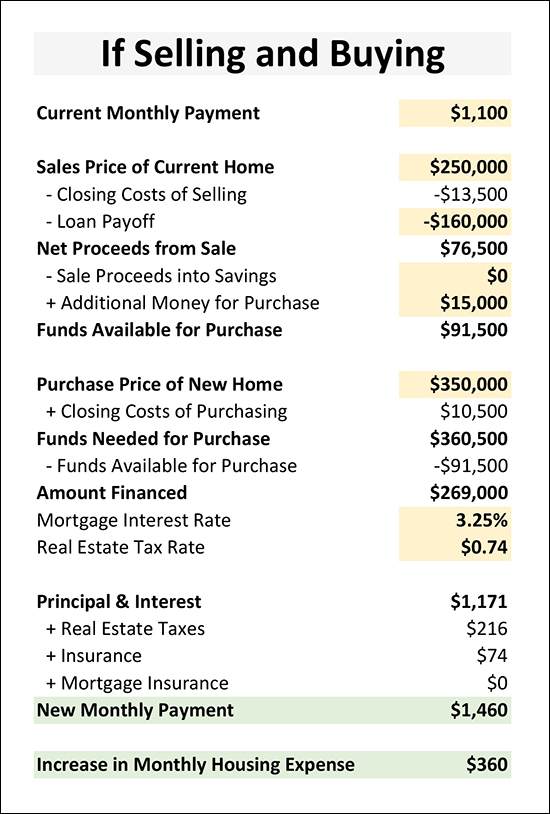

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

What If The Right Buyer For Your Home Is NOT Out There Right Now? |

|

If you are preparing your house well for the market - and pricing it appropriately, according to what other buyers have recently paid for similar houses - and the house is marketed fully and professionally...it should be under contract relatively quickly, and certainly within the first 30 days, right? Well... maybe... Sometimes, it just takes time. In the end, if the right buyer is not in the market right now, then it might not sell until the right buyer is ready to buy - and we shouldn't necessarily expect that the wrong buyer will buy your house just because it is prepared well, priced well and marketed well. Understanding how these dynamics will affect you and your listing is highly related to how many buyers are in your price range -- and in that pool of buyers in your price range, is your house likely to meet the needs of only a few, many or most of the buyers. So, if your home has been on the market for 30 days, or 60 or 90 or 120 or more days -- we should be thinking about...

If the answer is yes, yes and yes -- then we'll be left with two options...

| |

The Only Way I Can Try To Get You To Be More Excited About Raking All Of Those Leaves |

|

Are you raking a lot of leaves lately? Or trying to blow them in one direction or another with a leaf blower? Sounds like you have a lot of trees on your property -- and perhaps -- quite a few in front of your house. Here's the one upside to all of those leaves falling down onto your lawn -- we're finally entering the time of year when we can finally see the front of your house! :-) Many sellers list their homes in the spring or summer, which is often ideal for the timing of their move, and aligns well with when most buyers are in the market. However -- some houses are very difficult to be seen (and photographed) in the spring and summer because of large trees in the front yard. So -- while you're raking or blowing leaves this fall -- think about whether you are going to be selling your house this coming spring or summer. If you are, and if you have trees obscuring the front of your house, we should discuss taking some exterior photos SOON rather than waiting until later when we can't see your house at all. | |

Only The Top 5% Of Home Buyers In Our Market Pay Over $550,000 |

|

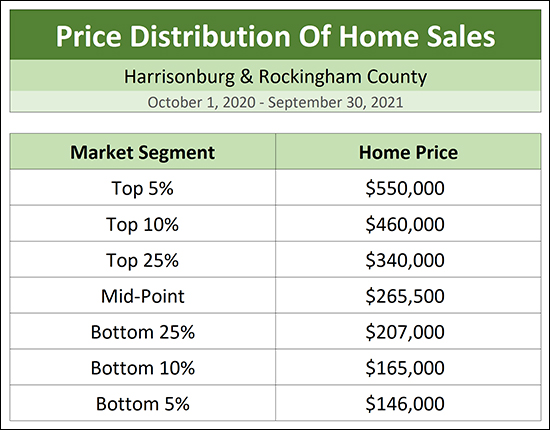

If you are selling a home over $550,000 -- you are only appealing to about 5% of the buying public as per the price distribution of the 1,654 home sales that were recorded in the HRAR MLS in Harrisonburg and Rockingham County over the past year. Looking to sell something over $460,000? That will appeal to about 10% of the buying public. You can slice and dice the data above however you'd like...

I think you get the point. :-) If you have ever wondered where your home falls into the overall distribution of home sales prices in this area -- now you know! Thanks, Tom, for the question that lead to this analysis! :-) | |

If Your Home Is Not Under Contract After 30 Days, And You Have Not Received Any Offers, Should You Consider Adjusting The Price? |

|

The answer to this question is not timeless -- it depends on the market dynamics -- so we should answer it differently now as compared to in five years ago as compared to in five years. But here's the question, again... If Your Home Is Not Under Contract After 30 Days, And You Have Not Received Any Offers, Should You Consider Adjusting The Price? Right now, in the current 2021 market, I'd say the answer is usually (but not always) yes. If your home has been on the market for 30 days and it is still available for sale (not under contract), without having received any offers, then you should likely consider adjusting the asking price of your home. After all, within that first 30 days you have likely had a good number of buyers consider your home -- either by viewing it online, driving by or walking through it. If none of these buyers have been inspired to make an offer, it is likely a good time to consider adjusting your asking price. With... a few exceptions... [1] If your home is priced in the top 10% (or 5%) of our market, you are appealing to a much smaller portion of the buyers in our market, and it might take longer for a buyer to be in the market to buy your home and you might not want to or need to adjust your asking price yet. [2] If your home is in a bit of an "out of the way" location that will only appeal to a small subset of buyers in the market, it might take longer for a buyer to be in the market to buy your home and you might not want to or need to adjust your asking price yet. You get the point... If there are plenty of potential buyers in the market to buy houses like what you are trying to sell -- and nobody has made an offer -- you should likely reconsider your pricing strategy. Again, though, this is market specific and property specific. The same advice might not apply a year or two from now -- and the same advice does not necessarily apply to every property on the market today. If we're listing your house for sale, while we'll be in constant communication in the first 30 days and thereafter, let's also plan to pause 30 days in to reconsider our pricing strategy if we haven't received any offers. | |

Do Some Of The Attributes Of Your Home Disqualify Some Buyers? |

|

There are plenty of ways in which attributes of your home may cause some buyers to not even consider it. When you are analyzing the market value of your home, it is important to understand whether a few, many, or most buyers will be disqualified based on those attributes of your home. Some examples...

We'll spend much of our time focusing on the positive attributes of your home and how they will appeal to buyers -- but we can't ignore the attributes of your house that will cause some buyers to disqualify themselves from considering your home. If a combination of the disqualifying attributes of your home cause only 10% of buyers in your price range to consider buying your home -- then we need to account for that in our pricing strategy. Your home likely won't sell for as much as we might have hoped, given that we will effectively be appealing to a much narrower segment of buyers. | |

Some Sellers Will Prioritize Certainty Over Price |

|

When a seller signs a contract with a buyer, they want to be as certain as possible that the contract will proceed to settlement. The king of all offers, providing the most certainty to a seller would be a cash offer with no contingencies whatsoever. As each of the contingencies below are added to a contract, the seller's certainty decreases...

It is important, as a buyer, to remember that most sellers are thinking about certainty alongside price. Which of these offers is likely to succeed?

When presented with these three offers I think many or most sellers would choose offer #1 even though it is $1K or $5K lower than the other two offers in hand. Give careful thought to the contingencies you do and do not include in your offer and understand how they affect the seller's view of the certainty that your contract will make it to settlement. | |

Will This House Sell For More Than The Asking Price? |

|

The answer to this question - will a house sell for more than its asking price - does not just relate to how the asking price compares to the market value of the home.

Certainly, if a house is priced too low, or even priced fairly in a competitive market, that will increase the likelihood that it will sell above the asking price... [1] A house worth $350K, listed for $330K, will almost certainly sell for more than the asking price. [2] A house worth $350K, listed for $350K, is likely to sell for more than the asking price in the current market. ... but there are other factors that affect this as well. [1] How many buyers have viewed the home? As the number of showings increases, the likelihood of a house selling for more than the asking price also increases. [2] How many buyers have made an offer? As the number of offers increases, the likelihood of a house selling for more than the asking price also increases. All of this might seem pretty straightforward, but pause to reflect on these dynamics as you are considering an offer on a house recently listed for sale. Consider these two fictional houses that came on the market (not really) yesterday, that we’re walking through today... [1] House listed for $350K, with 18 showings and four offers thus far. This house is very, very likely to sell for more than the asking price. :-) [2] House listed for $350K, with eight showings and one offer thus far. This house might sell for more than the asking price - if another buyer jumps in and makes a second offer. [2] House listed for $350K, with 12 showings and no offers. This house could, possibly, sell for more than the asking price, but it is not seeming very likely given that lots of buyers have looked at it already and there aren’t any offers. [3] House listed for $350K, with one showing and no offers. This house is almost certainly not going to sell for more than the asking price - unless a bit more time passes and several buyers all of a sudden go see the house at the same time and make simultaneous offers and then have to compete with each other to buy the house. So, to answer the question of whether a house is likely to sell for more than its asking price, we really need to start by asking how many showings a house has had and how many offers exist. | |

We Will Not Know How Many Potential Buyers For Your Home Are Waiting In The Wings Until We List Your House For Sale |

|

How much interest will my house have once it is listed for sale?

The answer? Assume nothing! Just because you are in a low price range with very low inventory that does not mean you will have high buyer interest if there are other factors of the property (location, condition, age, finishes, systems) that make it less than appealing to most buyers. Just because you are in an extremely high price range that does not mean you will not have lots and lots of early buyer interest and lots of offers. Just because you are in a popular neighborhood that doesn’t mean that you can price your home higher than is justified based on comparable sales once adjusted for how they differ from your home based on layout, finishes and condition. In the end, we can make some educated guesses on how much buyer interest (showings, offers) will exist once your house is listed for sale - but we won’t REALLY know until we list it for sale. Ah, the suspense… | |

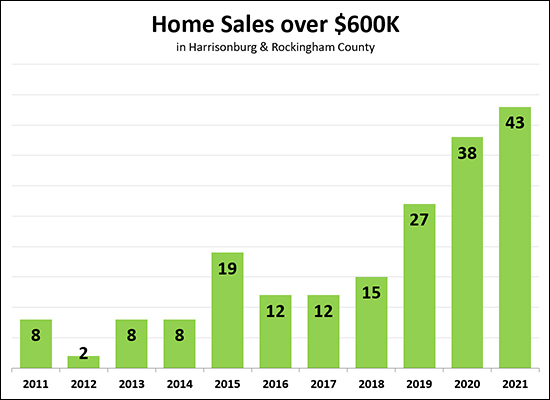

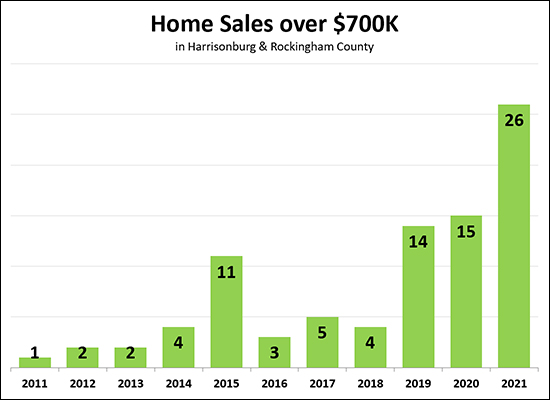

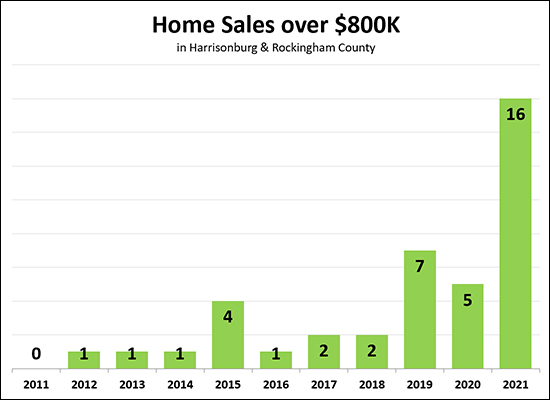

Harrisonburg Area High End Home Sales Booming In 2021 |

|

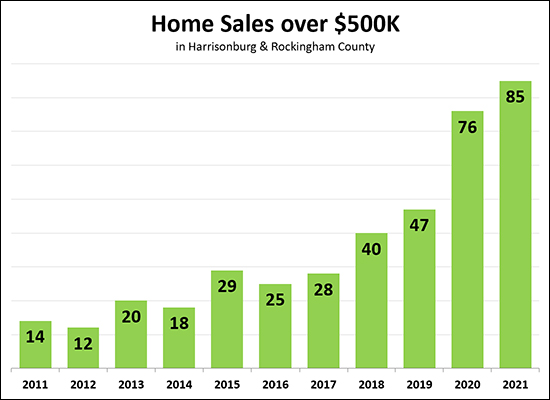

Only 7% of local home buyers spend $500K or more on their home purchase (per sales data over the past 12 months) but this segment of the local housing market has been strong over the past few years. As shown above, there were 76 home sales over $500K last year - which was wellmore than any time in the past decade. This year we have already exceeded that pace of $500K+ home sales even with just the first ninemonths of the year. There have already been 85 home sales over $500K up through October 4, 2020 and there is still time for a more before the end of the year.  We also saw a big jump in the number of home sales over $600K last year Last year was an extraordinarily strong year for home sales over $600K - with 38 such sales - well more than in any other year in the past decade. This year -- we're seeing even more $600K+ home sales, with 43 thus far and still three months to go! Let's keep narrowing our focus, now to sales over $700K...  The number of $700K home sales a year was averaging four sales per year between 2016 and 2018 and then more than tripled in 2019 to 14 sales, followed by another 15 sales in 2020. But this year -- wow! The number of home sales over $700K looks like it will likely double this year as we have already seen 26 such home sales in the first nine months of 2021! And... one more time... let's look at even more expensive homes...  This one surprised me. Well, most of the graphs did, but this one particularly. Before 2019 we were seeing around two sales a year over $800K. In 2019 and 2020 that jumped up to 7 (2019) and 5 (2020) -- but this year -- we have already seen 16 buyers pay over $800K for homes in Harrisonburg and Rockingham County! So -- overall, the high end home sales market is doing extremely well as compared to performance in past years! If you are thinking of selling your high end home (over $500K, $600K, $700K or even $800K) this might be the time to do so! | |

Moving Once Is Hard, But Moving Twice Is Harder |

|

Moving from one house to another is tough work! Even tougher (sometimes) is arranging the timing and logistics to work well for all parties. If you're selling a house in order to buy a house, it's possible that...

The spot for you to be can be somewhat easier -- you could stay at a hotel or with a friend for a night if needed. It's decidedly harder to put all of your belongings in the hotel room or in your friend's house. The options, generally speaking, are...

If none of these are possibilities -- I have even had some clients who had to put everything in storage, just for a few days -- and then move it out of storage into the new house. Again - even moving is tremendously hard - but arranging for it within the tight confines of closing timelines and when you do and do not have access to the old house and new house can make it even more difficult! | |

The Higher The Price Point Of The Home, The More Important The Layout Of The Home |

|

If a buyer is buying a home priced over $400K or $500K, or even over $300K, the layout of the home becomes very important to them. That is not to say that it is unimportant for a $200K buyer -- but someone buying a more expensive home oftentimes plans to stay in it for a longer time frame. If not the #1 feedback, then perhaps the #2 feedback I receive from showings of homes priced over $400K is that the layout just didn't work for the buyers....

| |

Yes, It Is Possible To Overprice Your Home, Even In The Current Crazy Market |

|

Home prices are increasing quickly these days -- we've seen a 13% increase in the median sales price over the past 12 months! As such, it might seem nearly impossible to overprice your home when you are listing it for sale. But it's possible. :-) Let's say homes in your neighborhood were selling for $400K a year ago and are now selling for $440K. That sounds about in line with that 13% increase described above. Even though market data points to a value of $440K for your home, you decide to list it for sale for $475K. Why not, right? Buyers will pay nearly any price in the current market! Here's what is likely to happen... [1] You will still have showings. [2] Some (or even many) of the buyers who view your home will want to buy your house, but not for $475K, and they will hesitate to make an offer because they figure there is probably some buyer who will pay $475K because the market is so crazy. [3] You won't have any offers on the house. [4] You'll wait 2 or 3 or 4 weeks and then reduce the price to $460K. [5] You will won't have offers. [6] You'll wait another 2 or 3 or 4 weeks and then reduce the price to $449K. [7] You'll get an offer of $440K and settle on a price of $445K. The offer will include an inspection contingency and an appraisal contingency. Now -- wouldn't it have been easier to go this route instead? [1] Price your home at $445k or $449K. [2] Have lots of showings and multiple offers. [3] Sell your home for $445K or $449K without an inspection contingency or appraisal contingency. Even in a strong seller's market, it is important to price your home reasonably within the context of past sales data and competing listings. Overpricing your home is likely to slow down your home sale, possibly lower the price for which you'll sell, and possibly result in an offer with more contingencies than you would have had if you had priced your home reasonably from the beginning. | |

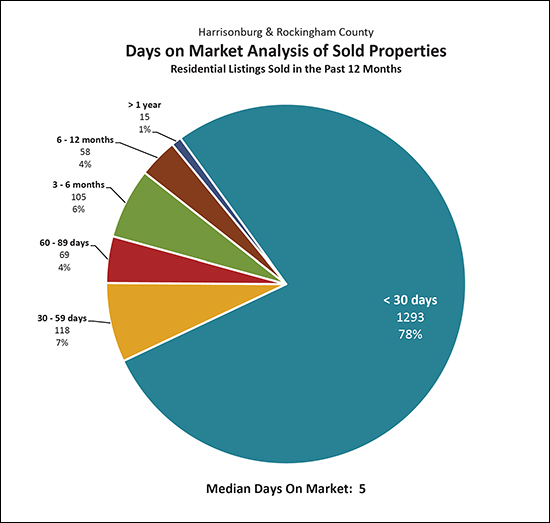

If Your House Is Going To Sell, There Is A Very Good Chance It Will Be Under Contract Within A Month |

|

So, you're thinking about putting your house on the market? And you're wondering how long it will take to go under contract? And how long it will take to get to closing? These days the chances are very high that your home will be under contract within 30 days and closed within 90 days -- and that's rounding up quite a bit. As shown above, 78% of homes that sold in the past year were under contract within 30 days. Technically, as per the stat at the bottom (median = five days) we can see that half of the homes that sold were under contract in five or fewer days! So, if you're wondering how the timing of your real estate transaction *might* play out, per the stats from the past year... Relatively (50%) Likely: under contract within 5 days, closed within 45 days. Very (78%) Likely: under contract within 30 days, closed within 90 days. One caveat, of course, is that your particular home, depending on it's location, price range, how well it is prepared, how well it is priced, how well it is marketed may over or under perform as compared to market norms. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings