Selling

| Newer Posts | Older Posts |

Your House Does Not Need To Be Photo Ready When I Visit For The First Time |

|

So, you're thinking about selling your home this fall? And we're getting ready to meet? I'm swinging by your house tomorrow morning to walk through it together and to talk about the process, the market, etc.? Don't stay up all night cleaning on my account!! There are plenty of times when I will want your house to be absolutely spotless, 100% organized, de-cluttered, picked up, minimalized (probably not a word), etc. For example...

But did you notice what is not on that list?

Some sellers feel pressure to have their house in absolutely tip top shape before we set up our first time to meet at your house to discuss your house, the market, the selling process, etc. You do not need to feel that pressure. I can look past the way that you (and most people) live everyday life - which is just not quite as 100% polished and put together as when your house is on the market. So -- if you want to get your house all the way to the point where it is ready for photos and showings before you have me over to start a conversation about your potential home sale, that is just fine -- but it is not my expectation that you do so. Talking early and often about selling (When should we list? What should we do before listing? What price expectations should we have?) can be very helpful for most home sellers. | |

Finding a Home Into Which You Can Downsize Can Be Difficult In Harrisonburg |

|

There are plenty of large-ish detached homes (2500 - 4000 SF) in Harrisonburg and Rockingham County that are occupied by a parent or parents who have raised their families in those homes but now find themselves with a family sized home without any kids living at home any longer. As you might expect, many of these homeowners would like to downsize. They don't need 3000 or 3500 SF just for themselves and the few times a year when the kids (and possibly kids' families) are back home to visit. But, sometimes downsizing is easier said than done... This homeowner would likely prefer to move into a home that is perhaps 1400 to 2200 SF, depending on how much they want to downsize, and they would likely prefer a home that won't require a lot of maintenance over the coming five to ten years and a home that has everything they need on one floor. There are only so many homes in this area that match this description, and they don't hit the market all that often -- and when they do, they usually sell quickly. Below are some of the popular downsizing destinations where buyers often find themselves in or near Harrisonburg. The links below will take you to a listing of recent sales in each area as this will show you some recent sales prices and because there aren't currently active listings in many of these locations. Popular Downsizing Neighborhoods: If you're in the situation described above, what other locations are you considering when you are looking to downsize? | |

Is A Cash Offer Really That Much Better Than One With Financing? |

|

Many sellers, when receiving a cash offer and one with financing, ask themselves (or their agent) whether a cash offer is really that much better than one with financing. As with many questions in real estate, it depends... First, a $400K cash offer and a $400K offer with financing will both (any other contingencies aside) result in the same amount money going to the seller -- $400K less mortgage payoffs and transaction costs. So, in that way, a cash offer and an offer with financing are pretty similar -- the seller gets the same amount of money. These two offers, though, start to feel pretty different...

In this case (above) the second buyer is likely is not very financially capable and that could mean there would be difficulties in the buyer obtaining financing to complete the home purchase. The fact that the lender is an unknown variable can also give a seller pause as they compare the two offers. These two offers, though, may very well seem pretty similar to a seller...

In this case (above) the second buyer would seem to be very financially capable, in that are putting a sizable deposit down and have a significant amount of funds to use as a down payment. The fact that the lender is a known variable (local, reliable) means that the offer is very likely to proceed quickly and smoothly to closing. So, in the end -- should a seller look at a cash offer as being undoubtedly better than any offer with financing? Not necessarily. An offer that is similar in offer price, with 80% financing, a sizable deposit, and where a buyer is working with a known local lender is just about as strong as a cash offer in almost all circumstances. | |

Now Can Be A Great Time To Sell An Investment Property |

|

Do you own a residential rental property? Or two? Or five? Or 10? Would you consider selling one or all of them? There are plenty of reasons why you might NOT do so...

But... if you are open to selling your residential rental property... it might be a GREAT time to do so, because...

If you own a rental property and the end of the lease is coming up, let's take a few minutes to chat about your options and whether it might make sense to sell that property instead of finding a new tenant. | |

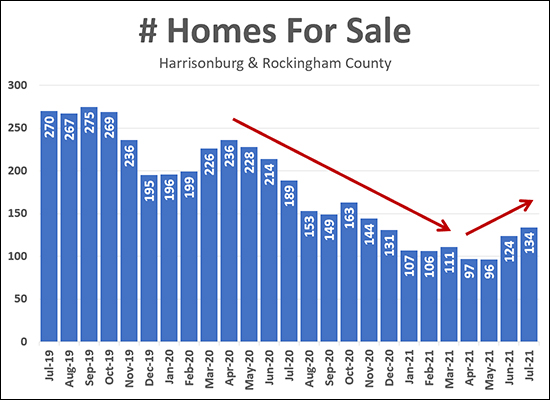

Are Inventory Levels Slowly Starting To Increase? |

|

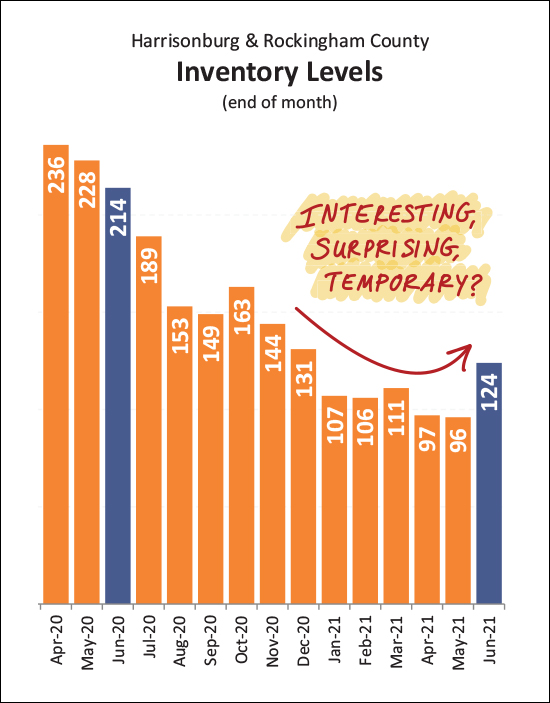

We may (finally?) be seeing inventory levels creep up a bit in Harrisonburg and Rockingham County. As shown above, after having dropped all the way down below 100 homes for sale -- inventory levels have increased over the past two months. We're still at basically all time lows other than what we've seen in the past six months -- so don't get to excited about the inventory levels rising -- but it's nice for the inventory levels not to be heading down even lower. Stay tuned as we see how inventory levels continue to adjust as we make our way through the rest of the summer and into the fall. | |

I Should Definitely Sell My House Right Now To Take Advantage Of This Market |

|

Yes. For sure. You should definitely sell your house right now to take advantage of this market. ... ... But... Where will you go? Where will you live? I have had this conversation (maybe I should sell my house!) with quite a few folks over the past few months. They are seeing homes sell in their neighborhood at prices that seem unrealistically high. It causes many neighboring property owners to say -- wow, maybe I should sell!!? And, indeed, it can be a great time to sell your home right now... ...if you have a plan for where you will go next and what you will do next! If you thought your home was worth $300K a year ago and now it seems like it could sell for $350K, that's exciting! It might make you want to just go ahead and sell and capture all of that equity that you now apparently have in your home. But... are you going to upgrade to that $400K house you were dreaming about a year ago? That house is likely now selling for $450K or higher. So, as exciting as it may be to think about selling your house to take advantage of the current market, we need to thoroughly examine what you will do (where you will live) after you sell to make sure that you are comfortable with the overall game plan. | |

I Will Offer You ONE MILLION DOLLARS For Your House... Oh, Contingent On An Appraisal... |

|

I've seen buyers use this strategy quite a few times lately... and sellers usually aren't interested, or fooled, or entertained. Here's the scenario... A house is listed for sale, priced at $250,000. Three offers come in, each one higher than the last, as is typical in this market...

Then, the fourth offer comes in. Offer #4 is an offer of $350,000. Contingent on the property appraising at or above the contract price. I'm exaggerating a bit to make my point here -- but not by much. Basically, a buyer offers WAAAAAY above the asking price -- well beyond what anyone would think would be a reasonable offer for the property -- but makes their offer contingent on an appraisal. I suppose the thought is that surely a seller would pick an offer of $350K instead of an offer of $255K, $260K or $265K, right!? Maybe not. I have had the chance to see several sellers respond to these absurdly, unrealistically high offers and again, sellers usually aren't interested, or fooled or entertained by such offers. Almost every seller I know would happily take Offer #3 as described above before they'd even start to entertain Offer #4. Clearly, buyers can attempt to negotiate however they'd wish to do so, but this particular strategy does not seem, to me, to be a winning strategy. | |

If Your Property Needs Improving, Do Not Price It As If It Does Not |

|

Buyers are tripping over themselves to buy houses these days. They'll pay a price higher than you'd expect for just about any property, regardless of condition, right? Well, maybe not all the time. If your property (where you live... or your rental property) needs painting, and flooring, and general repairs, and landscaping help... ...maybe you shouldn't price it as if it does not need those improvements. Again, in this market, anything is possible -- but if ten buyers come to see your house in the first week and they all would have liked the house at your list price if those improvements had been made -- but not without the improvements -- then you will probably find yourself needing to make a price adjustment. So, when you are pricing your home -- compare not only the specs (size, age, location) to other recent sales -- but also the condition! | |

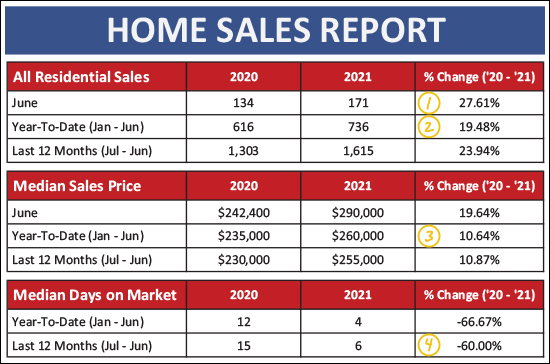

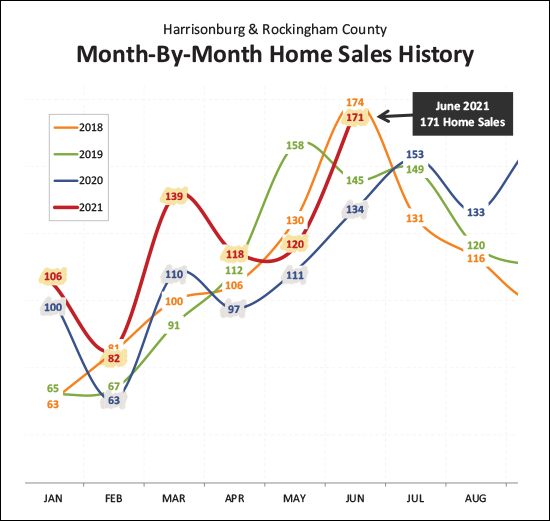

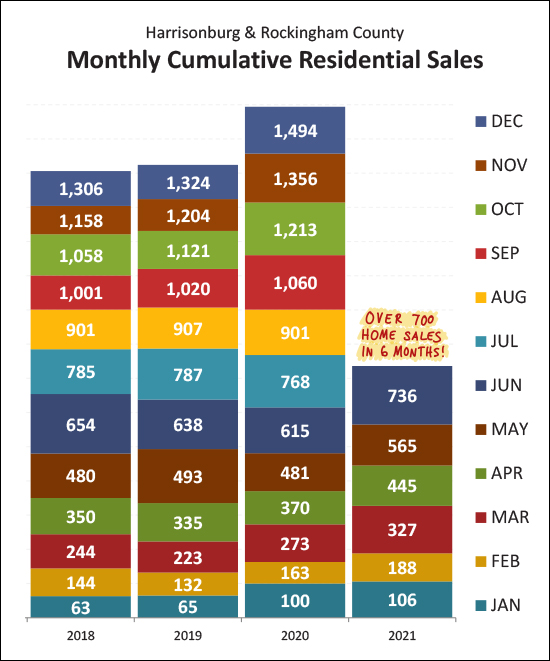

Special Saturday Edition: Home Sales, Prices Flying High In Harrisonburg Area |

|

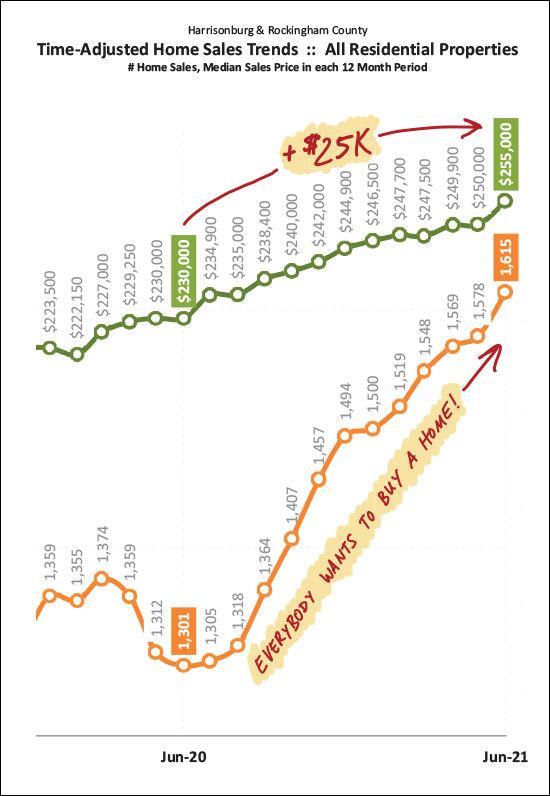

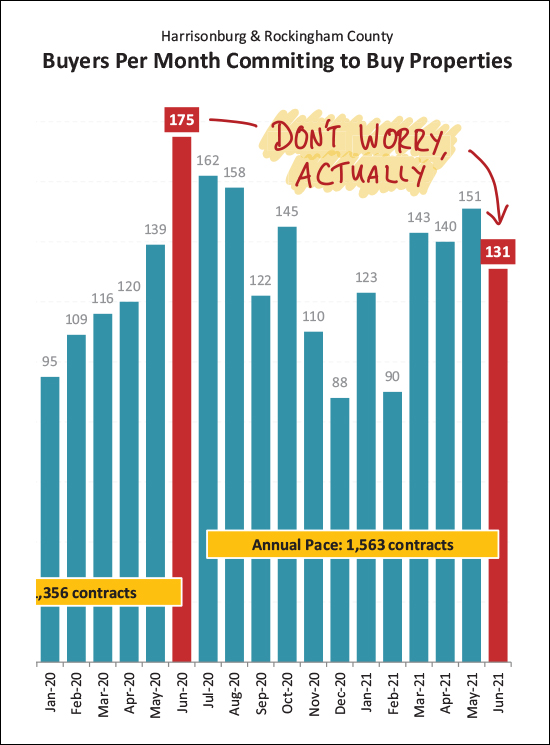

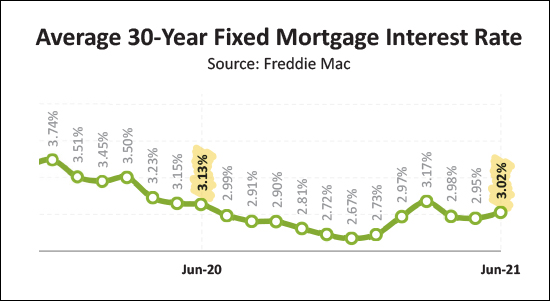

Happy Saturday morning to you! I hope you had a wonderful week. I am still unwinding a bit from a great time at the Red Wing Roots music festival last weekend. I enjoyed seeing many of you there, and if you missed it this year, you should consider attending next year! Back to the here and now, though -- I'm not sure what your weekend looks like -- but thus far mine has involved sipping coffee while my daughter and I have been drawing on our iPads. Admittedly, Emily is creating art, and I'm doodling on graphs and charts as included below - but fun times nonetheless. :-) Regardless of whether your weekend will include relaxing at home, traveling out of state to see family, heading to the beach for a week, or working in the yard -- I hope it is a weekend that includes at least some moments of fun and relaxation. When you get to a few free moments in your weekend, take a look through the remainder of this market update to learn more about what is happening in our quickly moving local real estate market. First, the full PDF of my market report can be found here, second, the featured home shown above is located at 261 5th Street in Broadway and you find details of it here, and now, let's dive in...  Quickly glancing through the numbers above, you might find your eyes opening wider than normal and your eyebrows rising higher than normal. There are some rather surprising things going on in our local housing market. Anyone who is selling their home, or trying to buy their home, knows about these dynamics -- but it's good to put some numbers to it... [1] There were 171 home sales in June 2021, which was 28% more than last June! [2] Thus far this year (we're halfway through it) there have been 736 home sales, which is 19% more than the first half of last year! [3] The median sales price in the first half of this year was $260,000 (!!) which is 11% higher the median sales price during the first half of last year which was only $235,000. [4] Over the past 12 months it has taken a median of six days for houses (that sold) to go under contract -- compared to a median of 15 days during the 12 months before that. So, yeah, lots of homes are selling, at much higher prices than a year ago, and much more quickly! Breaking it down between detached homes and attached (duplexes, townhouses, condos) homes reveals a few other details...  Above you might notice that... [1&3] There have been a 19% increase in the number of detached homes that have sold in Harrisonburg and Rockingham County over the past year -- but a much higher 37% increase in the number of attached homes that have sold! [2&4] The median sales price of detached homes ($285,000) has risen a bit more (14%) over the past year than the median sales price of attached homes ($200,000) which has only (haha) risen 11% over the past year. Those (above) are the long term trends. When we dial in a bit and look at things on a monthly we find that this strong increase in the number of home sales thus far in 2021 has been a month after month after month occurrence...  I have highlighted each of the first six months of 2021 in yellow above, and the corresponding month last year in gray. Now, it certainly bears noting that home sales during some of the months in the first half of last year were likely a bit lower than they would have been otherwise because of Covid, but regardless -- each month of home sales in 2021 has been head and shoulders above the corresponding month of 2020. And now, let's see how this first half of the year stacks up against the first half of the past few years... look for the dark blue bars...  As you can see, with over 700 home sales (736) in the first half of 2021 this year is well ahead of the pace of home sales in the first half of each of the past three years. Looking ahead, it currently seems quite reasonable to think that we would see 1500+ home sales in 2021, with one significant exception. Home sales were tilted towards the second half of the year last year due to Covid, so while we are seeing stronger sales in the first half of 2021 (compared to 2020) things might level out a bit when we get to comparing the second half of 2021 to an abnormally strong second half of 2020. The next visualization is still shocking to me each time I update it with another month of data...  A year ago, 1300-ish buyers were buying homes a year -- now that has risen to 1600+ buyers per year!?! Indeed, it feels like EVERYBODY wants to buy a home... because, keep in mind, this 1600+ per year figure does not include all of the would-be buyers who made offers on houses in the past year but were not successful in securing a contract to buy a house!?! Imagine if there had been enough houses on the market for all of those buyers to have bought as well... The price change (orange line above) over the past year is also somewhat of an eyebrow raiser. The median price has risen $25,000 in the past year. Thus, if you own a home, the value of that property may have very well increased $25,000 over the past year! Admittedly, this varies based on property type, location, price range, etc., -- but suffice it to say -- home values have increased quite a bit in the past year!! Now, just to keep you levelheaded this morning, the next two graphs might make you (and me) say "hmmm..." and "well, let's see what comes next"...  Above, it would appear that the pace of buyers signing contracts has dropped off considerably in June 2021!?!?! ;-) But don't worry too much -- I don't think!? The pace of contract signing in any typical March / April / May is usually quite (!!) active. Last year, buyer activity was significantly suppressed during those normally active months because of Covid -- we didn't know what was happening, what was going to happen, whether the housing market was going to slow down, etc. Then, buyer activity exploded in June of last year and remained quite strong throughout most of the remainder of the year. So, as you look at the decline in June 2021 as compared to June 2020, keep in mind that it was a very unusual June 2020. So, wait and see -- but I don't think June contract numbers mean that our local housing market is slowing down. And now, the second graph to make you say hmmm.....  Inventory levels have risen over the past month -- to the highest level in almost six months! This is somewhat interesting and surprising -- but I do also wonder whether it is temporary. I should also point out that this increase in inventory levels only takes us from super-super-super-super low inventory levels up to super-super-super low inventory levels. In the end, most buyers in most price ranges will still find very few choices of homes on the market at any given time. So, I think this is a wait and see -- as to whether we'll start seeing inventory levels rising again, or if this is a one month blip. Lastly, just to remind everyone of at least one of the reasons why so many buyers would LOVE to buy a house right now -- mortgage interest rates are phenomenally low right now...  Interest rates have been up and down over the past year, falling as low as 2.67% and rising as high as 3.17%. Clearly, though, anything under 4% still has to be described as absurdly low from any sort of a long term perspective. The cost of financing your home purchase will be very, very low if you are fortunate enough to secure a contract to buy a home in 2021. OK, that's all of the charts and graphs I have for you this morning. A few short takeaways from a big picture perspective... BUYERS: Get prequalified now, see new listings quickly, and carefully consider each contract term of your offer to make it as strong as possible. SELLERS: Prepare your home well, price it reasonably, enjoy a short period of time when you have to put up with showings, and enjoy likely being able to select from multiple offers with favorable terms. HOMEOWNERS: Enjoy knowing that your home value is increasing. :-) If you have questions about buying, or selling, or just want to tell me about the exciting plans you have for the weekend ahead -- drop me a line via email or call/text me at 540-578-0102. Otherwise, enjoy the weekend! | |

All The Cool Kids Are Offering To Pay Over Appraised Value These Days |

|

Escalation clauses are so YESTERDAY!?! ;-) Not really -- many/most buyers are still using them -- but they don't matter much if an appraisal is going to rein a sales price back in... Consider these three offers on a fictional home listed for $300K...

Hooray, the house sells for $355K to buyer #3, right? Well, probably... though if it then appraises for $300K, then none of the offer prices over the list price or the escalation clauses really amounted to anything. Thus, these days, many buyers are not only asking themselves how high they are willing to go with an escalation clause -- they are also asking themselves how much above the appraised value they are willing to pay for a house. Consider, then, the following three offers on the same house listed for $300K...

Clearly, a seller would toss out the first offer. Some sellers would then immediately jump to the third offer, since it is $10K higher than the second offer -- but -- that depends on your best guess as to the appraised value of your house. If you listed your home for $300K, presumably you think it should sell for around $300K and thus might appraise for $300K. If that is the case, then the second offer above is likely a better choice for you. That offer would stay at $325K even if the appraisal came in at $300K, whereas the third offer would start off higher at $335K but would then drop to $310K if the appraised value were $300K. So, as a buyer -- consider how much above the appraised value you are willing to pay for a house when you are competing with multiple other offers -- and as a seller, consider how an appraisal will impact each offer that you might accept. | |

Sometimes, Appraisals Are Reining In High Contract Prices, And That Can Keep Sales Prices From Getting Out Of Hand |

|

Let's say there's a house that comes on the market for $300K. Every Realtor and buyer that looks at it agrees that it is worth $300K because three identical houses sold the prior day for $299K, $300K and $301K. ;-) The house immediately has LOTS of interest, LOTS of showings and LOTS of offers. The house ends up going under contract for $335K. Wow! Now, a few things can happen from here...

So -- even if buyers are willing to (per their offers) pay higher and higher and higher prices for houses -- regardless of what other buyers recently paid for similar houses -- the appraisal process is still, often but not always, keeping things in check and preventing prices from skyrocketing too quickly. | |

Just Because Home Prices Are High Does Not Necessarily Mean You Should Sell Your Home |

|

Yes, clearly, home prices are quite high right now! The median sales price of properties sold in Harrisonburg and Rockingham County increased 10% in the past year. The median sales price increased 21% over the past three years. So, yes, your home is likely worth a good bit more than it was a year ago... or three years ago... or seven years ago... and so on. But, that doesn't necessarily mean you should sell your home. Let's assume you can sell your home quickly AND at a higher price than you thought. Where will you go? Are you planning to buying again? You'll probably pay a higher price than you thought. Are you planning to rent for a while? Are you hoping to buy when (more likely if) the market cools off a few years from now? Before we rush right into getting your house on the market for sale because prices are so high, let's think through where you will live next -- to make sure it is the best overall financial decision to sell your house now. We might very well conclude that it would best for you to NOT sell your house right now -- and I am happy to talk things through with you to figure out whether to sell -- or stay! | |

It Is Not Possible For You To Ask Too Many Questions When Selling Or Buying A Home |

|

Most people do not buy or sell a home every year - or even every few years. Oftentimes, when buying or selling a home, you haven't done so in 5+ or 10+ or even 20+ years. Thus, it is natural to have some questions about how things work when buying or selling your home. Your likely lack of recent personal experience with buying or selling is also compounded by the fact that laws and contract documents continue to evolve over time AND market conditions at any given time can affect how transactions typically flow. So, when you are buying or selling a home OR when you are thinking about buying or selling a home -- feel free to ask questions -- a LOT of them! But they're silly questions... There aren't any silly questions when it comes to buying or selling a home. You are getting ready to buy or sell what may be your most valuable finance asset -- it's a big deal -- so if you have a question, as the question. I won't laugh or snicker or smirk. Promise. But maybe you don't have time for all these questions... Sure I do. Feel free to email me if that's how you prefer to get a bunch of questions out there and I can provide you with some detailed feedback by email. Or maybe you prefer to process things aloud, in which case we can sit down at my office or over coffee and talk things through. I want you to be well informed and to feel confident as you approach and make your way through the home buying or selling process. I can't always anticipate all of the questions you might have -- so please do ask the questions as they pop into your mind -- all of them! ;-) | |

Is The Housing Market Still Crazy? Is The Sky Still Blue On A Sunny Day? |

|

So, yes... the housing market is still crazy... and the sky is still blue on a sunny day. Speaking of sun... and heat... looks to be a scorcher this week!?! A client asked me this weekend if the market was still pretty crazy / busy / active. Indeed, it is. Will it slow down sometime? I'm not thinking it will anytime in the foreseeable future. Maybe in November? I think there is a good chance that homes will keep selling as quickly as they are right now (median of 4 days on the market thus far in June) for the rest of the summer and into the fall. Which is GREAT if you are going to be selling your home and is AWFUL if you are trying to buy a home. But yes, you can buy a home -- it will just likely take a bit longer to find a home you like (given very low inventory levels at any given time) and to secure a contract amidst a likely multiple offer scenario which we are seeing on most property prepared, priced and marketed new listings. So, yes, the market is still crazy - and I'm not predicting that to change in the near term. What about you? Do you think things will slow down at all this summer or fall? | |

Selling A Home Is A Sprint, Buying A Home Is A Marathon |

|

"How's the real estate market these days? Moving pretty fast, right?" Well, yes and no. It depends on whether you are a seller or a buyer. :-) Indeed, if you are selling your home (or will be soon) the market is moving FAST and the process will seem like a sprint...

So, yes, the market is moving pretty fast if you are selling your home. But if selling a home is a sprint, buying a home is definitely more like a marathon! Many buyers these days are finding themselves making offers on multiple houses before finally securing a contract to buy a home. One of the buyers I am currently representing recently signed a contract on a home after having made unsuccessful offers on five other properties! So, yes, the market is moving quickly -- but while a seller gets the luxury of running a quick sprint in the house market -- most buyers need to prepare for running a marathon. | |

What Is A Seller To Do When The Appraisal Comes Back Lower Than The Escalated Contract Price |

|

You're ready to sell your home. Great! We look at comparable sales and decide that your home is likely to sell for $300K in the current market. We debate pricing your home for $299K or $305K and end up going with $305K because we're optimistic about the strength of the current market. After 20 showings in 48 hours, we receive eight offers with prices ranging from $305K to $335K. We settle on the contract with a price of $330K because of some of the other terms included in the offer. Then, the buyer gets the appraisal back and your house appraised for $300K -- all the way back to what we thought it was worth before putting it on the market. The only way the buyer can pay over that $300K is if they scrape together extra cash to bring to closing. They love your house and they find a way to come up with $5K so that they can pay $305K for your house -- but they are not able to pay the $330K contract price that you and they had agreed to some weeks back. Now you, as a seller, have some options to consider... Option 1 - Sell At Or Just Above The Appraised Value Perhaps you look at the big picture and decide that you are OK selling for the price you figured your house with worth ($300K) and maybe a bit above that ($305K) despite the short-lived excitement of thinking you would be selling your house for more than you thought it was worth. It can be somewhat difficult to come to this conclusions -- after all -- a day before the appraisal report was completed you thought you were selling your house for $25K more ($330K) than you would now ($305K) be selling your house. Option 2 - Put Your House Back On The Market And Hope For A Cash Buyer The only way to get completely around an appraisal with certainty is to sell to a cash buyer. It might seem farfetched to think there would be a cash buyer for your home -- but it is definitely possible depending on the price point, property type, etc. Option 3 - Put Your House Back On The Market And Hope For A Buyer Willing To Pay Over Appraised Value If you're not selling to a cash buyer, perhaps you will be able to find a buyer who will contract to buy your home at a price above where you know it recently appraised AND that is willing and able to pay a certain amount above the appraised value. Again, this is not all that farfetched. If a buyer had made an offer of $335K, previously, and now could agree to pay $320K for your house ($15K more than the buyer you are/were under contract with) so long as they were OK with paying up to $20K above the appraised value - they might be quite excited to do so. After all, they were ready to pay $335K for the house -- only having to pay $320K (even with a $300K appraisal) might be seen as a great opportunity. As you think through all of this, you'll likely also be thinking about the value of just moving forward with the buyer who is already under contract to buy your home. Yes, it is likely going to be easier and faster to move forward with that buyer -- but you may be walking away from $10K or $15K or even more by not exploring interest that may exist from other buyers. | |

The Ever Speedier Pace Of Our Local Real Estate Market |

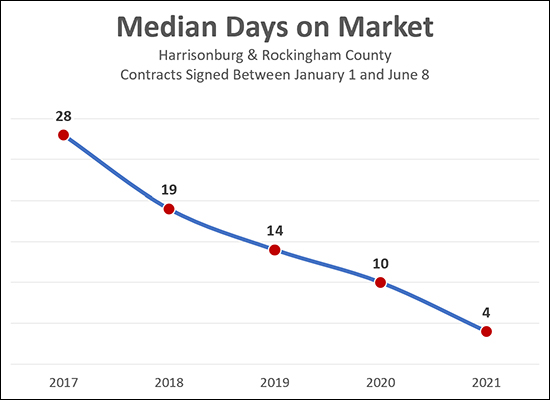

|

Maybe you've heard that homes are selling quickly these days? ;-) Indeed, they are! As shown above -- for the homes that have sold thus far in 2021, that went under contract in 2021, the "median days on market" was only four days! That means that half of these homes were under contract in four or fewer days! To put that in a greater context, as per the graph above -- that median was 10 days last year, nearly 20 days three years ago, and nearly 30 days four years ago. So, yes, homes are selling QUITE speedily this year! Buyers, as a result...

It's a STRONG seller's market out there right now, and this shows itself most clearly in the speed at which homes are going under contract. Enjoy, sellers! Good luck, buyers! | |

Why Are These Buyers Offering So Much Money For My House? |

|

In this craaaaaazzzy seller's market, some sellers find themselves asking... Why Are These Buyers Offering So Much Money For My House? It's a fair question. And sort of a funny one. :-)

Wait!? What?? Could this really be so? This is just an example, conceptually, of how things might feel when pricing your home in the current market. It seems that buyers are willing to pay ever, ever, ever increasing prices for houses in this area. So again... why!? Well, I think it stems from a few general things going on right now...

So, in the end, are buyers paying more than they should? Are buyers paying more than your home is worth? The answer is somewhere between probably and definitely - but today's buyers seem to be aware of it and comfortable with it. Thus, as a seller, enjoy being on the winning side of the housing market -- and hopefully you won't have to turn right back around and buy in this lopsided, one-sided market! P.S. I still haven't decided. Are we imagining the people in the picture I put at the top of this post to be the buyers or the sellers in this scenario? Imagine them as you will. :-)

| |

Welcome To The Ebb and Flow of the Summer Real Estate Market |

|

Week 1 - Lots of new listings Week 2 - A few new listings Week 3 - No new listings Week 4 - Lots of new listings Scramble and repeat. Welcome to summertime! This spring was rather busy in our local real estate market with lots of new listings -- most of which promptly went under contract, many with multiple offers, many over the asking price. But now, summertime. During the summer months we typically see a slow down for a few weeks as school ends and then a very sporadic flow of new listings through June, July and August. This is mainly a result of people planning to leave for vacation, being on vacation, and recovering from vacation. So - there will certainly be plenty of new listings to consider this summer, but the timing of when those listings come on the market may very well seem irregular and random. If you haven't developed patience thus far as a buyer through a tumultuous and competitive spring market, the ebb and flow of new listings this summer should help you get to a zen-like level of patience. ;-) | |

The Housing Inventory Shortage Is Not Likely To Quickly Work Itself Out |

|

Did you hear that...

It's not happening on every house in every price range in every location -- but it (lots of showings, multiple offers) is happening very frequently these days. Clearly, there are waaaaaay more buyers in the market than there are sellers. And, sadly, it doesn't seem that this housing inventory shortage is not likely to work itself out anytime soon. After all...

So, alas, for the foreseeable future...

I wish I saw an easy or fast or near-term way out of this situation, but I'm not currently seeing it on the horizon. In theory, the answer is new construction of "for sale" homes at scale, but we're not there yet... | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings