Selling

| Newer Posts | Older Posts |

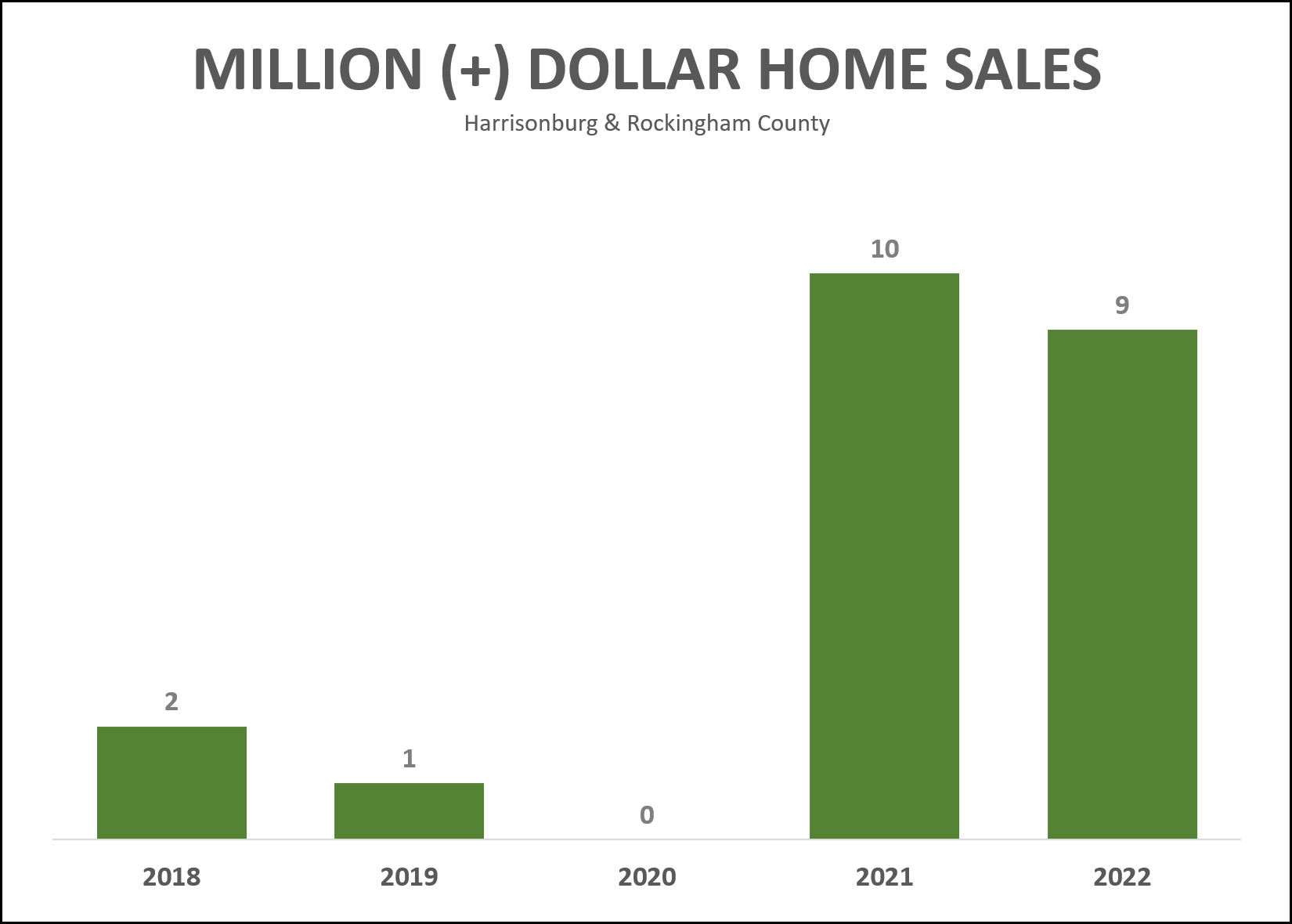

What A Great Time To Sell Your Million Dollar Home |

|

It's been a good time to sell a million (+) dollar home lately. After only three million dollar sales over three years (2018-2020) we have seen 19 million dollar sales over the past two years. Wow! Check out what people have been paying $1,000,000 for lately here. If you're ready to sell your home for one million dollars... let me know. ;-) | |

This (Late February, Early March) Can Be A Magical Time To List Your Home For Sale |

|

The first day of spring is March 20th. The spring real estate market is often seen as kicking off in mid to late March, or certainly by the first part of April. So, what about this timeframe we're in right now -- late February and early March? Is this a decent time to list one's home for sale? It can actually be quite a magical time to list your home for sale... 1. You will have very little competition from other sellers, as many sellers will choose to wait another month or more to list their home for sale. 2. You will potentially have pent up demand from lots of home buyers that have not found anything to buy over the past few months when there have been very few new listings from which to choose. Homes that hit the market in this pre-spring timeframe often get lots of attention and sell with very favorable terms. So, while your flowers may not have started blooming yet, and your grass might not be as green as it will be in another month, there can be some specific and magical benefits to getting your house on the market sooner rather than later! | |

Real Estate Has Seemed Like An Abnormally Liquid Asset Over The Past Few Years |

|

What is a liquid asset? Per Investopedia... "A liquid asset is an asset that can easily be converted into cash in a short amount of time." ...and further... "Liquid assets are often viewed as cash, and likewise may be called cash equivalents because the owner is confident the assets can easily be exchanged for cash at any time." ...and finally... "Generally, several factors must exist for a liquid asset to be considered liquid. It must be in an established, liquid market with a large number of readily available buyers. Ownership transfer must also be secure and easily facilitated." Real estate is generally understood to NOT be a liquid asset... as it can take time to sell real estate, the value for which a property will sell is not always certain, selling quickly to convert real estate to cash might result in a lower sales price, etc. But... over the past few years real estate has certainly SEEMED like a liquid asset for many property sellers. You want to sell your house? No problem. What to sell it quickly? We can make that happen. For an amazingly high price? Yep, that will happen too. So, while real estate was not (over the past few years) and is not (now) a liquid asset, it certainly seemed like it was to many property owners. Will this dynamic continue on into 2023 and 2024?

So, real estate -- which is definitely NOT a liquid asset -- might start to feel slightly less liquid over the next year or two based on the trends noted above. Or, maybe not. Maybe just about every home will continue to sell, without question, very quickly, at a very favorable price. The key takeaway here, as a buyer (or homeowner) is to remember that real estate is NOT a liquid asset. Don't buy a house today, paying any price, waiving all contingencies, if you might want to sell it again in 3, 6, 9 or 12 months. There are significant transactional costs of selling (and buying) a home and it is not a liquid asset - so it cannot always be quickly converted back into cash in your pocket. | |

Should Home Sellers Expect Offers With Home Sale Contingencies? |

|

You're getting ready to list your home for sale. You aren't desperate to sell, and you don't need a lightning fast sale... but you want things to move along at a steady pace. Should you expect to receive offers with a home sale contingency? It's not thrilling to think about a home sale contingency as a home seller... you'd just be trading in needing to sell your home... for needing someone else to sell their home. Is it reasonable to hope to or plan to only consider offers without a home sale contingency? Good news, home sellers (and bad news contingent home buyers) as current local housing market conditions still favor home sellers. As such, most home sellers are not finding it necessary to consider offers with home sale contingencies. Typically, if a home seller were to accept a contract with a home sale contingency, they would do by also adding a "kickout clause" that would allow them to continue to market their property to other buyers and to kick out the primary (home sale contingent) buyer if a new (not home sale contingent) buyer makes an offer. As such, one way to evaluate whether home sellers are readily accepting contingent contracts is to evaluate how many listings fall into each of the following two categories in the HRAR MLS. Pending - this means the property is under contract, in almost all cases without a home sale contingency, and certainly, without a kickout clause as per the status below. Active with Kickout - this typically means the property is under contract, but has a kickout clause, likely because the buyer still needs to sell their home in order to buy the listing. Here's how things currently shake out as of 2/19/2023... Pending = 231 properties Active with Kickout = 2 properties So, indeed, most home sellers do not seem to be finding it necessary to accept an offer with a home sale contingency. | |

Now Could Be An Ideal Time To Sell A Residential Rental Property! |

|

If you own a rental property in the City of Harrisonburg or in Rockingham County, perhaps a townhouse or duplex or small single-family home, this could be an ideal time to sell the property. If you would like to explore the possibility of selling a property that you have been renting out for the past few years, let’s talk about timing and logistics. You will likely be selling the property at a very favorable price with very favorable contract terms and as an added bonus you will be helping out what seems to be a continued backlog of owner occupied buyers who are still trying to buy a home and settle down in the Harrisonburg area. | |

This Is Completely Anecdotal, But Showing Activity Seems To Be Trending Upwards Again |

|

Clearly, showing activity (the number of showings on any listing) will vary from property to property, based on... - price range - property type - location - how competitively it is priced ...but, based on several of my recent listings, combined with conversations I have had with other local agents about their recent listings... ...it seems that showing activity is trending upward again. The number of buyers in the market to buy seemed to have trended downwards during November, December and January, but things now seem to be starting to speeding back up again. It's important to note that... [1] November, December and January are usually some of the slower (or slowest) months of the year, so it shouldn't be totally surprising that buyer activity might start increasing again as we move into and through February. [2] Mortgage interest rates climbed above 7% in November and then took there time during December and January drifting back down towards 6%. The average rate (for a 30 year fixed rate mortgage) is currently hovering around 6.1%. It shouldn't be totally surprising that buyer activity might start increasing again as rates settle in at or near (or just under!?) 6% -- if that is where they are over the next few months. [3] This is totally, totally, anecdotal. Over the next month or two (or three) we'll see what the actual data shows us as to the pace of buying activity. Until then.. just know that we're starting to see a few more buyers in the market, more showings on new listings, etc... after a few months of slightly slower buyer activity. | |

The First Three Questions We Will Try To Answer When Meeting To Discuss Selling Your Home |

|

So, you're planning to sell your home this spring? Perhaps we should meet to discuss! Here are the first three questions we will try to answer, together, when we meet... [1] TIMING We may talk this through forwards -- how soon are you ready to put your house on the market -- or maybe backwards -- how long do you want to be able to stay in your house. We'll talk about how long it will take you to prepare your house for the market... how long it is likely to be on the market before going under contract... and how long it will likely take to then get to closing. We'll map out a few different timeframes to make sure they work with everything else that you have planned -- which could be a simultaneous purchase, or a move out of town, etc. [2] PREPARING We'll walk through your home together to identify any small or large improvements or preparations you will make prior to putting your house on the market for sale. Plenty of this may end up being in the category of "straightening up -- or simplifying -- or decluttering" but we'll also talk about any small fixes or cosmetic improvements that might help your home show better or reduce the number of potential buyer hesitations. [3] PRICING We'll review the main selling attributes of your house (size, age, condition, features, neighborhood) that will both set it apart -- and will determine it's value in the current market. We'll then (during our meeting or as a follow up) build a list of comparable sales of the most similar properties to help guide us towards a pricing strategy. If you're ready to sell this spring, let's start the conversation sooner rather than later so that we can answer these first three questions of timing, preparing and pricing. Oh, and yes, you are welcome to have PLENTY of other questions all along the way... about the process, the market, and more! | |

A New And Improved But In 2023 (Keep Reading, Really) |

|

OK, OK, I'm not talking about workout goals. I'm not suggesting you get a better BUTT in 2023... I'm just pointing out that some would be home sellers have a better BUT this year... A Would Be Home Seller's But In 2022... I would sell my home BUT it's so hard to buy a home right now because soooo many buyers are competing over each new listing. A Would Be Home Seller's BUT in 2023... I would sell my home BUT I have a super low interest rate on my current mortgage and I don't really want to get a new mortgage on the new home with a much higher interest rate. Low inventory issues have been an issue (for buyers) in the Harrisonburg and Rockingham County for the past few years. There have been fewer and fewer options of houses on the market to for a buyer to purchase. It doesn't look like the inventory situation is going to improve anytime soon. Last year plenty of would be home sellers decided not to sell because they weren't confident they'd be able to secure a contract to buy a new home after they sold. This year plenty of would be home sellers likely won't sell because they don't want to let go of their super low interest rate on their current mortgage and exchange it for a higher rate on a new mortgage. So, while we can in some ways blame would be home sellers for the shortage of inventory... we can't really blame them for the reasons why many are choosing not to sell. | |

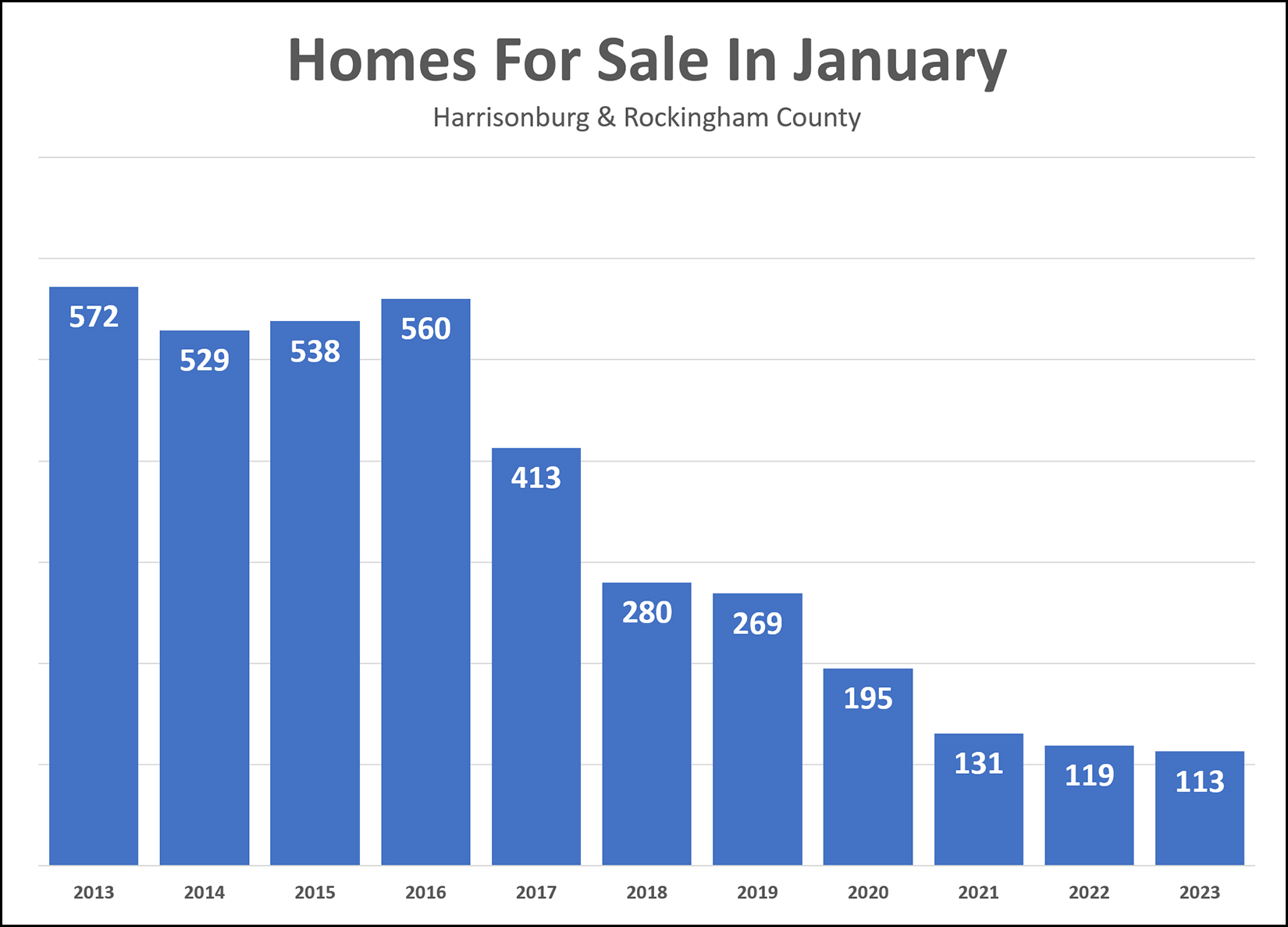

We Are Starting 2023 With Fewer Homes On The Market For Sale Than Anytime In The Past Decade |

|

Yet another reason why it seems relatively unlikely that we will see home prices start to decline in this area... One main factor that could cause downward pressure on home prices would be if inventory levels were starting to meaningfully rise. If more sellers wanted to sell homes than there were buyers to buy them... then we might see prices level out or decline. But... as shown above... we're starting 2023 with fewer homes on the market for sale than anytime in the past decade. So... there's that. Will we see meaningful increases in the number of homes available for sale at any given time during 2023? Buyers sure hope so... but it is not yet clear whether that will actually happen this year! | |

Trading Up For A New House Will Likely Also Mean Trading Up Your Interest Rate |

|

For about three years (2019-2021) the average mortgage interest rate for a 30 year fixed rate mortgage was less than 4%. It even dropped below 3% at times. As such, anyone who bought a home during that timeframe likely has a mortgage interest rate below 4%... and many (many) other homeowners refinanced during that timeframe to lower their rate and their mortgage payment. So now we find ourselves in a situation where many mortgage holders have a mortgage interest rate below 4% or even below 3%. Thus, when any such holder of a low mortgage interest rates considers selling their home to trade up for a new house... they will also be trading up their mortgage interest rate. It was often an easy decision to sell a $300K home and buy a $400K home when you were paying off a 5% mortgage and taking out a new 3.5% mortgage. Now, if you're selling a $300K home with a 3.5% mortgage and are considering the purchase of a $400K home with a 6.5% mortgage... the math is going to work out a BIT differently. I suspect there will still be plenty of people selling and buying homes in 2023, even with these higher mortgage interest rates, but I think there will be fewer people swapping one house for another unless it is a significant upgrade in the house... because it will more than likely be a significant upgrade in the mortgage interest rate. :-/ | |

An Appraisal Contingency Should Not Worry Most Home Sellers |

|

For a few years now, in a highly competitive seller's market, buyers were waiving contingencies left and right... No Home Inspection Contingency! No Radon Test Contingency! No Appraisal Contingency! No Home Sale or Home Settlement Contingency! Now, though, with much higher interest rates, and somewhat lower levels of buyer interest, we are sometimes seeing some of these contingencies sneaking their way back into offers. One of my general rules of thumb these days is that if you are making the only offer on a property, it is probably reasonable to include some of these contingencies that you might have waived if you had bought in 2020/2021... but if you are competing against multiple other offers, you may want to consider waiving some of these contingencies. As such... some sellers are now receiving offers with... my topic of the day... appraisal contingencies! Should a seller be concerned about an appraisal contingency? Should they counter back and propose not having an appraisal contingency? Generally speaking, I don't think an appraisal contingency should worry most home sellers. Appraisers are not personal crusaders with a mission of lowering market values by strategically coming up with low appraised value to wreak havoc on real estate transactions and to course correct the real estate market because they think homes are overvalued. ;-) Appraisers work to provide a detailed and objective estimate of the value of a house to the lender who is using that house as collateral for a mortgage. So, as a home seller, if your contract price is in line with recent sales prices of similar homes, you likely don't need to get too worried about an appraisal contingency. Certainly, it's another hoop to jump through, or another hurdle to clear, between contract and closing... but the existence of the contingency in an offer should not cause you undue stress or anxiety. | |

There Are Still Plenty Of Buyers For Many Houses In Many Price Ranges |

|

Some segments of the local real estate market are slowing down... New listings that would have had 20 showings in the first week a year ago are now only having two or three showings in the first week. But... that slowing down is not affecting all properties equally. Plenty of homes coming on the market are still experiencing a flurry of showings (10+ in week one) and sometimes multiple offers. Perhaps it's the great unleveling? Before the COVID induced real estate boom of 2020 and 2021, there was plenty of variability between properties. Some new listings would have lots of showings immediately after hitting the market... and some new listings wouldn't have any at all. But then, in 2020 and 2021, it seemed that almost every listing out there (any location, any price, any property type, any condition) would have lots of showings... right away. It didn't matter if you had a steep driveway... or a small yard... or if your home needed cosmetic updates. During the home buying frenzy of 2020 and 2021, nearly every home would have lots of early interest. But now, the great unleveling... Now, some properties (in some locations and some price ranges) will have plenty of showings... and some will not. As a seller, it's nothing to fear or obsess over... but you do need to recognize this changing market dynamic as you are developing a pricing and marketing strategy for your home. | |

What Home Improvements Should You Make (or not make) Prior To Selling Your Home? |

|

I don't have a master list of what improvements you should, and should not, make before you sell your home... but most improvements you might consider are probably worth discussing before you spend time and money making the improvements. Some of the questions we will be asking ourselves about each improvement will be... [1] What does this improvement cost and how much will it potentially increase the sales price of your home? [2] Will nearly every buyer want to make this improvement and who much will they estimate it would cost compared to the actual cost of the improvement? [3] Will making this improvement elevate your home into a different price bracket? [4] Does every other home comparable to your home already have this improvement completed? [5] Does the lack of making this improvement significantly affect the overall impression a buyer will have of your home? Again... there isn't a universal list of "do this" and "don't do this" -- but before you start making a LOT of improvements and/or before you decide to make ZERO improvements, let's walk through your house together and discuss the best strategy for how to improve your home before selling it. | |

Are Things Slower Now In The Local Real Estate Market? |

|

This is the number one question I am asked these days when I am chatting with non-buyers and non-sellers around town. In other words, folks who are not currently buying or selling or trying to buy or trying to sell. Are things slower now? The answer is, as perhaps you might expect... yes and no. Yes, things are slower...

No, things are not slower...

So, things definitely feel slower - the hectic, crazed, frantic pace of 2020-2022 has cooled off. But in many ways (number of sales, price of homes sold) the market is just as strong, brisk, vibrant, as ever... it's just not over the top, unbridled exuberance as it has been for the past few years. | |

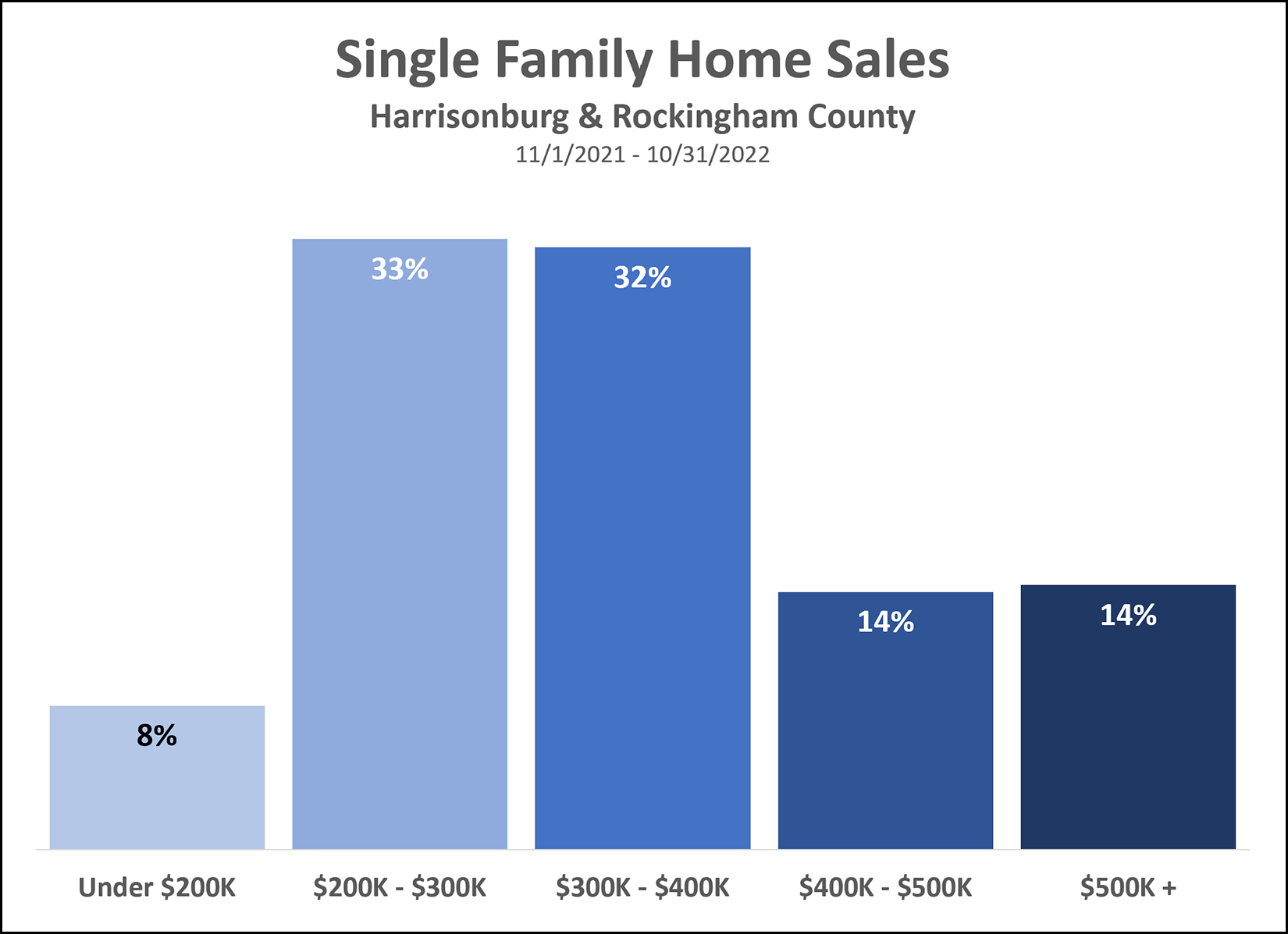

Fewer Than 10% Of Buyers Spend Less Than $200K On Single Family Homes In Harrisonburg, Rockingham County |

|

If you're hoping to buy a single family home for less than $200,000 in Harrisonburg or Rockingham County, you might find it challenging to do so. Only 8% of the single family homes sold in the past 12 months have sold for less than $200,000. Getting straight to the numbers... Total Detached Home Sales = 1,123 Detached Home Sales Under $200K = 86 | |

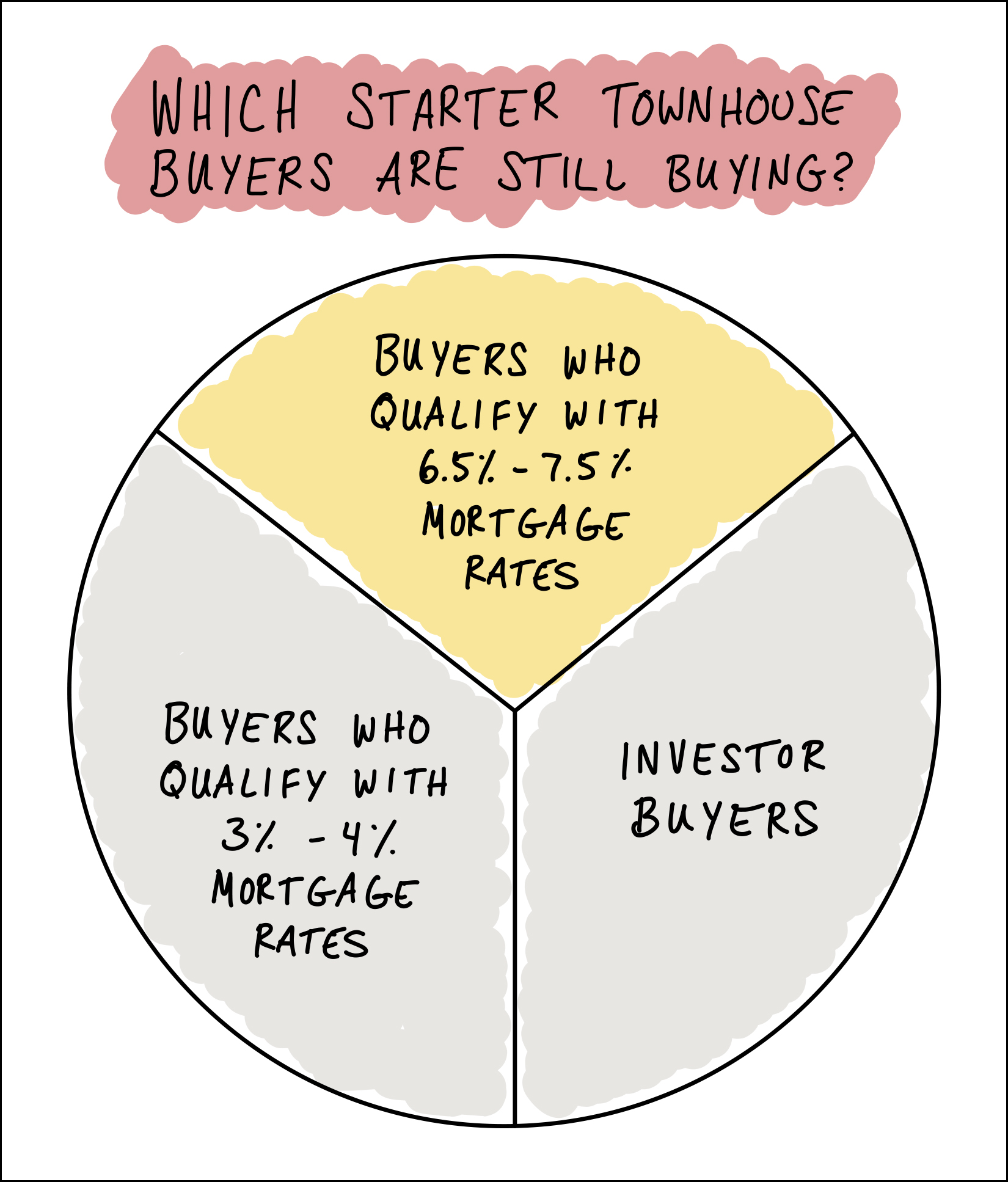

The Buyer Pool For Starter Townhouses May Be Smaller For Now |

|

Starter townhouses (think two story, 15 - 25 year old) in the City of Harrisonburg used to sell for $150K-ish but have increased in price over the past five years to a range of somewhere between $200K and $240K. Why have prices escalated so quickly? Similar to much of the market, it's largely related to low interest rates... [1] With mortgage interest rates of 3% to 4%, the pool of potential home buyers expanded considerably... lots and lots of potential first time buyers were delighted to find that they qualified to purchase a townhouse. [2] Real estate investors were also happy to scoop up these types of townhouses as they were able to finance those purchases with exceptionally low mortgage interest rates as well. Certainly, the interest rate would be higher for an investment purchase than for an owner occupant, but an interest rate that is higher than "very very low" is perhaps "very low" so plenty of investors were purchasing these properties as well. But now, mortgage interest rates are a bit higher... OK... twice as high. The current average 30 year fixed mortgage interest rate is 6.95%. As such, and as shown on the "not at all based on real numbers or data" graph above... [1] Would be home buyers who could only qualify to buy with a mortgage interest rate of 3% - 4% clearly do not quality any longer and thus are not buying. [2] Investor buyers who were delighted to buy when interest rates were quite low are also likely not buying right now. That just leaves owner occupant home buyers who still qualify with 6.5% to 7.5% mortgage interest rates. What does this actually mean for this segment of our local housing market? [1] There will likely be fewer buyers coming to see your townhouse if you are selling a starter townhouse in the City of Harrisonburg. [2] There will likely be fewer offers on said townhouse, and less competition from other buyers if you are trying to buy such a townhouse. [3] We might see these townhouses take a bit longer to sell. Maybe? [4] Maybe the price of these townhouses won't climb quite as quickly over the next year or two. Maybe? These are my observations about this segment of our local housing market, very unscientifically graphed above. Let me know if you have other observations, thoughts or questions about the market for this type of property moving forward into 2023. | |

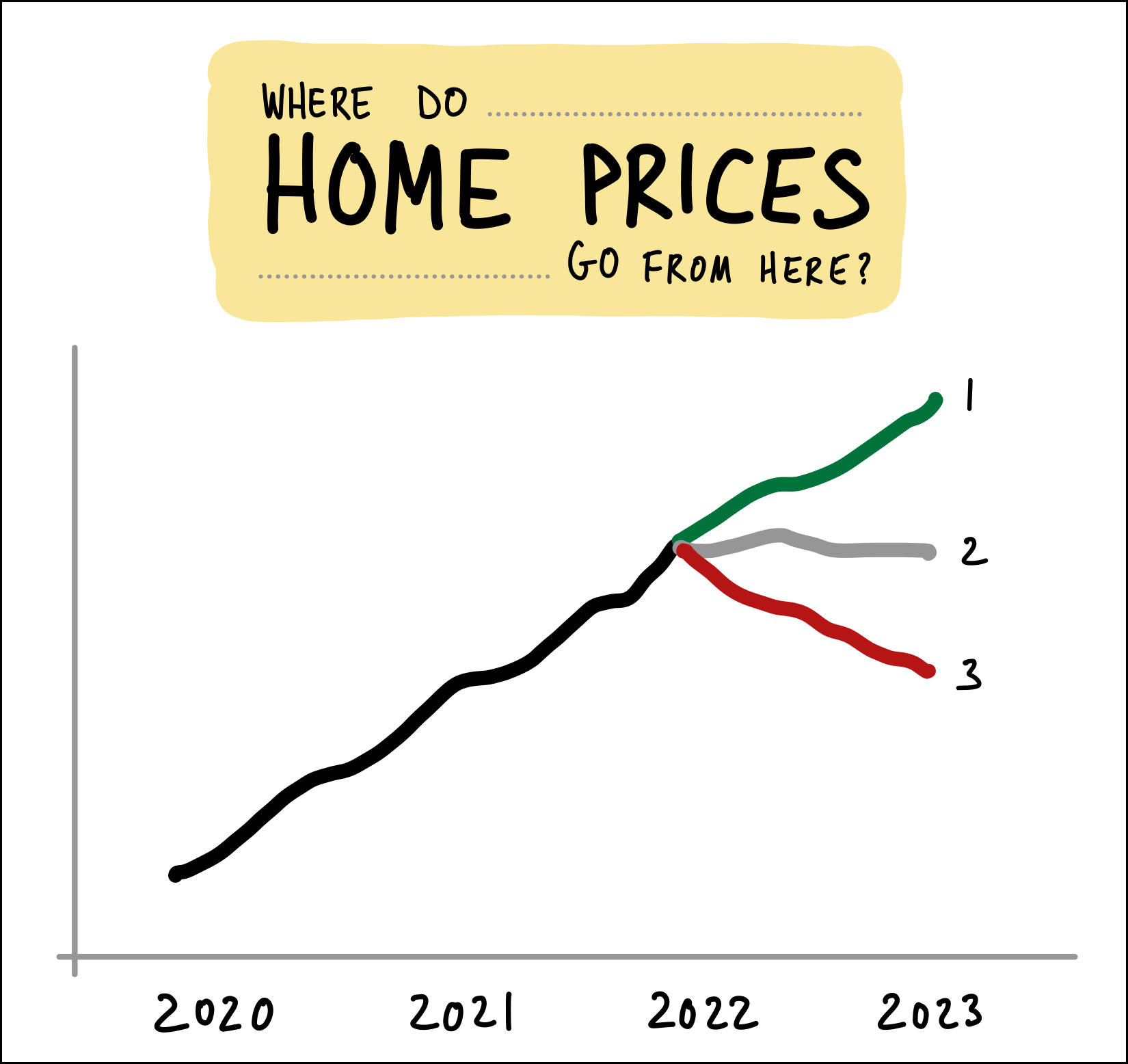

Where Do Home Prices Go From Here? |

|

This is a question very much on the mind of potential home buyers and potential home sellers in the local real estate market in late 2022... Where DO home prices go from here? As per the illustration above, do we see... 1. Home prices keep in rising, perhaps another 10% in 2023. 2. Home prices plateau in 2023, with similar prices as in 2022. 3. Home prices correct, drop, droop, decline by 10% in 2023. It's hard to imagine won't keep increasing (scenario one) given that they have through the first nine months of 2022 even in the context of quickly rising mortgage interest rates. But yet at the same time, it's hard to imagine that prices won't level out or decline some given those quickly rising mortgage interest rates. I can be convinced by those that I talk to (buyers, sellers, agents, bankers, appraisers) that prices will keep on rising in Harrisonburg and Rockingham County... and I can be convinced by those same folks (or a different set of them) that home prices will flatten out or decline slightly in 2023. So, I have absolutely zero answers as to what we should expect in 2023, but interestingly, even if home prices dropped by 10% in 2023... that would take us ALLLLL the way back to 2021 sales prices. ;-) | |

October 2022 Contract Activity Has Dropped Significantly, Sort Of |

|

Has the local real estate market slowed down? Oh yes, quite a bit! How so? Last October 156 homes went under contract in the first 27 days of the month... and this year only 81 homes have gone under contract in that time frame. Wow. Quite a bit slower! Indeed. -- So, yes, contract activity this month is much lower than it was last year during October... but as the graph above reveals, there may be more to the story. First of all, the orange and green bars represent 2020 and 2021 and I think we'll eventually look back and conclude that they were abnormal years, with buying activity super-charge by a worldwide pandemic, as unexpected as that was. So, the bright orange and bright green bars that tower above the rest of the months on the chart might be outliers. Looking for a moment, then, just at the blue bars... This August (2022) we saw a 13% increase in August contracts compared to August 2019. This September (2022) we saw a 10% increase in September contracts compared to September 2019. And...in October... we are dragging ever so slightly behind October 2019, but things aren't looking overly different from where things were three years ago, just before Covid. -- So... is this October slower than last October when it comes to contracts being signed? Yes, absolutely! Much slower! Is this October slower than the last pre-Covid October we have seen in this market? It's slower, but just barely. Is the pace of home buying slowing down in Harrisonburg and Rockingham County? Yes, it seems so... but by how much depends on whether we compare the present times to Covid times or pre-Covid times. | |

Good Reasons To Allow And Disallow Showings Before Your House Is Listed For Sale |

|

In almost all cases, I do not recommend having showings of your home before it is listed for sale. But, as with most things in life, there are some exceptions. Here are some of the reasons NOT to allow showings before your house is listed for sale... [1] Buyers who view your home before you list it for sale are not likely to feel much urgency to make a decision about an offer. They don't have any competition, after all, so they can just think about it. Once your house is on the market and lots of buyers know it is for sale, each and every buyer who views your home will feel the urgency of making a decision about whether to make an offer. That felt buyer urgency works in your favor when selling your home - and you miss out on it for any individual buyers who view your home before it is on the market. [2] If you receive an offer from a buyer who views your home before it is listed for sale you will be considering that offer without the market context of how much interest your house would have if listed for sale and how many offers you might have if it were listed for sale. You might list your home and have 2 showings and 1 offer, or you might have 20 showings and 10 offers... but you won't know when you are considering the singular offer from the buyer who viewed your home before it hit the market. [3] Since you only have one offer, you are at least somewhat likely to sell your house for less favorable terms than if you had listed it for sale. Certainly, you might list it for sale and only have one offer - but if there were multiple offers when you listed it for sale, you could then select from multiple offers with different prices (possibly escalated), different contingencies and from buyers with different financial capabilities. Letting a buyer see your house before it is listed for sale opens the door to having only one offer to consider, which might not result in the best possible terms for you. Here are some of the reasons you might ALLOW showings before your house is listed for sale... [1] It's a lot of work to get your house ready for photos and showings, and even more so if you have kids or pets. ;-) Some sellers would gladly show their house once, before it hits the market, and have it under contract shortly thereafter, rather than going through the process of completely preparing the house for photos and showings. Certainly, you'll still want your house to look good for that one buyers... but preparing for their showing likely won't be as intensive as preparing for fully putting your house on the market. [2] Some sellers have a friend, neighbor or co-worker that has already expressed interest in buying their house and they (the seller) would be delighted to sell the house to that person or persons. If you want to give some known potential buyer a leg up in the buying process, letting them see your house before it is listed for sale, and potentially make an offer without having to compete with other buyers, then you can certainly choose to do so. It does create the downsides described above, but you might still elect to go this route because of those relationships. [3] I tried to come up with a third reason. I didn't. Feel free to send me your suggestions. ;-) As you can see, there are plenty of reasons to allow or disallow showings of your house before it is listed for sale. Generally speaking, I don't recommend it - but there can certainly be situations where it makes sense to pursue that path. | |

If You Are Hoping To Sell Your Home In 2022, List It Very Soon, Or Adjust The List Price Very Soon! |

|

Summer just ended, right? It's just barely fall, right? There's plenty of time remaining in 2022, right? Well, sort of. Most real estate transactions take around 45 days to get from contract to closing. Certainly, some of them are happening in 30 days, but it's good to plan on a 45 day window between contract and closing. Thus, if you do not yet have your house on the market for sale, here's a potential timeframe that you might experience if you wanted to sell in 2022...

Don't forget, after all, that the Thanksgiving and Christmas holidays can often slow things down with lenders, title companies, etc., during November and December. If you have your house on the market for sale now, and it is not under contract, this is also an ideal time to consider making a price change to try to secure a contract with a buyer within the next week or two if you are aiming to have the closing take place before the end of the year. It can seem like there is plenty of 2022 left to go (there is) but when it comes to the timing of a real estate transaction, if you want to close on the sale of your home in 2022, you should likely be getting started soon! | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings