Selling

| Newer Posts | Older Posts |

If You Are Hoping To Sell Your Home In 2022, List It Very Soon, Or Adjust The List Price Very Soon! |

|

Summer just ended, right? It's just barely fall, right? There's plenty of time remaining in 2022, right? Well, sort of. Most real estate transactions take around 45 days to get from contract to closing. Certainly, some of them are happening in 30 days, but it's good to plan on a 45 day window between contract and closing. Thus, if you do not yet have your house on the market for sale, here's a potential timeframe that you might experience if you wanted to sell in 2022...

Don't forget, after all, that the Thanksgiving and Christmas holidays can often slow things down with lenders, title companies, etc., during November and December. If you have your house on the market for sale now, and it is not under contract, this is also an ideal time to consider making a price change to try to secure a contract with a buyer within the next week or two if you are aiming to have the closing take place before the end of the year. It can seem like there is plenty of 2022 left to go (there is) but when it comes to the timing of a real estate transaction, if you want to close on the sale of your home in 2022, you should likely be getting started soon! | |

Contract Activity Seems To Be Slowing Down (Quite A Bit) In October 2022 |

|

It's best not to get your face too close to the data. The closer we look at the data, at a smaller and smaller data set, the more likely we can find ourselves concluding one thing when another is actually true. So, as you ponder the meaning of the graph above, keep in mind that the last set of data (October 1 - 15) is a rather small set of data... from just two weeks in our local market... so it may or may not be indicative of an overall trend. But... with that length disclaimer having been thrown out there... After seeing modest declines in contract activity in August (-13%) and September (-15%) it seems that contract activity might be REALLY slowing down (-51%) in October. Last October, in the first half of the month, a total of 81 contracts were signed for buyers to buy and sellers to sell houses in Harrisonburg and Rockingham County. This year in those same 15 days, only 40 contracts have been signed. It's hard to say if this significant decline in contract activity will continue as we move through October and into November, but if things were slowing down slightly in August and September, they seem to be slowing down more quickly in October. | |

Price Reductions Will Likely Make Lots Of Sense To Some Home Sellers |

|

Fictional Seller Sally bought her home about eight years ago for $190K. Three years ago, Sally realized her home was worth $240K and was pretty happy about that. Last year, Sally was astonished to conclude that her home was likely worth $290K. Wow! Sally just landed a new job out of state and is getting ready to sell and the most recent comparable sales indicate that her home is likely worth $310K in the current market. Sally is elated! Sally lists her home for $309,500 and has had quite a few showings during the first three weeks on the market, but has not received any offers. Would it surprise you that Sally decides to go ahead and reduce her list price to $299K? Would it surprise you if three weeks later Sally reduces the price again to $289K? It wouldn't surprise me. While some sellers might think about $299K and $289K relative to the possible current value of $310K, Sally is thinking about $299K and $289K relative to... [1] Her original purchase price of $190K. [2] Her conclusion a year ago that her home was likely worth $290K. Certainly, Sally would be delighted if she could sell her home for $310K, but she will also be very happy to sell it for $299K or $289K. Moving forward through the balance of 2022 and in 2023 I suspect there will be some sellers who will happily sell for a bit less than the market might indicate their house is worth, as that "lower" price is still much, much higher than they could have imagined their home was worth for most of the time that they have owned it. This likely won't be all sellers, and perhaps not even most sellers, so it might not cause an overall shift in home values... but some sellers will likely be quite willing to reduce their price if their home does not sell in a timely fashion. | |

Should You List Your Home Now Or Wait Until Spring? |

|

Now or Later? Now! :-) I mean... don't get all panicky about it... but I would definitely recommend listing your home now, rather than waiting until the spring. Oftentimes homeowners who might sell in fall or might sell in the spring decide that they might as well wait until spring. I think this year is or should be different for homeowners who aren't sure whether to sell now or wait until spring. Yes, interest rates are high right now, but inventory levels are still low, homes are selling quickly, and at great prices. [1] Interest rates might have come down some, but they may also be just as high or higher. [2] Inventory levels could quite possibly be higher (more competition) if the market slows over the next six months. [3] Homes may not be selling as quickly. [4] Home prices might be even higher in six months, but they could also have flattened out or declined a touch. I am not predicting a major change in the state of our local housing market... and I am not saying that the sky is falling... and I don't think the local housing market is going to be much worse six months from now... ...but, I think the calculus on whether to sell in the fall or to wait until spring is a bit different this year, and some homeowners that might have normally waited until spring should probably consider listing their homes this fall instead. Just a thought. What are your thoughts? | |

As You Might Imagine, It Is Still A Pretty Swell Time To Sell A House |

|

Lots of homes are still selling, relatively quickly, at high prices. Yes, mortgage interest rates are higher, which limits the housing budget for some buyers, but thus far we are not seeing higher mortgage interest rates affect the prices for which homes are selling. Thus, home sellers are still enjoying the current market as a great time to sell... Lots of homes selling = YAY Low inventory levels = YAY Homes selling quickly = YAY Sales prices remaining high = YAY Higher mortgage interest rates = Yeah, so what? Certainly, if a home seller needs to turn back around and be a home buyer, the mortgage interest rates will impact their housing transition. But if you are just selling a home... it is still a very enjoyable time to sell... | |

I Was Going To Upgrade To A Larger Home Until I Saw That Larger Mortgage Payment!?! |

|

In more than a few conversations over the past week I have been chatting with friends and past clients who have shared that they had been recently toying with the idea of upgrading to a larger home. In each of these instances, they bought their home three to eight years ago and are now finding it to be a bit tight in various areas. A new kid (or two) stretching the bedroom usage... working from home part of the time with limited space in which to do so... older kids with friends coming over to hang out and wanting room to lounge, etc., etc. These various "life is changing and house needs are changing" situations prompted each of these homeowners to think about whether they ought to upgrade to a larger home. But... then they started running the numbers. At first, things look good... They bought their current home for $300K, have a mortgage payment of around $1600/month, they still owe $250K and could sell for $415K. Thus, they could walk away with about $140K after settlement. But then, things turn a bit... The larger home would cost them around $540K. They'd put $140K down, so they'd be financing about $400K. At current mortgage rates of around 6%, their monthly payment would be... $2900/month. As you can see from this rough math for this one homeowner's situation, even though their $300K home is now worth $415K, and even though they would be walking away with $140K after selling, and even though they'd only be upgrading from a $415K home to a $540K home... their mortgage payment would be jumping up from $1600/month to $2900/month. The big change here is, of course, the mortgage interest rate. Paying off that 3.25% mortgage and taking out a new 6% mortgage is going to cost ya! What does this mean for homeowners and our local market? I suspect there will be fewer elective home upgrades over the next few years if interest rates remain this high... which has the potential to further limit resale inventory of homes for sale. This story is not everyone's story... so if you're considering an upgrade (or a downgrade) let me know if you'd like to do some rough math together to evaluate the overall financial impact of making the change. | |

The Second Best Way To Know If Your House Will REALLY Sell For THAT Much!?! |

|

Home values have increased QUITE a bit over the past few years. The median sales price this year is 36% higher than it was three years ago in Harrisonburg and Rockingham County. That can leave a homeowner wondering... will my house REALLY sell for THAT much!? The best way to know if your house will sell for $____ is to put it on the market for sale and see what type of market response we have over the first few weeks. :-) The second best way to know if your house will sell for $____ is to see how quickly your neighbor's similar house sells and at what price. Very frequently, though not always, we can find a house that is relatively similar to your home that has sold in recent months that can provide concrete guidance on how you might price your home if you were to sell. If you are thinking about selling your home soon, let's start digging into the data now to see if it will REALLY sell for THAT much! ;-) | |

The Value Of The Smallest House In The Neighborhood |

|

How much should you be willing to pay for the smallest house in a neighborhood? Especially if it is a good bit smaller than all the other houses in the neighborhood? Let's imagine a neighborhood in Harrisonburg or Rockingham County where homes typically sell for $450K - $500K, with an occasional sale above $500K. All of these homes, however, are 3000 SF homes. There might be a 2800 SF homes that sells from time to time, but almost all are at, above, or well above 3000 SF. So -- when a 2300 SF home comes on the market in the neighborhood, how much should you be willing to pay? A seller might say $440K. After all, you have to pay $450K+ to buy any house in this amazing neighborhood, so even if my house is smaller than most, you'll need to pay pretty close to that floor of $450K. A buyer might say $400K. After all, the 2300 SF home is markedly smaller than just about every other home in the neighborhood, so the sales price should be quite a bit lower as well. If a 3000 SF home sells for $450K, I don't want to pay more than $400K for a 2300 SF home. I might say $420K. I think there is merit in both of the perspectives above, and a blending of those two concepts gets us close to what a buyer should be willing to pay. Keep in mind -- it is also possible that a buyer will come along who just LOVES the neighborhood and doesn't need much space at all. This buyer might just be willing to pay closer to that $440K - $450K price, especially if they are a cash buyer, or moving from a more expensive market, etc. | |

Which Comes First? Buying Your Next Home Or Selling Your Current Home? |

|

If you are getting ready to sell your home AND buy a home, it can sometimes be difficult to determine where to start... Do you start by finding a house you want to purchase? Or do you start by listing your home for sale? I would suggest that you start with whichever you anticipate will be the most difficult part of the two step process. If it will be difficult to sell your home (because of price, location, layout, features, age, etc.) and it will be at least slight easier to buy the next one (plenty of viable options are listed for sale) then you are likely best off starting with listing your home for sale. Work to get the more difficult half of the transition underway by getting your current home under contract, and then work on the easier side of the transition. If it will be more difficult to buy the next house (because of the specificity of your housing goals, or because of low inventory levels, etc.) and it will be at least slightly easier to sell your current home (because the property type, location or price are in high demand) then you are likely best off focusing first on finding the home to buy -- and then listing your home for sale. There are plenty of nuances we can discuss further to formulate a plan for attempting to simultaneously sell and buy -- but as a general rule of thumb, you'll be best off to start with the harder half of the transaction. | |

As Time On The Market Increases, Contingencies In Offers Often Increase |

|

Day 1 - If a buyer is interested enough to make on Day 1, and potentially be competing against other highly motivated buyers, there is a good chance they will waive some or many or all contingencies. They might not be proposing a home inspection, a radon test, or an appraisal contingency. Day 7 - If a listing is still available on Day 7, a buyer will likely tentatively feel comfortable proposing some contingencies (home inspection, radon test, appraisal, etc.) but perhaps not all of the above. Day 30 - If a listing is still available on Day 30, a buyer will likely feel comfortable proposing any and all contingencies, including a home inspection, radon test and an appraisal. Home Buyers -- Do you want to wait to make an offer to potentially be in a position to include contingencies that you'd prefer to have as a part of your purchase contract? Even knowing that waiting to make the offer might mean someone else buys the house before you make an offer? | |

Are Home Buyers Walking Away From Contracts In Harrisonburg? |

|

You may have read in recent news headlines that home buyers are cancelling their contracts to buy homes left and right. Here is one such news story... Homebuyers are backing out of more deals as high mortgage rates persist and recession fears linger (CNBC) This would cause plenty of people in our local area whether this is also happening locally. Are home buyers walking away from contracts in Harrisonburg? I'm going to say, anecdotally, a strong NO. That phenomenon does not seem to be happening in any significant way in the Harrisonburg and Rockingham County real estate market. Buyers generally seem to know what their mortgage interest rate is going to be before they make an offer (via a conversation with their lender) and are then locking in their interest rate once they are under contract. So, should sellers now wonder if their buyer will really make it to closing or if they might decide to back out of the deal? That does not seem to be a concern a buyer needs to have any more than at other times in the past 10+ years... at least in Harrisonburg and Rockingham County. | |

The Strength Of The Local Housing Market Is Likely To Start Varying By Price Range, Location And More! |

|

For the past few years the market has been moving so quickly, with such an excess of buyers in nearly every price range, that just about every house would sell very quickly - regardless of the price range and location. But... as interest rates have been rising over the past six months, there seems to be some variation in how strong different segments of the market are, based on price range, location, property type and more. If you are planning to sell your home this fall we need to look carefully at homes in your particular neighborhood, price range, etc. to see how quickly they are selling... and to compare the prices for which they are selling now compared to three or six months ago. | |

Plenty Of Properties Likely Sold Above Appraised Value Over The Past Few Years But Fewer Are Likely To Do So Moving Forward |

|

Home buyer attitude towards appraisals has certainly shifted over the past few years! PRE-COVID... Most buyers would include appraisal contingencies in their offers to reserve the right to have a conversation with the seller about the sales price if the appraised value ended up being lower than the contract price. Most sellers were comfortable with these appraisal contingencies and found them to be reasonable. EARLY COVID... Some buyers started to leave appraisal contingencies out of their offers to compete in multiple offer scenarios. These offers were no longer contingent on the property appraising at or above the contract price. IN THE THICK OF COVID... The market just kept heating up over the past few years, during Covid, and eventually, home buyers almost always found themselves competing with multiple (or many, or multitudes) of other offers. Home buyers started adding in specific language to their offers agreeing to proceed with the purchase so long as the appraised value wasn't any lower than $____ below the sales price, or agreeing to proceed with the purchase regardless of the appraised value. These offers would significantly reduce (or eliminate) the possibility of an appraisal disrupting the home sale. Home buyers were willing to go this route to try to compete to secure a contract on a house... and home sellers were delighted! NOW... Some new listings are still having 5+ offers within a few days, but plenty are only having one or two offers. With fewer competing offers, and with a feeling that the market might be slowing a bit, more home buyers are revisiting the topic of whether to include an appraisal contingency. Some buyers are now including appraisal contingencies in their offers once again. Buyers should likely decide whether to include an appraisal contingency based on whether they are competing with other offers, and based on how much they like a particular property. Some sellers find the return of the appraisal contingency to be quite reasonable. Some sellers think it is a terrible thing, and are insistent that they should be able to sell their home for more than an appraised value. Sellers should likely decide whether to accept an appraisal contingency based on how much interest exists in their home, how many offers they have, how long it has been on the market, etc. A shift in the way that home buyers and sellers see appraisal contingencies is normal as we start to see some early signs that the local housing market might be slowing down from a sprint to a fast run. As with all things housing market related right now, the dynamics described above to not equally apply to all property types, price ranges and locations. :-) | |

Harrisonburg Housing Market Still Showing Strength Despite Some Signs Of Slowing |

|

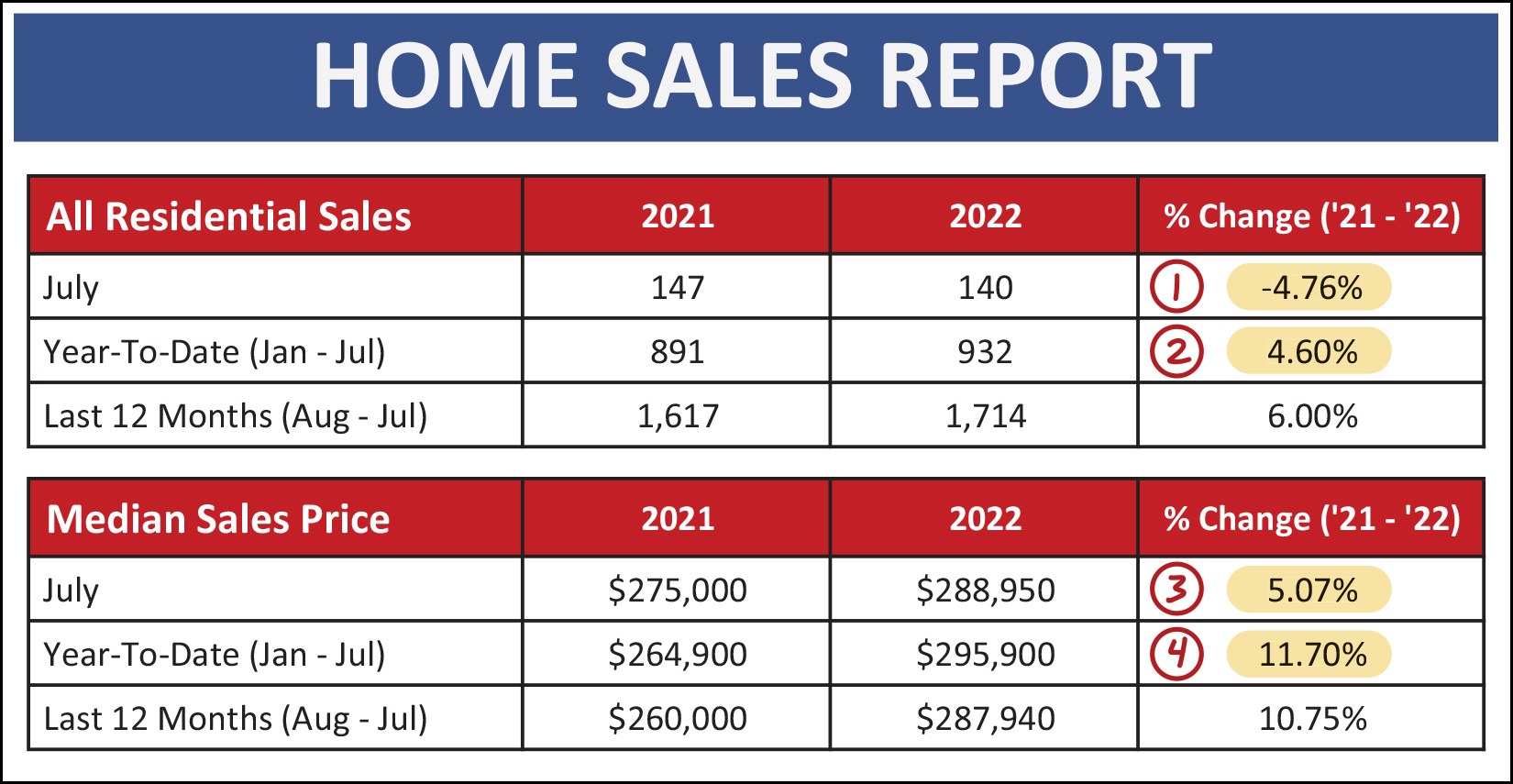

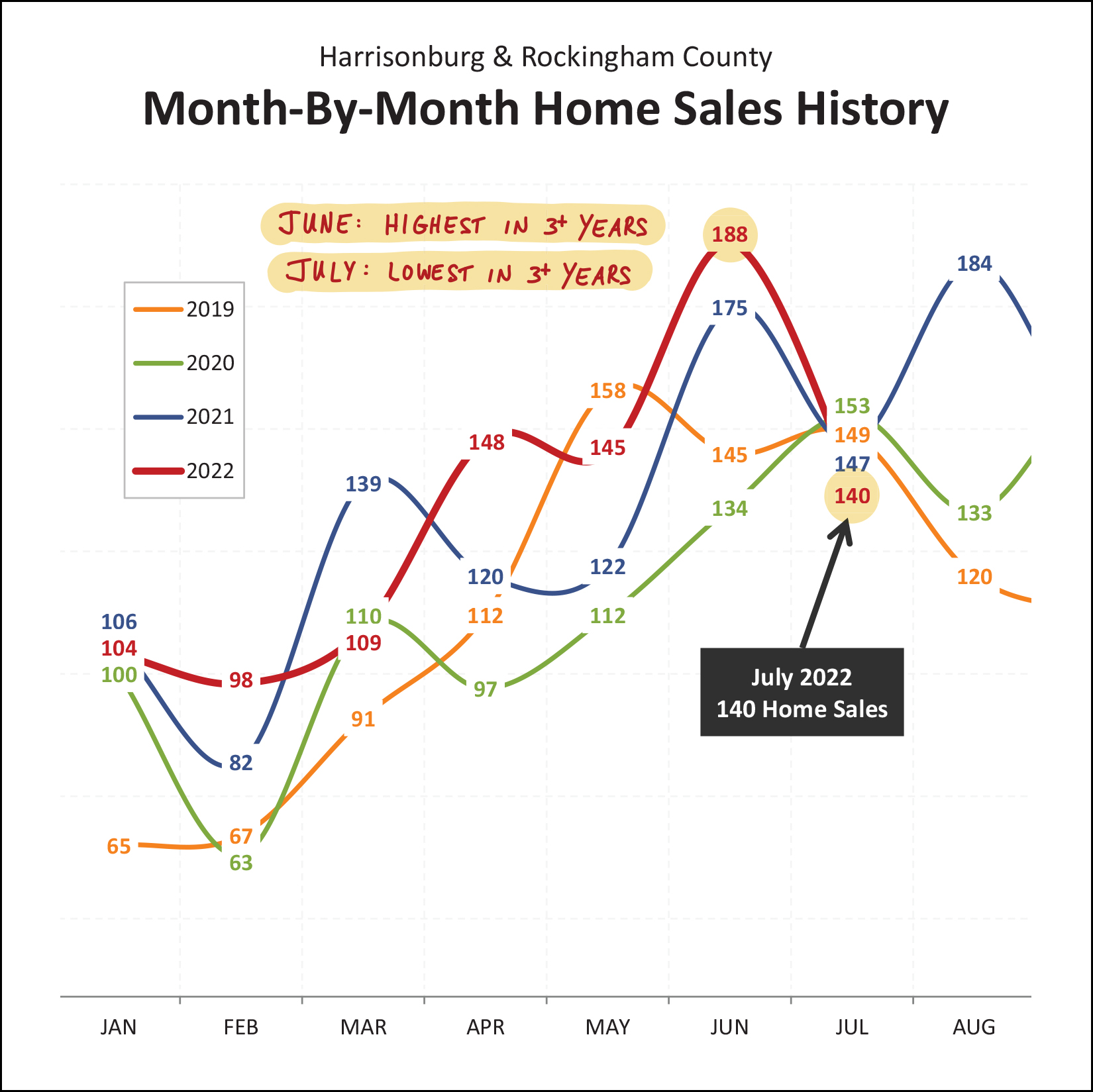

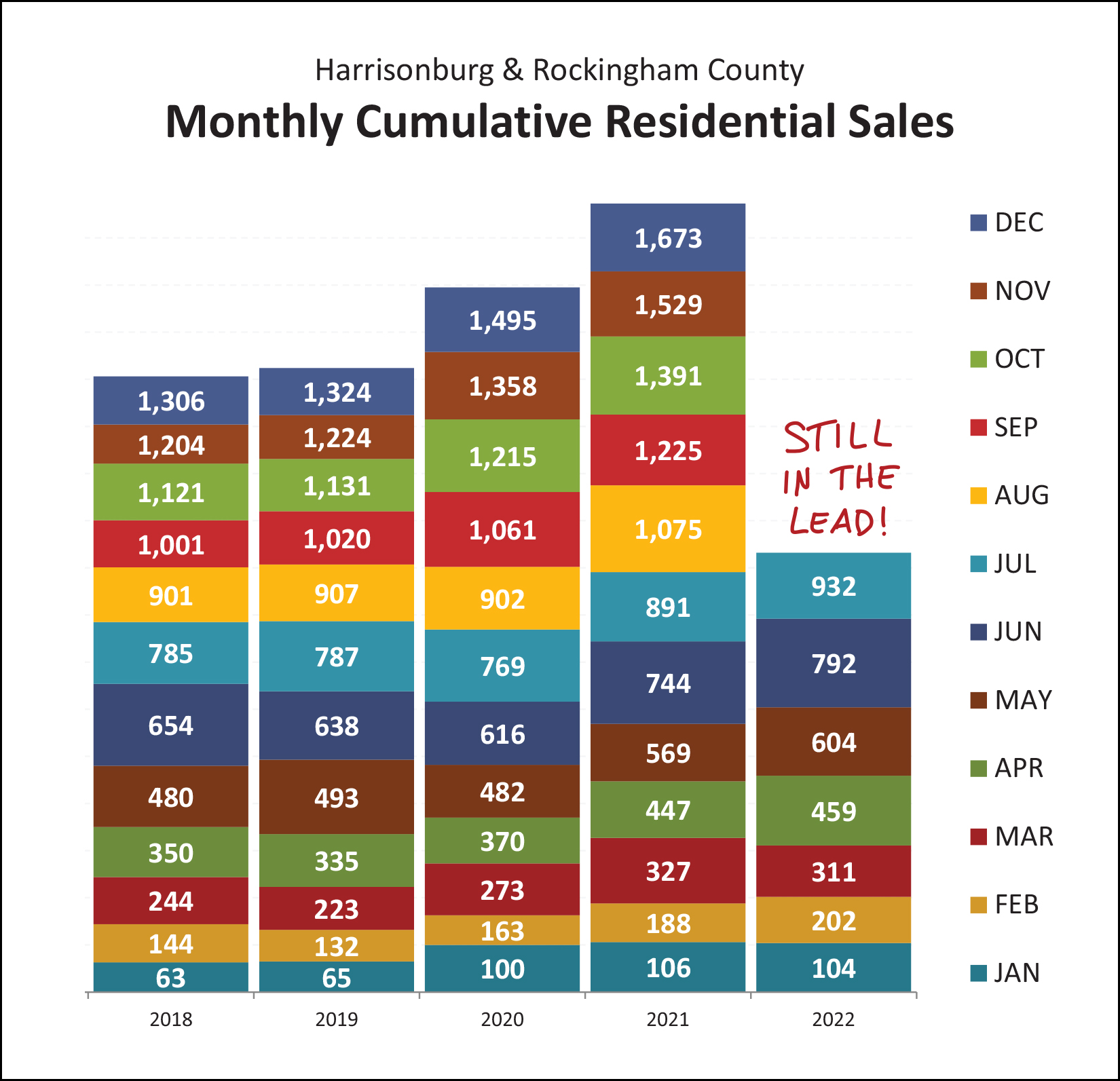

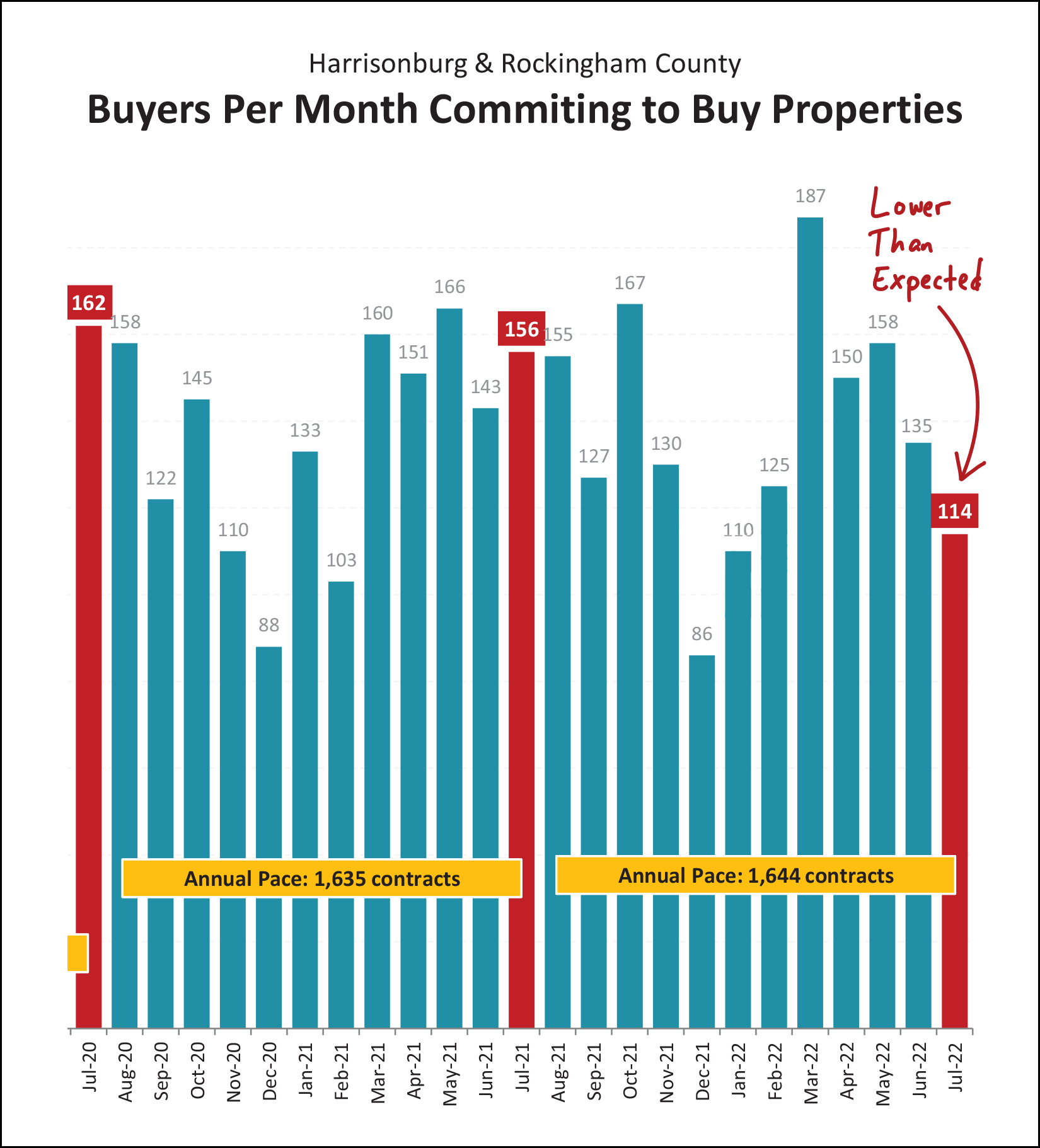

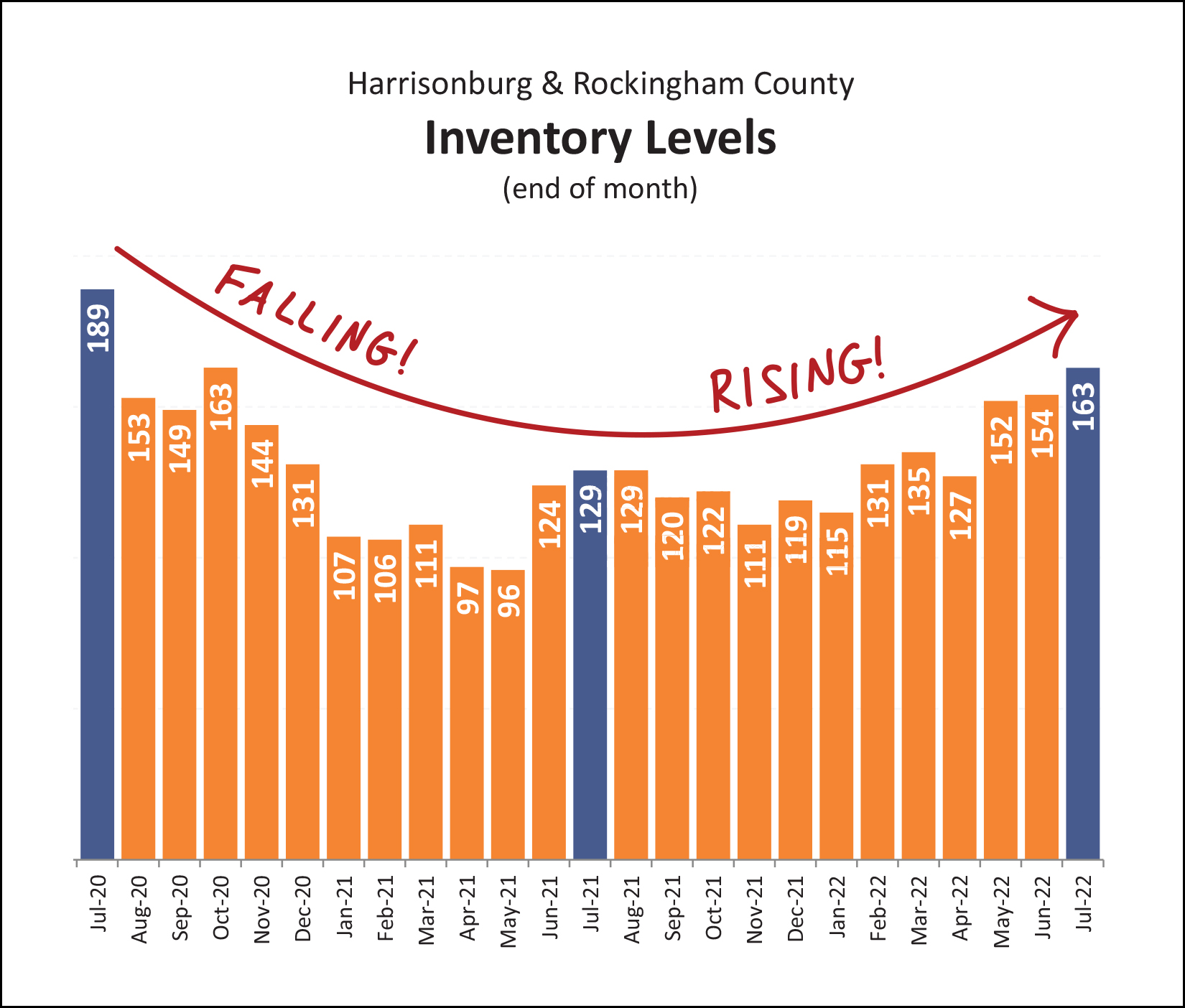

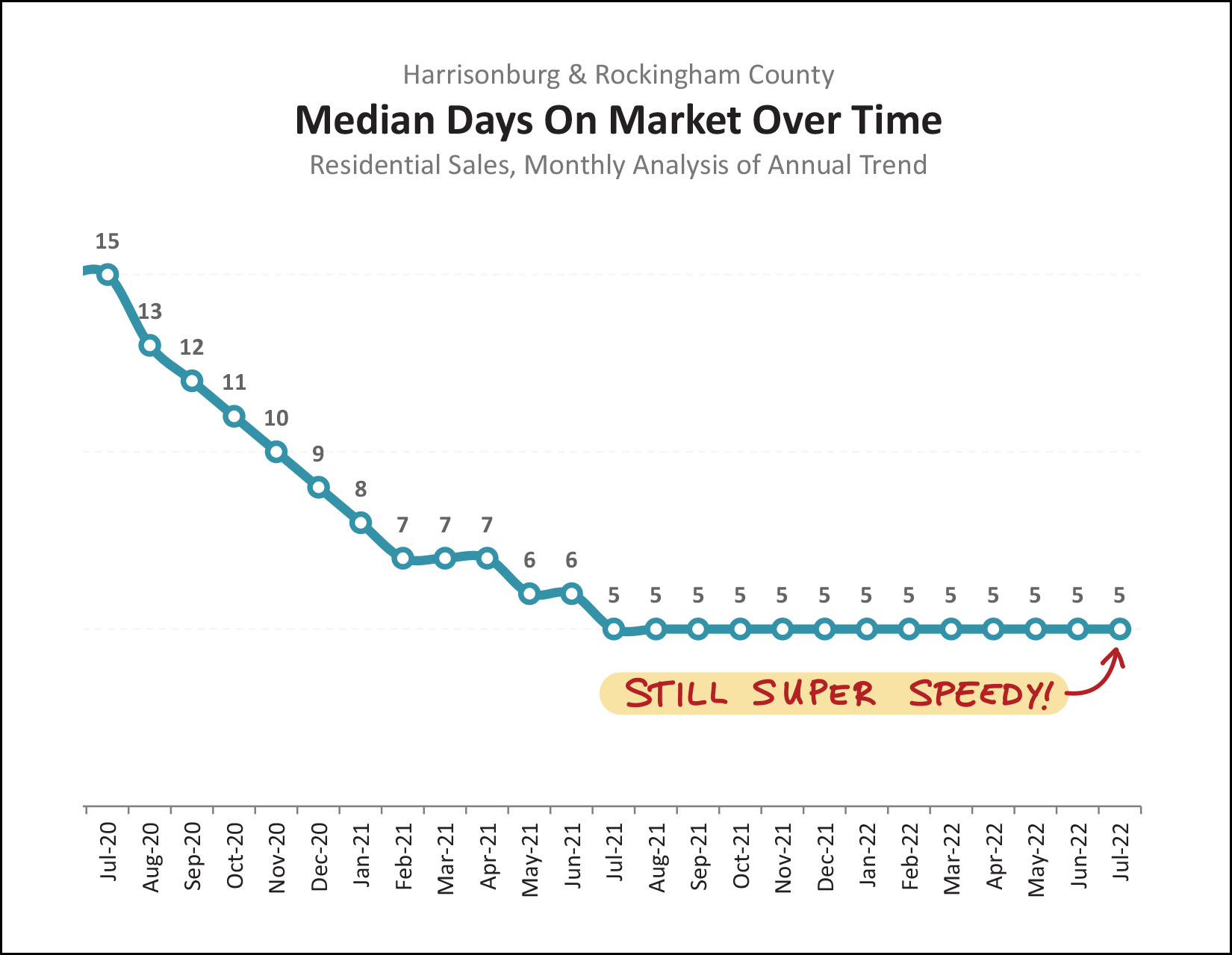

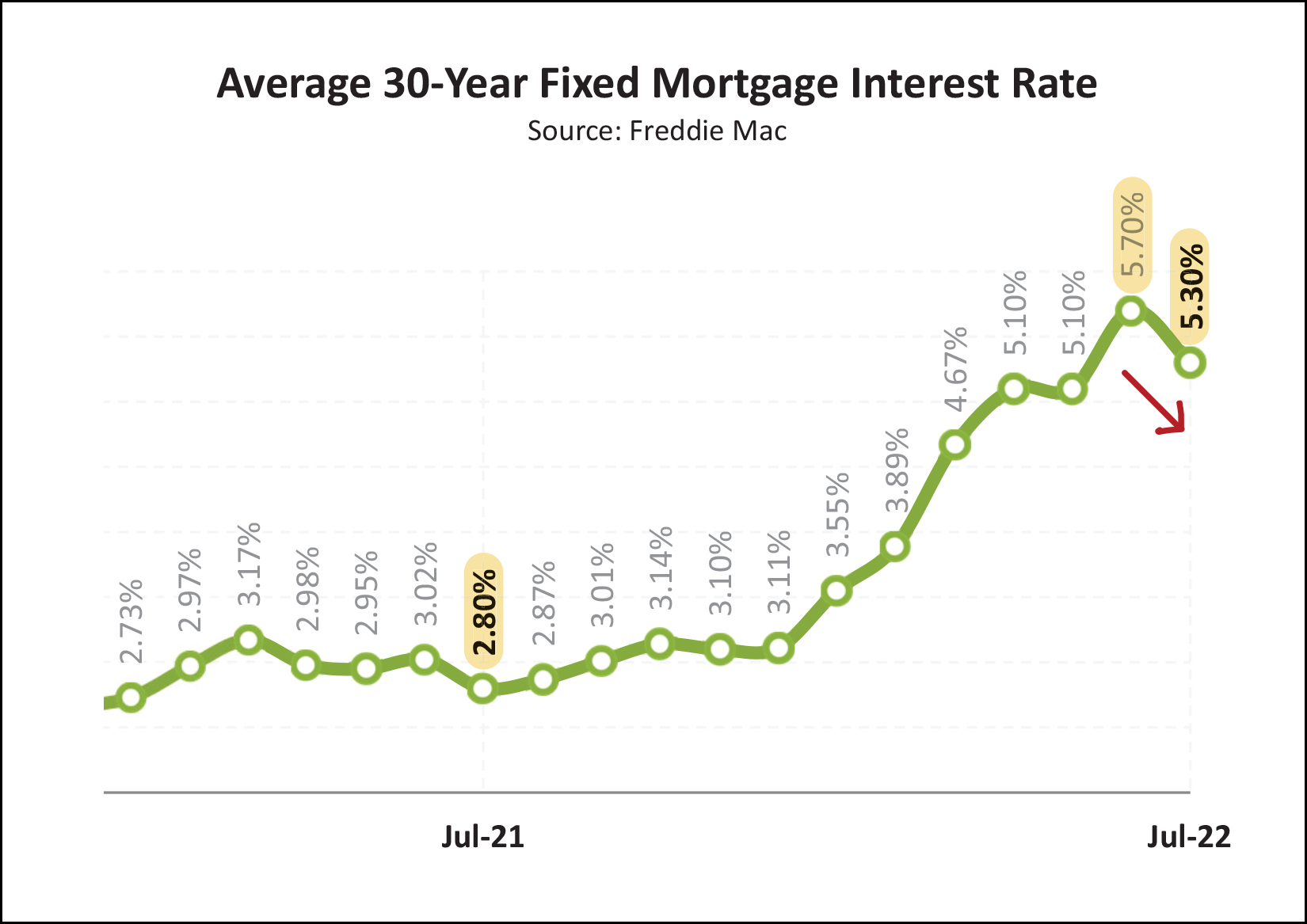

Happy Thursday afternoon, friends! As any student or teacher will tell you, summer is almost over! čśó I hope that you and your family had a wonderful summer and that you had at least one opportunity to sneak away... to the beach, the lake, a tropical island, a music festival, a rural AirBNB, a national forest, a campsite or a new city! One of my favorite spots to sneak away is Deep Creek Lake, MD...  But getting back to business... The beautiful house on the cover of this month's market report is located at 3161 Henry Grant Hill in Preston Lake and you can find out more about this spacious home here. Each month I have a giveaway, of sorts, for readers of this market report. This month's giveaway requires a special sort of market report reader... one who also likes to run... a lot. I enjoy running and frequently participate in races put on by VA Momentum, and thus I was excited to hear they are putting on a half marathon this fall. So... this month, you can enter for a chance to win a free registration to the Harrisonburg Half Marathon, to be held on October 15, 2022! Find out more about the half marathon here. Enter to win the free race registration here. Email me and tell me I'm crazy for thinking you'd run a half marathon here. čśë And now, after all that, let's dig in and see what is happening in our local housing market...  As noted in my headline above, there are some signs that our local real estate market might be slowing down a bit. This very well may mean, though, that it slows down from going 90 MPH in a 60 MPH zone to going 75 MPH in a 60 MPH zone. The latest numbers, as shown above, indicate that... [1] July home sales were slower (140) than last July. We'll see this again on a graph in a moment. [2] Thus far this year we have seen 932 home sales, which is 4.6% more than last year. We had a record number of home sales last year, so a further increase this year is... record breaking. [3] The median sales price in July was 5% higher than last July. [4] When looking at the first seven months of the year, the median sales price has risen 11.7% in Harrisonburg and Rockingham County. So... most of these indicators are quite positive, rosy, exuberant, except the slight slow down in July. This is seen a bit more clearly here...  Above, you'll note that in June 2022 we had an astronomical 188 home sales... higher than any of the past three months of June. But, then, July. In July 2022 we only saw 140 home sales, which is less than any of the past three months of July. Some might point out that looking at a single month of housing data, in a small-ish housing market, can make you think something is happening, when nothing is happening. I agree that can happen. If we smash the two months together, we find that there have been 328 home sales this June and July... compared to 322 home sales last June and July. So... maybe things are "just fine" right now, and maybe things are starting to slow, slightly.  As shown above, if things are starting to slow... they're only just starting to do so, and they're doing so verrrrry slowly. The 932 home sales seen thus far in 2022 is more than we have seen in the first seven months of any of the prior four years. Perhaps when we get another month or two into the year we will see things level out a bit in 2022?  Slicing and dicing the data once more, this graph (above) measures (each month) the number of sales in a 12 month period as shown with an orange line, and the 12-month median sales price (measured each month) shown with the green line. As you can see at the end of the orange line, it's possible that the overall pace of home sales is slowing a bit... but then again, maybe not. We'll need to watch this for a few more months to know for sure. Speaking of the future, our most reliable indicator of future sales is... current contracts...  This one surprised me a bit. We usually see around 150 to 160 contracts signed in any given month of July. But... not this July. There were only 114 contracts signed in July 2022, which is much lower than usual, and likely means we will see a lower than usual month of closed sales in August and/or September. This falls to the category of "things that make you say hmmmm...." and this will definitely be a trend we will need to continue to monitor. Somewhat fewer buyers signing contracts might mean that inventory levels would rise a bit...  Indeed, we are starting to see inventory levels creep up a bit. There are now 163 homes for sale in Harrisonburg and Rockingham County, which is a bit more than the 129 we saw at this time a year ago. It is important to note, though that these "slightly higher" inventory levels are really still VERY, VERY low. Many or most buyers in most price ranges and locations still have very few options of homes to buy right now. So, yes, inventory levels are creeping up a bit, but don't think that's necessarily giving buyers more choices... or giving buyers more leverage... at least not at this point. So... a few fewer sales... fewer contracts... slightly higher inventory levels... that probably means that homes aren't selling as quickly, right!? Well...  Looking at the 12 months of home sales prior to July 2021 (a year ago) the median "days on market" for those sales was only five days. That metric has remained constant for 13 months now... and today, when looking backwards by a year, the median "days on market" is still just five days. Narrowing the focus even more, to just the 114 properties that went under contract in July 2022, we might expect to see a higher "days on market" -- and we do -- but only barely. The median days on market during July 2022 was... six days. So, homes are still going under contract very, very quickly! Finally, maybe this (below) is a contributing factor to the slight slow down over the past 30 to 45 days?  A year ago, the mortgage interest rate was 2.8%. Six months ago it was 3.55%. During June and July it was as high as 5.81%, though it has started to decline now. It is quite possible that these higher mortgage rates have caused some buyers to not be able to buy any longer... or that it has at least partially dampened their enthusiasm. So, there you have it, friends. The housing market in Harrisonburg and Rockingham County is still showing great signs of strength with more sales than ever, at higher prices than ever. But... we might be seeing a slight slow down in home sales (from record high levels) and we might be seeing a slight increase in inventory levels (from record low levels). We'll have to give it a few more months to see how things continue to develop in the local market to know for sure. Until then... If selling a home is on your mind, let's talk sooner rather than later. Before you know it, we'll be halfway through fall and headed into winter. If you are planning to buy a home soon, let's start watching for new listings of interest and going to see them quickly when they hit the market. If I can be of any help with the above (selling, buying) please call/text me at 540-578-0102 or email me here so we can talk about working together to navigate your way through the ever changing Harrisonburg real estate market. | |

Anecdotally, A Smaller Percentage of Showings Seem To Be Resulting In Offers These Days |

|

I don't have any data to back this up, but it seems that a smaller percentage of showings are result in offers right now. A year ago, 20 showings might have resulted in 5 to 10 offers. Today, 20 showings seems to be resulting in 2 to 3 offers. It's hard to know what exactly is driving this change... [1] Home prices are certainly higher now than they were a year ago, and maybe it's harder for buyers who look at houses to get excited about paying today's prices as compared to the prices a year ago? Though, a year ago, prices seemed pretty high to most folks as well... [2] Mortgage interest rates are certainly higher now than they were a year ago, and maybe buyers are excited about Home X at Price Y but when they run the numbers and determine Mortgage Payment Z their excitement cools? Though, they could have known that before they decided to go see the house... [3] The housing market was on fire a year ago with no signs of cooling off, whereas now some markets are seeing sales and/or prices level off or decline slightly. So, maybe buyers are a touch more hesitant to act today as compared to a year ago because there is some small amount of doubt of whether home prices will continue to accelerate upwards over the next few years? Though, a year ago, there was some doubt about whether prices would keep accelerating upwards because they had been increasing so quickly up until that time... So, it's hard to say why, but a somewhat smaller portion of buyers who go to view homes seem to be deciding to make an offer on those homes right now. Does this matter to sellers? Not necessarily. [1] Homes are still selling very quickly. [2] Homes are still selling at prices that are very favorable to sellers. [3] Sellers are still often having more than one offer to consider, even if they don't have ten offers. So, changes are afoot, but they aren't necessarily changes that are affecting the pace of sales or sales prices in our local market. | |

Some Home Sellers Optimize For Speed, Convenience or Certainty Instead Of Price |

|

What are you optimizing for?

As a home seller, you are always optimizing for something. PRICE - Maybe you are willing to wait as long as it takes to get the price that you want for your house. Even if it takes months longer than you had hoped and even if it means that you aren't able to continue on with other life transitions that you had planned, at least you go the price you wanted. TIME - Maybe it's important to you that you wrap up your home sale (have the house under contract) within a few days or weeks. If so, you might be willing to price your home a bit lower to maximize the possibility that you accomplish your timing goals. CONVENIENCE - Maybe your strategy for when you list your home and your pricing strategy all revolve around making it a seamless transition to your next home. You're willing to be flexible on timing and on pricing so long as it lets you accomplish your goals of buying that perfect next home. CERTAINTY - Some sellers don't mind working their way through inspection contingencies, but some would opt for a slightly lower priced offer without an inspection if that meant they would have certainty that the sale would move forward. | |

Home Inspections Are Likely To Become A Thing Again, And They Should |

|

Over the past two years I have told countless home sellers something along the following lines as they have made final preparations to sell their home... "That recent listing over in that neighborhood had five offers within the first week and none of those buyers included home inspection contingencies." "That townhouse just went under contract after receiving eight offers, and only one of the eight buyers was asking to be able to conduct a home inspection." As such, many home sellers over the past two years have not had to work their way through home inspection contingencies and the negotiations that sometimes take place after those inspections. And... my point today... most home buyers over the past two years have not had the option of conducting a home inspection during their purchase process. As our local real estate market starts transitioning into a market that is not quite as piping hot of a market as it has been for the past two years, we will very likely start to see more offers with home inspection contingencies. This is great news for buyers! A home purchase is a major financial decision both in the near term and the long term. You are paying a large amount of money for a home in which to live... but that home may very well need some items repaired or need some system maintenance or replacement in the near future. A home inspection allows a buyer to more clearly understand potential home maintenance costs over time by learning more about the condition of the components and systems of the house. As a side note, I am much more of a fan of home inspections being used by buyers to learn about a house and to propose slightly different contract terms if major issues are discovered -- more so than home inspections being used by buyers to try to renegotiate the deal just because they can threaten to walk away from the deal based on the inspection contingency. Home sellers today should be prepared for offers that may include inspection contingencies. Home buyers today should consider including inspection contingencies if they are not competing with multiple other buyers to secure a contract on a hot new listing. | |

Last Call For Sellers Hoping To Sell To Buyers Hoping To Move Before School Starts |

|

I don't want to mention... the school year... but... it's coming, sooner than we realize. :-) With the start to school only 40-ish days away (depending the school system) we're now approaching the end of a golden window for buyers and sellers, when... [1] Buyers can buy and still get moved in before school starts. [2] Sellers can sell and still get a buyer moved in before school starts. So, if you're hoping to sell your home to someone who wants to be in your house by the time the school year starts... you should be getting your house on the market sometime in the next week or two. OK... everyone may now return to focusing on summer and pretending that the coming school year is way off in the far distant future. ;-) | |

Price Your Home Reasonably And You Will Receive Reasonable Offers |

|

Now more than ever, appropriate pricing is the key to a successful sale of your home. TOO HIGH... If an identical home sold a month ago for $325K... we shouldn't price your home at $335K or $340K or $350K. If you price your home too far above other recent sales, buyers may come to see your home... but they likely will not make an offer. TOO LOW... Likewise, and equally important, if an identical home sold a month ago for $325K... we shouldn't price your home at $300K or $305K or $310K. If we price your home too far below other recent sales, we will likely have an offer or two, but we can't necessarily count on enough offers with escalation clauses to increase your "too low" list price up to the "just right" market value. JUST RIGHT... If an identical home sold a month ago for $325K, we should likely consider a list price of $319K, $325K or $329K. Not too high. Not too low. Just right. Disclaimer: I'm oversimplifying here. :-) Rarely is there an "identical" house that sold in the past month to provide such a straight forward guidance on pricing. But, despite my oversimplification, hopefully the general sentiment of my guidance is clear enough. ;-) | |

How Quickly Will We Plan To Respond To An Offer On My House? |

|

When we receive an offer, how quickly will we plan to respond to that offer? Well, as is often the answer... it depends... We will certainly look at the acceptance deadline on that offer to see when the buyer hopes we will respond... but we might not always respond within that timeframe. Here are a few of the guidelines that will likely inform our response timeline... [1] If the offer is an extremely strong offer with very favorable terms, we will likely respond sooner rather than later. [2] If the offer is OK or good, but not great, we will likely wait until nearly the end of that response timeframe, or possibly even later. [3] If we already have feedback from every other buyer who has viewed the home and none of them plan to make an offer, we will likely respond sooner rather than later. [4] If there were a half dozen showings today and we're still waiting to hear back as to if those buyers will be making offers, we will likely wait a bit to respond to the offer. [5] If we have no other showings scheduled or requested, we will likely respond sooner rather than later. [6] If we have a dozen more showings scheduled and requests coming in beyond that, we will likely wait a bit to respond to the offer. So... as you can see, there isn't one set answer to how quickly we respond to any given offer. It will depend on the context for that offer as informed by the factors noted above, and other factors as well. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings