| Newer Posts | Older Posts |

An Absence Of Competing Listings In A Broad Price Range Does Not Mean You Can (Or Should) Round Your List Price Up To The Top Of That Range |

|

Most (all?) home sellers want to sell their homes for as high of a price as is possible. Makes sense. Why wouldn't you want the best possible price for your home? Pricing in a low inventory can lead to some interesting questions... If we look at recent sales that are comparable to your home, and we see a sale for $395K, $400K and $405K... we might conclude that your home is worth right around $400K in the current market. Different sellers then might choose different pricing strategies:

But what if, as you are choosing a price for your home, and you see these list prices of homes in your school district...

It might be a bit tempting, for some sellers, to then round up from that intended $400K target sales price all the way up to $449K or $450K. After all, if someone wants to buy in that school district, and they're going to pay $400K or more, they don't have any options until they get up to $455K. So, why not just price a bit under that competing house? Well, maybe you can already tell from the information laid out above, but buyers will likely look at your $449,500 price and think... [1] This house seems a lot more similar to those other homes that recently sold for $400,000. [2] This house is a good bit smaller than the competing $455,000 listing. [3] I don't think $449,500 is a reasonable price for this house. [4] It's hard to imagine negotiating a $449,500 house down to $400K or even $410K, so I won't make an offer. | |

The First Buyer To Make An Offer Will Likely Not Include An Escalation Clause, At Least Not At First |

|

Yes indeed, we're still in a market where we often see multiple offers on new listings... and when there are multiple offers, we are likely to see some escalation clauses. If you are selling one of these popular new listings, should you expect that the first offer you receive will have an escalation clause? Probably not. Here's why... An offer only needs an escalation clause if it is in competition with another offer... and thus, if a buyer is making the first offer, the escalation clause is not needed. For example, if a house is listed for $325K, an interested buyer might offer $325K - but they are unlikely to offer $325K with an escalation clause going up to $350K. Why not include the escalation clause up front? If the first offer a seller receives includes an escalation clause, they are almost certainly going to be motivated to... wait for other offers. If your home is listed for $325K, and you have eight showings lined up, and the first buyer to see the house makes an offer of $325K that escalates to $350K -- you'll want to wait to see if you have any other offers, hopefully above $325K, that would cause that escalation clause to kick in. Now, certainly, that first buyer will want the opportunity to consider adding an escalation clause if or when there is a second offer with which they are competing. Thus, they may ask to be notified if any other offers are received -- and it would make sense for a seller to give them a heads up if or when a second offer is received. So... BUYERS: You likely don't need to have an escalation clause in your offer if you are the first buyer to make an offer -- but you should be ready to adjust your offer (to add one) very quickly if/when you hear that there is a second offer. SELLERS: Don't be surprised if the first offer you receive does not include an escalation clause. Likewise, don't be surprised if those buyers add an escalation clause once a second offer exists. | |

Home Sellers Will Not Voluntarily Sell Their Homes For Lower Prices Because Of Higher Interest Rates Unless Competition Forces Them To Do So |

|

Quite a headline, I know. All for something that isn't actually happening in the local market. Here it is again... Home Sellers Will Not Voluntarily Sell Their Homes For Lower Prices Because Of Higher Interest Rates Unless Competition Forces Them To Do So Looking back a bit... Mortgage interest rates declined from 5% to 3% between 2018 and 2020 and then remained around 3% until early 2022. Median sales prices rose from $212K to $300K between 2018 and 2022. When mortgage interest rates started rising (quickly) in early 2022, many thought or said... Home prices rose so quickly between 2018 and 2022 (+41%) because mortgage interest rates were so low. ... and ... Now that mortgage interest rates are rising, home prices are destined to decline. We're now more than a year past the rising / higher mortgage interest rates and what can we now conclude? [1] It is quite possible that the rapid rise in sales prices between 2018 and 2022 was partially fueled by super low mortgage interest rates. That wasn't the only thing that caused home prices to increase, but it definitely kept sales moving briskly and prices rising quickly. [2] Despite mortgage interest rates rising from 3% to 6% in a year's time, home prices have not declined in the local real estate market. Which is what causes me to conclude that... Home Sellers Will Not Voluntarily Sell Their Homes For Lower Prices Because Of Higher Interest Rates Unless Competition Forces Them To Do So Certainly, if higher mortgage interest rates slowed down home buyer activity AND if inventory levels started to rise... then we might see home prices start to flatten out or decline as sellers competed with other sellers to attract buyers. But now that we're more than a year into having mortgage interest rates higher than 5% (and eight months into having rates higher than 6%) I think it's safe to say that rising mortgage interest rates have not caused home prices to decline in our local market. | |

Homes Are Still Selling Quickly, So You Should Know (Or Think About) Where You Are Going Next Before You List Your Home For Sale |

|

Perhaps you are one of the many homeowners living in homes in Harrisonburg and Rockingham County who has lived in their home for 20+ years but are now ready for a change. [1] You might be downsizing because you don't need as much space now that the kids are grown and gone. [2] You might be downsizing to a home that offers one level living. [3] You might be looking for a home with fewer ongoing maintenance needs such as lawn care, gardening, etc. [4] You might be relocating to another part of the country where your kids (and grand kids) now live. [5] You might be moving into a retirement community. Regardless of the generalities of the "where" -- we should pause to think about the specifics of the where before we put your house on the market. If you know you want to do one of the things listed above, let's think through or look into the details of what it will take to buy and move into such a "next place" after you sell your home. We shouldn't just put your house on the market for sale and figure out where you'll live next while we wait a few months for your house to sell -- because -- it is not likely that it will take a few months for your house to sell! Homes are still selling quickly, and thus, you should know (or think about) where you are going next before you list your home for sale. I'm happy to help you think through, research and strategize on these items - just let me know if or how I can be of help. | |

Are You Ready To Sell Your Rental Property? |

|

If you own a rental property, you might wonder from time to time whether you should keep or sell that property. I generally advise my clients to keep their rental properties, and not to sell them unless there is a good reason to do so. Here are some of those good reasons... VALUE - If the value of your rental property is currently high, and there is a reasonable chance that it won't be quite as high in the coming years, then now could be a good time to sell the rental property. INVENTORY - If there are very few competing properties for sale right now (which would lead to a speedy sale) but there will be many, many new properties built in the near future (which could result in a slow sale) then it might make sense to sell the rental property now vs. later. EQUITY - If you have owned the property for a decent period of time you may have a good bit of equity tied up in the property - and perhaps you'd like to do something else with that money. Maybe you'll use the sale proceeds for another investment (real estate or otherwise) or to pay off some debt, make a large purchase, go on a trip, who knows, but sometimes selling a rental property is a key part of freeing up some cash to make some other financial moves. HASSLE - Maybe you are tired of dealing with owning a rental property. Regardless of whether you manage the property yourself, or have a professional property manager, there can still be some annoying details to attend to with property maintenance, uncooperative tenants, etc. MAINTENANCE - Perhaps your rental property is 20 years old and you're pretty sure that if you keep it for another 3 - 5 years you'll have to pay for a new roof, new heating system and new water heater. If so, it might make sense to sell the property now to avoid those major capital expenses. TENANTS - If most of the prospective buyers for your rental property will be owner occupants, then the time between tenants might be the perfect time to sell your rental property. PARTNERS - If you purchased the rental property with a friend or family member, and they would like to move their investment dollars elsewhere, then it might be a good time to sell the property. RENTAL RATES - If rental rates are starting to decline, changing the performance of your investment, it might make sense to go ahead and sell, unless you see a turn around happening in the near future. IMPROVEMENTS - Perhaps your most recent tenant absolutely trashed the property, and you have just completely renovated it, such that the property has never looked better. This could be an ideal time to sell before the condition starts to deteriorate again. | |

Should We Let Buyers View Your Home Before It Hits The Market? |

|

Q: Should we let a buyer (or two or three) look at your house before it is listed for sale? A: Usually... no... though it depends on your goals. Despite higher mortgage interest rates, there are still lots of buyers in the market (more than there are sellers) and thus we still have a shortage of houses available for sale in many/most price ranges in Harrisonburg and Rockingham County. This shortage of housing inventory means that there will still probably be a good bit of buyer interest in your home when it is listed for sale. During the first week that your house is listed for sale there are likely to be quite a few showings - many with buyers who have been searching for a home for months and have not been successful in buying a home because of competition from other buyers. Here's why this early, steady flow of eager buyers is great for you as a seller...

All of this happens, though, because your house is simultaneously available to all local buyers and thus they feel the pressure of competing with other potential buyers. When a seller is preparing their home for sale, they will sometimes hear through a neighbor or co-worker that there is someone interested in their home that would like to come view it before it hits the market. Should you allow for that? In most cases, in my opinion, probably not. Letting a buyer (or buyers) view your home before it is officially on the market might result in that buyer making an offer before your house is on the market, thus not giving you the opportunity to see how much other interest existed. One buyer making an offer without other buyers possibly coming in with their offers simultaneously almost always leads to offer terms that are not as favorable to you. Why would the only buyer to have seen your house (because it is not yet listed for sale) include an escalation clause in their offer? Why would they waive a home inspection? They wouldn't. It's the competition from other buyers that causes them to do so. So, as exciting as it is to hear that someone is interested in your house even before it is listed for sale -- you are almost always going to sell your house with more favorable terms if you list it for sale and expose it to the broadest possible pool of buyers currently in the market to buy. The main exceptions I can think of are...

So -- if you're getting ready to sell, and you hear from a buyer that they are interested in viewing the house before you list it for sale -- considering telling them "I'm so sorry, but I want to wait until the house is on the market..." and letting them know the date that you anticipate that it will be hitting the market. | |

Building Your Lists Of Definitely Yes, Definitely No, Maybe When Preparing Your Home To Sell |

|

Walking around and through your house together can be help us build three lists related to preparing your house to go on the market... [1] Definitely Yes [2] Definitely No [3] Maybe The first two lists are usually the easiest to compile. There are usually some things that you should DEFINITELY do to prepare your home for the market and some things that you DEFINITELY don't need to do to prepare your home for the market. Then, there are usually a variety of items that go on the maybe list. What you end up doing from the "maybe list" will likely depend on... [1] Your time frame for getting the house on the market. [2] The resources you have available (time, know how, money) to get the jobs done before your house goes on the market. [3] The amount of buyer demand in your segment of the market. If you are looking to get your home on the market quickly and you don't have the time, know how or money to get things on the "maybe list" completed and there is an abundance of buyer demand in your segment of the market... then maybe you don't address very many of the items on the maybe list. If you plan to get your home on the market sometime in the next few months, and you have the time, know how and/or money to get things completed and there aren't as many buyers looking to buy in your corner of the market... then you probably should address most of the items on the maybe list. This all starts with walking around and through your home and having a conversation about all of the above. If you're looking to sell your home this summer, the best time to have this conversation would be now or soon. | |

Different Segments Of Our Local Market Are Performing Differently. This Is Normal. |

|

Over the past few years almost every house, in any location, at any price point, would have double digit showings and multiple offers and would likely sell over the asking price. This is still happening (10+ showings, multiple offer, selling over list price) for many new listings... but not all. Plenty of other new listings are having 1 - 5 showings, receiving only one offer, and selling at the list price. Which houses have tons of interest and which have less interest can be related to all sorts of things these days... [1] property type [2] property location [3] price range [4] appropriateness of pricing [5] age and condition [6] marketing Is it normal for different segments of our local market to be performing... differently? Yes, it is quite normal. As always, this means that the pricing, preparations of your home, and marketing of your home are very important as we see different segments of the local market in flux. | |

In The Real Estate World, It Is Almost Time For Kids To Go Back To School |

|

Yes, I know, I know, the school year hasn't even ended yet. So why am I already thinking about when school aged kids are going to be going BACK to school in the Fall!?! Well, because buying a home is not an overnight process. Neither is moving into a home. If you are planning to sell your home in the next six months -- and you think some of the buyers who might have interest in your home would have school aged kids -- consider this... June 1, 2023 - we put your house on the market June 10, 2023 - we have the house under contract (could be faster, could be slower) July 31, 2023 - closing on your house (typically 45 - 60 days) Mid/Late August - school starts So, as you can see, if a buyer is going to buy your home -- and move in before the next school year starts -- they need your house to be on the market soon! | |

The Probability Of Selling Your Home Is Still Hovering Around 99 to 100 Percent |

|

Will I be able to sell my home? Almost certainly, YES! For the past few years, the probability of selling one's home (just about any home!) has been extraordinarily high. Will it sell? Yes, almost certainly. Now, of course... this has to fit within the context of pricing, preparation/condition, and marketing... but most homes sold. This has not always been the case. Five or more years ago there wasn't a guarantee that every home would sell... though I suppose some would argue that at SOME price EVERY home would sell. That said... right now, we are still very much in a time when it is extremely probable, highly likely, nearly certain... that your home will sell. So if we don't have to wonder WHETHER your house WILL sell, these then are the questions we'll be focused on... 1. How should I price my home? 2. What do I need to prepare my home for the market? 3. How should my home be marketed? We may very well get back to a (normal!) time again when it is not as certain that every house will sell (quickly and at a favorable price) but until/unless we get there... home sellers can keep on enjoying this strong seller's market. | |

Run The Numbers On Selling And Then Buying A Home |

|

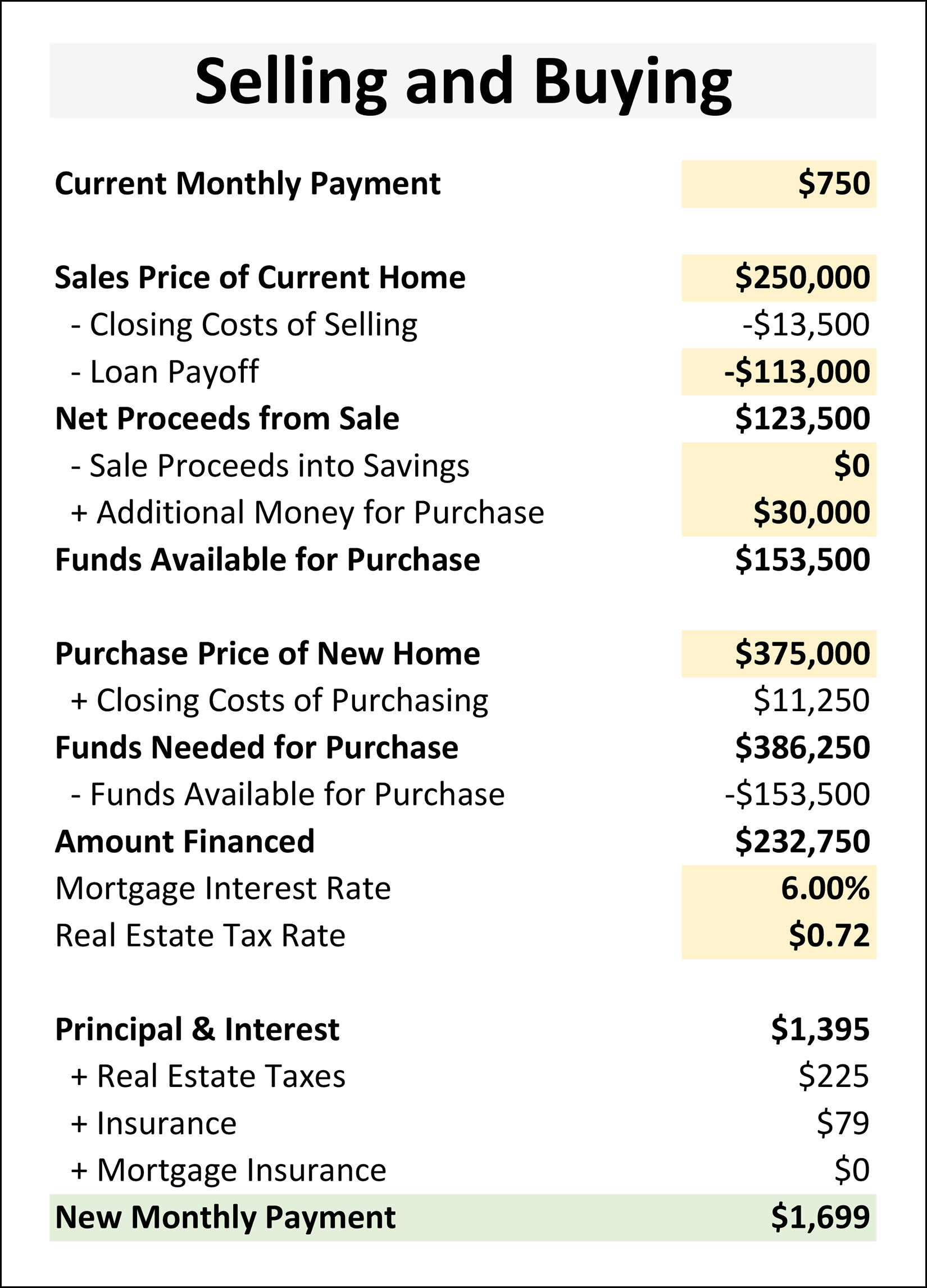

If you will be selling your home to buy another, there are a lot of numbers floating around....

Above you will see a spreadsheet I put together to help you think about some of these numbers as you are evaluating if and when you will make a move to a new house. In yellow, are all of the inputs you will need to provide, or that you and I can determine together, such as your current payment, your home's current value, your mortgage payoff, whether you will be putting any additional money into the transaction, etc. In green, I have identified your potential future mortgage payment and the net change in your monthly payment. All of the numbers without a background color will automatically calculate for you. Click here to download this worksheet as an editable Excel file. | |

No, You Do Not Need To Round Your List Price Up To Give Yourself Room To Negotiate |

|

Let's say that after we review the market analysis of your home together we decide your home is likely worth $550,000 in the current market. Being a reasonable home seller you decide you would like to try to sell your house to someone for $550,000. Seems like a solid plan. So, which is the correct list price? a) $575,000 b) $565,000 c) $549,000 or $550,000 d) $525,000 The answer is... C. I think the answer is always C!? In the current market (in most price ranges, in most locations, with most houses) you don't generally need to round your list price up to give yourself room to negotiate with a buyer. Buyers in today's market will come see your house if it is for $565K or $575K, but they likely won't make an offer. Thus, if you believe your home is worth $550K, and you hope to sell for $550K... in many cases, the best list price will be $550K... or maybe $549K. Clearly, this can't be one size fits all for all properties, in all price ranges, locations, etc.-- but the point I'm driving at here is important -- you shouldn't feel the need to round up your list price (in the current market) in order to get the price you really hope to have a buyer pay for your home. | |

Higher Mortgage Interest Rates Are Making Would Be Home Buyers More Thoughtful About Offers |

|

Back when mortgage interest rates were 3% - 3.5%... 10:00 AM - new listing hits the market 10:10 AM - drive by 10:11 AM - text Realtor to set up showing 1:30 PM - walk through the house 1:55 PM - get kicked out by the next buyer in line to see it 2:30 PM - make an offer on the house (90% chance you'll make one) Home buyers didn't have to think very hard at all about whether to make an offer on a house they liked because their mortgage payment would be pretty darn low given historically low mortgage interest rates at the time. Now a days, with mortgage interest rates of 6% - 6.5%... 10:00 AM - new listing hits the market 12:15 PM - drive by 12:30 PM - text Realtor to set up showing (next day) 10:00 AM - walk through the house 4:00 PM - talk through the mortgage payment details with lender (next day) 9:00 AM - make an offer on the house (33% chance you'll make one) Buying a $350K house (for example) is a big decision! Buying a $350K house can seem like a smaller decision with 3.5% mortgage interest rates. It's only a $1600/month mortgage payment given a 20% down payment. Buying a $350K house can seem like a really big decision with 6.5% mortgage interest rates. It's a $2,115/month mortgage payment given a 20% down payment. As noted in the comparison above, buyers are still making decisions relatively quickly -- but they're thinking things through a bit further -- and they're not always choosing to make an offer. These higher mortgage interest rates do impact the market, even though they haven't caused home prices to drop in Harrisonburg and Rockingham County. | |

Home Sellers Still Are Not, For The Most Part, Accepting Home Sale Contingencies |

|

As we make our way through the spring real estate market, plenty of folks are getting geared up to buy a home. Some of those would-be home buyers also need to sell their current home. No worries, right? We can just make an offer to buy contingent on you selling your home. Right? Right??? Maybe not. There still seem to be MANY, MANY more buyers in the market to buy than there are homes available for them to purchase. As such, home sellers are not, for the most part, accepting home sale contingencies. An offer with a home sale contingency technically means the seller has their house under contract -- but does it really matter? The sale won't head to closing unless some other house (your house) also goes under contract. If you are selling a home this year, I am likely going to tell you that you won't have to accept an offer with a home sale contingency. If you are buying a home, the same logic applies, a seller is unlikely to have to accept an offer with a home sale contingency. Case in point... there are 266 houses under contract right now in Harrisonburg and Rockingham County in the HRAR MLS. Of those...

* These are houses marked as "Pending" in the MLS ** These are houses marked as "Active with Kickout" in the MLS So... if you're looking to buy, and you need to sell, we need to talk through the logistics of how you can accomplish that in this competitive market where most other buyers are likely making offers on houses without home sale contingencies. | |

Homes Are Selling Quickly, Often At Or Above The Asking Price, But... |

|

Homes are selling quickly... often at or above the asking price... but... ...that doesn't mean you can put any price on your home and successfully sell quickly and at or above the list price. -- Let's say you own a townhouse and you are getting ready to sell it. Three other townhouses on your street sold for $250K in the past two months. If you list your home for $250K or $255K (or possibly even $259K) you'll likely find early success in securing a buyer for your home at or above the list price. If you list your home for $275K you are much less likely to quickly secure a contract with a buyer at or above your list price. If you list your home for $299K you are very (very) unlikely to quickly secure a contract with a buyer at or above your list price. -- If you own a home that you think might be worth $450K and we discover that other recent buyers have paid $460K and $470K for similar homes... great! A list price of $459K or $465K or $470K will likely result in an early, strong offer. A list price of $489K is much less likely to result in an early, strong offer. A list price of $510K probably won't get you very far at all. -- So, yes, many or even most buyers are paying very close to the list price -- the list price -- or above the list price -- BUT that's because most home sellers price their homes appropriately for the market. | |

Start Monitoring Listings And Sales In Your Market Segment A Few Months Before Selling Your Home |

|

Will you be selling a home in the ___ neighborhood later this spring or summer? Will you be selling your home in the low $_00's later this spring or summer? If you plan to sell soon (but not quite yet) it can serve you well to start monitoring listings and sales in your market segment now. Watch for the next few listings in your neighborhood, or price range, to hit the market for sale... 1. What does the list price tell you about the value of your home? 2. How quickly does the new listing go under contract? Then, watch for closed home sales in your neighborhood, or price range... 3. What does the sales price tell you about the value of your home? If you'll be selling soon, starting to tune in and watch the most recent happenings in your segment of the market can help you make even better decisions about pricing and selling your home when the time comes. | |

Home Sellers Often Sell Homes Perfect For First Time Buyers... To Investors |

|

Over the past few years, townhouses in or near the City of Harrisonburg between $175K and $250K have been a hot commodity! This type of property is perfect for first time home buyers... ...but... ...this type of property has also been quite attractive to investors. And, what is a seller to do when receiving the following three offers on their townhouse... [1] An offer from an intended owner occupant contingent on the buyer financing 95% of the purchase price. [2] An offer from an investor contingent on the buyer financing 75% of the purchase price. [3] A cash offer from an investor. If all other terms (price, contingencies) were equal, most sellers would find the third offer to be most preferable, followed by the second offer. The first offer would be the least favorable to most sellers. For many or most sellers, the amount of a buyer's downpayment (5%, 25%, 100%, etc.) is often a proxy for certainty of successfully making it to closing. If a buyer already has the cash to buy the property - wonderful! If a buyer has 25% of the purchase price as a downpayment - still pretty good! If a buyer only has 5% of the purchase price as a downpayment - not as ideal. And as you can imagine from the information outlined above, so long as there are investors making offers on properties that would be perfect for first time buyers.... the investors will probably be the ones securing the contract to buy said property. So what? For Sellers - This is not a problem at all. Having a variety of offers from which to choose is... ideal! For Investor Buyers - This is great. It's nice having a leg up over some of the other competing buyers. For First Time Buyers - This stinks. I'm renting a townhouse now... and you're telling me I can't manage to buy a townhouse because I'm competing against investor buyers who are going to buy townhouses and then rent them out to people such as myself? Ugh. How do we break the cycle? Indeed... if there were a desire to make this dynamic / situation "work better" for first time buyers... how would it be done? [1] Individual sellers could certainly opt to sell their townhouse to first time buyers with less favorable (less certain) financing. [2] Investors could (maybe?) eventually decide to stop buying as many properties as rental properties if prices (or interest rates) are or become too high to make that type of an investment feasible. [3] The City could provide a financial incentive to sellers of properties under $250K (for example) if they sold them to first time buyers. ;-) It's hard to imagine this one happening but it could be an interesting strategy for the City to utilize to attempt to increase home buying opportunities for first time buyers. | |

One Of The Best Market Indicators Right Now Is How Quickly Houses Similar To Your Home Are Going Under Contract |

|

Are you getting ready to list your home for sale this spring? Are you trying to figure out how to price your home? Step one - as usual - is to look backwards, at past sales, to see how much buyers have paid for houses similar to your home over the past six (or more) months. But another market indicator that we shouldn't overlook is... ...how quickly houses similar to your home are going under contract. FOR EXAMPLE... If we look around at past sales and we find that buyers have recently paid $410K, $415K and $420K for houses similar to your home... ...we might plan to list your home for $415K or $419K or $425K. Let's say we're super optimistic and we're planning to list your home for $425K. But, then, if you're not putting your home on the market for a few weeks, we should carefully monitor similar houses coming on the market for sale. If we see... [1] Three similar houses come on the market for $420K, $425K and $429K, each of which go under contract in a matter of days... then we should be encouraged to stick with our plan of pricing your home at $425K. [2] Three similar houses come on the market for $410K, $412K and $415K, all each of which are still available for sale after being on the market for two weeks... then we might want to consider a list price of $415K or $419K instead of $425K. So, with pricing these days, we need to look backwards at past sales, but we also need to see how quickly buyers are contracting to buy houses similar to your home. Let me know if you're ready to start thinking through potential pricing (and timing) for selling your home this spring. | |

Buyer Demand Exceeds Supply In Varying Degrees By Price Range |

|

As one might expect, there are more buyers able to and interested in buying a home for $200K than for $300K... and more buyers able to and interested in buying a home for $300K than for $400K. You get the picture. As such, we currently find buyer demand exceeding supply in varying degrees by price range. These numbers are completely made up, but are likely not too far off base given recent listings or transactions I have been a party to or have heard about in our local market... SHOWINGS IN WEEK ONE, BY PRICE RANGE:

If you're seeing more showings than outlined above, your house may be slightly more popular than the average house based on its location and condition - or you might have priced it "just right" for the current market. If you're seeing fewer showings than outlined above, your house maybe slightly less popular than the average house based on it's location and condition - or you might have priced it "a bit too high" for the current market. Again, the data above is completely fictional (not based on actual showing data) but is included to paint a general picture of the differing amounts of buyer demand in different price ranges in the current market. | |

Detached Resale Home Sales Decline 39% In Two Years, Down To... Pre Covid Norm |

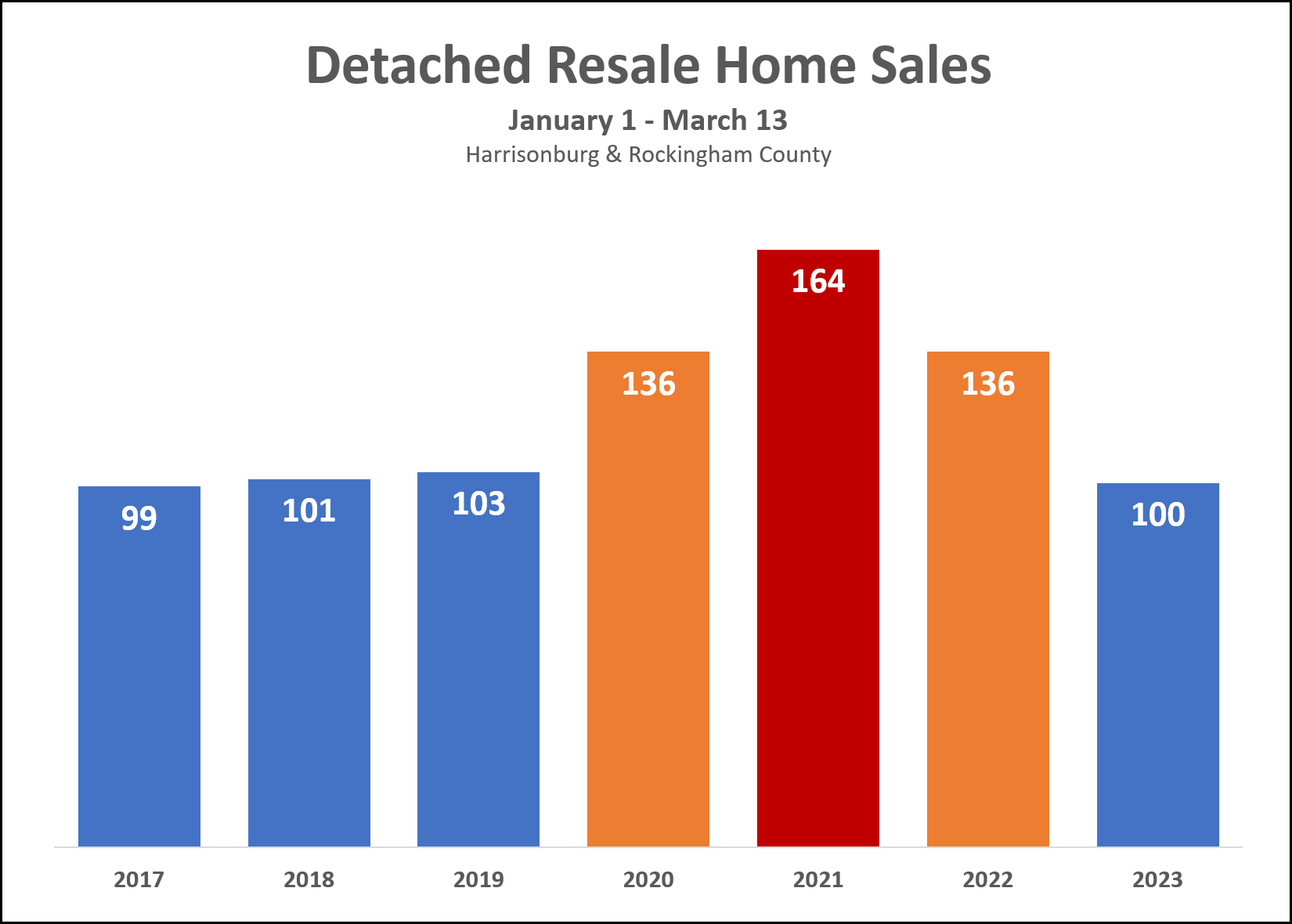

|

First, a definition... Detached Resale Home Sales = not townhouses, not duplexes, not condos, not new homes Now, then, an observation... Detached Resale Home Sales have declined 39% over the past two years when looking at first 2.5 (ish) months of the year. Oops, wait, another observation... Detached Resale Home Sales have dropped all the way down to... pre covid norms. In the three years leading up to Covid (2017, 2018, 2019) we saw home sales between January 1 and March 13 totaling 99, 101 and 103 home sales for each of the above referenced years. But then, the three most recent years showed a very different pace of sales... Jan 1 - Mar 13 of 2020 = 136 sales! Jan 1 - Mar 13 of 2021 = 164 sales! Jan 1 - Mar 13 of 2022 = 136 sales! But, then, back to what seems to have been the pre-Covid norm... Jan 1 - Mar 13 of 2023 = wait for it... 100 sales So, two things seem to be true right now... There are significantly (!!!) fewer detached, resale homes selling right now compared to how many we saw during the same timeframe over the past three years. But, yet, the number of detached, resale homes selling right now is quite normal per the historical trends before Covid started messing with the housing market. Prospective home buyers in 2023 should thus realize that... [1] There will likely be a historically normal number of homes that you could buy this year... if we ignore the three most recent years. [2] There will be far fewer options of homes to buy this year compared to last year and the year before. [3] There may very well be more competition from other buyers for that smaller number of homes that will be available for purchase. As you can see through all of this -- the decline in home sales is very much due to a restrained supply (only so many sellers willing to sell) rather than a restrained demand (only so many buyers wanting to buy). | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings