Taxes

| Older Posts |

Harrisonburg City Council Approves Increase In Real Estate Tax Rate |

|

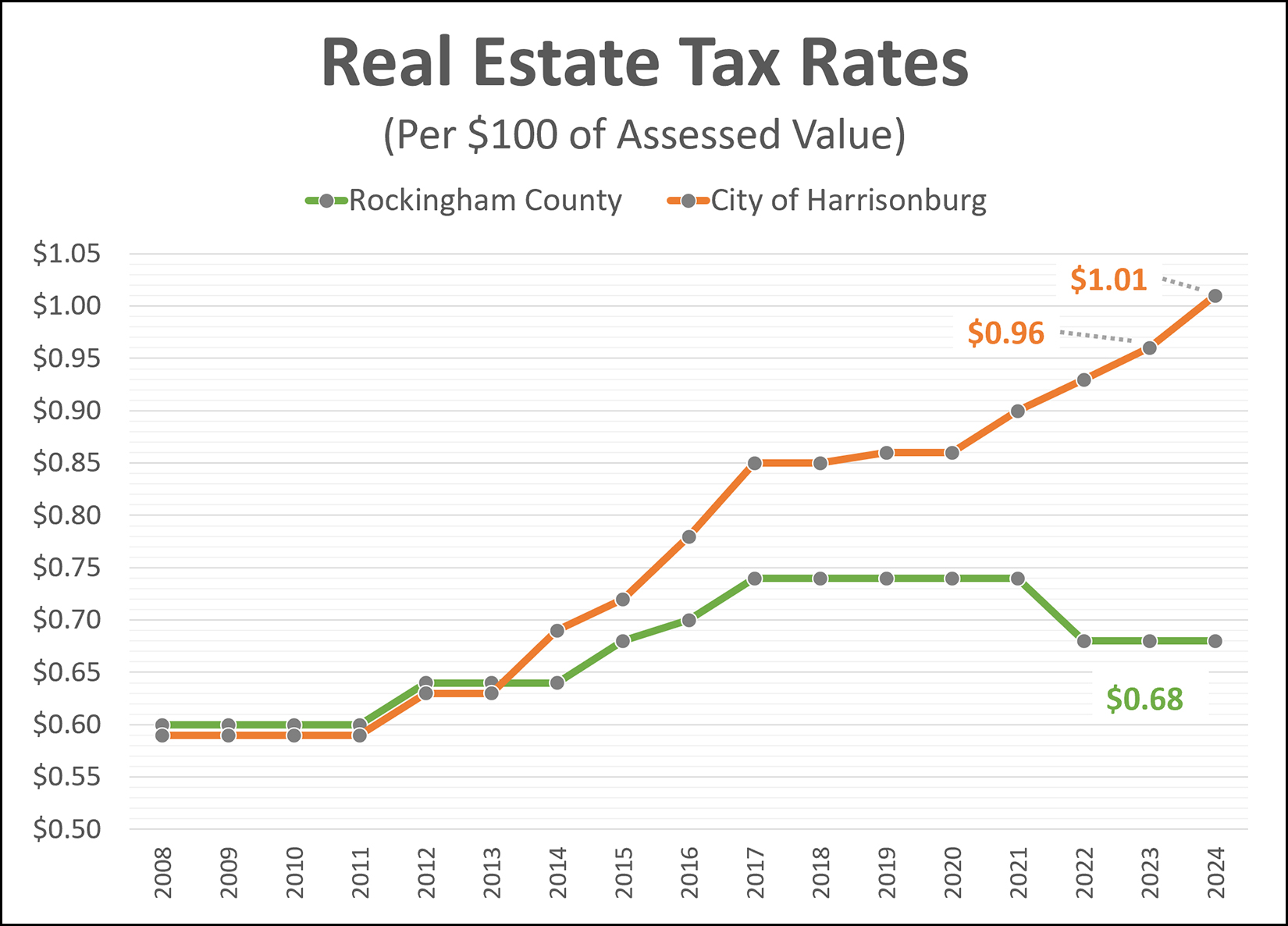

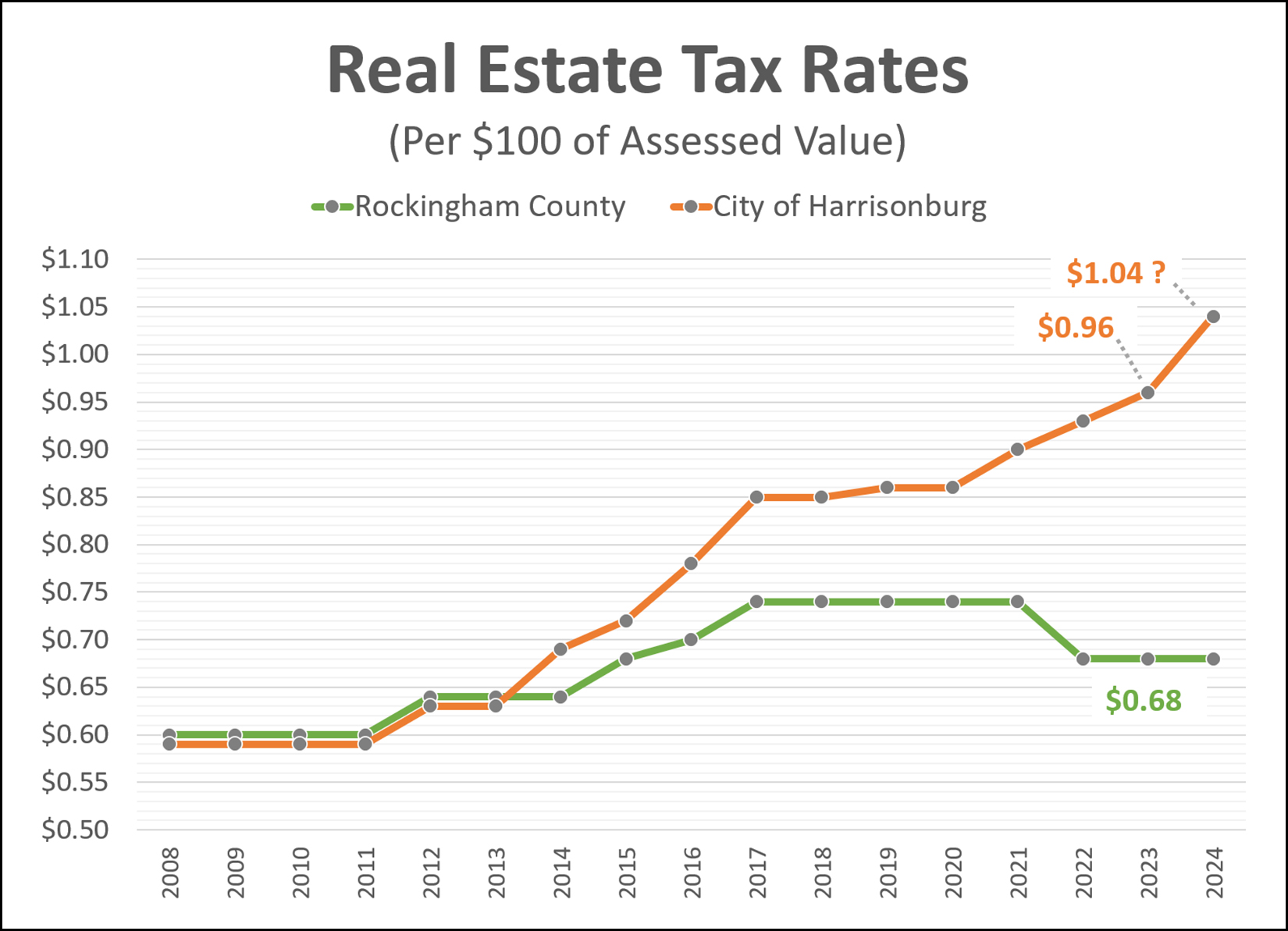

The real estate tax rate in the City of Harrisonburg will be increasing again for the 2024-25 fiscal year... rising $0.05 to $1.01 per $100 of assessed value. This is the fourth year in a row that the City of Harrisonburg has increased the real estate tax rate...

You can read a good bit more about the decision, rationale and citizen comments over at The Citizen... As you likely realize, we have also seen a rather significant increase in home values during the five year period referenced above, which further increases the property tax bill for city property owners. | |

City Of Harrisonburg Considers 8% ($0.08) Increase In Real Estate Tax Rate |

|

The current real estate tax rate in the City of Harrisonburg is $0.96 per $100 of assessed value. That means that if you owned a home assessed at $280,000 (median City sales price over the past 12 months) you would pay $2,688 of real estate taxes each year... or $224 per month. City Council is considering an increase of the real estate tax rate to $1.04 per $100 of assessed value. If this change is approved, your real estate tax bill on your $280,000 home would increase to $2,912 pear year... or $243 per month. Looking at the details and the big picture, both of these statements seem to be true... [1] This $19 increase in monthly real estate taxes is not a huge change. [2] Home values have increased significantly over the past four years and so has the city real estate tax rate. Four years ago the median sales price was $200,000 and the real estate tax rate was $0.86. This cumulative twofold increase has resulted in a significant increase in city real estate taxes. Four years ago ($200K, $0.86) the tax bill would been $1,720/year or $143/month compared to today's tax bill ($280K, $1.04) of $2,912 or $243/month. In whole, over four years, a monthly real estate tax bill may have increased by $100/month. The potential increase in the city tax rate seems to be primary due to the opening of Rocktown High School. From the City's "budget in brief" (link below) we read... "For some time, we have known that the 2024-2025 budget would need to accommodate staffing the soon-to-open Rocktown High School. That effort, in addition to other needs within Harrisonburg City Public Schools, resulted in the school system's ask for an additional budget transfer of $6.6 million, equating to the 8-cent tax increase you will see in this year's budget proposal. Of the $6.6 million increase, $4.2 million is requested specifically for Rocktown High." Read more about the potential upcoming changes in the City real estate tax rate here... Daily News Record: City Council Hears Budget Proposal The Citizen: City leaders mull 8-cent property tax increase to pay for new school's opening, other services | |

Monthly Tax Bills in the City of Harrisonburg and Rockingham County Over Time |

|

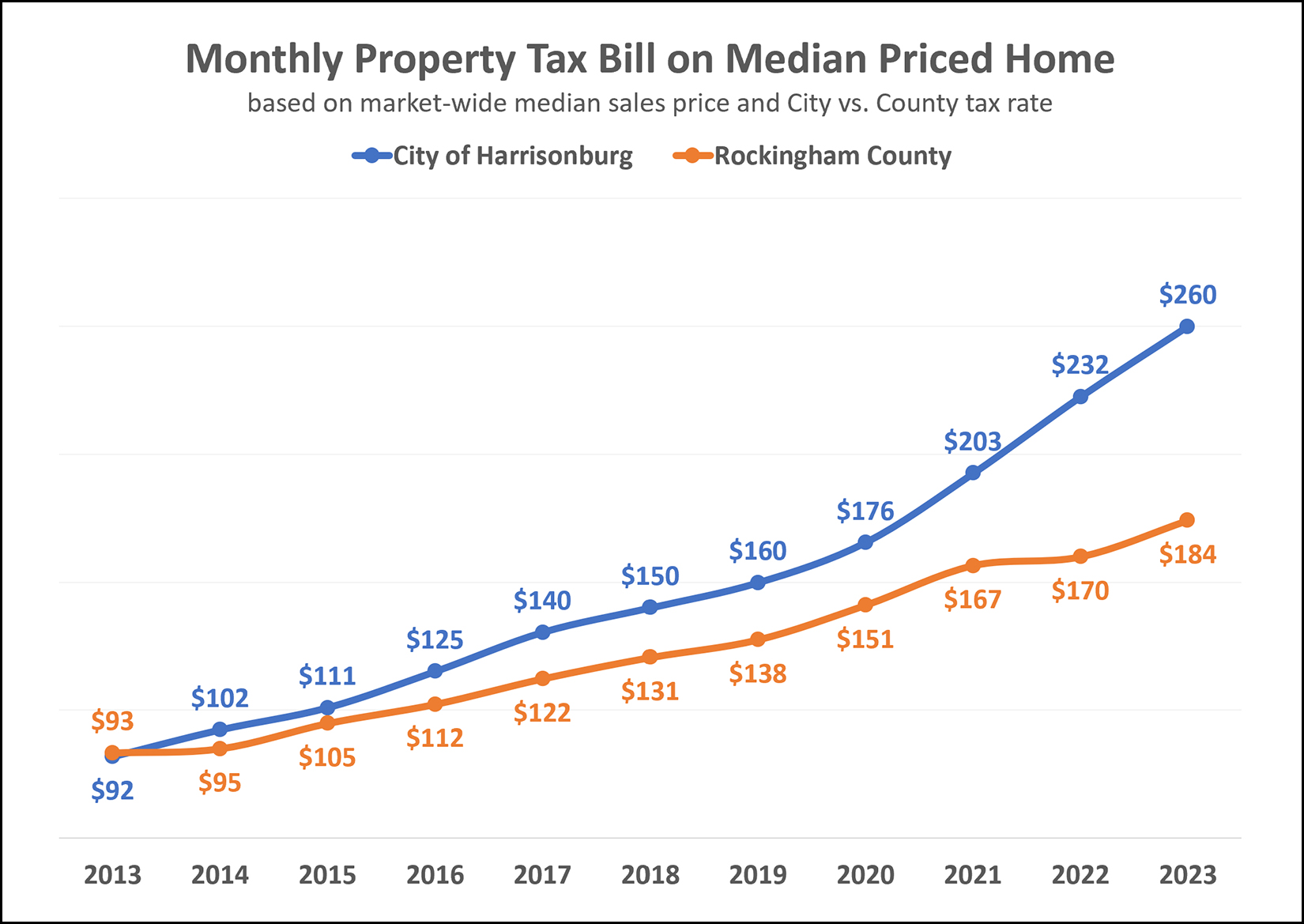

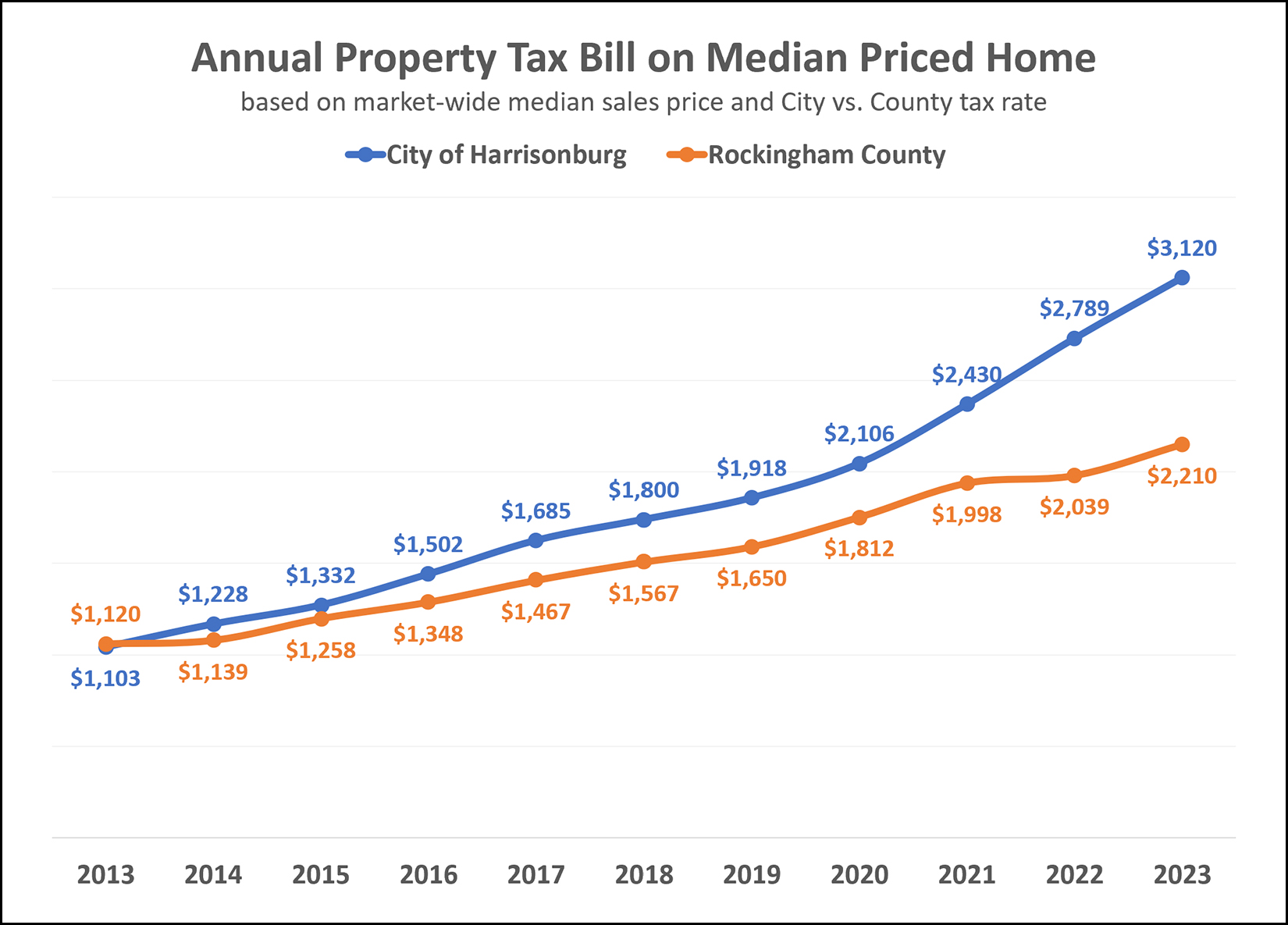

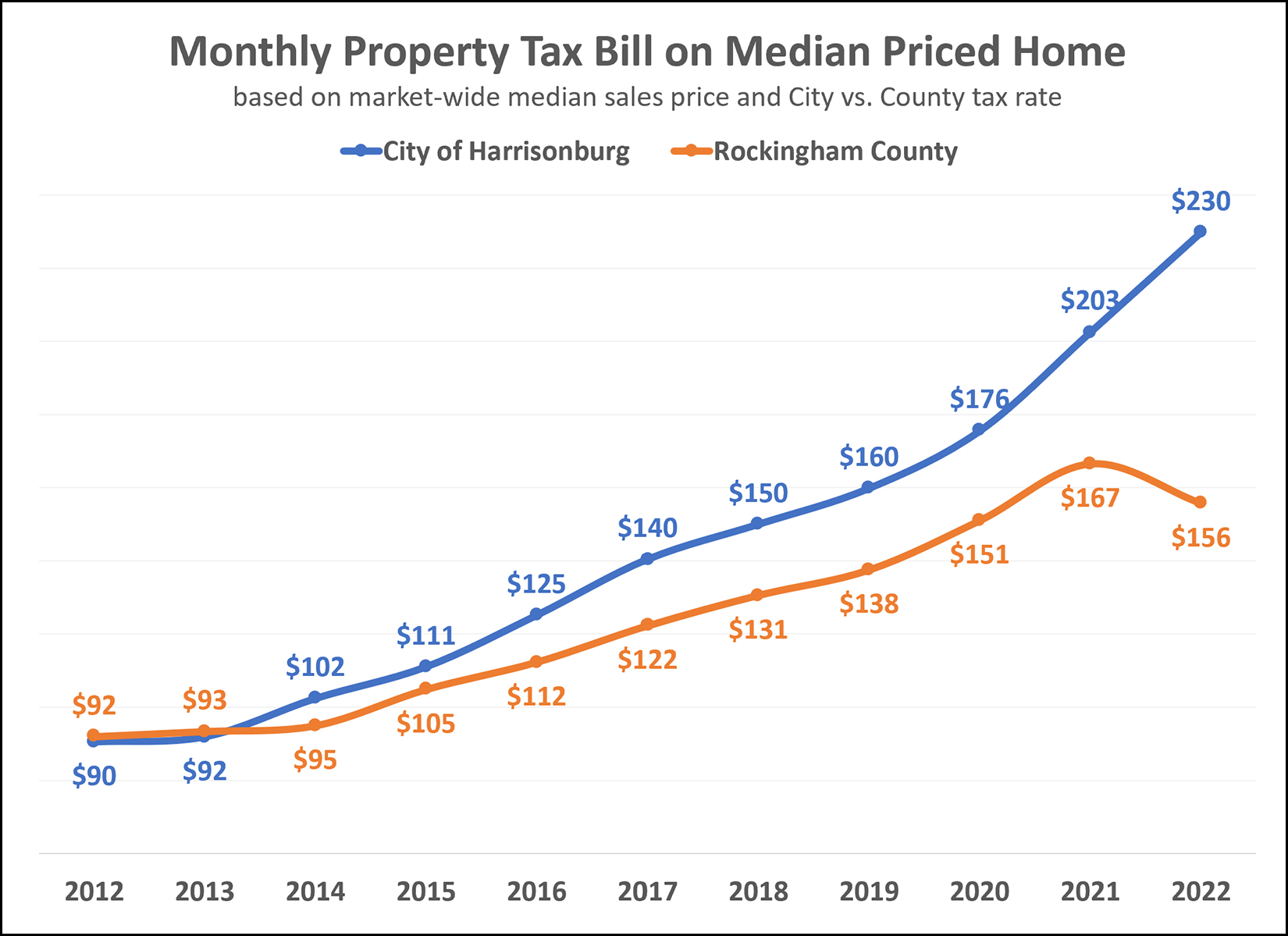

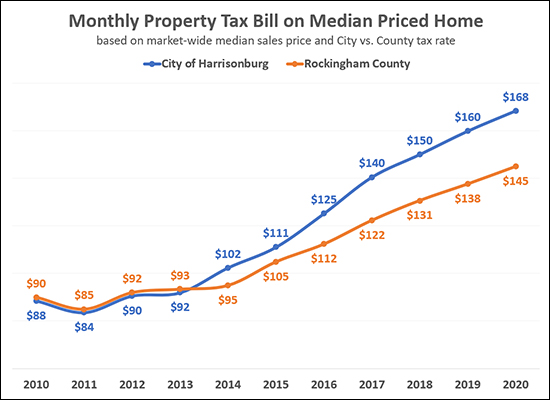

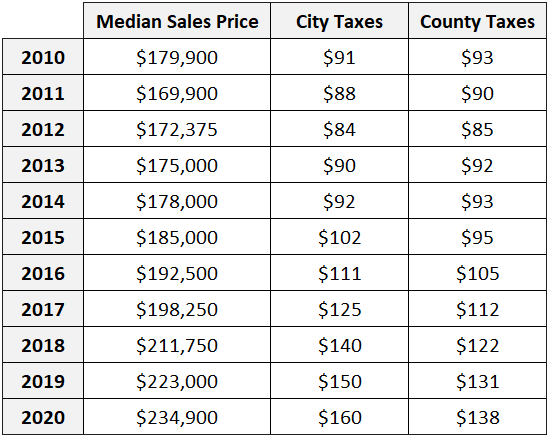

If you're buying a median priced home in our market (Harrisonburg and Rockingham County) you would be spending $325,000. Will you pay more in property taxes if that house is in the City or the County? In most cases, you will pay more property taxes if you live in the City. The analysis above looks at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

Also of note -- this analysis of monthly property tax bills over time does not adjust for inflation. A $260 monthly tax bill in the City of Harrisonburg in 2023 is not the same as a $260 monthly tax bill in 2013 as inflation has been running hot over the past few years. Certainly, one reason why the City tax bill has increased as much as it has over the past few years has been to fund the new high school currently under construction in the City. Will this difference in tax rates in the City and County result in some buyers deciding to buy homes in the County instead of the City? Maybe - but my experience has been that the tax rate is not what causes a home buyer to consider a home in one locality or the other. Multiplying by 12, here's a look at the annual tax bill in the City vs. County for a median priced (market wide) home in our area...  | |

Will A $300K Townhouse Be More Expensive In The City Or The County? |

|

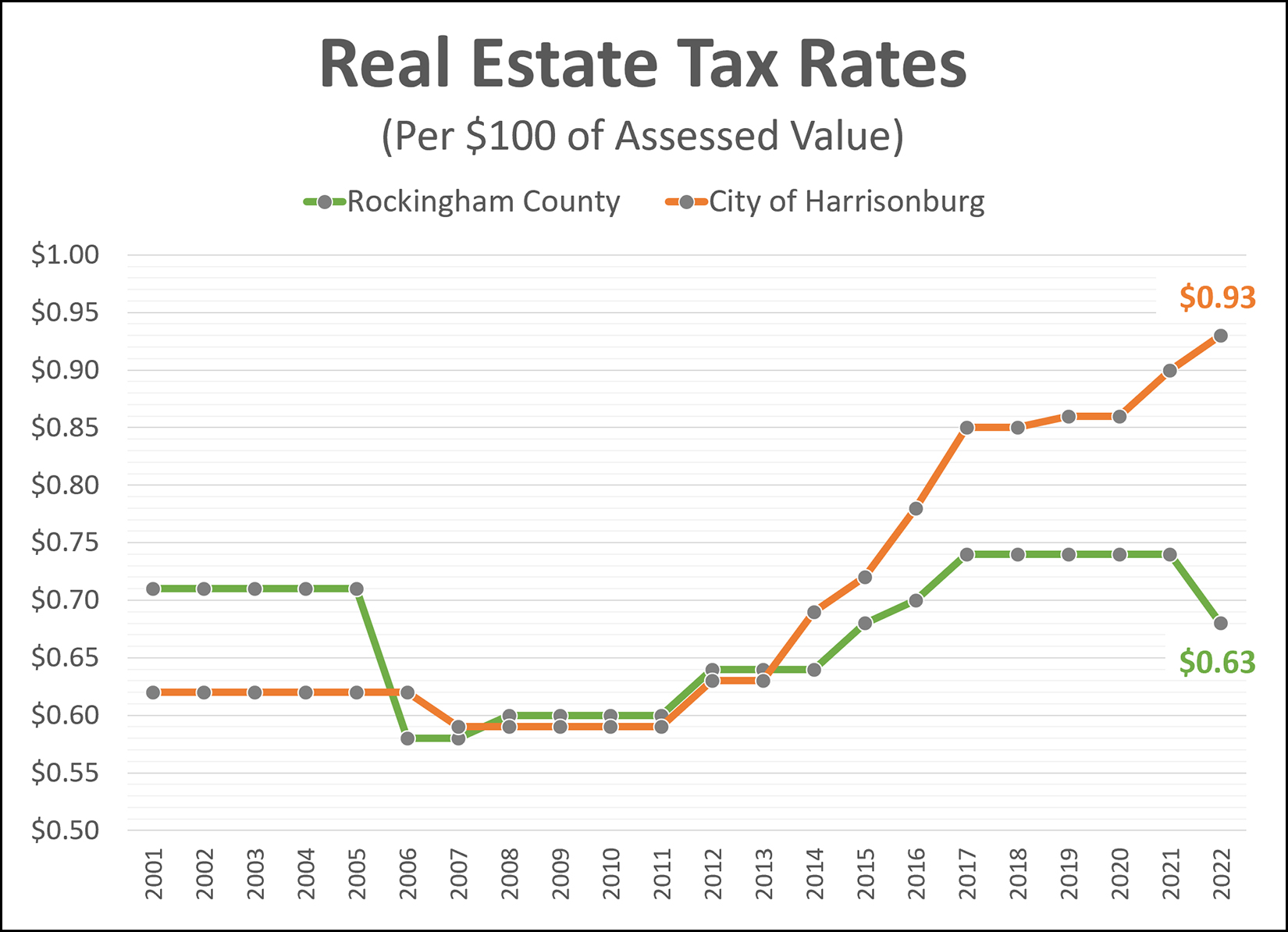

It sounds like a trick question, right? Will A $300K Townhouse Be More Expensive In The City Or The County? Certainly, my monthly payment for a $300K townhouse in the City will be the same as for a $300K townhouse in the County, right? Nope. The difference is the real estate tax rate... City of Harrisonburg = $0.93 per $100 of assessed value Rockingham County = $0.68 per $100 of assessed value As such, here's how the monthly mortgage payments break down if you financed 90% of the purchase price over 30 years with an interest rate of 6.25%... City of Harrisonburg = $1,958 Rockingham County = $1,895 So, they're close... but you'll pay approximately $63 per month more on your $300K City townhouse as compared to a townhouse at the same price point in the County. Or, annually, you'll pay about $750 more to live in the City than in the County. | |

Harrisonburg Considers An Additional Increase In The Real Estate Tax Rate |

|

It's that time of year again... the City of Harrisonburg must decide how much money it can, will or must spend... and where that money will come from. City Council met last week and began to discuss a draft budget for Fiscal Year 2023-2024 presented by City staff. You can read more about the meeting and discussion here. You can view the draft budget here. In summary... the City is planning on a budget of around $362M in FY24, which is about a $27M increase from FY23. Where does all of that money come from? A variety of sources, including these top four funding sources... 34% from real estate taxes 11% from personal property taxes 11% from sales taxes 11% from restaurant food taxes The amount of real estate taxes collected (to fund the budget) depends on... [1] the value of real estate in the City [2] the real estate tax rate The planned budget includes (as shown on the graph above) a $0.03 increase in the real estate tax rate, from $0.93 to $0.96. What impact will this 3% increase in the real estate rate have on owners of real estate in the City of Harrisonburg? The median sales price of homes sold in the City of Harrisonburg over the past year was $255,000. Real estate taxes with a tax rate of $0.93 on this $255K home would cost a homeowner $2,371.50 per year. Real estate taxes with a tax rate of $0.96 on this $255K home would cost a homeowner $2,448.00 per year. So... a $76.50 increase per year... or about $6.38 per month. Two important notes related to these calculations... [1] The $255K figure of the median sales price is not necessarily perfectly aligned with the median tax assessed value of all residential properties in the City. The $255K figure is based on their sales prices... not the assessed values... and just of the homes that have sold... not all homes that exist. [2] The median sales price has increased 12% in the City of Harrisonburg over the past 12 months. This may mean that assessed values will rise when properties are next assessed by the City, which would result in a further actual increase in real estate taxes based on new assessed values. Finally, two other general notes... [1] For anyone wondering what the City spends $362M on in a year, the "Budget in Brief" document found on this page is a very helpful summary of the City budget. [2] From the article on The Citizen linked above (and here)... "This tax increase is a continuation of the city’s plan to raise that tax by 10 cents over three years to pay for the new Rocktown High School, which is expected to cost about $100 million." | |

Comparing Tax Bills in the City of Harrisonburg and Rockingham County Over Time |

|

If you're buying a $300K house, will you pay more in property taxes if that house is in the City or the County? In most cases, you will pay more property taxes if you live in the City. The analysis above looks at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

As shown above, City property taxes have increased by 155% over the past decade while County property taxes have increased by 70% during the same timeframe. | |

Lake Shenandoah Stormwater Control Authority to Construct New Taylor Spring Detention Basin |

|

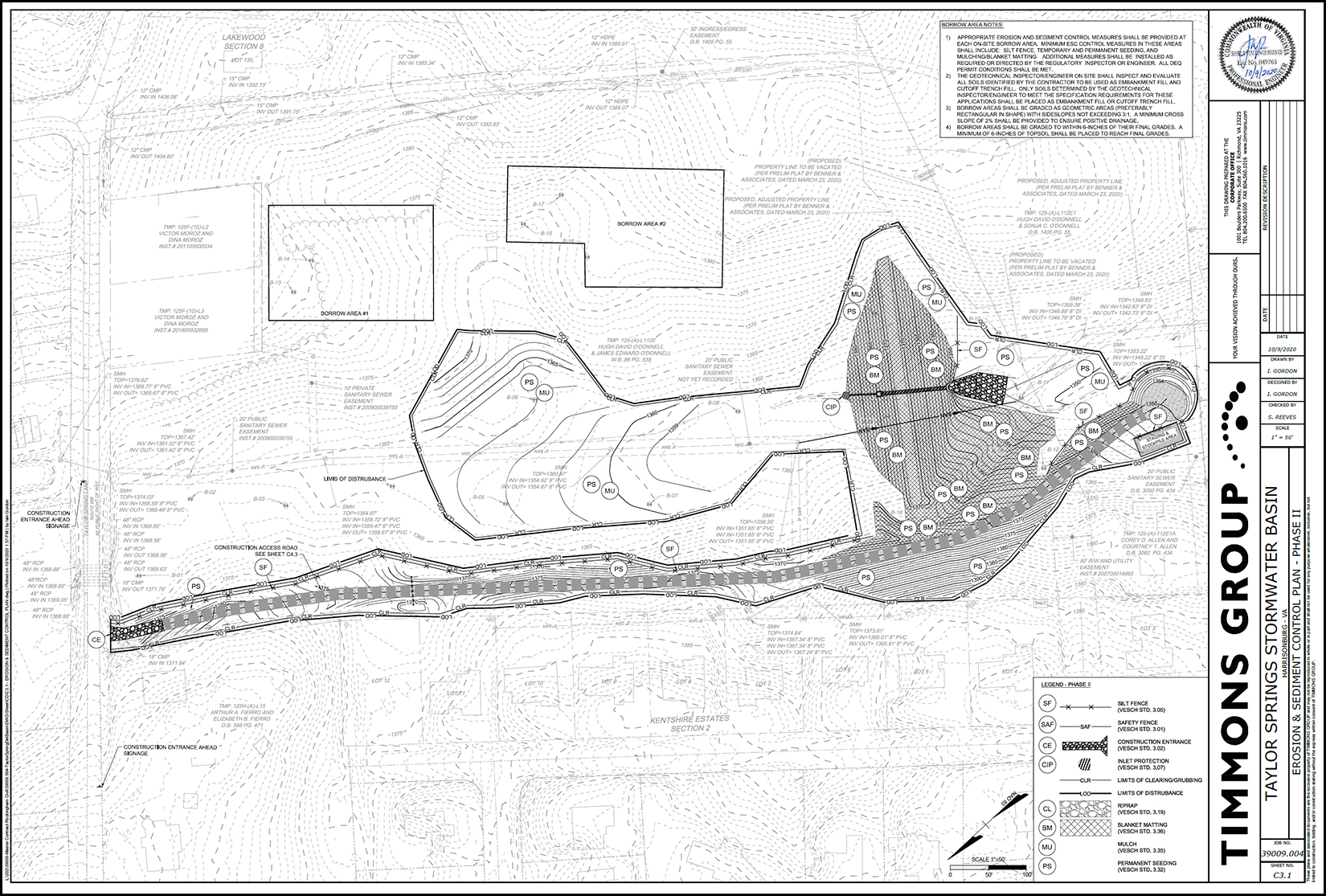

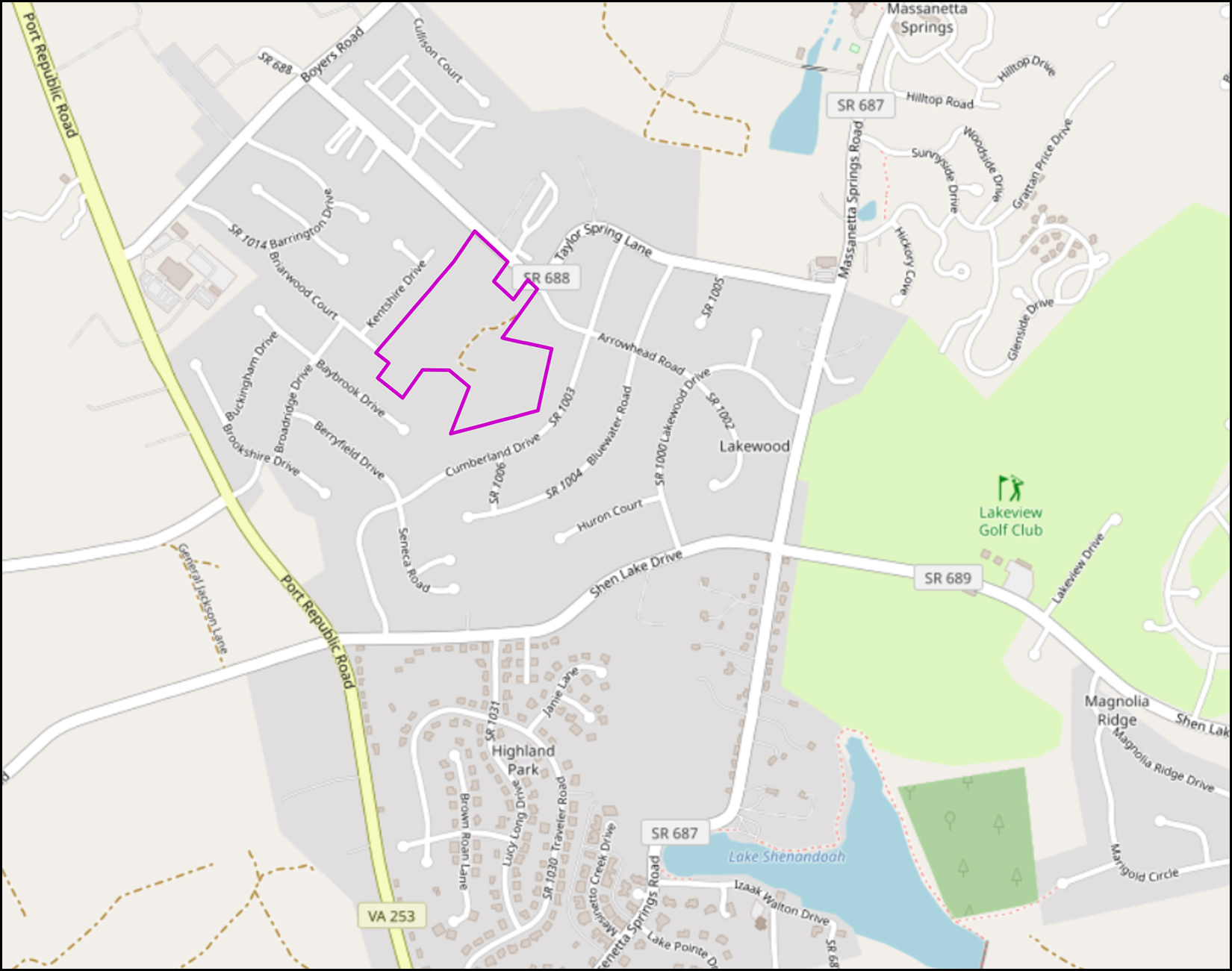

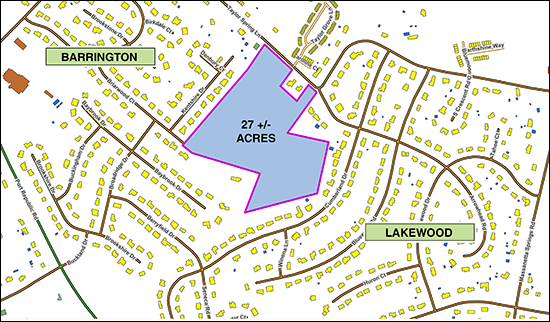

If you live in the Lake Shenandoah Drainage Area you are currently paying an additional tax alongside your real estate tax... with the new tax going to the Lake Shenandoah Stormwater Authority. The tax per property is based on $0.08 per year per square foot of rooftop area and went into effect in December 2020. Also in 2020, Rockingham County purchased a 28.878 acre property within the Lake Shenandoah Drainage Area for use as a stormwater storage area. Now, more details have emerged via an invitation to bid that closes today. Per the government documents, work is to be completed by December 1, 2022. This new stormwater facility will be located on land that is currently undeveloped between Barrington, Kentshire Estates, Lakewood, Taylor Spring and Taylor Grove subdivisions in the area outlined in pink/purple above. View engineering plans for the stormwater facility by clicking the image below... Update 5/26/2022: Rockingham County rejects single bid received | |

Real Estate Tax Rates Moving Up and Down |

|

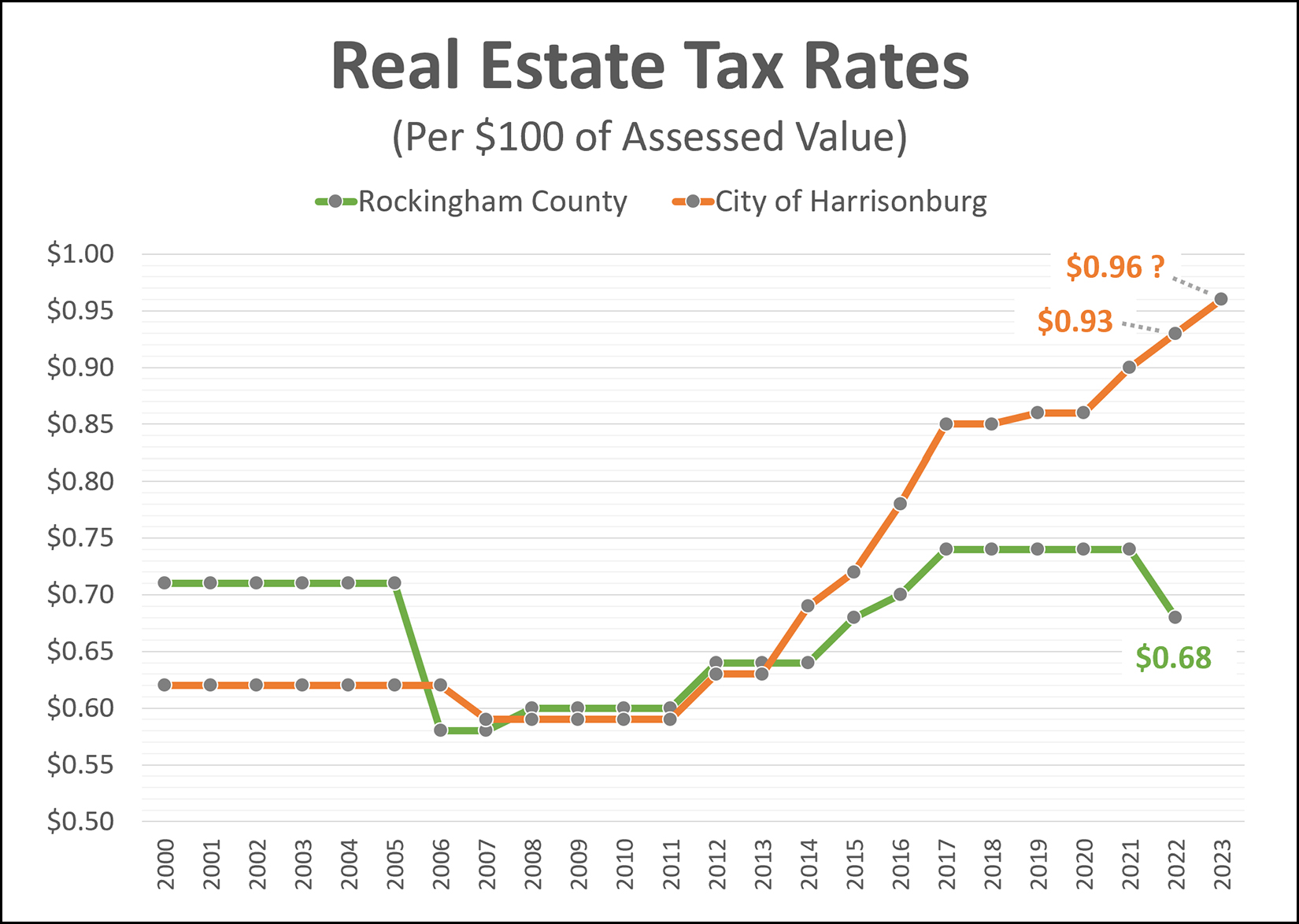

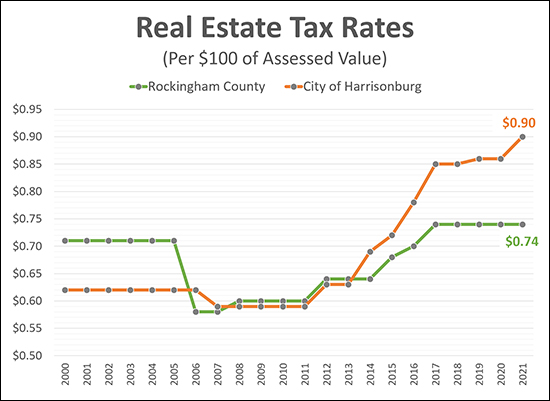

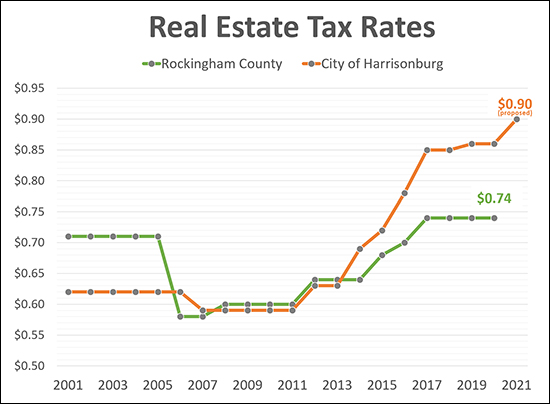

Rockingham County - tax rate down 8% The Rockingham County real estate tax rate is currently $0.74 per $100 of asssessed value, but the Board of Supervisors just approved a reduction in the tax rate to $0.68 per $100 of assessed value. But... that is in the context of recently updated tax assessed value for all properties in Rockingham County, most of which increased significantly because the last reassessment took place four years ago before significant shifts in market values in this area. As a result, most Rockingham County property owners will see an increase in their tax bill despite the reduction in the tax rate. City of Harrisonburg - tax rate up 3% (pending approval) The Harrisonburg City Council will soon consider increasing the tax rate from $0.90 per $100 of assessed value to $0.93 per $100 of assessed value. The City of Harrisonburg updates their assessed values every year, so while many or most property owners recently received notice of the updated assessed value of their property, those values likely did not increase as drastically as assessed values did in Rockingham County. As a result, almost all City of Harrisonburg property owners will see an increase in their tax bill because though small increases, their assessed value and tax rate are both likely to have gone up or to go up. | |

Real Estate Assessments On The Rise, Big Time, In Rockingham County |

|

If you own a property in Rockingham County you likely received a notice in the past week or so that your property has a new tax assessed value! I have heard from quite a few folks who are very surprised by the large increase in the assessed value of their property -- and the corresponding increase in their tax bill. Some property owners seem to have seen a 20%, 25%, 30% or an even larger increase in the assessed value of their property and their tax bills. A few important notes... Rockingham County reassesses real estate every four years. Even though it might seem like this increase in the assessment of your property is a one year change, from 2021 to 2022, it's really not. The last time your property was reassessed was back in 2018. Thus, this increased assessment is based on how the value of your property has changed over the past *four* years. The 2018 assessment would have been largely based on 2017 sales data and the median sales price (per the HRAR MLS) of detached homes in Rockingham County during 2017 was $220,000. The median sales price of detached homes in 2021 was $288,000. That change from $220K to $288K is a... 31% increase in the median sales price of detached homes in Rockingham County. That's some very rough math - but it would seem that many property values have likely increased 30% (or slightly more or slightly less) over the past four years. As such, it makes sense that assessed values would also have increased by a similar amount between four years ago and today. Finally, don't panic (yet) thinking that your tax bill will increase 25% or 30% this year. It might, but it seems likely it will not. The potential tax bill shown on your notice of a new assessed value is showing you what your tax bill would be with your new assessed value and the current tax rate. But... the County has not yet set the tax rate. Will the County keep the same tax rate, leading to you having to pay as much in property taxes as shown on your notice of your new assessed value? Let's see what would happen if they did keep the same tax rate... Per the "Budget in Brief" for 2021-2022 for Rockingham County (here) it seems that the revenue for property taxes in the budget was $101,297,000. Yes, that is 101 million dollars. Working backwards, given the current tax rate of $0.74 per $100 of assessed value, that means that all of the real estate that was taxed had an approximate combined value of $13,688,783,783. Yes, that is almost 14 billion dollars. So, let's say the 14 billion dollars (approx) of real estate increased in value by 25% given the new assessments. I rounded down a bit from the 31% referenced above. That means the combined taxable properties may very well be worth $17,110,979,730 today -- yes, a bit over 17 billion dollars. Stick with me here -- if the tax rate ($0.74 per $100 of assessed value) remains the same in 2022 it would potentially generate tax revenue of $126,621,250. This would be over 25 million dollars more tax revenue for the 2022-23 budget than existed in the 2021-2022 budget. So, will your property tax bill increase by as much as is shown on the notice of your updated real estate assessment? Maybe -- if the County needs an additional 25 million dollars of revenue to balance their budget. :-) Is that likely? It doesn't seem like it to me. While expenses may be increasing, I doubt there are 25 million dollars (a year) of new expenses that would require that much additional tax revenue. So, in summary, for Rockingham County property owners... 1. The change in your assessment really marks the change in your property value over four years -- not over one year. 2. Real estate values in Rockingham County (per sales prices) seem to have increased by about 30% over the past four years. 3. The actual amount of your property tax bill won't be known until the County sets the tax rate as a part of the budget process. Questions? Feel free to ask me... or call the Rockingham County Reassessment Office at 540-564-5079. :-) | |

Median Residential Harrisonburg Real Estate Assessment Increases 10.5% In 2022 |

|

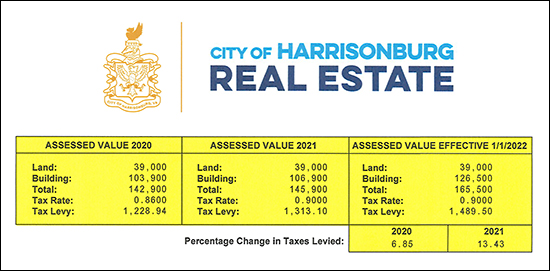

If you own a property in the City of Harrisonburg you likely recently received a "Change of Assessment Notice" in the mail. Harrisonburg updates the assessed value of every parcel of real estate every year... and some years (like this year) the assessed values increase quite a bit! The sample change in assessment notice above, for a townhouse in the City of Harrisonburg, shows the following assessed values...

You might also note that the tax rate changed a bit over time...

The increased assessed value, combined with the increase in tax rate results in the following increase in annual taxes...

In speaking with Lisa Neunlist, the real estate director for the City of Harrisonburg, she shared that there has been a 10.5% increase in the median assessed value of the approximately 9,600 residential properties (single family, townhomes, duplexes, condos that are not primarily students) in the City of Harrisonburg. Should this increase in assessed values surprise us? Probably not. The median sales price in our local area (City+County) has increased 12% over the past year. As such, a 10.5% increase in the median assessed value is not shocking. It will be interesting to see whether the tax rate is changed at all for 2022. The tax rate increased 4.6% (from $0.86 to $0.90) between 2020 and 2021 -- at least in part to help pay for building a second high school in the City of Harrisonburg -- though there was discussion of a possible need to increase that rate even further in 2022. Perhaps the increase in tax assessed values of properties in the City of Harrisonburg will provide enough additional tax revenue that the tax rate will not need to increase further at this time? Of note -- for the sample property I referenced above, if the tax rate remains at $0.90 in 2022 the annual taxes will increase by $176, which is a $15 per month increase. | |

Does An Increase In The Real Estate Tax Rate Directly and Significantly Affect Housing Affordability? |

|

The City of Harrisonburg recently increased the real estate tax rate from $0.86 per $100 of assessed value to $0.90 per $100 of assessed value. Does this affect housing affordability for home buyers and homeowners? I tried to say "yes and no" for this question -- but it's somewhat difficult to say that the increase in the real estate tax rate (alone) has a meaningful increase on housing affordability. Technically, yes, the increased tax rate does increase the cost of owning a home -- but not by much... For a property assessed at $250,000...

So, for the house assessed for $250,000 -- the monthly payment would increase by $9 per month based on this change in tax rates. So, certainly an increase in monthly housing costs, but not much of one. To put this change in monthly housing cost in context... If a homeowner had financed 90% of their purchase price of $250K at 3.5%, their mortgage payment would likely be right around $1,243 before the change in tax rate -- and right around $1,251 after the increase in real estate taxes. So, this change in tax rates increases their monthly payment by less than 1%. Am I saying that the City of Harrisonburg can just keep on raising the real estate tax rate forever without any impact on housing affordability? No. But it's hard to argue that this increase in the real estate tax rate, on its own, dramatically changes the financial picture for many or most homeowners. Now, I'll pivot a bit to a few other common talking points related to real estate taxes... Increased Tax Rates + Increased Assessed Values If we look at both at the increase in property values AND the increase in the real estate tax rate, then yes, the change in one's real estate tax bill is more significant. That said, the assessed values of real estate do not (at least right now) seem to be increasing as quickly as sales prices are in the current real estate market. While the median sales price has increased by about 10% over the past year, this year's property value assessments increased a net of 2.9%. As such, we shouldn't hastily calculate the increase in a tax bill using the increase in our local median sales price to show a large increase in real estate taxes, because market values are currently escalating much more quickly than tax assessed values. Tax Rate Increases + Income Changes A somewhat common refrain is to say "real estate tax rates increased by __% over such and such timeframe -- but my income didn't increase by that much during that timeframe!" This argument doesn't make a lot of sense to me. Let's make it as extreme of a point to point comparison as possible. The real estate tax rate was $0.59 ten years ago and is now $0.90. That is a 53% increase over a ten year period. So, per the argument above, I'd need a 53% increase in my income during the same time period in order to afford those higher real estate taxes, right? Well, probably not. :-) I'm going to use very rough, inaccurate numbers here, but let's pretend Fred owned a home assessed for $150K ten years ago and today it is assessed at $250K. His annual tax bill would have been $885 a decade ago at that $0.59 tax rate and that would have increased to an annual tax bill of $2,250. That's quite an increase! In fact, it's a $1,400 increase in annual real estate taxes over ten years. So, per the prior argument, he probably needs to have seen a 53% increase in his income because the real estate tax rate increased 53% over a decade, right? Well, maybe not. If Fred was earning $35,000 a decade ago, a 53% increase over the past ten years would mean that he would be earning $53,000 today. If you made it through all of my ramblings, thanks for reading and engaging on this topic. Do I think higher taxes are OK or good or great? No. I would love for everybody to pay the same or lower taxes forever and ever. Do increases in the local real estate tax rate directly and significantly affect housing affordability? In the short term it's very hard to say "yes" to this ($9/year) based on the information above. Over the mid to long term, certainly, this does have a cumulative impact - but I believe we should be precise with our language. Do you agree or disagree or have another counterpoint? Email me at scott@hhtdy.com. | |

City Approves Increase In Real Estate Tax Rate, No Change In County |

|

If you own real estate in the City of Harrisonburg, you'll be paying slightly more in real estate taxes due to a recently approved increase in the real estate tax rate. Previously, properties were taxed at a rate of $0.86 per $100 of assessed value. Now, the tax rate has increased to $0.90 per $100 of assessed value. For a property assessed at $250,000 this means...

As a point of comparison, for the same value of property in the County...

At least part of the reason for the increase in the real estate tax rate in the City is to fund the new high school. | |

City of Harrisonburg Considers 5% Increase In Real Estate Tax Rate |

|

Here's the current lay of the land as it relates to real estate taxes in the City of Harrisonburg...

Harrisonburg City Council is considering an increase in the real estate tax rate...

Stay tuned for further news of decisions from City Council as to changes in the real estate tax rate! | |

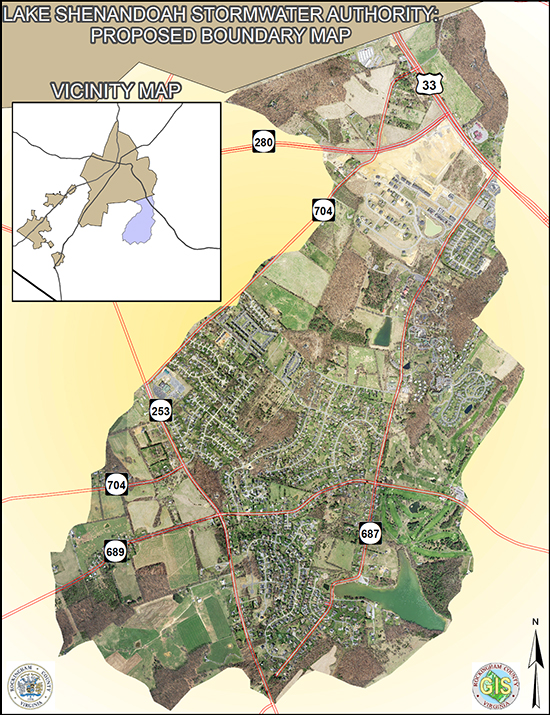

Rockingham County Considers Purchase of 27 Acres Between Barrington, Lakewood for Stormwater Management Purposes |

|

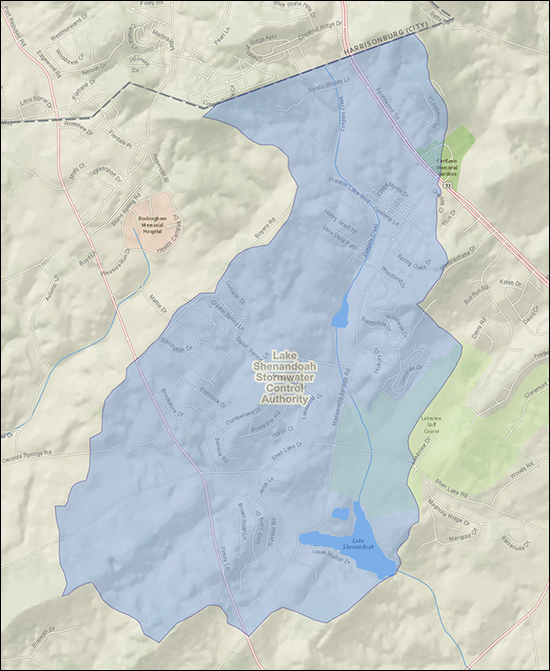

Rockingham County will likely purchase the 27-ish acre parcel on Taylor Spring Lane between Barrington and Lakewood to use for managing stormwater in the Lake Shenandoah Watershed. The purchase has not been finalized, but the County is in discussions with the land owner regarding the purchase. The County does not have a design for how the property will be used, but according to Lisa Perry, (Environmental and Land Use Manager for Rockingham County) it is safe to say that the low lying areas of the parcel will be used for stormwater storage capacity. My understanding is that only half of the property will be needed for stormwater management and that the County intends to use the other half of the land for a future County park once funding is available to build the park. Here's a reminder of some of the details of the Lake Shenandoah Stormwater Authority... If you live in (or own property in) the area shown above, you'll have a new tax to pay come December 2020 - a fee that will go towards funding upgrades in the stormwater infrastructure in the Lake Shenandoah Watershed.

These fees should bring in approximately $2.8 million over the next ten years - though the total estimated costs for the needed infrastructure improvements are between $3.15 million and $4.75 million. Also in their June meeting, the Lake Shenandoah Storm water Control Authority Board (made up of the same members as the Rockingham County Board of Supervisors)

If you live in this area, hopefully the news of this new tax isn't a surprise to you -- as it has been discussed for about a year now. The County held the first public hearing on this matter back in July 2019. | |

Rockingham County Approves Stormwater Fee for Properties In Lake Shenandoah Watershed |

|

If you live in (or own property in) the area shown above, you'll have a new tax to pay come December 2020 - a fee that will go towards funding upgrades in the stormwater infrastructure in the Lake Shenandoah Watershed.

These fees should bring in approximately $2.8 million over the next ten years - though the total estimated costs for the needed infrastructure improvements are between $3.15 million and $4.75 million. Also in their June meeting, the Lake Shenandoah Storm water Control Authority Board (made up of the same members as the Rockingham County Board of Supervisors)

If you live in this area, hopefully the news of this new tax isn't a surprise to you -- as it has been discussed for about a year now. The County held the first public hearing on this matter back in July 2019. Learn more about the Lake Shenandoah Stormwater Control Authority here. | |

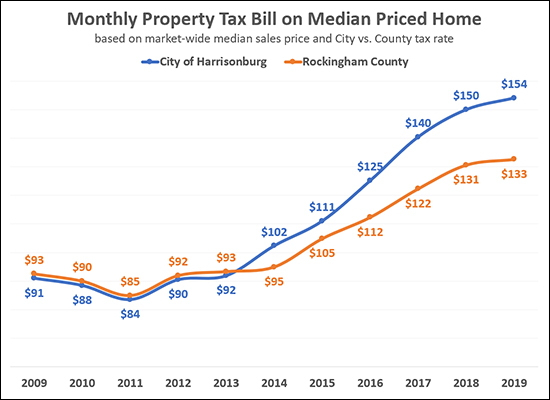

Comparing Monthly Property Tax Bills Between Harrisonburg and Rockingham County |

|

It seems that the real estate tax rate will stay the same in Harrisonburg and Rockingham County for 2020-21...

Despite no change in the real estate tax rates, many homeowners will see an increase in their real estate tax bill due to rising property values. The graph above tracks the City vs. County real estate tax bill for a median priced home -- and here is the underlying data...  As shown above, it has become more expensive (16%) to pay property taxes on a home in the City of Harrisonburg as compared to a similarly priced (assessed) home in Rockingham County. | |

Fee Structure Proposed for Property Owners in Lake Shenandoah Watershed |

|

download a high resolution PDF here The Lake Shenandoah Stormwater Control Authority (currently made up of the members of the Rockingham County Board of Supervisors) have set a proposed fee schedule for collecting revenue from property owners within the Lake Shenandoah Watershed to allow for funding of the stormwater management improvements needed within the watershed. A public hearing will be held on March 25, 2020 regarding the fees, but here are some details of the proposed fee structure...

In other news, the Stormwater Authority is considering moving forward with The Timmons Group to provide engineering services to determine appropriate flood mitigation projects. As shown on the map above, the Stormwater Control Authority will include all or part of the following areas:

| |

All The Areas That Will Pay A Bit Extra In Taxes To Help Manage Stormwater in The Lake Shenandoah Watershed |

|

download a high resolution PDF here In late August, the Rockingham County Board of Supervisors approved the creation of the Lake Shenandoah Stormwater Authority. The authority will work to manage stormwater and mitigate damage from that stormwater throughout the Lake Shenandoah Watershed. Read more via the DNR on 8/29/2019) here. The Authority will potentially spend around $3.2 million to improve the stormwater system by creating new detention facilities and increasing the capacity of ditches and pipes. Property owners in the area shown above will pay some additional taxes that will fund the work of this Stormwater Authority, though the Authority will also pursue grant funding for the needed infrastructure improvements. As shown on the map above, the Stormwater Control Authority will include all or part of the following areas:

| |

There Might Not Be Anyone To Blame For Urban Flooding in the Lake Shenandoah Watershed Area |

|

If your house, or street, or neighborhood floods during heavy rainfall events in the Lake Shenandoah watershed area, it likely seems that someone must be at fault - someone must have messed up - someone must be blamed for the drainage problems. But who is to blame? Many neighborhoods were developed just southeast of Harrisonburg over the past 20 years - and in each case, the developer would be told by the County how to develop the land from a stormwater perspective based on requirements from the State. So - if the State (Commonwealth of Virginia) creates guidelines, the County enforces them, and the developer implements them, who is to blame if your house, street or neighborhood is flooding? It is tempting to say that the developer must be at fault - but they were just doing what the County was telling them to do to manage stormwater. We could then blame County officials - but they were just doing what the state was telling them to do to manage stormwater. So, hmmm.... Here's a bit of further commentary from Mr. Miller (the County's attorney) at the public hearing held by the Board of Supervisors...

So, if everything was being done based on what the experts at the state were mandating - then it seems that local builders, developers and County officials aren't really the ones to be blaming for urban flooding. Yes, if all of these neighborhoods were developed today, the developer would be told by the County to do more to mitigate stormwater based on requirements from the state - but those guidelines and requirements were not in place when these neighborhoods were developed. A few other related notes...

If this topic interests you, consider attending the Work Session on the topic to be held this Wednesday (August 21, 2019) at 6:00 PM at the Rockingham County Administration Center. No action will be taken at the meeting, but it is an opportunity for further discussion and input. Also, as a refresher, these recent conversations are a result of the County's proposal to create a Stormwater Authority specifically for the Lake Shenandoah Watershed. The Authority could potentially spend around $3.2 million to improve the stormwater system by creating new detention facilities and increasing the capacity of ditches and pipes. If the cost of these potential improvements was divided evenly between the affected parcels, it would cost approximately $200 per year per parcel. Though... "Mr. Miller stated these are only estimates, because there are too many unknowns until engineering studies are conducted. Assistant County Administrator Armstrong noted that the $3.2 million cost is with no contribution from state or federal grants that the County may be able to obtain to offset costs." | |

Comparing Monthly Property Tax Bills Between Harrisonburg and Rockingham County |

|

Getting a bit further into this topic -- yesterday I was looking only at the changes in the property tax rates in the City and County -- as shown here. Today (thanks for the idea, Mike) I looked at how a monthly property tax bill has changed over the past decade for a median priced home in the City and County. To be clear, this analysis uses:

As shown above, it has become more expensive (16%) to pay property taxes on a home in the City of Harrisonburg as compared to a similarly priced (assessed) home in Rockingham County. Now -- does this cause anyone to move from the City to the County? Or does it cause anyone new to the area to buy in the County instead of the City? Not necessarily - or at least that has not been my experience in working with buyers and sellers in the past ten (+) years. | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings