Taxes

| Newer Posts | Older Posts |

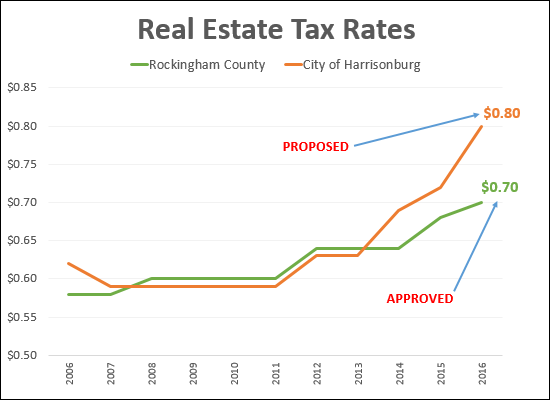

$0.70 Real Estate Tax Rate Approved by Rockingham County |

|

Taxes, taxes, all about taxes. Clearly, lots on the blog lately about real estate tax rates. Well, Rockingham County has officially approved their budget and an increase of the real estate tax rate from $0.68 to $0.70. Stay tuned for news on the final decision on the Harrisonburg real estate tax rate. | |

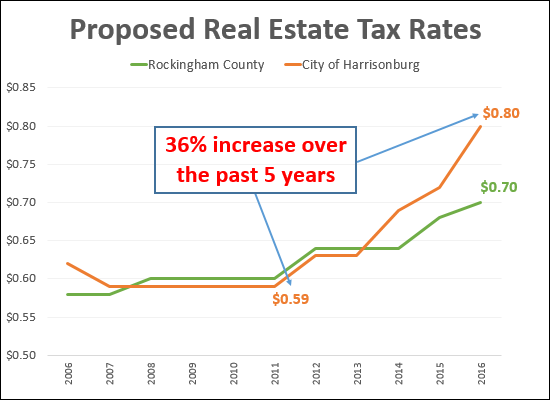

The proposed city real estate tax rate, contextualized |

|

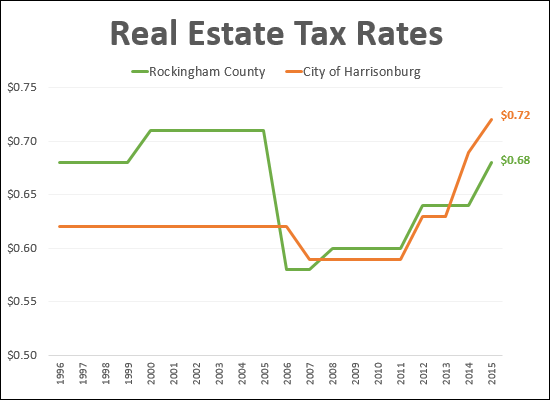

The real estate tax rate in the City of Harrisonburg might increase to $0.80 per $100 of assessed value per the City's proposed 2016-17 budget. As shown above, this would be a 36% increase in the tax rate over a five year period. The context that might be missed by just looking at this increase includes....

Interested in knowing more? Read today's article in the Daily News Record (City Eyes Tax Hike In Budget Proposal) or attend the public hearing on the budget this evening at the City Council meeting at 7PM in City Hall Council Chambers. | |

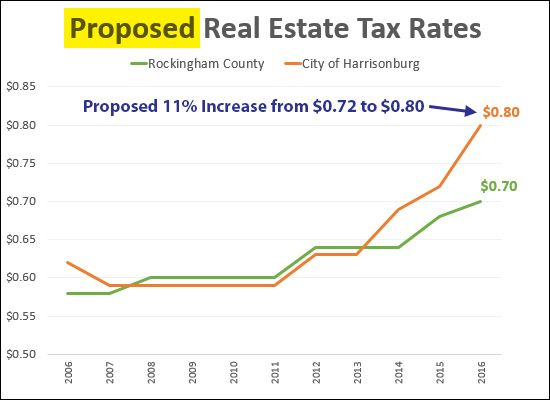

City of Harrisonburg Proposes 11% Increase in Real Estate Tax Rate |

|

The City of Harrisonburg has released its proposed budget for the 2016-2017 fiscal year, and it includes a proposed $0.08 increase in the tax rate from $0.72 per $100 of assessed value up to $0.80 per $100 of assessed value. A few excerpts of note from the City Manager's letter to City Council are included below. The bold sections are directly from the letter. City costs are increasing as population increase, even without increases in services.... As noted last year, the impact of a growing community continues to have a significant effect on our budget. That trend continues this year as we added another 1,263 new residents as of July 1, 2015 per the Weldon Cooper Center population estimates. I have stated in my budget transmittal letter for several years that even if we are not adding new services or programs, we have more people needing/consuming the services, programs, and facilities that we already provide, and we have added more infrastructure to be operated and maintained (streets, sidewalks, bike trails, emergency communications, juvenile and adult detention facilities, athletic fields, etc.) in support of our services and programs. Large new costs for 2016-17 include:

Natural revenue growth, while increasing, has not kept pace with the costs of all of the immediate needs. Lots of new costs without significant new revenue resulted in a recommendation for increasing the real estate tax rate.... As City staff developed the budget, they had a gap of about $7.5 million between revenues and expenditures. We began the development of the FY 16-17 general fund budget with a gap of about $7.5 million between anticipated revenues and expenditures. To varying degrees, all of the submitted requests had merit and were intended to address what department directors and management felt to be present or pending needs for providing services to our citizens. This budget does not include any increases to any of the "discretionary" outside agencies (listed as "Contributions – Community and Civic Organizations" in the budget) that receive City funding, nor does it propose adding any new agencies, programs or projects for funding. We attempted to build this budget based on available projected revenues and not expenditure requests, starting with a base revenue budget of just under $102 million (which included about $1.6 million in new revenue), less any use of fund balance. In spite of this effort, to meet the commitments we have in core service areas, a $3.15 million gap remains. As such, management believes an increase of approximately $0.08 in the real estate tax rate will be required to balance the FY 16-17 budget, pending Council direction as to other possible budget revisions or identification of reduction targets. The draft budget (and above-referenced letter, and supporting documentation) can be found here ("2017 Proposed Budget"). Next, the budget will be reviewed by City Council and opportunities will exist for public comment. | |

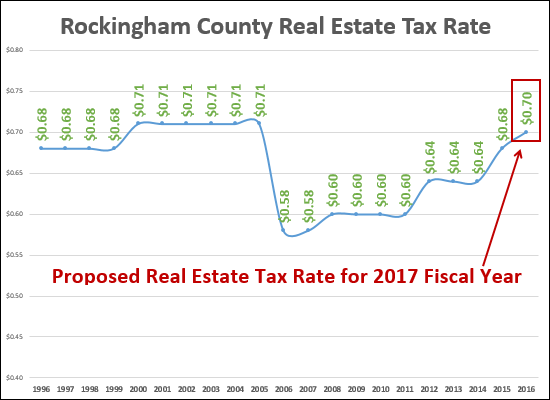

Rockingham County Proposes 2 Cent Increase in Real Estate Tax Rate |

|

Rockingham County's proposed budget for the 2017 fiscal year (July 1, 2016 - June 30, 2017) includes a 2 cent increase in the real estate tax rate -- from $0.68 to $0.70 per $100 of assessed value. This would bring it closer to Harrisonburg's $0.72 tax rate, but not all the way up there. If you want to give your figurative two cents to the County about their proposal for using your actual two cents (per $100 of assessed value) then show up at the public hearing on April 13th at 7PM at East Rockingham High School. Read more via Monday's Daily News Record article.... County Proposes Tax Hike | |

Did your Harrisonburg Tax Assessment Go Up or Down? |

|

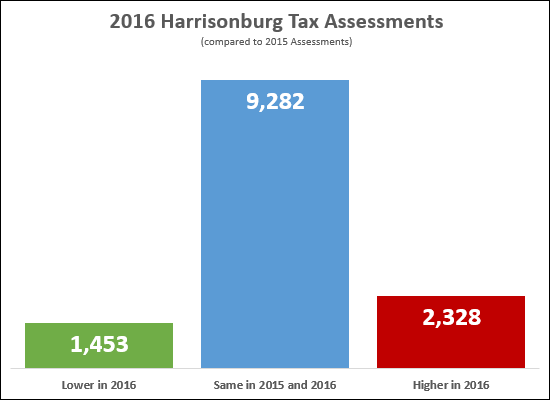

Did your 2016 tax assessment go up or down? As shown above, most properties had the same tax assessed value in 2016 as compared to 2015....

Also of interest....

| |

What is a cash proffer, what do the proposed bills in the General Assembly mean for Rockingham County? |

|

According to the Virginia Department of Housing and Community Development.... A cash proffer is (a)any money voluntarily proffered in a writing signed by the owner of property subject to rezoning, submitted as part of a rezoning application and accepted by a locality pursuant to the authority granted by Va. Code Ann. Section 15.2-2303 or Section 15.2-2298, or (b) any payment of money made pursuant to a development agreement entered into under authority granted by Va. Code Ann. Section 15.2-2303.1.In other words, cash paid by a developer to a locality for the ability to rezone a piece of development land. There are several bills in the General Assembly that would amend Virginia's proffer system by requiring that proffers be limited to impacts directly attributed to a new development. Apparently, some localities in the more densely populated areas of Virginia (Richmond, Northern Virginia) are using cash proffers for projects unrelated to the new developments. As per today's Daily News Record article (County Officials Blast Development Proposal), officials in Rockingham County are not in favor of this bill being passed, because it would require that the County would hire an independent body to examine all proposed proffers in the future, which would be an added cost the County, and thus taxpayers. My read on the matter is that a reform of the proffer system would improve how things work in Richmond and Northern Virginia (making sure that proffers are really only for projects related to the new developments) but would add additional requirements, processes and costs for the rest of the localities throughout Virginia. | |

Tax Rates in Harrisonburg, Rockingham County |

|

For planning purposes, just a reminder that the tax rate in Rockingham County was both $0.66 and $0.68 during 2015 -- but we can likely now just plan on it being $0.68 (or higher?). The tax rate for the first half of the year (2015) was $0.66 and then it increased to $0.68 for the second half of the year. The City of Harrisonburg continues to have a slightly higher ($0.72) tax rate than Rockingham County. | |

Updated City Real Estate Assessments Released |

|

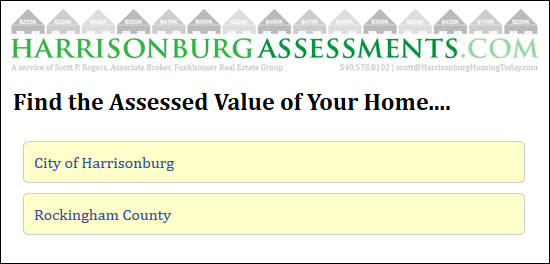

Updated assessed values were released earlier this month for all properties in the City of Harrisonburg, and they have now also been updated on HarrisonburgAssessments.com. As per the December 3, 2015 Daily News Record article....

Read more in the DNR article, or find the assessed value of any property in the City (or County) at HarrisonburgAssessments.com. | |

City real estate tax rate drops $0.015 after increasing $0.045, so really, still an increase |

|

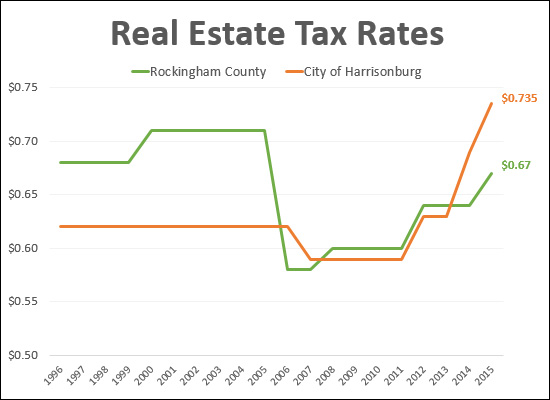

The City of Harrisonburg had decided to increase the tax rate by 4.5 cents in 2015 to 73.5 cents per $100 of assessed value. That has now been ratcheted back down (by 1.5 cents) to a final tax rate of $0.72. Read more in the Daily News Record. | |

4.2 Acre, $5.5 Million Park planned for downtown Harrisonburg |

|

A 4.2 Acre, $5.5 Million Park is planned for downtown Harrisonburg, the potential layout of which is shown above. Click any of the images above/below for a larger/clearer version. Read more about the park and its status in last week's Daily News Record article, an excerpt of which follows.... "It [the park] would include a ship-themed children's play area, a "great lawn" that would host events and performances, and a broad tree-lined promenade arching from South Liberty Street south of the Turner Pavilion to Bruce Street at Blacks Run." Connect with the group behind this effort, Plan Our Park, via Facebook.   | |

City of Harrisonburg Real Estate Tax Rate To Rise To $0.735 |

|

Per today's Daily News Record article, the City tax rate will be increasing to 73.5 cents per $100 of assessed value. This is a good bit (but not a whole lot) above the new Rockingham County real estate tax rate of an effective $0.67. | |

Real Estates Taxes Likely to Rise in Both City and County |

|

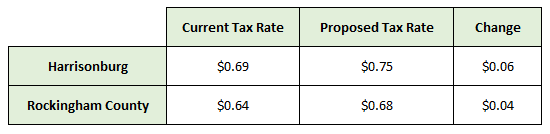

Old News: Rockingham County will likely increase their real estate tax rate to $0.68 per $100 of assessed value. (read more here) Somewhat New-ish News: The City of Harrisonburg will likely increase their real estate tax rate to $0.75 per $100 of assessed value. Review the proposed 2016 budget for the City of Harrisonburg here. | |

Real Estate Tax Increase Proposed in Rockingham County |

|

The proposed budget for Rockingham County includes a four cent increase in the real estate tax rate for 2016. This would not be the highest (or lowest, clearly) that we have seen in the past 20 years. Read more about the proposed budget in today's Daily News Record article. | |

Finding the Assessed Value of Your Home |

|

How, you might ask, do you find the assessed value of your home?

You can now search for your home's assessed value on HarrisonburgAssessements.com. Before you go search, however, please remember that....

| |

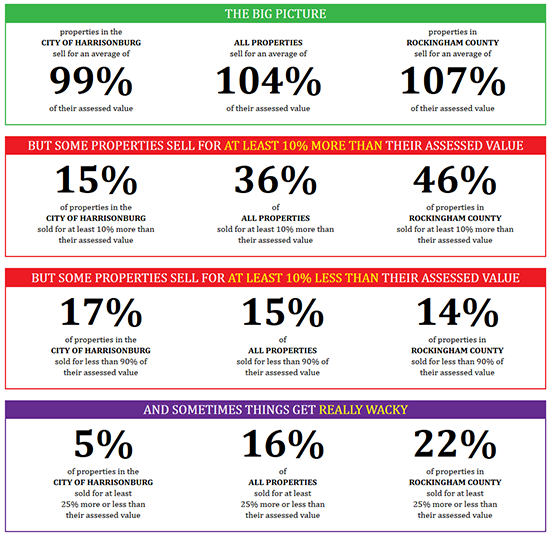

How do Assessed Values compare to Market Values? |

|

How do Assessed Values compare to Market Values? Wonder no longer! You can now find out via HarrisonburgAssessments.com. You'll want to visit this new site for full details, but here is a quick snapshot....  Find out more about the relationship between market values and assessed values at HarrisonburgAssessments.com. | |

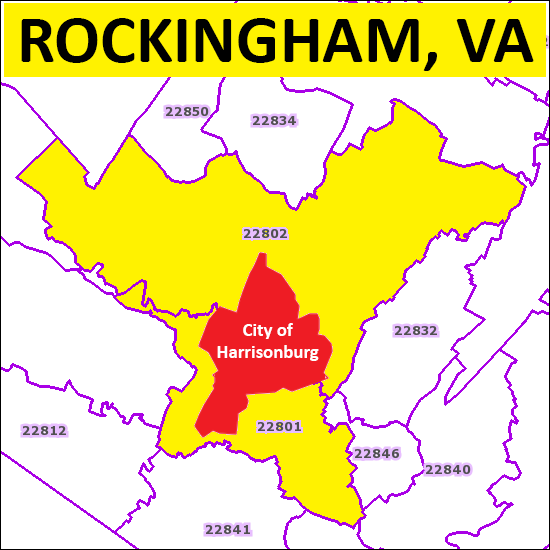

Do you now live in Rockingham, VA? |

|

If your zip code is 22801 or 22801, and you live in Rockingham County (shown in yellow above) then your mailing address can be written in two different ways starting in February 2015....either as "Harrisonburg, VA 22801" or "Rockingham, VA 22801", and it's all about taxes.... From today's Daily News Record article.... Starting in February, the U.S. Postal Service will begin updating its database so the two ZIP codes will have a default mailing address of Harrisonburg, VA, and an "alternate preferred" address of Rockingham, VA.Read the rest of the article here. | |

Proposed Site of New Jail for Harrisonburg and Rockingham County |

|

click here for a larger version of this map Moseley Architects has released a planning study recommending that a new jail be built at the site shown above, located in the City of Harrisonburg. Before we get to the details of this potential new facility, you may want to read up on this issue at Old South High.... A $60 million new jail by the landfill that's projected to reach capacity in seven years is the plan to fix overcrowding – that is, if it's actually a real plan at allNow, a few snippets about the proposed new facility, from today's Daily News Record article provide some insight into what this facility would be used for.... According to the planning study, the annex would "primarily be a minimum security, treatment and program based building" with 315 beds.A bit about the costs of the proposed new jail.... The total cost of the project is estimated at more than $63.26 million, half of which would come from the state and the rest split between the city and county.And it's possible future expansion.... The cost includes a possible future expansion of the new facility to accommodate an additional 385 beds — for a total of 700 — estimated to cost $5.78 million.And the timing of this potential project.... Officials aim to submit a corrections study to the state by the end of the year. With state approval expected to take roughly a year, officials are hoping to receive state funding for construction in 2016.Read more in today's Daily News Record article.... Jail Study Recommends New Building Daily News Record, November 21, 2014 | |

Harrisonburg City Council approves Hotel and Conference Center deal between City, JMU and private developer |

|

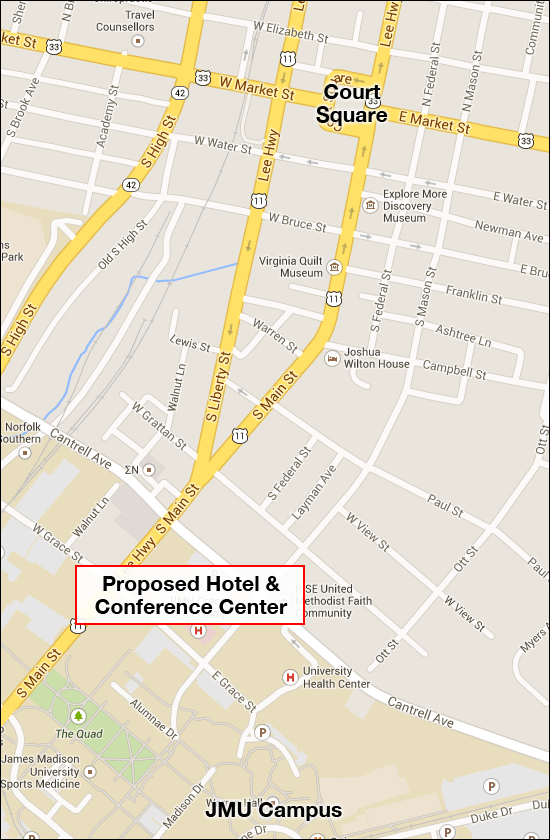

City Council approved a deal for the City of Harrisonburg to enter into a partnership with JMU, the JMU Foundation and a private developer to construct a hotel and conference center A few items to note, from today's Daily News Record article.... "The plans call for a 205-room hotel, to be dubbed Hotel Madison, and a connected conference center to be built on university-owned land bounded by South Main, Mason and Grace streets, and Martin Luther King, Jr. Way.As such, my understanding is that the City isn't really "funding" this development.

From a taxpayer's perspective, is this good or bad? I think it depends on what you believe would happen with the land if the deal did not come together. If the property is not developed, then there wouldn't be any tax revenue that the City is "missing out on" by giving those tax revenues to the JMU Foundation. Many of those in support of this deal (which has now been approved) believe that the hotel and conference center will generate other economic activity for Harrisonburg, and thus it is good thing that this deal is happening. I tend to agree -- it's hard to imagine people coming in to stay at a hotel to attend a conference and not spending any other money in the City. Many of those opposed to this deal (which has now been approved) seem to believe that the City is using taxpayer dollars to pay for this project. Technically, this is true, as future tax revenues generated by the project will be essentially retroactively applied to the cost of the project. But as explained above, those tax revenues would not have been there without the complex being built in the first place. Read the full Daily News Record article here. Here's a brief history of this project....

| |

Will Hotel Madison ever be built in Harrisonburg? |

|

If Hotel Madison is built in the location shown above, it is likely to be without any financial support from the City of Harrisonburg. A private developer, JMU and the City of Harrisonburg have been negotiating for months on details of a potential partnership between the three entities to build a hotel and conference center on the site shown above -- but that deal has now apparently fallen apart. The developer was asking for $10 million towards the conference center construction, which would be a part of the overall $40 million cost of the entire project. Per today's Daily News Record article, after nearly every detail was in place, the City made a few changes to the draft memorandum of understanding, and the JMU Foundation could not agree to those changes. The developer indicates that the project will not be able to move forward without the now unlikely private-public partnership. Read more in today's Daily News Record article, or catch up on how this all played out....

| |

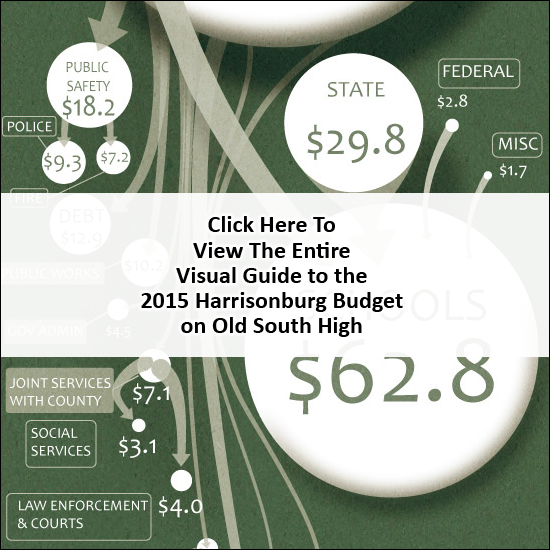

Understanding the 2015 City of Harrisonburg Budget |

|

Are you curious about how the City of Harrisonburg spends their money -- and where it comes from in the first place? Check out this very helpful illustration on Old South High -- graphic by Elwood Madison, commentary by Old South High. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings