| Newer Posts | Older Posts |

9.5% Increase In City Real Estate Tax Rate? |

|

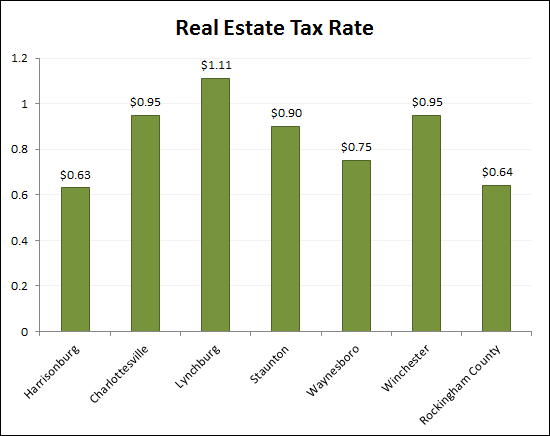

The City of Harrisonburg may increase its tax rate from $0.63 (per $100 of assessed value) to $0.69. This would be a 9.5% increase in real estate taxes for property owners in the City of Harrisonburg. This would still leave us with a very low tax rate compared to many other areas around Virginia:

As noted in today's in depth article in the Daily News Record: Under the fiscal 2015 proposal to raise the rate 6 cents, the owner of a city home valued at $ 150,000 will pay $ 1,035 in real estate taxes, compared to $ 945 now. A house valued at $ 200,000 will be taxed at $ 1,380 next year, according to the draft. That owner pays $ 1,260 now.Read the DNR article here, and view the proposed City budget here. | |

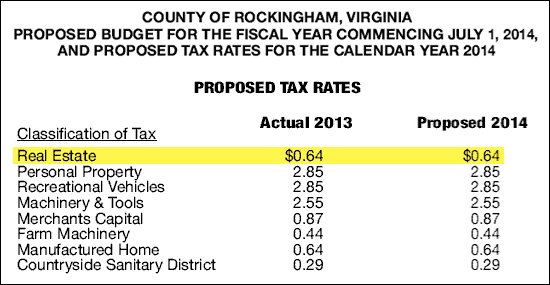

No change proposed for real estate tax rates in Rockingham County |

|

Per the proposed budget published in the Daily News Record on 04/14/2014, Rockingham County is not proposing an increase in the real estate tax rate. If the budget is approved as proposed, the tax rate would remain at $0.64 per $100 of assessed value. Click here to view the entire proposed budget. | |

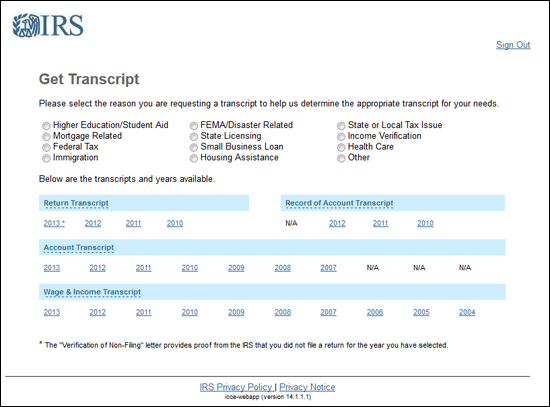

Download your tax returns from the IRS! |

|

This may be a helpful resource as you are providing documents to your lender during the home buying process. You can now download your tax returns from the IRS. I created an account and downloaded my transcripts relatively easily after dealing with some pop up windows being blocked. I found the "Record of Account Transcript" document to be the most comprehensive and helpful. It's nice to be able to download what the IRS is considering to have been your final tax filings. Check it out here: http://www.irs.gov/Individuals/Get-Transcript | |

Understanding Real Estate Assessments |

|

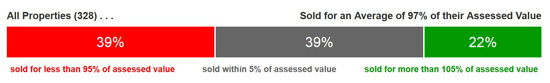

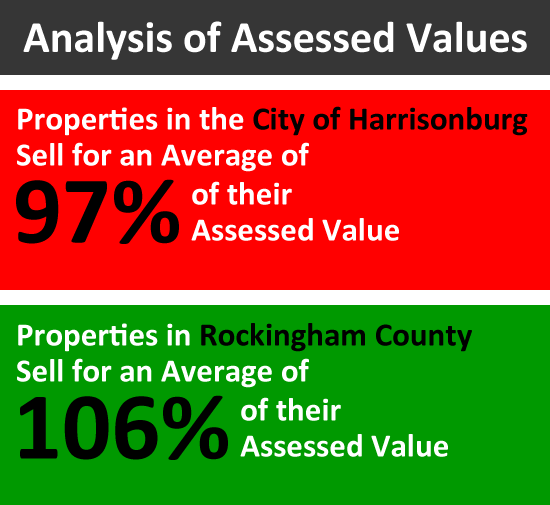

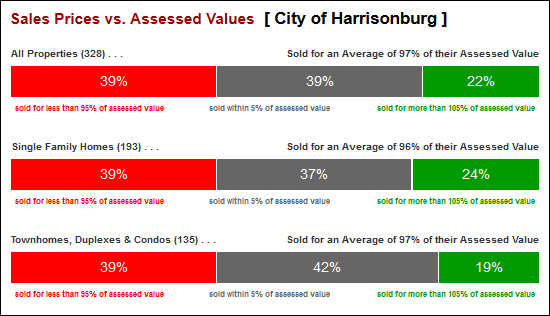

As recently published in the Shenandoah Valley Business Journal.... It's that time of year again, when homeowners (at least in the City of Harrisonburg) are receiving notices of the reassessment of their property. As you strive to understand the new (or current) assessment of your property, let's have a brief refresher course on real estate assessments. First, many people (erroneously) believe that the assessment of their property is an indication of their home's value. In actuality, the assessed value of a property is the value assigned to the property by the local assessor's office, for the purpose of determining how much you will pay in taxes. Certainly, the assessed value is intended to be the precise value of your home – but it is quite possible that there is a disparity in this assessed value and market value. The market value of your home is the price at which it would sell in the current market. Sales Prices vs. Assessed Values in the City of Harrisonburg  To better understand how assessed values relate to market value, I checked on the 2014 assessed value for each of the 328 properties that sold between January 1, 2013 and November 30, 2013. What I discovered, is that properties in the City of Harrisonburg sold, on average, for 97% of their assessed value. Looking a bit deeper, just over a third of City properties (39%) sold within 5% of their assessed value – the remaining 61% had a sales price that was more than 5% higher or lower than the assessed value. Sales Prices vs. Assessed Values in Rockingham County  Performing the same analysis in Rockingham County, we discover that County properties are selling for slightly more than their assessed value (average of 106%) as compared to City properties that are selling for a bit less than their assessed value (average of 97%). Given the great variation in assessed values and market values, homeowners should not rely on their tax assessment for an understanding of their property's value. Furthermore, home buyers should not rely on assessed values to guide them in understanding the market value of a home that they might purchase. Both buyers and sellers should strive to understand the market value of a particular piece of real estate my analyzing similar homes that have recently sold and those currently on the market in a given neighborhood or price point. The relationship between assessed values and sales prices varies based on the price, size, age and location of the home. For a more thorough analysis of the topic, visit HarrisonburgAssessments.com. | |

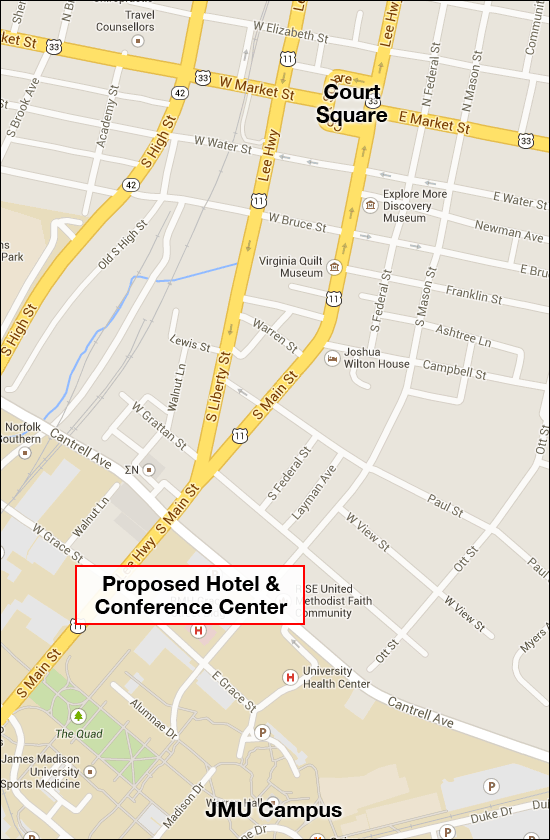

Update on Hotel Madison |

|

A 205-room hotel and 21,000 SF conference center might be built on South Main Street between Grace Street and Cantrell Avenue through a public-private partnership. This $40 million project could result in over $1 million in tax revenues for the City during its first year of operations per a feasibility study recently provided to the City. The City of Harrisonburg is being asked to pay for $10 million of the project, which would cover the cost of the conference center. The developer would build the hotel and conference center on JMU-owned land in the location described and shown above. As a side note, this is being described as a downtown hotel and conference center --- though the corner of Cantrell Avenue and South Main Street doesn't quite seem downtown to me --- or to the creators of the downtown maps. Read more about this project....

| |

Understanding Assessments in Harrisonburg, Rockingham County |

|

Learn More Here: City | County The ASSESSED VALUE of a property is the value assigned to the property by the local assessor's office, for the purpose of determining how much you will pay in taxes. The MARKET VALUE of a property is the price at which a property would sell in the current market. As shown above, properties in the City of Harrisonburg tend to sell for a bit less than their assessed value.....while properties in Rockingham County tend to sell for a bit more than their assessed value. However -- there is a great deal of variance --- explore the data via... HarrisonburgAssessments.com | |

Comparison of Assessments and Sales Prices in the City of Harrisonburg |

|

click here for more details I frequently hear from homeowners wondering why their assessed value is so high AND from other homeowners wondering why their assessed value is so low. Some homeowners know they could never sell their home for the assessed value, and others know they could it for more than the assessed value. So, to further understand assessed values, let's explore their relationship to sales prices. Click here to view a full comparison of 2013 Sales Prices and 2014 Assessed Values for the City of Harrisonburg. | |

City SFH Assessments Down 1%, Sales Prices Up 3% |

|

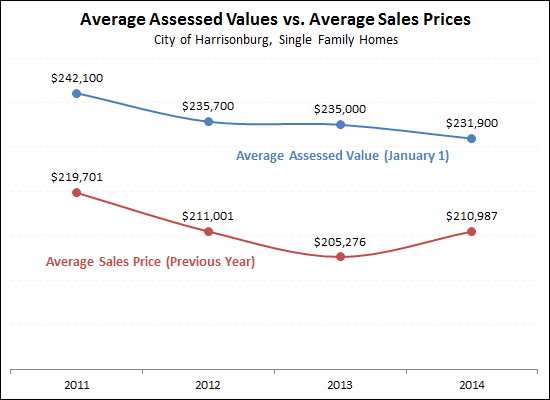

As reported in today's Daily News Record, assessed values in the City of Harrisonburg stayed relatively stable over the past year. As shown above, the average assessed value of single family homes decreased 1% over the past year from $235,000 to $231,900. In the same time period, average sales prices increased by 3%. A few clarifying notes....

Read more about the latest update to City of Harrisonburg assessed values in the DNR article or read more about market values at HarrisonburgHousingMarket.com. | |

Will Harrisonburg pay $9.5M towards a $40M downtown public-private hotel and conference center? |

|

A private developer (dpM Partners, LLC) is proposing to build a hotel and conference center in Downtown Harrisonburg. The $40M project would be (per the proposal) paid for with $9.5M of public funds towards the 18,180 SF conference center.....and the remaining $39.5M of private funds would help build the remainder of the project to include a 205-room hotel and a restaurant. Thus far.....

And the latest update is that the developer will likely be ready to present the detailed plans (and feasibility study) to City Council by early summer. Read today's DNR article for more details. | |

Harrisonburg Real Estate Taxes To Increase 6% in 2013? |

|

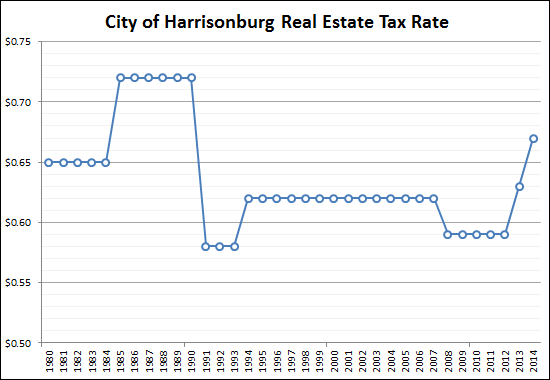

Per the proposed 2013-14 budget, real estate taxes in the City of Harrisonburg may increase from $0.63 per $100 of assessed value to $0.67 per $100 of assessed value. Above you'll note that Harrisonburg real estate taxes continue to be quite low compared to other Virginia localities. Review the entire budget here: 2013-14 Proposed Budget. Read an article from the Daily News Record here. A public hearing for the budget is planned for April 23rd. Of note, we're not yet setting new records for historical high tax rates....  | |

Harrisonburg Property Assessments Decline 1% for 2013 |

|

New assessed values have been calculated for the City of Harrisonburg. These new assessed values will determine the property taxes that each property owner will pay in 2013 --- and the values are based on sales data from the previous year. Harrisonburg has 12,531 taxable parcels, and roughly 9,000 of those parcels will see a change in their assessed values (and thus property taxes) for 2013. How does this 1% overall decline in City property values compare to what we've seen in the Harrisonburg Rockingham Association of Realtors Multiple Listing Service (HRAR MLS)?

This 1% decline in assessed values may or may not be accompanied by a change in Harrisonburg's property tax rate. That rate increased from $0.59 (per $100) to $0.63 (per $100) effective July 1, 2012. City Council will discuss the property tax rate when the City develops the 2013/2014 budget. Click here to read today's full Daily News Record article on City assessments. | |

Understanding Real Estate Assessments |

|

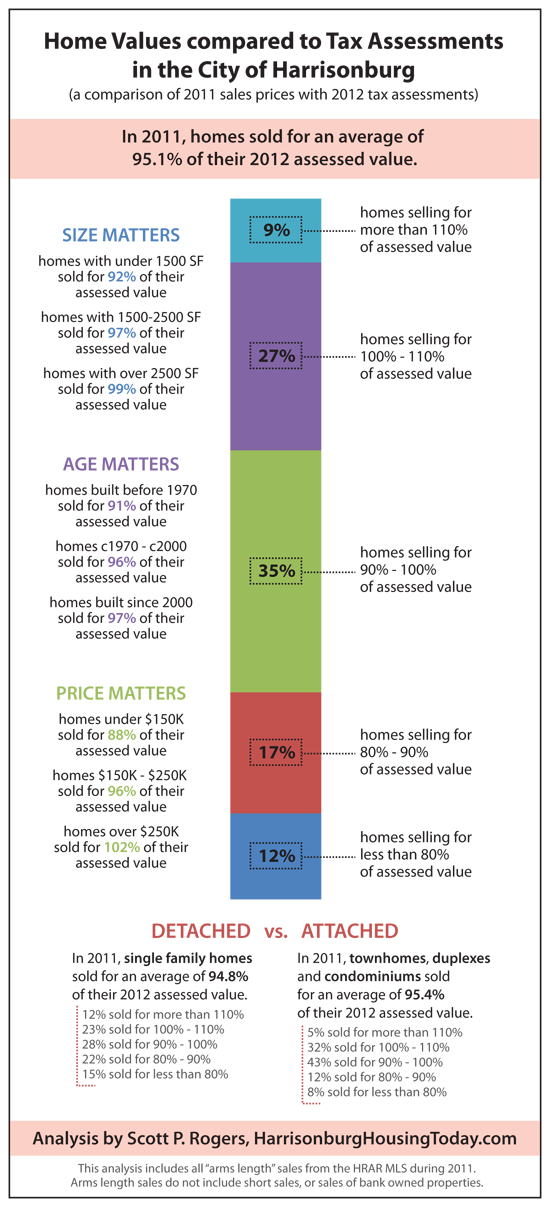

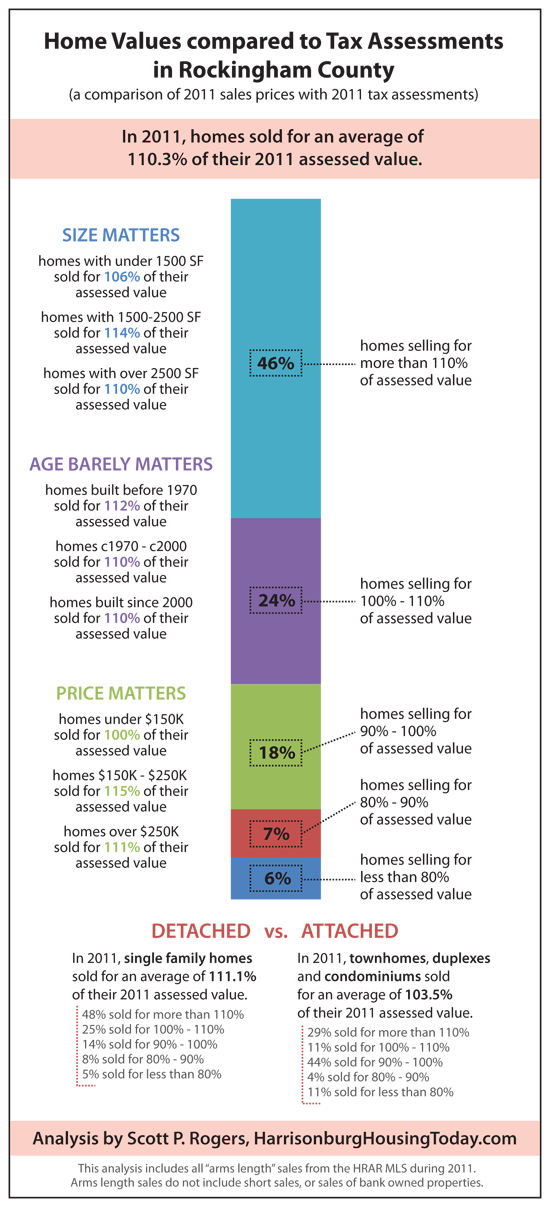

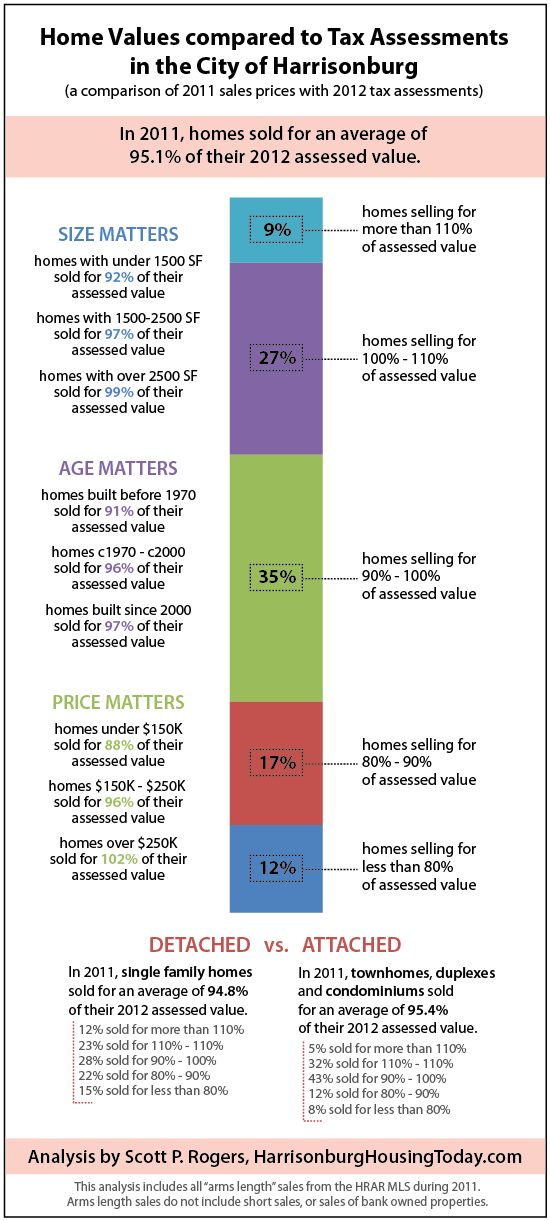

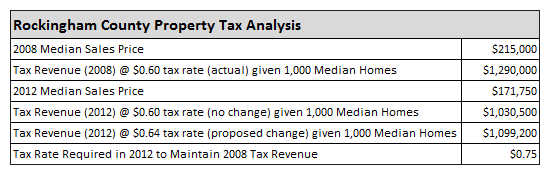

As published yesterday in the Shenandoah Valley Business Journal. Many people believe the assessment of their property istheir home's value. In actuality, theassessed value of a property is the value assigned to the property by the localassessor's office, for the purpose of determining how much you will pay intaxes. Certainly, the assessed value is intended to be the precise valueof your home – but quite frequently there is a disparity in this assessed valueand market value. The market value ofyour home is the price at which it would sell in the current market. Of interest, the City of Harrisonburg real estateassessments are currently a bit more accurate than those in RockinghamCounty. As can be seen in theinfographic, homes sold during 2011 in the City of Harrisonburg sold for 95.1%of their current assessed value. Breaking it down further, 64% of the homes that sold during 2011 in theCity of Harrisonburg sold at a lower price point than their assessed value. This is an indication that many City propertyassessments are likely a bit too high. In Rockingham County, most property assessments are too low –as 70% of properties that sold in 2011 sold for more than their assessed value– and on average, properties sold for 110% of their assessed value. Of note, homes in the City of Harrisonburgare re-assessed every year, while homes in Rockingham County are onlyre-assessed every four years. In thepast, this has resulted in lower than expected assessments in Rockingham Countydue to the infrequent updates to their assessed values. Given the great variation in assessed values and marketvalues, homeowners should not rely on their tax assessment for an understandingof their property's value. Furthermore,home buyers should not rely on assessed values to guide them in understandingthe market value of a home that they might purchase. Both buyers and sellers should strive tounderstand the market value of a particular piece of real estate my analyzingsimilar homes that have recently sold and those currently on the market in agiven neighborhood or price point. Click on either image below for a printable PDF.... | |

Real Estate Tax Analysis in Harrisonburg and Rockingham County |

|

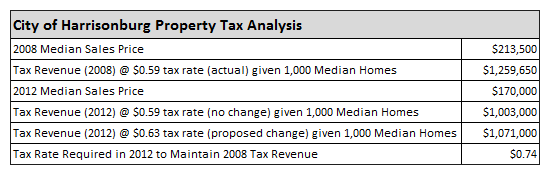

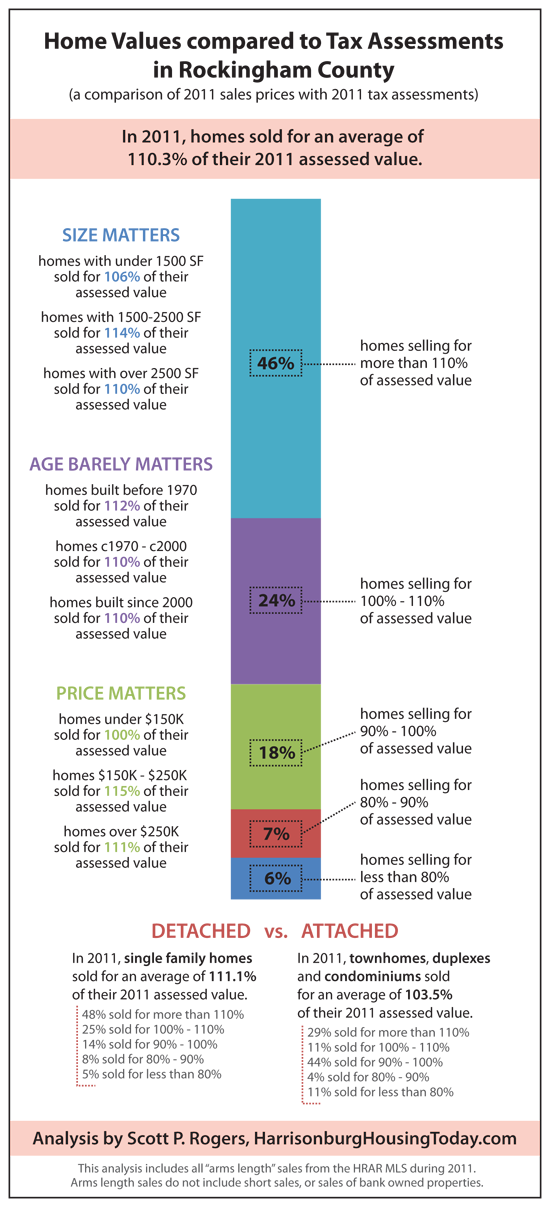

The City of Harrisonburg is considering increasing the real estate tax rate from $0.59 per $100 of assessed value to $0.63 per $100 of assessed value. Rockingham County is also considering a $0.04 increase, from its current tax rate of $0.60 per $100 of assessed value to $0.64 per $100 of assessed value. To understand the potential rationale behind such an increase, let's examine funding levels given a few assumptions to make the math a bit easier. First, we will assume that all tax assessments are at exactly 100% of the market value of properties. Second, we will assume that both Harrisonburg and Rockingham County are comprised of 1,000 privately owned homes. Third, we will assume that all homes have market values (and assessed values) of the median sales price.  As shown in the table above, the median sales price in the City of Harrisonburg declined 20% between 2008 and 2012 from $213,500 to $170,000. If the City of Harrisonburg were comprised of 1,000 median-priced homes, the tax base and thus the tax revenue would also decline by 20% from $1.26M to $1M. Even with the proposed $0.04 proposed increase in the tax rate (from $0.59 to $0.63) the tax revenue would still decline by 15% from $1.26M to $1.07M. In fact, the tax rate would need to increase to $0.74 (a 25% increase) in order to maintain the same tax revenue as in 2008 --- assuming that assessed values have tracked precisely with median sales prices.  As shown in the table above, the median sales price in Rockingham County declined 20% between 2008 and 2012 from $215,000 to $171,750. If Rockingham County were comprised of 1,000 median-priced homes, the tax base and thus the tax revenue would also decline by 20% from $1.29M to $1.03M. Even with the proposed $0.04 proposed increase in the tax rate (from $0.60 to $0.64) the tax revenue would still decline by 15% from $1.29M to $1.1M. In fact, the tax rate would need to increase to $0.75 (a 25% increase) in order to maintain the same tax revenue as in 2008 --- assuming that assessed values have tracked precisely with median sales prices. | |

Home Values compared to Tax Assessments in Rockingham County |

|

I'm asked quite frequently about the relationship between home values and tax assessments. After a lengthy analysis of the 528 home sales in Rockingham County during 2011, as recorded in the HRAR MLS, here is what I'm finding.... (click here for the same information for the City of Harrisonburg)  click the infographic above for a printable PDF version. The bottom line here is that County properties seem to be under-assessed by an average of 10%. Most buyers pay more than assessed value for the properties they purchase. | |

Home Values compared to Tax Assessments in the City of Harrisonburg |

|

City of Harrisonburg real estate tax rate likely increasing 7%, mirroring Rockingham County increase |

|

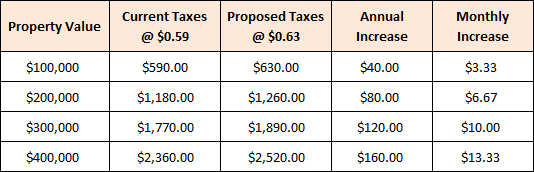

Rockingham County is considering raising the real estate tax rate from $0.60 to $0.64 per $100 of assessed value (details here). The City of Harrisonburg is now considering a similar increase, from $0.59 to $0.63 per $100 of assessed value. The reasons cited for the proposed tax rate changes are increased Virginia Retirement System costs, and decreased property values. There are a few other tax rates that would change, but here is how the real estate tax rate changes would impact homeowners in the City of Harrisonburg....  Of note, the City's real estate tax rate was $0.62 per $100 of assessed value very recently -- it was adjusted down to $0.59 per $100 of assessed value in the 2008 fiscal year. Thus, looking at this over six years (2007-2013) this is only an increase of $0.01 per $100 of assessed value -- thus an effective 1.6% increase in the tax rate over the past 6 years. Click here for the full article from the Daily News Record. | |

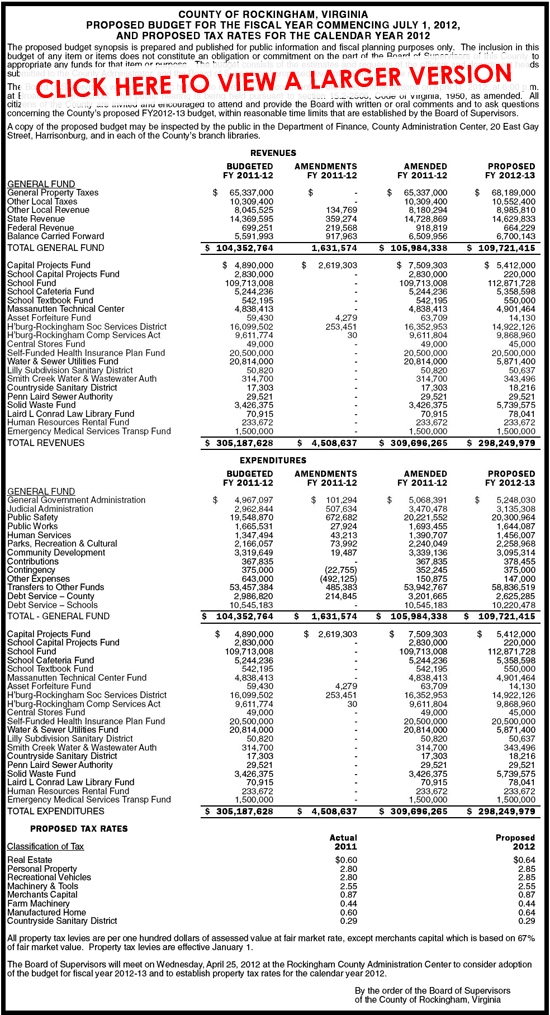

Proposed Rockingham County budget (2012-2013 fiscal year) and proposed 2012 tax rates ($0.64 for real estate) |

|

Some observations without knowing much about the budget:

| |

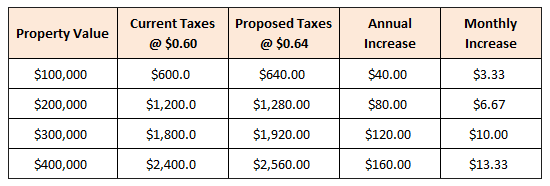

Rockingham County considers 7% increase to real estate tax rate |

|

As per the Daily News Record today, the Finance Committee for Rockingham County has proposed an increase of the real estate tax rate --- from $0.60 per $100 of assessed value up to $0.64 per $100 of assessed value. Here's how that would impact a few different price ranges of homes....  In many ways, it is actually surprising that we haven't seen an increase in tax rates before now --- many localities across the country have been forced to do so in order to continue to pay for public services. Click here for the full article from the Daily News Record. | |

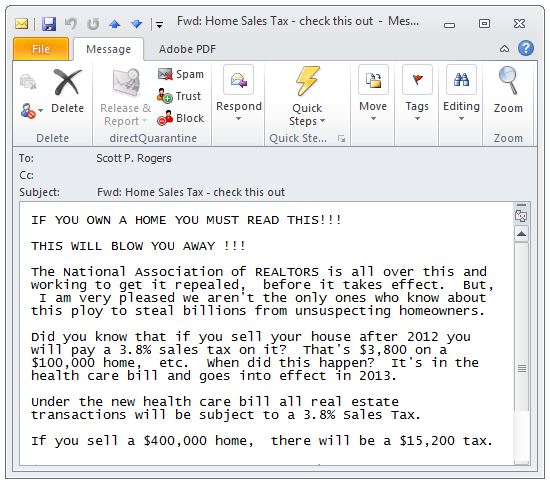

Is there really a new 3.8% Real Estate Sales Tax? |

|

I have had several people ask me about this in the past week, so I thought I'd clarify. The e-mail above is an example of what you might hear about -- a scandalous part of the health care bill that will charge everybody a sales tax of 3.8% of their home sales price starting in 2013. Is it legit? Will you pay this sales tax if you sell? Most likely not. Let's take a look.... The 3.8% tax is a tax on a very narrow band of investment income for high-wealth households (those who earn $250,000 in a joint return or $200,000 as an individual) that could come into play on the sale of a house if the sales gain is more than $500,000 for a married couple or $250,000 for an individual. Even in the unlikely event the sales gain is more than that amount, the tax would only apply based on other considerations having to do with the household's income and tax situation. The bottom line is that the tax, which was imposed to help shore up Medicare, will hit only some portion of investment income. (source here, and more here) So, here's a quick test to help you understand how wide of an affect this 3.8% tax will (or will not have):

So, back to the original e-mail --- Will the seller of a $100K home pay $3,800 per this tax? Absolutely not -- how could they have had a $250K profit if they sold their house for $100K? Will the seller of a $400K home pay $15,200 per this tax? It's possible -- if they are single, and they bought the house for only $150K, and they make over $200K/year. Hopefully you can see how far from reality the rumors are of this 3.8% real estate sales tax. Feel free to call me (540-578-0102) or send me an e-mail (scott@HarrisonburgHousingToday.com) with any questions.. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings