| Newer Posts | Older Posts |

Most Buyers Include A Study Period In A Contract For A Building Lot Or Land |

|

Getting ready to build your dream home? Exciting!!! Did you find the perfect building lot in a neighborhood? Or an ideal 2.5 acre lot in the County where you plan to build? Fantastic!!! You have two options at this point... [1] Continue to do lots of research and planning, and then if it all pans out, make an offer and try to negotiate a deal with the seller. [2] Make an offer with a study period. Most buyers seem to be more comfortable with the second option -- going ahead and making an offer, with a study period. This strategy allows you to make sure you can negotiate a deal with the seller that works for you from a price (and other terms) perspective -- before then spending a good bit of time, and possibly money, on confirming that the lot or land is suitable for your building plans. During your study period (often 30, 60, 90 days or longer - depending on the property type) you will likely... [1] Walk the building lot with your builder. [2] Research details of utility locations and/or availability. [3] Confirm any easements that would affect where you could build. [4] Research how much rock may exist and whether that will affect your building plans. [5] Get pricing from your builder for building your dream home now that you have a proposed site/location for it. These are just a few of the items we might research during the study period in your contract -- all pointing us to a greater understanding of whether your plans for building on the lot will work well for you. If you're ready to explore some land or building lots, be in touch! | |

Depending On How Long You Plan To Be In Your Home, A Rate Buy Down May Make Lots Of Sense! |

|

One option you will have when finalizing your loan terms with your lender will be buying down your mortgage interest rate. Current mortgage interest rates are right around 6.7% -- but you very likely will have the option to pay some extra closing costs to buy down that mortgage interest rate. The more you pay, the lower that rate will go - and the that lower rate will last for the life of your loan. Of note, if you think you might be selling your home within two to three years, it might not make sense to pay thousands of dollars up front to secure a lower than market interest rate -- but your lender can help you determine the length of time you would need to be in your home to make the cost of the rate buy down make sense. If you know (or believe) you will be in your home for many (many!) years to come, you may very well want to go ahead and buy down that interest rate. There are lots of options to consider when securing a mortgage, and if you have questions about the many different options, feel free to run them by me. | |

The Snow Has Melted, Bring On The Power Washing, Mulching And Exterior Painting In Preparation For Listing Your Home Soon Or This Spring |

|

For anyone preparing to sell a home shortly-ish after the first of the year, they may have had a temporary setback in the way of SNOW -- that didn't melt in the short 48 hours that snow usually sticks around in the Valley. A decent bit of snow, plus some cold (COLD) temperatures kept the snow around longer than many had anticipated. But, it's mostly gone now -- and I'm not seeing any snow in the forecast over the next two weeks. So, if you're hoping to list your home soon, now is the time do that final outdoor prep... [1] Maybe some pressure washing? [2] Touch up paint on any wood trim areas that need some attention. [3] Add some fresh mulch and clean up the edges of your lawn and landscaping beds. If you need help with any of these sorts of jobs, let me know, and I can point you towards some resources to help you get the job done. And then... assuming you've been working on prepping your home's interior as well... it will be time for photos, some conversations about pricing, and we'll be ready to get your house on the market. For home buyers that haven't been seeing many options of homes for sale over the past two months, I hope there will be some good options for you over the next two months. Just listen for those pressure washers starting up... the home sellers are getting ready for you! | |

Some Townhomes Owned By Investors Are Being Offered For Sale. Will They Be Purchased By Owner Occupants Or Other Investors? |

|

Lots and lots of townhouses in and near Harrisonburg are owned by investors. I know, that's a very exact and precise figure. ;-) Anecdotally, I've seen some of those townhouses hitting the market for sale over the past two months. Not an overwhelming number... more than five but fewer than ten. My curiosity is in whether these investor owned townhouses will remain investor owned -- if another investor will buy them -- or if an owner occupant will purchase them. I work with plenty of investor clients, and so in some sense I'm rooting for them, if any of them want to buy another investment property. But... I think I'm rooting for the would-be owner occupants just a smidge more than the investors. Buying a home, moving in, investing in that home and in a neighborhood, having a sense of stability and permanence are all things that help build the Harrisonburg community that we know and love. If or as folks decide that they would like Harrisonburg to be their home for the long term, I'd be delighted for them to be able to *buy* a home and not just have to *rent* a home -- IF their financial situation points to that being a wise and sustainable decision. Anyhoo... only time will tell whether these (few) recent investor owned townhouses will be purchased by other investors or by owner occupants... but I'm a big fan of homeownership, so here's hoping that at least some of them will be purchased by those who plan to live in them and make Harrisonburg their home for years to come. | |

Will We See A Fast Moving Real Estate Market In Spring 2024 In Harrisonburg And Rockingham County? |

|

Many or most resale homes have been going under contract very quickly when they have been listed for sale over the past four years in Harrisonburg and Rockingham County -- largely because demand for these homes has exceeded supply. I don't expect that we will see supply exceeding demand this coming spring, but I also don't know that most sellers should expect to have their homes under contract within just a few days as has often been the case for the past few years. Looking at resale homes that have closed in Harrisonburg and Rockingham County over the past 60 days...

Will we see a fast moving real estate market in Spring 2024 in Harrisonburg and Rockingham County? Likely so. Will most home sellers be able to count on their homes being under contract within a few days? Maybe not. | |

Would Be Home Buyers Are Finally Finding (Some) Relief In The Way Of Mortgage Rates |

|

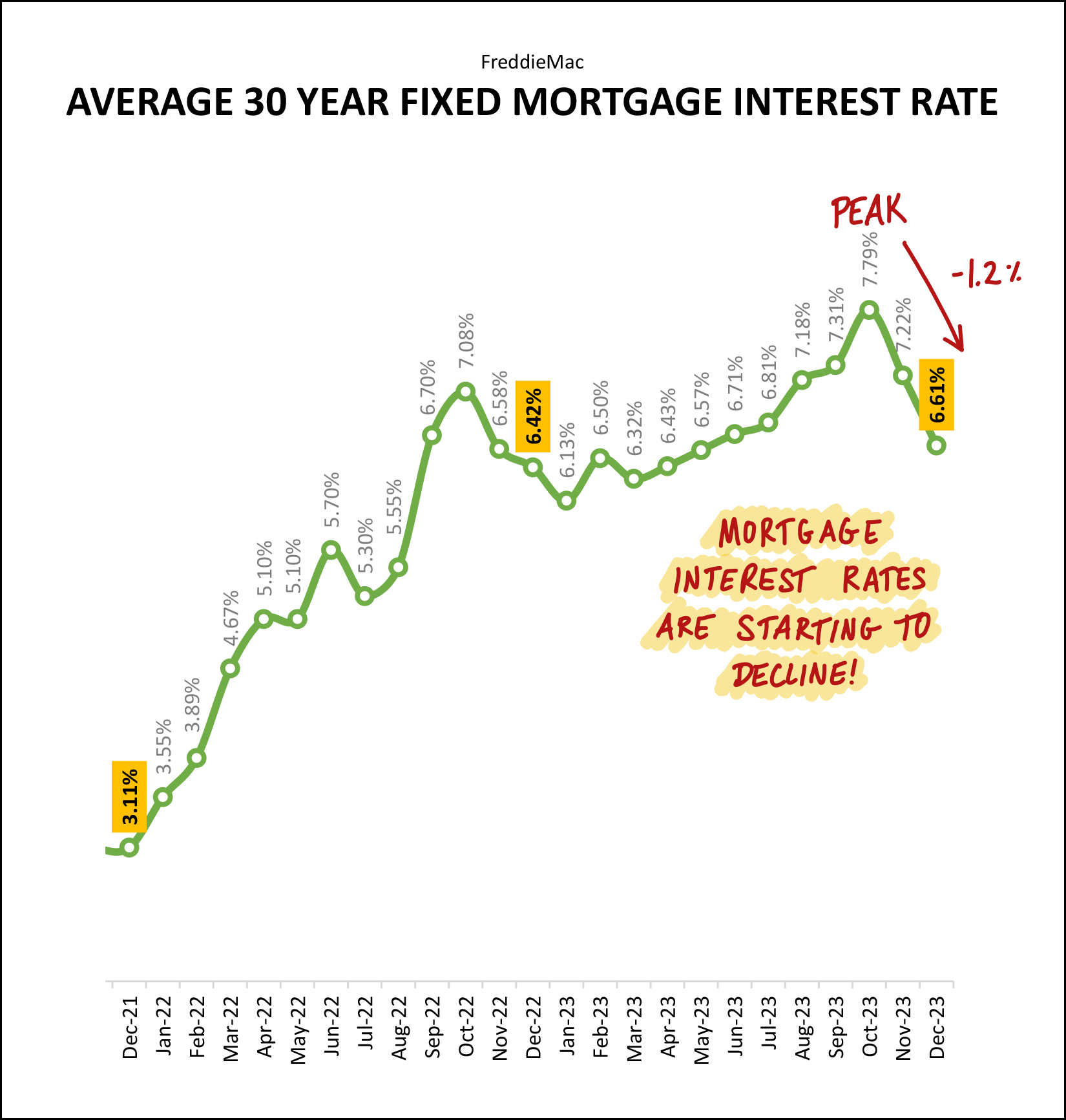

For over 10 years (Feb 2011 - Apr 2022) mortgage interest rates were below 5%. For about 3 years (May 2019 - Mar 2022) mortgage interest rate were below 4%. But since that time, they shot past 6%, past 7% and nearly hit 8%. Perhaps unsurprisingly, many buyers have found themselves priced out of the homes they want to buy over the past year. Not only were these buyers facing ever higher mortgage rates -- home prices were also continuing to climb, with the median sales price increasing 10% over the past year. But finally, some buyers are finding some relief in the way of lower mortgage interest rates. After peaking at 7.79% in October 2023 we have seen the average 30 year fixed rate mortgage drop steadily to it's current level at 6.60%. We're still not back down to 4% or 5% -- but a mortgage payment at 6.6% certainly makes many houses more affordable than they were at 7.79%. If you plan to buy a home in 2024 and you last talked to your lender in October or November of this past year, connect with them again soon -- you will likely be pleasantly surprised at how your projected monthly payment has adjusted given declining rates.

| |

So Many Different Ways To Consider Buying A Home If You Also Need To Sell A Home |

|

If you have own a home... but are ready to buy a new one... sometimes the biggest challenge is figuring out how to buy the next home while selling the current one. This list doesn't include all the possible ways to do it... but it includes quite a few options to consider and explore... Buy First, Seller Later. If you are qualified for a mortgage to purchase the next home before you sell your current home, this may be the way to go. This will allow you to make an offer on a house you love without a home sale contingency, which often won't be be accepted by a seller. Certainly, there are some risks to this approach -- you won't know how quickly your home will sell or for what price -- but it will be a lot easier logistically. In addition to being able to make an offer without a home sale contingency, you will also be able to move into the new home before having to move out of your existing home. List Your Home For Sale After Having A Contract To Buy The Next Home. Shifting pretty far from the prior strategy - the concept here would be waiting to list your home until you have secured a contract to buy the home you want to buy. But... this isn't necessarily a realistic strategy in the current market. Most home sellers aren't going to be interested in your offer if it is contingent on you listing your home, getting it under contract, working through any contingencies and then getting to closing. So... it's fine to make offers with this contingency but it is not necessarily realistic to think that a seller will go along with your proposed plan. List Your Home For Sale After Seeing The Perfect House To Buy. This one is a bit tricky from a timing perspective, but it's trying to end up somewhere between the two strategies noted above. This game plan would involve waiting until a perfect house comes on the market for sale, and then listing your home for sale. The hope would be that you could get your current house under contract quickly enough to then make an offer contingent on your (under contract) home making it to closing -- instead of contingent on your (not yet listed) home being listed, going under contract and making it to closing. Most sellers will be more excited about your offer this time -- since your house is already under contract -- but your offer will still likely be seen as less favorable compared to an offer without a home sale contingency at all. List Your Home For Sale, Contingent On You Finding A House To Buy. If you have tried the above strategy (listing your home for sale as soon as a perfect house to buy comes on the market) a few times without success -- because another buyer jumped on that perfect house before your house was under contract -- then maybe this strategy is for you. We can list your home for sale without knowing what you will buy. When a buyer is ready to commit to buying your home, we can propose contract terms that make the sale of your home contingent on you securing a contract on a home you would like to purchase. Some buyers might go along with this, but some won't like the uncertainty of whether they are really buying your house. This strategy is asking the would-be buyer of your house to take on the risk of whether you will be able to find a house to buy and have your offer on that house accepted. List Your Home For Sale, Hope For The Best For A Next House. If you have tried the above strategy (listing your home for sale, contingent on you securing a contract on a house to buy) and it didn't work -- because buyers don't like that uncertainty -- then maybe this strategy is for you. We can list your home for sale, when a buyer comes along we can propose a slightly longer (60-75 day) closing timeframe, and then hope that a perfect house comes along in the next few weeks, allowing you to (hopefully) contract on the next house, with both closings to coincide. Certainly, if the right house doesn't come along, or if that seller doesn't like your contingent (on home settlement) offer then you might not be able to secure a contract to buy a home -- and you would still need to sell your current house (and move out of it) per the terms of your contract with a buyer. Eek. List Your Home For Sale, Hoping For A Flexible Buyer. We wouldn't want to bank on this being possible -- but if we list your home for sale, and a buyer comes along that is either an investor (planning to rent out your house) or is very flexible about when they would move in -- then you could contract with this flexible buyer knowing you wouldn't have to move out right away when the settlement date rolls along. This might buy you a few extra months to find the right home to contract to buy -- either making an offer contingent on your home getting to settlement (if closing hasn't happened yet) or not contingent on a home sale at all if the closing has taken place. Come To Terms With Moving Twice. This is perhaps the least exciting logistically. Nobody really likes moving. Moving twice is just about twice as bad as moving once. But... if the fact that you need to sell your home limits your ability to purchase the home (or homes) that you want to buy -- then you may need to sell your home, move into a rental, and then make offers without having a home sale contingency. If you will be buying a home -- but you need to sell a home -- we'll talk through all of these options and more to figure out the best strategy for getting you to that next home. | |

Will Would Be Home Buyers Have More Competition Two Months From Now Than They Have Today? |

|

It seems likely that would-be home buyers will have more competition from other buyers two months from now compared to today. Here's why... [1] Mortgage interest rates have been trending steadily downward since late October. They seem likely to continue to trend downward over the next two months, even if not quite as quickly as they had been dropping. [2] Many more buyers seem to be looking buy homes in the spring than in the winter. [3] Many leases end in spring/summer - so any would-be buyers who are currently renting will be more seriously considering a purchase two months from now more so than they are today. [4] We will likely start to see more listings coming on the market in March and April, which seems to draw even more buyers out into the market. All that is to say that if you are thinking about buying a home sometime in the next six months -- you should carefully evaluate all current listings to see if there is a good fit that might be on the market right now for you to buy. Two months from now you will likely have more competition from other buyers. As an added bonus -- current home sellers who have had their home on the market for more than a few weeks may be more motivated to strike a deal with you than they (or other sellers) will be two months from now. | |

Many Homeowners Are Not Motivated To Sell Their Homes And Do Not Anticipate Being So Motivated Anytime Soon |

|

Over the past five-ish years we were all living in a world of rapidly rising home prices, a fast moving real estate market and super low mortgage interest rates. Thus, if you owned a home but saw another home hit the market for sale that tickled your fancy, you might very well decide to sell your home. After all... [1] Your home was worth a good bit more than it was last year or a few years ago. [2] You were certain to be able to secure a contract on your home very quickly. [3] Your new mortgage payment would be oh, so low given 3% - 4% mortgage interest rates. But... some of these factors have changed now, though admittedly, some have not... [1] Your home is still likely worth a good bit more than it was last year or a few years ago. [2] Your home still relatively likely to go under contract quickly, though that is not the case for all homes any longer. [3] Your new mortgage payment will be oh... so... high !?! given mortgage interest rates above 6%. That last point... the potential housing payment for your new place if you decide to sell... is what is keeping many homeowners right where they are. Most homeowners are not very motivated to sell their homes right now -- because of their current low mortgage interest rate compared to the much higher rate if they sold and bought today -- and that low motivation level to sell does not seem positioned to change anytime soon. | |

There Are A Limited Number Of Available Building Lots For Custom Homes In Our Area |

|

Just an observation here, but there are currently a very limited number of options for buying a building lot, hiring a home builder and building a custom home. Furthermore, I don't know if that will change much over the next few years. There are (27) building lots on the market (per the HRAR MLS) in or near Harrisonburg -- with a "Harrisonburg" or "Rockingham" address. Of those 27 building lots... 7 are in Crossroads Farm, 9 are in The Springs at Osceola,and the other 11 are scattered around here and there. In the time I have been in real estate (20 years or so) there have been quite a few single family home neighborhoods where future homeowners (or builders) could purchase a building lot to build a home. These included:

Now, there aren't any (or many) undeveloped building lots in these neighborhoods... and I don't know what the next neighborhoods will be to go on this list. Most current new developments or proposed developments seem to be one of three varieties... [1] Apartments [2] Townhouses [3] Detached Homes all to be built by a regional or national builder So, when will we (will we?) see other neighborhoods planned and developed where building lots can be purchased where a builder can be hired to build you a home? | |

Phase One Plat For Bluestone Town Center Proposed To Include 146 Apartments, 106 Townhomes, 38 Manufactured Homes on 28.31 Acres |

|

The developers of Bluestone Town Center are proposing a plat for the first phase of the development to include the following property types on 28.31 acres...

A few other interesting details about this upcoming first phase of the development include...

| |

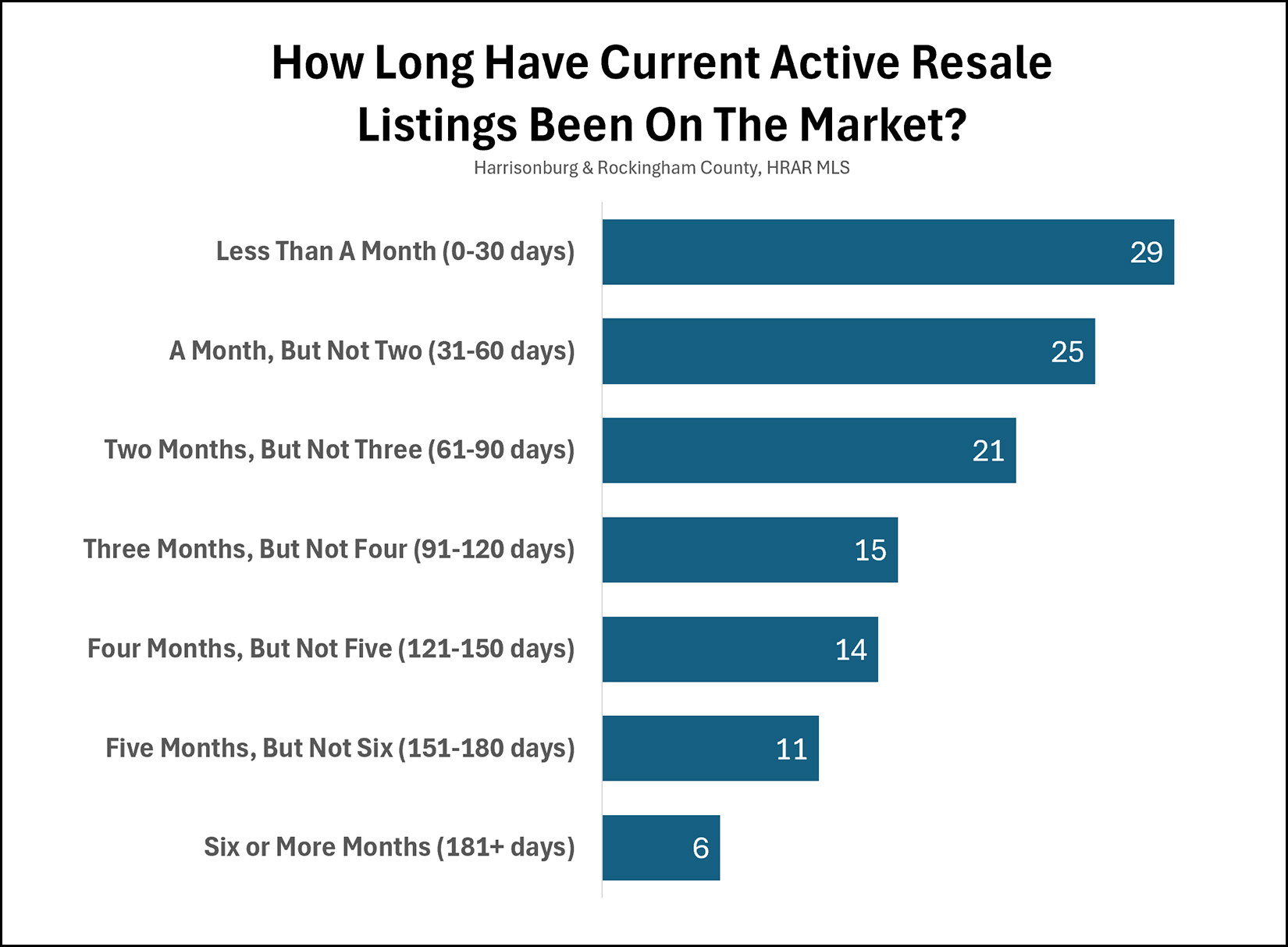

How Long Have Current Active Resale Listings Been On The Market? |

|

The graph above speaks for itself, but I'll point out a few more things that aren't explicitly referenced above... 76% of currently active resale listings (not new homes) have been on the market for more than a month. The median days on market of all 121 active listings is 65 days. That is to say that half of the current resale listings on the market have been on the market for 65 or fewer days... and half have been on the market for 65 or more days. The data above is relative to active listings. Let's contextualize this a bit further by looking at pending listings and then sold listings. Of the 87 resale homes currently under contract, the median days is 33 days. Of the 114 resale homes sold in the past 60 days, the median days on market was 17 days. Of the 894 resale homes that sold in the past 365 days, the median days on market was 7 days. So... Active listings = 65 days Pending listings = 33 days Sold in past 60 days = 17 days Sold over past year = 7 days Days on market -- the time it takes a home to sell -- seems to be drifting upward, at least recently, at least on resale homes. | |

2023 Recap On Our Local Housing Market Shows 23% Fewer Home Sales At 10% Higher Prices |

|

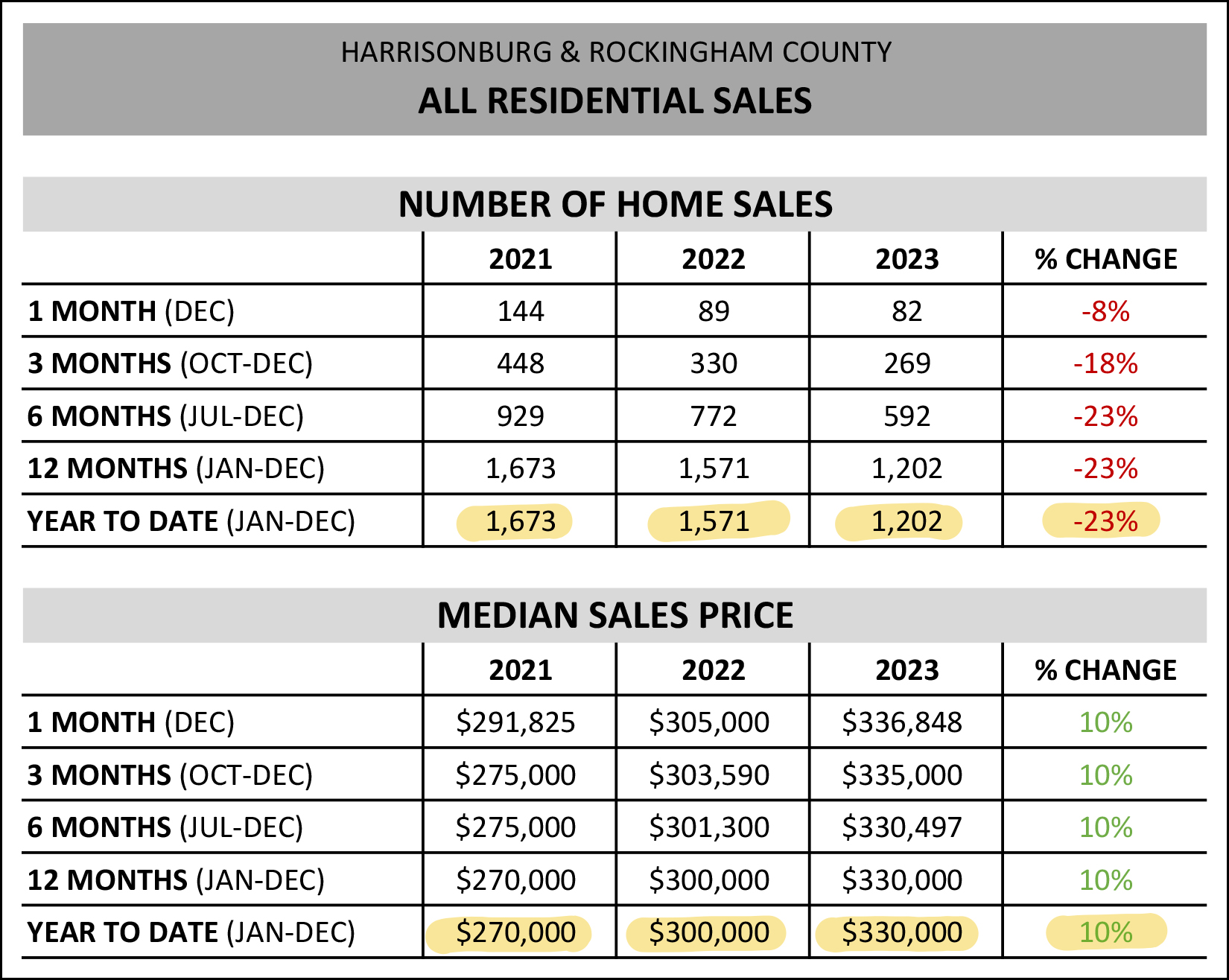

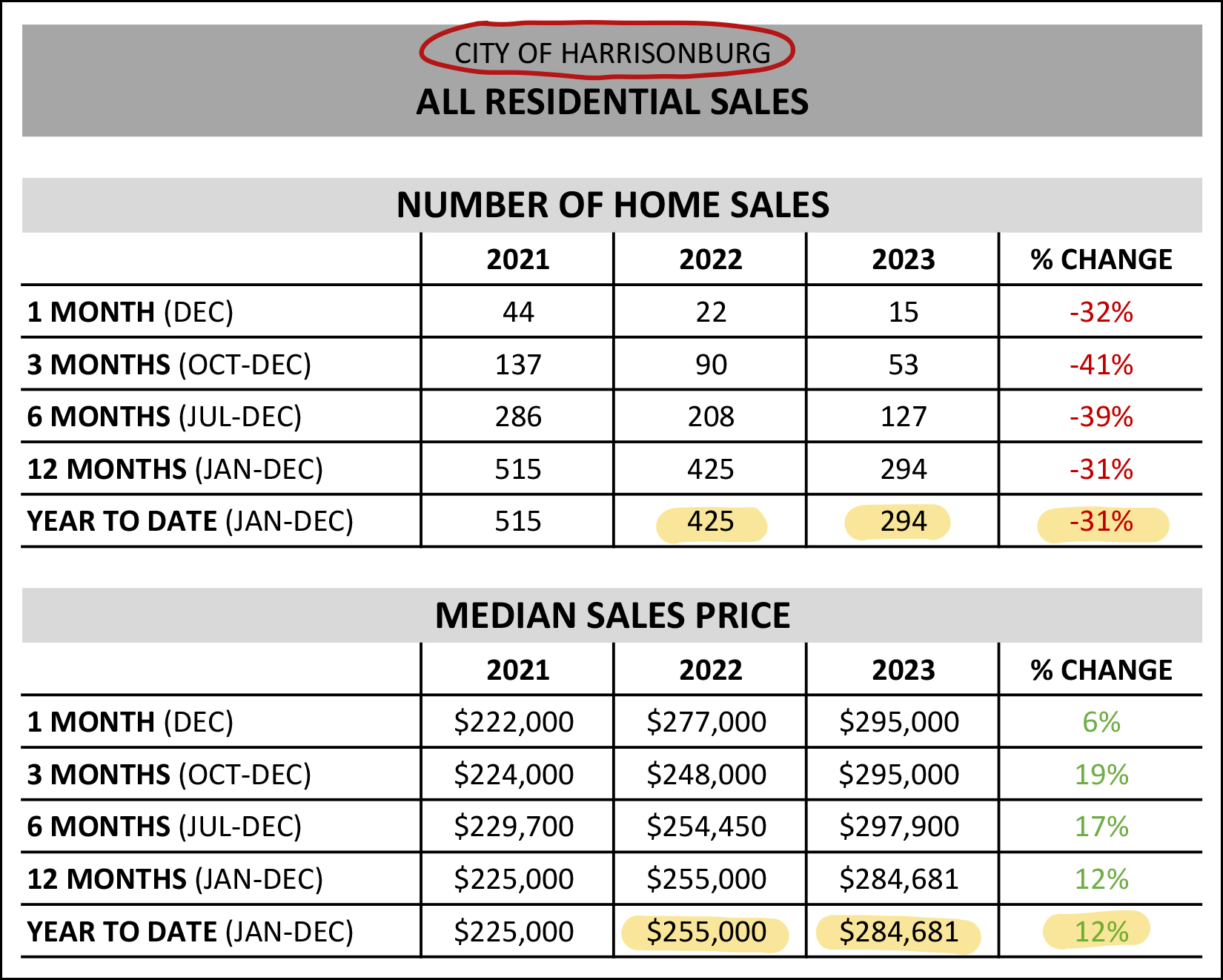

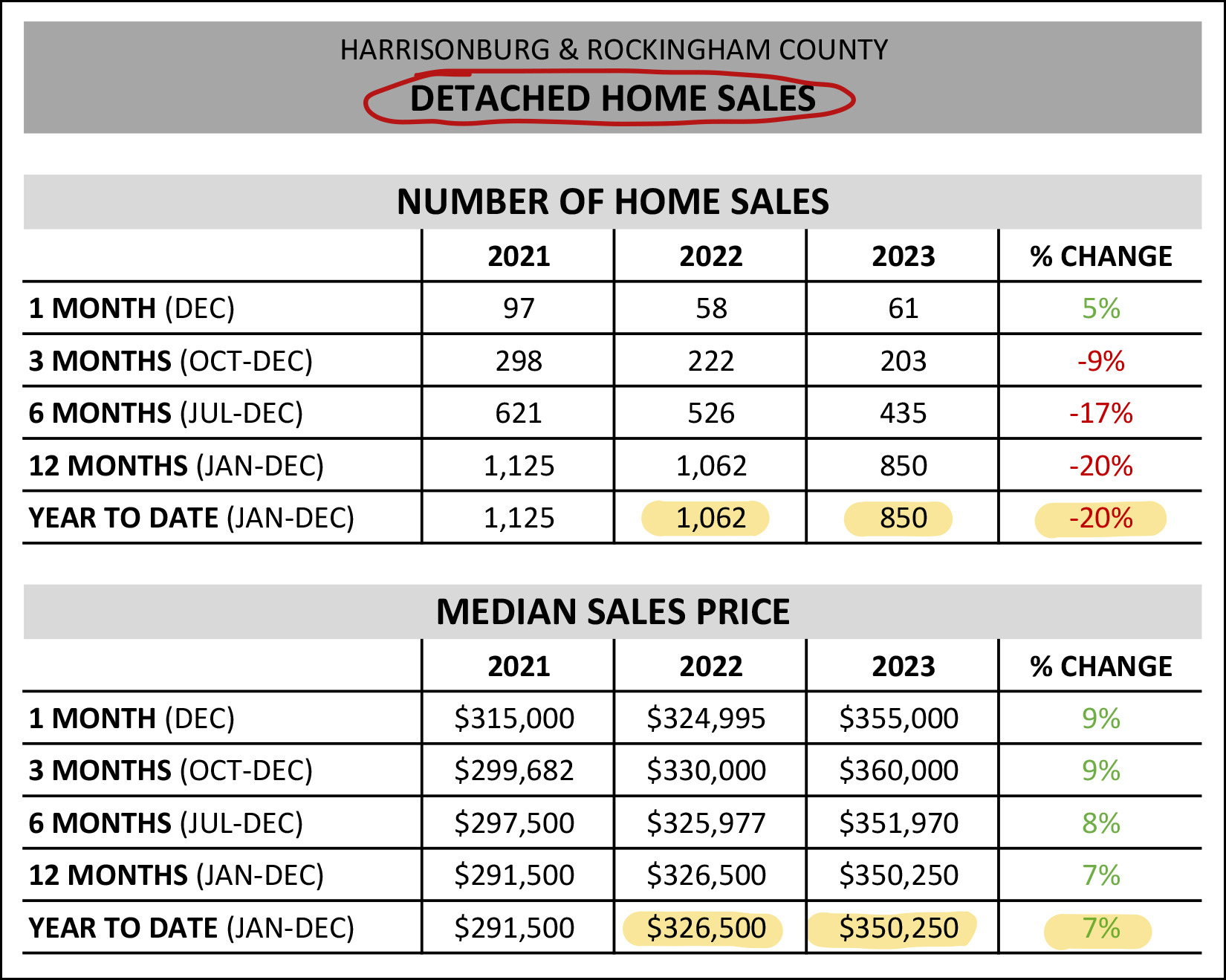

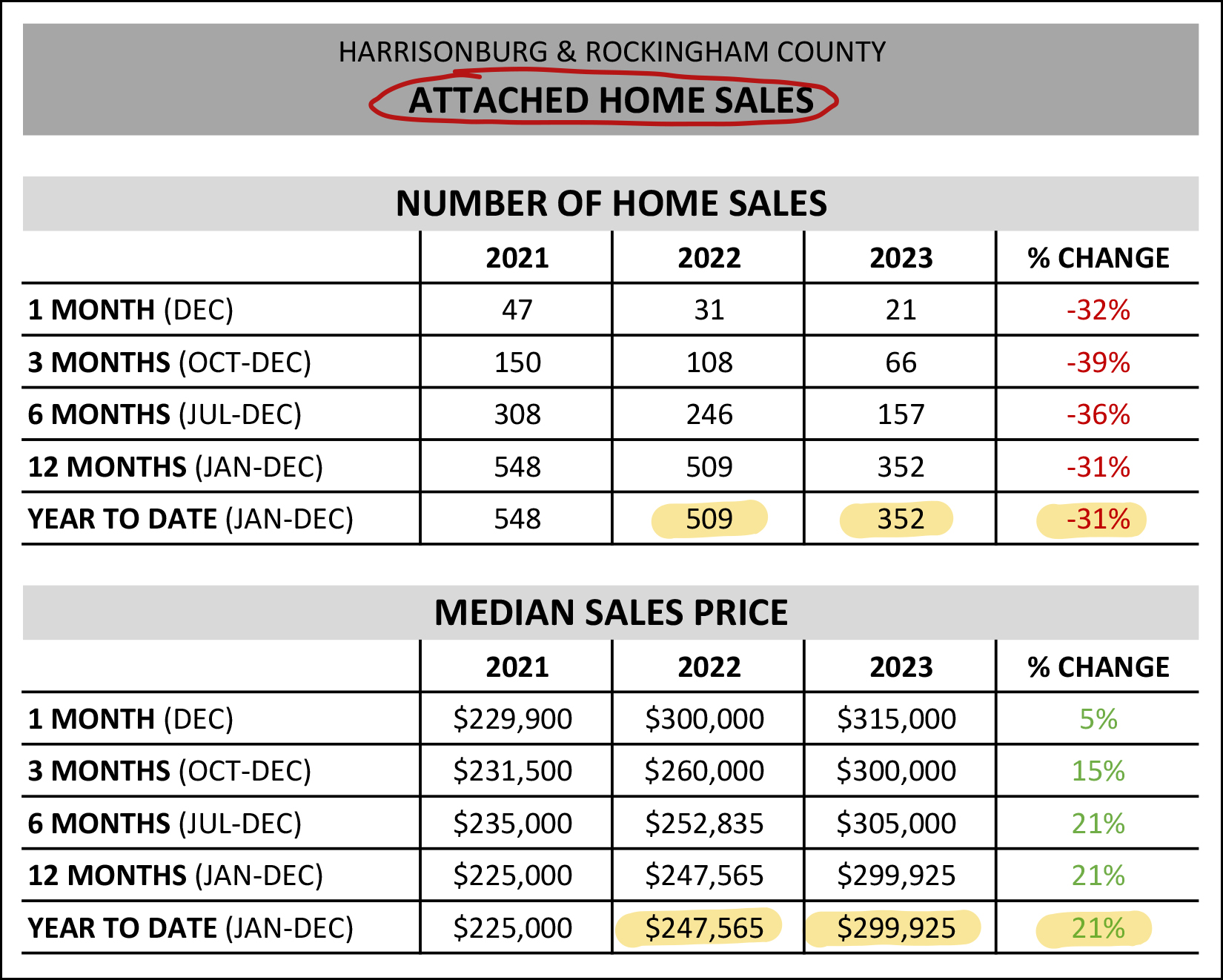

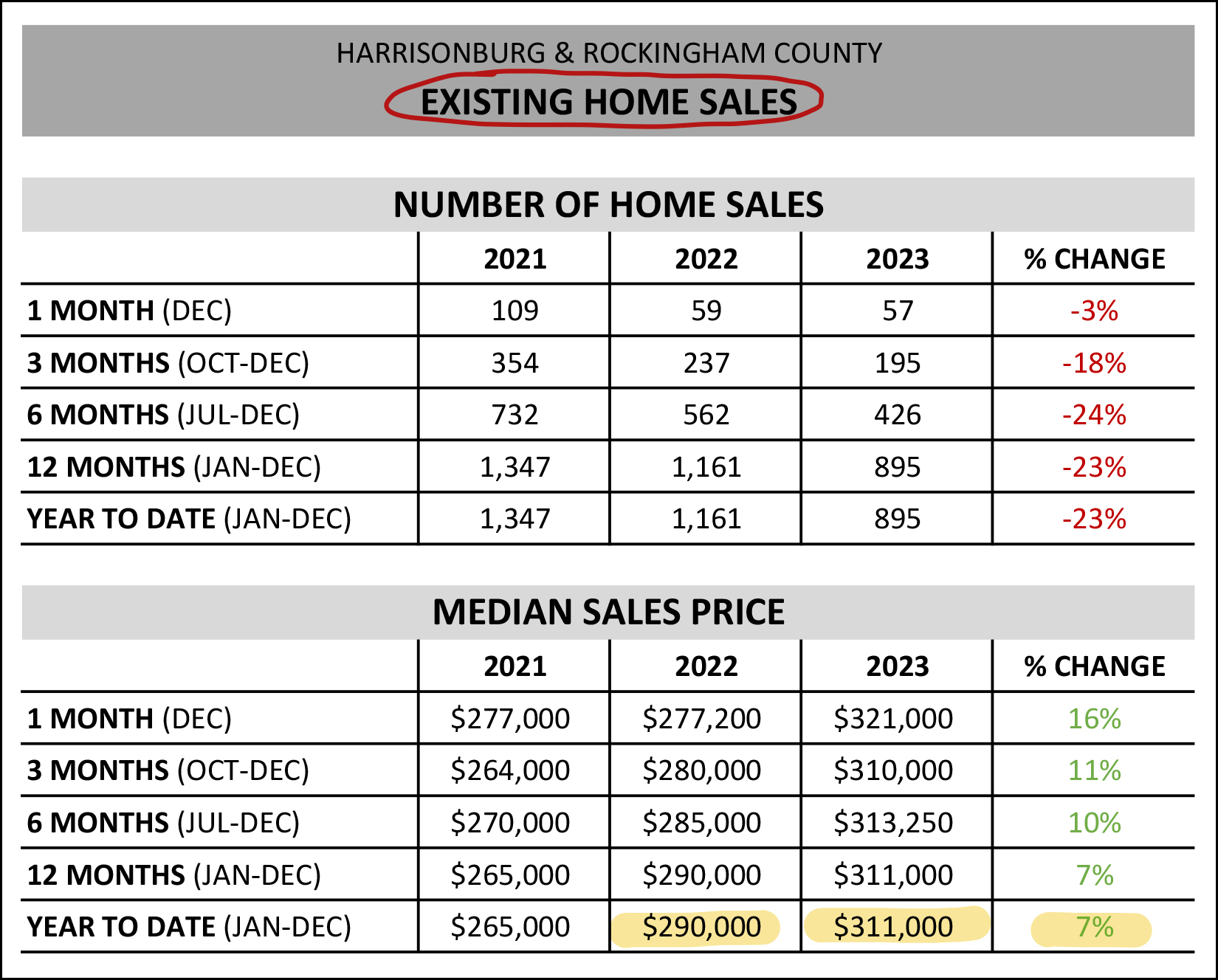

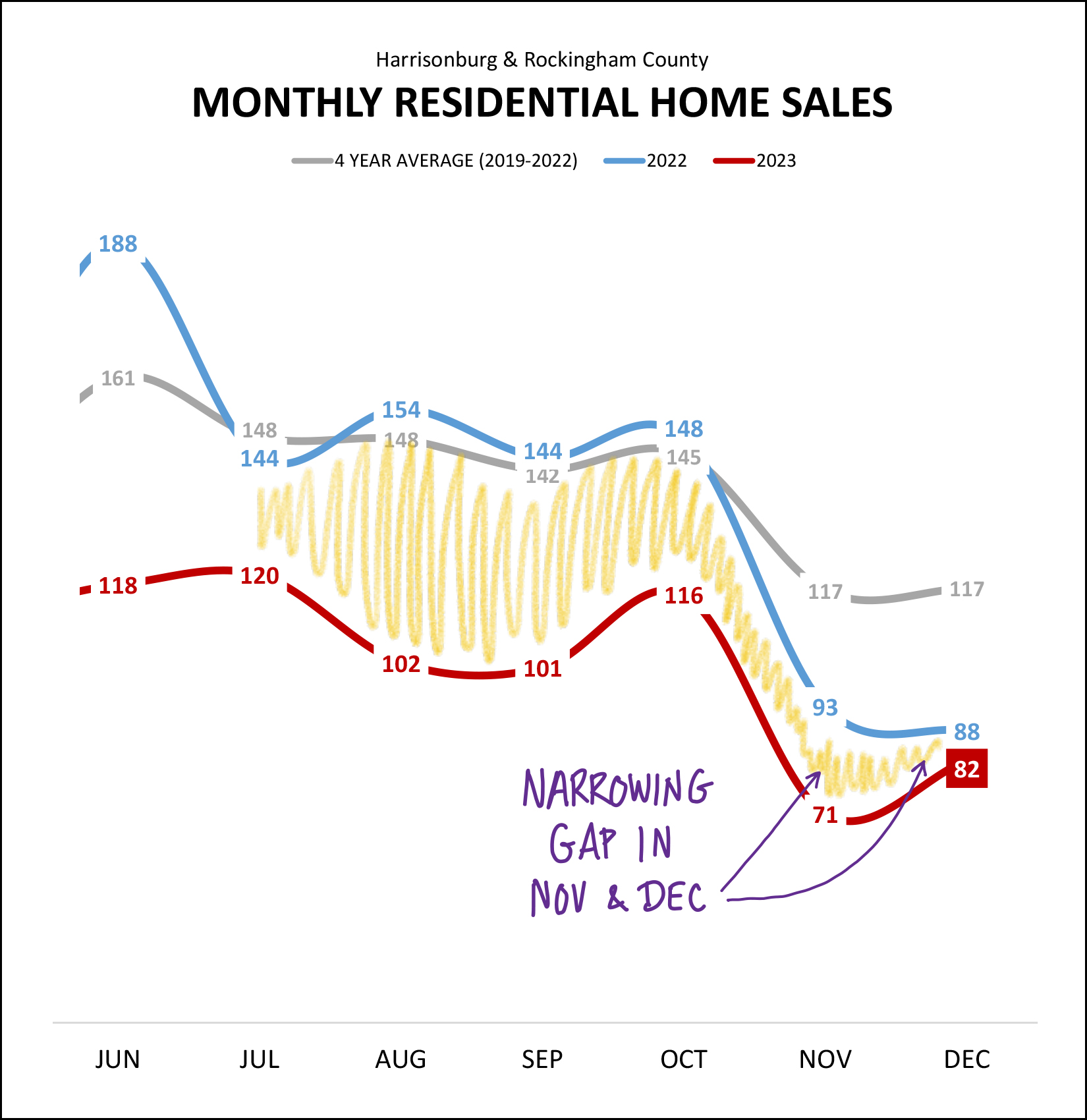

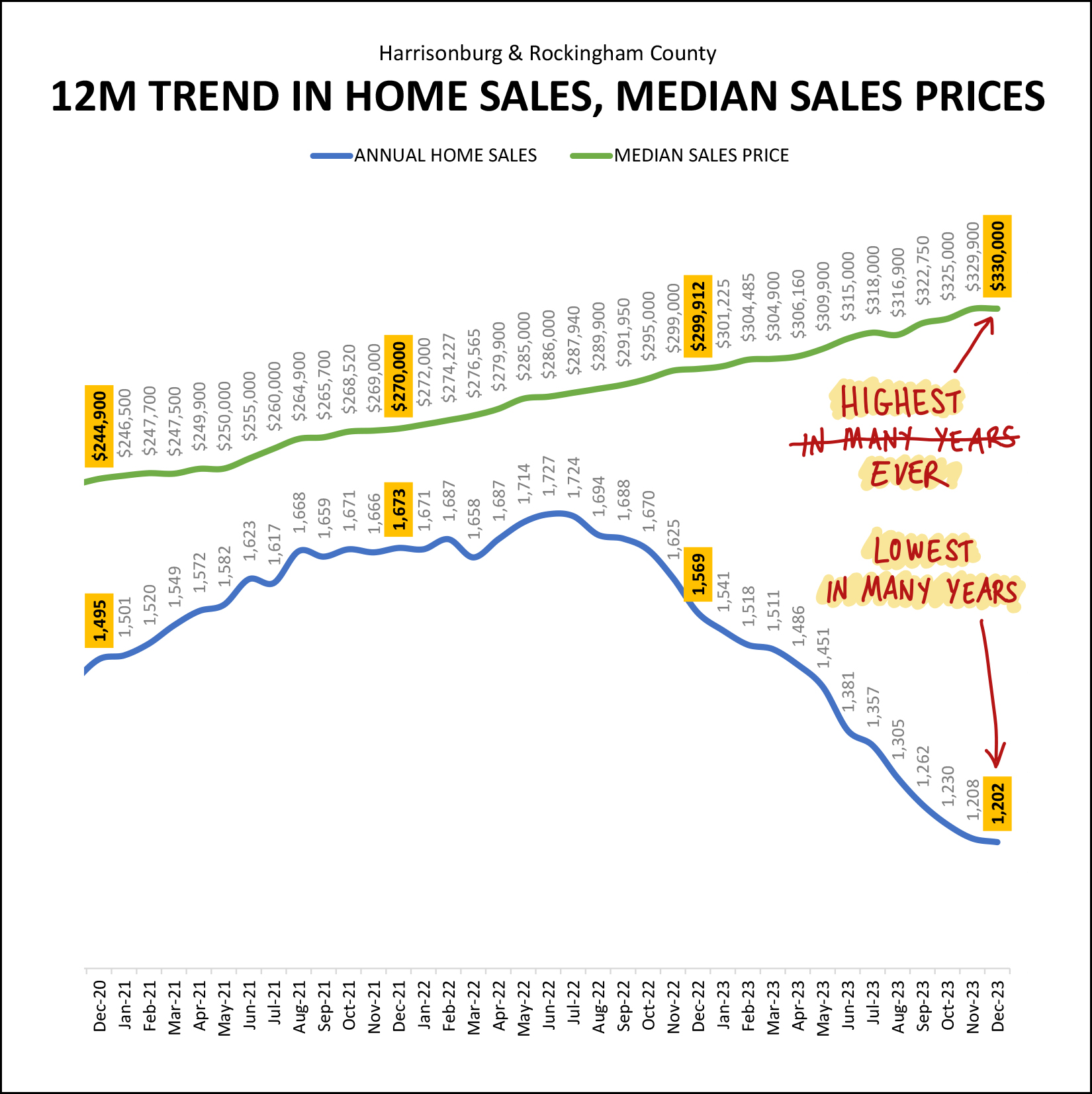

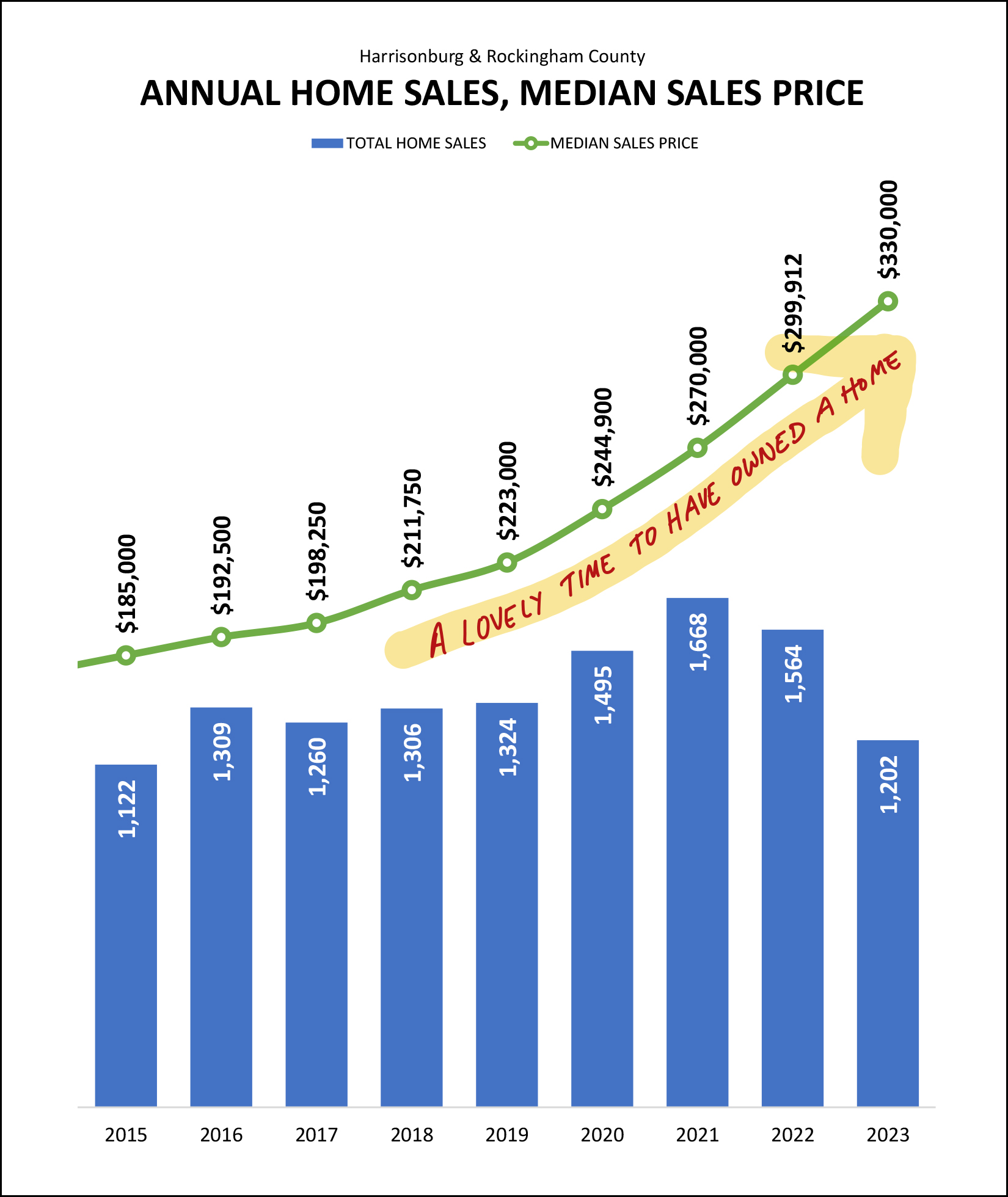

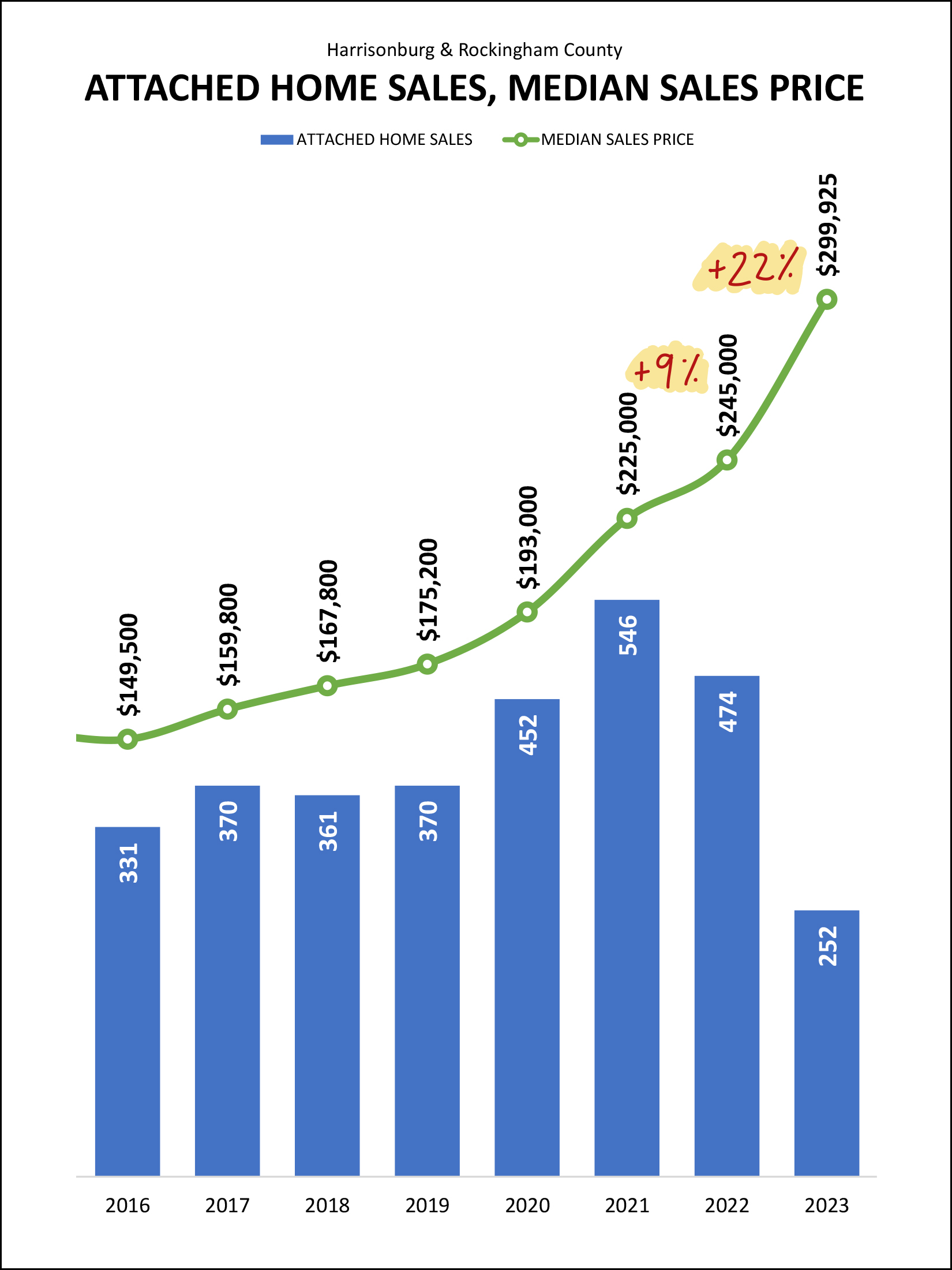

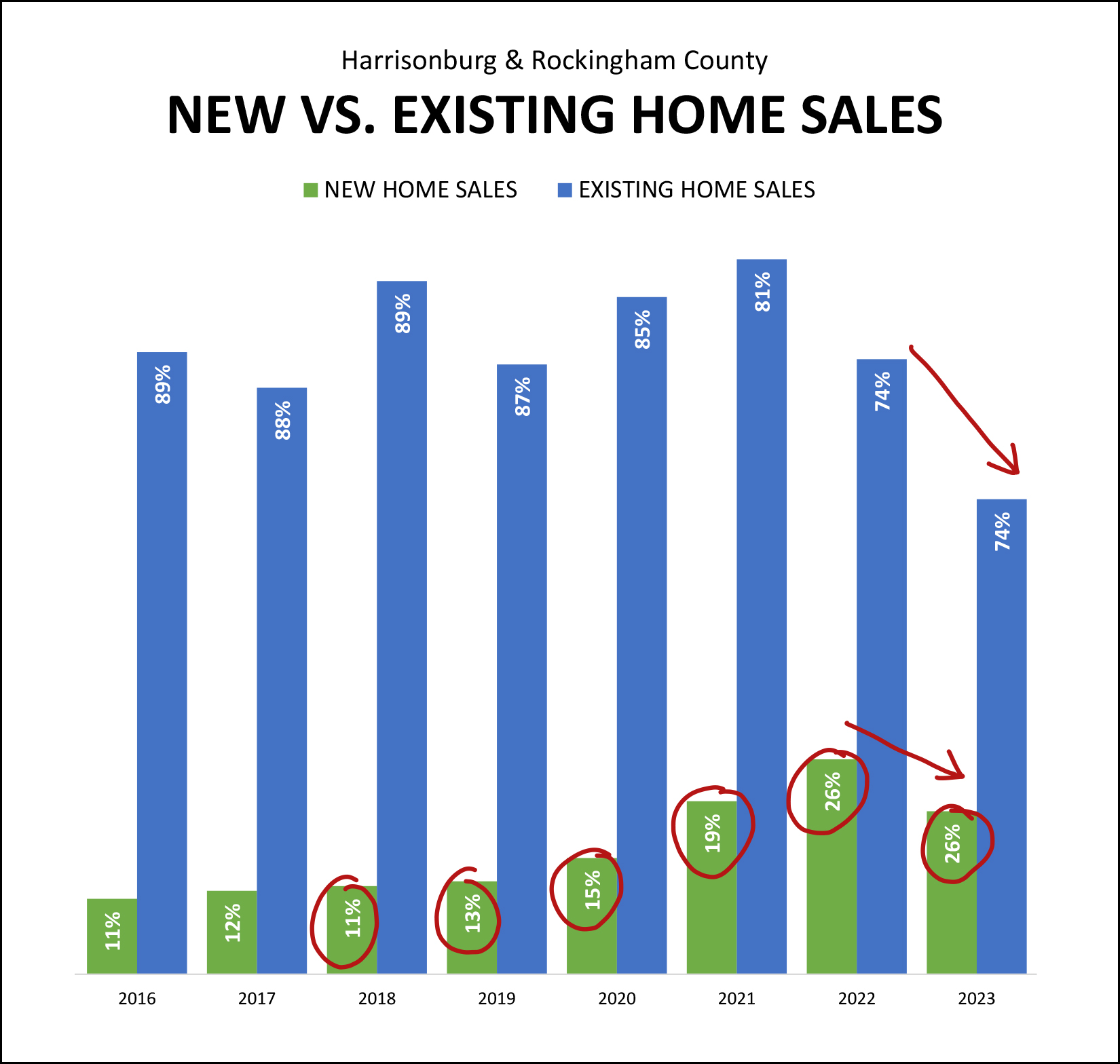

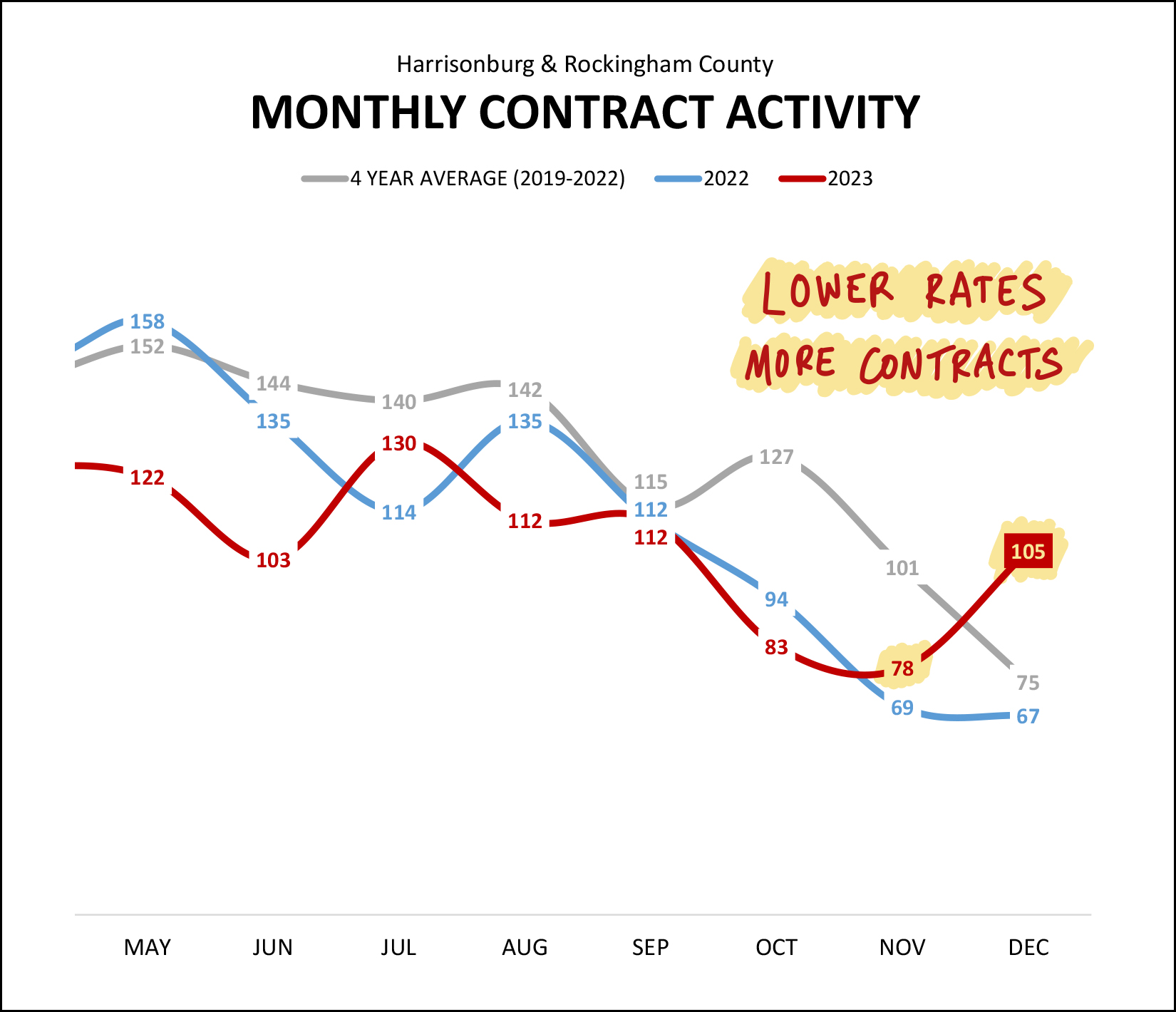

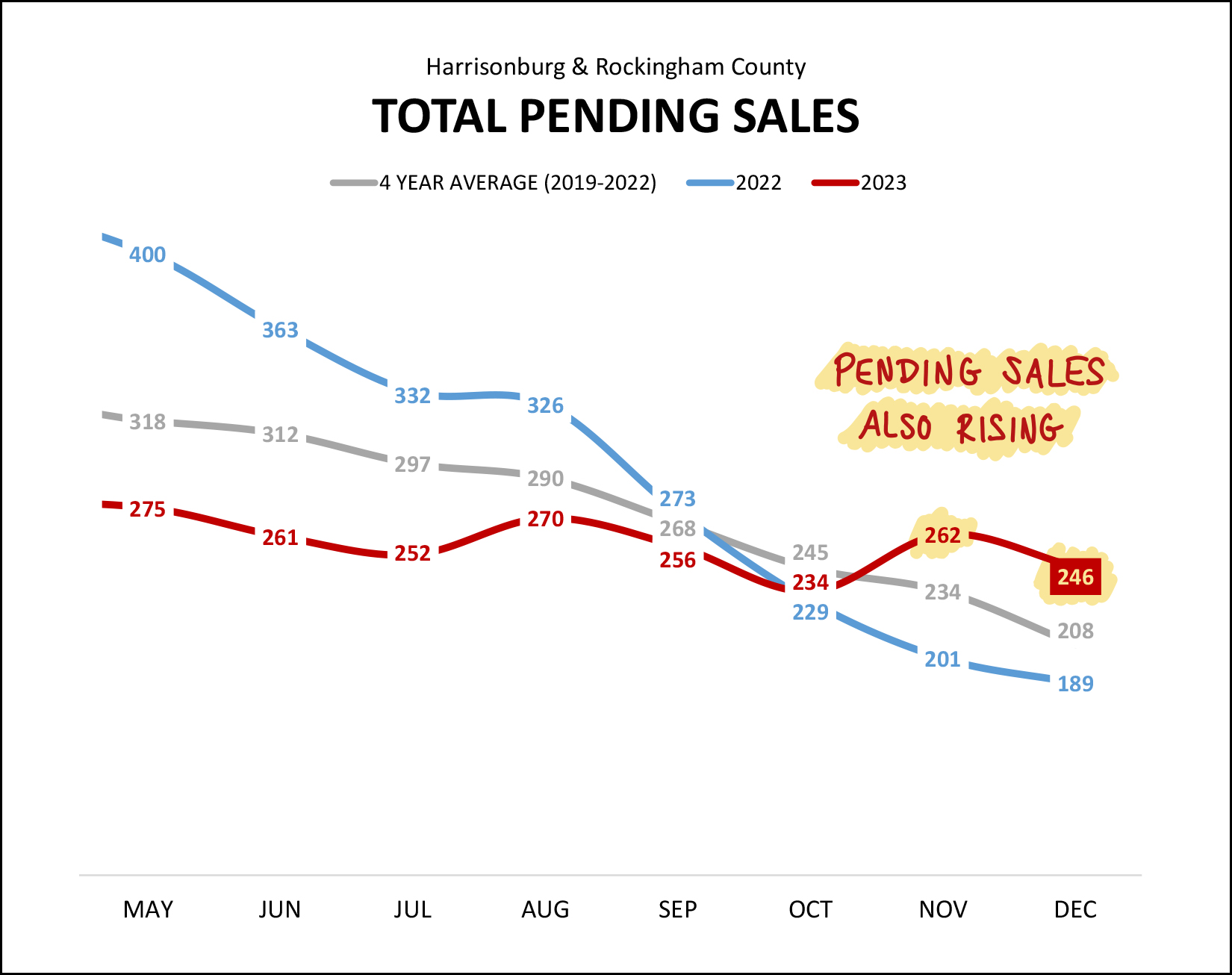

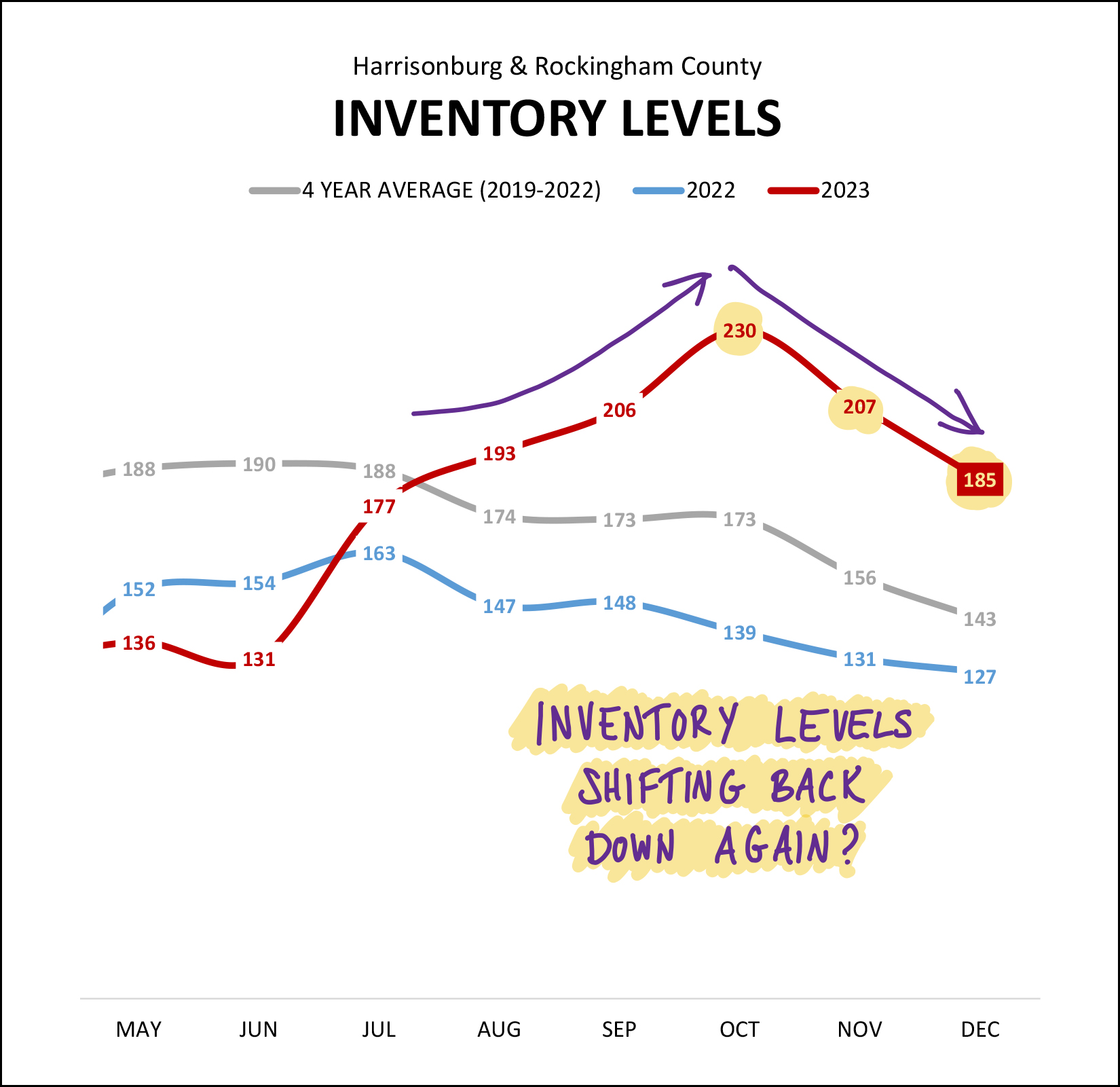

Happy New Year, Friends! I hope your 2023 wrapped up nicely and that you had some time with family and friends over the holidays! I had a wonderful time over the past few weeks making tons of great memories with family (including my brother and his family visiting from out of state and so many others), eating lots and lots of delicious food (including plenty of Christmas cookies), relaxing, sleeping in, and I closed out the year by running in (and badly spraining my ankle in) the New Years Eve Glow Run. My ankle buckled after about 2.5 miles (I think when I landed on some uneven ground?) and I managed to cut up my knee as I rolled off the path... so I had to fake my way to the finish line with a bloody knee...  As a result, I have found myself limping and hobbling my way into the New Year -- but beyond this temporary mobility setback, I couldn't be more excited for the year ahead. ;-) Below I have outlined a variety of trends we are currently seeing in the local real estate market, but before we get started with the numbers and charts and graphs... each month I provide a giveaway, of sorts, for readers of my monthly market report. This month I'm highlighting one of my favorite sandwich spots downtown... Lola's Delicatessen. They create some amazing sandwiches and are a great spot to stop for lunch in downtown Harrisonburg. If you haven't checked out Lola's -- you should -- and click here to enter your name for a chance to win a $50 gift certificate to Lola's Delicatessen! Now, let's take a look at some data on our local housing market...  First up, the big picture of where we ended up after a full year of real estate data in Harrisonburg and Rockingham County in 2023... We continue to see fewer homes selling in Harrisonburg and Rockingham County. After a 6% decline in the number of homes selling between 2021 and 2022... we saw a much larger, 23%, decline in the number of homes selling in our market in 2023. As we'll see on a later graph, this is the lowest number of homes selling in quite a few years. The prices of those homes that are selling continue to rise, quickly. After an 11% increase in the median sales price in 2022, we saw a very similar, 10%, increase in the median sales price in 2023. As we'll see on a later graph, this is the highest median price we have seen in this area, ever. Let's now use that 23% drop in the number of homes selling and that 10% increase in median homes prices as a benchmark against which to understand other similar but slightly different trends in 2023...  The chart above analyzes the sale of only homes located in the City of Harrisonburg. Compared to the market-wide 23% drop in number of homes selling and 10% increase in median sales prices... [1] The number of homes selling in the City of Harrisonburg declined even further (31%) than the market-wide (23%) change in home sales. [2] The median sales prices of homes selling in the City of Harrisonburg increased even more (+12%) than all homes in the market (+10%). Now, beyond location, let's break things down briefly by property type...  The chart above evaluates only detached homes (single family homes) in the City of Harrisonburg and Rockingham County. Compared to the market-wide 23% drop in number of homes selling and 10% increase in median sales prices... [1] The number of detached homes selling didn't decline quite as far (-20%) as the market overall (-23%) in 2023. [2] The median price of detached homes only increased 7% over the past year, as compared to the market-wide increase of 10%. This a good example of why every homeowner in Harrisonburg and Rockingham County shouldn't necessarily assume that their home's value increased by 10% over the past year. If you own a detached home that change may very well have only been 7%. And how about those attached homes?  The chart above evaluates only attached homes (duplexes, townhomes, condos) in the City of Harrisonburg and Rockingham County. Compared to the market-wide 23% drop in number of homes selling and 10% increase in median sales prices... [1] We saw a somewhat larger decline (-31%) in the number of attached homes selling in 2023 compared to the overall market (-23%). [2] We saw a much (!!) larger increase in the median sales price of these attached homes (+20%) as compared to the overall market (+10%). But... before you assume that your attached home increased in value by 20% over the past year... remember that plenty of these attached homes were new homes, thus selling at higher prices, thus helping elevate this median sales price. Speaking of new homes, let's look at how things trended for just the existing homes in our market...  When looking at only existing home sales (not sales of new homes) we find... [1] The decline in existing home sales is exactly in line (-23%) with the overall market. [2] The median sales price of existing homes only rose 7% over the past year, compared to the market-wide increase of 10%. If you love the data and want to dig into these charts and related charts even further, you can do so here. :-) Now, let's see if some pictures (graphs) can help us further understand the current state of our local housing market and where we might be heading next...  The graph above tracks the number of home sales that took place each month in 2023 (red line), 2022 (blue line) and the average number taking place per month over four years (2019-2022). As you can see from the shaded yellow area, all through the summer and through most of the fall we were seeing monthly home sales at levels quite a bit below last year's levels. But... then came November and December. In those final two months of the year we started to see the most recent year of home sales (2023) almost catching back up to the same month of home sales in 2022. To put things into an even longer / broader perspective...  The current annual trend of home sales in the City and County has been falling (blue line) for the past year and a half. This annual sales pace peaked at 1,727 home sales in a year back in June 2022... but has been falling ever since. The current pace of 1,202 home sales a year is the lowest in many years! The current annualized median sales price in the City and County has been rising for just about a decade now, and at $330,000 it is at the highest point point it has ever been in our local area. To be clear, we've been setting new annual records for the median sales price for each of the past five (+) years -- so the "highest ever" isn't a new phenomenon -- it has been happening year after year since 2018. If you own a home, look at the next graph. If you don't... maybe don't look at the next graph? :-/  As shown above, it has been a LOVELY time to have owned a home over the past five years. Home prices have been blazing their way upward between 2018 and 2023 with a total of a 56% increase in the median sales price during that timeframe! What happens next, you might ask? I think it is highly unlikely that we will see another 56% increase in the median sales price over the next five years... but home values do seem poised to continue to increase in our local area over the next few years, even if not as quickly. And now to help you visualize the faster than the overall market increases in the median sales price of attached homes...  Indeed, as shown above, the median sales price of attached homes (townhouses, duplexes, condos) is increasing QUICKLY! Between 2021 and 2022 we saw a 9% increase in the median sales price of attached homes in Harrisonburg and Rockingham County. In 2023, we saw a 22% increase in this median sales price! Again, at least a portion of this is the influence of higher prices of new attached homes -- but regardless of how you slice and dice the data, the price of attached homes is rising, quickly. This next graph looks at new (vs. existing) home sales -- in two ways...  First, we should note that the number of both existing homes (blue bars) and new homes (green bars) declined between 2022 and 2023. We saw fewer sellers selling and buyers buying -- both existing homes and new homes. But... five years ago new home comprised 11% of the total number of home sales in 2018... and this past year new home sales made up a much larger 26% share of overall home sales. I expect that we will continue to see a significant share of total home sales being new home sales... especially since so many existing homeowners (would be sellers) have very low fixed mortgage interest rates and won't be all that excited to sell their homes while interest rates are still at/above 6%. Now, looking at some of the most recent market activity... contracts being signed...  The red line above shows the number of contracts signed per month compared to the same month last year in a blue line. You'll note that most of this year's (red) data points are a good bit below last year. But... not November of December. Contract activity this November snuck (barely) past last November... and contract activity this December blasted past last December with 105 contracts this December (2023) compared to only 67 the prior December (2022). And, as you might imagine, the increased pace at which contracts were signed in those two months pushed the "pending sales" numbers past where we were a year ago...  For most of 2023 we saw pending sales levels (total number of under contract properties) below where they were in the same month last year. But... that changed in October 2023 and contract activity in November and December pushed the pending sales numbers well ahead of where things were a year ago. We closed out 2022 with 189 properties under contract... compared to 246 properties under contract in December 2023! Have these contracts being signed start to make a dent in inventory levels that were otherwise rising? Good guess...  After seeing steady (rather rapid) increases in inventory levels between June 2023 and October 2023 (131 up to 230) those inventory levels started to decline again in November (to 207) and followed that trend in December (down to 185). Certainly, a higher than expected number of buyers signing contracts goes a long way towards reducing inventory levels. Was there anything else that declined, similarly, in November and December 2023? Let's see...  Indeed, if we're looking for at least one of the answers to why contract activity rose and inventory levels decline in November and December -- it's likely that we are looking at it above. Mortgage interest rates rose throughout most of 2023 from a low of 6.13% in January all the way up to a peak of 7.79% in October. But... they have been falling steadily since that time -- and in just two months they have dropped all the way back down to 6.61%. I suppose it's no surprise, then, that we saw contract activity start to tick back up in November and December -- it became (slightly, relatively, progressively) more affordable to do so in November and again in December! That, then, brings us to the end of the charts and graphs. So, let's take a look at what various people ought to be focusing on as they look ahead to the remainder of 2024. If your home is on the market now but not yet under contract... Lower mortgage interest rates seems to be bringing new buyers to the table for many properties. Let's hope that is the case for your home, but let's also examine our current pricing and determine whether an adjustment might be necessary to make your house attractive enough to buyers. If you plan to sell your home in 2024... Preparing your house well will likely be more important than ever this year so let's start developing and implementing those plans sooner rather than later. We'll also need to make sure to price your home appropriately to sell for the best possible price for you -- but also in a timeframe that works best for you. If you plan to buy a home in 2024... If it's been a few months since you talked to your lender, do so again soon. Mortgage interest rates have dropped quite a bit and your projected monthly payments will likely be lower than you had anticipated. Keep in mind that many new listings are likely to go under contract very quickly again in 2024, so be ready to go see new listings quickly and be prepared to make a speedy-ish decision about buying. If you own your home and don't plan to sell it anytime soon... Congrats to you on your (likely) ever increasing home equity. Enjoy the ride, and enjoy the likely low mortgage interest rate on your mortgage. :-) If you're me... Try really, really hard not to run for at least the next few weeks in order to follow the doc's orders and to avoid further injury to my ankle. And for ALL OF YOU reading this market report... If I can be of help to you related to real estate, or otherwise, don't hesitate to reach out. You can contact me most easily at 540-578-0102 (call/text) or by email here. I'll send you another update in about a month... now, who wants to guess how much snow we'll see between now and then? A foot? A few inches? None??? | |

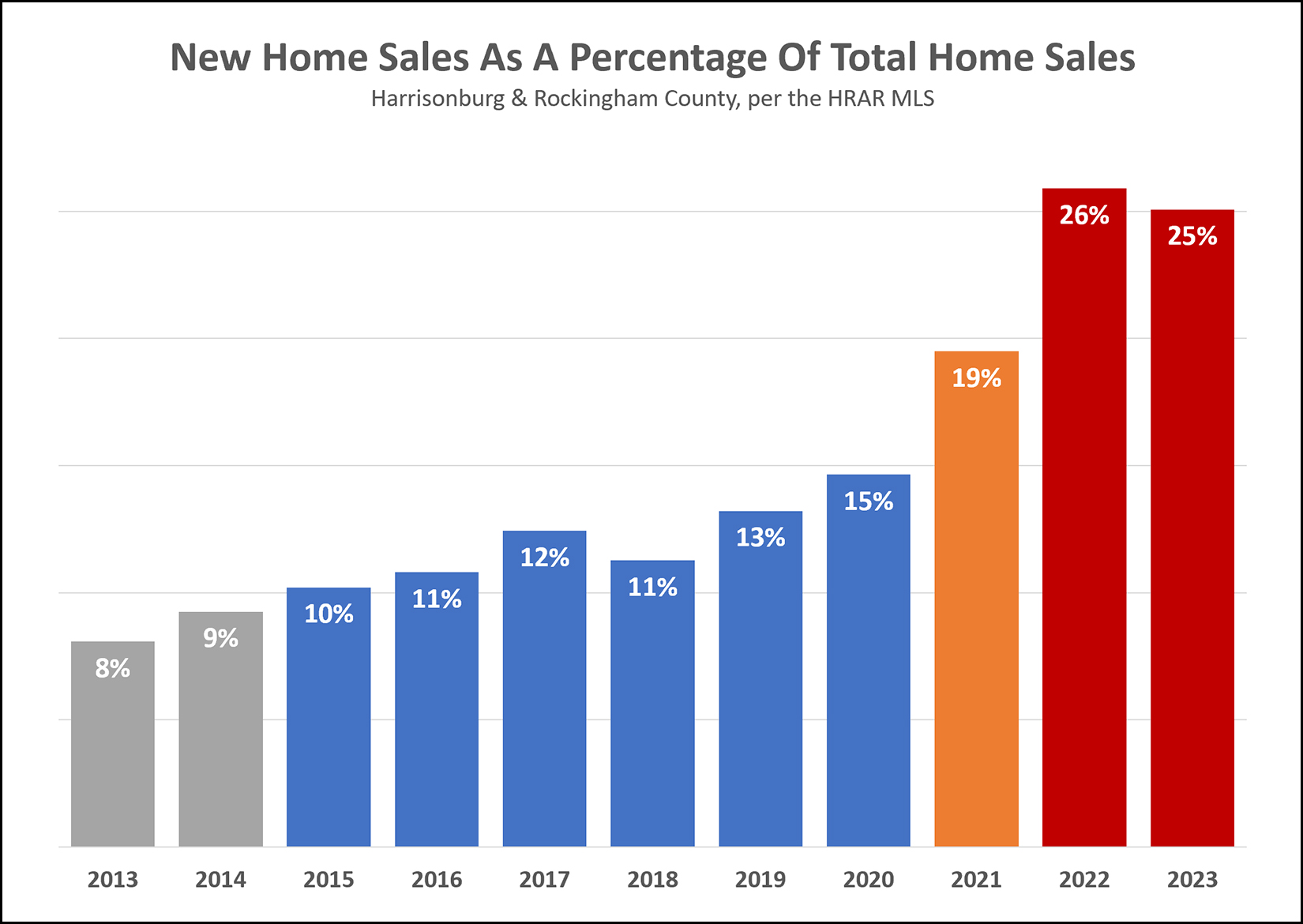

An Increasing Portion Of Home Sales Are New Home Sales |

|

Between 2015 and 2020 the portion of annual home sales that were new homes ranged from between 10% and 15% per year. But... we started to see the share of new home sales increase significantly in 2021 when the shared of new home sales jumped up to 19% of total home sales. Then, in 2022 that rose to 26% and dropped off a touch in 2023 to 25% of all home sales being new homes. A few thoughts regarding this trend... [1] New home sales are and will continue to be an important segment of our local housing market given that our local population is increasing. [2] This increase in the share of new home sales in 2021 (and continuing through 2022 and 2023) coincides with when we started seeing more regional or national home builders in our marketplace. The three main regional or national builders we are seeing develop communities in our area are Evergreen Homes, Ryan Homes and DR Horton. [3] Super low mortgage interest rates between 2019 and 2022 has resulted in a LOT of homeowners currently having very low interest rates (below 4%) on their current mortgages. This will likely result in less turnover (resale) of existing homes over the next year or two so long as current mortgage interest rates stay at or above 6%. | |

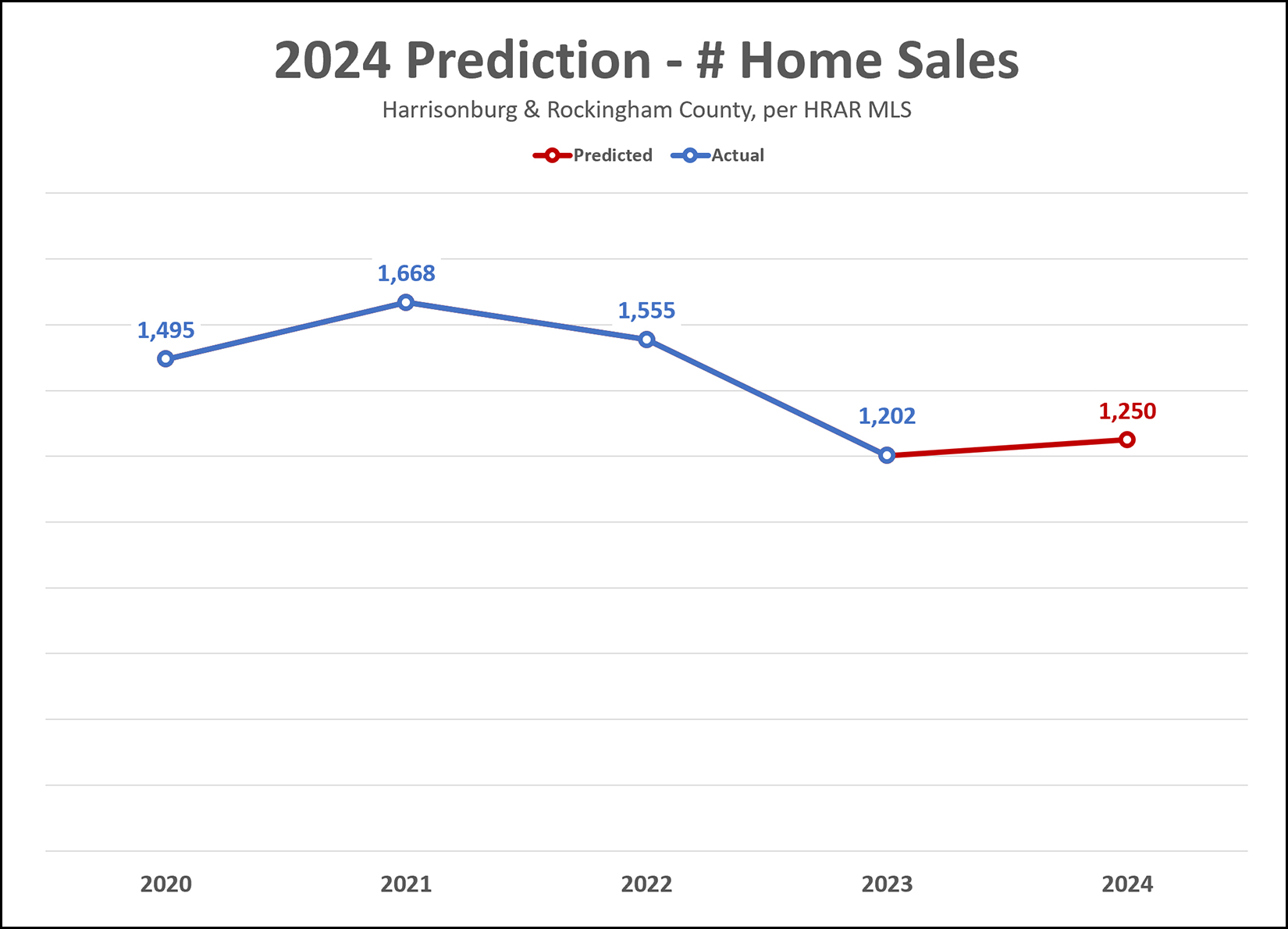

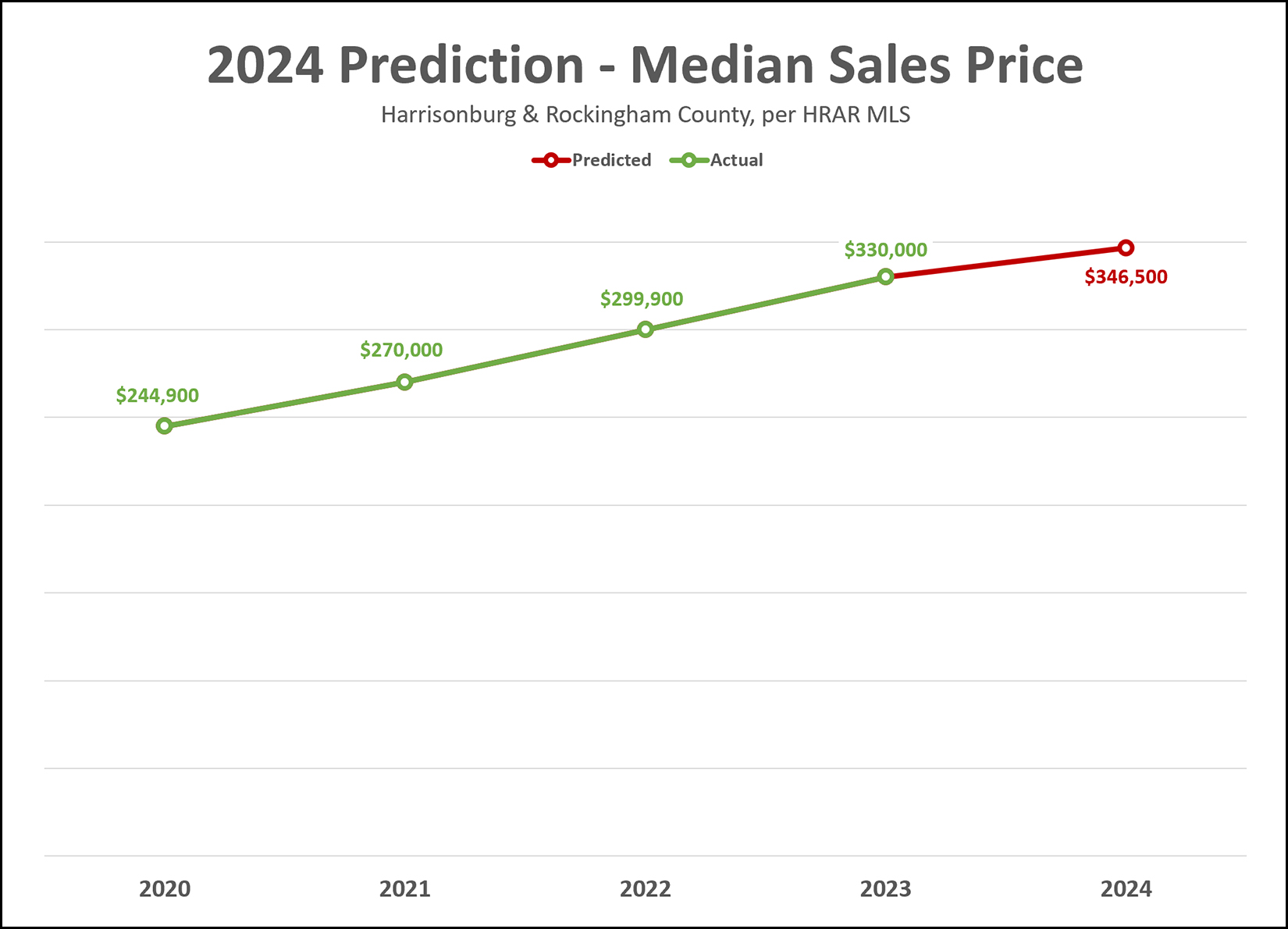

My Predictions For The 2024 Real Estate Market In Harrisonburg, Rockingham County |

|

The real estate market has been anything but predictable over the past few years, but read on for my predictions for what we'll see in the Harrisonburg and Rockingham County real estate market this year... 4% Increase In Number of Home Sales As shown above, I am predicting that we will see a 4% increase in the number of homes selling in Harrisonburg and Rockingham County in 2024 -- an increase from 1,202 home sales last year up to 1,250 home sales this year. If we do indeed see 1,250 home sales in 2024 this will be the second slowest year of home sales since 2015. I think we'll see (4%) more home sales this year than last because we are starting to see mortgage interest rates decline after they hit 20+ year highs. Over the past two-ish months the average 30 year fixed mortgage interest rate has dropped from 7.8% to 6.6%. I suspect that lower mortgage interest rates this year than last will lead to slightly more (4%) home sales this year than last. I am not, however, envisioning a 10% or 20% increase in home sales as interest rates above 6% will still likely keep many homeowners in their homes (not selling) if they have an interest rate below 4% -- and most homeowners with mortgages do have rates that low, so long as they have not bought in the past two years. So, I'm predicting we'll see slightly more (4%) home sales this year (1,250) than last, but certainly not much of a rebound towards the 1,400+ home sales we saw in 2020 (1,495 sales), 2021 (1,668 sales) and 2022 (1,564 sales). And how about those sales prices...  We have seen steady gains in the median sales price over the past several years... 2021 = +10% 2022 = +11% 2023 = +10% Despite three years in a row of double digit increases in the median sales price, you'll note that I am only predicting a 5% increase of the median sales price in 2024. I do think that continued buyer demand in the context of limited seller supply will keep prices rising, but I don't think they will rise as much as they have for the past three years. The inflation rate was above 5% between May 2021 and March 2023, which I believe makes the above increases in the median sales price seem even larger than they were once you consider them in the context of changes in inflation and the consumer price index. The inflation rate is now back down to around 3%, but mortgage interest rates (which directly affect house payment affordability) are still above 6%. As such, I think we will continue to see home prices rise, but not quite as quickly as we saw in 2021, 2022 and 2023. But enough about my predictions -- what about your predictions? Will we see more or fewer home sales in 2024 than in 2023? Will we see higher or lower sales prices in 2024 than in 2023? Email me with your thoughts or predictions! | |

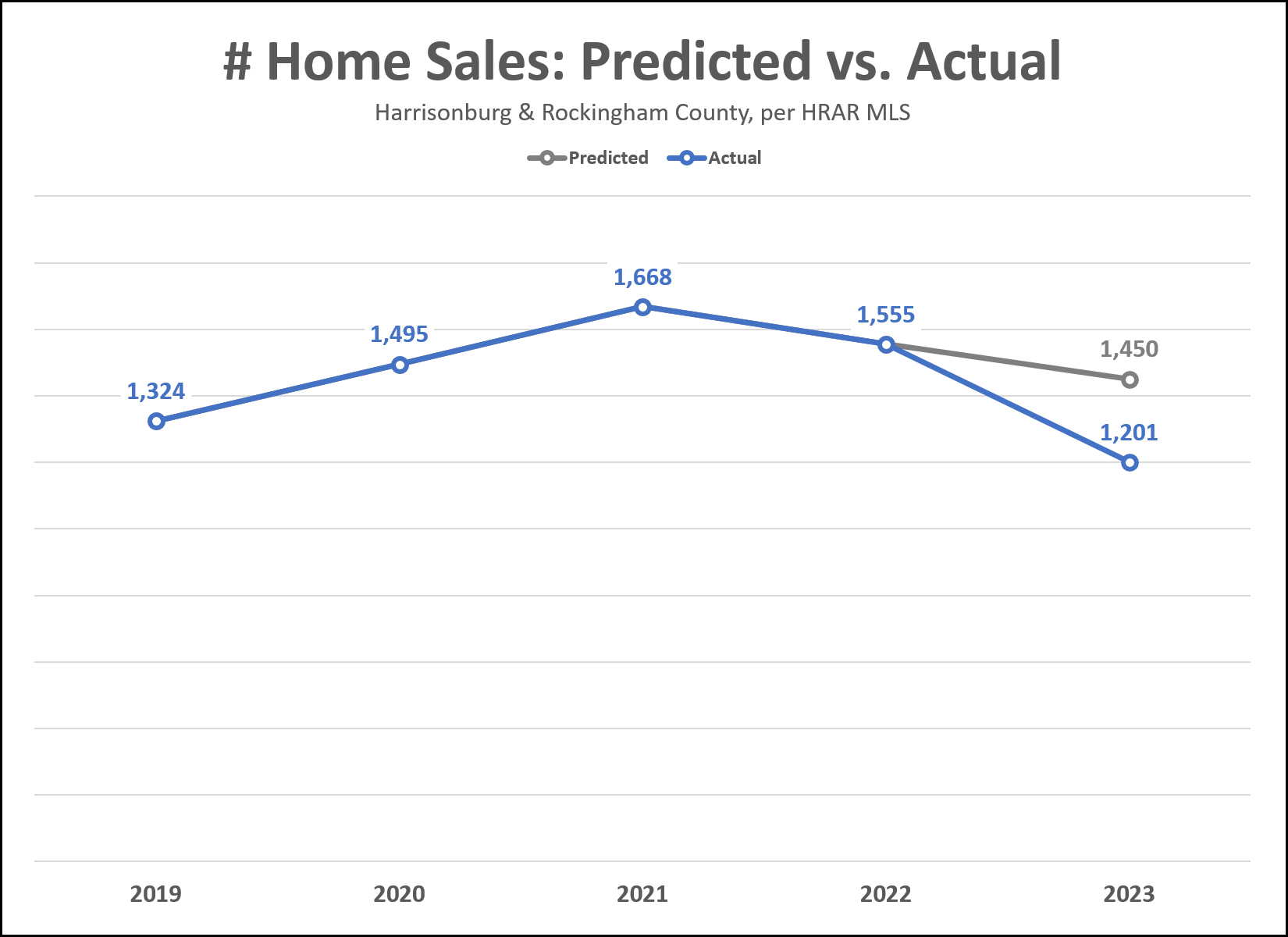

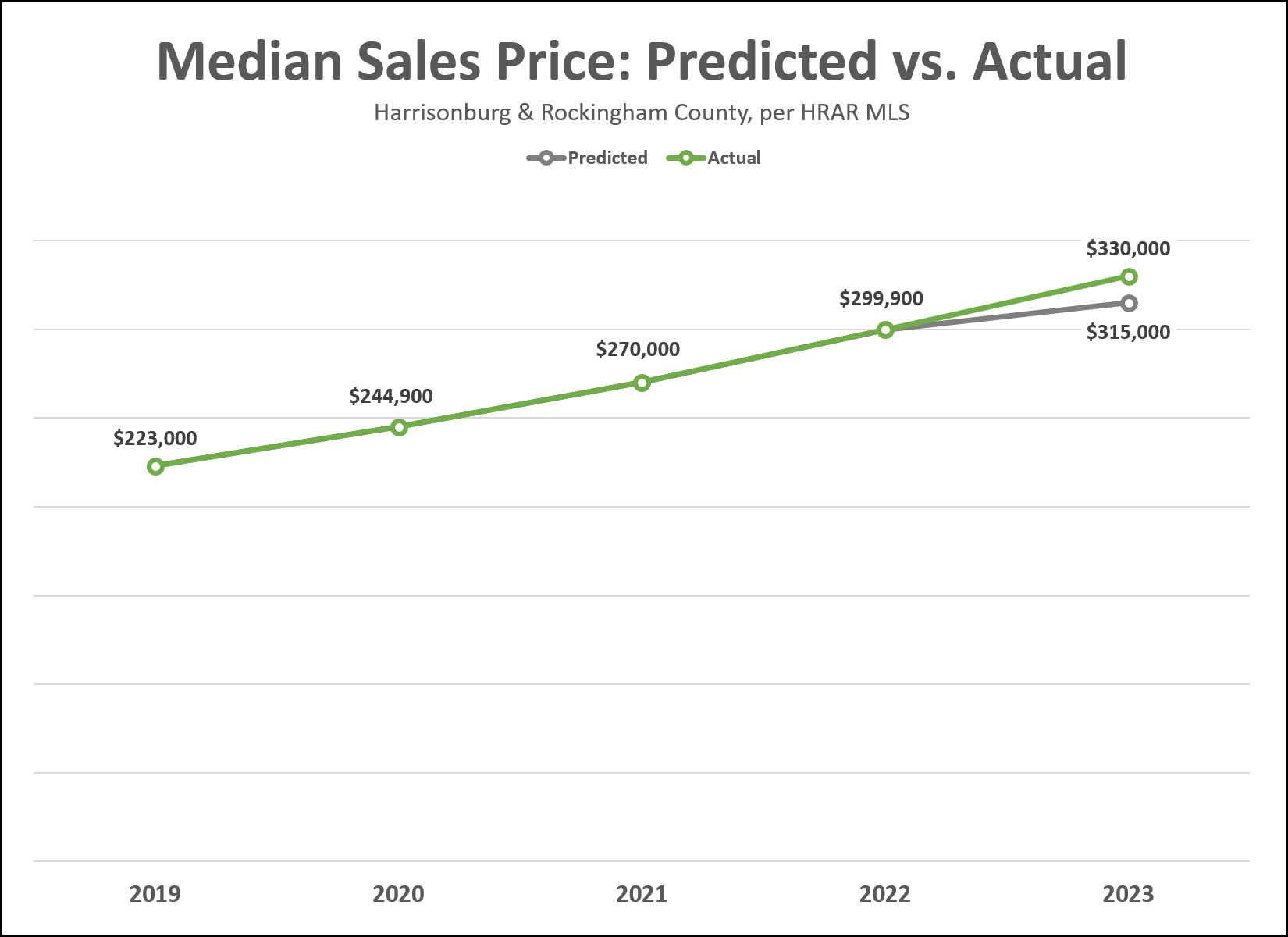

Reviewing My Predictions From Last January For The 2023 Real Estate Market |

|

Well... my predictions for last year's local housing market weren't exactly spot on. :-) Let's take a look. Above you'll see actual versus predicted number of home sales in Harrisonburg and Rockingham County within the context of the past few years... [1] We saw a decline in home sales between 2021 and 2022 -- and I was predicting another decline in 2023. [2] I predicted a 7% decline in annual home sales. [3] We ended up seeing a 23% decline in annual home sales! So, yes, the number of homes selling in our area did indeed decline -- but much further than I had predicted. And how about sales prices...  Again, the realities of the 2023 real estate market didn't quite match my predictions... [1] We saw an 11% increase in the median sales price in 2022. [2] I predicted a smaller (5%) increase in the median sales price for 2023. [3] We ended up seeing a 10% increase in the median sales price last year. So... the market slowed down more than I thought it would... and median sales prices rose much more than I thought they would. But don't worry... soon I'll put my prediction failures behind me and will make some new predictions for 2024. :-) | |

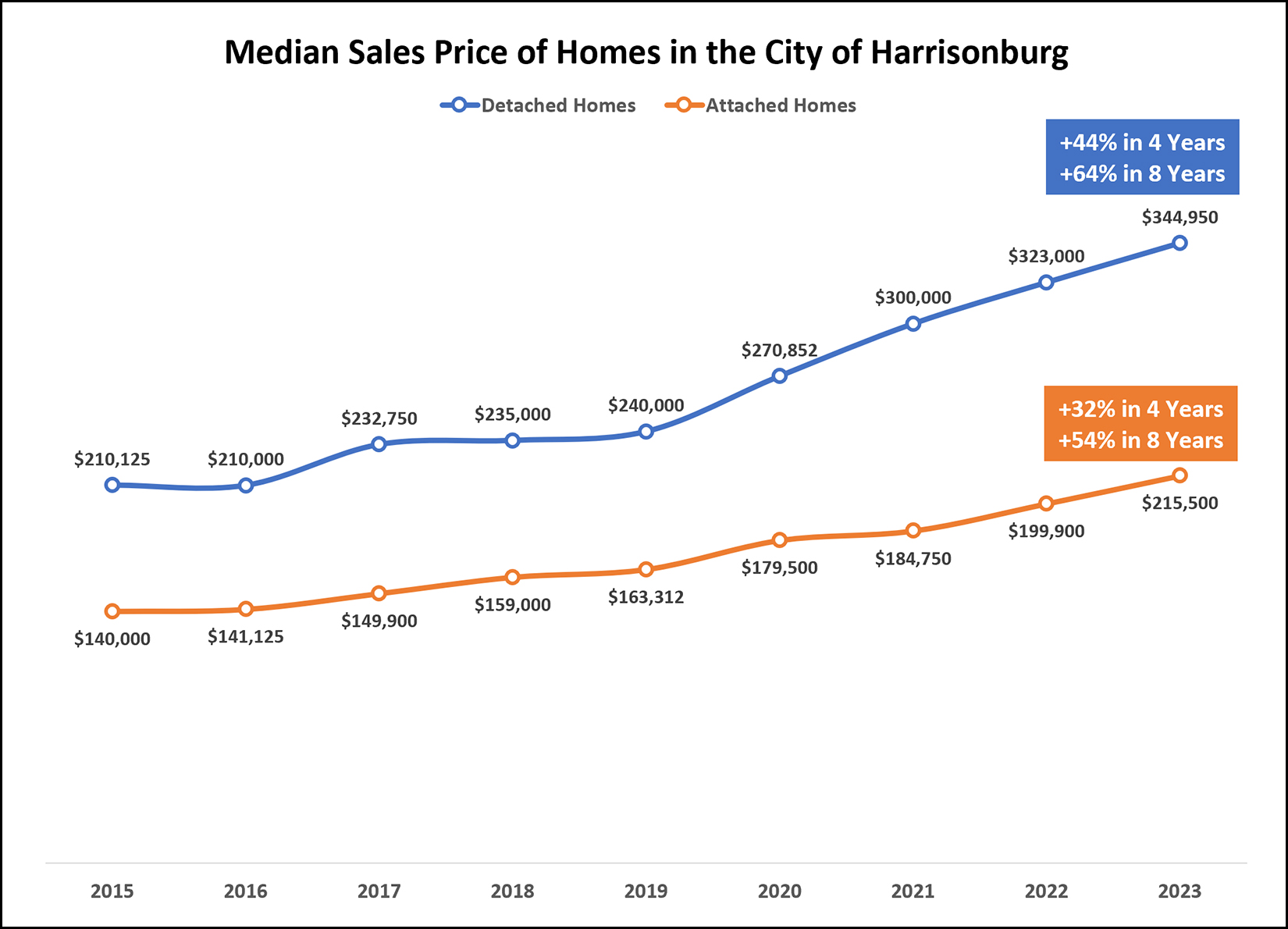

The Median Sales Price Of Detached Homes Has Been Rising Faster Than Attached Homes In The City Of Harrisonburg |

|

The median sales price both detached and attached homes has been rising rapidly in the City of Harrisonburg over the past eight years -- but the median sales price of detached homes has been rising somewhat faster than that of attached homes. Over the past four years we have seen:

Over the past eight years we have seen:

Looking ahead, I suspect we will continue to see both of these metrics rise... but we will likely still see detached home prices increasing faster than attached home prices. | |

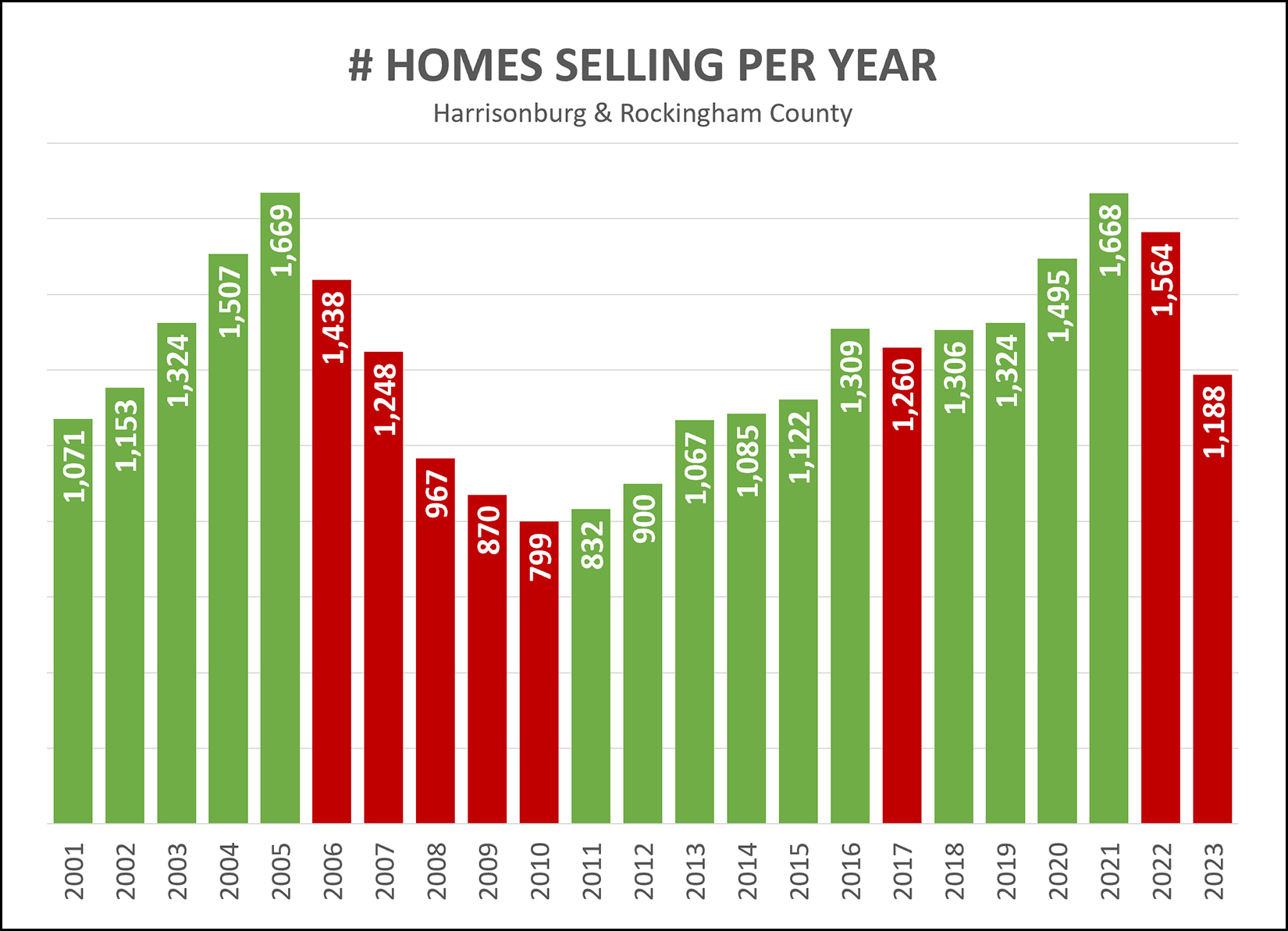

Number Of Homes Selling Per Year In Harrisonburg And Rockingham County |

|

A few more 2023 home sales might be reported in the HRAR MLS over the next week -- but the total shown above will be relatively close to the total number of home sales for Harrisonburg and Rockingham County last year. A few observations about the graph above... [1] The 1,188 home sales that took place last year was the lowest number of home sales since all the way back in 2015. [2] Interestingly, annual home sales peaked in 2005 at 1,669 home sales -- and then again at 1,668 home sales in 2021. Will we ever get up to that 1,670 mark? ;-) [3] After the 2005 peak of 1,669 home sales, we saw declines in the number of home sales for five straight years. Since the 2021 peak of 1,668 home sales we have seen two years of declines -- will we see another in 2024? [4] The peak of 1,668 home sales in 2021 was the culmination of a long run of year after year growth in annual home sales with 10 out of the 11 previous years showing an increase (green bar) in annual home sales. Mortgage interest rates jumped to 22 year highs in 2023, which significantly impacted the number of homes that sold. Now that mortgage interest rates are coming back down, somewhat, will that result in a leveling off of the decline in the number of homes that are selling? I think it is too early to predict whether we'll see more 2024 home sales than in 2023 -- but I'll go ahead and make predictions anyhow in the coming days. :-) | |

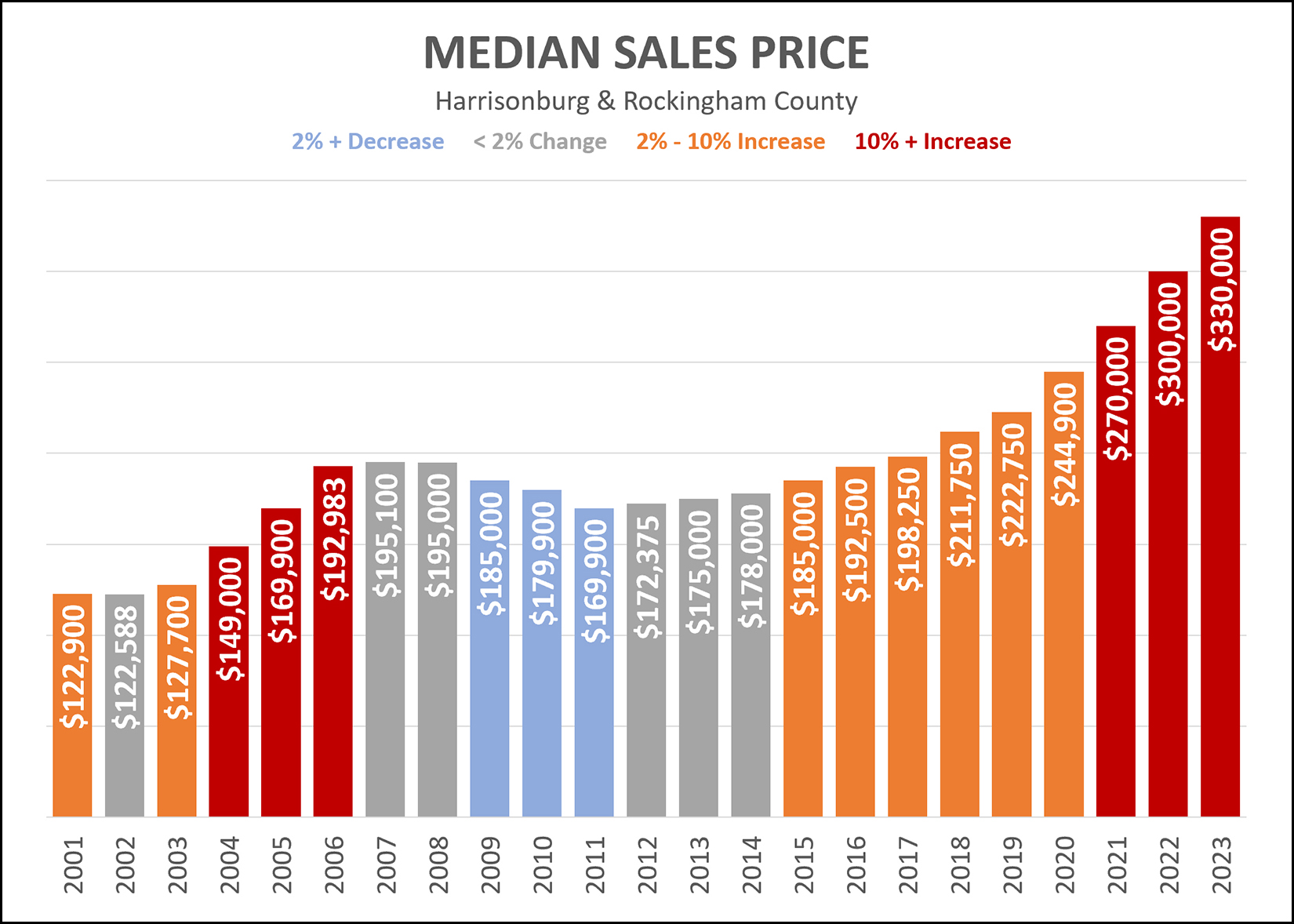

Median Sales Price In A Larger (Longer) Context |

|

The graph above tracks the median sales price each year for the past 20+ years in Harrisonburg and Rockingham County based on home sales recorded in the HRAR MLS. You'll note that... [1] Home prices increased rapidly (more than 10% per year) between 2004 and 2006. [2] Home prices then stayed relatively level for just over a decade, 2006 through 2016) with a few years of declines and a few years of increases. [3] Home prices started to climb again, though at a pace of less than 10% per year between 2015 and 2020. [4] Home prices have increased by 10% per year or more for each of the past three years, between 2021 and 2023. What are your predictions for what we will see over the next few years? | |

Will Your New Years Resolution Be To Buy A House? |

|

For whatever reason, the close of one year and the start of a new year cause many of us to pause and reflect on the big picture. What do we hope will remain the same in the new year? What do we hope to change in the new year? If you are considering a home purchase in the new year, here's one bit of welcome news... Mortgage interest rates have been falling steadily for the past eight weeks! In October, the average 30 year fixed mortgage interest rate peaked at 7.79%. Since that time, they have dropped all the way down to 6.67%. Rates actually started the year (Jan 2023) at 6.48% -- so we're closing out the year a touch higher than that, but things are headed in the right direction. It definitely seems possible that we'll see mortgage interest rates between 6% and 6.5% some time in the first few months of 2024. So, if your new years resolution is to buy a home, let's set up a time to meet to discuss the process and the market -- and you should talk to a lender sooner rather than later to get prequalified for a mortgage. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings