| Newer Posts | Older Posts |

Home Buyers Who Want To Buy A Home In The Next Year Likely Should Not Wait For Mortgage Interest Rates To Come Back Down |

|

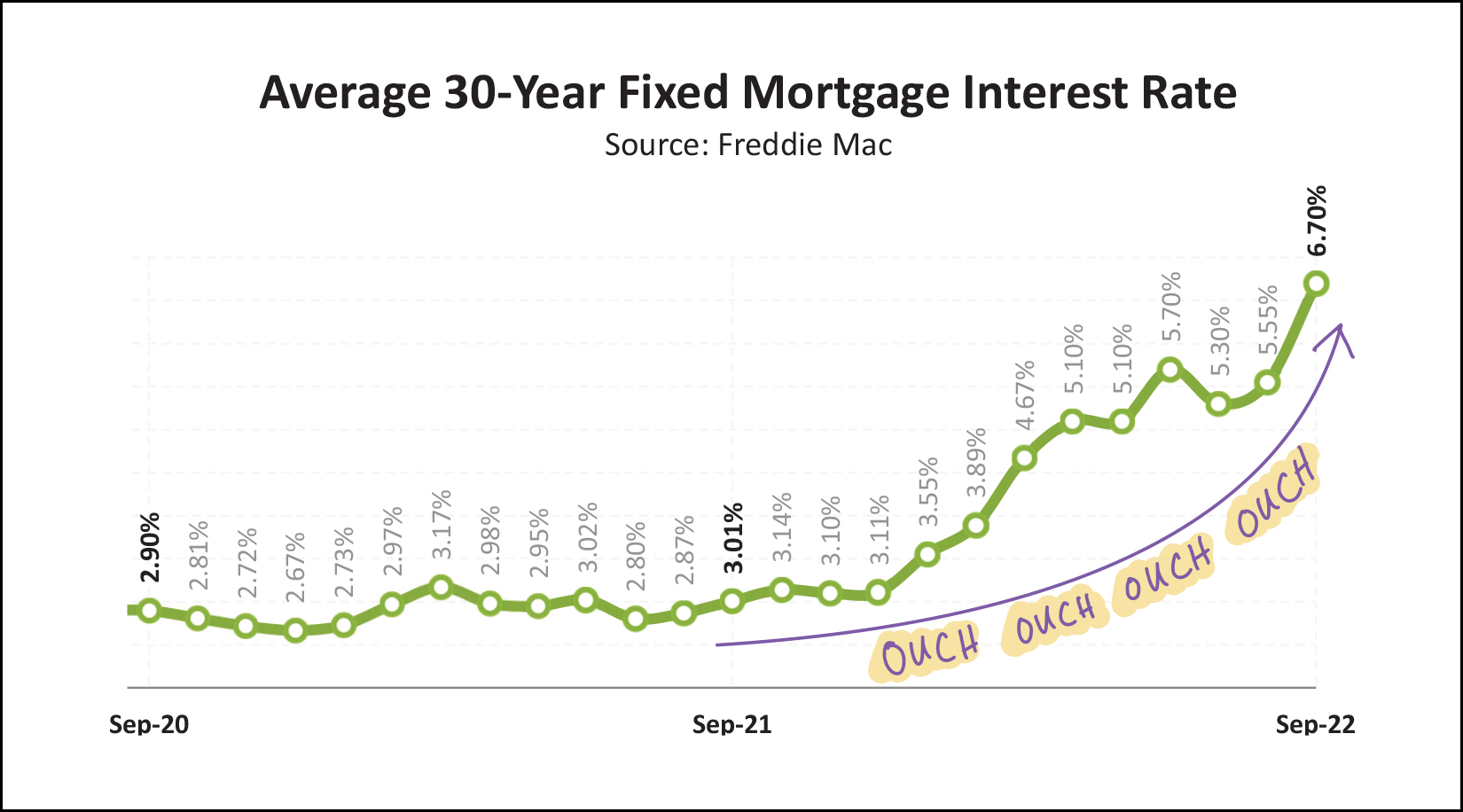

If you are looking to buy a home right now you might be surprised by higher mortgage interest rates than we have seen for much of the past year... January = 3.45% February = 3.92% March = 4.16% April = 5.00% May = 5.30% June = 5.78% July = 5.51% August = 5.13% September = 6.02% Now = 6.94% How could mortgage interest rates be close to 7% after having started the year at 3.45%? Surely mortgage interest rates will start coming back down again soon, to 4% or 5%, right? Or even 6%? I don't think that we can assume that mortgage interest rates are going to drop substantially at this point. Mortgage interest rates may very well continue to be between 6% and 7% for the next 12 months. As such, if you are thinking about buying a home right now, you should see what your payments will look like at current mortgage interest rates and decide if that is a monthly payment that will work for you. If so, it may be worth going ahead and moving forward with a purchase rather than holding off in hopes of lower mortgage interest rates. While it is certainly possible that mortgage interest rates will start declining again, I don't think we can assume that is what will happen next. | |

If You Are Hoping To Sell Your Home In 2022, List It Very Soon, Or Adjust The List Price Very Soon! |

|

Summer just ended, right? It's just barely fall, right? There's plenty of time remaining in 2022, right? Well, sort of. Most real estate transactions take around 45 days to get from contract to closing. Certainly, some of them are happening in 30 days, but it's good to plan on a 45 day window between contract and closing. Thus, if you do not yet have your house on the market for sale, here's a potential timeframe that you might experience if you wanted to sell in 2022...

Don't forget, after all, that the Thanksgiving and Christmas holidays can often slow things down with lenders, title companies, etc., during November and December. If you have your house on the market for sale now, and it is not under contract, this is also an ideal time to consider making a price change to try to secure a contract with a buyer within the next week or two if you are aiming to have the closing take place before the end of the year. It can seem like there is plenty of 2022 left to go (there is) but when it comes to the timing of a real estate transaction, if you want to close on the sale of your home in 2022, you should likely be getting started soon! | |

Contract Activity Seems To Be Slowing Down (Quite A Bit) In October 2022 |

|

It's best not to get your face too close to the data. The closer we look at the data, at a smaller and smaller data set, the more likely we can find ourselves concluding one thing when another is actually true. So, as you ponder the meaning of the graph above, keep in mind that the last set of data (October 1 - 15) is a rather small set of data... from just two weeks in our local market... so it may or may not be indicative of an overall trend. But... with that length disclaimer having been thrown out there... After seeing modest declines in contract activity in August (-13%) and September (-15%) it seems that contract activity might be REALLY slowing down (-51%) in October. Last October, in the first half of the month, a total of 81 contracts were signed for buyers to buy and sellers to sell houses in Harrisonburg and Rockingham County. This year in those same 15 days, only 40 contracts have been signed. It's hard to say if this significant decline in contract activity will continue as we move through October and into November, but if things were slowing down slightly in August and September, they seem to be slowing down more quickly in October. | |

Income From A Short Term Rental In Your Home Can Make Housing More Affordable |

|

Home prices are higher than they have been anytime in the past decade. Mortgage interest rates are higher than they have been anytime in the past decade. And, thus, for many buyers, housing costs (mortgage payments) are higher than they have been anytime in the past decade. What is a home buyer in 2022 to do given these high housing costs? One strategy being pursued by some home buyers is to look for a property where they have the possibility of generating additional income with some portion of their home. In most cases, these days, that is considering renting out some part of a home on a short term basis via AirBNB or otherwise. Sometimes it might be a basement efficiency apartment, sometimes a space over a garage, or any number of other configurations depending on the property. There certainly aren't enough properties for sale (in any given timeframe) that offer this extra income possibility to match the number of buyers who would have interest in the configuration - but when these properties do become available, they can offer a buyer the opportunity to offset their total housing costs. | |

Price Reductions Will Likely Make Lots Of Sense To Some Home Sellers |

|

Fictional Seller Sally bought her home about eight years ago for $190K. Three years ago, Sally realized her home was worth $240K and was pretty happy about that. Last year, Sally was astonished to conclude that her home was likely worth $290K. Wow! Sally just landed a new job out of state and is getting ready to sell and the most recent comparable sales indicate that her home is likely worth $310K in the current market. Sally is elated! Sally lists her home for $309,500 and has had quite a few showings during the first three weeks on the market, but has not received any offers. Would it surprise you that Sally decides to go ahead and reduce her list price to $299K? Would it surprise you if three weeks later Sally reduces the price again to $289K? It wouldn't surprise me. While some sellers might think about $299K and $289K relative to the possible current value of $310K, Sally is thinking about $299K and $289K relative to... [1] Her original purchase price of $190K. [2] Her conclusion a year ago that her home was likely worth $290K. Certainly, Sally would be delighted if she could sell her home for $310K, but she will also be very happy to sell it for $299K or $289K. Moving forward through the balance of 2022 and in 2023 I suspect there will be some sellers who will happily sell for a bit less than the market might indicate their house is worth, as that "lower" price is still much, much higher than they could have imagined their home was worth for most of the time that they have owned it. This likely won't be all sellers, and perhaps not even most sellers, so it might not cause an overall shift in home values... but some sellers will likely be quite willing to reduce their price if their home does not sell in a timely fashion. | |

If You Will Be Buying A Home In The Next Year, Sooner Might Be Better Than Later |

|

Home prices have increased quite a bit over the past few years. Clearly, that's a bit of an understatement. ;-) Mortgage interest rates have increased drastically (doubled+) over the past year. As such, some would be home buyers might be wondering whether they should go ahead and buy a home now, or wait until next year. Waiting would make sense... if you thought home prices were going to decline and/or if you thought mortgage interest rates were going to decline. I think there is a relatively low possibility that we will see a significant decrease in home prices and/or mortgage interest rates over the next six to twelve months. Buying sooner rather than later would make sense... if you think home prices will either stay at about the same level or they might increase... and if you think mortgage interest rates will either stay at about the same level or they might increase. I think there is a relatively high possibility that home prices and mortgage interest rates will either stay at the same level or increase over the next six to twelve months. So, if you are almost certainly going to buy a home in the next 12 months, then the chances are sooner will probably be better than later. Clearly, this guidance is based on my best guesses (or your best guesses) about future trends in home prices and mortgage interest rates... so we're all just guessing. Only waiting and watching will show us what really will happen. Let me know if you want to chat further about this topic as it relates to your particular portion of the local housing market. | |

Harrisonburg Area Home Sales Slowing Slightly But Prices Keep Rising |

|

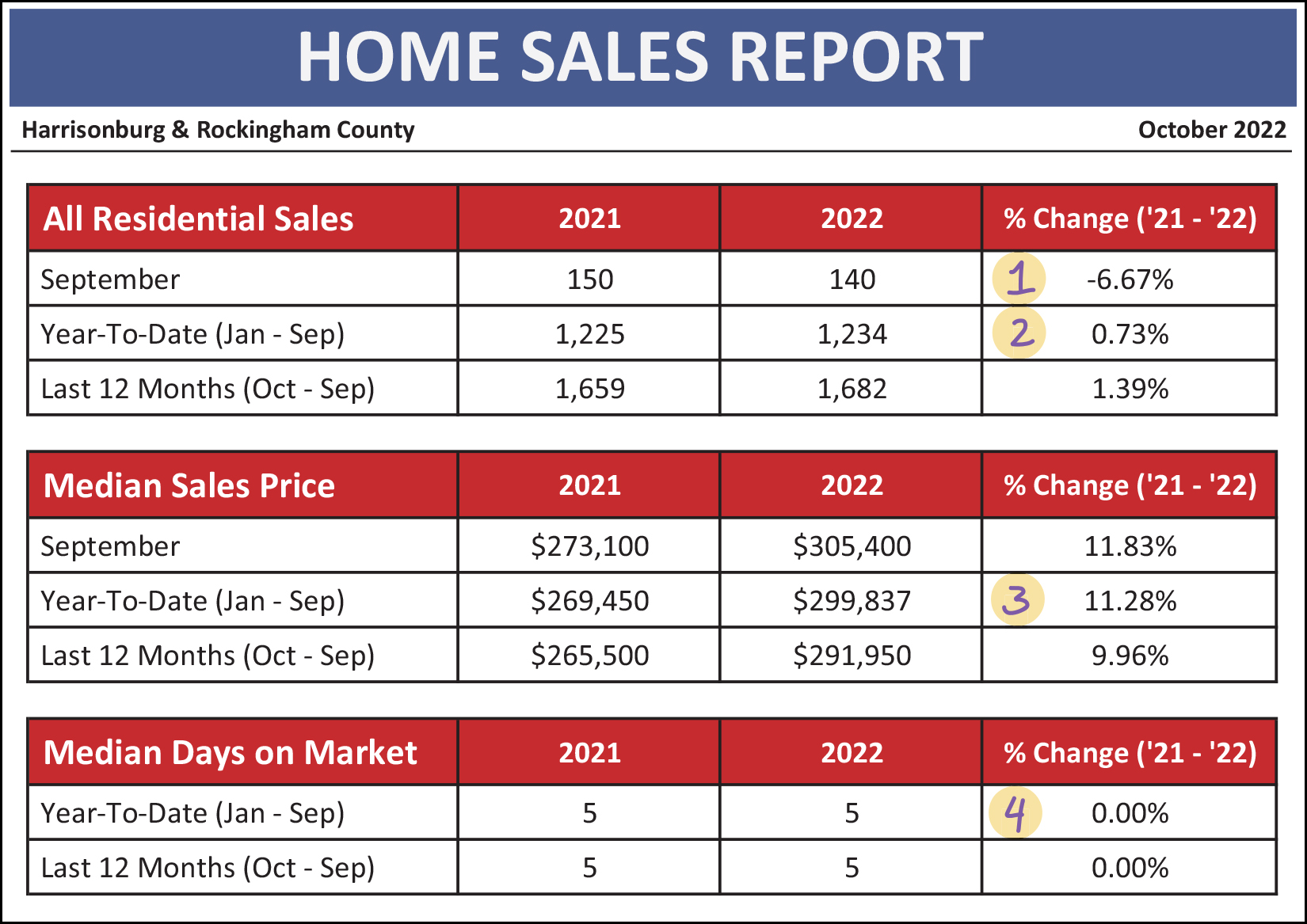

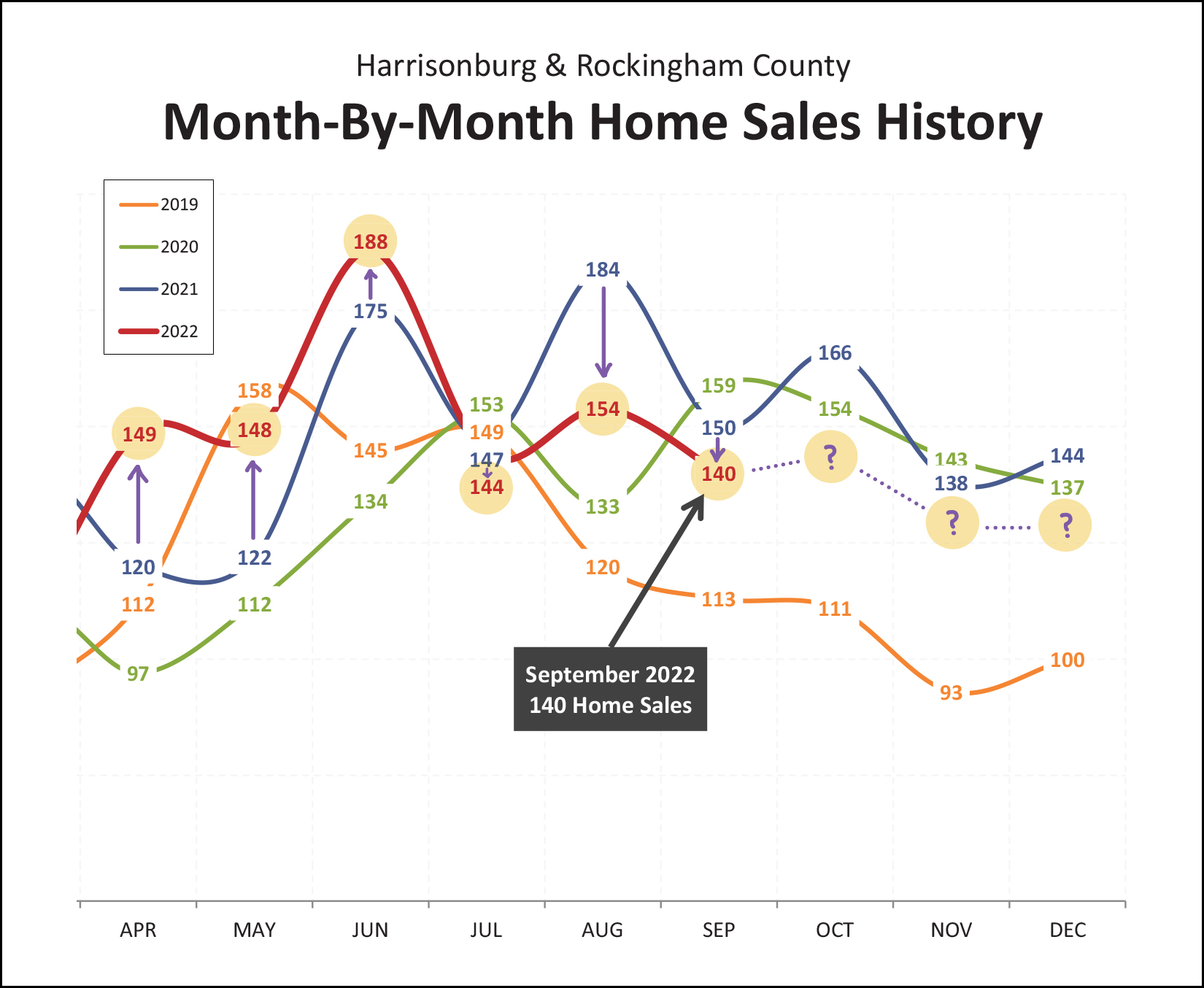

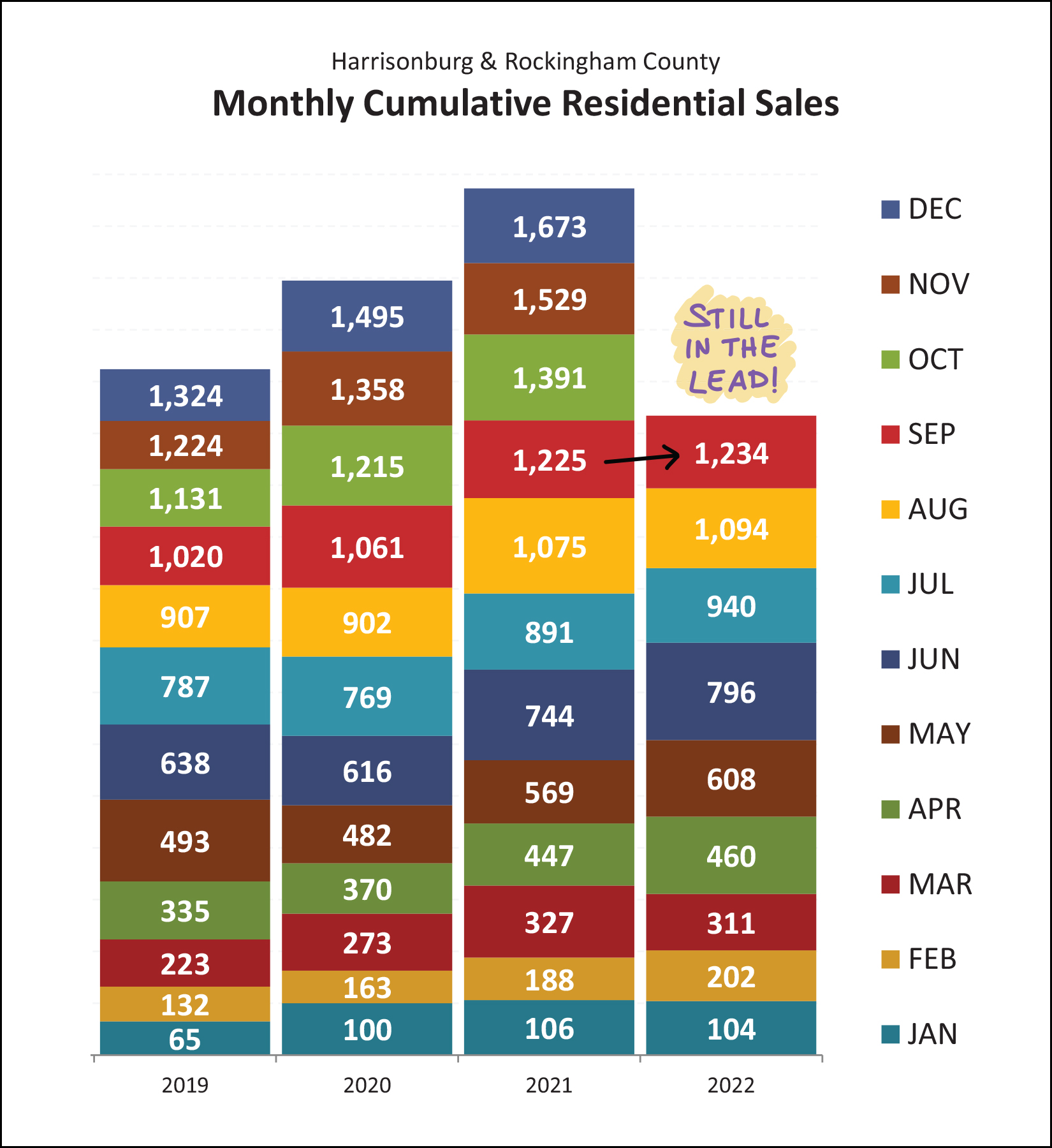

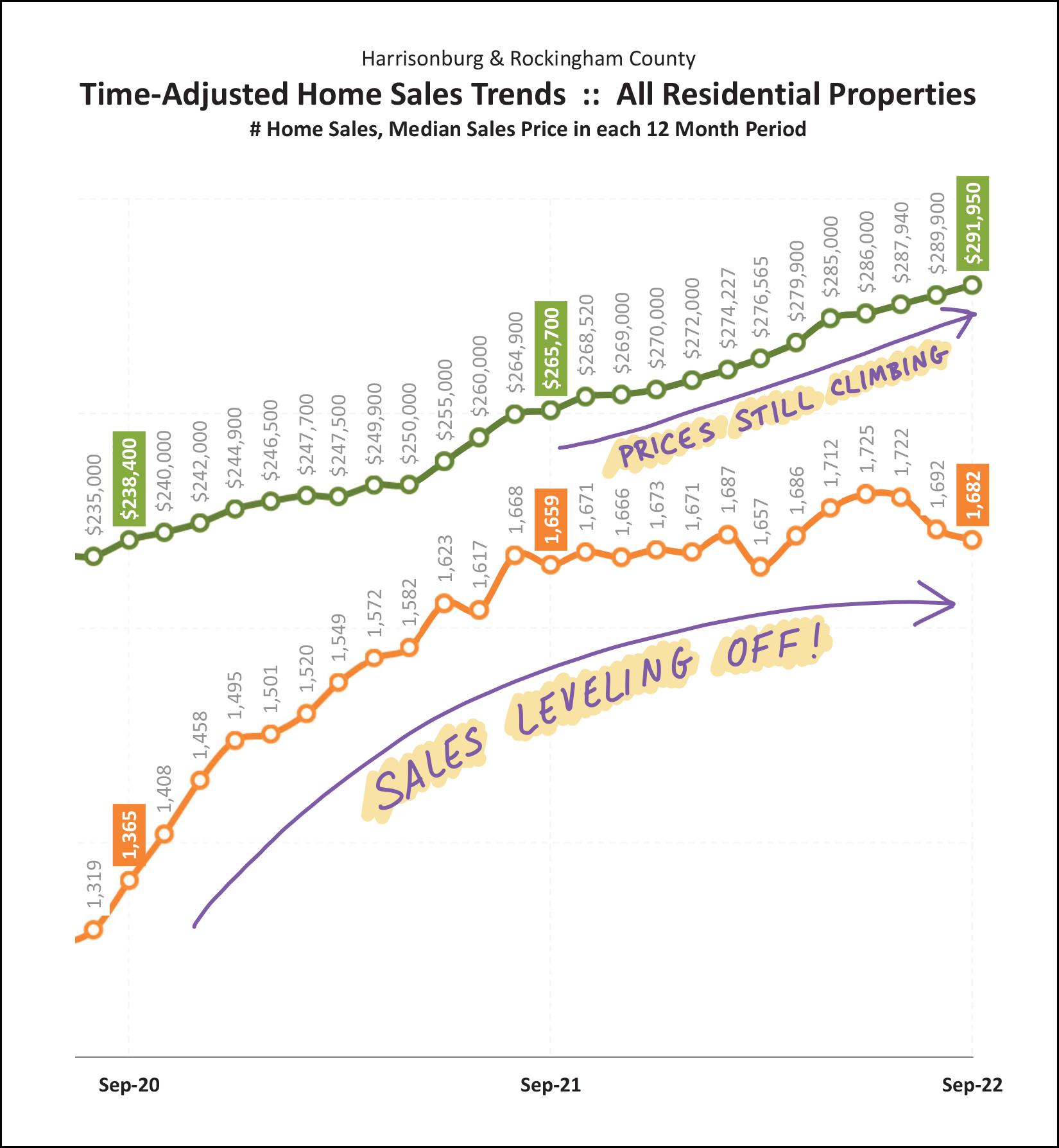

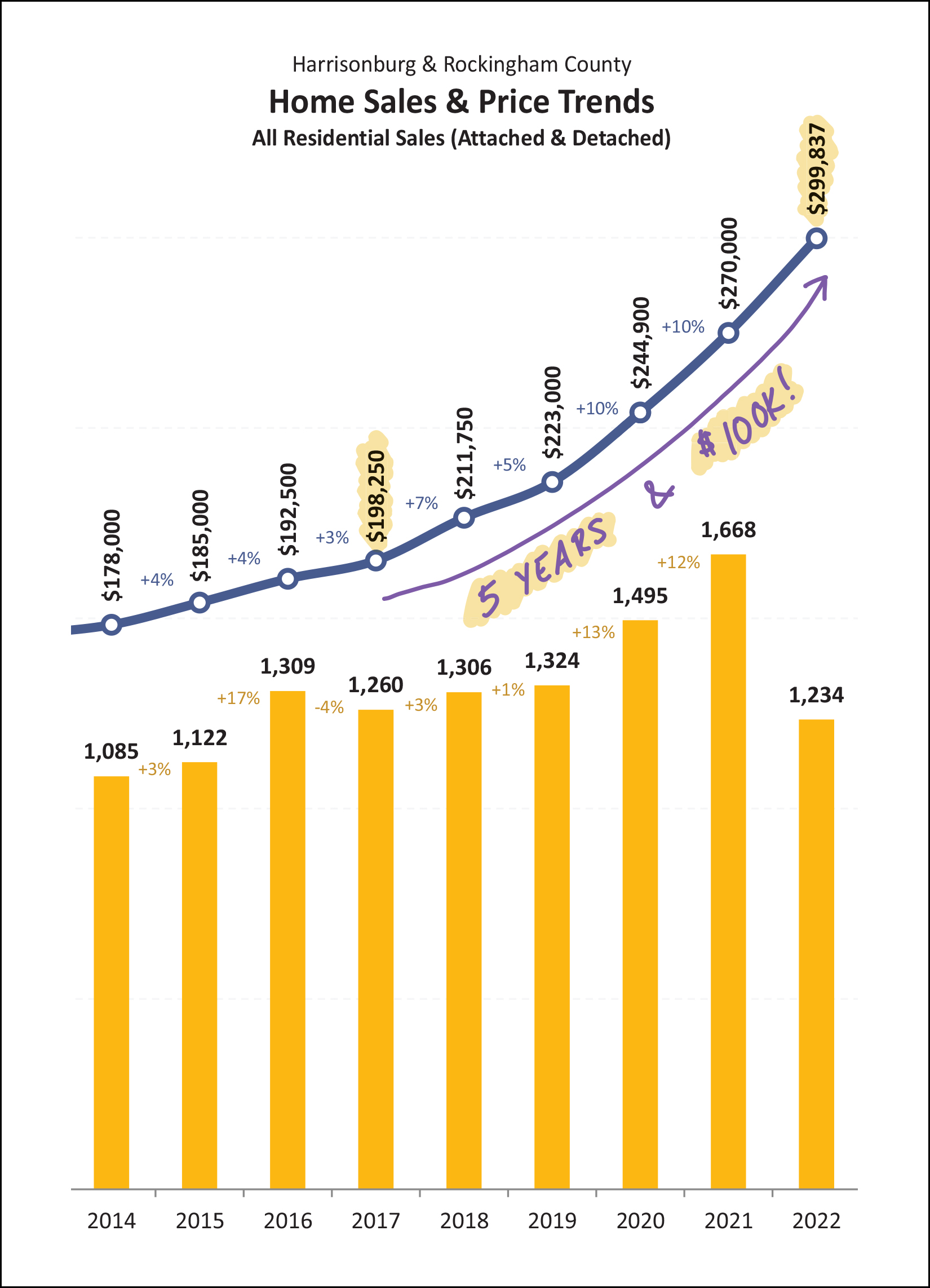

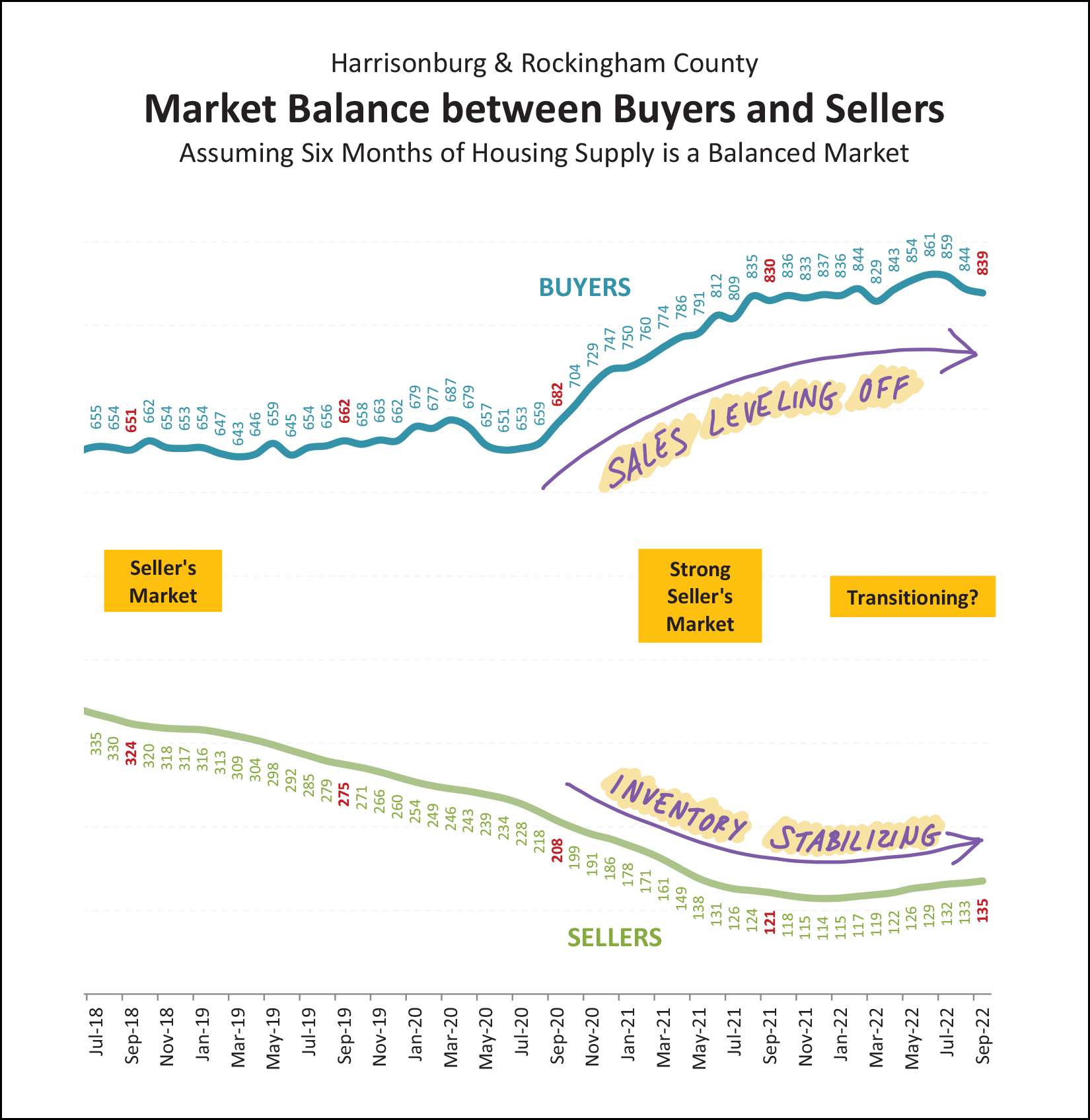

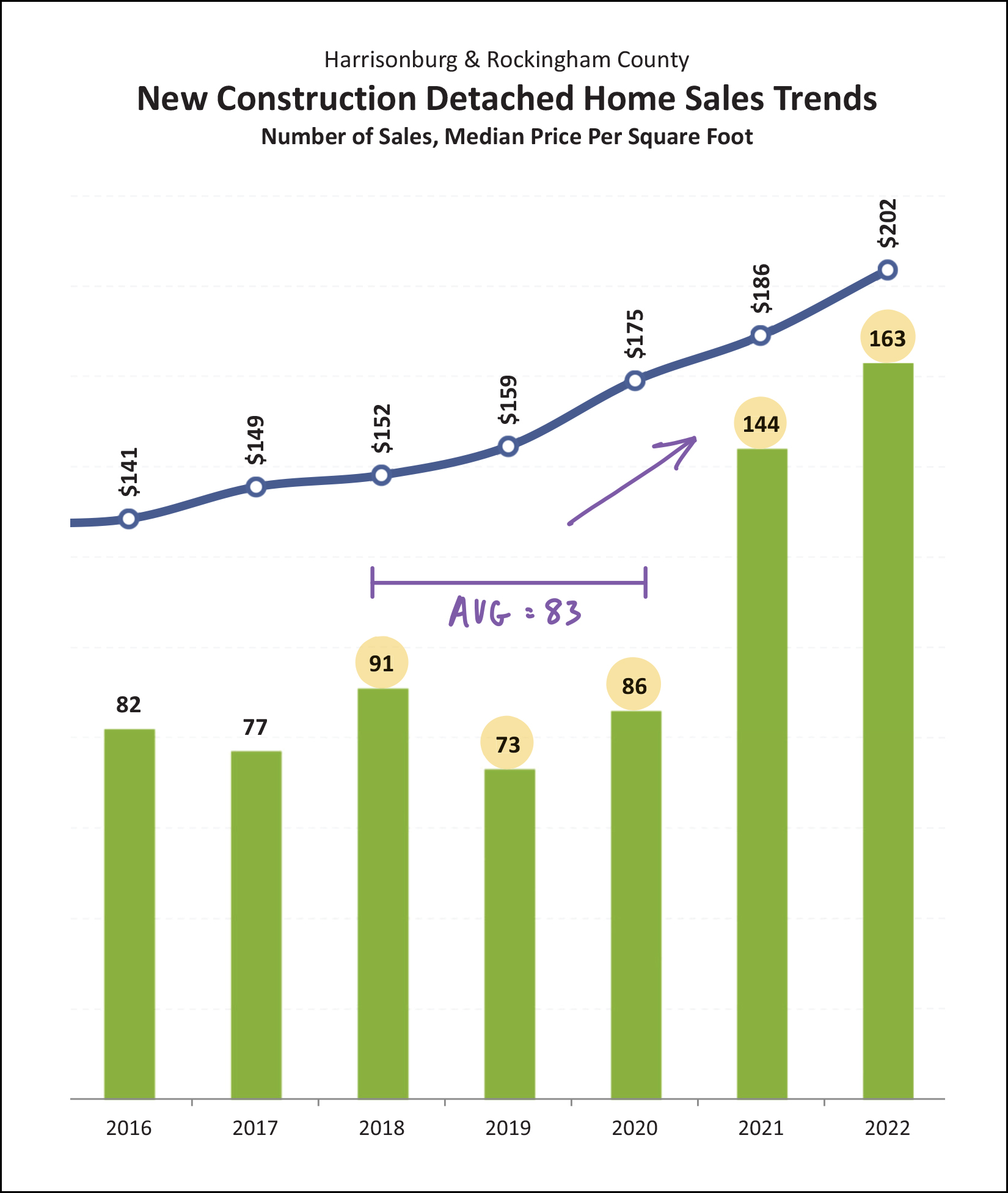

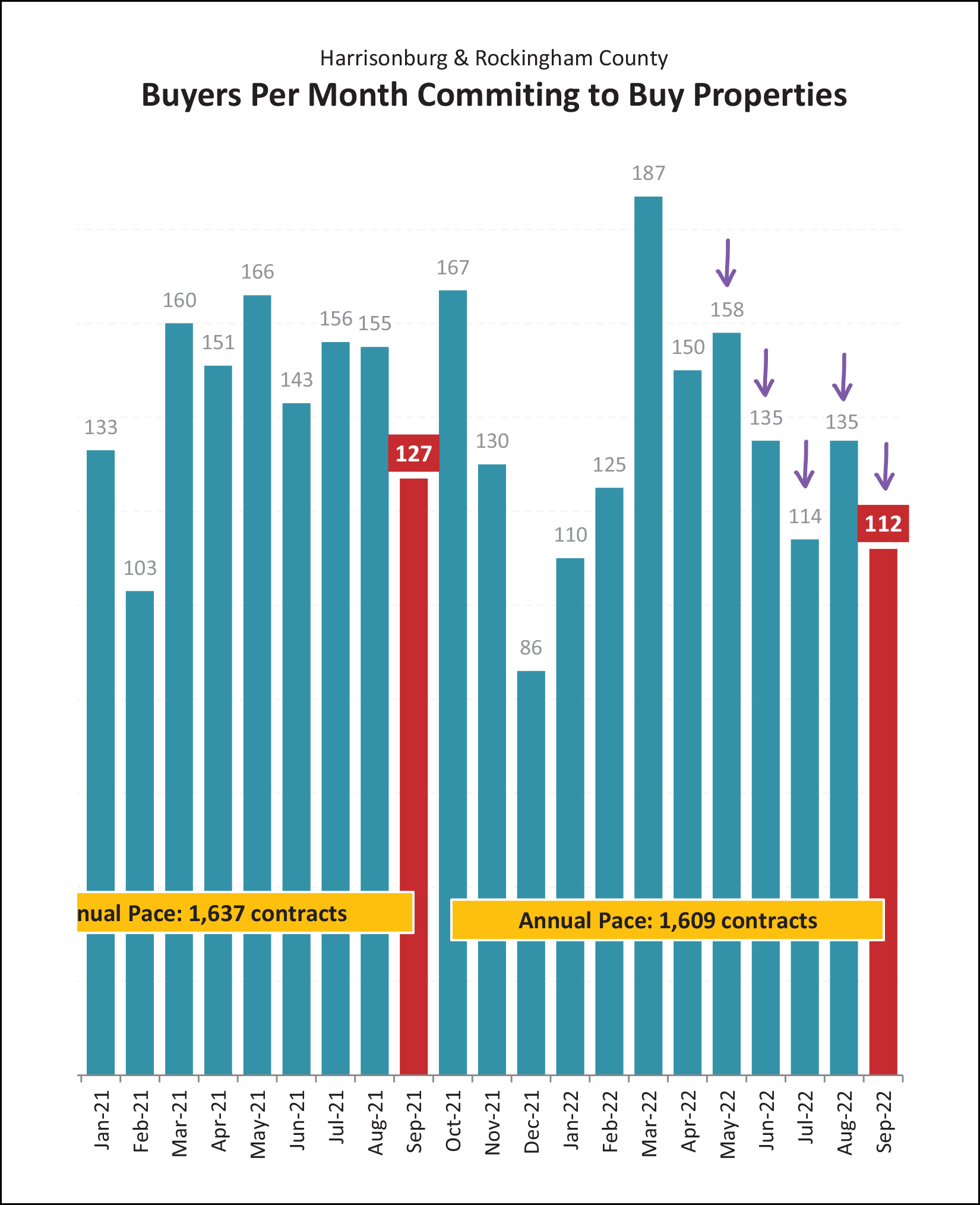

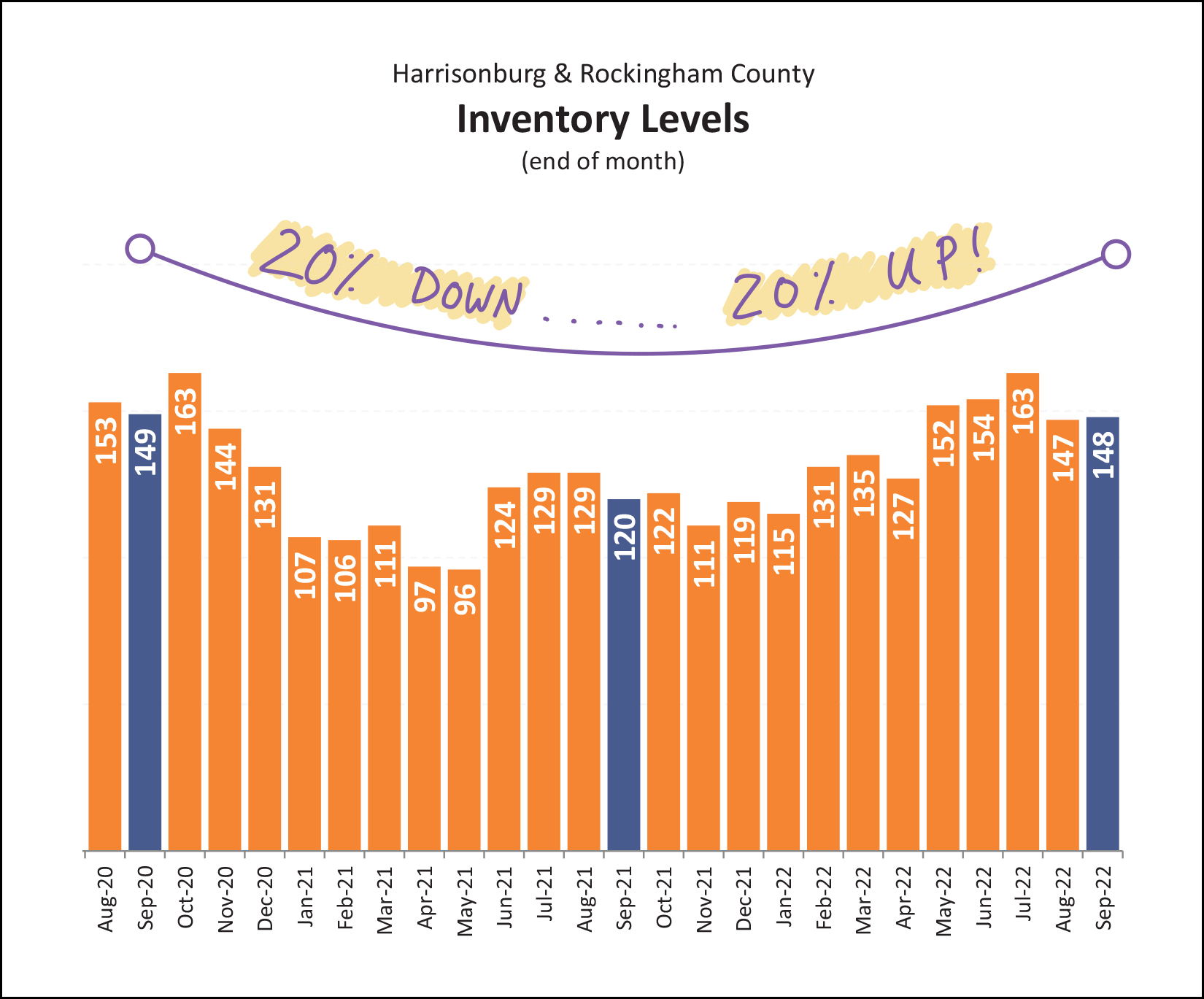

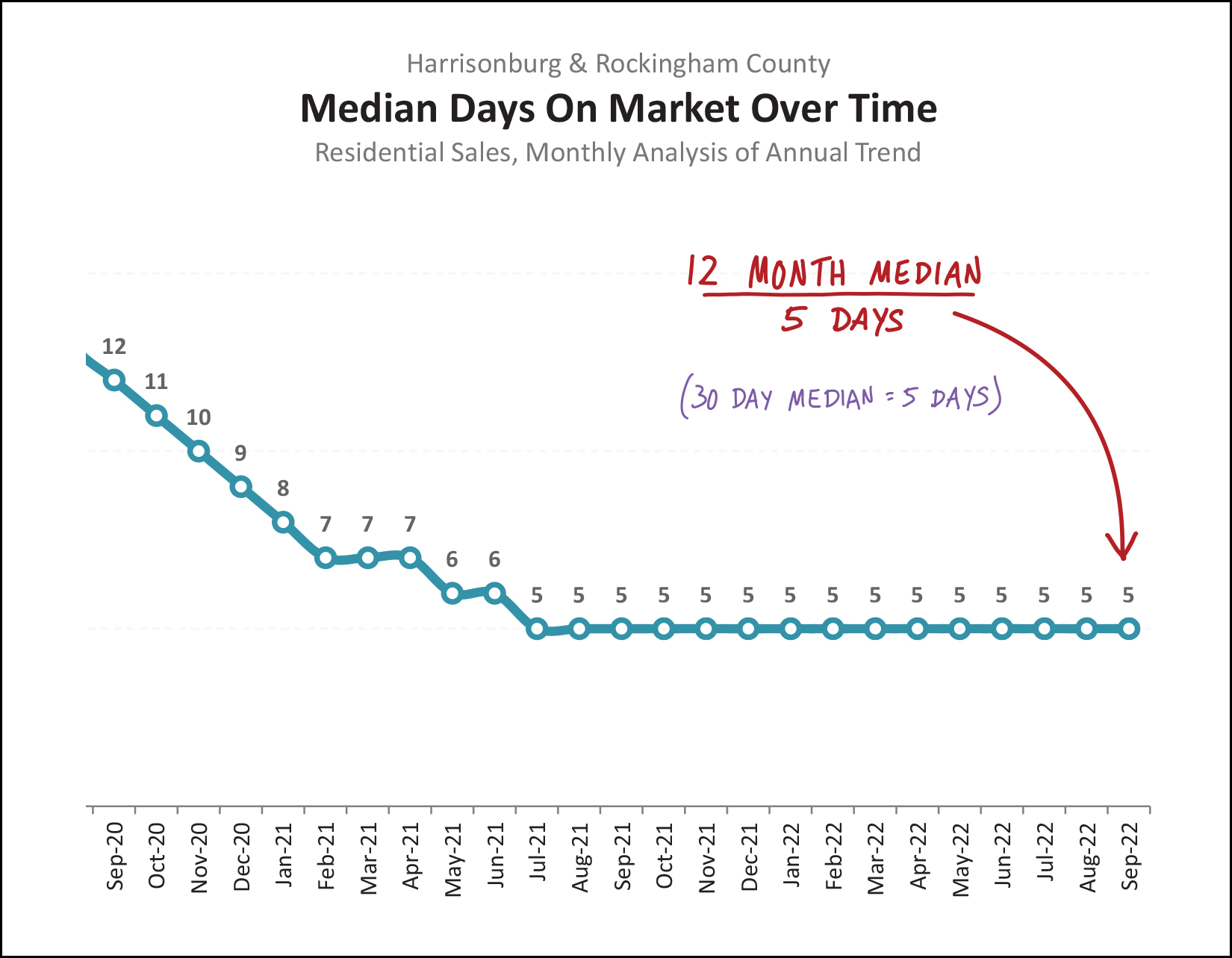

Happy Thursday afternoon, friends! Fall is upon us... with cool mornings and evenings, but often still reaching pleasant afternoon temperatures... and beautiful colors on trees throughout the Valley! Fall is my favorite season for the reasons above, and because it's volleyball season. My daughter plays JV volleyball and I coach middle school volleyball, both of which bring a lot of fun, excitement and joy to my life each fall. I hope that your fall, likewise, is full of fun, excitement and joy! Before we get to real estate... Each month I offer a giveaway, of sorts, for readers of this market report, highlighting some of my favorite places (or things) in Harrisonburg. Recent highlights have included Black Sheep Coffee and the Harrisonburg Half Marathon and the JMU Forbes Center. I'm bouncing back to another of my favorite spots to grab a cup of coffee... Bella Gelato, located on West Water Street in downtown Harrisonburg where you can enjoy delicious gelato that is made by hand on site, plus a pastry case of baked goods, and an espresso and coffee bar where you'll often find me ordering a caramel latte. Interested in checking out Bella Gelato? Click here to enter to win a $50 gift card to Bella Gelato! ...and this month's featured home is... The beautifully renovated home on the cover of this month's market report is located on the corner of Franklin Street and Myers Avenue, just a short walk from the many restaurants and shopping destinations in downtown Harrisonburg... such as Bella Gelato. ;-) Check out 400 Franklin Street here. ...and now, the real estate market update... First, before we get to the numbers, let's start with the big picture...it feels like the local housing market is changing or transitioning in some ways. Mortgage interest rates have increased drastically over the past six months and that seems to be impacting the amount of buyer activity and enthusiasm in our local market. Most sellers are experiencing fewer showings and fewer offers in the first week or two of their homes being on the market. But yet, we are still seeing relative stability in the number of homes selling in this area, combined with continued increases in the prices for which homes are selling.  As shown above... [1] Home sales were 7% slower this September than last, with 140 home sales this year compared to 150 home sales last year. [2] Thus far this year we have seen 1,234 home sales in Harrisonburg and Rockingham County, which is 1% more than we saw in the first nine months of last year. [3] The median sales price has increased 11% over the past year in Harrisonburg and Rockingham County, from $269K to $300K. [4] Homes are still selling very quickly, with a median days on market of only five days. More on this later. So if things feel slow lately, how are things still stable? Good question... see below for a month by month breakdown...  As shown above, we saw much higher numbers of home sales this year during April, May and June, followed by lower numbers of home sales this year during July, August and September. So, we had a very strong second quarter of the year, followed by somewhat weaker third quarter. What, then, will the fourth quarter of the year show? Given that mortgage interest rates keep creeping up higher and higher, I am anticipating that the fourth quarter of this year will show fewer home sales than the fourth quarter of 2021... which would then lead to an overall decline in the number of home sales between 2021 and 2022... if my guess is correct... and I make plenty of guesses that are not correct. ;-) The following graph helps put this year in an even more helpful context...  Two few observations about this "stacked up" graph above... [1] Yes, 2022 is still slightly ahead of 2021 through September... but we the gap is much narrower than it was a few months ago. [2] Even if we don't see 1,673 home sales in 2022 to match last year's total count, it seems very likely that we will still eclipse both 2019 and 2022. The following two trends seem to be running counter to each other, at least thus far...  The orange line above shows the number of homes selling on an annual basis in Harrisonburg and Rockingham County. The number of annual sales was climbing quickly through the end of 2021 but has mostly leveled off since the start of 2022. It seems unlikely that the annual pace of home sales will start increasing again anytime soon. The green line above shows the median sales price of homes selling in a 12-month period. As you can see, sales prices keep on rising. The median sales price over the past 12 months has been $292K... which is about $26K higher than the median sales price of $266K just a year ago. Moving forward, I expect we'll see home sales (green line) stay level or decline somewhat... while sales prices (orange line) will likely keep rising or possibly level out a bit. Changes in home prices over time are pretty wild if we scoot back a bit and look at a multi-year picture...  If only everyone had bought a median priced home ($198K) five years ago... then everyone would own a home that is now potentially worth $100,000 more, given the current median sales price of $299,837 in Harrisonburg and Rockingham County. This is a drastic shift in sales prices over a relatively short timeframe, meaning that... [1] Housing is more expensive for anyone who does not currently own a home. [2] Anyone who has owned a home during this time likely saw a significant increase in their home value and net worth. I am simultaneously thrilled for all of my past clients who have bought homes and are feeling good about these trends... and depressed for all of my clients who have not been able to purchase a home and are now faced with much higher purchase prices (and interest rates) in today's market. But back to that leveling off thing...  This graph shows that home sales (blue line) are starting to level off and inventory levels (green line) are starting to stabilize and increase a bit. If there continue to be slightly fewer buyers in the market, and slightly more sellers in the market, then... [1] Home buyers might have a slightly easier time securing a contract on a home they hope to purchase. [2] We might see a slightly smaller increase in the price of homes over time. Read that twice, please. I'm not currently anticipating a decline in prices, but rather, a slightly smaller increase in prices. I don't hit on this every month, but it can be helpful to realize that we have seen a pretty good sized increase in the number of new homes being built and sold in this area...  This graph is showing the number of new detached home sales per year in Harrisonburg and Rockingham County. This does not include attached home sales... which would would be duplexes or condos. After averaging 83 new home sales per year between 2018 and 2020, we saw a significant increase in 2021 to 144 new homes... and thus far in 2022, that is a total of 163 new home sales. Many, but not all, of these new detached home sales have been in Ryan Homes communities. It will be interesting to see how new home sales and resale homes track over the next few years especially within the context of higher mortgage interest rates. Now, a peek into the near future...  In each of the past five months (purple arrows) we have seen fewer contracts signed than were signed in the same month last year. This probably doesn't surprise anyone who has been paying attention to changes in mortgage interest rates. Ever higher interest rates have changed the potential mortgage payment for buyers, which is definitely impacting how many potential buyers are capable of buying or interested in buying. Multiple (five) months of lower levels of contract activity means that we will continue to see lower levels of closed sales over the next few months... which is why I expect we'll see a slower fourth quarter of home sales this year as compared to last year. And after years of saying inventory levels are down, now we see that...  Inventory levels are actually rising a bit. When looking at two years ago compared to one year ago we see about a 20% decline in inventory levels. When looking at one year ago compared to today we see about a 20% increase in inventory levels. Today's inventory levels are still *very* low compared to historical norms, but buyers today seem happy to have slightly more choices of homes for sale, or to see homes sticking around on the market for slightly longer before going under contract. Though... about that time on market trend...  Over the past 12 months, the median number of days it took for homes to go under contract once listed for sale was... five days! We first hit that low (low!) level of a median of five days back in July 2021, and we have been hanging out at that same level ever since. Interestingly, I suspected that if I looked at a shorter, more recent, timeframe that I would find that it is taking homes longer to go under contract. With that theory in mind, I looked at the median days on market over the last 30 days and it was... still five days. So, the market (overall) seems to still be moving very quickly with half of new listings that go under contract doing so in five or fewer days. And finally, a visual to show you how quickly mortgage interests have been rising...  A year ago, mortgage interest rates were right around 3%. Six months ago, mortgage interest rates were right around 4.7%. Now, today, they are all the way up to 6.7%. As you might imagine, this increase in mortgage interest rates significantly affects a buyer's mortgage payment - and potentially their ability to purchase the home they might hope to purchase. So where does all of this leave us? Despite what may be going on in other real estate markets around the state or the country, here's what seems to be true in our local market at this moment in time... [1] Contract activity and home sales has slowed in the second half of 2022, though the highly active first half of 2022 is still keeping us on track with 2021 thus far. [2] Higher mortgage interest rates are affecting buyer behavior which is often resulting in fewer showings and fewer offers. [3] Despite the points mentioned above, homes are still going under contract very quickly and home prices keep on rising. As you look ahead to the remainder of fall, and into the winter months, if you're thinking about buying a home, or selling a home, we should chat about how things are going in your segment of our local market as it relates to the property type, price, size, location and age of your home. I'll check in on the market again in about a month, but until then, enjoy your fall days, and best of luck to anyone else running in the Harrisonburg Half Marathon this Saturday! | |

Buy A Home For You, Not Just The Next Owner |

|

As we walk through houses thinking and talking about if each house works well (or not) for you and your family... it can be tempting to start putting each house in a far future context... "Yes, this layout and these room sizes would be great for us... but will the next buyer like them?" "I love the backyard and gardens... but maybe the next buyer will think they are too small?" "I love this house and I don't mind at all that the bathrooms are a bit small in... but maybe that will be a sticking point for the next buyer?" Sometimes I see a home buyer fall IN LOVE with a home, but then talk themselves out of it because they aren't confident about whether they will find a future buyer that loves the house just as much to whom they can sell the house in the future. Yes, it is important to think a bit about future resale when you are buying a home... but it is even more important that you love the home that you are about to buy. Don't buy a home that you don't like, that will be easy to sell later. Don't decide not to buy a home that you like only because it won't necessarily be easy to sell later. Buy a home for you... not just the next owner! | |

University Boulevard To Be Realigned In Forest Hills Area |

|

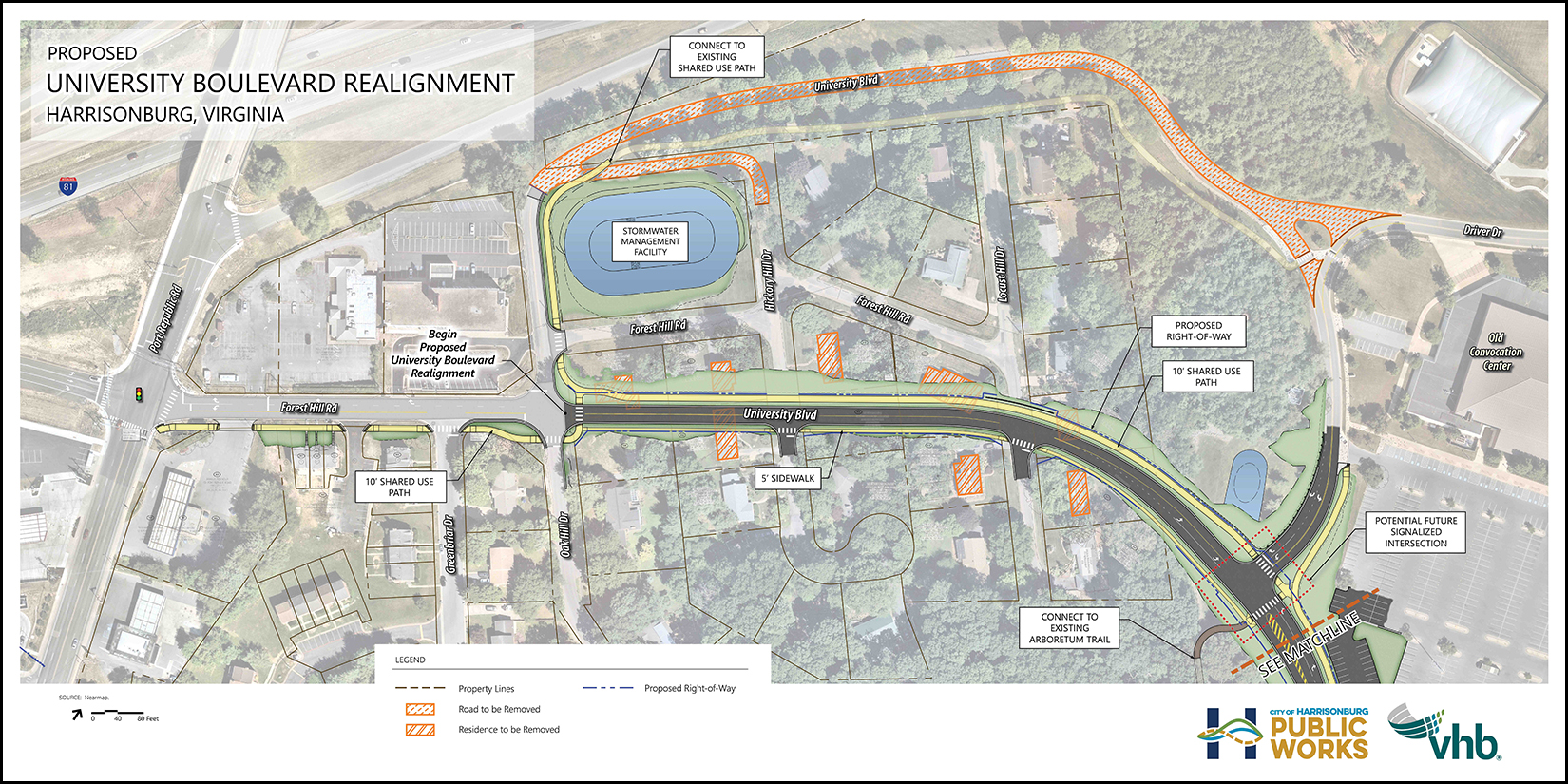

The (winding) section of University Boulevard between the Convocation Center parking lot and the intersection of Forest Hills Road and Oak Hill Drive will be realigned and widened to include both a roadway, shared-use path and sidewalk... but, likely not until 2025. Who will pay for this transportation transformation? The project is estimated to cost about $10.4 million and these costs will be paid as follows...

View a larger version of the map above here. Learn all about this realignment project on the City website here, or via this recent Daily News Record article. | |

Updates On Proposed Residential Developments In Rockingham County |

|

BOYERS CROSSING September 2022 - Approved by Rockingham County Board of Supervisors ZEPHYR HILL September 2022 - Approved by Rockingham County Board of Supervisors THE GLEN AT COOKS CREEK August 2022 - Approved by Bridgewater Town Council AND MORE Find out about the many new developments and proposed developments here at HarrisonburgNewHomes.com. | |

How Will Our (Local) Climate Change Over The Next 20 (plus) Years? |

|

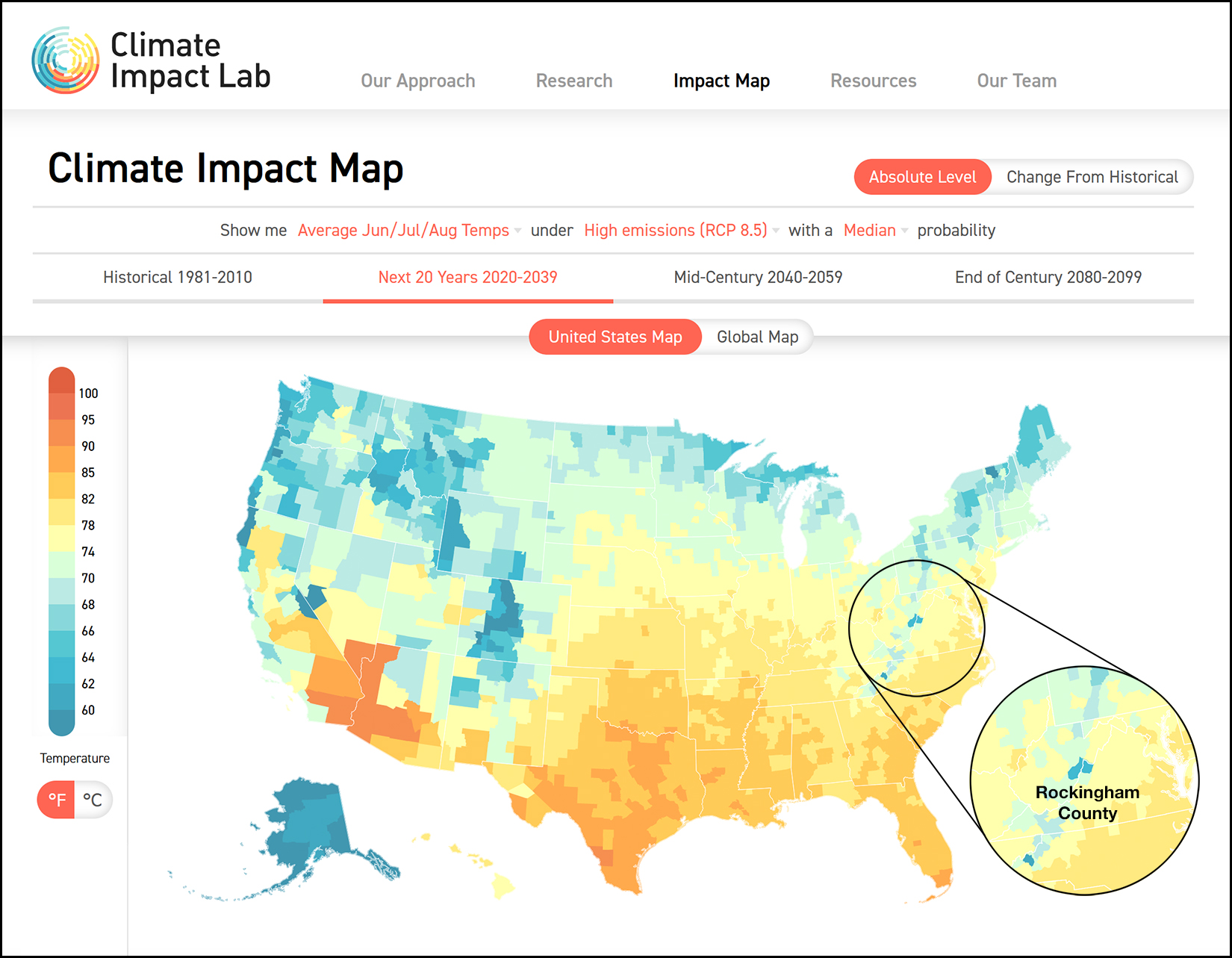

Give it 20 years, and Harrisonburg and Rockingham County might be the "coolest" place to be living in these parts. The map above is showing projected temperatures about 20 years from now, but you can look even further into the future on Climate Impact Lab's interactive map here. | |

Help Shape The Future Of Rockingham County! |

|

Rockingham County is revising and updating its Comprehensive Plan, which is a document that sets the vision and goals for the next 10 to 20 years! The last review was approved by the Board of Supervisors on September 23, 2015. The Comprehensive Plan addresses topics such as:

The policies defined in the plan will guide the County's future direction and priorities for growth, services, and land use regulation. And... YOU... can have a voice in the updated Comprehensive Plan! Take a few minutes to complete the Public Input Survey by clicking here. Find out more about the Comprehensive Plan update here. | |

Should You List Your Home Now Or Wait Until Spring? |

|

Now or Later? Now! :-) I mean... don't get all panicky about it... but I would definitely recommend listing your home now, rather than waiting until the spring. Oftentimes homeowners who might sell in fall or might sell in the spring decide that they might as well wait until spring. I think this year is or should be different for homeowners who aren't sure whether to sell now or wait until spring. Yes, interest rates are high right now, but inventory levels are still low, homes are selling quickly, and at great prices. [1] Interest rates might have come down some, but they may also be just as high or higher. [2] Inventory levels could quite possibly be higher (more competition) if the market slows over the next six months. [3] Homes may not be selling as quickly. [4] Home prices might be even higher in six months, but they could also have flattened out or declined a touch. I am not predicting a major change in the state of our local housing market... and I am not saying that the sky is falling... and I don't think the local housing market is going to be much worse six months from now... ...but, I think the calculus on whether to sell in the fall or to wait until spring is a bit different this year, and some homeowners that might have normally waited until spring should probably consider listing their homes this fall instead. Just a thought. What are your thoughts? | |

Where Might Mortgage Interest Rates Go From Here? |

|

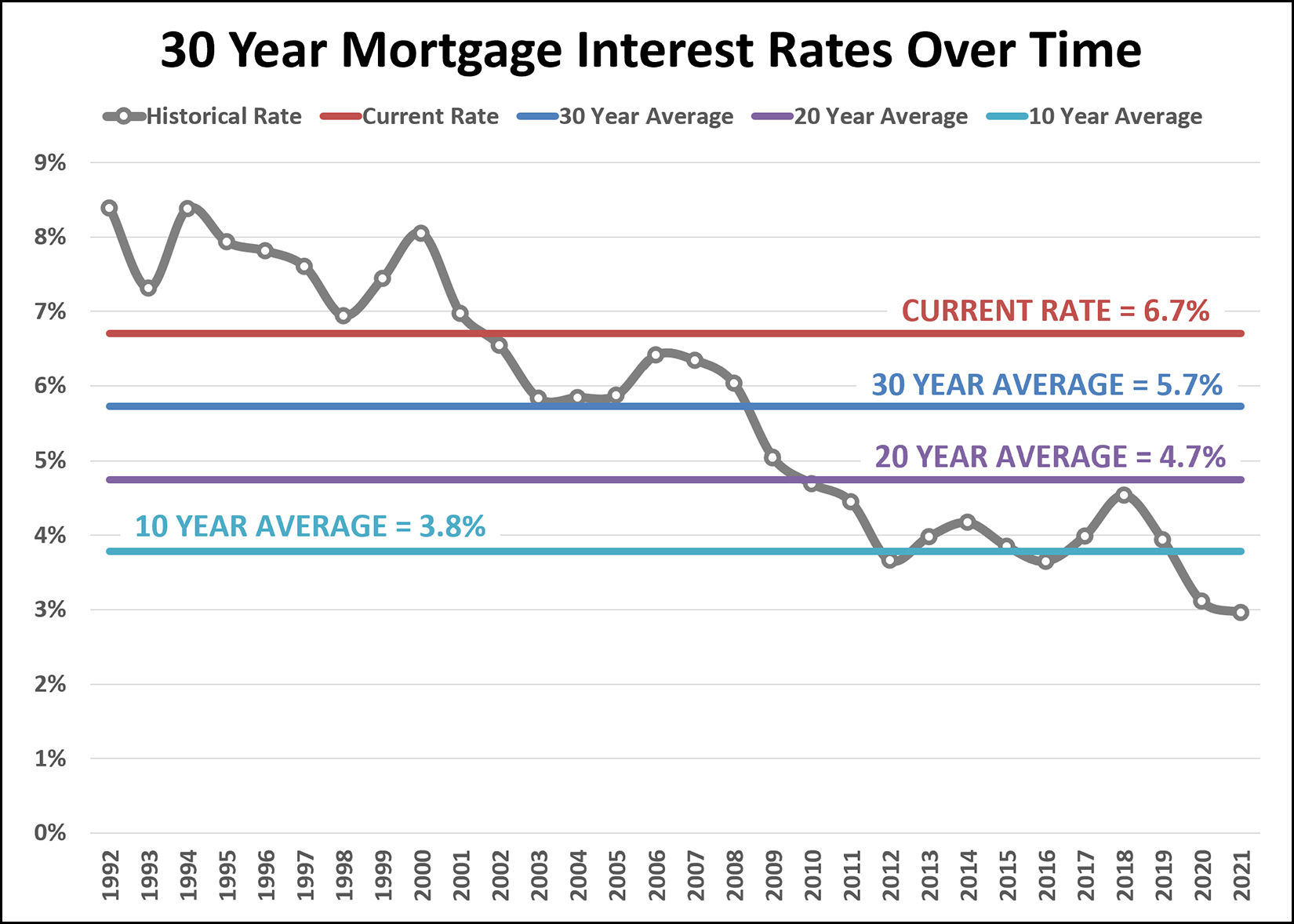

30 year fixed mortgage interest rates were around 3% a year ago... and now they are up to 6.7%. Ahhhh! Some home buyers today, taking out mortgages at today's rates, are wondering whether it is likely that they will be able to refinance their mortgage anytime soon to get a mortgage rate lower than 6.7%. It's very difficult to know whether that would be likely... but a lot of that would have to do with what historical norm we may or may not gravitate back towards within the next few years. Are mortgage interest rates going to settle back down to 3%? That seems extraordinarily unlikely. Might they drop back down to the average rate over the past 10 years, of 3.8%? That seems somewhat possible, but still not necessarily likely. Might mortgage interest rates drop down to the average rate over the past 20 years, which was 4.7%? That seems quite possible, which would result in a 2% drop from today's 6.7% to the average over the past 20 years of 4.7%. Or, if you want to be even more conservative, we could look at the average mortgage rate over the past 30 years... which was 5.7%, still a full percentage point below the current rates. Another way to look at this is to note that mortgage interest rates were above the current 6.7% rate between 1992 and 2001... and below the current 6.7% rate between 2001 and 2021. Are we headed back towards mortgage interest rates we saw in the 90's? Or the early 2000's? As you might have gathered, I have no actual answers here other than to point to this historical data as a greater context for current mortgage interest rates. :-) | |

Well, I Suppose This Was One Way To Revive The Market For Future Mortgage Refinances? |

|

Sorry. Bad joke. Probably too soon. Mortgage interest rates have risen even further this week... with the current average rate on a 30 year mortgage now at 6.7%. One year ago it was 3.01%. Also one year ago, some said that every last person who could ever possibly think about refinancing their mortgage certainly must have done so. But now it seems some buyers are likely entering into fixed rate mortgages at rates that are high enough that they will be planning to refinance sometime in the next few years with the assumption that at some point we won't be looking at 6.7% interest rates any longer. I suppose it is also important to note that a 5/1 ARM is currently at 5.3%, which might be a MUCH better option for some home buyers. This mortgage interest rate would stay level at 5.3% for five years, and then have the potential to adjust once a year each year thereafter. It's a topsy-turvy time in the mortgage world right now, which can impact the home buying world, which can impact the home selling world. The steady increase in mortgage interest rates has certainly affected housing affordability, especially when piled on top of higher home prices. | |

Does Building College Student Housing In Harrisonburg Impact City Schools? |

|

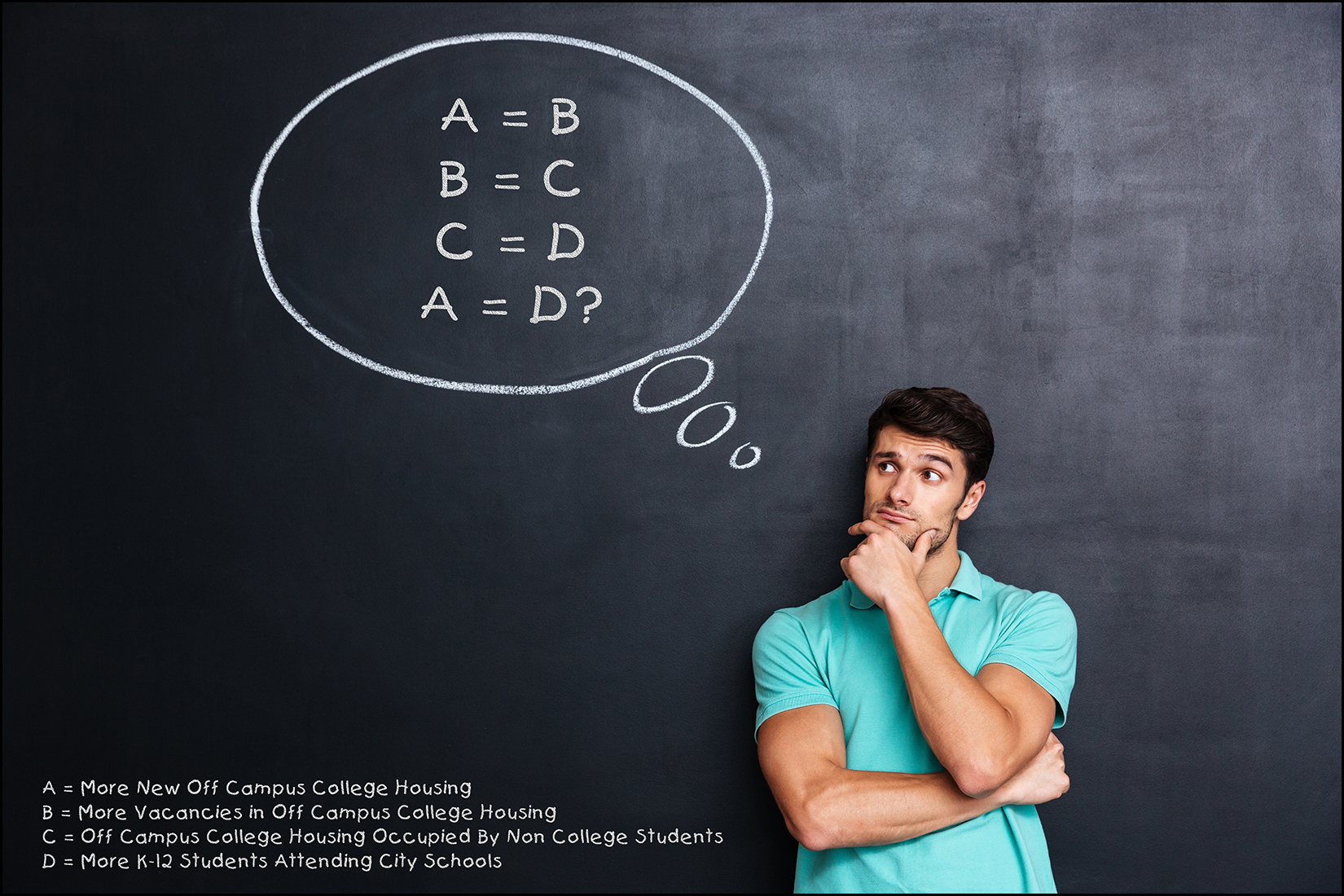

At first glance, the answer to this question seems obvious... If more college student housing is built in Harrisonburg, those college students are very unlikely to have children attending K-12 schools in the City of Harrisonburg. So, there is not a connection between college student housing construction and K-12 student population, right? Well... maybe there actually is an indirect connection... Using some rough, and certainly inaccurate numbers, let's pretend... [1] There are 21,000 students at JMU. [2] Of those, 7,000 students live on campus. [3] Thus, 14,000 students live off campus. And let's pretend that today, there is enough off campus college student housing for... magically... 14,000 students. Clearly, it's not this cut and dry, but I can pretend. Now, what happens when more off campus college student housing is built? What happens when there is enough new housing to fit 500, 1000 or 2000 more college students? First off, yes, JMU is growing and will continue to grow over time... but not that fast!? Now, after this new off campus college housing for 2,000 more students is constructed we will have off campus student housing for 16,000 college students... but only 14,000 college students who need housing! What seems to inevitably happen in Harrisonburg, is that when new off campus student housing is built... some of the existing (usually older) off campus student housing is no longer occupied by college students. And then, yes, the new tenants... who are not college students... may have children... who would attend City schools. So, while it may seem at first glance that building off campus college student housing does not impact the City school population (and thus the City budget to pay for educating more students) it seems that this new off campus college housing actually can indirectly impact City schools. As to the illustration above... A = More New Off Campus College Housing B = More Vacancies in Off Campus College Housing C = Off Campus College Housing Occupied By Non College Students D = More K-12 Students Attending City Schools If A=B and if B=C and if C=D... then, does A=D? A few pretty broad disclaimers... 1. I'm not saying it's a bad idea to build more off campus college housing. 2. I am saying it's a good idea to discuss and understand the primary and secondary impacts of building new off campus college housing... or any other type of housing. 3. I'm not saying it's a bad thing to have non college student rental housing created through increased vacancies at what were previously college student housing complexes. Perhaps that's a good thing... or a normal part of the housing cycle in a college town? As with most of my writing about the dynamics of our local housing market... I'm not trying to convince you that one thing or the other is a good or bad... I'm just trying to get some discussion points out there for you, and others, to consider and decide what you think. :-) | |

Will A 6% Mortgage Interest Rate Seem High After A Year Of 6% Rates? |

|

Many (though not all) home buyers in the market today have been shopping for homes for the past three, six or 12 months. As such, when they encounter today's mortgage interest rate of around 6.25% they find it to be high. Quite high! After all, six months ago, the average 30 year fixed rate mortgage interest rate was 4.25%... and a year ago, the average rate was a touch below 3%. So, of course, a 6.25% mortgage rate seems high compared to 4.25% or 3%. But... fast forward a year... if mortgage interest rates have remained around 6% for a full year, will they then stop seeming and feeling high? Clearly, a 6.25% mortgage interest rate a year from now will still result in the same mortgage payment as a 6.25% mortgage interest rate does today... but perhaps that payment (and that interest rate) will no longer be viewed in the context of what could have recently been... at 4.25% or 3%. Of course, I'm hoping mortgage interest rates don't really stay this high (around 6%) for a full year, but if they do, maybe they won't seem quite as high to home buyers a year from now. | |

55 (More) Townhomes Proposed On Pear Street |

|

Just a short walk down Pear Street from where 33 townhomes are proposed there is now a new request for a rezoning of 6.77 acres to allow for 55 more townhomes to be built. This proposed development, to be called Zephyr Hill, is intended to consist of both two and three story townhomes, with and without garages. These 55 proposed townhomes would also be adjacent to the Cobblers Valley development currently being built by Ryan Homes. Here's the proposed site plan for these 55 townhomes...  The full County rezoning packet is available here. | |

As You Might Imagine, It Is Still A Pretty Swell Time To Sell A House |

|

Lots of homes are still selling, relatively quickly, at high prices. Yes, mortgage interest rates are higher, which limits the housing budget for some buyers, but thus far we are not seeing higher mortgage interest rates affect the prices for which homes are selling. Thus, home sellers are still enjoying the current market as a great time to sell... Lots of homes selling = YAY Low inventory levels = YAY Homes selling quickly = YAY Sales prices remaining high = YAY Higher mortgage interest rates = Yeah, so what? Certainly, if a home seller needs to turn back around and be a home buyer, the mortgage interest rates will impact their housing transition. But if you are just selling a home... it is still a very enjoyable time to sell... | |

I Was Going To Upgrade To A Larger Home Until I Saw That Larger Mortgage Payment!?! |

|

In more than a few conversations over the past week I have been chatting with friends and past clients who have shared that they had been recently toying with the idea of upgrading to a larger home. In each of these instances, they bought their home three to eight years ago and are now finding it to be a bit tight in various areas. A new kid (or two) stretching the bedroom usage... working from home part of the time with limited space in which to do so... older kids with friends coming over to hang out and wanting room to lounge, etc., etc. These various "life is changing and house needs are changing" situations prompted each of these homeowners to think about whether they ought to upgrade to a larger home. But... then they started running the numbers. At first, things look good... They bought their current home for $300K, have a mortgage payment of around $1600/month, they still owe $250K and could sell for $415K. Thus, they could walk away with about $140K after settlement. But then, things turn a bit... The larger home would cost them around $540K. They'd put $140K down, so they'd be financing about $400K. At current mortgage rates of around 6%, their monthly payment would be... $2900/month. As you can see from this rough math for this one homeowner's situation, even though their $300K home is now worth $415K, and even though they would be walking away with $140K after selling, and even though they'd only be upgrading from a $415K home to a $540K home... their mortgage payment would be jumping up from $1600/month to $2900/month. The big change here is, of course, the mortgage interest rate. Paying off that 3.25% mortgage and taking out a new 6% mortgage is going to cost ya! What does this mean for homeowners and our local market? I suspect there will be fewer elective home upgrades over the next few years if interest rates remain this high... which has the potential to further limit resale inventory of homes for sale. This story is not everyone's story... so if you're considering an upgrade (or a downgrade) let me know if you'd like to do some rough math together to evaluate the overall financial impact of making the change. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings