| Newer Posts | Older Posts |

Will Buyer Activity Continue Full Strength In January? |

|

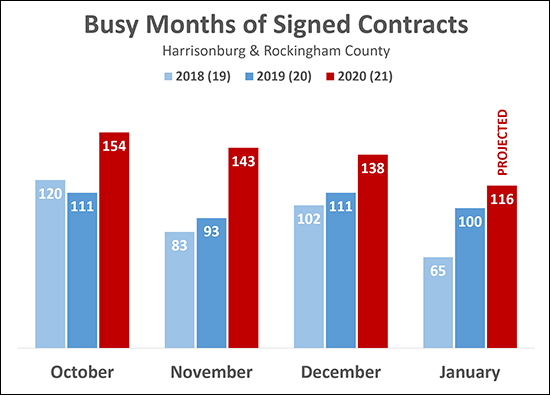

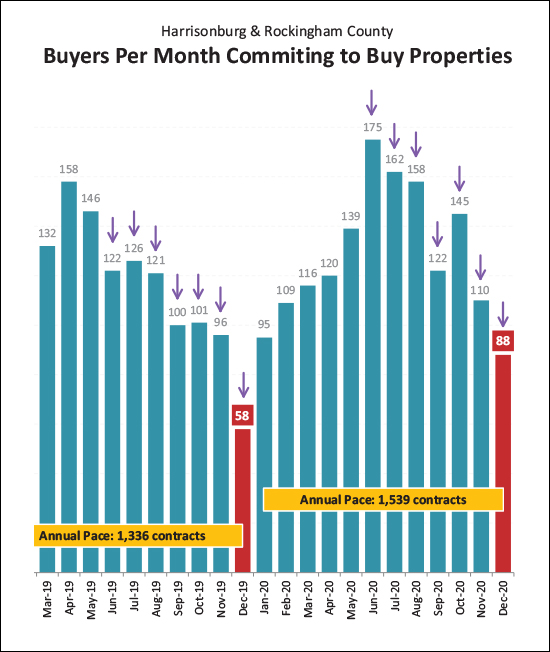

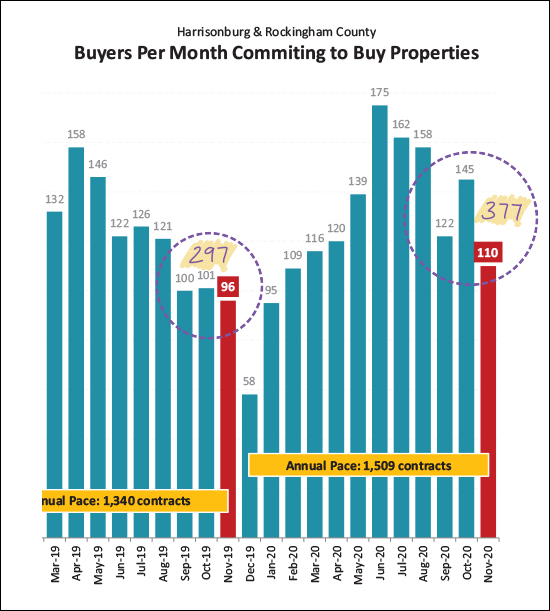

As shown above, the past three months (October, November and December) were absolutely bonkers as far as contract activity in Harrisonburg and Rockingham County. We saw far more contracts being signed than is typical for those months of the year. If we average the number of contracts seen in the fourth quarter of 2018 and 2019 we might have thought we would have seen 310 contracts signed in the fourth quarter of 2020. Instead, there were 435 contracts signed! So, how will things turn out in January? So far -- it seems buyer activity will continue to be strong in January 2021. There were 75 contracts signed between January 1 and January 20 which points to a projected total of 116 contracts potentially being signed during the full month of January, which would -- again -- surpass normal market activity for the month of January. Stay tuned to see how long this strong wave of buyer activity will continue... | |

Maybe Some Townhouse Developments Have Fewer Homeowners (Living In Those Townhouses) Than I Thought |

|

Before I look at any given set of real estate data, I usually have some sort of an idea in my head of what the data is likely going to indicate. I'm not always exactly right in my guess as to what I'll find when digging into the data - but I'm usually not overly surprised. A fellow agent asked me a few weeks ago about how many townhouses in Taylor Spring I thought were owner occupied vs. tenant occupied. I think I guessed that 80% or more were owner occupied. That was just my general feel for the neighborhood. It seems to mostly be homeowners. I was wrong. Pretty significantly wrong. I pulled the property records for all townhouses in Taylor Spring and then determined which were owner occupied based on whether the tax bills are sent to the actual property (likely owner occupied) or sent to a different address (likely not owner occupied) and this is what I found... Total Townhouses = 185 Owner Occupied = 94 Percent Owner Occupied = 51% So, it seems that about half of the townhouses in Taylor Spring are rentals. I was surprised, though mainly just because of my general assumption about what I was going to find. Are you surprised? | |

Juniper Hill Commons, A Multi-Generational Cohousing Community Is Under Development On Keezletown Road |

|

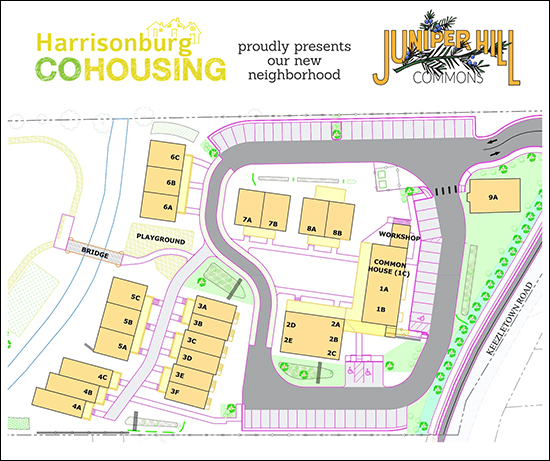

A new cohousing community is under development on Keezletown Road to feature (27) homes with 800 to 2400 SF. All homes are intended to include solar panels, spacious front porches and six inch thick walls. There are a variety of house plans intended to be built at Juniper Hill Commons such as this triplex...  What, you might ask, is a Cohousing Community? Here's the vision for this neighborhood...

Learn (A LOT) more about this planned neighborhood by visiting their website where you can find a plat, house plans, neighbor bios and much more! | |

Most Homes Sold Quickly In 2020! |

|

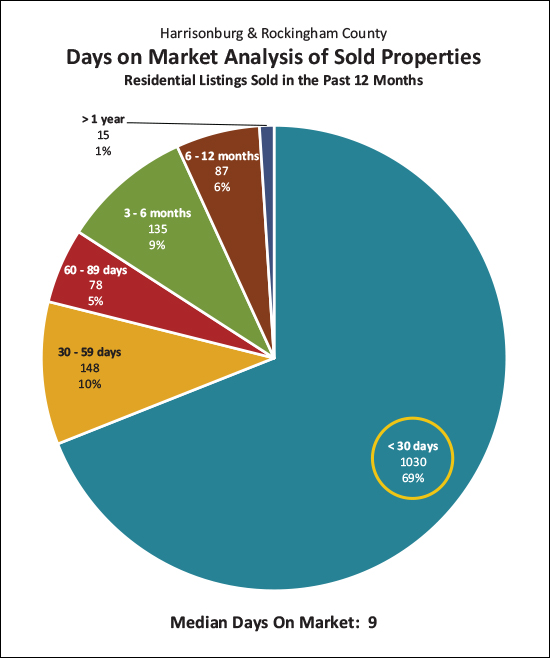

The graph above is an analysis of all of the homes that sold during 2020 in Harrisonburg and Rockingham County. You'll note that 69% of those homes sold (went under contract) within 30 days of being listed for sale! I expect that we will continue to see this dynamic in 2021. There are still plenty of buyers looking to buy homes, and very low inventory levels. As such, many homes are being scooped up by buyers within days (or weeks) of first hitting the market for sale. Home buyers in 2021 will need to be ready to act QUICKLY to secure a contract to purchase a home! | |

Not Much Negotiability In Home Prices In 2020 |

|

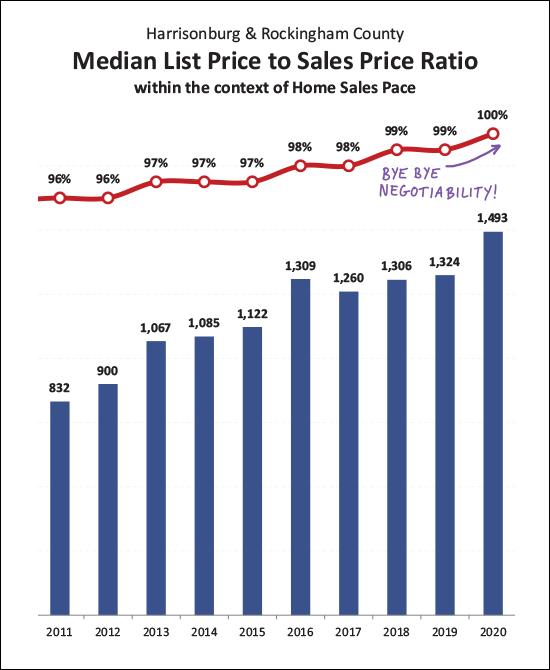

Looking back at a full year of data now for 2020, it is impressive to note that the median "list price to sales price ratio" was 100% for the year. This means that at least half of sellers sold at or above their list price! Home buyers likely aren't surprised by this revelation as they have experienced it first hand if they bought - or tried to buy - in 2020. New listings that are prepared well, priced well and marketed well are receiving multiple offers within days of hitting the market. Oftentimes, buyers are not discussing whether to make a full price offer - they are discussing how far above list price to go with their offer. Home sellers must still remember that this is not a blank check. Just because buyers are so eager to buy that they are often going above list price does not mean that you can list your home for any price you'd like. If your home is potentially worth $300K in the market right now, you ought not list it for $350K and then be surprised when you don't have a rush or showings and don't have any offers. You still need to price your home based on recent sales, though you might be able to round up a bit more than you had in the past when pricing your home. I expect this dynamic (most homes selling for the list price or higher) to continue as we move through 2021. | |

At Year End, Home Sales Up 13%, Prices Up 10% in 2020 in Harrisonburg, Rockingham County |

|

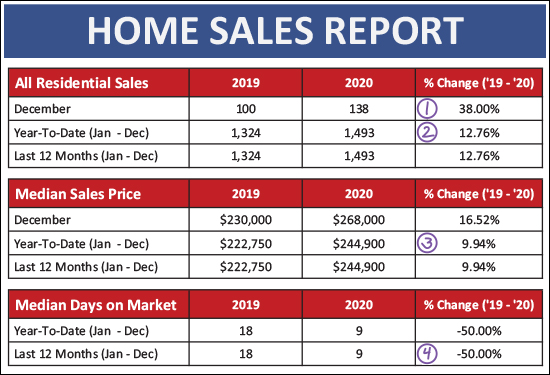

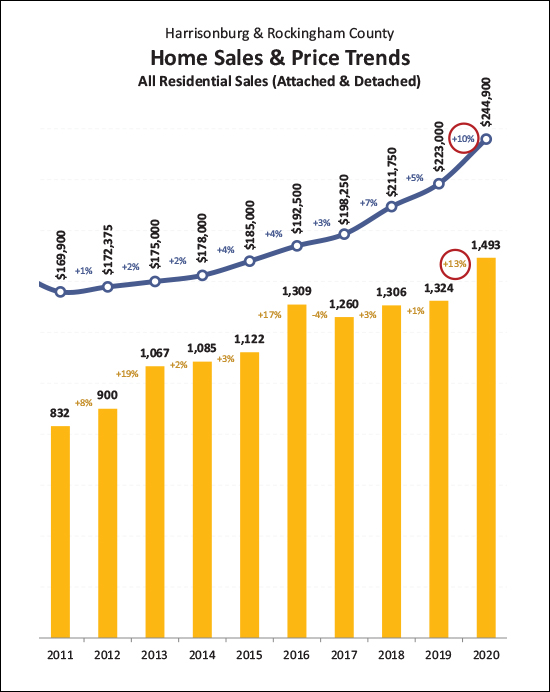

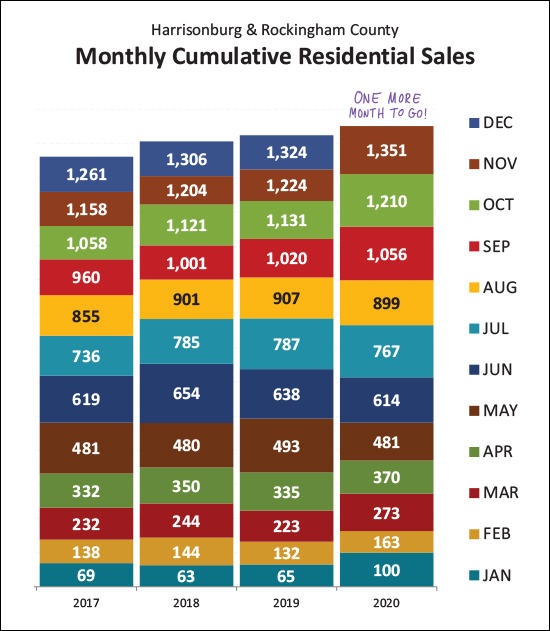

Happy New Year, friends! 2020 was a year like no other - in our local housing market - and in many (many!) other ways. I hope you and your family are doing well, staying healthy, and are full of hope looking forward to the year ahead! Below, I'll walk you through some of the overall trends we are seeing in our local housing market when reflecting back on a full year of 2020 home sales data. Before we get started, though, check out the featured home above here and feel free to download the full PDF of my market report here. Now, to the data...  What a wild finish to the year! A few things to note when looking at this overall data...

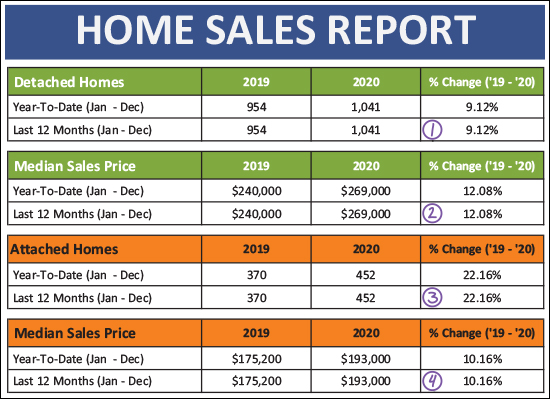

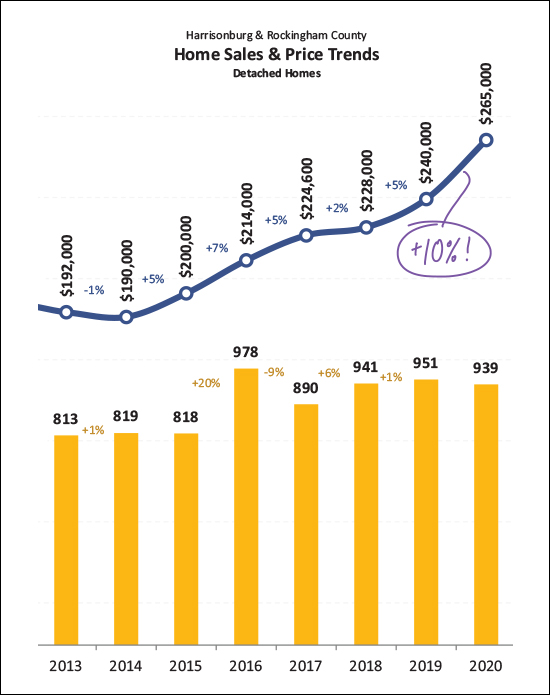

Looking a bit further, let's break down the detached homes as compared to attached homes. Attached homes are duplexes, townhomes and condominiums.  As you can see above...

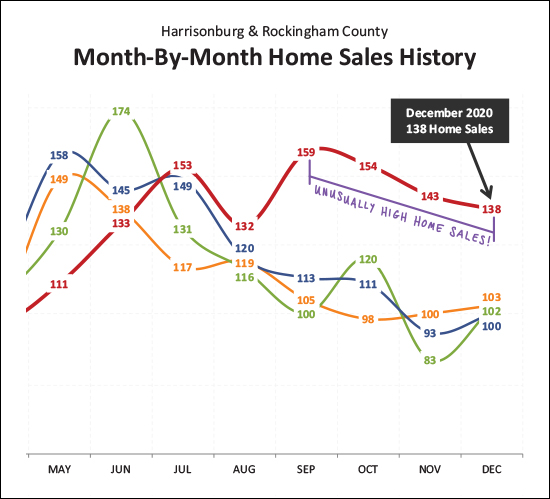

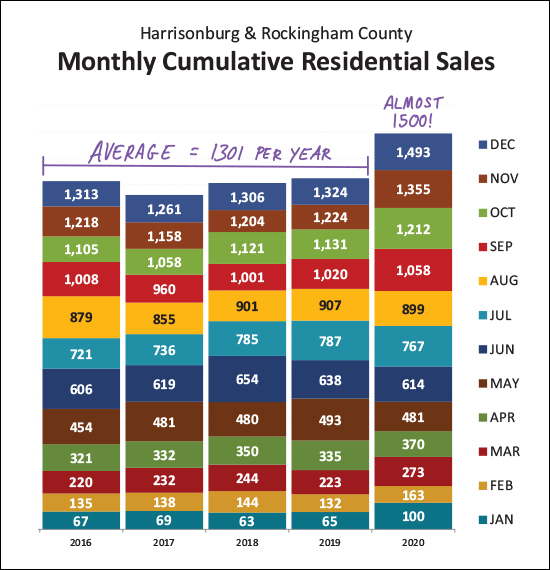

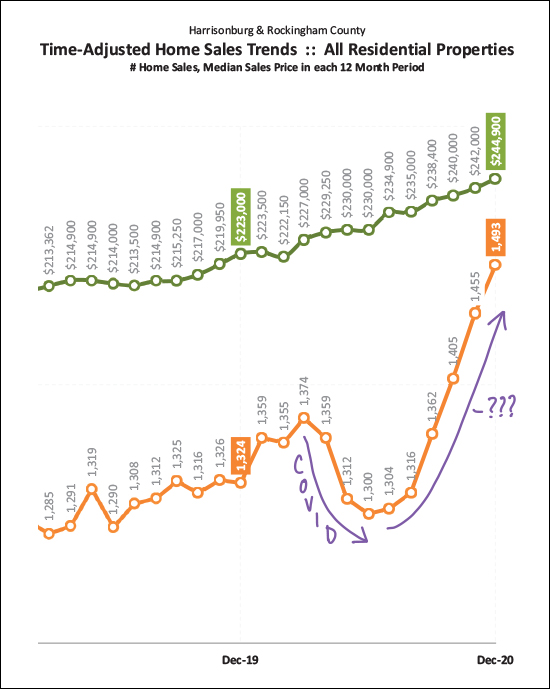

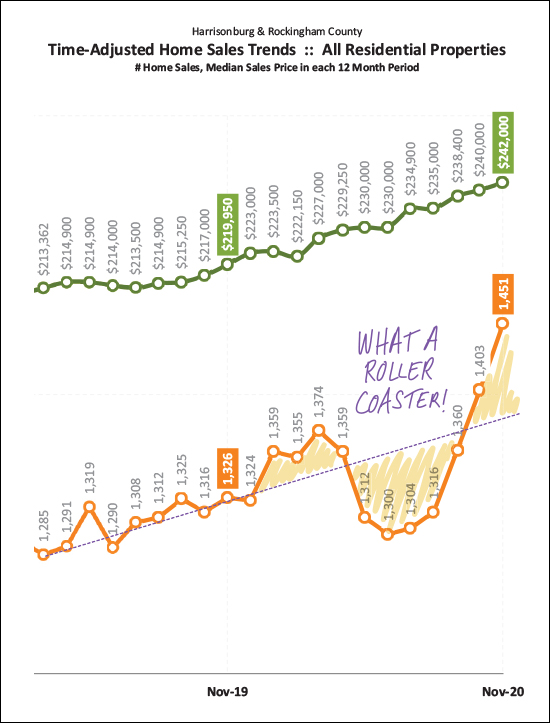

It's hard to think of the best metaphor for the monthly pace of home sales in 2020. Perhaps someone running a race that tripped and fell and slowed down considerably a third of the way into the race, but who slowly picked up speed over the next third of the race and who absolutely SPRINTED through the final third of the race?  Take a look at September through December of 2020 above, marked with a red line. This is not normal / typical / expected. We expect to see an average of about 100 home sales per month for the last four months of the year. In 2020, it was an average of 149 home sales per month! This, clearly, makes me hesitant to guess about what we'll see in January and February. These winter months are typically the slowest months of the year for home sales -- but not in 2020. I expect we'll continue to see stronger than usual home sales for at least the first few months of 2021. And, looking at those sales on an annual basis...  If you track along any particular color band in the graph above you can see where we were at that point of the year for each of the past five years. In August (yellow) of 2020 we were tracking right around where we would expect to be based on 2019 sales. But then those last four months of the year happened, catapulting us waaaaay ahead of where we have been for any recent year in Harrisonburg and Rockingham County! Here's an even crazier look at what has been happening for the past four months...  The more interesting (confusing!?) line above is the orange one. That is showing the number of home sales we're seeing per year in our area. That trajectory took a nose dive in early 2020 thanks to COVID but has been absolutely skyrocketing over the past four months. Why, why, why? Here are some guesses...

OK, I went on a bit more than I expected there, let's look one more time at the annual trends before we move on...  Two main things to note above...

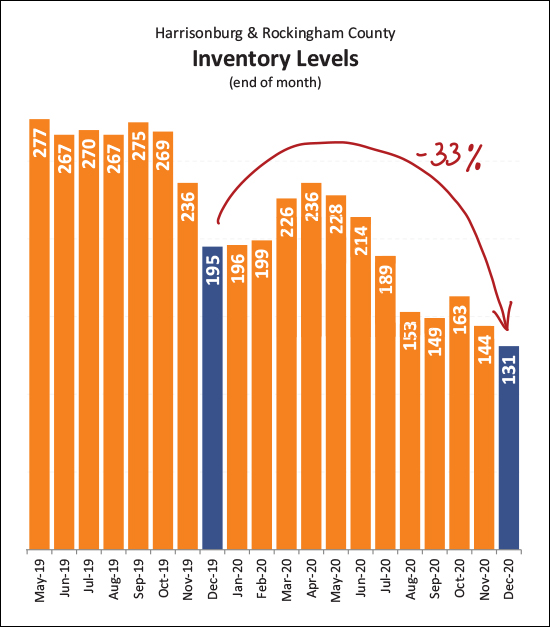

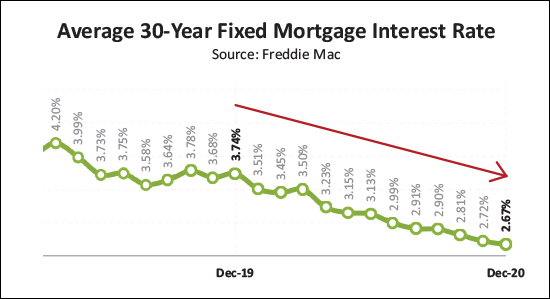

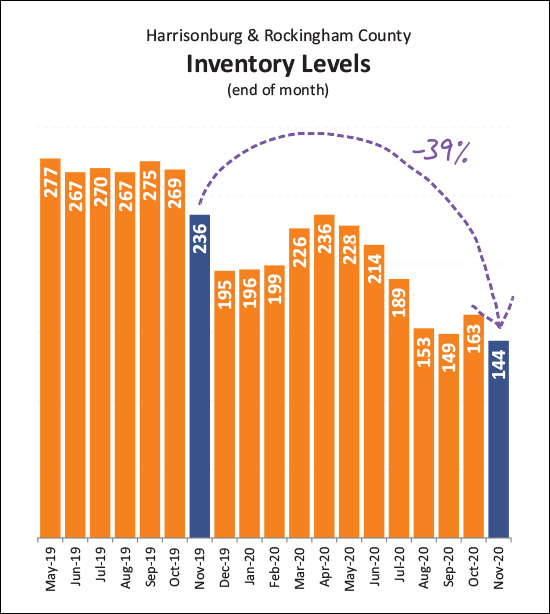

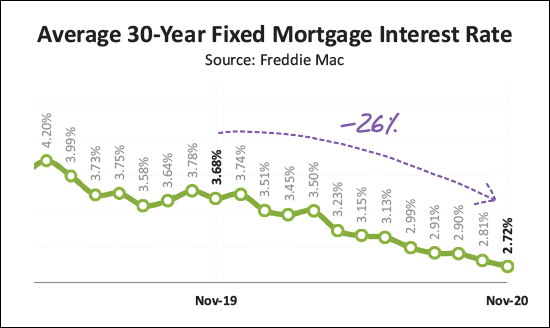

Now, looking briefly at what is to come...  After I meticulously drew all of those purple arrows to point something out (see below) I realized it might seem like I was saying those numbers were decreasing. They're not. I didn't re-draw the arrows. You'll forgive me? OK - now to the point -- if you look at the seven purple arrows on the left you'll see that I'm pointing out the contracts signed between June and December of 2019 -- a total of 724 contracts. The seven purple arrows on the right are pointing out the contracts signed between June and December of 2020 -- a total of 960 contracts. So -- here's that evidence of a big increase in contract activity in the second half of the year. We saw that bear itself out in lots of closed sales between September and December, and I think that is going to keep on rolling into January and February. I expect we will see stronger than normal months of home sales for the first few months of 2021 if not longer. As I've alluded to a few times thus far, there is a lot of competition amongst buyers as each new listing hits the market. This abundance of buyers in the market, and scarcity of sellers, has caused continued downward shifts in inventory levels...  As you can see above, end-of-year inventory levels fell 33% over the past year. The important detail to note here is that these are just "moment in time" inventory levels. How many homes are on the market, actively listed for sale, on a particular day. Clearly, the 33% decline in inventory levels did not result in a decline in home sales in 2020. Perhaps it's actually the other way around -- the 13% increase in home sales in 2020 caused inventory levels to drop another 33% OK, one last graph to illustrate something I've referenced above...  I told you mortgage interest rates had fallen - but look at how far they have fallen! Less than two years ago, the average 30 year mortgage interest rate was above 4%. Only a year ago it was 3.74%. Now, it's 2.67%. That marks a 29% decline in interest rates over the past year. This makes mortgage money cheap -- and monthly payments low -- and is part of what allowed median sales prices to rise 10% over the past year. Buyers were willing to pay higher prices for homes at least partly because their monthly costs keep declining. OK, I'll wrap it up there for now. Again, 2020 was a wild year and not at all what I expected it to be in March and April when things started slowing down. I did make a few predictions for 2021, but given how many surprises 2020 threw at us, it's certainly hard to imagine where exactly things might go in 2021. If you're thinking about buying a home in 2021, let's chat sooner rather than later if I can be of help to you in that process. You'll want to get pre-approved for a mortgage right away and then we'll want to start stalking the new listings as they hit the market. If you're thinking about selling your home in 2021, it is likely going to be a lot of fun to do so -- even if still a bit stressful. You will still need to prepare your house well, price it according to pertinent market data, and we'll need to market it thoroughly, but many sellers in most price ranges and locations are finding it to be a very favorable time to sell. If/when you're ready to connect to talk about buying or selling, feel free to email me (scott@hhtdy.com) or call/text me at 540-578-0102. Happy New Year! | |

Largest Inventory Declines In Lowest Price Ranges |

|

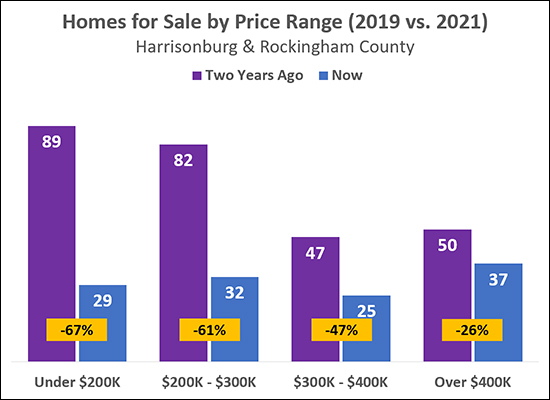

As will come as absolutely no surprise to anyone looking to buy a home under $200K, or even under $300K, there are far fewer options of houses on the market now as compared to two years ago. The graph above compares "beginning of the year" inventory levels today (blue bars) to two years ago (purple bars) to see how the market has shifted. As noted in gold, the lowest price ranges (under $200K, $200K - $300K) have seen over 60% declines in the number of homes on the market. It is a lot tougher to find a house to buy these days if you are hoping to buy for less than $200K, or even less than $300K. If you are planning to buy in that price range, get pre-approved, plan to see new listings the first day they come on the market, plan to make an offer immediately if it is of interest, and consider including an escalation clause to compete on price! | |

Local Home Prices Increase 32% In Five Years |

|

The median sales price five years ago (2015) was $185,000 in Harrisonburg and Rockingham County. Last year, five years later, it was $244,900. That's a 32% increase in the median sales price over five years! A variety of thoughts come to mind...

That's all from me, for now. If this 32% increase in prices over five years seems shocking, or depressing, or awesome to you -- drop me a line (scott@hhtdy.com) and let me know what you're thinking or how you're feeling about these changes in home values in our area. | |

So, Will My House Sell For 10% More This Year Than Last? |

|

It's a reasonable question. The median sales price increased from $223,000 to $244,900 between 2019 and 2020 -- which is a 10% increase. So, would your house sell for 10% more this year than last? Maybe. A good, solid, maybe. Whether your home would sell for 10% more than a year ago largely depends on its location and the buyer demand for homes like your home. If you live in a popular neighborhood where lots of buyers want to buy homes -- and few sellers are selling homes -- it is much more likely that your home would now sell for 10% more than it would have last year. In analyzing the market value of a property to prepare to list it for sale, we aren't going to look for comparable sales from 12 to 18 months ago and then add 10% to those sales prices. We will look for comparable sales from 6 to 12 months ago and then also examine current listings that are either actively for sale or are under contract. When prices are increasing quickly (10% over a year puts us in that zone) it is even more important to be precise and intentional with the pricing of your home. Pricing your home for sale won't always be a super straight forward decision but usually there are enough data points of recent sales and pending listings to give us enough guidance to make a good decision to maximize both the price for which you sell your home and the speed at which you sell your home. If you're getting ready to list your home this spring, it is definitely worthwhile to start looking at market value now. We can then continue to monitor listings and sales between now and when you list your home for sale to affirm our decision on pricing. | |

My Predictions for the 2021 Real Estate Market |

|

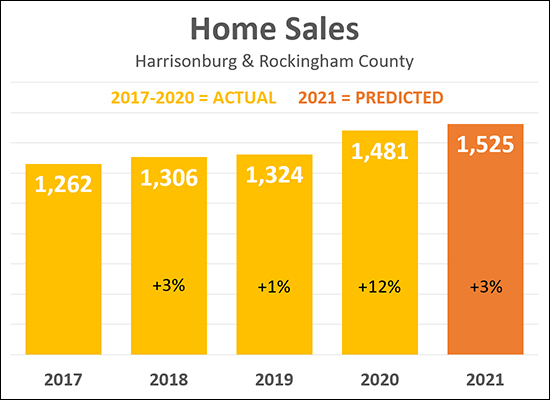

As I mentioned yesterday, my 2020 predictions for our local housing market were WAY off base. :-) I did not see such a strong market coming, and if I had known about COVID my predictions for 2020 would have been even more dire. But yet, despite COVID, 2020 was a robust year in our local housing market with 12% more sales and a 10% increase in the median sales price. So - knowing that my 2020 predictions were quite wrong - will I still take the time to make some predictions for the 2021 market? Sure! Why not!? :-) As shown above, I am anticipating a 3% increase in the number of homes selling in Harrisonburg and Rockingham County in 2021 as compared to 2020. Here's why...

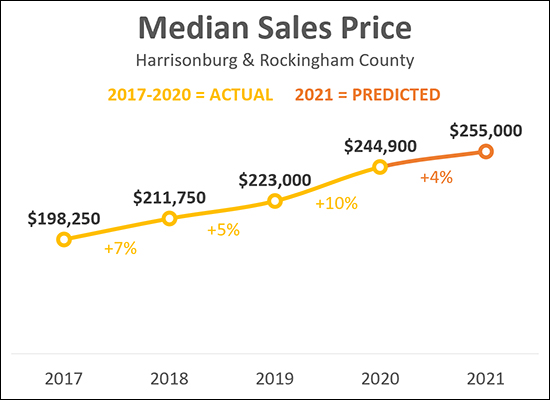

So, given that I am anticipating an increase in home sales, albeit smaller than last year, what am I predicting on sales prices?  After as 7% increase in the median sales price in 2018 and a 5% increase in 2019, we saw a much higher, double digit, increase in 2020. The median sales price increased 10% from $233,000 up to $244,900. Again, I did not see this coming. I think this increase in the median sales price was largely the result of lots of buyers wanting to buy, low interest rates keeping mortgage payments affordable despite higher sales prices, and a limited inventory of homes for sale. So, where are we headed in 2021? I am predicting a 4% increase in the median sales price in 2021 in Harrisonburg and Rockingham County, which would get us up to $255,000. Here's why...

OK - enough about my predictions --what about for you? Email me (scott@HarrisonburgHousingToday.com) and let me know where you think our local market will go in 2021. And keep up with all the market data between now and next January by signing up to receive my monthly housing market report by email if you are not already receiving it. | |

Comparing My 2020 Housing Market Predictions To Reality |

|

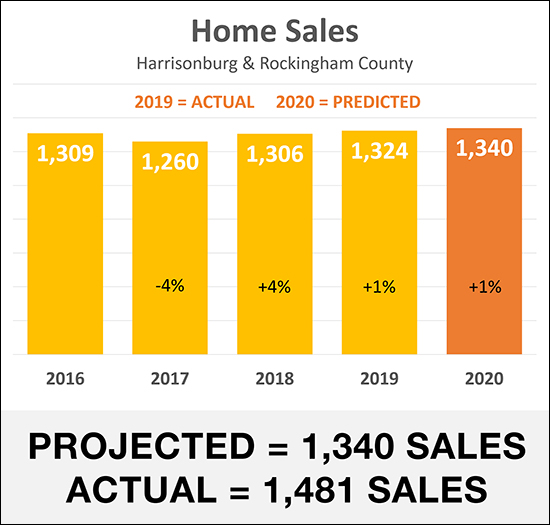

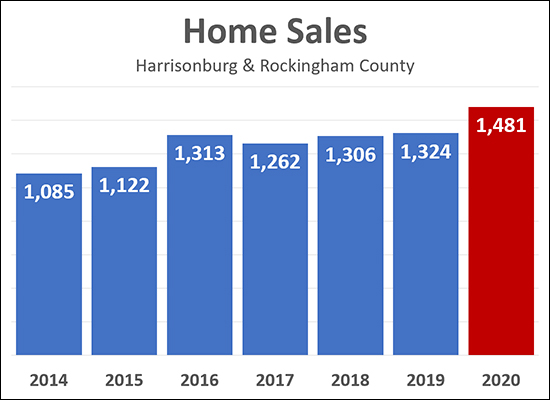

As shown above, I was terribly (!!!) inaccurate in predicting how many home sales would take place in Harrisonburg and Rockingham County in 2020. We saw a 1% increase in home sales between 2018 and 2019 and so I made the rather unexciting prediction that we'd see another 1% increase in 2020 to a total of 1,340 home sales. Wow, was I wrong! Home sales actually increased almost 12% to 1,481 home sales in 2020. This double digit increase in the pace of home sales is surprising because we were in the middle of a global pandemic for much of 2020 - but perhaps this is a part of why the increase happened. Here are some ways that the global pandemic (Covid) could have contributed to a significant increase in local home sales in 2020...

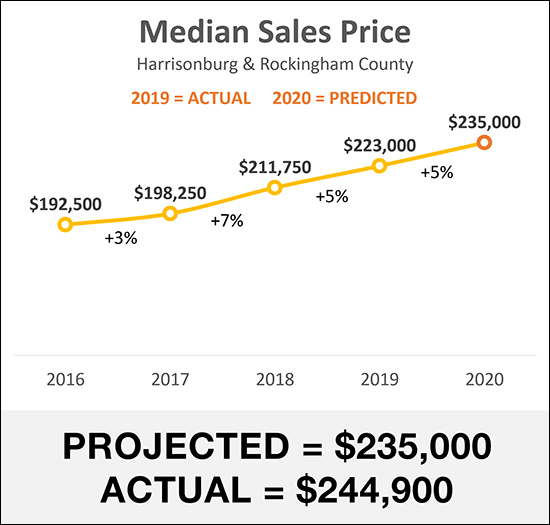

These (above) are some but certainly not all of the reasons why we saw an increase in home buying activity in 2020. In March and April of this past year as many aspects of our lives slowed to a stop, I certainly would not have predicted we see such a large increase in home sales locally -- but once we hit July, there seemed to be no stopping this quickly moving local housing market. So, given that I was wildly wrong on the number of home sales we would see in 2020, is it safe to assume I also erred on predicting the change in median sales price? Let's see...  ...and, yes, I was also quite off the mark when it came to predicting the median sales price for 2020! After a 5% increase in the median sales price in 2019, I predicted that we would see another 5% increase to a median sales price of $235,000. When the year closed out, we actually saw a 10% increase in the median sales price -- from $223,000 in 2019 up to $244,900 in 2020. Wow! So, what could have caused this significant increase in the median sales price?

So -- given how inaccurate my 2020 predictions were you must, certainly, be looking forward to my predictions for 2021, right? :-) Stay tuned for my best guesses on what we'll see in our local market in the year ahead! | |

Home Sales Rise Around 12 Percent In 2020! |

|

All home sales have not yet been reported but it is seems that we will see around a 12% increase in the pace of home sales in Harrisonburg and Rockingham County between 2019 and 2020! There have been 1,481 home sales recorded in the MLS thus far for last year and we may see that figure rise a bit more over the next few days, but not by much. This 12% increase is a SIGNIFICANTLY larger increase than we have seen in the last few years...

Stay tuned for my full market report in the next week or two, as well as predictions for the 2021 housing market. Oh, and HAPPY NEW YEAR! | |

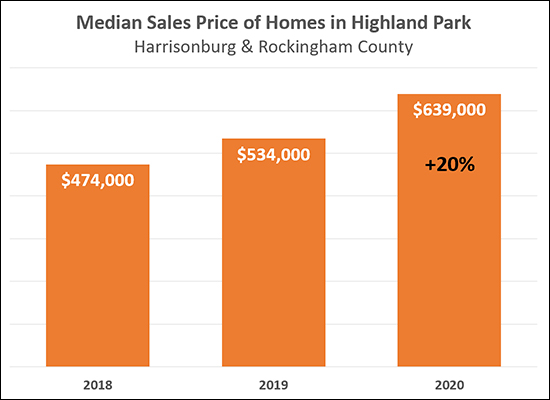

Did Home Value Rise 20 Percent In Highland Park in 2020? |

|

This post could also be called "The Dangers of Micro Market Analysis" as you'll discover... The graph above shows that the median sales price of homes in Highland Park has increased 20% over the past year from $534K to $639K! How could this be!? I know home values are going up (10% in 2020) but are homes in Highland Park really increasing in value at a rate of 20% per year? I believe this 20% increase in the median sales price is more related to which homes sold in each of the two years more than it is related to the value of homes in that neighborhood going up by 20% in a single year. As you can imagine, if larger, more recently built, more upgraded or more updated homes sell in a given year compared to another - then the median sales price of homes that year will be higher. And thus, this is the danger of analyzing a micro market -- a small amount of data points might lead you to incorrect conclusions. So when you look at home value trends in a specific neighborhood, make sure to check out both the sample size (how many homes sold in a given time period) as well as which homes actually sold in each time period. | |

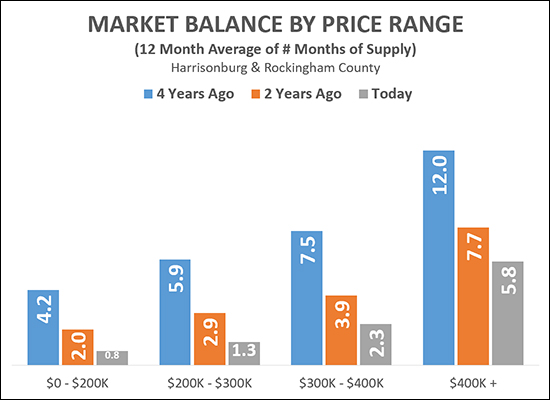

Market Balance (Months of Supply) By Price Range |

|

Most housing market analysts consider six months of inventory (active listings) to be an indicator of a balanced market (between buyers and sellers). We have been out of balance for quite a few years now in most price ranges. Under $200K Even four years ago there were only 4.2 months of supply available in this price range, and now that is down to a shockingly low 0.8 months of supply. $200K - $300K We saw a balance four years ago with 5.9 months of supply available, but that has dropped to only 1.3 months of supply as of last month. $300K - $400K There was an oversupply of homes in this price range four years ago, with 7.5 months of supply on the market - but today this price range is significantly undersupplied with only 2.3 months of inventory on the market. Over $400K This price range was drastically oversupplied four years ago with 12 months of supply available, and now is "at a balance" with 5.8 months of supply available. | |

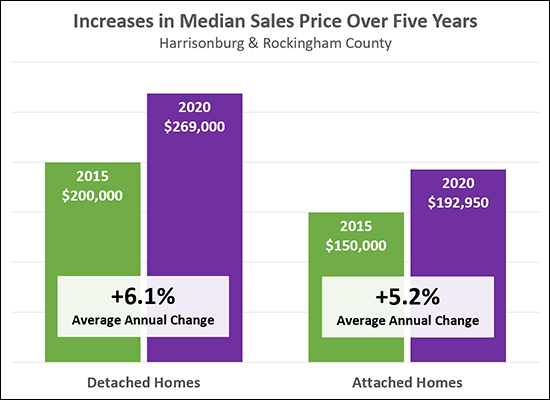

Do Detached Or Attached Homes Appreciate More Over Time? |

|

Over the past five years, detached homes have increased slightly more in price (on average, per year) than attached homes (townhouses, duplexes, condos). Detached homes have increased at an average of 6.1% per year from $200K to $269K while attached homes have increased at an average of 5.2% per year from $150K to $193K. This (detached homes increasing in value more quickly over time) wouldn't necessarily always be the case if we looked back over the past 20 years -- we could likely find time periods when this were not true -- but we have seen some larger than normal swings in home values during some of those past 20 years. | |

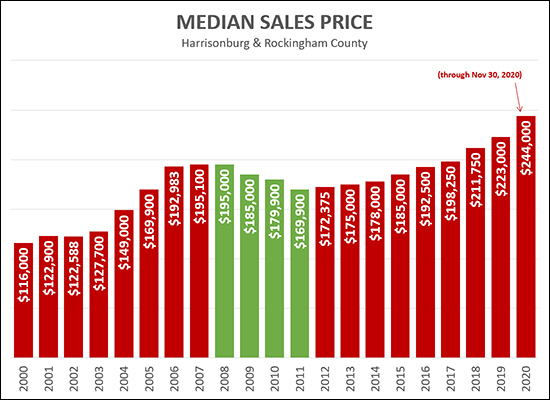

Median Sales Price In A Larger (Longer) Context |

|

The median sales price has never been higher in Harrisonburg and Rockingham County! Thus far in 2020, the median sales price of all homes sold has been $244,000 as of the end of November. This is the highest median sales price we have ever seen in this area on an annualized basis. A few other observations...

| |

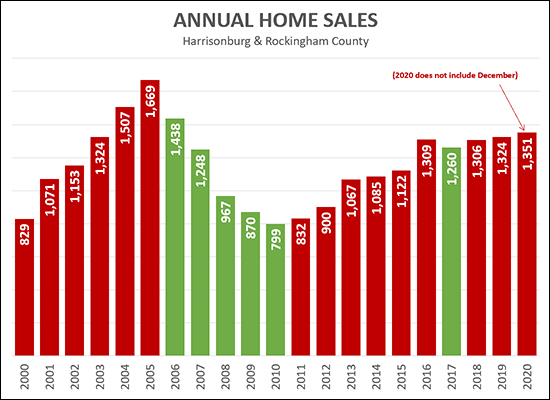

Annual Home Sales In A Larger (Longer) Context |

|

The graph above shows how many home sales took place each year for the past 20 years. The only incomplete data point is 2020 which only includes January through November home sales. When December home sales are in the books, we're likely to have seen 1400+ home sales this year. A few observations...

As for next year -- I'll hold off on my predictions for a bit longer... | |

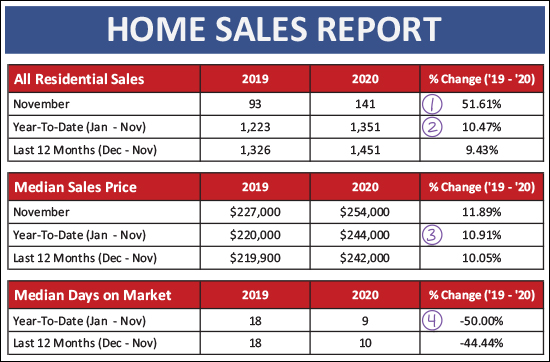

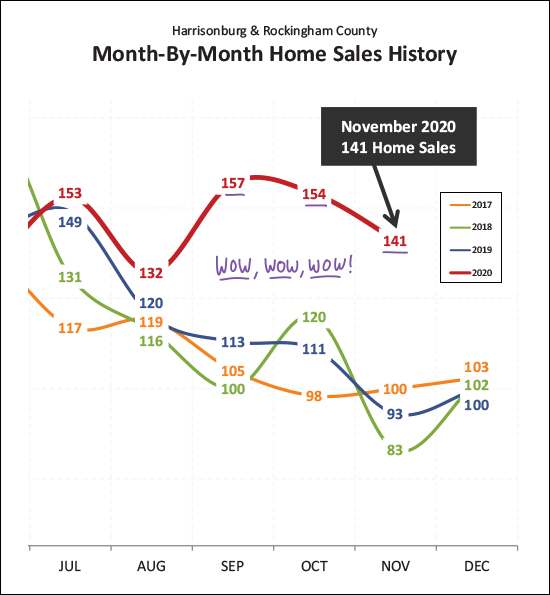

Harrisonburg Area Home Sales Up 10%, Prices Up 11% Thus Far In 2020 |

|

Happy Tuesday, friends! They say it might snow tomorrow. I'm currently seeing predictions of 6 to 9 inches. What is your best guess? We haven't had a sizable snowstorm in the Harrisonburg area in several years - maybe it's finally showing up? Or maybe it will just be rain - you know - 2020 and all... ;-) But enough about whether the snow will be piling up tomorrow -- home sales have been piling up BIG TIME this year and the last few months have been surprisingly busier than you'd expect at this time of year! Read on for details, or download a PDF of my full market report here. But first, not to be overlooked, the home shown above is the last home to be built at Heritage Estates. If you know someone who wants to live in this active adult community in Harrisonburg, this will be the last opportunity for a new home in the neighborhood. OK, now, an overview of the basics...  Check out the crazy numbers above...

So, did I mention the fall home sale season has been a bit atypical?  Yes, as you can see by the red line above, fall 2020 has been crazy! Usually, home sales fall during the fall. They gently decline into the slower winter season. This year, not so much. Home sales shot up in September and have stayed at unpredictably high levels through the end of November! And when you pile all of those strong months of sales on top of each other...  As you can see above, the number of home sales we've seen (1,351) in the first 11 months of this year is more than we have seen in any of the past three years... during the entire year! So, once we pile December on top, we're likely to be looking at well over 1,400 home sales this year -- and maybe as many as 1,450? But we didn't get to these high levels of home sales without some dips...  The orange line above shows the number of home sales in a 12 month period -- each month for the past year+ and it reveals the roller coaster that we've been on for the past year. Just before COVID started impacting our lives, the annual pace of home sales was starting to sneak up above its previous normal trendline. But then, COVID, and the annual pace of home sales dipped down quite a bit and it was uncertain where we'd go next. But by the time we got to August it was evident that the home sales market was roaring back and it is now well above where we might have expected it to be a year ago! And all that interest in buying homes has caused prices to rise...  Over the past five years we have seen the median sales price of detached homes rise anywhere from 2% to 7% per year and average out at about 5% per year. But this year -- how does 10% sound? I suppose it sounds good if you are a seller and it sounds pretty rotten if you are a buyer who has not yet found a home to buy! A year ago the median sales price of detached homes (not townhouses, duplexes or condos) was $240,000. Today... $265,000! Looking forward -- will we keep seeing lots of home sales?  It seems likely. During the past three months 377 buyers (and sellers) have signed contracts to buy (and sell) homes. Looking back a year ago to the same three months we only see 297 contracts signed. Thus, we should probably expect a relatively high number of closed home sales in December and January. Maybe things won't slow down as much as usual this winter. Hard to believe! And as 2020 goes, houses are getting about as hard to find as toilet paper...  Indeed, there have been fewer and fewer homes for sale at any given time this year as compared to last. Rampant buyer activity has caused many (most?) new listings to be snatched up as quickly as they have been listed for sale. This has driven inventory levels lower than I thought we'd ever see. A bit under a year ago we dropped below 200 homes for sale which was a shocker... but now, fewer than 150 homes for sale!? It's tough to be a buyer right now in many locations and price ranges! But if you do find a house to buy... you'll love those low interest rates...  Mortgage interest rates have been steadily declining for the past 18+ months now, and are solidly below 3%! It's hard to believe, but most buyers are locking in interest rates at 2 point something -- fixed for 30 years! These lower rates have allowed mortgage payments to stay relatively steady over the past year despite increases in home prices.

OK, folks, that's all for now. I have to go see if I can find my snow shovel just in case it really does snow tomorrow. I hope you have a wonderful remainder of the 2020, and I look forward to connecting with you again in 2021! Reach out anytime by calling/texting me at 540-578-0102 or by dropping me an email at scott@hhtdy.com. | |

City and County Neighborhoods With The Highest Price Per Square Foot |

|

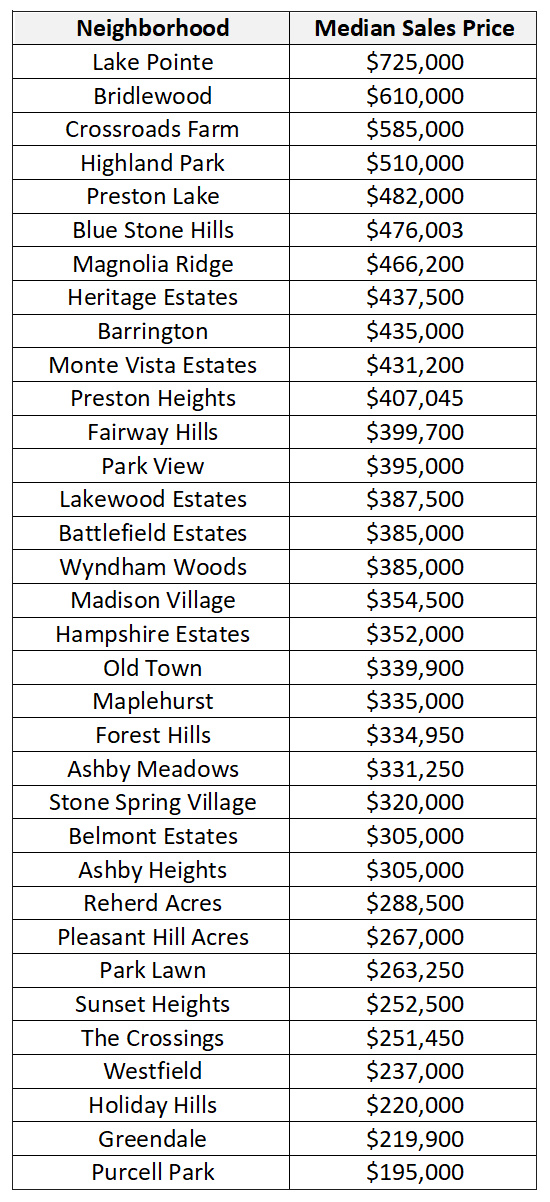

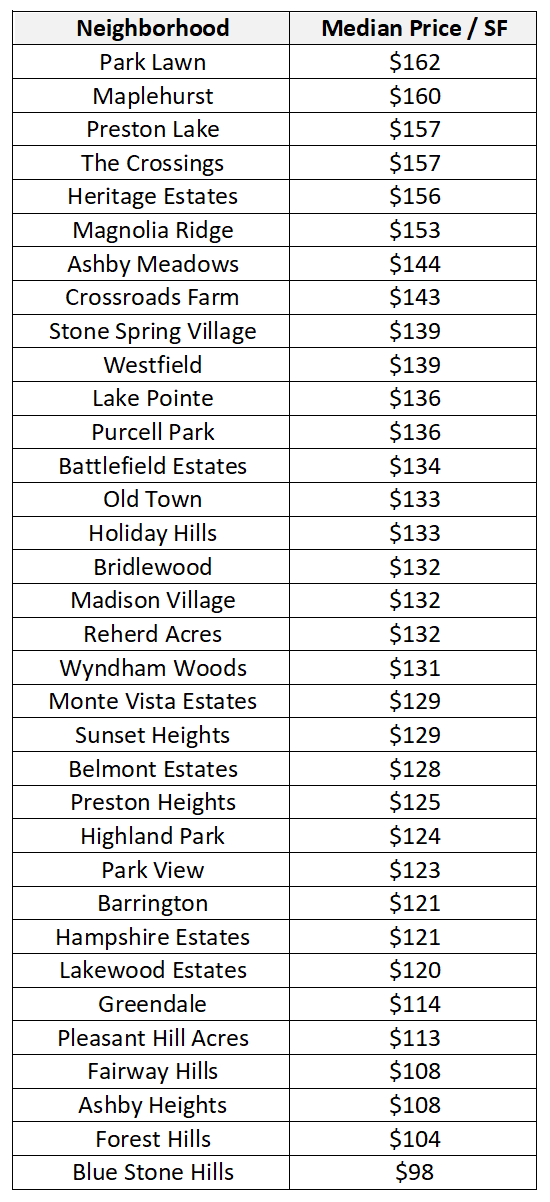

I'll start with what is probably a predictable sorting of neighborhoods based on sales prices over the past three years...  But now, a new sorting of the neighborhoods based on sold price per square foot reveals a very different order...  Does the second list surprise you? It might if you were thinking that the neighborhoods with the highest price per square foot would be revealing the most expensive neighborhoods for homes. As it turns out, the price per square foot in neighborhoods with expensive homes ends up being lower than in some neighborhoods with medium sized homes. Explore these neighborhoods further by visiting HarrisonburgNeighborhoods.com. | |

More Details On Preston Lake Apartments, Upscale Apartments Just Outside Harrisonburg |

|

If you are in the market for a recently built, reasonably nice, non-student apartment in or near Harrisonburg, the only current option at scale (aside from much smaller developments) is The Reserve at Stoneport -- located catty-corner from the Sentara RMH Medical Center. Prices at The Reserve at Stoneport currently seem to fall in these ranges...

But now there is another option in town -- or there will be soon. Preston Lake Apartments are currently under construction on Stone Spring Road at its intersection with East Market Street. These apartments are owned by and built by a different entity than the developer/builder of Preston Lake the adjacent residential neighborhood where new homes are being built. Prices at Preston Lake Apartments currently seem to fall into these ranges...

| |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings