Archive for March 2009

| Older Posts |

Weyers Cave Real Estate Market Report |

|

I had a client ask about how the Weyers Cave real estate market had performed over the past year in comparison to Harrisonburg and Rockingham County (HBG/RCK). Weyers Cave is located in Augusta County, just outside Rockingham County --- but many Rockingham County buyers also consider buying in Weyers Cave. Let's take a look....

| |

How do buyers find homes for sale in Harrisonburg? |

|

National research shows that the top means by which buyers found the house that they eventually bought were:

Realtor

| |

Has the Harrisonburg real estate market hit bottom? |

|

I was asked that two times yesterday.....and the hypothesis of the two people asking was that the Harrisonburg real estate market has indeed hit bottom. But what do we mean "hit bottom"? When people use this language in most other real estate markets, they are referring to the end of a period of declining home values. But in Harrisonburg (and Rockingham County), we saw a 1% increase in home values between 2006, 2007 and less than 1% change between 2007, 2008. So, without an overall decline in home values, we probably wouldn't be referring to home values when we say "hitting bottom" --- if we were, we should be asking if home values are starting to increase again (after 2 years of treading water). Perhaps when people ask if the Harrisonburg housing market has "hit bottom" they are referring to the dramatic decline in sales activity. The number of home sales in our local market peaked in 2005 (1,669) and have declined ever since (-14% in '06, -13% in '07, -25% in '08). I do hope that we see that we have "hit bottom" in terms of this steady decline in market activity. More specifically, I hope that we see at least the same amount of home sales in 2009 as we saw in 2008. A broader view... In a sense, we may see market activity pick up in Harrisonburg and home values increase again when other real estate markets across the country are deemed to have hit bottom. Some analysts are predicting that we are seeing the beginning of that in March. Factors that may be contributing to an increase in sales activity and home values (in Harrisonburg and otherwise):

| |

What do we mean by "Rent to Own"? |

|

The problem with "rent to own" is that everybody means something a little different by it. Here are some examples of what someone might mean when they are talking about a "rent to own" scenario:

| |

Exploring huge variances in Price Per Square Foot |

|

From a loyal blog reader... "I used your lovely search tool to look at all of the Belmont Estate listings. One thing that surprised me is the vast difference in the price per sq ft. Some were as low as $88 and others were as high as $139+. I'm curious to know why there's such a difference." An excellent question! Here's what she was noticing....  One reason for these differences is based on whether the homes have basements. You'll note (below) that the three homes without basements have a much higher price per square foot than all other homes in the neighborhood. What is really going on here is that when you start to add basement finished square footage into the "total livable square footage" (which is then used to calculate price per square foot) you are able to achieve a much lower price per square foot in a home with a basement. So....while the homes without basements seem to be really expensive on a price per square foot basis, it's really that the homes WITH basements are able to look less expensive using that metric.  Another item to notice is that the largest homes (on a total livable square foot basis) are able to achieve the lowest price per square foot (see below). Three of the largest homes in this group have the lowest price per square foot.  Given all of this, remember that it is best to compare relatively similar homes using the price per square foot metric. If some of the homes you are comparing have basements, and others do not, or if they are vastly different in total livable square feet, then you are likely to find significant a variation in the cost per square foot. | |

Buying real estate for your son or daughter to live in while they attend JMU |

|

Many parents of JMU students consider buying a property in Harrisonburg for their son or daughter to live in while attending college. This can be a great financial alternative to paying several years of rent, especially if there is, or may be more than one student in a family attending JMU. But you can't just come to Harrisonburg, buy any property, and put your students and all of their friends into it. Here's what you need to know about buying houisng for your JMU student to live in with friends:

| |

Finding "that" house for sale in Harrisonburg |

|

Are you ever looking for a house that is for sale with only one or two clues? If you only know the street name, subdivision, or Realtor's name, you'll have a difficult time finding the home on most web sites. Funny thing --- because if you're driving by a house you'll often only know one of these (rather essential) bits of information. As you can see above, I have accommodated for these frequent searches on my web site. You'll quickly be able to search for a property by its street name, subdivision, Realtor, or MLS number. A few notes.... Subdivision: This can be quite helpful as you explore a variety of neighborhoods where you are considering a purchase. Realtor: This search will allow you to search by any Realtor in our local MLS, not just those at Coldwell Banker Funkhouser Realtors. Try it out --- type in the name of a local Realtor and you'll see all of the properties they have listed for sale. Quick Search Tab: Don't forget you can also quickly search for a property by Address, MLS# or Realtor from anywhere on my web site using the Quick Search Tab in blue to the right of "My Services". If you have any suggestions for making your home search process even easier or faster, feel free to leave them in the comments below, call me at 540-578-0102, or e-mail me at scott@cbfunkhouser.com. | |

Benefits of $8,000 tax credit, record-low interest rates |

|

Let's assume for a moment that a first-time buyer decides to buy a $150,000 townhouse in Harrisonburg. With the appropriate income and credit scores, they may be able to obtain a rate as low as 4.625% on a 30 year fixed rate mortgage, with no downpayment. In the first year, this first-time buyer would likely have the following income and expenses:

Contrast this to a buyer who closes on December 1 of this year. At that point, the tax benefit will have ceased, and I predict that rates will be at least as high as 5.75% on a 30 year mortgage.

The combination of the tax credit, and the extremely low interest rates we are currently experiencing are likely to save you almost $9,000 in the first year of homeownership. As you can see, much of the above $9,000 of savings is in the $8,000 tax credit for first time buyers --- but the additional savings because of a low interest rate becomes quite dramatic over the course of the loan. Buying now at very low rates (4.625%) may save you as much as $37,000 over the next 30 years as compared to buying at 5.75%.

| |

Urban Exchange Update: blue bridge, first kitchen, electric car, sales office |

|

Just a few days ago, the third (blue) bridge was installed at Urban Exchange! Click here to view updated construction photos of the blue bridge and other exciting developments at Urban Exchange. If you look through all of the photos you'll also notice:

| |

Heritage Estates, 55+ Community in Harrisonburg, Virginia, launches new web site |

|

We are pleased to announce that Heritage Estates, a 55+ community in Harrisonburg, Virginia has launched a re-vamped web site . . .  Don't be bashful, tell me what you think of this new web site, in the comments below, by e-mail (scott@cbfunkhouser.com) or by phone (540-578-0102). Some exciting additions to the web site include:

Heritage Estates is an active adult community located in Harrisonburg, Virginia. Heritage Estates boasts superb French Country architecture with flowing interior floor plans that are wonderful for entertaining.You'll also enjoy spectacular views of the Blue Ridge Mountains, the golf course immediately beside Heritage Estates, the community swimming pool, and a maintenance-free lifestyle. | |

How do sales prices compare to assessed values? |

|

Homes in the City of Harrisonburg are currently selling at approximately 95% of their assessed value.  Taking a look at the data above, you'll note that approximately 30% of homes in Harrisonburg sold above their assessed value in 2009 thus far. An additional 40% (roughly) of homes sold between 90% and 100% of their assessed value, and the final 30% sold for less than 90% of their assessed value. The average (and median) ratio between sale price and assessed value is 95% thus far this year. Is this actionable? Not necessarily --- assessed values are not a reliable measure of what you could sell your home for in any given real estate market. But, do note that we can no longer assume that most if not all properties sell at or above their assessed value. In fact, 3 out of 4 properties selling these days are selling below their assessed values! Additional yet-to-be-opened can of worms: are home prices lower now than they were a year ago, or are assessments to high? This is another great question from a client --- if you have a question about our local real estate market that could be best answered with some data analysis, send it my way! Call me at 540-578-0102 or e-mail me at scott@cbfunkhouser.com. | |

How much can I negotiate off of a home's asking price? |

|

Over the past year in Harrisonburg and Rockingham County, 93% of all homes sold have sold within 10% of the seller's asking price.  Given this market data, keep the following things in mind as you are considering making an offer on a home, or as you are considering pricing your home to sell:

Happy negotiating! | |

Habitat Home to be built at 2009 Home and Garden Show |

|

In an exciting (and very ambitious) move, the Green Building Committee of the Shenandoah Valley Builders Association will be building a home with Habitat for Humanity ON SITE at the 2009 Home and Garden Show!  The foundation for this home is being poured this week in Grottoes, and after the home show, the home will be moved to Grottoes to be set in place. Volunteers from MANY different companies and organizations will be working together to build the home during the three day (April 3, 4, 5) home and garden show at JMU's Convocation Center. If you, your company, or your organization would like to donate materials or labor to this tremendous effort, please contact Aaron Yoder by e-mail at homestead.frame@gmail.com. | |

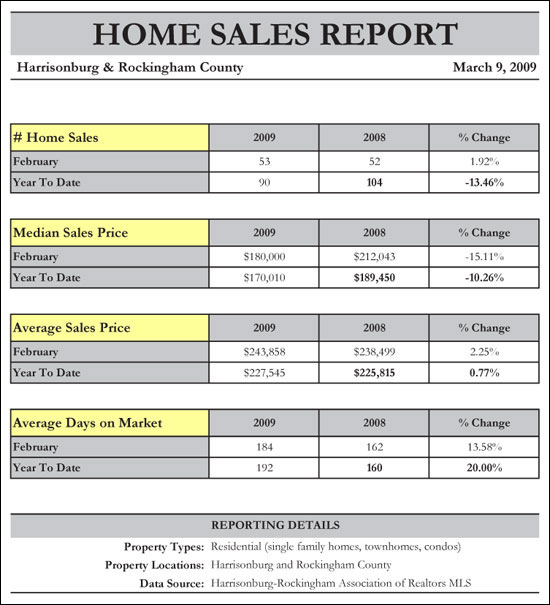

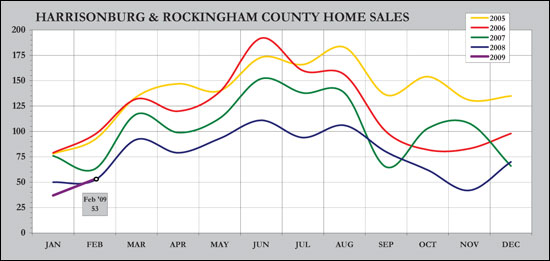

Home sales increase in February, is our local market poised for a recovery? |

|

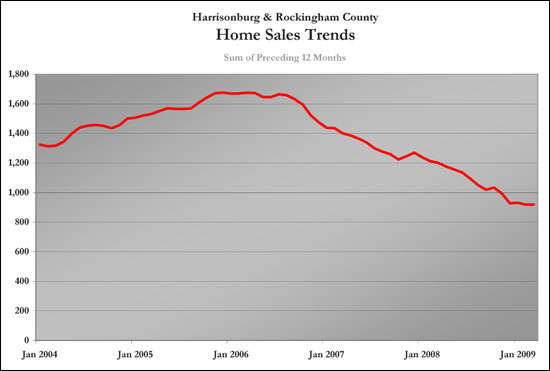

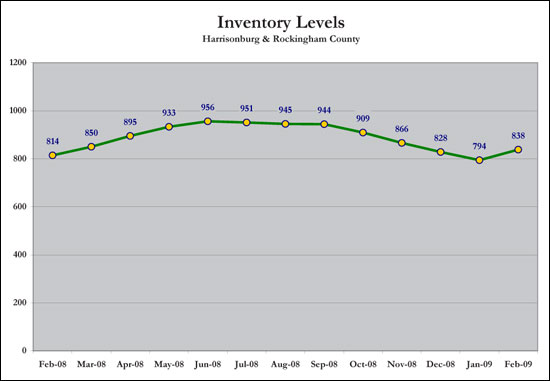

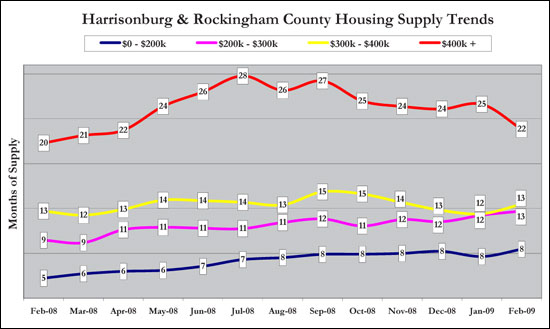

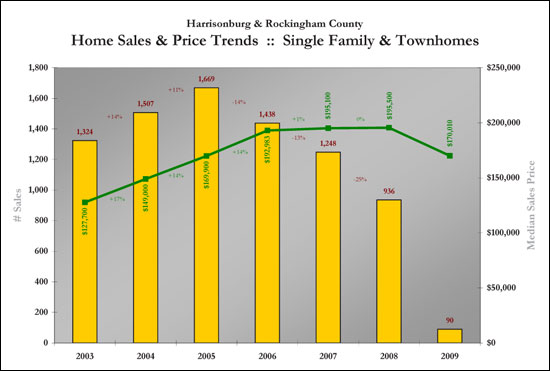

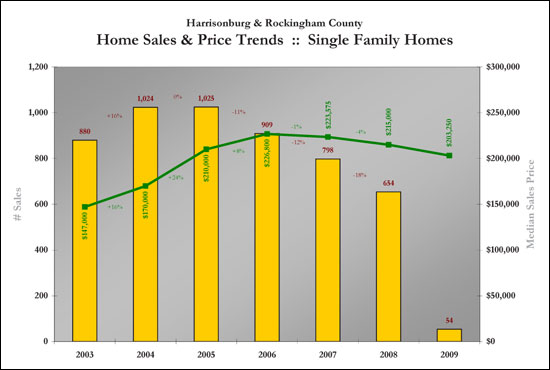

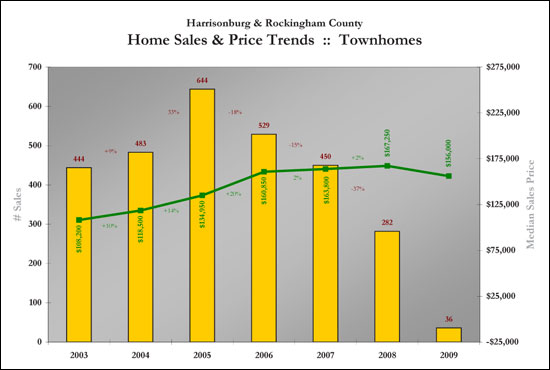

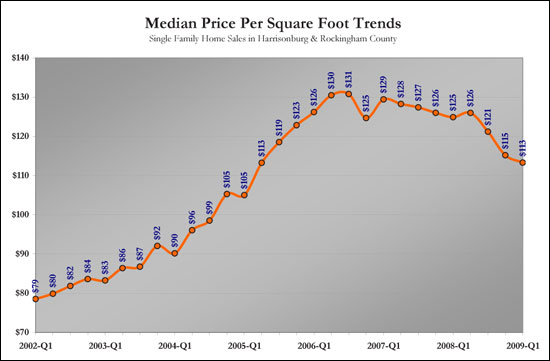

Click here to view/print a PDF of my real estate market report. Enjoy!  This month's home sales report (above) has several surprises, the first ofwhich is the increase in sales in February 2009 compared to February2008. Though only a modest increase, we have only seen this type ofincrease in sales (compared to the same month the prior year) 3 timesin the past 14 months. Median sales prices have fallen considerably when comparing Jan/Feb2009 with Jan/Feb 2008. This is, however, solely based on two monthsof data (a small sample size), and thus these figures may be affectedby the sales price distribution of the properties that have closed inthese two months. Somewhat contradictory to the median sales pricetrends, we see that average sales prices have increased when comparingJan/Feb 2008 to Jan/Feb 2009. Average Days on Market has increased somewhere between 14% and 20%during the past year, which is likely no surprise to sellers, many ofwhom have experienced a longer than typical length of time on themarket.  Home sales in February 2009 (53) were stronger than in February 2008 (52), perhaps suggesting that we may see 2009 turn into just as strong of a year as 2008. After several years of consecutive declines in real estate activity, February's sales figures should be an encouragement for homeowners --- perhaps the pace is finally increasing again in our local residential real estate market.  This graph shows a normalized trend of home sales by charting the ongoing sum of the preceding 12 months' sales. This normalized trend line is now showing a leveling off of home sales, perhaps indicative that the market is becoming more stable.  Likely as a result of the coming spring real estate market, inventory levels are now headed back up. If we continue to see an increase in the number of homes on the market, buyers will have even more negotiating power as we move forward.  Supply levels in the $400,000+ price range dropped significantly (from 25 months to 22 months) --- due in large part to a significant increase in sales in this price range. We continue to see the healthiest supply levels in the lowest price ranges.  This graph captures all residential real estate activity as reflected in the Harrisonburg/Rockingham Multiple Listing Services. The pace of home has decreased significantly over the past four years, but home values have continued to stay level or increase slightly.  When we examine solely the single family home market we find a somewhat more significant decrease in median sales price (4% between 2007 and 2008), but we don't see as much of a drop off in the number of sales taking place. Of note, the record growth in median sales prices was 2004 when we saw a 24% increase.  Sales in the townhouse market have drastically decreased, with a 37% decrease just between 2007 and 2008. Sales of townhouses are now down below even 2003 levels. The good news, however, is that the median sales price of townhouses continues to increase, with a 2% increase between 2007 and 2008.  Examining the median price per square foot of sold single family homes in Harrisonburg and Rockingham County reveals an overall decline in home values (as defined by this metric). We are now at 2005 First Quarter prices per square foot, which is a decline of 14% since the peak in 2006. | |

Urban Exchange bridge installation scheduled for Tuesday at 8AM |

|

Yellow, Red Bridge to be installed on Tuesday! All day tomorrow (Monday) we'll be setting up a HUGE crane next to the Urban Exchange construction site. Then, on Tuesday between 8:00 a.m. and 10:00 a.m. we'll be using the crane to (carefully, slowly) lift the red bridge and the yellow bridge over top of the East Wing, and down between the wings to span the courtyard area. Feel free to drive by to see the action, or watch it live from across the street! Call me (540-578-0102) or e-mail me (scott@cbfunkhouser.com) with any questions. Become a fan of Urban Exchange on Facebook! Are you on Facebook? If so, become a fan of Urban Exchange --- click here to visit the Urban Exchange page on Facebook. | |

Examples of Great Deals in Harrisonburg |

|

Yesterday, I mentioned that there are good deals available on investment properties in Harrisonburg, with the key to finding them being: Seek properties listed at prices under market value in neighborhoods (subdivisions) where it is easy to understand market value. To continue that theme, here are a few examples of what I'm referring to: 1296 Victorian Village Drive (Beacon Hill) Asking price: $139,900 Average recent sale price: $155,633 Average current list price: $152,720 view details 1043 Meadowlark Drive (Reherd Acres) Asking price: $136,100 Average recent sale price: ~ $150,000 Average current list price: ~$150,000 view details There are other possibilities on the market right now, and these opportunities will continue to present themselves over time. If you have funds available (10% - 20% of the purchase price) to buy an investment property in Harrisonburg, I'd be more than happy to help you sort through the available properties to find some of your best options. | |

"Good Deals" on Investment Properties in Harrisonburg |

|

I met with a client earlier this week who has funds available to purchase an investment property, and we were contemplating what might make the most sense in the Harrisonburg. Here's what we came up with... Seek properties listed at prices under market value in neighborhoods (subdivisions) where it is easy to understand market value. If we consider, for a moment, townhouses and duplexes in the City of Harrisonburg --- we find that most of these properties are barely viable investment properties given their current market value and the rental income that they can generate. Most new-ish two-story townhomes in the City are selling between $155k and $165k, and might generate $850-$950 per month in rental income. When you consider 80% financing, insurance, taxes, association fees, you'll likely have (on average) $900 of rental income to offset (roughly) $900 of monthly expense. This "barely break even" scenario can make sense to some investors --- they are not only in it for the monthly cash flow, but also for the tax savings, principal reduction and appreciation. But consider this --- if you can purchase a townhome in one of these communities between $135k and $145k, the scenario can be quite different. Dropping the purchase price by $20k reduces your monthly obligations by approximately $110, which creates a nice buffer between income and expenses. Furthermore, you will likely be picking up some "instant equity" because you are buying below market value. A few important notes:

Feel free to call me (540-578-0102) or e-mail me (scott@cbfunkhouser.com) to get started. | |

Urban Exchange: Marriage Proposal, Bridge Installation and more! |

|

An Urban Exchange Marriage Proposal! Congratulations to Bobby and Jenna on their engagement! Bobby proposed this weekend in the apartment at Urban Exchange where the couple will eventually be living --- after her surprise (Jenna thought she was just getting a tour of their apartment's progress) --- she said yes! Bobby is a chef at Eastern Mennonite University and Jenna is a graduate student. We wish Bobby and Jenna well, and are excited about the life they will share together at Urban Exchange! Many thanks to Rebekah Girvan Budnikas, a top-notch local wedding and family photographer, who not only captured this special moment, but is also soon to be opening a high-end photography studio in downtown Harrisonburg! Six Days to Bridge Installation BREAKING NEWS --- the three bridges that will connect the two wings of Urban Exchange will be installed on Tuesday, March 10th, beginning at 8:00 a.m. We will be using an enormous crane to lift each section of the bridge up, and lower it into place between the two wings. We will certainly post photos of this exciting event online, but feel free to stop by to watch the action! Work was completed this past weekend on the metal columns that will support the bridges. Click here to view these updated photos --- which also include a glimpse of some small bridge sections. Classic Kitchens Prepares for Kitchen Installation Class Kitchens now has all of the granite and cabinetry components in Harrisonburg for installation at Urban Exchange. Click here to view photos from the Classic Kitchens warehouse, where the kitchen components will be staged and partially fabricated before being brought to the Urban Exchange site. Condo Specifications Are you curious about the detailed specifications of the apartments and condos being built at Urban Exchange? We have now posted a list of specifications for the condos and apartments at Urban Exchange. Please let me know if you have any questions about these specifications. Stay tuned for more exciting announcements about Urban Exchange in the coming weeks. For more information about the condos and apartments, feel free to reply to this e-mail, or call me at 540-578-0102. For all leasing matters, please call 540-421-9341 or e-mail info@LiveUE.com.. | |

Short-term home ownership doesn't always work well |

|

In days gone by (2002, 2003, 2004, 2005) you could buy a home in Harrisonburg or Rockingham County and sell it two years later for a tidy profit. Home values were escalating so rapidly that you no longer had to consider how long you would be in the home before needing to sell it. Today's recent home buyers, however, find themselves in a significantly different scenario. The graph below shows the progress made over time in paying down the principal balance of a 30-year mortgage of $225,000 at 5.5%.  As you can see, the majority of the principal is paid off in the tail end of the mortgage life cycle --- 53% of it is paid off in the last 10 years. But if we take an even closer look at the first five years, we can see what some recent home buyers would be facing if they needed to sell just two years later.  Consider these three factors:

What do you need to take away from this illustration?

| |

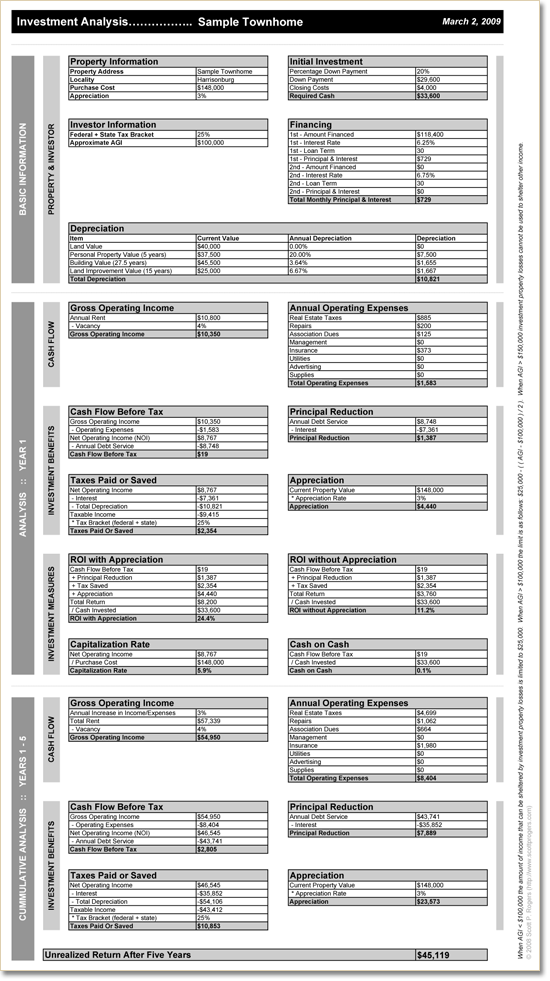

Analyzing Investment Properties |

|

When considering the purchase of an investment property, you ought to account for the following investment benefits:

Click on the image for more detail.  | |

| Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings