Archive for July 2022

Home Inspections Are Likely To Become A Thing Again, And They Should |

|

Over the past two years I have told countless home sellers something along the following lines as they have made final preparations to sell their home... "That recent listing over in that neighborhood had five offers within the first week and none of those buyers included home inspection contingencies." "That townhouse just went under contract after receiving eight offers, and only one of the eight buyers was asking to be able to conduct a home inspection." As such, many home sellers over the past two years have not had to work their way through home inspection contingencies and the negotiations that sometimes take place after those inspections. And... my point today... most home buyers over the past two years have not had the option of conducting a home inspection during their purchase process. As our local real estate market starts transitioning into a market that is not quite as piping hot of a market as it has been for the past two years, we will very likely start to see more offers with home inspection contingencies. This is great news for buyers! A home purchase is a major financial decision both in the near term and the long term. You are paying a large amount of money for a home in which to live... but that home may very well need some items repaired or need some system maintenance or replacement in the near future. A home inspection allows a buyer to more clearly understand potential home maintenance costs over time by learning more about the condition of the components and systems of the house. As a side note, I am much more of a fan of home inspections being used by buyers to learn about a house and to propose slightly different contract terms if major issues are discovered -- more so than home inspections being used by buyers to try to renegotiate the deal just because they can threaten to walk away from the deal based on the inspection contingency. Home sellers today should be prepared for offers that may include inspection contingencies. Home buyers today should consider including inspection contingencies if they are not competing with multiple other buyers to secure a contract on a hot new listing. | |

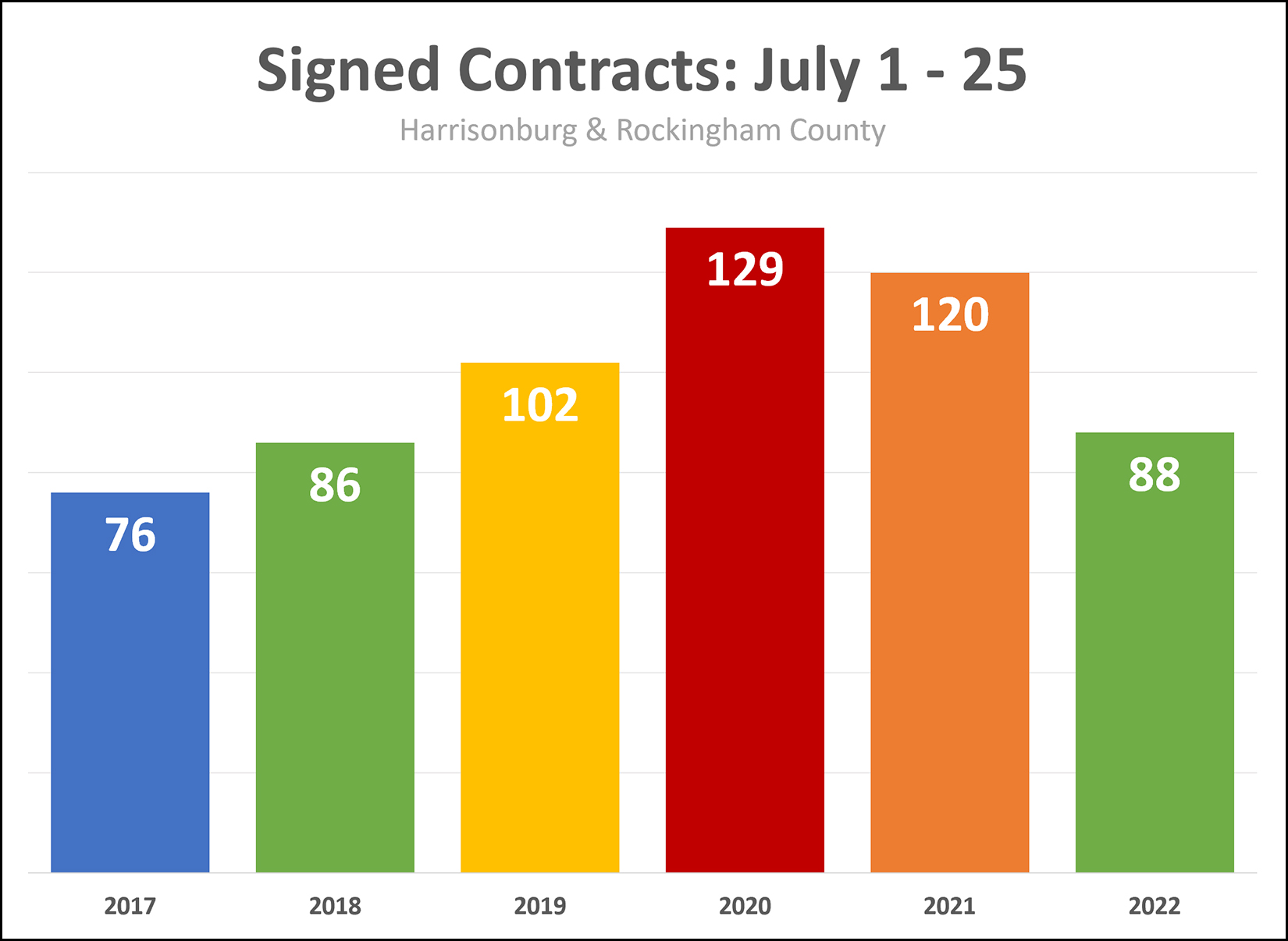

Contract Activity Slowing A Bit In July 2022? |

|

In the first 25 days of July 2022, we have seen 88 signed contracts. Some context and notes...

Is this a massive slow down or a one month anomaly? Only time will tell, but thus far, contract activity in July is certainly seeming slower that I would have expected. | |

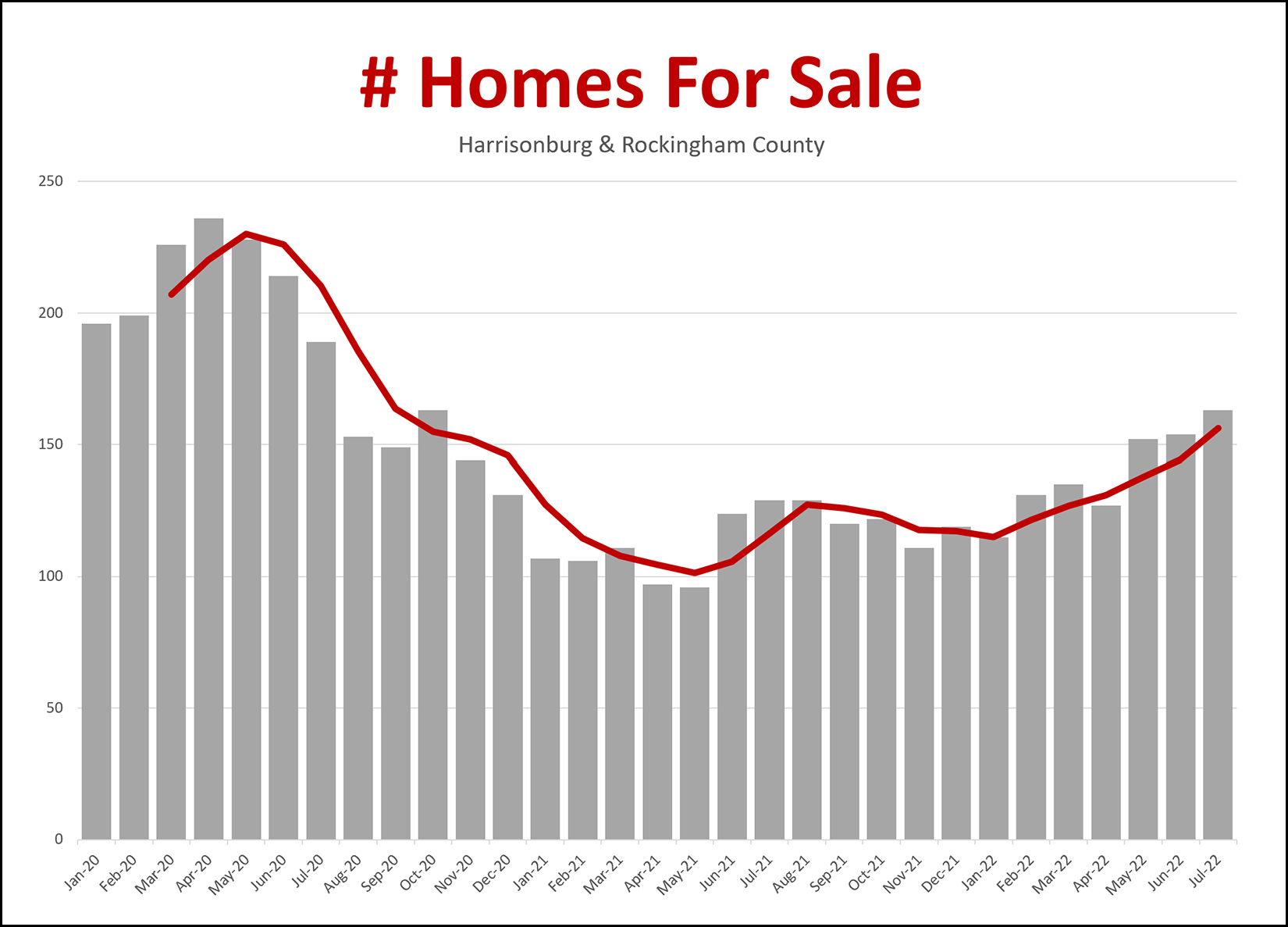

Inventory Levels Creeping Slowly Upward, To Higher Low Levels |

|

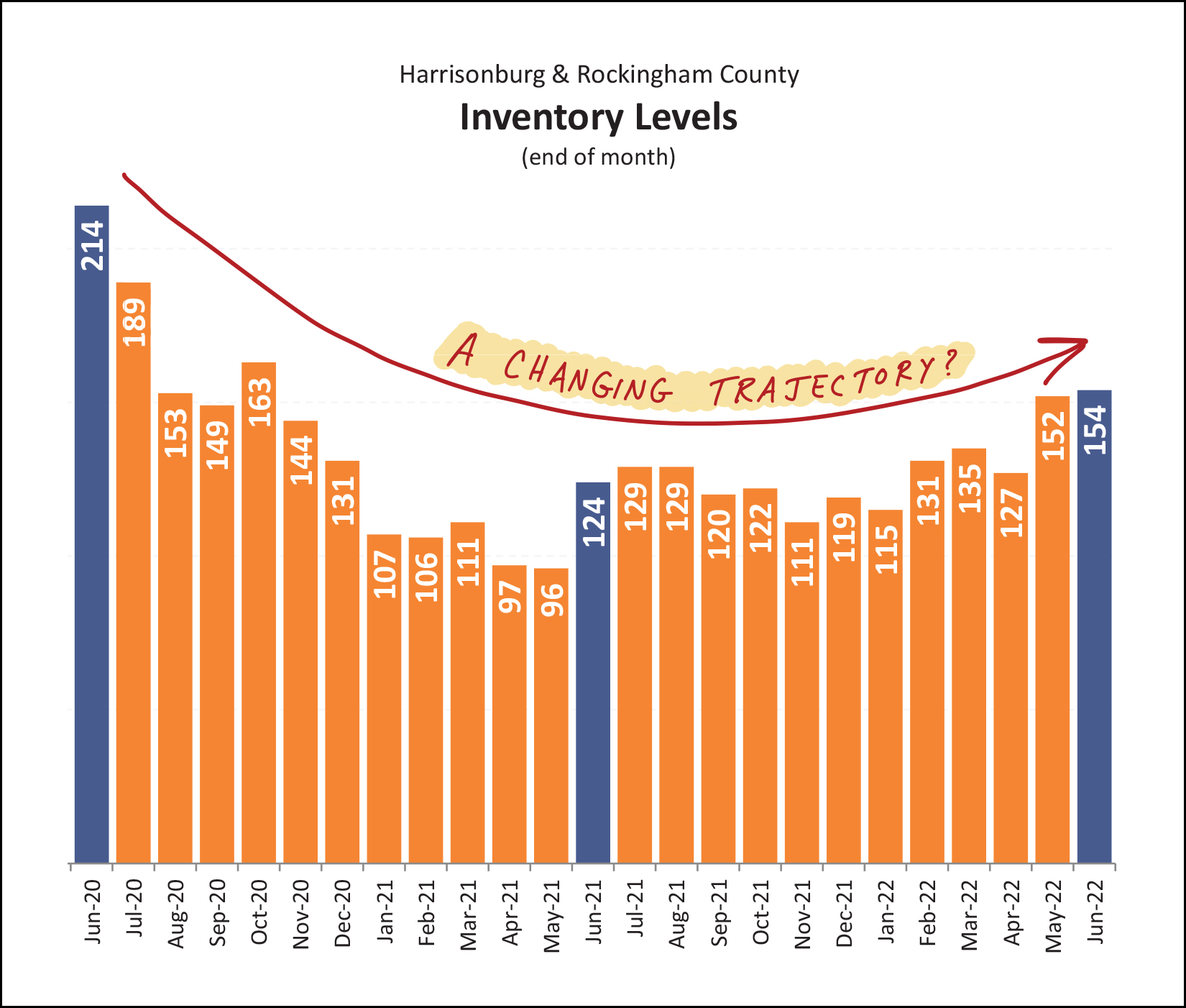

Inventory levels - the number of homes for sale at any given time - have been creeping upward for the past 6+ months. With 163 homes for sale, we are now seeing more homes for sale than we have seen at any time since late 2020. The gray bars above show the number of homes on the market at the end of each month. The red line above shows a moving three month average to show the overall trend more clearly. To put this in a bit of context though, these new highs are actually still pretty low... Homes for Sale In...

So, yes, July 2022 inventory levels are higher than a year ago... but are also much lower than any other recent July... | |

There Will Come A Time When Homes Will Not Sell Instantly, And That Is OK |

|

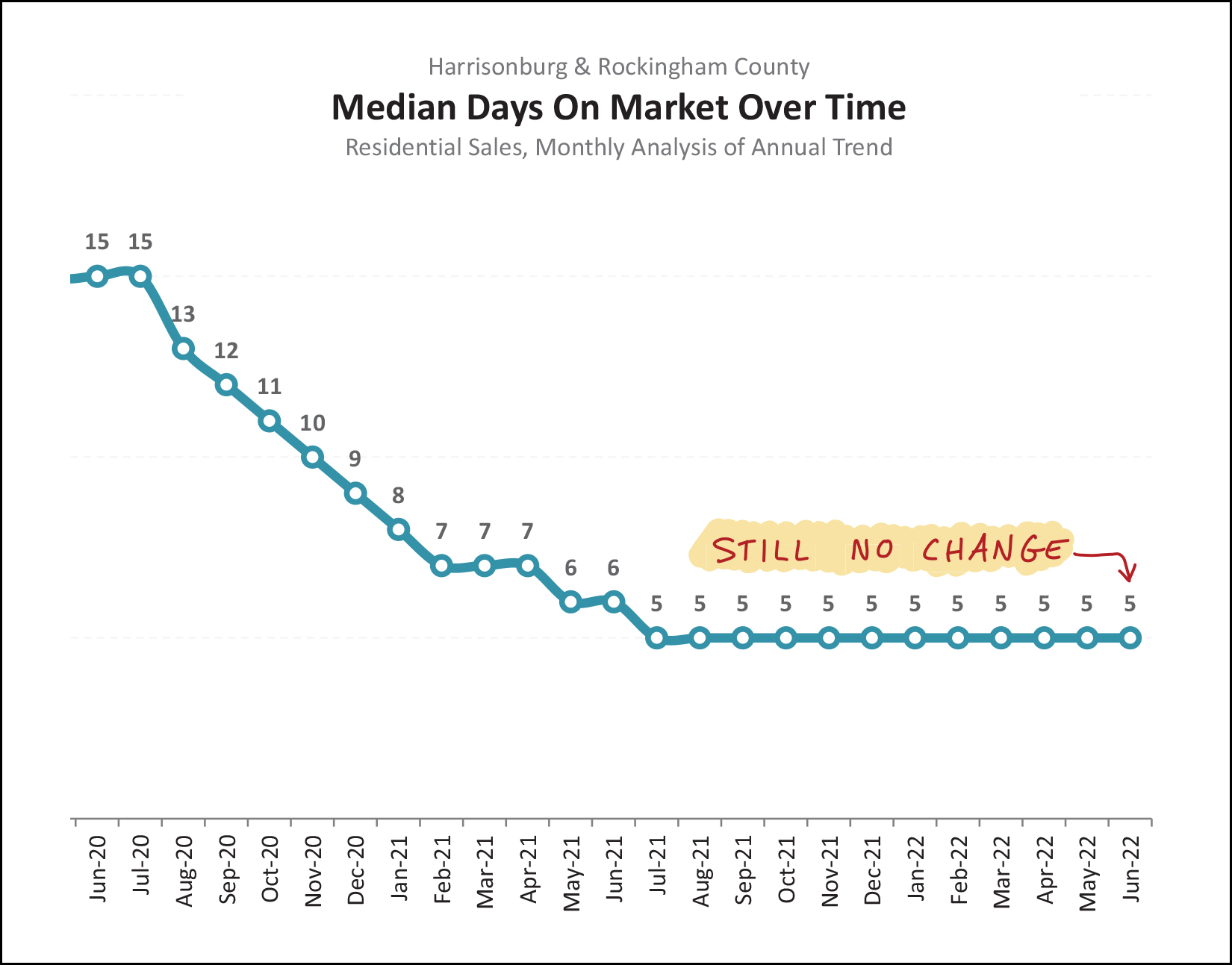

Over the past year, the median "days on market" has been five days in Harrisonburg and Rockingham County. That means that half of homes that sell are under contract in five or fewer days. That is fast. It's the fastest homes have ever sold in this market. Just three years ago, the median "days on market" was 23 days -- a bit over three weeks. That is also rather fast, but certainly not as fast as five days. And guess what folks, just as ridiculously low mortgage interest rates stuck around for a few years and then came to an end -- it is very likely that we will eventually see the time it takes to sell a home start to increase from this record median of five days. For example... in the past 30 days, the median days on market was seven days... yes, a full two days longer than that prolonged low of five days. If we do start to see the pace of homes selling starting to slow a bit... maybe from a median of five days on the market, to seven days, to (gasp!) a median of 10 days, here's what it might mean for our local market... [1] Home buyers will still need to look at homes quickly when they go on the market, but they might be able to sleep on the decision of whether or not to make an offer. [2] We might eventually see fewer multiple offer scenarios, at least in some price ranges. [3] Many homes (those in desirable locations, price ranges, etc.) will still sell very quickly, perhaps in five days, even if the overall market statistic increases. [4] Sellers will need to put up with showings for more than a few days. :-) One nice part about a fast moving market is that many home sellers only had to put up with home showings for a week or less - and that might start to change. There are plenty of additional *possible* implications of the pace of the market slowing. But rather than speculate as to what they will be, what they will mean, and when they will happen, I'll keep monitoring the data to see what is actually happening on the ground in our local market. Of note, related to median days on market (DOM) in our local market... Median DOM in the past 12 months = 5 days Median DOM in the past 30 days = 7 days Median DOM in the past 30 days for homes priced under $250K = 5 days So, even if the overall market slows down -- a smidge -- many segments of the overall market will likely still be moving quite quickly! | |

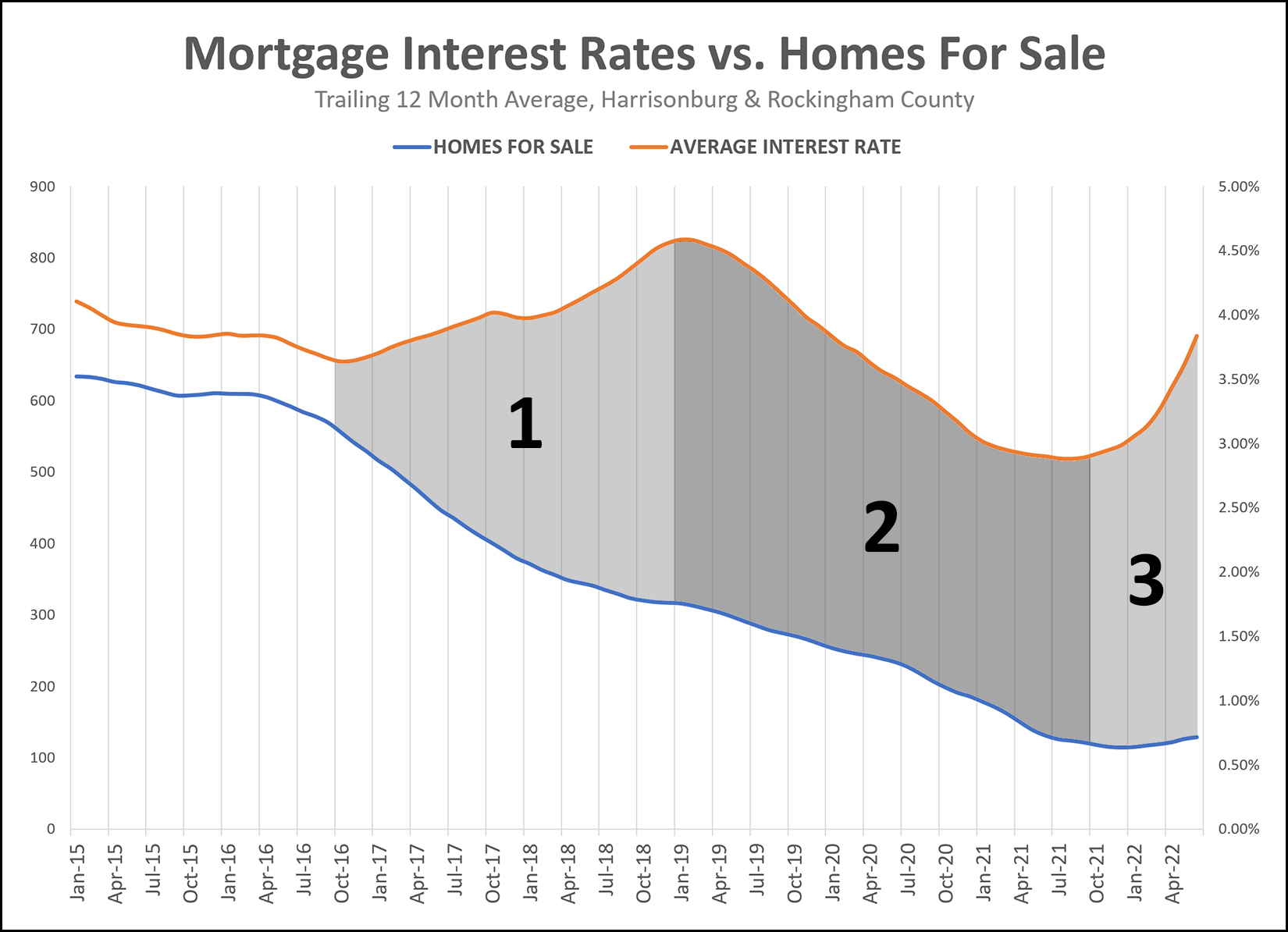

Do Inventory Levels Rise (and fall) With Mortgage Interest Rates? |

|

Q: Do Inventory Levels Rise (and fall) With Mortgage Interest Rates? A: Sometimes Interest rates are on the rise right now... and inventory levels are rising as well. Interest rates were falling for quite a few years just prior to 2021... and inventory levels also fell during that timeframe. So... do inventory levels just track right along with mortgage interest rates? Sometimes, but not always, it seems. Of note... The graph above shows a 12 month average of the number of homes for sale (blue line) and a 12 month average of a 30 year fixed rate mortgage interest rate (orange line). So, the last data point (June 2022) is showing the average number of homes for sale in the 12 months prior to and including June 2022... and the average mortgage interest rate in the 12 months prior to and including June 22. Looking back, then, to the beginning of 2015, we can see four general trends taking place, three of which I have labeled. [0] The unlabeled portion of the graph (2015-2016) showed very little upward or downward movement in inventory levels or interest rates. [1] Between 2016 and 2018 we saw interest rates rising, but inventory levels falling. This runs counter to the premise proposed above, that inventory levels rise and fall as interest rates do the same. [2] Between 2019 and 2021, indeed, interest rates declined, and inventory levels did as well. [3] Since late 2021 we have seen interest rates start to climb (and even faster and further in 2022) and inventory levels have started to climb as well. So... yes, there seems to be some connection between interest rates and inventory levels... at some times... but not always. The unspoken here, is the main connection between these two factors... which is home buyers. As interest rates decline, in theory there are more buyers, which would in theory, cause inventory levels to decline. As interest rates rise, in theory there are fewer buyers, which would in theory, cause inventory levels to rise. Beyond all of these theoretical connections and consequences, what does this mean for 2022 and 2023 in our local housing market? So long as interest rates are rising, there is a decent chance that inventory levels will rise somewhat as well, as some buyers won't be able to afford some houses any longer... or will choose to limit their home buying budget. The big question, of course, is whether it will be a four part chain reaction... [1] Interest Rates Rise [2] Fewer Buyers Buy Homes [3] Inventory Levels Rise [4] Prices Flatten Out or Fall Thus far in our local market, we are seeing... [1] Interest Rates Rising [2] More Buyers Buying (not fewer as predicted above) [3] Inventory Levels Rising (slightly, not significantly) [4] Prices Are Still Rising (not flattening out or falling as predicted above) Do keep in mind that every housing market trend you see in the national news may or may not actually be representative of what is happening in our local market. | |

The Local Real Estate Market Is Constantly Changing |

|

Over the past two years as home sales and home prices have rapidly accelerated upwards, we couldn't assume anything about pricing... We know - your neighbor's identical house sold three months ago for $350K. We assume - your house will sell for around $350K. And then - your house actually sells for $380K. Home prices were increasing so quickly that a recent sales price of $___ did not necessarily mean the next similar home would sell for that same price. And now, as the market seems to be slowing down a bit, we still can't assume anything about pricing... We know - your neighbor's identical house sold three months ago for $375K. We assume - your house will sell for around $375K. And then - your house might sell for $350K, $375K or $400K. These days... [1] There are certainly plenty of homes that are going on the market and selling very quickly, often with multiple offers. [2] There are some homes that are going on the market and sitting around for a bit before having an offer. [3] Some homes are still selling for more than we would have thought based on recent sales prices. [4] Some homes are selling for a bit less than we would have thought based on recent sales prices. I don't think we're seeing a wholesale shift at this point. We're still seeing more sales, at higher prices. But I don't think we can assume as reliably that home prices are steadily marching upwards at a rate of 10% per year right now. | |

Last Call For Sellers Hoping To Sell To Buyers Hoping To Move Before School Starts |

|

I don't want to mention... the school year... but... it's coming, sooner than we realize. :-) With the start to school only 40-ish days away (depending the school system) we're now approaching the end of a golden window for buyers and sellers, when... [1] Buyers can buy and still get moved in before school starts. [2] Sellers can sell and still get a buyer moved in before school starts. So, if you're hoping to sell your home to someone who wants to be in your house by the time the school year starts... you should be getting your house on the market sometime in the next week or two. OK... everyone may now return to focusing on summer and pretending that the coming school year is way off in the far distant future. ;-) | |

Price Your Home Reasonably And You Will Receive Reasonable Offers |

|

Now more than ever, appropriate pricing is the key to a successful sale of your home. TOO HIGH... If an identical home sold a month ago for $325K... we shouldn't price your home at $335K or $340K or $350K. If you price your home too far above other recent sales, buyers may come to see your home... but they likely will not make an offer. TOO LOW... Likewise, and equally important, if an identical home sold a month ago for $325K... we shouldn't price your home at $300K or $305K or $310K. If we price your home too far below other recent sales, we will likely have an offer or two, but we can't necessarily count on enough offers with escalation clauses to increase your "too low" list price up to the "just right" market value. JUST RIGHT... If an identical home sold a month ago for $325K, we should likely consider a list price of $319K, $325K or $329K. Not too high. Not too low. Just right. Disclaimer: I'm oversimplifying here. :-) Rarely is there an "identical" house that sold in the past month to provide such a straight forward guidance on pricing. But, despite my oversimplification, hopefully the general sentiment of my guidance is clear enough. ;-) | |

The Harrisonburg Housing Market Keeps Defying Expectations |

|

After A Worldwide Pandemic...

After Mortgage Interest Rates Almost Doubled...

When the pandemic began, I was convinced home sales would slow and prices might drop as well. The market defied my expectations. When interest rates skyrocketed, I was convinced home sales would slow and prices might drop as well. Thus far, the market has defied my expectations. As you can see, the Harrisonburg housing market doesn't always do what we might expect, even with significant external factors having the potential to make large impacts on our local market. So... don't assume our local housing market will do whatever you might read in national headlines... the local market seems to keep having some surprises for us! | |

Harrisonburg Housing Market Still Speeding Right Along |

|

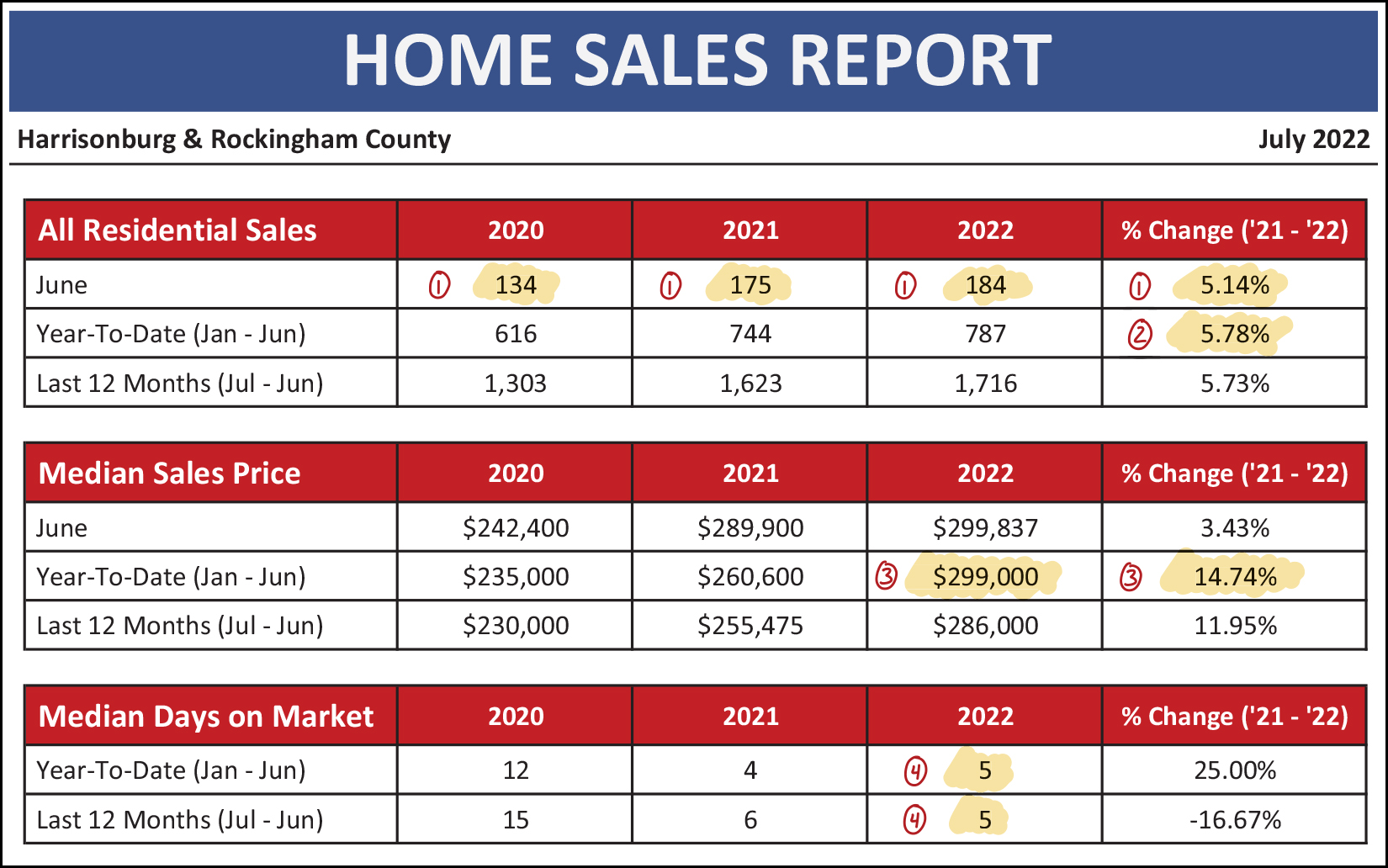

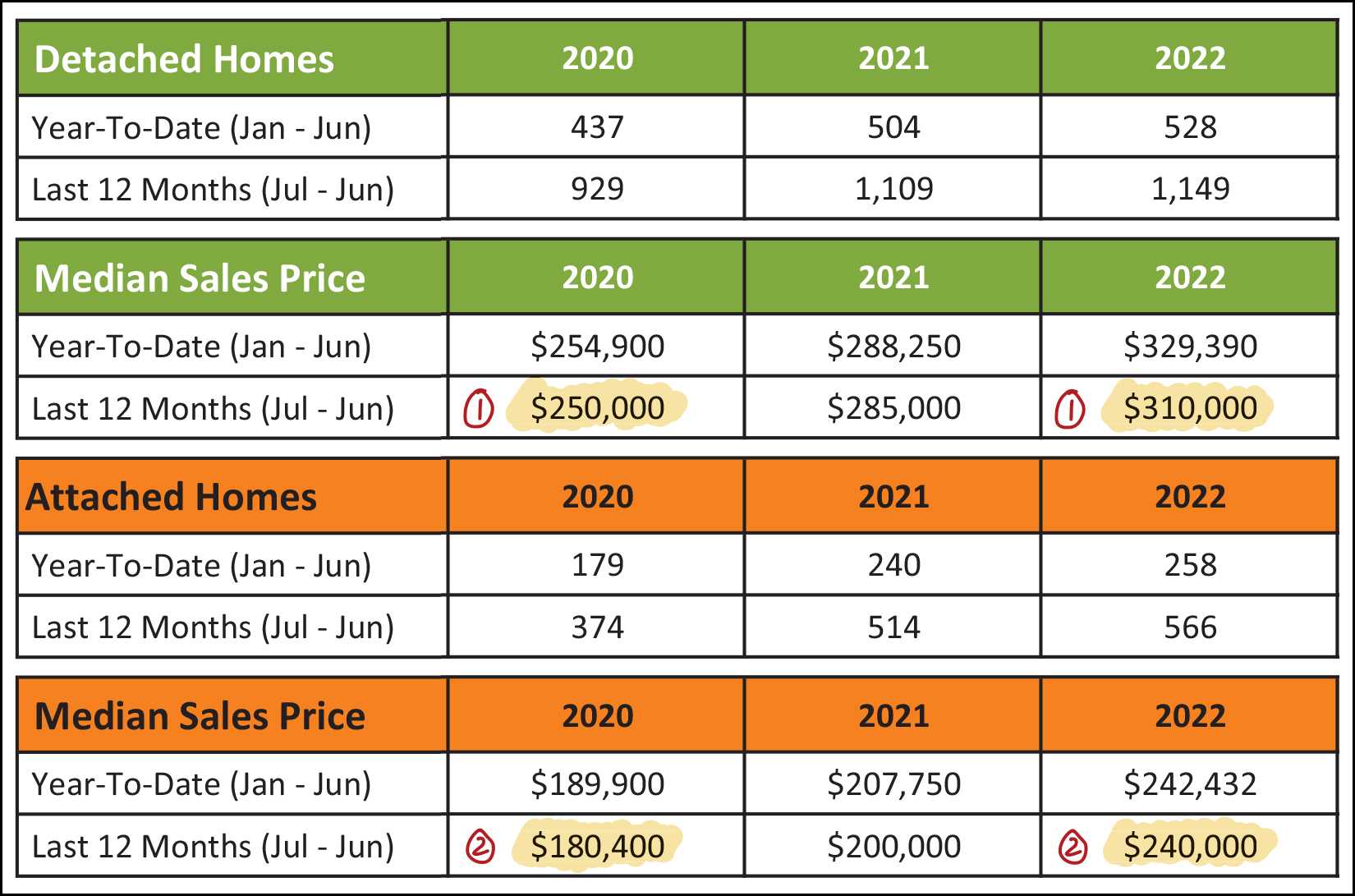

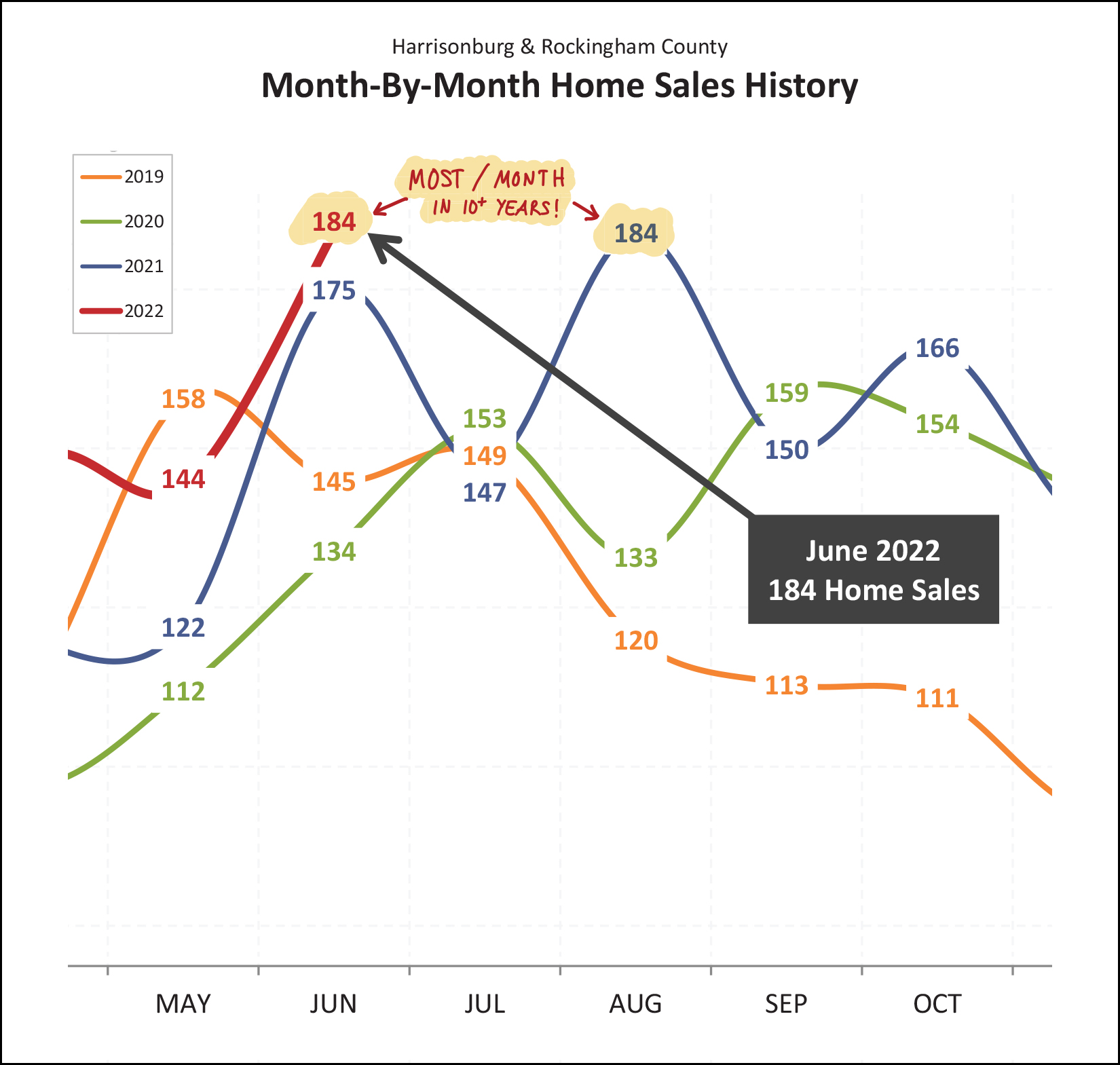

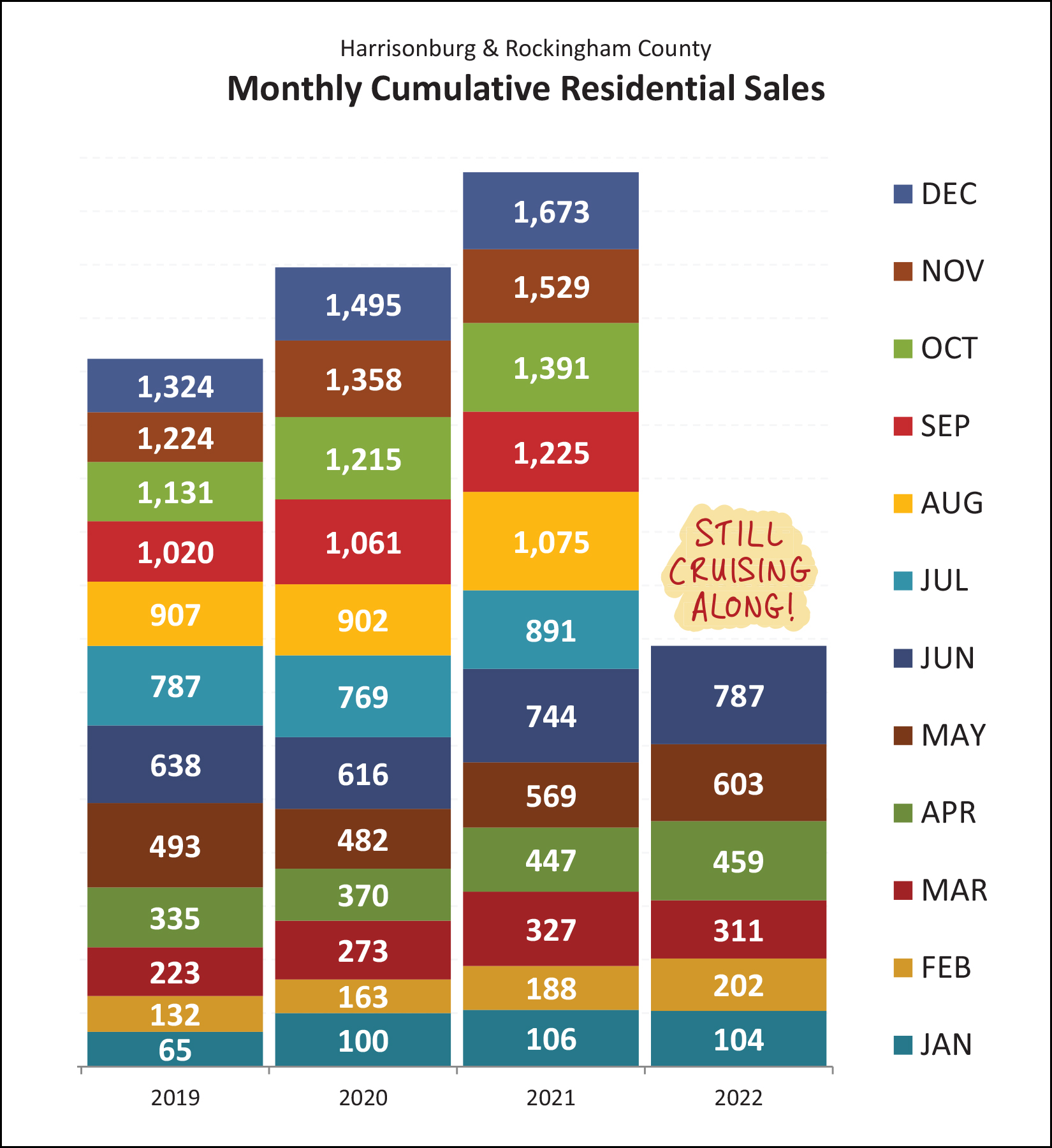

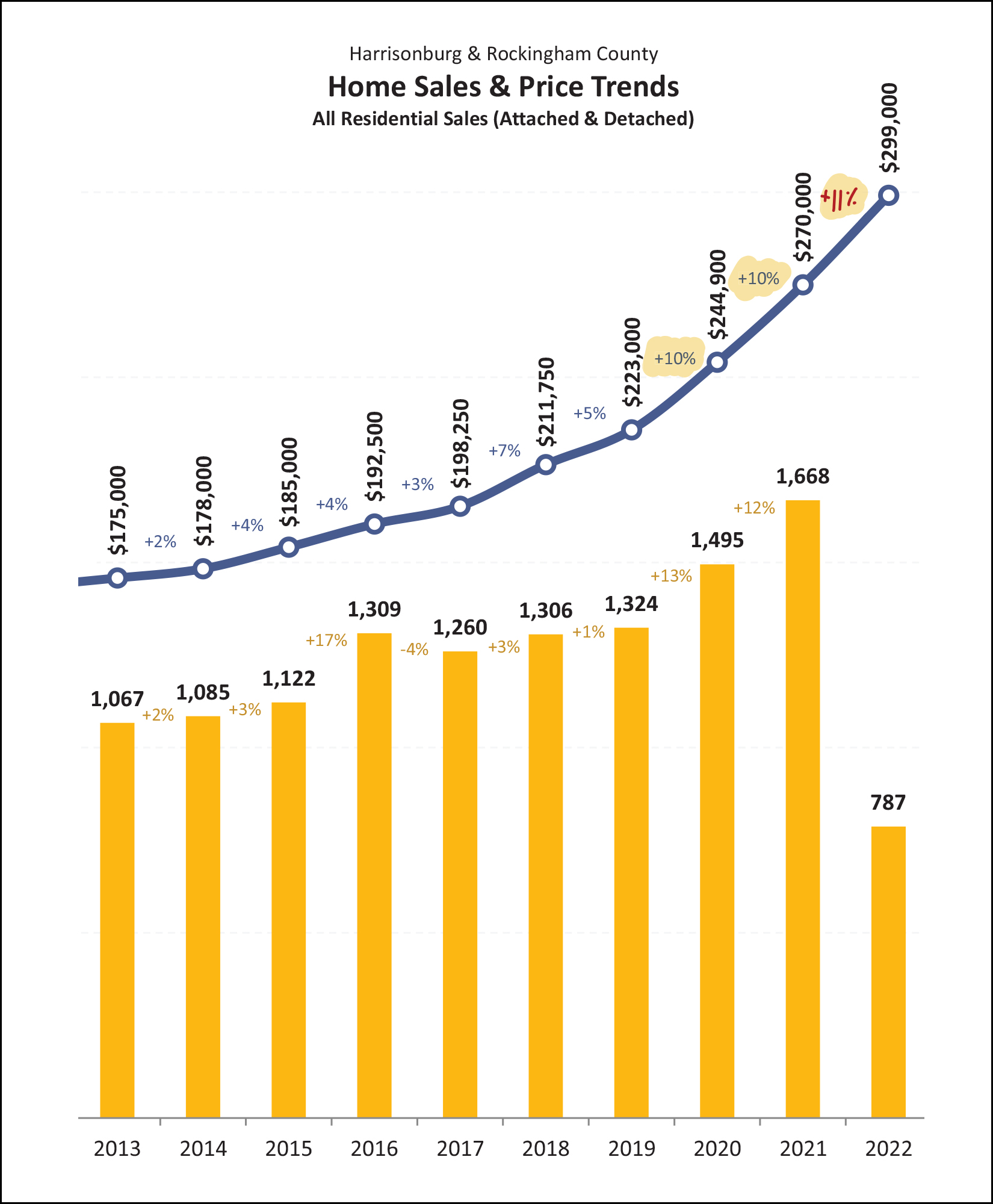

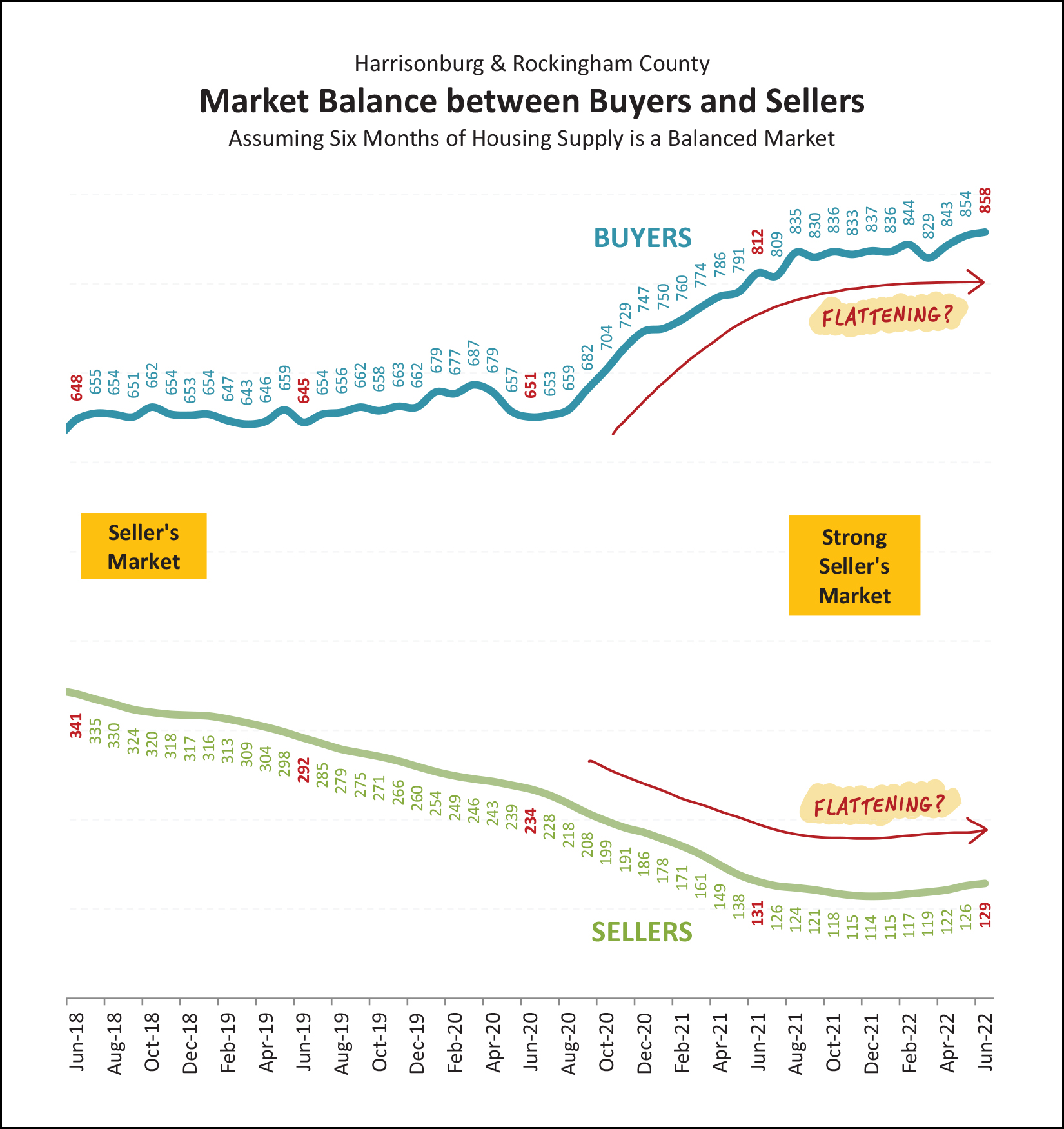

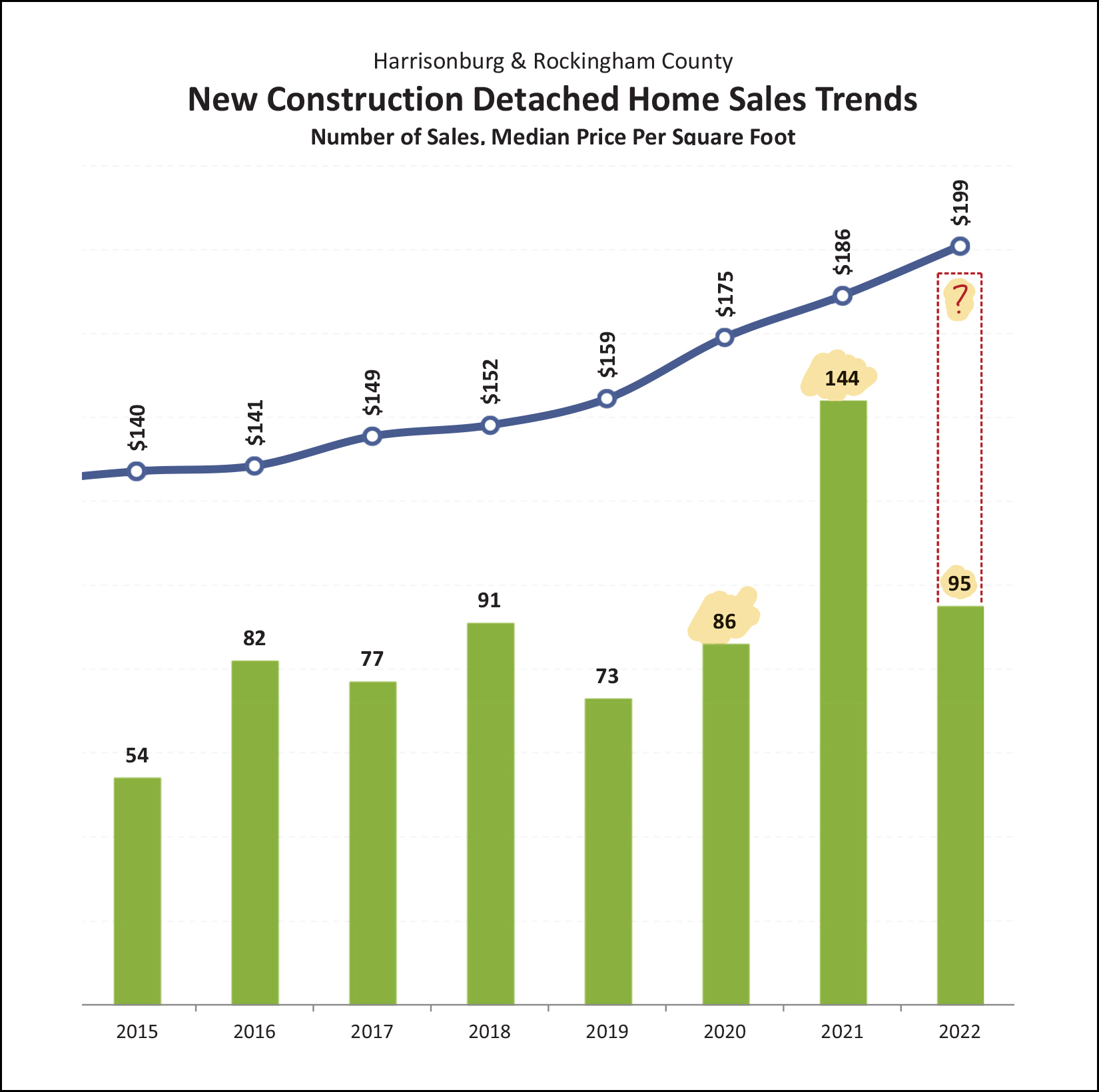

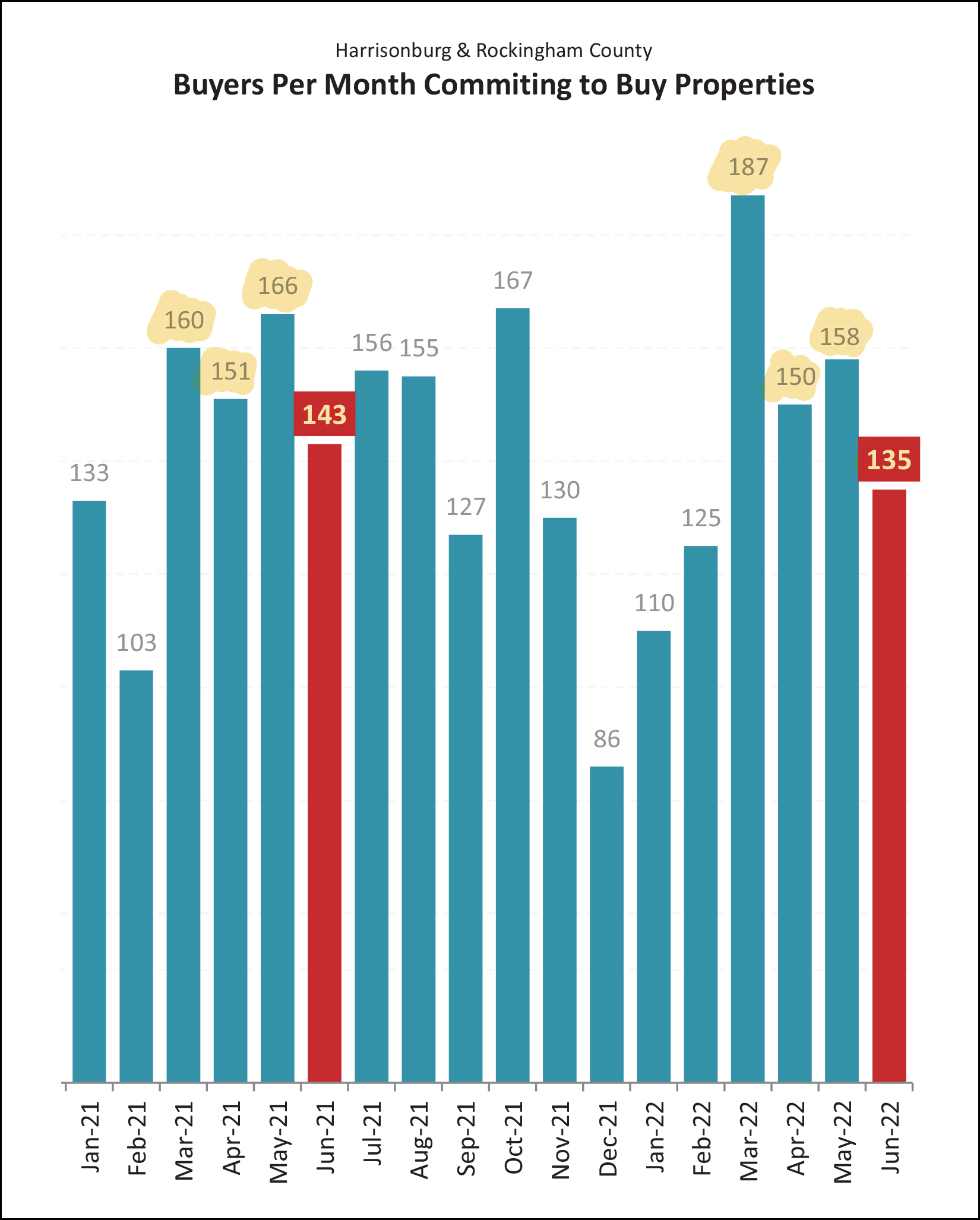

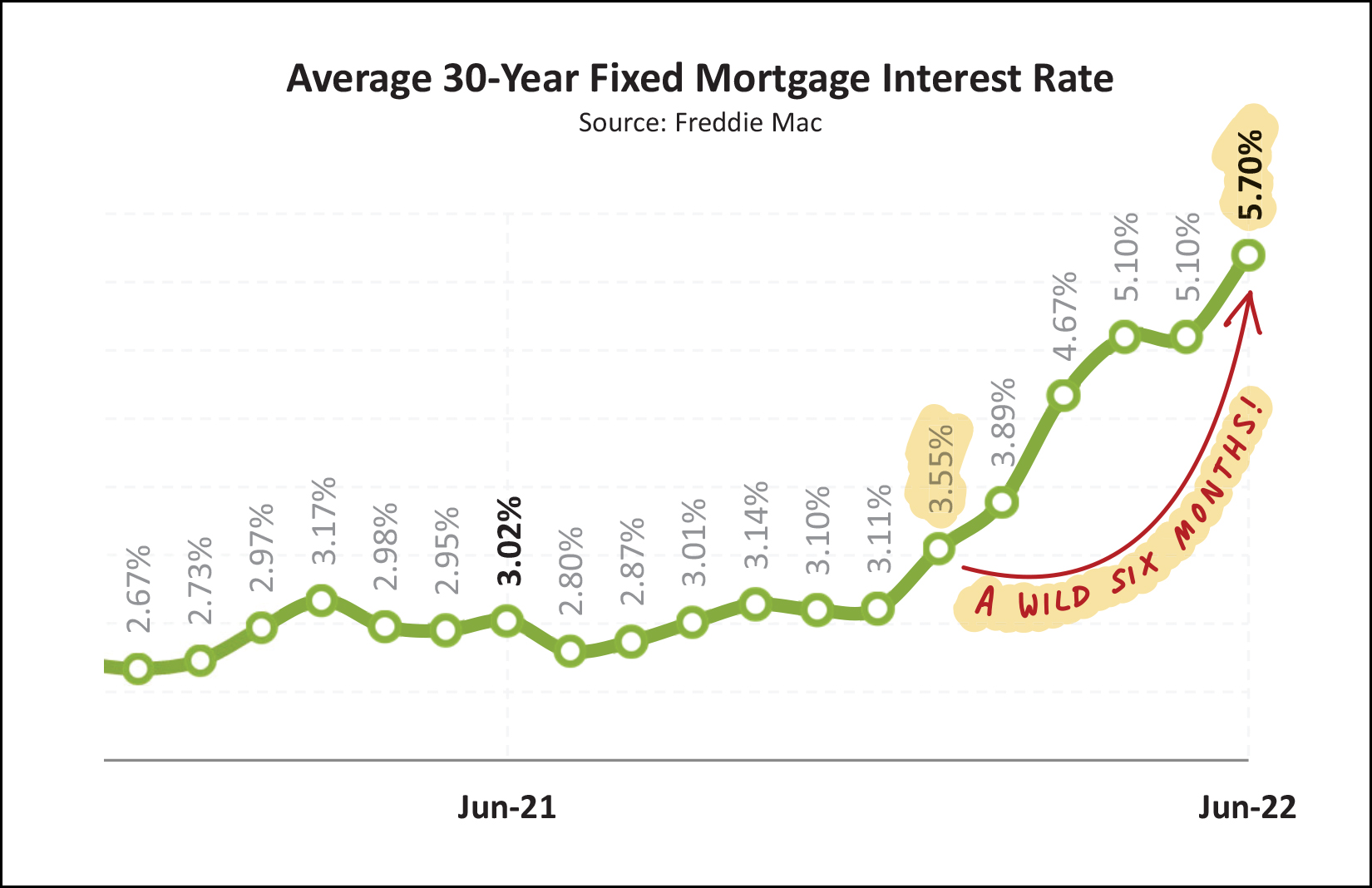

Happy Tuesday morning, friends! The starting and ending point of summer likely varies for many of us, but it seems like we're somewhere around the middle of summer. Gasp! As such, I hope the first half (or so) of the summer has treated you well, and that you still have some fun, adventures and relaxation in the works for the second half of summer. Before we get to the real estate news of the day, I'll mention that Red Wing was *fantastic* this year...  I enjoyed seeing many of you out at Natural Chimneys over that long (but not quite long enough) weekend and I hope the rest of you will consider checking it out next year! Sign up for Red Wing Updates here. Next, I should mention that the beautiful home on the cover of my market report is on the market, for sale, as of this morning! Find out more about 390 Callaway Circle here. Finally, if you're looking for a good cup of coffee (or a caramel latte) one of my favorite coffee spots in the 'burg is Black Sheep Coffee, tucked away over on West Bruce Street. Interested in checking out Black Sheep Coffee? I'm giving away a $50 gift certificate, which you can enter to win here! And now, let's spend a few minutes together exploring the latest news and happenings in our local housing market...  Right off the bat, we get to some rather fascinating updates just checking out the very basic metrics of our local market. As referenced in the tiny red numbers above... [1] A normal June might have around 135 or 145 home sales. Last June (2021) we saw an impressive 175 home sales. I did not think we would clear that high bar this June. But... we did. There were an astonishing 184 home sales in June 2022! [2] The median sales price in the first half of this year was $299,000! That is almost 15% higher than it was in the first half of last year, when it was $260,600. Even with *much* higher mortgage interest rates, homes keep selling at higher and higher prices! [3] Homes are still selling fassssssssst! The median days on the market in Harrisonburg and Rockingham County during the first six months of 2022 was... only five days, just as fast as when we look at the entire past 12 months of data. So... lots of sales, prices that are higher than ever, and homes are going under contract faster than ever. Hmmmm... things don't seem to really be slowing down thus far in 2022!? This fast moving market has been one contributor to the steady increases in home prices seen over the past two years. Take a look at these increases...  [1] The median sales price of detached homes was only $250,000 just two years ago... but over the past two years that median sales price has risen to $310,000! [2] The median sales price of attached homes (townhomes, duplexes, condos) was only $180,400 just two years ago... but over the past two years that median sales prices has risen to $240,000! Homeowners have been delighted with these increases. Sellers have also been big fans. Buyers... not so much. It can be tough for buyers to get excited about paying a *much* higher price alongside their *much* higher mortgage interest rate... but buyers still seem to be moving forward full steam with their home purchases thus far in 2022. Those home buyers are moving along so steadily that we're breaking (tying) some records...  Over the past ten years, the most home sales we have seen in a month has been 184 home sales... which took place last year, in August. Well, what do you know!? This June (last month) we saw... 184 home sales! Looking ahead, what should we expect for July? The past three months of July have been tightly clustered around that 145 - 155 range, so I'm going to play it safe and guess we'll see right around that many home sales in July 2022. Perhaps 150 on the nose!? As I have mentioned to many of you, I fully expected (and still expect) that we'll see a bit of a slow down in home sales activity in 2022 due to higher mortgage interest rates... but... the data just isn't agreeing with me thus far...  As shown above, the 787 home sales we've seen in the first half of 2022 exceed the number of home sales in the first half of each of the past three years! If I didn't know better, I'd think mortgage interest rates must be *lower* than ever in 2022 to spur on so much buyer activity!? But, no, not so much. More on that later. Looking at these big picture trends in a slightly different way, it's astonishing to see three years in a row of double digit growth in the median sales price in our market...  How much did our area's median sales price increase in 2020? 10% How much did our area's median sales price increase in 2021? 10% How much has our area's median sales price increased thus far in 2022? 11% It's been an astonishing few years in our local market to see home values escalating so quickly... without any signs of slowing down. But... to try to reel us back in a bit from cloud nine...  It's hard not to look at the graph above and think that things could be, might be, possibly be changing... [BLUE] The top, blue, line shows the number of buyers buying in a six month period as evaluated over the past four years. This metric has been steadily marching upward over the past two years... but... it seems that the number of buyers buying might be flattening out a bit. Again, not that the amount of buyers buying is decreasing, but buyer activity might not be continuing to increase as quickly as it has for most of the past two years. [GREEN] The bottom, green, line shows the numbers of sellers selling at any given time... the inventory levels at the end(ish) of each month. For most of the past four (plus) years we have seen fewer and fewer (and fewer and fewer) homes on the market, due largely to excessive amounts of buyer demand. But... over the past six months... we're starting to see some modest flattening out of inventory levels in our local area. Inventory levels seem to be steadying themselves. Bear in mind that it is still definitely a strong (strong!) seller's market, but we might be starting to see some early signs that the market might be slowing down a touch... perhaps cooling off from a strong-strong-strong seller's market to a strong-strong seller's market!? Changing gears, slightly, here's an interesting trend to make sure that we recognize...  After typically only seeing around 70 - 90 new (detached) home sales per year, we saw a remarkably high 144 such sales last year... and this year we seem to be on track to see around 180 new detached home sales in Harrisonburg and Rockingham County. These recent, steady increases in the number of new homes selling in our market is doing two things... one, allowing the overall number of home sales to increase without relying just on resale homes as inventory... and allowing the median sales price in our market to keep climbing, given that new homes are typically more expensive than resale homes. OK, shifting back to the overall sales market, here's a look at recent months of contract activity... measured by when contracts are signed...  Looking at the highlighted months... [2022] We have seen 630 signed contracts in the past four months. [2021] In the same months last year, we saw 620 signed contracts. So, yes, even with *much* higher mortgage interest rates, we are seeing more buyers sign contracts to buy homes now as compared to a year ago. Is this surprising? Yes, relative to interest rates. No, relative to what seems to be a significant number of buyers who wanted to buy homes in this area in the past two years who have not yet been able to do so. In other words, demand exceeds supply. There are still lots of buyers who want to buy... even if the interest rates are higher than they were previously and higher than they would prefer. So, demand is high. How about supply? Well...  It is possible that our local housing supply is increasing, slightly. After multiple years of constantly declining inventory levels, we now seem to be seeing inventory levels increasing a bit. Sadly, these *slightly* higher inventory levels aren't evenly spread across all property types, locations and prices... so many buyers will still find inventory levels to be *quite* low in their segment of our local market. Because inventory levels are still so low in most segments of the market, we are still seeing homes selling just as quickly has they have for the past year...  As shown above, the pace at which homes go under contract once listed (days on market) declined steadily through 2020 and 2021 until it seemed to bottom out at a median of five days on the market. That is to say that half of homes go under contract in five or fewer days... and half go under contract in five or more days. This metric hit a median of five days on the market back in July 2021 and has stayed there ever since. If or when the market starts to slow, soften or cool, we'll start to see this metric drift upward again. Finally, that one topic that isn't quite as exciting to talk about... mortgage interest rates...  Just six months ago... the average mortgage interest rate for a 30 year fixed rate mortgage was... 3.55%. Now, it has risen all the way up to 5.7% as of the end of June. This drastically affects the monthly payment for buyers in today's market as compared to just six (or twelve, etc.) months ago. I don't think we'll see interest rates rise above 6% but it is definitely possible. If there is one thing that could cool off our local housing market, it's this "cost of money" in the form of the mortgage interest rates. But, again, it hasn't happened yet despite drastic changes in interest rates. And here we find ourselves again, at the close of what seems to be another red hot month of real estate activity in Harrisonburg and Rockingham County. By the headlines... [1] More and more home sales are selling! [2] Homes are selling at higher and higher prices! [3] Homes are selling as fast as ever! [4] Inventory levels are increasing, slightly, in some pockets of the market. [5] Mortgage interest rates are higher than they have been in years! What will we see over the next few months in our local real estate market? Most likely, more of the same... but we won't know for sure until those next few months pass... and I'll pause each month to check the numbers and share some thoughts with you so that we can all have a good sense of where we have been, where we are and where we might be going next. Speaking of next... If you are planning to SELL a house in the next few months, sooner is likely better than later, and I'd be delighted to chat with you about how we might work together. If you are planning to BUY a home in the next few months, you ought to check in with your lender sooner rather than later to get proper expectations of your potential mortgage payments within the context of rising mortgage interest rates... and yes, I'd be delighted to help you with buying as well. Be in touch at any point if I can be of any help to you or your family or friends. You can call/text me at 540-578-0102 or email me here. Until next month... may your summer be as relaxing as this crazy real estate market can be stressful! ;-) | |

How Quickly Will We Plan To Respond To An Offer On My House? |

|

When we receive an offer, how quickly will we plan to respond to that offer? Well, as is often the answer... it depends... We will certainly look at the acceptance deadline on that offer to see when the buyer hopes we will respond... but we might not always respond within that timeframe. Here are a few of the guidelines that will likely inform our response timeline... [1] If the offer is an extremely strong offer with very favorable terms, we will likely respond sooner rather than later. [2] If the offer is OK or good, but not great, we will likely wait until nearly the end of that response timeframe, or possibly even later. [3] If we already have feedback from every other buyer who has viewed the home and none of them plan to make an offer, we will likely respond sooner rather than later. [4] If there were a half dozen showings today and we're still waiting to hear back as to if those buyers will be making offers, we will likely wait a bit to respond to the offer. [5] If we have no other showings scheduled or requested, we will likely respond sooner rather than later. [6] If we have a dozen more showings scheduled and requests coming in beyond that, we will likely wait a bit to respond to the offer. So... as you can see, there isn't one set answer to how quickly we respond to any given offer. It will depend on the context for that offer as informed by the factors noted above, and other factors as well. | |

But Officer, I Just Slowed Down!?! |

|

So, you're cruising along on Interstate 81 (somehow not stuck in traffic) in a 70 MPH speed zone.... ...but, you're going 115 MPH. Wow! But then, you slow down a bit, to 95 MPH. When your friendly, neighborhood police officer pulls you over and asks you why you were going so fast... 95 MPH... you tell the officer you just slowed down. "Sure, pal, you may have slowed down... but you were still driving very fast!" Maybe you see where I'm going with this... The local housing market has been moving very quickly over the past two-ish years, perhaps it's been going 115 MPH... well beyond the speed limit, and definitely a seller's market, often with 5+ or 10+ offers on new listings within days if not hours. The local housing market has now slowed down a bit, perhaps to 95 MPH... still well faster than normal, still definitely a seller's market, often with 1 to 3 offers on new listings within days, but likely not within hours. So, yes, the local real estate market seems to have slowed down a bit over the past few months -- but it is still moving very, very quickly! | |

The Short Term Rental Market Seems To Be Quite Active In and Around Harrisonburg |

|

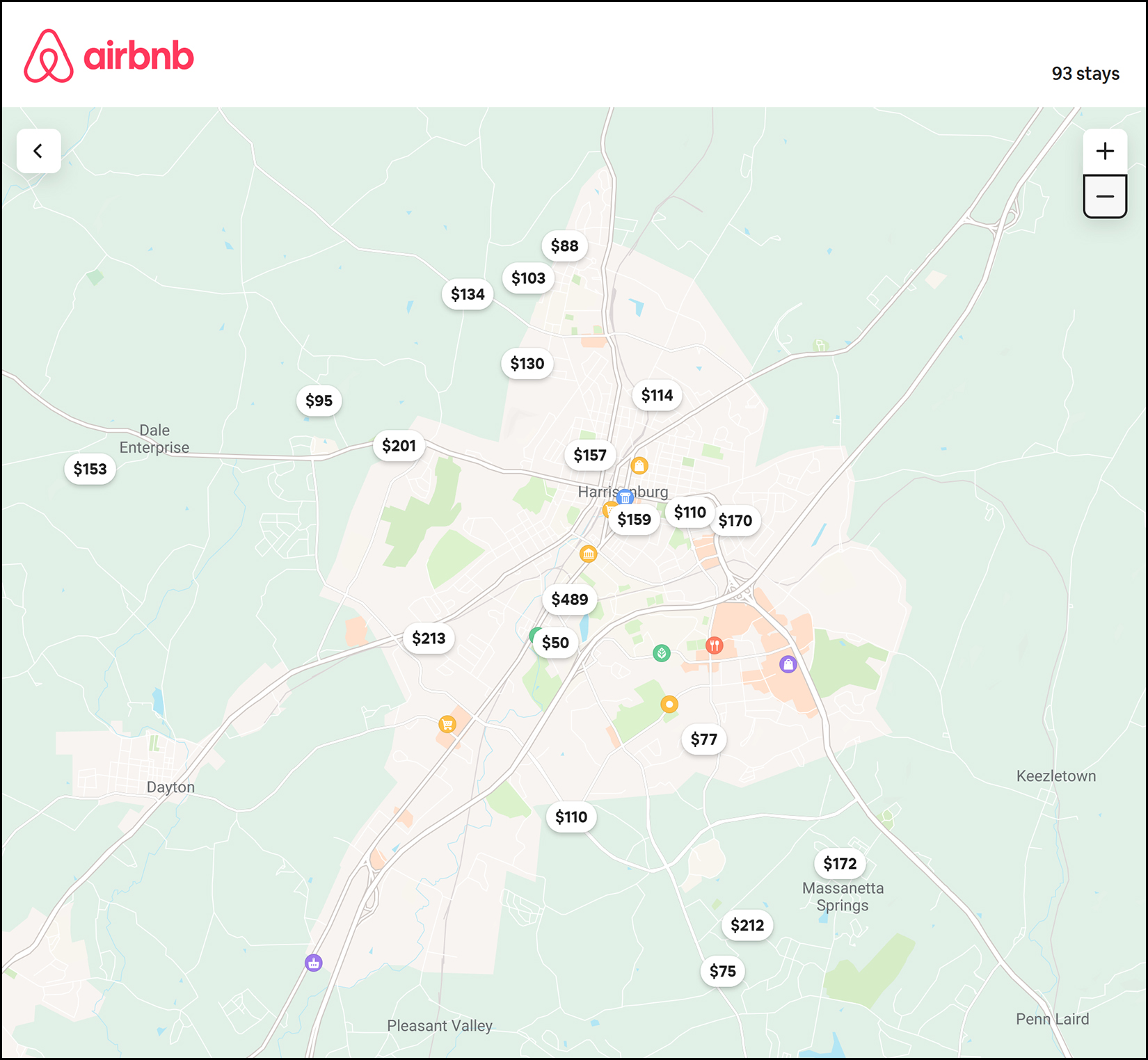

If you are looking for a weekend stay, or a week long stay, in or near Harrisonburg there seem to be LOTS of options on AirBNB. The search above, showing 93 options, was with flexible dates in August / September / October. If you are considering purchasing a property to use as an AirBNB, keep in mind that there seem to be plenty of current options for those looking to book a short term stay. Driving a bit further east, there seem to be right around 300 available options at or near Massanutten Resort. What a difference from just a few years ago when short term rentals were just starting to pop up in this area! | |

New Home Construction (For Sale or Rent) Is Likely The Only Path Towards A More Balanced Local Housing Market |

|

Over the past two (to five) years the local real estate market has seen... [1] More and more homes selling. [2] Higher and higher sales prices. [3] Higher and higher rental rates. Over the past six months, mortgage interest rates have increased significantly (from around 3% to nearly 6%) and yet... [1] We're still seeing just about the same number of homes selling. [2] Sales prices keep climbing. [3] Rental rates keep climbing. One conclusion that I keep coming back to in recent weeks and months is that... There are more people who want to live in Harrisonburg and Rockingham County than there is housing in which they can live. Generally speaking, when demand for housing exceeds supply, prices go up... that's what we're been seeing over the past few years. So, what's the answer? If there are 134,000 people living in Harrisonburg and Rockingham County, but there are 140,000 or 150,000 who would like to live here... ...the only path towards a more balanced housing market is to have... ...more homes. So, whether it's new homes being built to be sold... or new homes being built to be rented... that will help bring balance to our local housing market. It's certainly not clear how much more housing is needed, in what locations, or of what property types, sizes, or prices... but overall, more housing needs to be created (built) to account for the ever increasing number of people who would like to live in this area. | |

An Early Look At June 2022 Home Sales |

|

As mortgage interest rates rise, many continue to wonder whether it will significantly slow down the amount of home buying activity we are seeing in our local market. It's a reasonable thing to wonder about. Here's a quick preview of how things went last month (June 2022) compared to the same month a year ago... June 2021 Mortgage Interest Rate at Start of Month = 2.99% Closed Home Sales in Harrisonburg & Rockingham County = 175 Contracts Signed = 143 June 2022 Mortgage Interest Rate at Start of Month = 5.09% Closed Home Sales in Harrisonburg & Rockingham County = 168 Contracts Signed = 129 Conclusions By the numbers... there were 4% fewer home sales this June compared to last June... and 10% fewer contracts. So, maybe (?) things are slowing down, a bit? That said, in many months over the past few years home sales seem to be constrained by the number of sellers willing to sell, and not so much the number of buyers interested in buying. Stay tuned for further updates as I take a fuller look at the market over the coming week. | |

Price Reductions In A Fast Moving Housing Market |

|

A few years ago (maybe five) a home seller would often wait a month or two before giving serious thought to adjusting the asking price of their home if it was not yet under contract. But now, with a median "days on market" of just five days... home sellers are often concluding much more quickly that their asking price might need to be tweaked to inspire a buyer to make an offer. This faster pace of price reductions makes a lot of sense unless you have a super unique house or property that is only going to appeal to a very small pocket of buyers. In the current market, if you listed your home for $450K (for example) and didn't have any offers in the first two weeks, you may very well have priced it a bit higher than the market will bear. Perhaps it should have been priced at $425K instead. So... for as long as the market continues to move as quickly as it has been for the past few years, you can gather pricing feedback rather quickly once your house is on the market, and quickly adjust your pricing if you are not generating offers... or if you are not generating enough showings to make you confident that an offer will be forthcoming soon. | |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings