| Newer Posts | Older Posts |

Harrisonburg Property Assessments Decline 1% for 2013 |

|

New assessed values have been calculated for the City of Harrisonburg. These new assessed values will determine the property taxes that each property owner will pay in 2013 --- and the values are based on sales data from the previous year. Harrisonburg has 12,531 taxable parcels, and roughly 9,000 of those parcels will see a change in their assessed values (and thus property taxes) for 2013. How does this 1% overall decline in City property values compare to what we've seen in the Harrisonburg Rockingham Association of Realtors Multiple Listing Service (HRAR MLS)?

This 1% decline in assessed values may or may not be accompanied by a change in Harrisonburg's property tax rate. That rate increased from $0.59 (per $100) to $0.63 (per $100) effective July 1, 2012. City Council will discuss the property tax rate when the City develops the 2013/2014 budget. Click here to read today's full Daily News Record article on City assessments. | |

Harrisonburg might set sights on fight on blight |

|

Harrisonburg has an ordinance to take action when a property owner's neglect of their property affects public safety -- but they might go one step further with a new ordinance that they have asked City staff to draft. The new anti-blight ordinance would potentially require a property owner to submit an improvement plan to the City, and would let the City perform the improvements if the owner did not do so themselves. Read more from yesterday's DNR article. | |

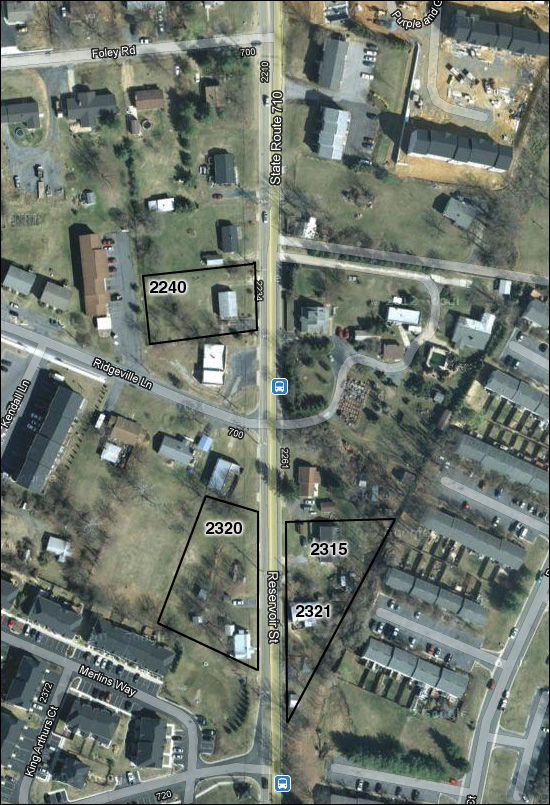

City of Harrisonburg starts buying up Reservoir Street properties |

|

The first of the Reservoir Street acquisitions started showing up in the Property Transfers this week..... 2320 Reservoir Street - purchased for $250,160 - assessed for $252,100.  2321 Reservoir Street - purchased for $172,500 - assessed for $142,900  2315 Reservoir Street - purchased for $192,400 - assessed for $192,400  2340 Reservoir Street - purchased for $158,000 - assessed for $162,500 To put those in context....  | |

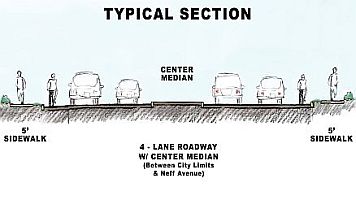

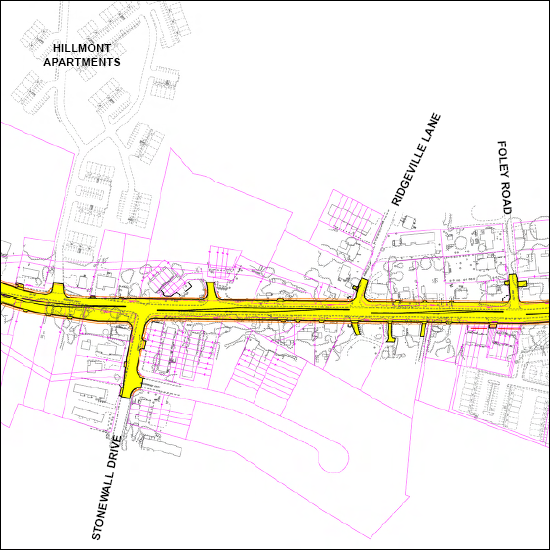

Reservoir Street Improvements |

|

Reservoir Street is being improved / expanded in the near future, between University Boulevard and the eastern City limits. The improved road will feature:

If you are buying a home near Reservoir Street (Stonewall Heights, Avalon Woods, etc) you should:

View the Reservoir Street Improvement website for a PDF map of the new road. P.S. Did you know that 18 buildings along Reservoir Street will be demolished to make way for the improved road? | |

Harrisonburg City Council spends $4.76M on Roads, Sidewalks, Employee Bonuses, Northend Greenway, Bluestone Trail, Smithland Soccer Complex |

|

Did you miss it? The Harrisonburg City Council spent $4.76 million last night. These funds were "reserve suplus funds" --- which are undesignated funds that have built up over time --- not a surplus in a single year's budget. How did the City Council decide to spend the funds?

So What? Why does this matter? Wasn't it just extra funds that had to be spent? Why should we care where the funds went? I believe these expenditures reveal the priorities of the City of Harrisonburg --- road improvements, sidewalks, bicycle and pedestrian trails, employee retention, parks, soccer fields. Personally, I think these are great priorities for the City of Harrisonburg to be focusing on to make it a safer, more enjoyable place to live. | |

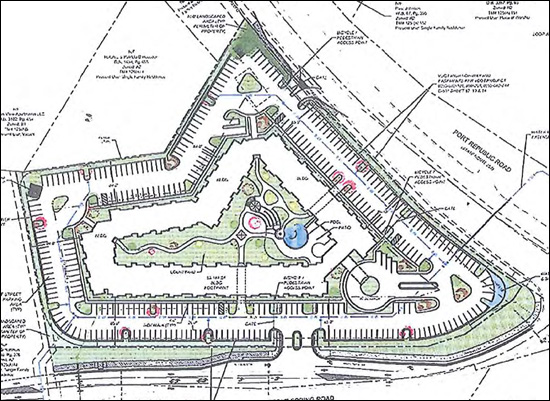

A glimpse into a rezoning request, via Aspen Heights |

|

Aspen Heights is a planned college student housing community on Port Republic Road. Or, as described by the Aspen Heights marketing team.... A neighborhood of craftsman homes with all the convenience and amenities of a luxury multi-family dwelling complex.  To its credit, this does seem to be a notably different type of community compared to most other college housing complexes in Harrisonburg. That said, it is being built amidst (adjacent to) several existing single family home neighborhoods (Ashly Meadows, Stone Spring Village) and those homeowners have a vested interest in it being a well-planned community. This PDF (from the Rockingham County Planning Commission's April 2012 meeting) gives some insight into the Rockingham County rezoning process, showing some very detailed information including:

| |

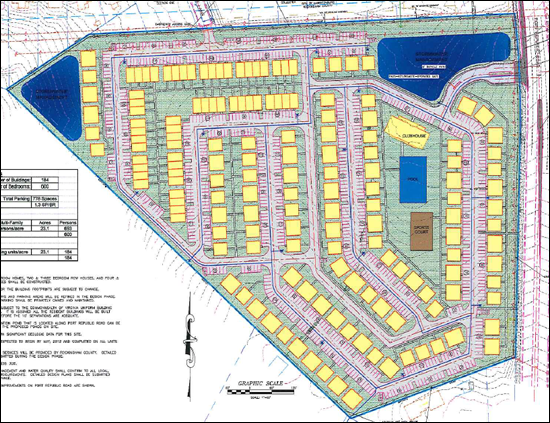

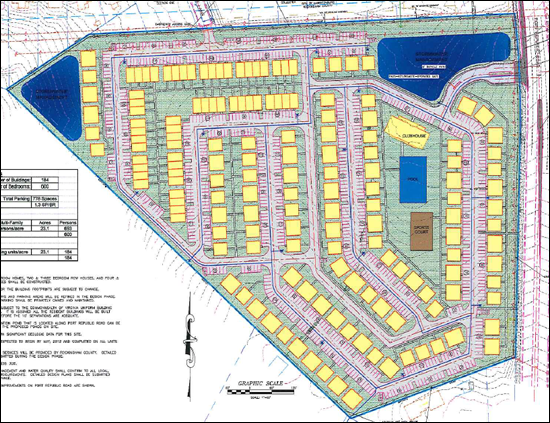

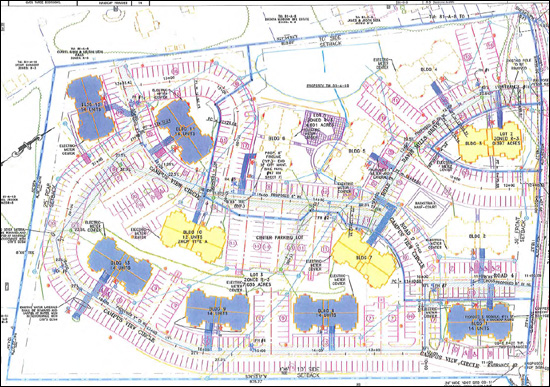

Site Plan for Aspen Heights, Stone Spring Courtyard, Campus View Condos |

|

It has become a part of my routine to take a look through the City of Harrisonburg Planning Commission board packets, as these are available for public consumption, and often have some interesting insights into forthcoming developments in the City of Harrisonburg. Read on for some highlights of what will be discussed during the October 10, 2012 meeting (at 7PM).  Above is the site plan for Aspen Heights which is the new gated student housing complex being built on Port Republic Road. View more details on their Facebook page or web site. Per the site plan, there will be 183 buildings with a total of 600 bedrooms.  Above is the site plan for Stone Spring Courtyard (here as a PDF) the new luxury gated apartment community on Port Republic Road.  Above is the revised, proposed site plan for Campus View Condos (here as a PDF) showing the new layout of buildings as proposed by the new developer of the complex. The original developer was foreclosed on, and the new developer is proposing to 108 apartments in 8 buildings, instead of the same number of units 9 buildings. View the full Planning Commission board packet (and from previous meetings) here. | |

No more than 2 unrelated people can live in an R-1 property in Harrisonburg |

|

Visit the City Council chambers today at 4PM for a (potentially) lively discussion about the R-1 zoning classification in the City of Harrisonburg. Here's a summary....

Read more....

| |

Conference Center (and hotel) coming to Downtown Harrisonburg? |

|

Last night the Harrisonburg City Council discussed a proposed conference center and hotel to potentially be built in downtown Harrisonburg. The proposal went before City Council because the developers are seeking public funding for part of the project. City Council made a decision to seek competing proposals, which are due to the City by Nov 13, 2012. After competing proposals have been received, the City can decide whether to move forward with a feasibility study to provide more data with which to make a decision about whether to provide the public funding for this project. The hard costs of the potential feasibility study will be paid by the City with funds paid by each developer that submits a proposal. The project team that is working on this proposed conference center and hotel include:

dpM Partners is based out of Gaithersburg, MD, has recently developed a Westin Hotel in Virginia Beach. Its principal, was the lead developer on the Stonewall Jackson conference center in Staunton and he is also a JMU graduate. The W.M. Jordan Company (proposed general contractor) recently completed the Hilton at Short Pump. The proposed conference center facility would be 18,180 square feet --- twice the size of the JMU Festival Conference Center --- and would be the largest conference center between Northern Virginia and Roanoke. The hotel would feature 205 rooms and would have a full-service restaurant. If eventually approved, the City would be contributing nearly $10 million of public funds to this project in the way Tax Increment Financing Bonds. The specific site has not been publicly identified, for competitive reasons, but it is in downtown Harrisonburg within walking distance of Main Street. I believe this is exciting news for Harrisonburg as it could potentially grow our local economy even further by bringing regional conferences into our area. It would also certainly be a boon for downtown retail businesses and restaurants. Stay tuned -- within the next 60 days the City will be seeking competing proposals, and then they will be deciding whether to move forward with a feasibility study. | |

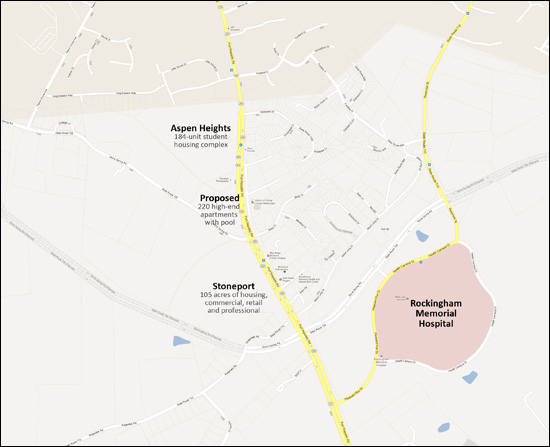

New hospital, road infrasture lead to new developments along Port Republic Road |

|

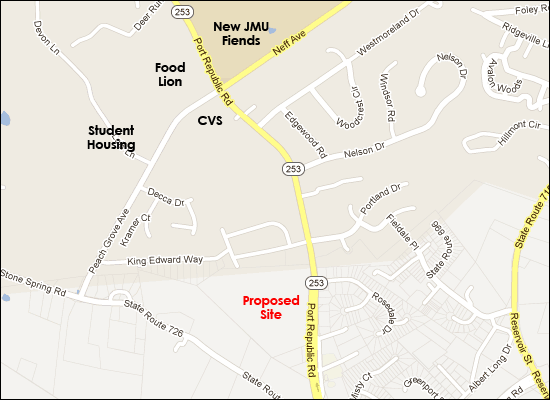

Click on the map above to view a larger version. In the past several years we have seen quite a few changes on Port Republic Road on the map shown above, including:

All of this new road infrastructure, plus the new hospital, plus a clustering of residential developments over the past 15-20 years has lead to quite a few new projects labeled on the map above.

Given the new hospital, the new road infrastructure, and the large area of existing housing, it is not surprise that we are seeing these new developments along Port Republic Road. Stoneport is the largest of the new projects, and it will certainly be interesting to see what businesses are established in that location. | |

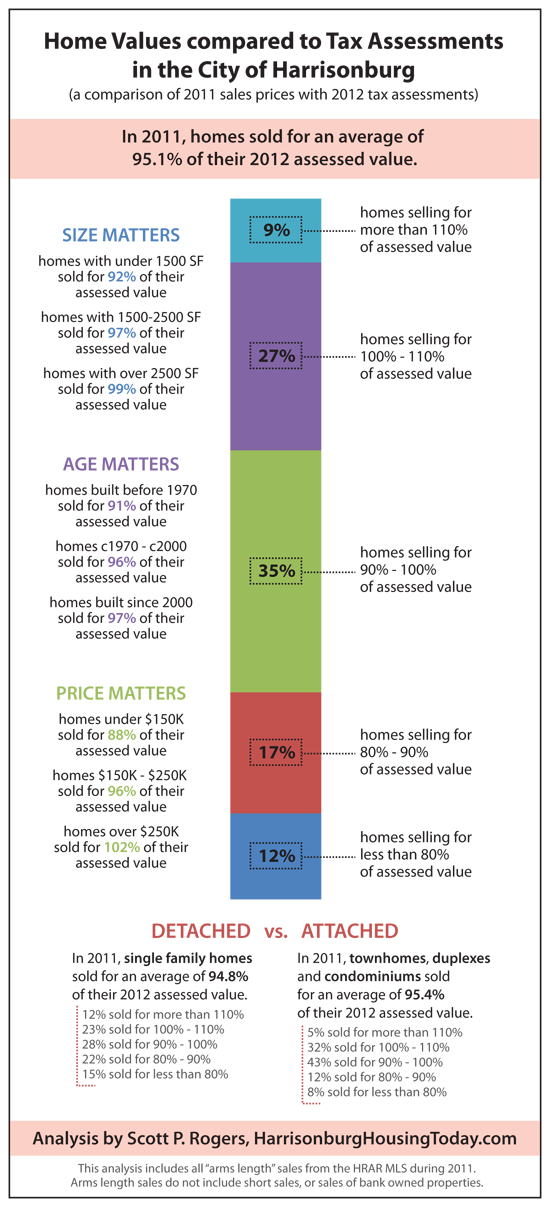

Understanding Real Estate Assessments |

|

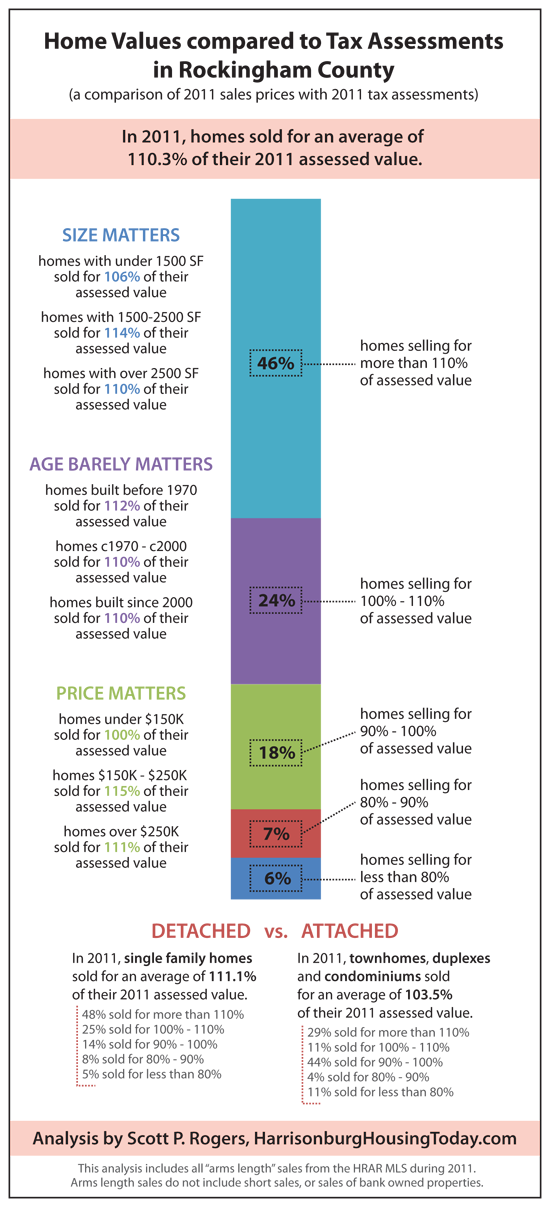

As published yesterday in the Shenandoah Valley Business Journal. Many people believe the assessment of their property istheir home's value. In actuality, theassessed value of a property is the value assigned to the property by the localassessor's office, for the purpose of determining how much you will pay intaxes. Certainly, the assessed value is intended to be the precise valueof your home – but quite frequently there is a disparity in this assessed valueand market value. The market value ofyour home is the price at which it would sell in the current market. Of interest, the City of Harrisonburg real estateassessments are currently a bit more accurate than those in RockinghamCounty. As can be seen in theinfographic, homes sold during 2011 in the City of Harrisonburg sold for 95.1%of their current assessed value. Breaking it down further, 64% of the homes that sold during 2011 in theCity of Harrisonburg sold at a lower price point than their assessed value. This is an indication that many City propertyassessments are likely a bit too high. In Rockingham County, most property assessments are too low –as 70% of properties that sold in 2011 sold for more than their assessed value– and on average, properties sold for 110% of their assessed value. Of note, homes in the City of Harrisonburgare re-assessed every year, while homes in Rockingham County are onlyre-assessed every four years. In thepast, this has resulted in lower than expected assessments in Rockingham Countydue to the infrequent updates to their assessed values. Given the great variation in assessed values and marketvalues, homeowners should not rely on their tax assessment for an understandingof their property's value. Furthermore,home buyers should not rely on assessed values to guide them in understandingthe market value of a home that they might purchase. Both buyers and sellers should strive tounderstand the market value of a particular piece of real estate my analyzingsimilar homes that have recently sold and those currently on the market in agiven neighborhood or price point. Click on either image below for a printable PDF.... | |

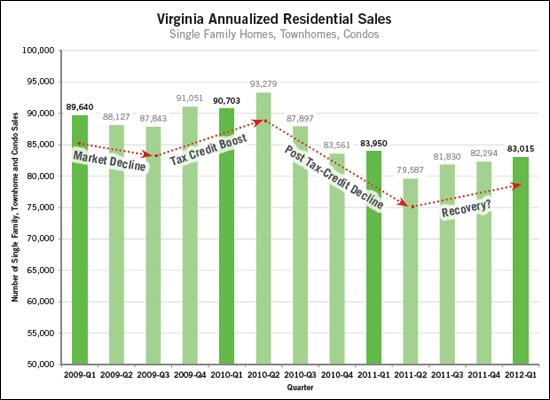

Was the federal home buyer tax credit worthwhile? |

|

I suppose it was helpful from a very short-term perspective --- it gave the market a boost between 2009-Q3 and 2010-Q2. But those artificially elevated sales levels didn't last -- sales declined to even lower levels after the tax credit than where they had been before it. Thankfully, the last year has shown steady growth in the number of home sales in Virginia, without the assistance of the tax credit. | |

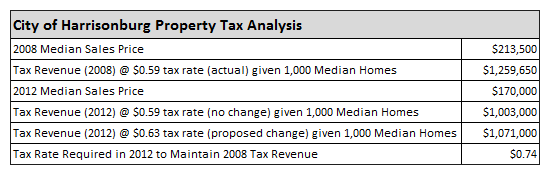

Real Estate Tax Analysis in Harrisonburg and Rockingham County |

|

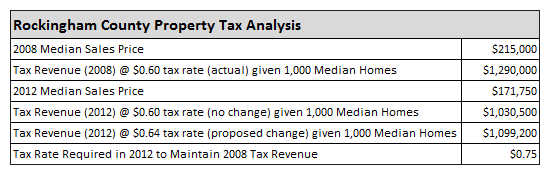

The City of Harrisonburg is considering increasing the real estate tax rate from $0.59 per $100 of assessed value to $0.63 per $100 of assessed value. Rockingham County is also considering a $0.04 increase, from its current tax rate of $0.60 per $100 of assessed value to $0.64 per $100 of assessed value. To understand the potential rationale behind such an increase, let's examine funding levels given a few assumptions to make the math a bit easier. First, we will assume that all tax assessments are at exactly 100% of the market value of properties. Second, we will assume that both Harrisonburg and Rockingham County are comprised of 1,000 privately owned homes. Third, we will assume that all homes have market values (and assessed values) of the median sales price.  As shown in the table above, the median sales price in the City of Harrisonburg declined 20% between 2008 and 2012 from $213,500 to $170,000. If the City of Harrisonburg were comprised of 1,000 median-priced homes, the tax base and thus the tax revenue would also decline by 20% from $1.26M to $1M. Even with the proposed $0.04 proposed increase in the tax rate (from $0.59 to $0.63) the tax revenue would still decline by 15% from $1.26M to $1.07M. In fact, the tax rate would need to increase to $0.74 (a 25% increase) in order to maintain the same tax revenue as in 2008 --- assuming that assessed values have tracked precisely with median sales prices.  As shown in the table above, the median sales price in Rockingham County declined 20% between 2008 and 2012 from $215,000 to $171,750. If Rockingham County were comprised of 1,000 median-priced homes, the tax base and thus the tax revenue would also decline by 20% from $1.29M to $1.03M. Even with the proposed $0.04 proposed increase in the tax rate (from $0.60 to $0.64) the tax revenue would still decline by 15% from $1.29M to $1.1M. In fact, the tax rate would need to increase to $0.75 (a 25% increase) in order to maintain the same tax revenue as in 2008 --- assuming that assessed values have tracked precisely with median sales prices. | |

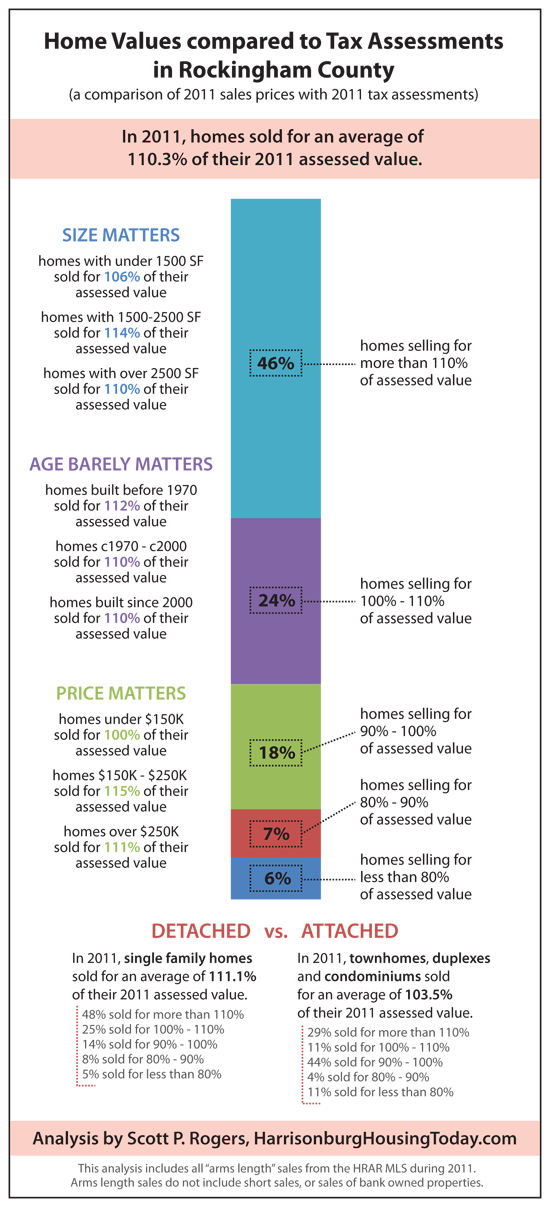

Home Values compared to Tax Assessments in Rockingham County |

|

I'm asked quite frequently about the relationship between home values and tax assessments. After a lengthy analysis of the 528 home sales in Rockingham County during 2011, as recorded in the HRAR MLS, here is what I'm finding.... (click here for the same information for the City of Harrisonburg)  click the infographic above for a printable PDF version. The bottom line here is that County properties seem to be under-assessed by an average of 10%. Most buyers pay more than assessed value for the properties they purchase. | |

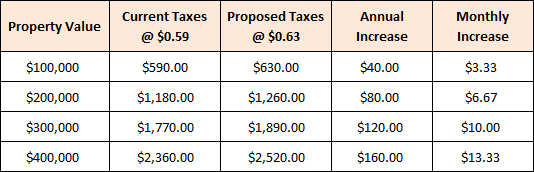

City of Harrisonburg real estate tax rate likely increasing 7%, mirroring Rockingham County increase |

|

Rockingham County is considering raising the real estate tax rate from $0.60 to $0.64 per $100 of assessed value (details here). The City of Harrisonburg is now considering a similar increase, from $0.59 to $0.63 per $100 of assessed value. The reasons cited for the proposed tax rate changes are increased Virginia Retirement System costs, and decreased property values. There are a few other tax rates that would change, but here is how the real estate tax rate changes would impact homeowners in the City of Harrisonburg....  Of note, the City's real estate tax rate was $0.62 per $100 of assessed value very recently -- it was adjusted down to $0.59 per $100 of assessed value in the 2008 fiscal year. Thus, looking at this over six years (2007-2013) this is only an increase of $0.01 per $100 of assessed value -- thus an effective 1.6% increase in the tax rate over the past 6 years. Click here for the full article from the Daily News Record. | |

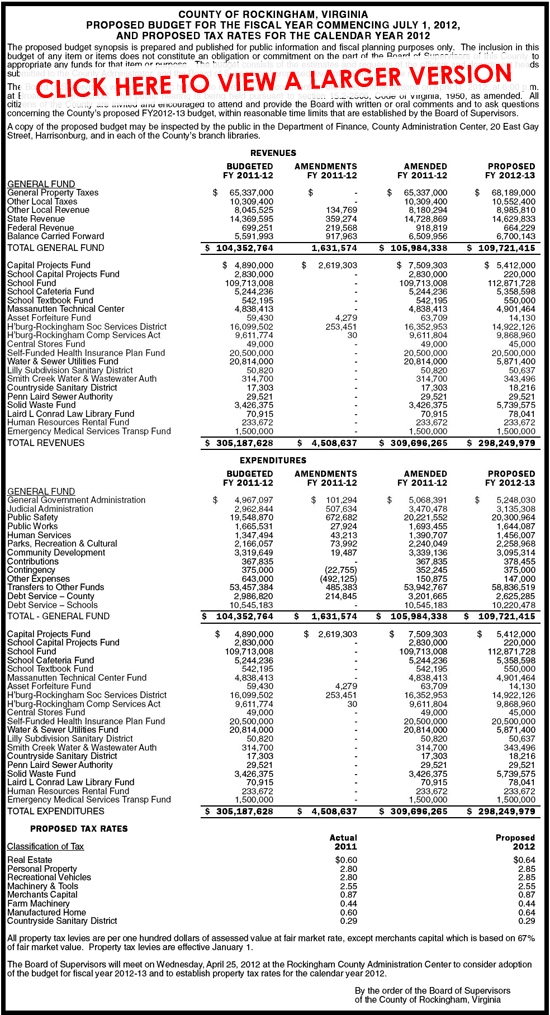

Proposed Rockingham County budget (2012-2013 fiscal year) and proposed 2012 tax rates ($0.64 for real estate) |

|

Some observations without knowing much about the budget:

| |

New gated luxury community for JMU students on Port Republic Road? |

|

Aspen Heights LLC, is attempting to rezone a 23-acre parcel of land on Port Republic Road (shown above) for a gated, luxury community for students. The city has some doubts, per the Daily News Record article, which seem to include the current glut of student housing in Harrisonburg, as well as the surrounding largely owner occupied neighborhoods.  Some of the student housing developments that Aspen Heights, LLC has built (yes, the photo above is a student housing development) seem quite nice. View photos of their communities, their current locations, and what they believe sets them apart as a student housing community. This Tuesday there will be a Planning Commission meeting to discuss this potential rezoning. In other related student housing news, you'll notice some new student housing popping up on Stone Spring Road near the RMH Wellness Center. | |

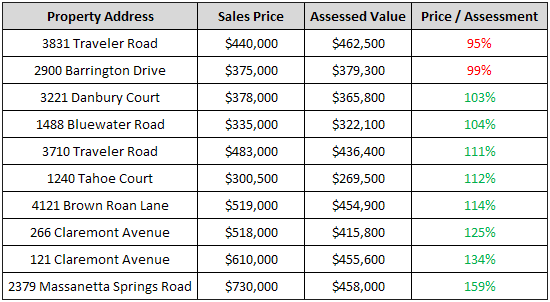

Assessments of $300k+ Rockingham County Homes |

|

Property assessments are used to determine the amount of taxes that each property owner will pay. Can these assessed values also be used to estimate the value of a home? In theory, yes --- after all, the assessed value is intended to be the true market value of the home --- but it doesn't always seem to work. Case in point....one of my clients is considering two homes (among others) that have very similar assessed values, but have asking prices over $50k apart. Is the owner of the higher priced home just being unrealistic? Or are the assessments less than accurate? One way to examine this is to compare recent sales prices to assessed values. I'm going to focus on homes over $300k, as I sense that there might be more disparity in assessments with higher priced homes. In the past three months, there have been 10 sales of homes in Rockingham County with sale prices over $300k, with Harrisonburg mailing addresses.  As you can see, there is an enormous swing in the ratio between sales prices and assessed values. These ten buyers paid, on average, 16% more than assessed value for their homes. A few inconclusive conclusions:

| |

Should Local Government Make Rezoning Decisions Based On Market Conditions? |

|

In my opinion, there is already more than enough college student in Harrisonburg. That said, a developer will soon be starting a new student housing complex on South Main Street near Valley Lanes. So....maybe Harrisonburg needs a student housing moratorium? Joe Fitzgerald states (at the link above) "We can't flat out ban student housing, but we can stop rezoning more land for it." I never considered that a moratorium on rezoning could be enacted. Several questions then come to my mind.... Is local government overstepping its bounds to create such a moratorium (via *not* rezoning)? Perhaps not --- local government wouldn't be prohibiting development, just the rezoning for development. So, local government is now making rezoning decisions based on market conditions? Isn't a landowner entitled to make that part of the decision? If a surplus of student housing creates a burden on the locality in some way (based on the new use or non-use of the old student housing??) then perhaps local government ought to factor in market conditions? What does this sort of a moratorium look like? Is this an unspoken stance of local government? Or a drafted and approved policy? Could this be challenged legally? So, perhaps this all comes back to property owner rights? Certainly, a property owner has the right to use or develop their property as the zoning ordinances allows them to do so. But does a property owner have any rights when it comes to rezoning? Are there reasonable, and unreasonable factors that can and cannot be used in a zoning decision? Weight in if you have an opinion -- this raises more questions than answers for me. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings