| Newer Posts | Older Posts |

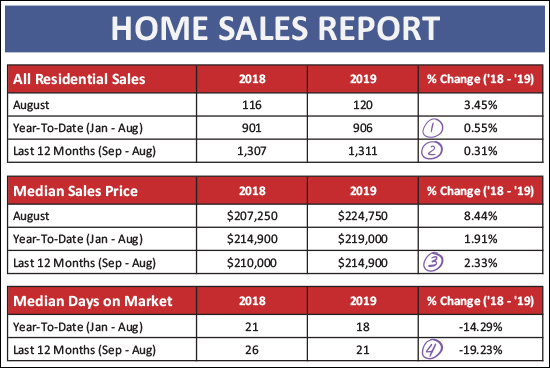

Home Sales Stable, Median Prices Slowly Rising in Harrisonburg, Rockingham County |

|

Summer might not officially end for another six days, but today has certainly has been a nice taste of the cool Autumn days to come. That said, even if the temperatures are starting to cool down, home sales are not yet ready to do so in our local market. Before we take a look at the most recent market trends, take a few minutes to check out this spacious Colonial in Barrington that is pictured above by visiting 2980BrookshireDrive.com. Now, then, let's get down to some overall market stats...  First above, lots (and not much at all) to observe here...

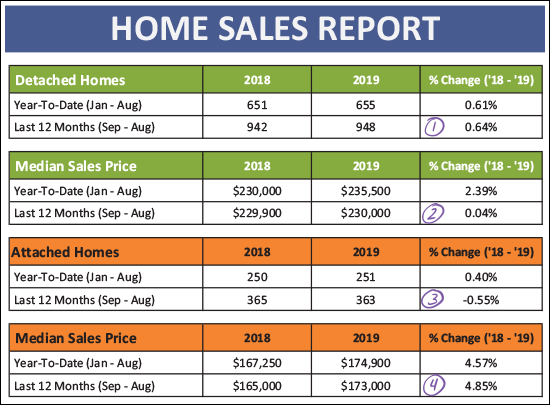

And how about if we break it down between detached homes (almost all purchased by owner occupants) and attached homes (mostly purchased by owner occupants, but also purchased by investors)...  Here's what we're finding...

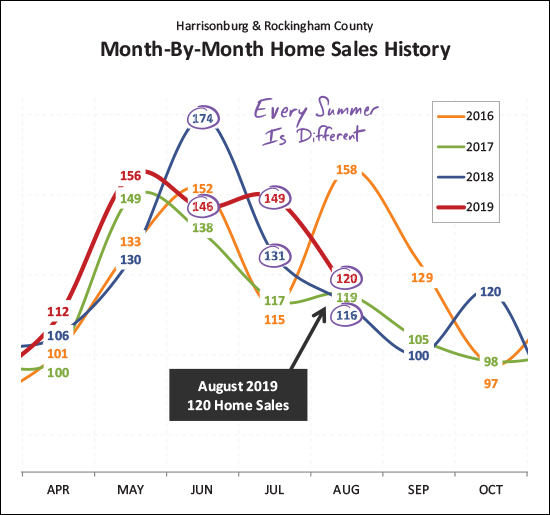

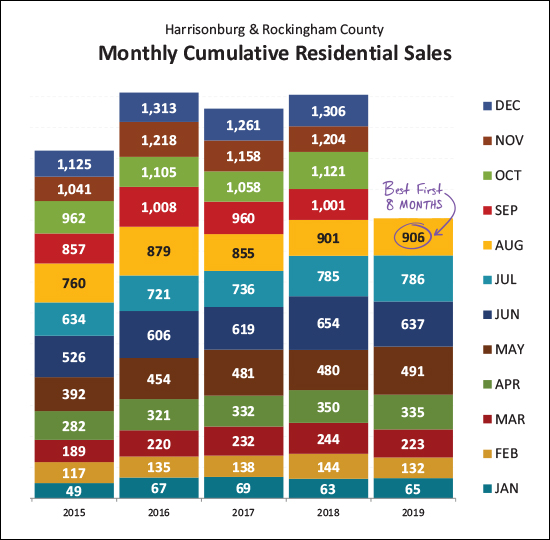

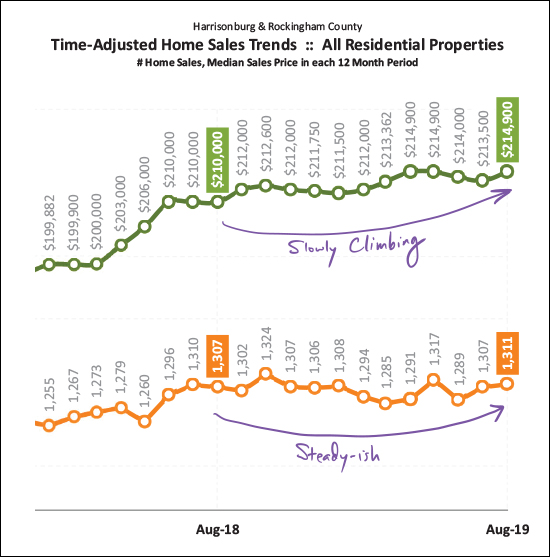

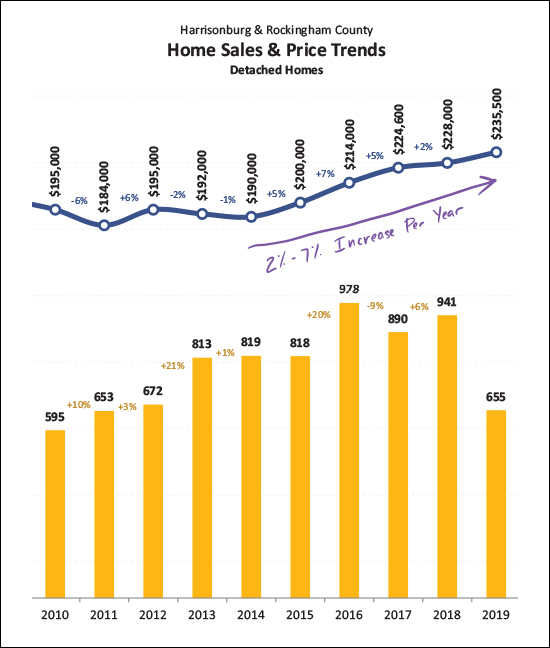

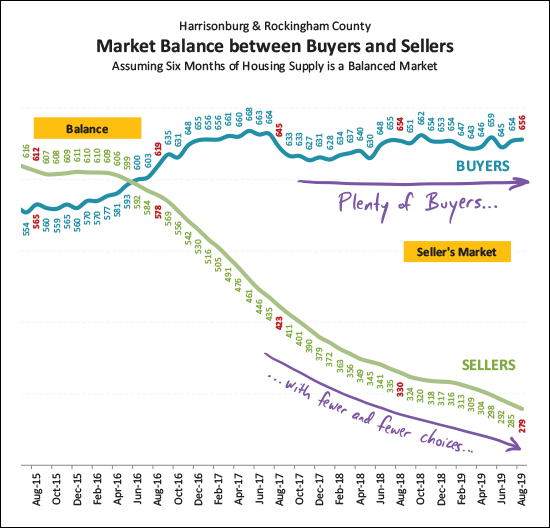

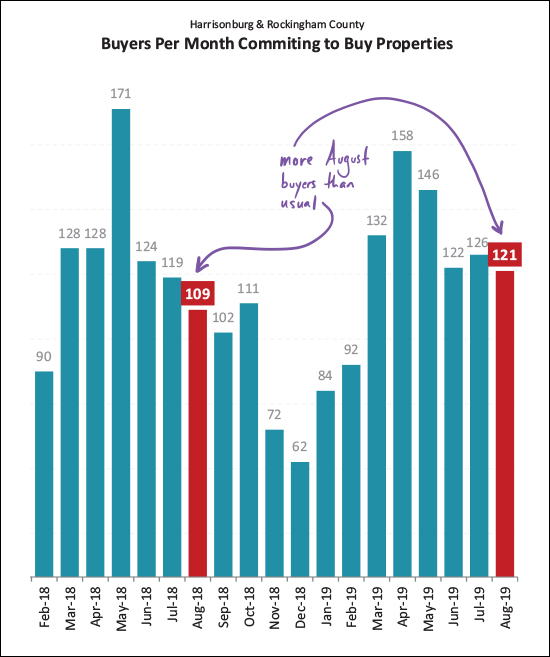

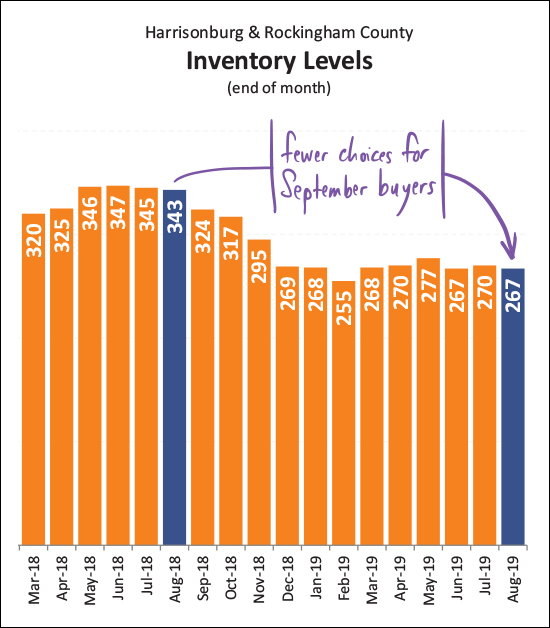

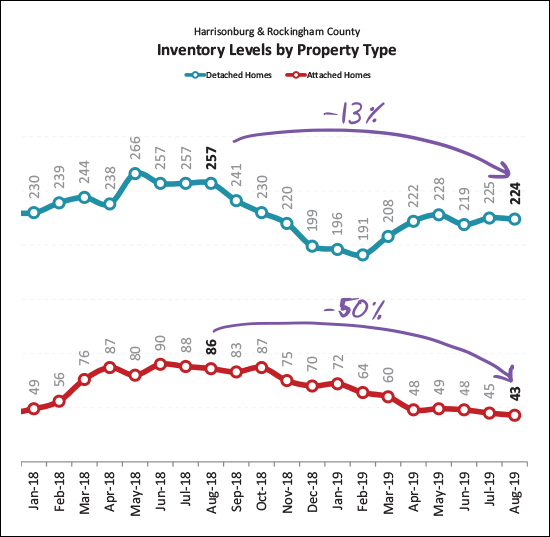

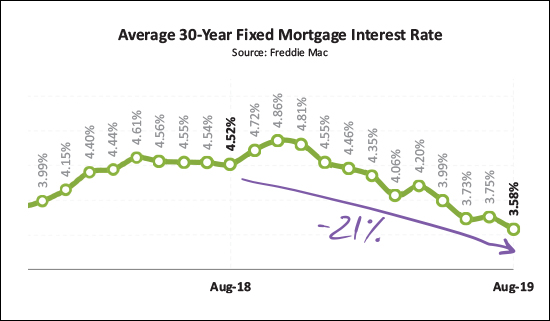

And now for that pretty visualization of the month to month ebb and flow of home sales...  Here (above) we note that every summer is different. Last year (blue line) June was a spectacular month for home sales - with 174 closings - more than seen anytime (ever!) in our local area. This year (the red line) June home sales were mediocre at best. But then, July and August home sales were stronger this summer as compared to last year. Looking ahead to September, I anticipate that we're likely to see around 110 home sales - slightly more than the past two years, but not quite as many as back in 2016.  When we pile all of the months on top of each other we can get a clearer view of how the first eight months of this year (Jan-Aug) compares to the first eight months of the past four years. And this is where we find that we have had the best first eight months of anytime in at least the past five years. Given the current trajectory, it seems likely that we'll see at least 1,300 home sales this year.  This graph shows us the overall long term trends in local home sales. The green line is the median sales price which has been creeping its way up over the past year. The orange line shows the annual rate of home sales, which has been hovering around 1,300 home sales for the past year.  Focusing in just on the detached homes, we see that the median sales price has been increasing anywhere from 2% to 7% per year for each of the past four years. This year we are likely to see another increase in the median sales price somewhere in that range.  With steady home sales and increasing sales prices, it's a great time to be a seller. But not as great of a time to be a buyer. As shown above, there have been a relatively stable number of home buyers over the past few years, but the number of homes for sale at any given point has been steadily declining for over three years.  Why do I think we'll see 110 home sales in September? Well, partially because 120 home buyers signed contracts in August. This was a higher rate of contract activity than last August and suggests that sales will continue to be relatively strong as we continue into the Fall.  And here (above) are those overall inventory numbers. The number of homes for sale has been declining over the past year. We used to see much more of an increase in available inventory during the Spring months but this past year buyers were contracting on new listings almost as fast as they were being listed, which kept the inventory levels low.  Here's a startling statistic. Inventory levels have declined 13% over the past year when we look just at detached homes -- but when we look just at attached homes (duplexes, townhouses, condos) we find a shocking 50% decline in the number of homes for sale! It is a tough time to be a first time buyer these days!  Finally, mortgage interest rates. If there is any consolation for today's home buyer it is that their mortgage interest rate is likely to be lower than anytime in the past year or longer. Interest rates have fallen 21% over the past year -- from 4.52% to 3.58%. A few final notes and thoughts for those that made it this far...

That's all for today. Have a delightful, pleasant, cool evening! | |

Do Detached Or Attached Homes Appreciate More Over Time? |

|

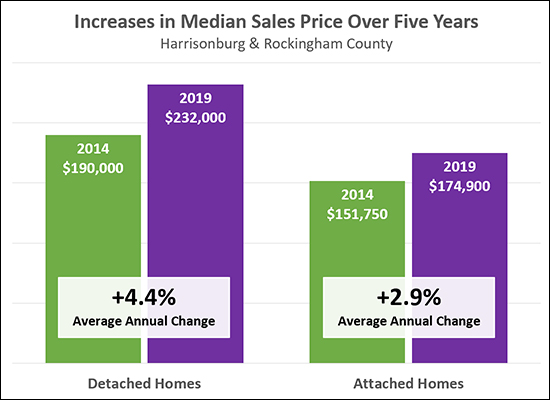

Over the past five years, detached homes have increased more in price (on average, per year) than attached homes (townhouses, duplexes, condos). This wouldn't always be the case if we looked back over the past 20 years -- we could find time periods when this were not true -- but we have seen some larger than normal swings in home values during some of those past 20 years. My general sense (beyond the numbers) is in line with what the graph above shows -- which is that over time (5+ years) both detached and attached homes are likely to increase in value, but detached homes are likely to increase in value a bit more quickly than attached homes. | |

The 67 Places You Could Build A Home NOT In A Subdivision |

|

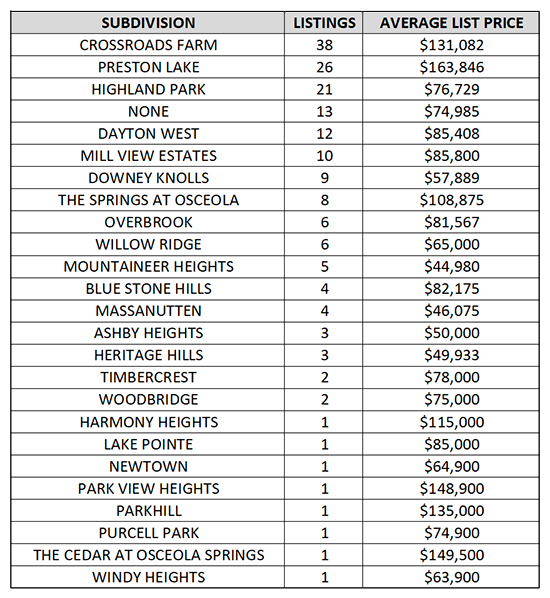

Yesterday I was taking a look at the various locations, mostly in subdivisions, where you can buy a lot in Harrisonburg or Rockingham County with public water and sewer, including...

But you don't have to build in a subdivision -- or on a lot with public water and sewer -- and sometimes that's the goal -- to get a bit more land. So, here's a VERY wide look at properties currently for sale in Harrisonburg and Rockingham County *without* public water and sewer that are *not* in subdivisions, priced under $200K... View these 67 (as of today) properties by clicking here. Plenty of folks looking to build homes start to think about it at this time of year -- hoping to acquire a property to start building in the Spring. So, as you start considering a new build -- think about how much land/space/privacy you'd like, whether you'd like to be in a subdivision, whether you'd prefer to have public water and sewer, etc. | |

Where Might You Build Your New Home? |

|

Where might you build your new home? There are 180 building lots for sale in Harrisonburg and Rockingham with public water and sewer priced under $200K. The list below shows the subdivision / location of the lots. If you're interested in further details about any of these lots or locations, let me know!  | |

When To Actually Apply For A Mortgage When Buying A Home |

|

As Late As Possible

Incredibly Proactive

A Reasonable Middle Ground

I try to encourage all of my clients to at least be in the "reasonable middle ground" sequence as outlined above. This gives them a firm idea of what they can afford and how a home price will compare to a loan payment. This also allows them to make a stronger offer, already having a pre-qualification letter in hand. I strongly discourage my clients from following the "as late as possible" sequence as outlined above. This doesn't help them make the best decisions about which houses to pursue, how far to negotiate, etc. This also doesn't allow us to make as strong of an offer on a house. Occasionally, one of my clients will fall into the "incredible proactive" sequence as outlined above, and wow, this makes the financing process a joy to work through! These buyers have already done so much of their work with the lender before even thinking about which house to buy -- which then allows them to focus on buying, negotiating, inspecting, etc., rather than be bogged down in the process of securing their mortgage. Let me know if you have questions about how I have described these sequences -- and let me know if you would like a few recommendations for lenders in the Harrisonburg area. | |

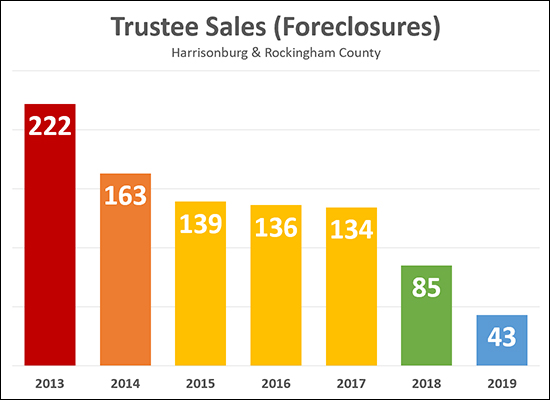

Fewer and Fewer Foreclosures in Harrisonburg, Rockingham County |

|

Here's a reminder of what is a good indicator that our local housing market continues to get healthier over time -- as shown above, the number of foreclosure sales per year has declined over the past several years. To put these into an even larger context:

All in all, it is a good sign for our local housing market when the number of foreclosures per year declines. It means more homeowners are able to stay in their homes, and make their mortgage payments, which is a general sign of a stronger local economy. | |

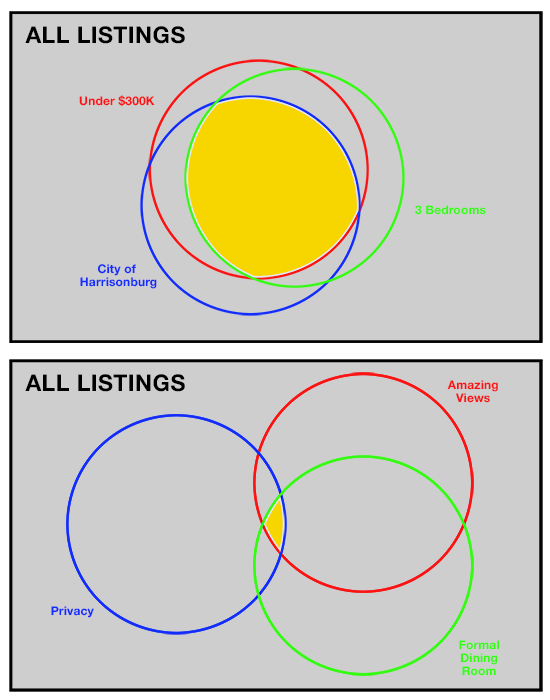

How Much Do Your Home Search Criteria Overlap? |

|

If you have three non-negotiable home search criteria, it is important to reflect on (or at least be aware of) how much overlap exists between these criteria. Above are two examples of this way of thinking about your home search.... The first set of buyers will likely have lots of options (large yellow overlap area) because many homes share these criteria:

The second set of buyers will likely have very few options (small yellow overlap area) because there are very few homes that share these criteria:

These are fictitious illustrations -- they don't represent the actual amount of overlap that does or does not exist based on the criteria noted above -- but you should give some thought to how small of an overlap area you are creating for yourself based on what you are defining as non-negotiable in your home search. If that area is too small, you'll have very few options to consider, and eventually you may decide to flex a bit on what you had previously considered to be a non-negotiable point. | |

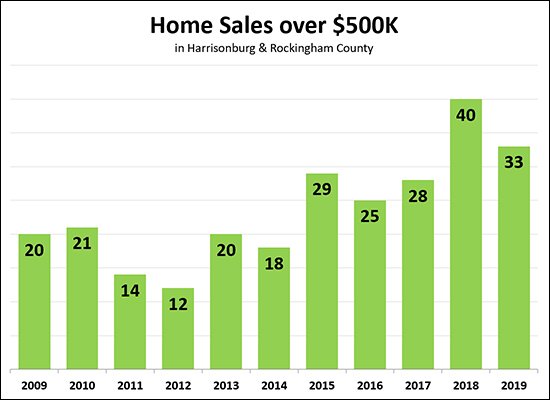

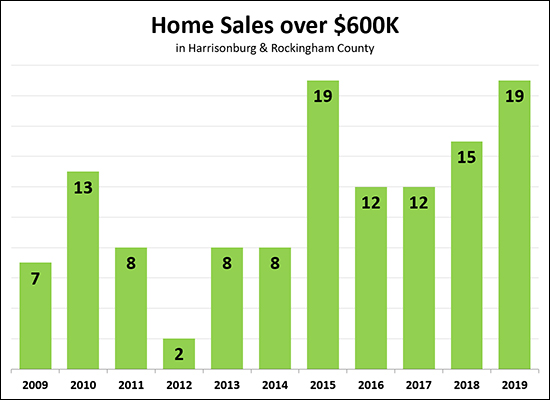

Harrisonburg Area Home Sales Over $500K Small But Strong Segment of Local Market |

|

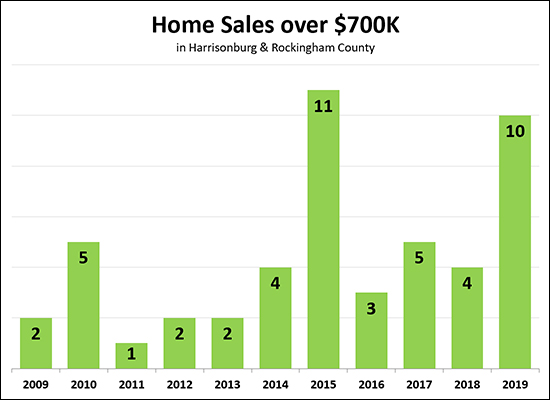

Only 3% of local home buyers spend $500K or more on their home purchase (per sales data over the past year) but this segment of the local housing market has been strong over the past few years. As shown above, there were 40 home sales over $500K last year - more than any time in the past decade. This year we seem to be on track to possibly match that, with 33 home sales over $500K in the first eight-ish months of the year. Reigning in our enthusiasm a bit, though, this is a relatively small number of buyers. If you are selling a home over $500K, you need to keep in mind that only about 40 buyers per year (just over 3 per month) spend that much money on a home in ALL of Harrisonburg and Rockingham County! Let's look a bit further into even smaller segments of the high end local market...  While last year (15 home sales) wasn't quite the strongest year for $600K+ home sales -- this year looks like it will be. We have already -- in eight months -- matched the highest number of $600K+ home sales seen in a year when looking back for 10 years. And one more look at an even higher price point...  Above, you'll see that most years there are only 5 or fewer home sales over $700K. But back in 2015 there were 11 (which was more than double the norm) and this year there have already been 10 such home sales! So -- overall, the high end home sales market is doing well -- comparatively, but that is not to say that selling a home over $500K is an easy task - it's not. Home sellers over $500K are aiming for a tiny pool of potential buyers -- even if that pool of buyers might be slightly stronger this year than last. | |

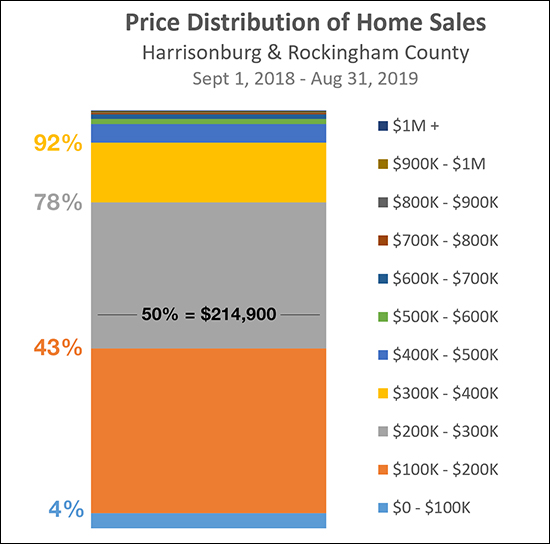

Fewer Than 1 In 4 Home Buyers Spend Over $300K in Harrisonburg, Rockingham County |

|

Lots to observe / conclude here...

| |

How To Respond When A Buyer Reacts Irrationally To A Home Inspection |

|

The purpose of a home inspection contingency is to allow a buyer to learn more about the property they have contracted to purchase -- and then to request repairs to the property if they discover new issues of which they were unaware when they contracted to purchase the property. For example -- a buyer contracts to buy a home for $250K and believes the electrical wiring and plumbing are all in good condition. The home inspection takes place and the inspector discovers that there are four plumbing connections that are leaking in the unfinished basement. It is then reasonable for the buyer to ask the seller to repair these plumbing leaks prior to closing. They agreed to pay $250K for a house that they did not believe had plumbing leaks -- and thus they request the seller restore the house to being a leak-free house. This is certainly an oversimplification of the matter, as there are often many discoveries during a home inspection -- of varying levels of seriousness or complexity -- but stick with me for now. Back up at our prior example -- rarely would a seller be disappointed, surprised, or unhappy if a buyer asked for plumbing leaks to be repaired. But what is a seller to do when a buyer starts to behave irrationally -- in a way that the seller believes no other buyer would certainly ever respond? For example --

I could go on and on. The point is -- sometimes buyers behave irrationally -- for whatever reason they have decided that they cannot / will not buy the house, and they are going to dig in their feet and make irrational repair requests until the seller finally caves and releases them from the contract. Or, rather, given the standard Virginia home inspection contingency, the buyer just terminates the contract on the basis of the home inspection even though their decision to do so was based on a view of the property condition (and of needed repairs) that is unlikely to be shared by any other buyer, ever. So, what in the world is a home seller to do in such a situation?

Of course, I hope this advice is absolutely never pertinent to you. May you never be in the midst of a home sale -- under contract -- just working your way through contingencies and excitedly anticipating a closing in the near future -- and then have the rug pulled out from under you by a home buyer with unreasonable expectations or demands. But if you do find yourself in this situation, try to move on quickly and be transparent with future buyers -- after getting angry, frustrated and discouraged, of course! | |

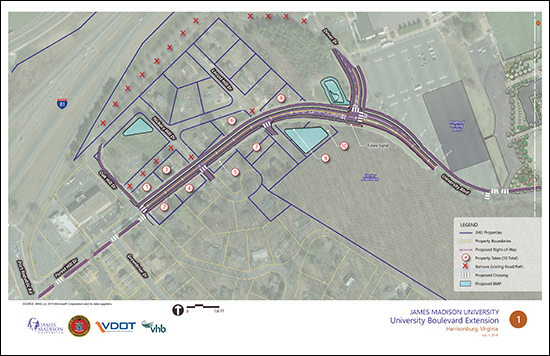

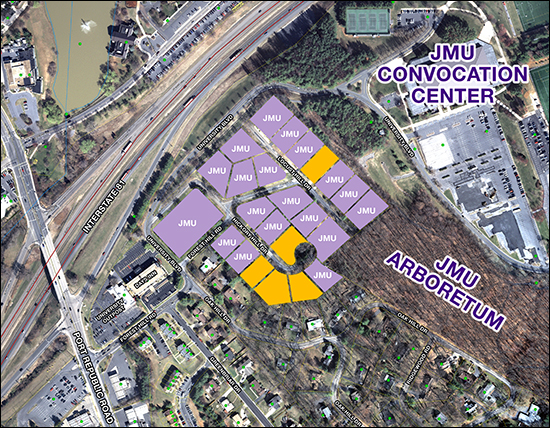

Maybe JMU Bought Those Houses To Straighten Out A Road? |

|

(click the map for a larger file) I'm not sure if it was the plan all along, but it seems JMU's acquisition (over quite a few years) of homes in the Forest Hills area has allowed it to now (potentially) partner with the City and Commonwealth to straight out the end of University Boulevard that has a big (slow) loop as it approaches the Days Inn. Here are the properties that JMU owns per my most recent accounting... (click the map for a larger file) The most recent development, as covered by The Citizen (Council takes next step toward major re-routing of University Boulevard) is that the City Council approved the Department of Public Works' plan to seek money from the Commonwealth of Virginia to accomplish this project. Here's how it would go down...

If this funding request is approved, construction on this realignment of University Boulevard would not be complete until December 2023. So, stay tuned, but don't expect any changes to the road in the immediate future. | |

How Many Bedrooms Does Your House REALLY Have? |

|

You don't have to be a math major to count bedrooms, right? Well, technically, that's true -- but counting bedrooms for real estate purposes can become a bit nuanced. Now, the basic rule of thumb for what makes a bedroom is that it needs a window and a closet. So -- if you have a room with a bed, where someone sleeps (regularly, or on occasion) but it does not have a window or does not have a closet, it might not be considered by Realtors, buyers or appraisers as being an actual bedroom. Now -- the National Appraiser Roster has all sorts of nuances surrounding this topic....

Wow. OK. Lots to consider there. So -- the short answer is that you can count your bedrooms based on whether they have windows and closets -- but it may require a bit more thought and analysis before we decide how many bedrooms we'll say that your home has when we put it on the market. Oh, and two final notes....

| |

Risk and Reward in Buying College Student Housing Rental Properties |

|

If you are looking to purchase a rental property for your JMU student to live in while they are a student at JMU, there are two basic paths you could go down....

Option 1 -- A property in a traditional student housing neighborhood. These will allow the most students to live in the property and will maximize the rental income per dollar spent on the purchase. However, it will also expose you to a more turbulent segment of the market, as rental rates and sales prices of these properties can vary quite a bit over time as the supply of competing student housing ebbs and flows based on large complexes being built by student housing developers. You can find purchase options in this category here. Option 2 -- A townhouse in a community that has many owner occupants, some non-student renters and some student renters. Many of these will not allow as many unrelated students to live in the property (per zoning regulation or restrictive covenant) and will not provide quite as much rental income per dollar spent on the purchase price. However, they will be in segment of the real estate market that is much more predictable and less volatile from a rental rate and/or sales price perspective. You can find purchase options in this category here and here. I work with parents of JMU students each year who go down each path outlined above, each for different reasons. Most of the time, though, it boils down to their tolerance for risk or their desire for reward. It can also be related to their intended time horizon for owning the property. If you are interested in buying a rental property for your son or daughter to live in while they are at student at JMU, let me know. Oh, and you might also want to read up here... | |

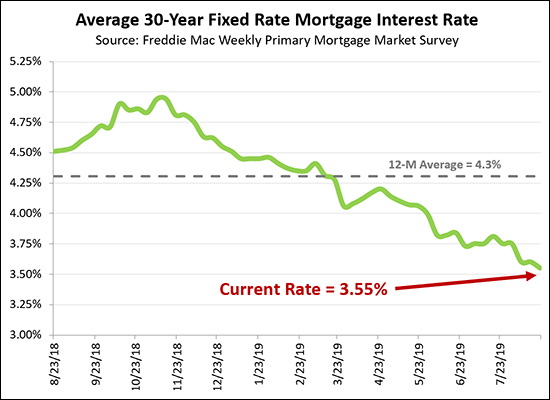

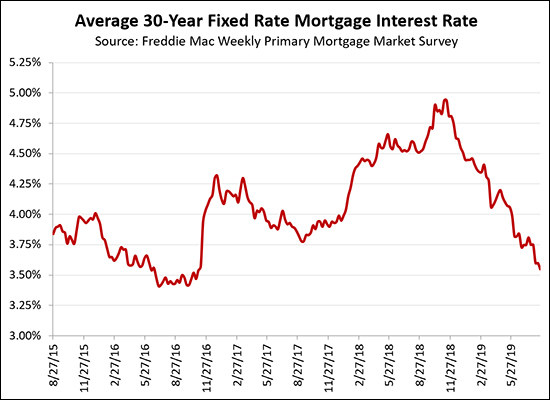

High Temps, But Low Mortgage Rates Throughout Summer 2019 |

|

Mortgage interest rates kept dropping lower - and lower - and lower all summer long! The current average rate for a 30 year fixed rate mortgage is only 3.55%, well below the 12 month average of 4.3%. If we look back even further, we're approaching the lows of mid-2016...  All of this adds up to VERY favorable times to be buying a house - in that you can lock in your monthly housing costs at some of the lowest long term interest rates ever seen. | |

Fall Is Not The Worst Season For Selling Your Home |

|

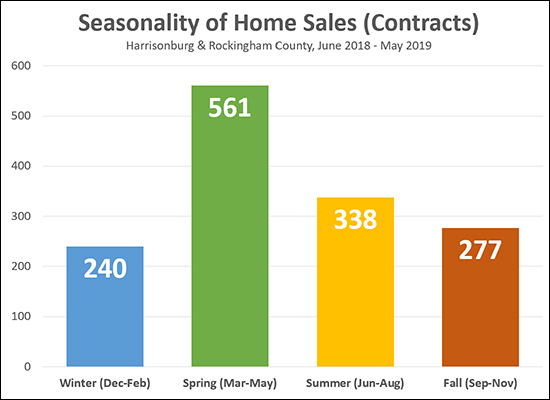

As is likely no surprise -- the busiest time for home sales (contracts) is SPRING -- by far! There is then a relatively large drop off from Spring to Summer. Somewhat surprisingly, it is not an enormous decline between Summer and Fall. So -- Fall is not the worst season for selling your home, but it is far from the best. Of note, the data above reflects the timeframe during which properties went UNDER CONTRACT -- not when they closed. Plenty of the Summer contracts turned into Fall closings -- but the 277 figure is a reflection of how many buyers made buying decisions (signed contracts) between September and November of last year. So....if you want to sell your home (and close on it) in 2019, you should be thinking about getting it on the market sooner rather than later. Fall is definitely a better time to sell than Winter! | |

How Big (in Square Feet) Is Your Home? |

|

So -- are you trying to figure out the square footage of your home? Here are a few methods that are NOT necessarily going to give you the correct answer....

So, how do you really measure square footage? It starts outside the home! You'll need to measure the exterior dimensions of each level of your home -- and then subtract any open areas, such as the open space above a foyer. This measurement method, as odd as it may be, is what is used by nearly every appraiser, as it is how "gross living area" is defined by Fannie Mae, HUD, FHA, ERC and ANSI. As such, it is important that you're measuring the square footage of your home in the same way that nearly every appraiser and Realtor would be measuring it, so that you're comparing apples to apples when comparing the size (SF) of your home to another home that has sold or that is on the market for sale. And here's why I consider it to be an odd way to measure square footage....

| |

Should You Rent or Buy With a 2, 3 or 5 Year Time Frame? |

|

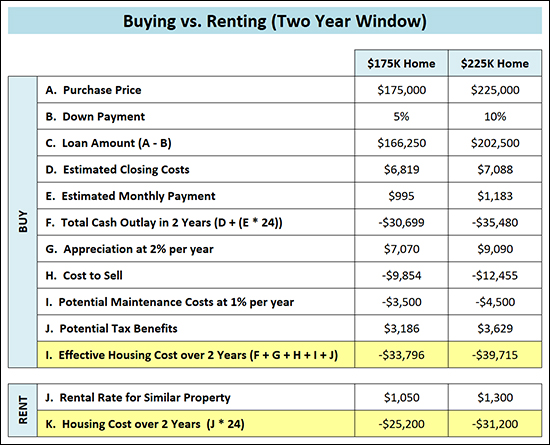

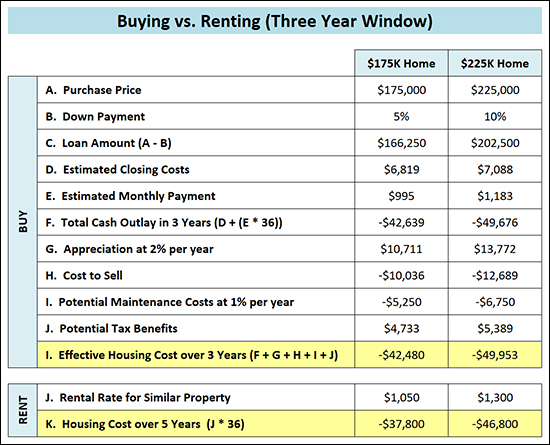

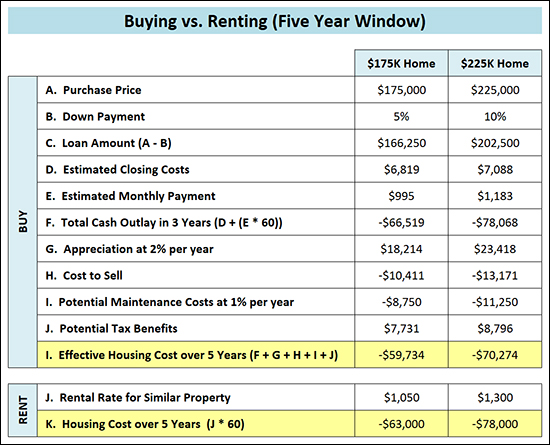

Should You Rent or Buy With a 2, 3 or 5 Year Time Frame? Looking at two different price points for townhouses ($175K, $225K) a quick analysis would indicate that...

So, buy the townhouse, right? Well, sort of... The comparison above ONLY accounts for the monthly payments and does not account for...

So, let's look at it again, a bit more thoroughly...    Above I have tried to account for ALL of those factors, and looking at a two year window, three year window and five year window. This analysis indicates that you should probably plan to be in your home for 5+ years if you want the total financial transaction(s) to be a net positive. That said, there are, of course, plenty of extenuating circumstances. Many people might buy a $175K house (or townhouse) even if they are planning to be there for only 3 years --- because they want their own home (not their landlord's), or to get in a certain neighborhood, or because of the tax benefits, etc. Every buyer's situation is different, and I'd be happy to help you run an analysis similar to those shown below if you're interested in analyzing your best housing move. | |

How To Strengthen Your Low Offer Without Paying More |

|

If you are making a low offer, you can increase the appeal of your offer by strengthening your other offering terms.... DEPOSITS Make the largest deposit you are comfortable with so the seller knows you have money "on the line" and that you won't risk losing that money by attempting to walk away from the deal. CLOSING COST ASSISTANCE Sellers don't just look at the contract price --- they calculate their net proceeds based on the offer price and any credits or closing cost assistance. Only ask for assistance if you truly need it. FINANCING Provide as much detail as possible about your financing intentions, and always include a pre-approval letter. Sellers who believe you are capable of financing the purchase will be less hesitant as they consider other terms of your offer. And yes -- offer cash, a large pile of it, if you are able. :) PERSONAL PROPERTY Don't automatically ask for everything the seller intends to convey --- if you don't need them all, leave them out of the offer. Allowing the seller to keep their washer/dryer (for example) may make them more flexible in other areas. INSPECTIONS Having a professional inspect the property you are purchasing is usually a good idea; however if you only intend to do it for informational purposes, consider leaving it out of the contract negotiations and conducting it post-settlement. SETTLEMENT & POSSESSION If possible, cater your settlement date and the details of transferring possession of the property to the needs or wants of the seller. This can go a long way towards gaining seller flexibility on other contract terms. Finally, research the seller's context for selling. That information can be invaluable in negotiating a successful contract. | |

There Might Not Be Anyone To Blame For Urban Flooding in the Lake Shenandoah Watershed Area |

|

If your house, or street, or neighborhood floods during heavy rainfall events in the Lake Shenandoah watershed area, it likely seems that someone must be at fault - someone must have messed up - someone must be blamed for the drainage problems. But who is to blame? Many neighborhoods were developed just southeast of Harrisonburg over the past 20 years - and in each case, the developer would be told by the County how to develop the land from a stormwater perspective based on requirements from the State. So - if the State (Commonwealth of Virginia) creates guidelines, the County enforces them, and the developer implements them, who is to blame if your house, street or neighborhood is flooding? It is tempting to say that the developer must be at fault - but they were just doing what the County was telling them to do to manage stormwater. We could then blame County officials - but they were just doing what the state was telling them to do to manage stormwater. So, hmmm.... Here's a bit of further commentary from Mr. Miller (the County's attorney) at the public hearing held by the Board of Supervisors...

So, if everything was being done based on what the experts at the state were mandating - then it seems that local builders, developers and County officials aren't really the ones to be blaming for urban flooding. Yes, if all of these neighborhoods were developed today, the developer would be told by the County to do more to mitigate stormwater based on requirements from the state - but those guidelines and requirements were not in place when these neighborhoods were developed. A few other related notes...

If this topic interests you, consider attending the Work Session on the topic to be held this Wednesday (August 21, 2019) at 6:00 PM at the Rockingham County Administration Center. No action will be taken at the meeting, but it is an opportunity for further discussion and input. Also, as a refresher, these recent conversations are a result of the County's proposal to create a Stormwater Authority specifically for the Lake Shenandoah Watershed. The Authority could potentially spend around $3.2 million to improve the stormwater system by creating new detention facilities and increasing the capacity of ditches and pipes. If the cost of these potential improvements was divided evenly between the affected parcels, it would cost approximately $200 per year per parcel. Though... "Mr. Miller stated these are only estimates, because there are too many unknowns until engineering studies are conducted. Assistant County Administrator Armstrong noted that the $3.2 million cost is with no contribution from state or federal grants that the County may be able to obtain to offset costs." | |

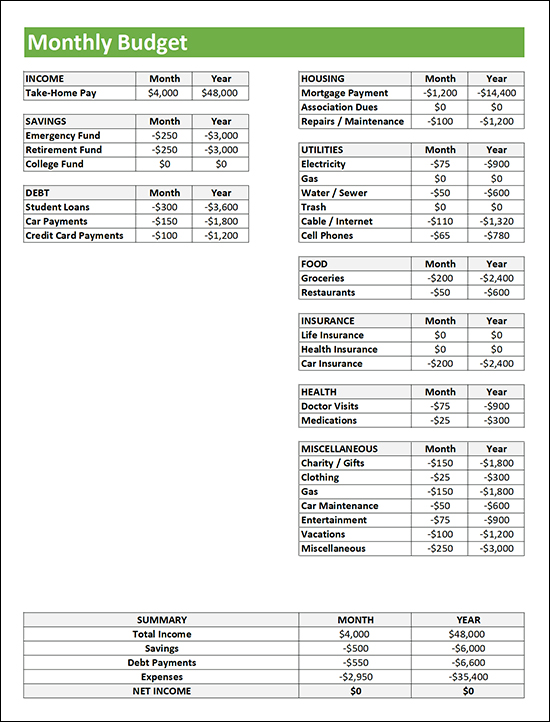

Building A Budget When Buying A Home |

|

Several buyers have recently asked me about how to determine how much they can and should spend on a home purchase. Those are actually answered differently... CAN -- How much you *can* spend will best be determined through a conversation with a mortgage lender. They will evaluate your income, existing required recurring debt payments, credit score, etc., to tell you the maximum that you can spend on a home. SHOULD -- How much you *should* spend is best determined by calculating what portion of your income you are comfortable spending on housing while still having enough left over for all of your other life expenses. In other words, a budget! I created the budget spreadsheet shown above (download it here) as a starting point for thinking this through. Let me know if you have questions about how to use this spreadsheet. And let me know if you'd like a recommendation on a local mortgage lender. | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings