| Newer Posts | Older Posts |

Choose A New Route to Starbucks (Scheduled Turning Restrictions on Port Republic Road) |

|

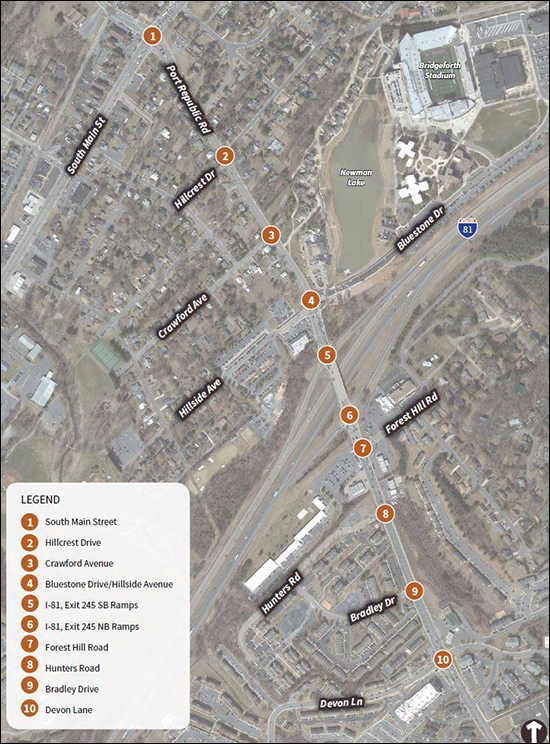

Do you drive towards JMU from the County, on Port Republic Road? Are you a regular customer at the drive through Starbucks each morning? You'll need to re-route slightly starting next week - or visit the other Starbucks directly across from JMU campus on weekday mornings starting next Monday. Starting this coming Monday, August 19, there will be three streets where left turns will be limited on week days between 7:00 AM and 9:00 AM and between 3:00 PM and 6:30 PM. Those streets are:

Left turns (which would have to cross two lanes of oncoming traffic) will no longer be permitted onto or off of the three streets above during the timeframes noted above. There will not be any turning restrictions on weekends. Some further notes from the City of Harrisonburg...

There are options, though, so maybe you can get your drive through Starbucks fix via Bradley Drive, one turn earlier on Port Republic Road?

And yes, the City knows these changes won't be convenient for some folks, but...

Click here to read more about the Port Republic Road corridor study that was conducted last year. | |

What If You Could Build A Duplex On Every Single Family Home Lot? |

|

What if, on any single family home lot, you could build a duplex -- or even a townhouse! Would that help more affordable housing to be built? Would that upset existing single family home owners? Oregon is giving it a try! :-) From NPR... Some excerpts of interest follow...

Read the entire article for further commentary and perspectives... | |

Summer Is Fading Away. Home Sales Are Not. |

|

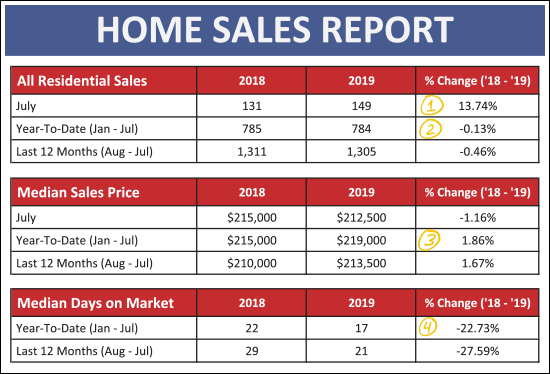

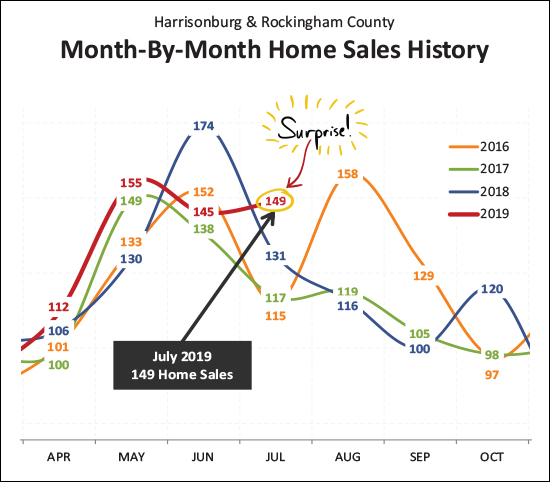

Summer is here! Oh wait, summer is gone!? Once that first week of August hits, it seems it's almost time for school to start again. Where did the summer go!?! While I ponder how another summer flew by so fast, let's take a few minutes to reflect on the state of our local housing market. But first - the beautiful home pictured above is this month's featured home - a spacious upscale home in Barrington with a finished basement, guest house and private courtyard! Check out the details at 2860BarringtonDrive.com. Now, onto the data! Download the full 28-page market report as a PDF, or read on...  As shown above, July was a strong month for home sales...

Diving slightly deeper, let's see how detached homes compared to attached homes. An "attached home" is a duplex, townhouse or condo...  As shown above, there are some differences in these two broad segments of our local market...

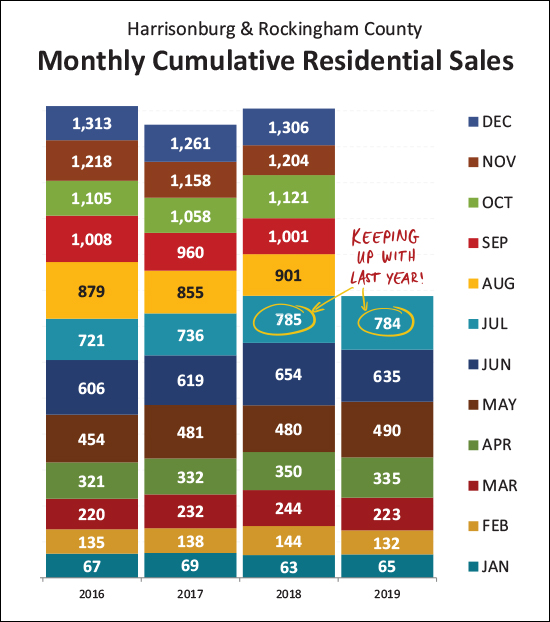

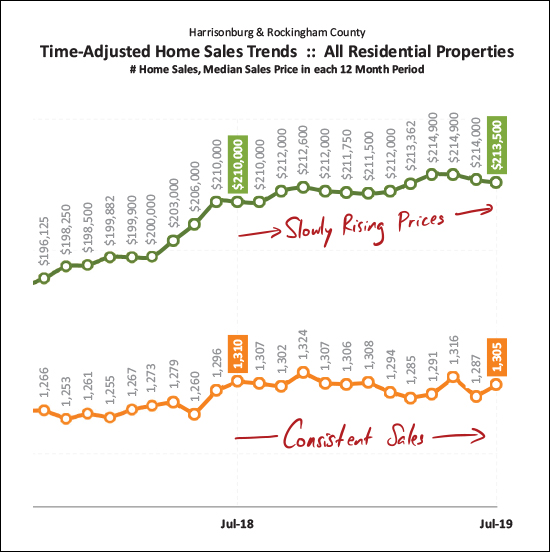

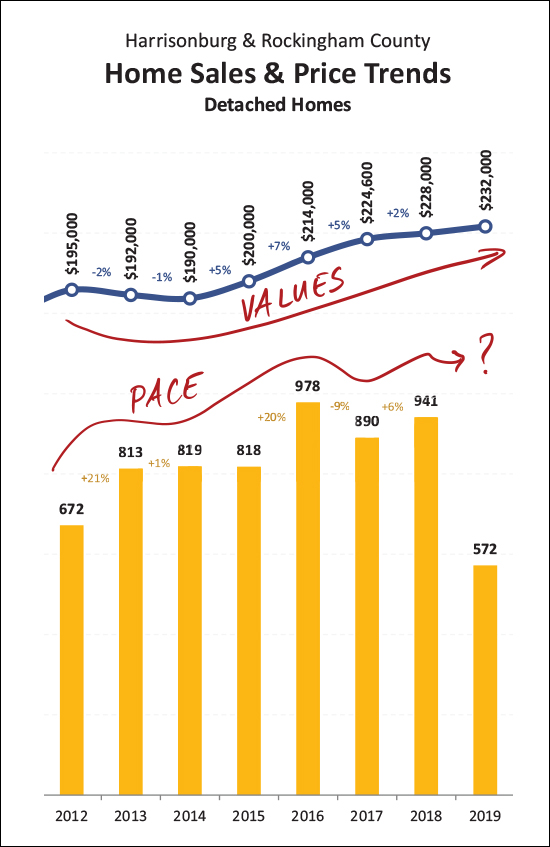

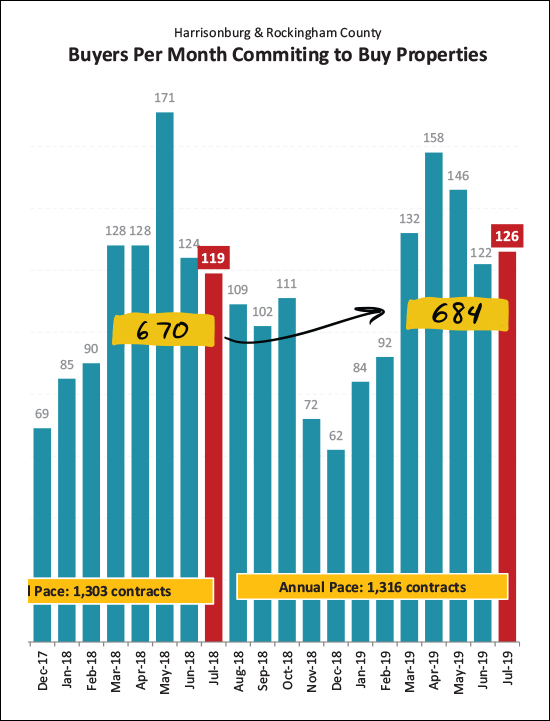

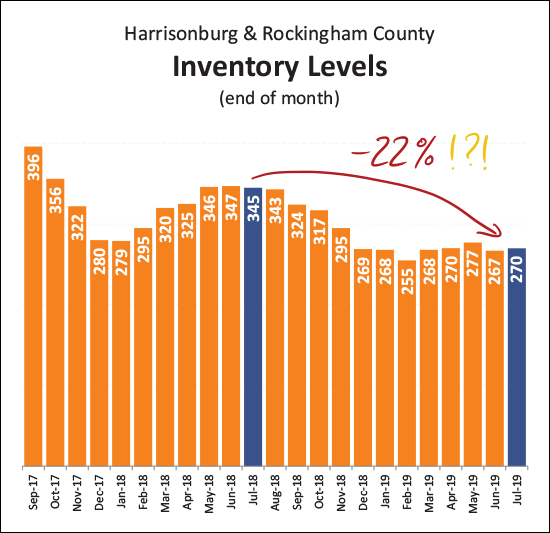

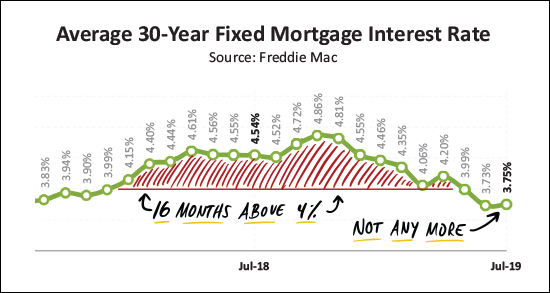

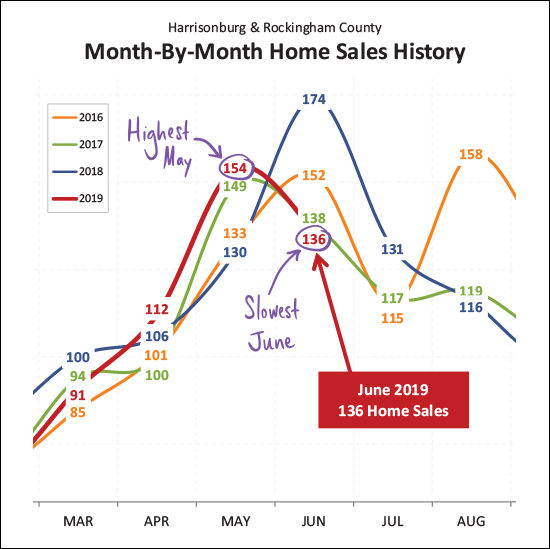

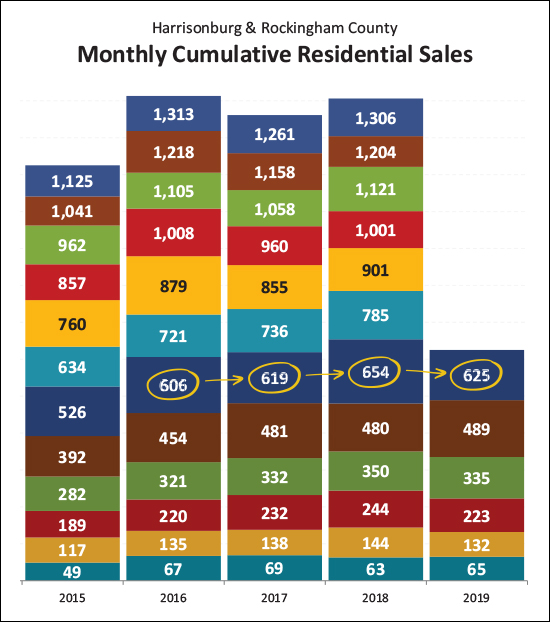

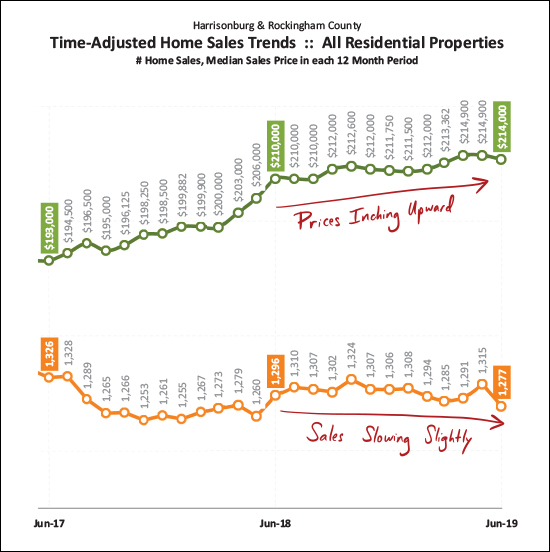

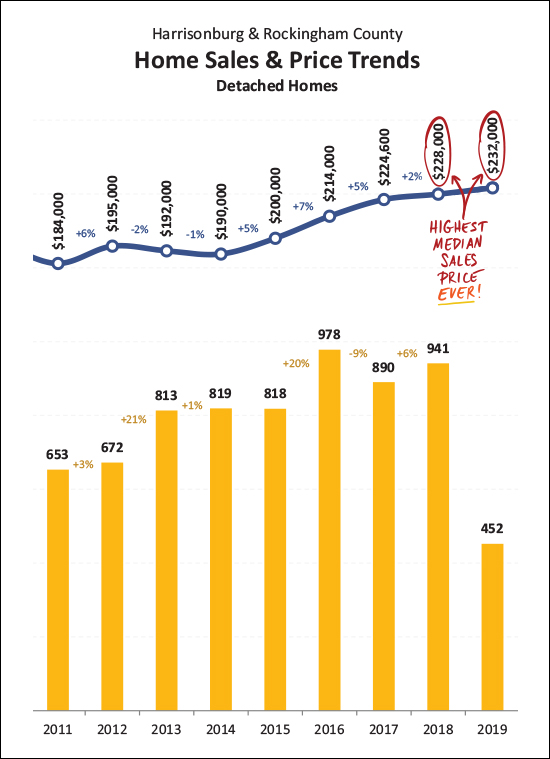

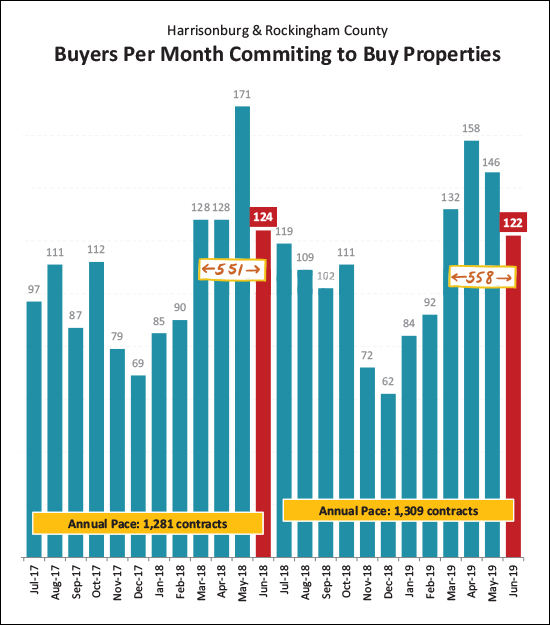

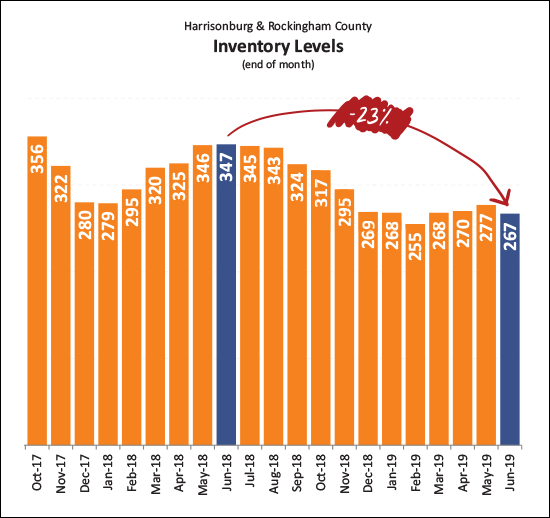

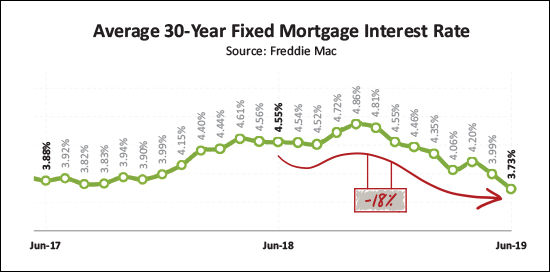

And just how did this past July compare to some other months of July?  This was a bit of a surprise to me! June home sales were rather slow compared to previous months of June. I didn't anticipate that a slower June would so quickly translate into a faster paced July - but wow! Looking back at the past three years we have seen 115, 117 and 131 homes sales during July. This year it was 149 home sales! An impressive showing for buyers in the local marketplace! And here's how that strong month of July contributed to the overall year...  If we were a bit behind as of the end of last month (635 vs. 654) we just about (just about!) caught back up in July -- as there have now been 784 home sales thus far in 2019 compared to 785 last year. it would seem we'll probably make it back to around 1300 home sales this year. And now, let's step back a bit...  This is the slooooooooowest moving graph ever - it looks at a rolling twelve months of sales data. Here, though, we see that the general trend is a consistent-ish pace of home sales -- and slowly rising prices. And when we look for some overall indicators just for detached homes...  This is where we see (above) that despite some year to year turbulence as to the pace of home sales, we're seeing overall increases in sales prices all the way back to 2014. Some years (2015, 2016, 2017) have been larger increases than others (2018, 2019) but it has followed the same general trend. So, what's next?  Well -- it would seem we are likely to see another strong month of home sales in August. After all, we saw an uptick (from 119 to 126) in July contracts, and over the past five months there have been 684 contracts signed, as compared to only 670 during the same months last year. How, though, will those contracts come together with such limited inventory?  That is, of course, an excellent question! Inventory levels have fallen 22% over the past year. This means today's buyers are finding fewer and fewer options when looking for a home to buy at any given time. That said - a relatively consistent number of homes are selling - so a buyer might just have to be a bit more patient, and then be ready to jump quickly when the right house comes on the market. And one last note about mortgages and financing...  In case you missed it, today's buyers are locking in below 4% on 30 year fixed rate mortgages! We went through 16 months with rates above 4%, and we have now been back below 4% over the past few months. Anyone who locked in at 4.25%, 4.5%, 4.75%, etc., still has a wonderful long-term fixed rate mortgage interest rate -- but 3.something? Wow! I'll wrap it up there for now, with a few closing thoughts...

Until next time, have wonderful remainder of your summer, and a great start to your school year if you or someone you know will be getting back to the classroom this month! | |

Should You List Your Home in August or September or October? |

|

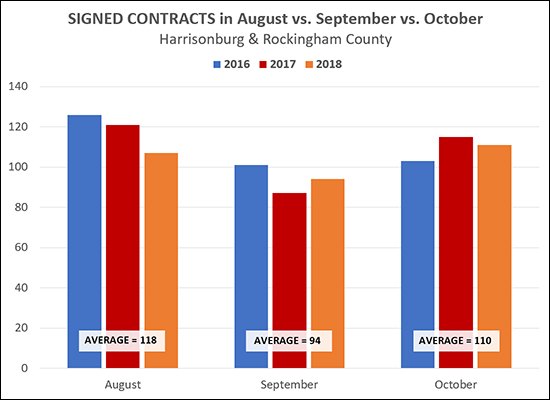

Generally speaking, you should list your home sooner rather than later. As shown above, we are likely to see a declining number of buyers signing contracts between August and September - though then a slight increase again in October. If you want to sell your home in the next few months, let's meet SOON (!!) to start discussing market value and any preparations you need to make in your home before putting it on the market. | |

If You Are Not Able To Buy Quite Yet Should You Still Start Looking At Homes? |

|

Some buyers are close -- so close -- but not quite in a position to be able to make an offer yet on a house. It might be a matter of a few weeks -- or a month or two -- before you are able to actually sign a contract. This might be because you are waiting for a new job to start, or to finish paying off your car, or any number of other reasons. So -- if you're not able to make an offer on a house quite yet, should you still start looking at homes? Yes and no. YES - you should start looking at homes...

Understanding all of these things will help you be a better prepared buyer when you are actually ready to buy. NO - you should not start looking at homes...

So - for most buyers, I recommend "yes, up to a point". Let's start looking at homes that would be of interest if you were ready to sign a contract today. Let's build that context to allow you to understand your segment of the market. Let's get a sense of how often homes of interest will become available - and how quickly they go under contract. And then, after we have built somewhat of an understanding of the market, it will be your call as to whether to continue to look at homes that are not likely to actually be available for you to buy once you are able to do so. So, in conclusion - even if you are a few weeks or a few months out from being ready and able to sign a contract to buy a home, it is not necessarily too early to start going to see some houses. | |

Arranging the Timing and Logistics of Selling, Buying and Moving |

|

Moving from one house to another is tough work! Even tougher (sometimes) is arranging the timing and logistics to work well for all parties. If you're selling a house in order to buy a house, it's possible that...

The spot for you to be can be somewhat easier -- you could stay at a hotel or with a friend for a night if needed. It's decidedly harder to put all of your belongings in the hotel room or in your friend's house. The options, generally speaking, are...

If none of these are possibilities -- I have even had some clients who had to put everything in storage, just for a few days -- and then move it out of storage into the new house. Again - even moving is tremendously hard - but arranging for it within the tight confines of closing timelines and when you do and do not have access to the old house and new house can make it even more difficult! | |

Sometimes Buyers Will Find It Difficult To Make Rational Decisions About Home Inspection Findings |

|

Buying a house can be an enormous decision - full of plenty of emotions - anxiety, apprehension, excitement and much more! Buy a house is likely to be one of the largest financial decisions you will ever make - AND you are making a decision (where you will live) that will affect countless other aspects of your life, likely for many years to come. So, are you good at making difficult decisions in a highly emotional state? Many people find that to be difficult! Let's imagine this scenario -- you're buying a $245,000 home and you are SO excited to buy it because if it's charm, character, location, and so much more! It is within walking distance of the downtown scene - and even though it is an older home, it seems to have been well maintained and updated. But then, you do the home inspection and you find out that the ___ will need to be replaced in the next few years. Technically, this could be any number of items -- heating system, roof, appliances, etc. What to do...what to do!? Perhaps it is going to cost another $5,000 to make this update - and the seller is not willing to adjust the contract terms based on your inspection findings because, after all, the ____ is still working properly now. So - do you throw the whole purchase out the window? You're going to have another $5,000 of costs within the next few years!? The seller should be willing to negotiate to cover some of that cost!? Is your "really good decision" now actually a "really bad decision"?!? This advise is not prescriptive to all situations, but I would encourage you to consider the big picture as rationally as possible. You are about to buy a home that is (in my fictional scenario) going to totally change your life. It's a home you can see yourself living in for 10 - 15 years. You look forward to the memories formed in the house, the places you can walk and experience based on its location, the opportunity to have a garden in the backyard, and so much more! A question that you could then ask yourself would be whether you'd pay $250K for this awesome, amazing, perfect, life changing house and opportunity, instead of the $245K you have contracted to pay. If so, and if you'll have cash available to make the needed upgrade to the ____ sometime in the next few years, then maybe it's not really a terrible idea to continue with the purchase despite the newfound information about the condition of the house and despite the seller's unwillingness to assist with it financially. Again - this is not generic advice of "don't worry about the issues that come up in the inspection" - but more of an encouragement to consider the big picture of what you are buying, why you are buying it, what it is worth to you, etc. | |

Consider Purchasing a Home Warranty Depending on the Age of the Systems of the Home |

|

What is a Home Warranty? A home warranty one-year service agreement that covers the repair or replacement of many major home system components and appliances that typically break down over time due to normal wear and tear. One company that many of my clients have used for a Home Warranty is American Home Shield. They offer several plan options:

If you're buying a brand new home, you likely don't need a Home Warranty. If you're buying a home where the heat pump, appliances and water heater have just been replaced, you probably don't need a Home Warranty. If you're buying anything else, you should consider a home warranty. | |

The Variable Value Of A Basement |

|

There are a lot of types of basements - and they have very different values to buyers and appraisers. Here are a few examples, to get you thinking...

You get the idea. :-) To say "this house has a basement!" can mean so many (so many!) different things. And, the value of that basement (to a buyer or an appraiser) will vary quite significantly. So when you see a house for sale with 2600 square feet -- but with 1200 of those finished square feet being in the basement -- you might just have to go see the house in person to understand which of the various basement types listed above best describe these 1200 square feet. | |

Median Price Per Square Foot Rising Again In 2019 |

|

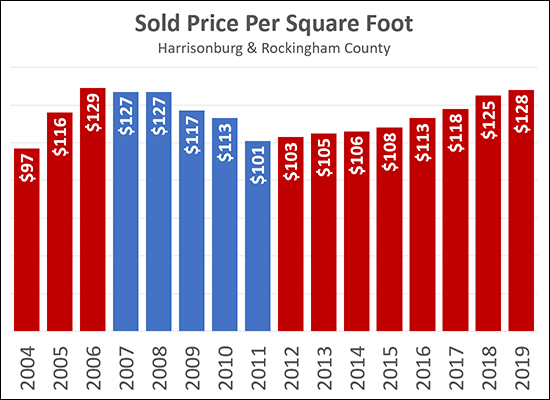

In addition to watching how the median sales price changes over time, it can be quite insightful to see how the median price per square foot of sold homes changes over time. The graph above tracks the median price per square foot of single family homes (not townhouses, duplexes or condos) in Harrisonburg and Rockingham County over the past 15 years.

Price per square foot fell 22% between 2006 and 2011 as the market cooled back off. Since that time, however, we have seen a slow and steady increase in this metric -- from $101/SF in 2011 to $125/SF last year -- which marks a 24% increase over the past seven years. I do not expect that we will see any drastic increases in this metric in the next few years, though an increasing number of buyers (more demand) and significantly fewer sellers (less supply) does make you wonder if we will start to see more rapid increases in sales prices, and thus in price per square foot. ALSO OF NOTE -- this metric is most helpful in understanding value trends over time -- not in calculating the value of one particular property. This median price per square foot is the mid point of many very different homes -- new homes, old homes, homes with garages, homes without garages, homes with basements, homes without basements, homes with acreage, homes on small lots, etc. A median price per square foot can be more helpful in understanding the potential value (or value range) of a single property if we pull that median value based on a smaller data set of more properties more similar to the single property. | |

JMU Ownership In the Maplehurst Neighborhood |

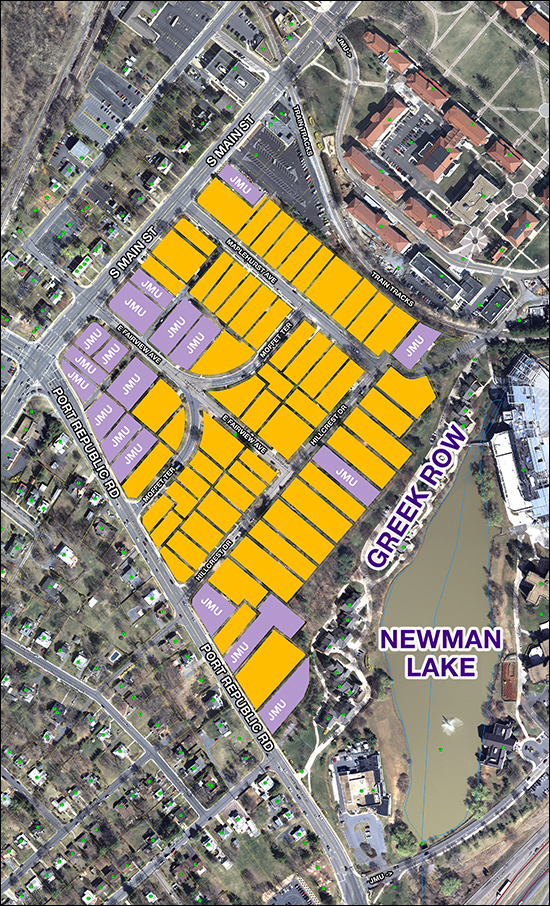

|

Download a larger map here. While it is not as expansive as JMU's ownership in the Forest Hills neighborhood -- it is interesting to see JMU continue to purchase properties in the Maplehurst neighborhood -- some of which have recently been turned into parking lots. Thus far, their focus seems to be mainly on the corner of South Main Street and Port Republic Road - though they now (as of a year ago) also own a property backing up to Greek Row. Download a larger map here. | |

Home Buyers Have Had Fewer Choices Nearly All Year |

|

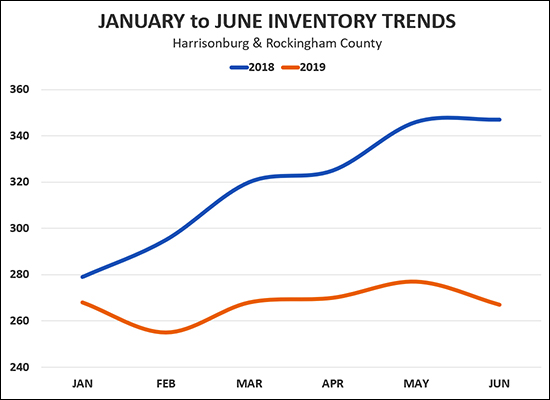

The blue line above shows the number of homes for sale at the end of the month for the first six months of last year, 2018. The orange line shows the same (homes for sale at the end of the month) for the first six months of 2019. Last year, inventory levels rose 24% between the end of January and the end of June. This year, inventory levels actually dropped negligibly (by one listing) between the end of January and the end of June. So - for all you would-be home buyers out there feeling like you don't have many options, or that the ones you do are going under contract quickly after having had multiple offers, the data backs up the pain you are feeling. What's next? How do we get out of this trend of fewer and fewer homes for sale? New construction is the likely anecdote, but there doesn't seem to be a whole lot on the horizon right now. | |

Resolution to Create Stormwater Authority Tabled |

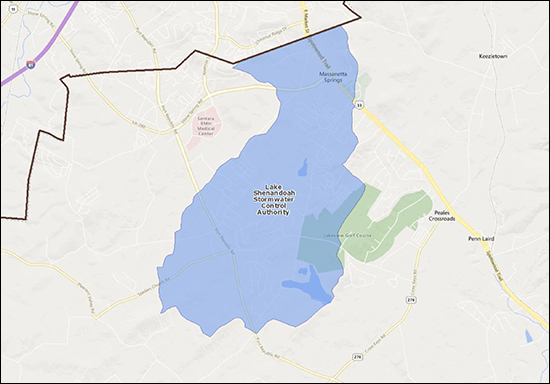

|

A public hearing was held on July 17, 2019 and it drew quite a crows (70+ people) and lead to several hours of discussion. At the end of the meeting, the Board of Supervisors decided that they needed to spend more time looking into the comments and concerns raised by local residents. The Board tabled the resolution that would have created the authority, and it is not clear when any next steps will be taken. It seems that much of the concern and discussion was related to how to pay for the needed upgrades to the stormwater system. I don't think anyone questions that those upgrades are needed. Here is an excerpt from a July 18, 2019 article in the Daily News Record, Stormwater Authority Tabled...

For further context, the County's website (linked above) explains that...

| |

Home Sales Slow, Prices Inch Higher In First Half of 2019 |

|

It's hard to believe, but half the year has already flown past! Let's take a few minutes to review some recent trends in the local housing market -- but first...

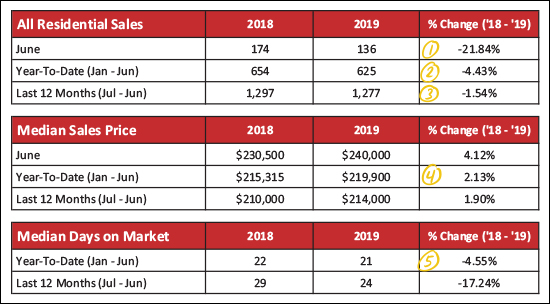

Now, starting with some data packed charts before we get to the colorful graphs...  Looking at the market overview above, here's what's popping out to me...

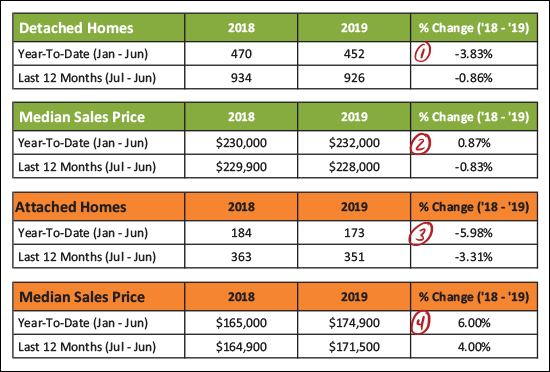

Now, let's see how detached home sales compare to the sale of attached homes. Attached homes are townhouses, duplexes and condos...  The green chart above is detached home sales, and the orange chart is attached home sales, and here's how things break down...

And now, the pretty graphs...  What a roller coaster! As shown above we just experienced the HIGHEST month of May home sales in the past few years, and then the LOWEST month of June home sales in the past few years. So, right, hard to conclude much there -- other than that May and June are some of the busiest months for home sales. Looking ahead, hopefully we'll see a nice mid-range July -- how about 120 or 125 sales?  I use the graph above to see how we're doing in the current year as compared to the prior four years. As you can see, the 625 home sales in the first half of this year is about on par (above two, below one) with the past three years when we have ended up with 1250+ home sales. So, if I had to guess, we'll probably see between 1250 and 1300 home sales in total this year.  The graph above is the best indicator of overall long term trends. Each data point reflects 12 months of sales data. As you can see, the pace of home sales (orange line) has been declining slightly over the past year -- while the median price of those home sales has been inching upwards to its current level of $214,000.  I'm throwing this one (above) in for fun - because I haven't highlighted this fact lately. The median sales price of detached homes is $232,000 thus far in 2019, and was $228,000 in 2018. Both of these median sales prices are/were the highest median sales price we have seen for Harrisonburg and Rockingham County -- ever! We've come by these prices slowly and steadily over the past five years.  Those new contracts, they keep getting signed! A total of 122 properties went under contract in June 2019 as compared to 124 last June -- and when we look at the March-June timeframe, we find 558 contracts this year and 551 last year. As such, this year's Spring/Summer buyers (and, incidentally, sellers) are certainly keeping pace with last year at this point.  And what are those buyers buying? Well, it seems that they have fewer, and fewer, and fewer choices at any given point in time. As shown above, current inventory levels (267 homes for sale) are 23% lower than they were a year ago -- and just about as low as we saw inventory levels drop over this past Winter!?! Well priced, well prepared, well marketed new listings are going under contract quickly partially because of how few options buyers have these days.  Those buyers who are fortunate enough to secure a contract on one of the few available listings are super fortunate to find astoundingly low mortgage interest rates! Over the past year, the average 30-year fixed mortgage interest rate has fallen 18%, down to its current level of 3.73%. I didn't think we'd see rates below 4% after they soared up to 4.5% a year or so ago - but today's buyers are certainly enjoying locking in some low housing payments given these low rates! Let's pause there, folks. Hopefully that gives you a good general sense of what is happening in our local housing market. And as always, if you have follow up questions about YOUR portion of the local housing market - based on price range, neighborhood, property type, etc. - just let me know! SELLERS -- even though it is a seller's market in just about every price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

Should You Go Ahead And Adjust The List Price Of Your Home? |

|

We should have another solid 90 days of strong buying activity (contracts being signed) before things start to slow down into the Fall, and then slow down even further in the Winter. If you are intent on selling your home before the end of the year, you may want to consider a price reduction now, rather than later.

If you reduce your list price next Monday -- on July 15 -- you likely have a good 90 days of exposure to a larger pool of buyers before contract activity slows down. If you wait, and reduce your price on October 15, you have already had a large number of buyers pass your house by. Think strategically about how your house is priced to best position it to realistically be under contract within a timeframe that best works for you. | |

How Do I Make An Offer On A House? |

|

How, you might ask, do we go about getting from the point of wanting to make an offer --- to actually making the offer? Here's a brief overview....

When we get to step seven, above, we will be discussing and deciding on the terms of the offer. Below is a list of the main contract terms we will need to discuss in preparing to make an offer.

Before and after making an offer, there is a lot more to know about and think about regarding the home purchasing process. Read more at....  | |

Make Sure To Think About The Total (Near Term) Cost Of Purchasing A Home |

|

As one small example... A first time buyer looking to buy a detached home (not a townhouse or duplex) under $225K might find themselves considering mostly homes that are at least 50 years old. Said buyer might find the **perfect** home built in 1945 that is "move-in ready" with pretty paint on the walls, and beautiful furnishings, and a well-kept garden, and a quaint covered front porch, and on and on. This buyer is likely head-over-heels excited about the house at this point, as it is priced at $230K, just barely above their target maximum of $225K. But before the buyer signs that contract to make an offer on the house they should probably pause at least for a moment to ask some questions and to consider...

There are plenty of other items that might need updates or replacements in the next three years, but they are all either of a lower cost or elective - though these costs could also add up:

But circling back to the first two items - the roof and heating system - these are pretty much non-negotiable. If either quits working as it should, you'll need to replace it. And if you're maxing out your housing budget with a $225K-$230K home purchase, and then within a year or two you need to spend $8K - $15K on a roof and $8K - $15K on a heating system, that will likely create some financial stress for you. So - always be sure to think about the total cost of purchasing a home, especially when you are on a tight budget or when you are buying an older home. | |

All Square Footage Is Not Created Equally |

|

So -- if your neighbor's 2400 SF, circa 2000, 4 BR, 2 BA home just sold for $300K... Then it's probably reasonable to think that your 2400 SF, circa 2000, 4 BR, 2 BA home will also sell for $300K, right? After all, you have made the same updates (systems and cosmetic) over time -- and you're on the same street!

Well, maybe -- but maybe not! Consider the possibility that....

These two homes will not be seen as having an equivalent value -- not by potential purchasers and not by an appraiser. Above grade square footage has a higher value attached to it -- both specifically by appraisers, and generally by purchasers. Even if all of the other factors (condition, age, location, bedrooms, bathrooms) are the same between two houses, if one has a significant portion of the square footage in the basement then it will be seen as less valuable than the home that has all of its square footage above grade. | |

Extra Three Day Tickets to Red Wing Roots Music Festival |

|

One of my favorite weekends of summer is coming up - the Red Wing Roots Music Festival, where more than 40 musical groups (folk, Americana, roots music) will be performing at Natural Chimneys Park in Mount Solon, VA. Other fun activities at Red Wing include camping, great food, hiking, biking, swimming, running and more. The music festival is hosted by The Steel Wheels and is an extraordinarily relaxed family-friendly environment. So, what are you doing July 12th, 13th and 14th? Maybe I'll see you at Red Wing? Extra Three Day Tickets To Red Wing... I have a few extra 3-day tickets that I won't be using. If you or your family would like to go, but haven't bought tickets, drop me an email at scott@HarrisonburgHousingToday.com to see if I still have any remaining. | |

The Buyers Did Not Like The Layout Of Your Home |

|

If a buyer is buying over $400K, or even over $300K, the layout of the home becomes very important to them. That is not to say that it is unimportant for a $200K buyer -- but someone buying a more expensive home oftentimes plans to stay in it for a longer time frame. If not the #1 feedback, then perhaps the #2 feedback I receive from showings of homes priced over $400K is that the layout just didn't work for the buyers....

| |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings