| Newer Posts | Older Posts |

Local Home Sales, and Prices, Soar in June 2018 |

|

Learn more about this fantastic home in Massanutten Resort: 127FortRoad.com. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market... OK -- now, let's take a look at some of the overall market indicators this month...  As shown above...

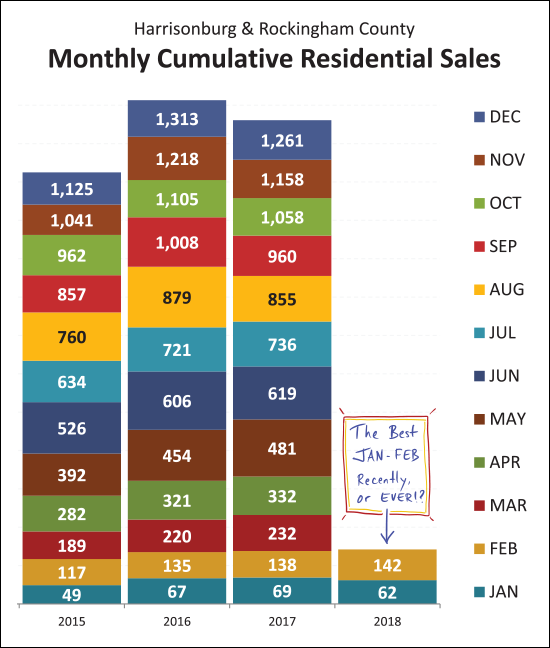

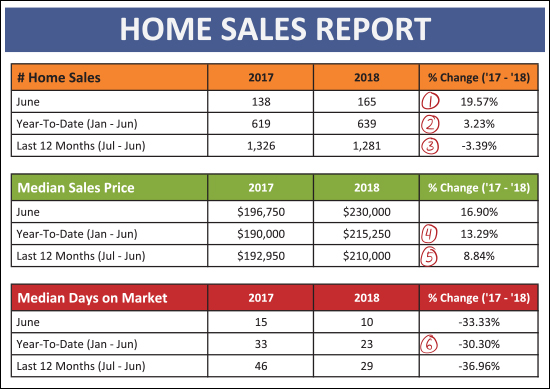

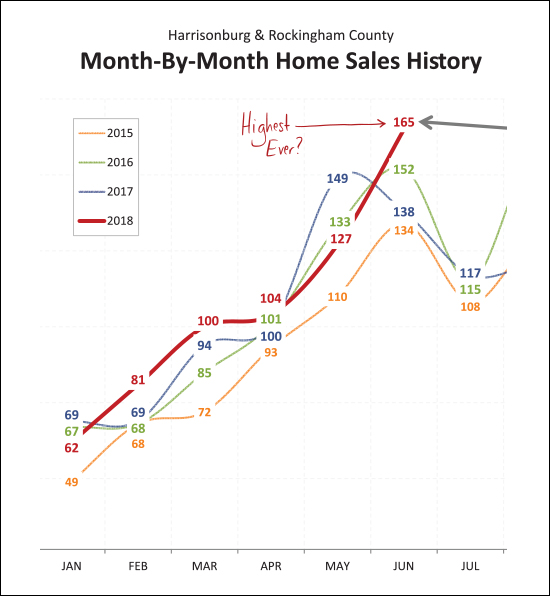

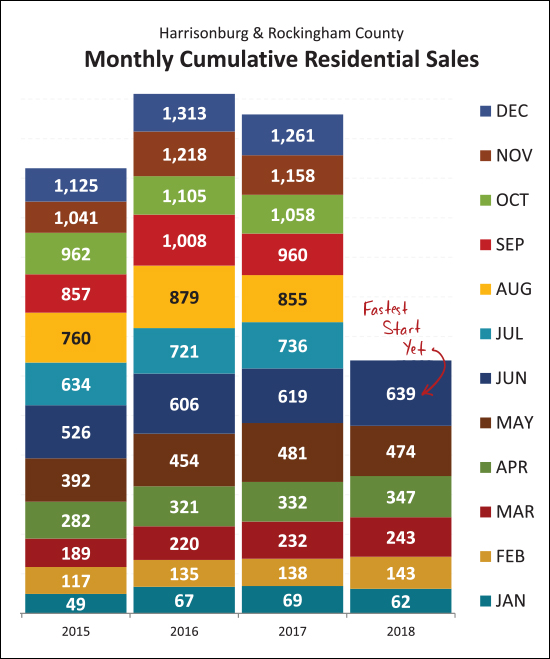

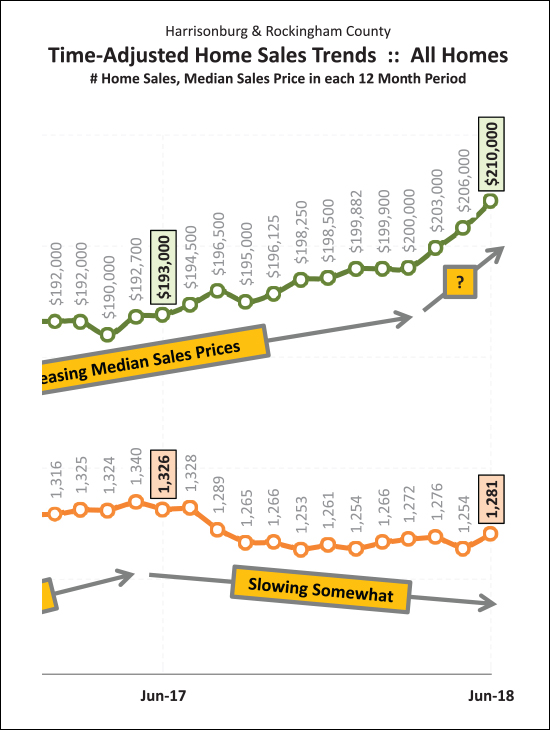

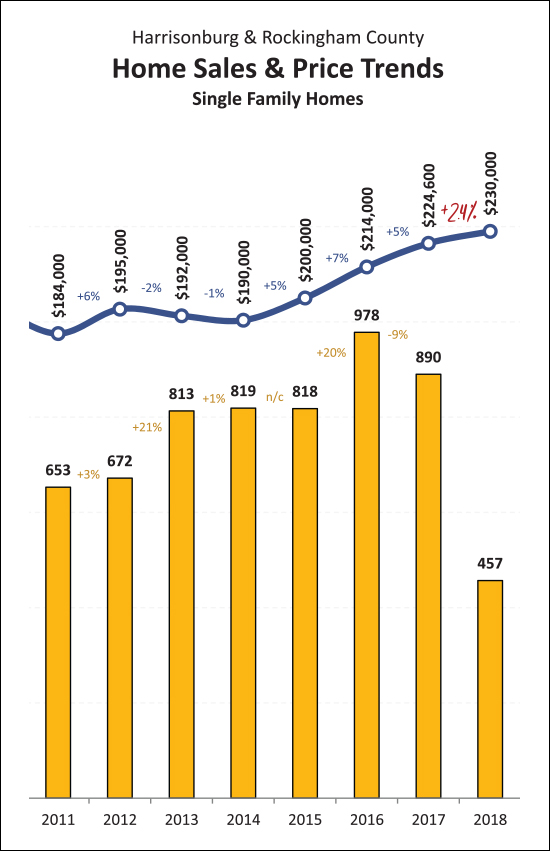

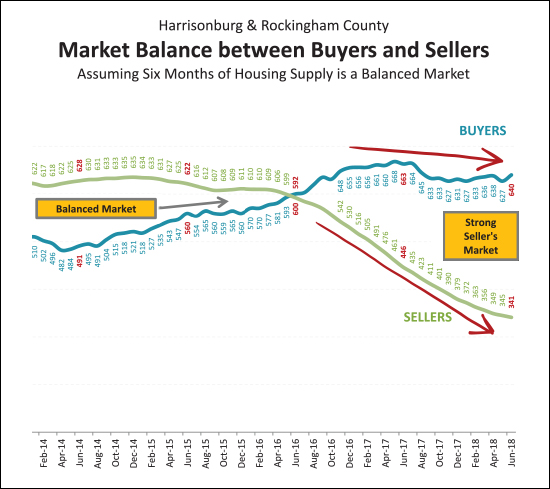

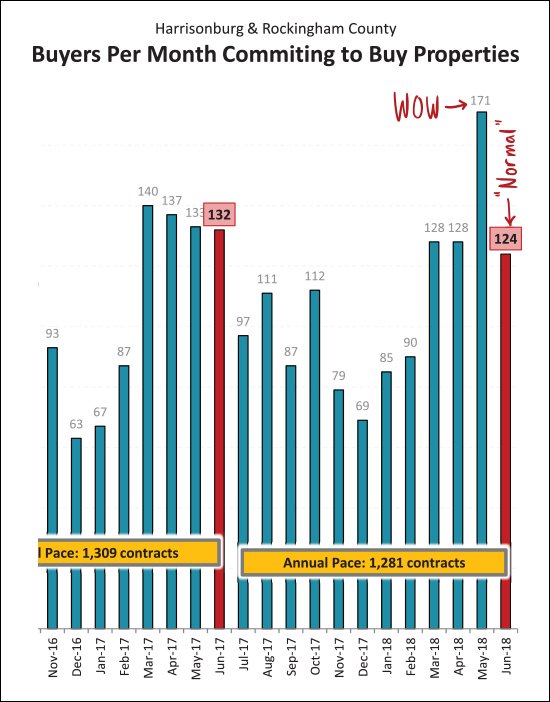

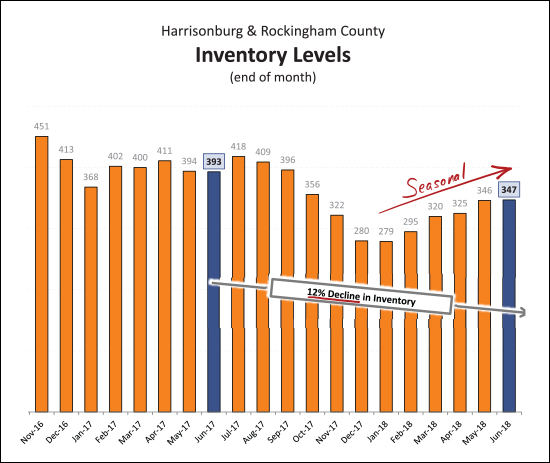

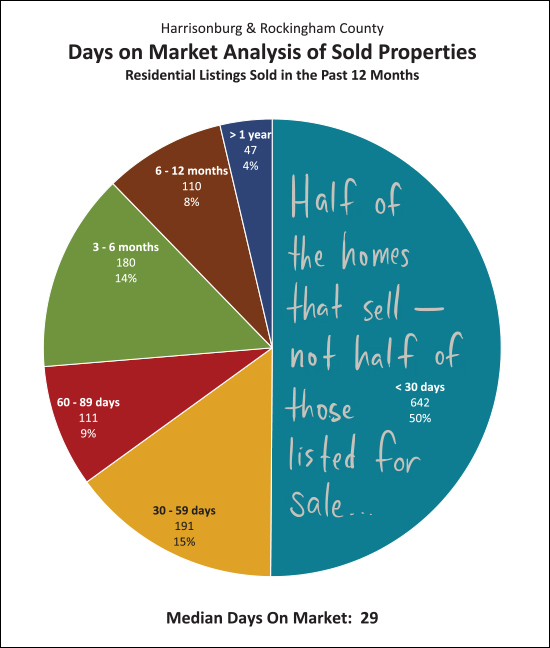

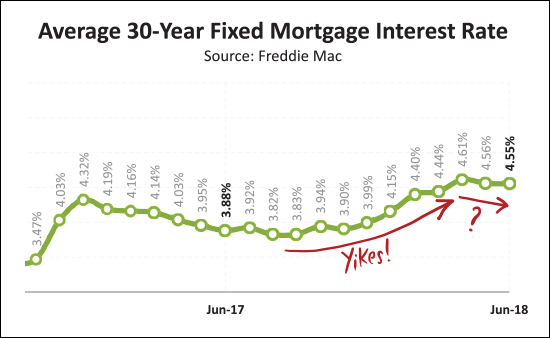

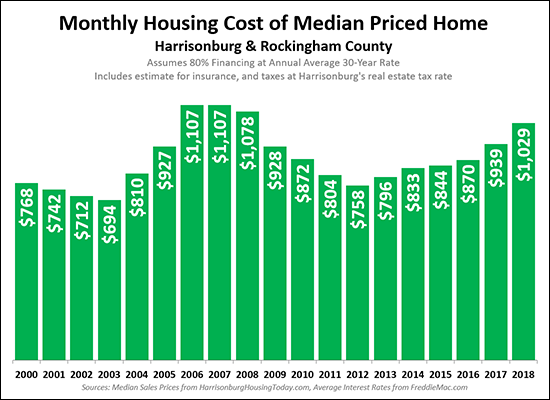

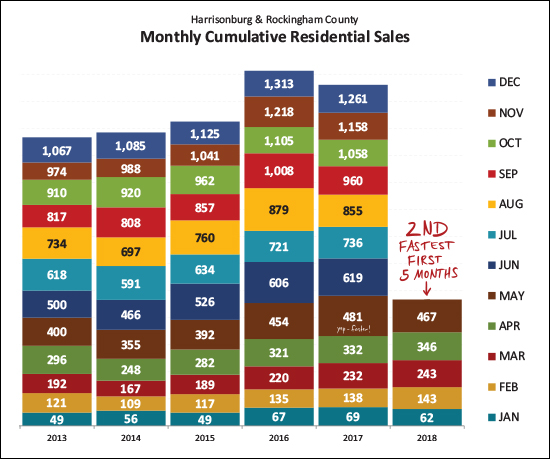

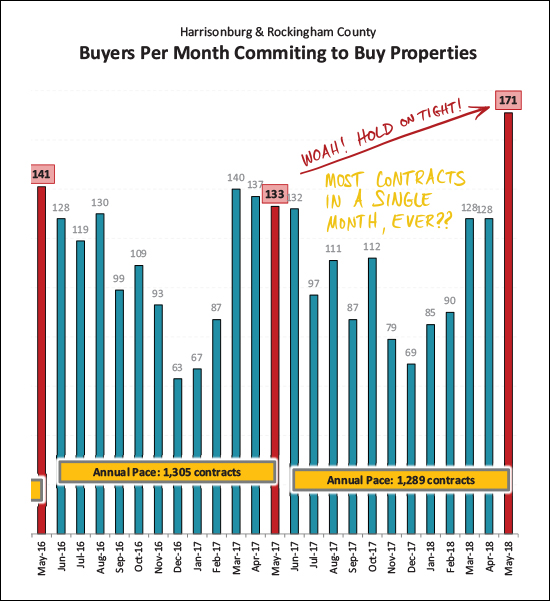

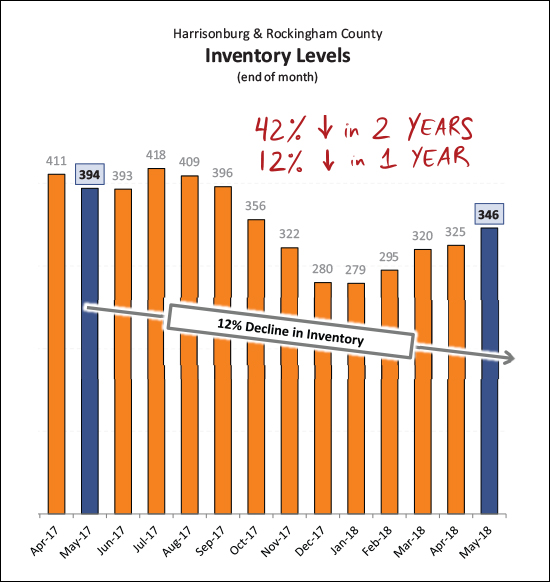

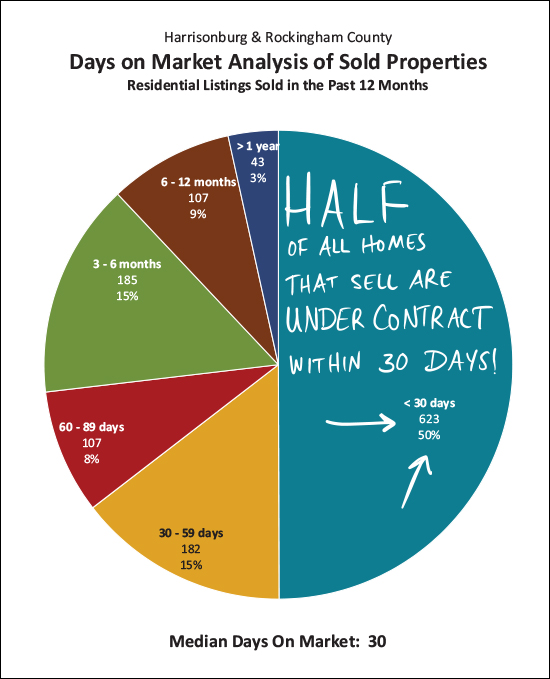

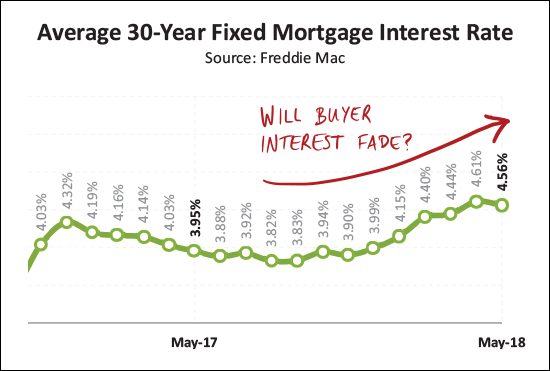

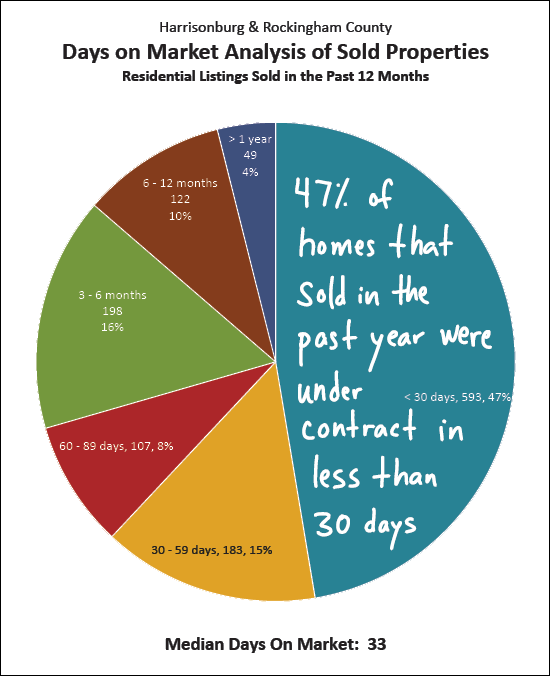

Wow! Just wow! The 165 sales seen in June 2018 is the highest seen any time in the past several years -- in fact -- it is the most sales in a single month any time in the past 10 years! I actually have data back to 2003, and the only times that we have seen more than 165 home sales in a single month have been: June 2004 (174), June 2005 (173), July 2005 (166), August 2005 (183) and June 2006 (192).  Needless to say, this is the fastest start to the year we have seen anytime in recent history. As shown above, the 639 home sales in the first half of 2018 exceeds the number seen in the first half of the past three years. Looking back further, the only times we saw more home sales in the first half of the year were in 2004 (706), 2005 (764) and 2006 (759).  As shown above, despite slowing sales over the past year-ish, median sales prices have been slowly rising -- and over the past three months have started escalating quickly -- from $200K to $210K between March 2018 and June 2018. So -- record numbers of sales, quickly rising prices -- hmmm -- something about this seems familiar. Should we be worried? Maybe, or maybe not...  The figures shown in all prior charts and graphs has been for all residential sales -- including detached homes, duplexes, townhouses and condominiums. The graph immediately above focuses only on Single Family (detached) Homes and this can often give us the truest indicator of market trends. Perhaps it is (or could be) some comfort, then, that the median sales price of these detached homes has only risen 2.4% over the past year. This may mean that the rapid increases in prices we are seeing has more to do with what is selling (property type, price range) and/or is being skewed by non-owner occupied home sales/purchases.  It is also important to note that while the number of home sales has been dropping slowly (3% decline comparing past 12 months to prior 12 months) part of that may be due to a change in market balance. It is a strong seller's market now, as there are a roughly equivalent number of buyers in the market as compared to a year ago -- with a drastically lower number of sellers in the market.  And here, folks, is the reason why we saw so many home sales this month -- it was a result of the crazy number of contracts signed last month. Last month's 171 contracts was the highest number I have seen anytime since I have been tracking these figures. Thus, slightly slower contracts in June is to be expected -- and we are likely to still see a strong month of sales in July based on some May contracts rolling over into July closings.  And here it is again -- declining inventory levels. While inventory levels have seen a seasonal increase over the past six months, there has been a net year-over-year decline of 12% in the number of homes on the market. Fewer homes for sale, with a roughly equivalent number of home buyers, has lead to a strong seller's market -- and a frustrating time for many buyers!  Perhaps because there are so many buyers fighting over each listing, homes are selling more quickly. Half of the homes that have sold in the past year have been under contract within 30 days of having been listed for sale. Again, this is not half of all properties that are listed going under contract in 30 days -- just half of those that actually do sell.  As shown above, mortgage interest rates have been increasing over the past year -- almost an entire percentage point. This has not seemed to have made a drastic difference in the pace of buyer activity (yet) and it has been nice to see these edge downward somewhat over the past few months. OK -- I'll stop there for now. Again, you can download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market One last note for anyone thinking of buying or selling soon -- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

How Many Home Sellers Pay Closing Costs For Buyers? |

|

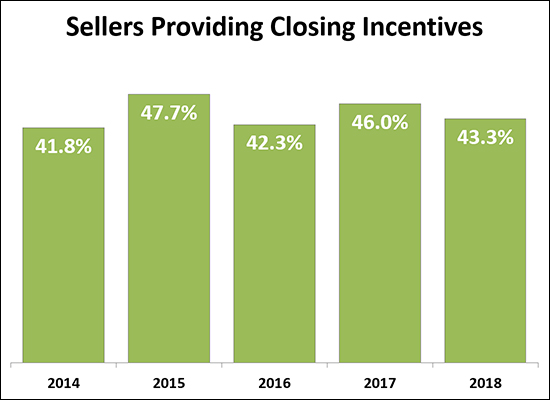

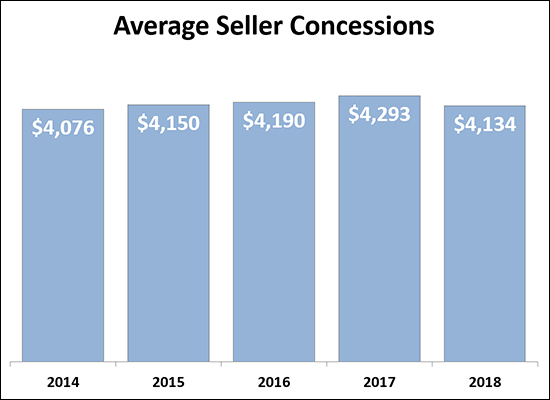

Almost half of sellers (43.3%) pay some portion of a buyer's closing costs in the form of a credit at closing. Over the past five years, the number of sellers providing a "concession" of this sort to buyers have stayed between 40% and 50%.  Of interest -- sellers have paid more and more of a buyer's closing costs over the past five years, but that has edged back down during 2018. Why would sellers be paying more of a buyer's closing costs? It's hard to say exactly -- buyers might be asking for more money, sellers might be agreeing to provide a larger credit, or perhaps the total amount of closing costs that a buyer has to pay is increasing as well?  If, as a seller, you are paying part of a buyer's closing costs, you are most likely to be paying between $4K and $6K --- or between $2K and $4K. And again, as a seller, if you pay part of the buyer's closing costs -- you are not alone -- 43% or so of sellers do so! | |

Monthly Housing Costs On The Rise |

|

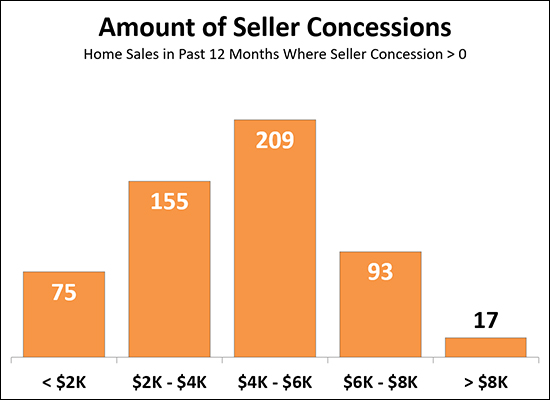

It should come as no surprise that monthly housing costs are increasing, after all...

Thus, the 22% increase in monthly housing costs over the past three years should not be too surprising. For this analysis, I am measuring "monthly housing cost" by determining the mortgage payment amount (principal, interest, taxes and insurance) for a median priced home in Harrisonburg and Rockingham County, if a buyer were financing 80% of the purchase price and paying Harrisonburg real estate taxes. Looking forward, I would expect that all three of these factors (prices, interest rates, tax rates) that influence housing costs would likely continue to increase. | |

Just How Fast Are Home Selling These Days? |

|

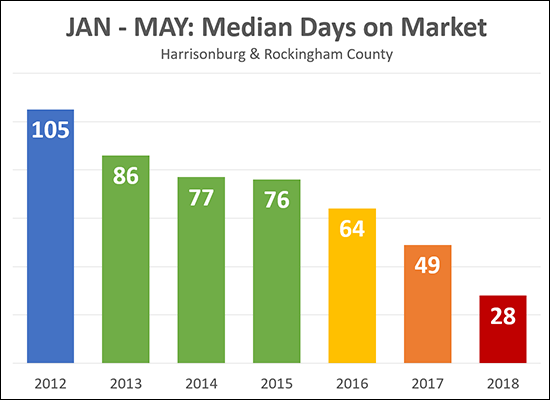

"Days on Market" is the number of days that pass before a property is under contract. Thus, if a home is on the market for 10 days before a contract is signed, the "days on market" will be 10 for that property. The "Median Days On Market" for any given time frame gives us a good sense of how quickly homes are selling. For example, the median of 28 days for the first five months of 2018 means that half of the homes that sold in the first five months of 2018 were under contract less than 28 days after they hit the market -- and half took more than 28 days to go under contract. It is important to note that this does NOT mean that half of homes that are LISTED are under contract within 28 days -- just that half of those that actually SOLD were under contract within 28 days. The trend line here is rather remarkable. Just six years ago (2012) the median days on market was right around 3.5 months -- and now the median is just under one month! | |

More Buyers Signed Contracts in May 2018 Than In Any Other Month, Ever |

|

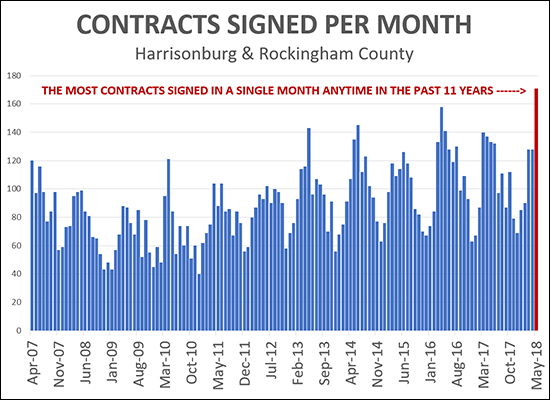

To say that May 2018 was a busy month for contract signing seems to be an understatement. I have data all the way back to April 2007 -- and the number of contracts signed last month (171) seems to be the highest month of contract activity we have ever seen in Harrisonburg and Rockingham County. It's hard to say how those contracts will show up as closings -- they will likely spread out between June and July -- so we might not have the highest month of home sales ever in June 2018. But, then again, we might. :-) Read more about our local housing market in the most recent edition of my monthly market report... | |

Home Sales Slow, Prices Pop, Contracts Climb |

|

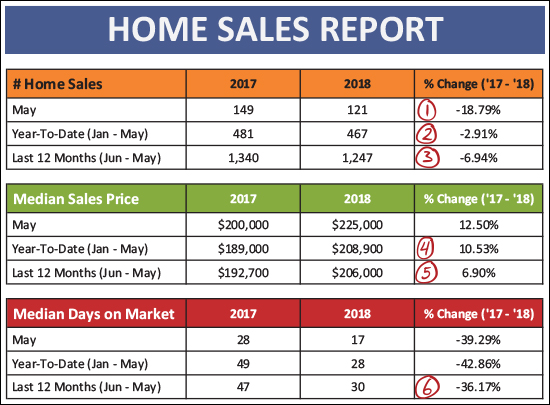

Find out about this beautiful home at Preston Lake: 3168PrestonLakeBoulevard.com. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market... OK -- now, let's take a look at some of the basic market indicators this month...  Plenty of statistics of interest above, including...

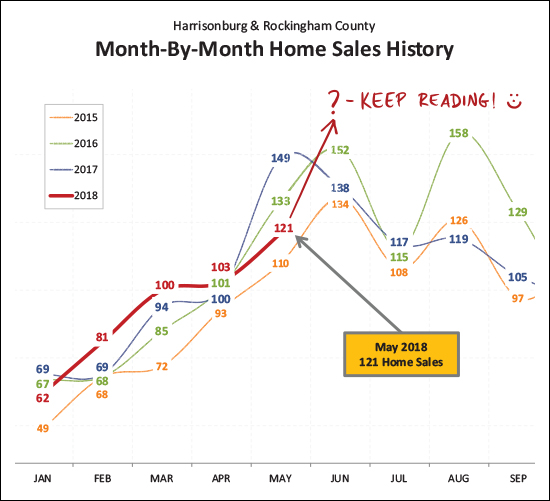

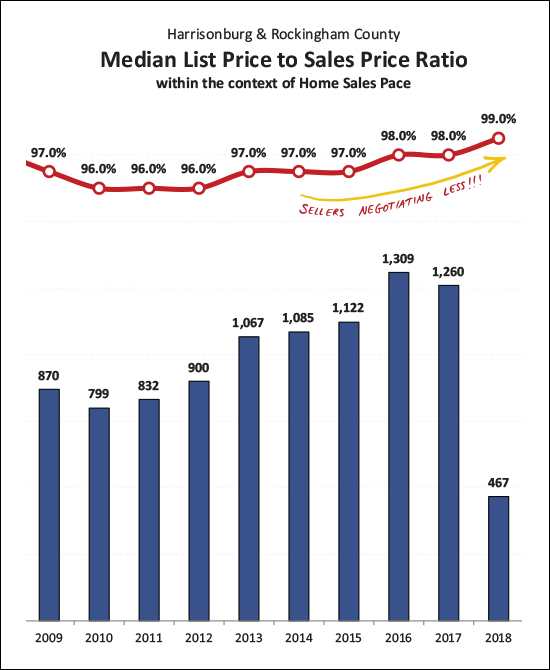

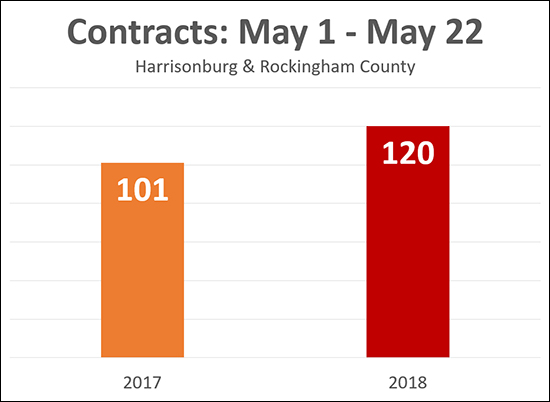

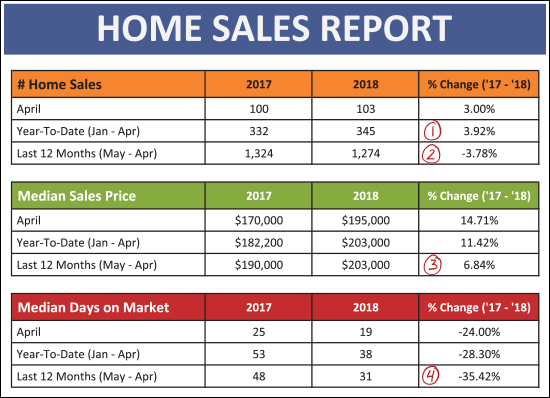

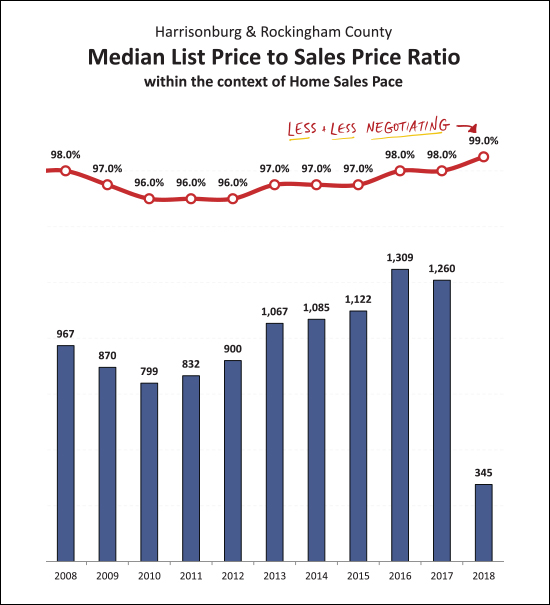

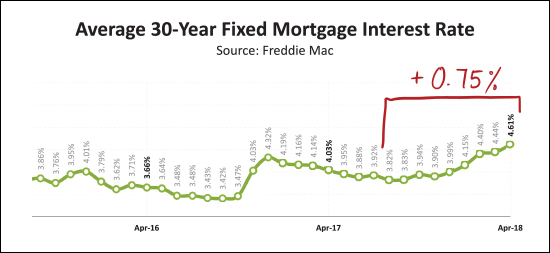

So, as seen above, May sales were slower than (I) expected. After the best February, March and April in recent memory -- home sales in May 2018 fell below both May 2017 and May 2016. What gives? Well, perhaps, it is just some month-to-month variation between years. Keep reading to find out why all is not lost when it comes to late-Spring and early-Summer home sales. :-)  Looking at a slightly longer timeframe, the pace of home sales in the first five months of this year is only lagging slightly behind where we were last year -- and thus putting us in second place for the pace of home sales in Harrisonburg and Rockingham County.  Have you heard it's a seller's market? There are fewer and fewer sellers (keep reading for details) and this has buyers fighting over properties in some price ranges (and locations) -- which has resulted in sellers needing to negotiate a bit less on their price than in years past. The median ratio between the sales price and list price is now 99%, as compared to 97% - 98% over the past five years.  Yep -- this is the crazy one! Last May we saw 133 homes go under contract -- this May there were 171!?! I'll have to check my historical archives to be sure, but I think this may be the MOST contracts we have EVER seen in a single month EVER. Wow. So -- even if we were despairing that home sales were slowing in May -- perhaps we can excitedly look forward to June (and July) when these May contracts start turning into closed sales. Again -- wow!  And yes, as mentioned above, inventory levels are falling -- fewer and fewer homes are on the market available to a buyer on any given day. We have seen a 42% decline in inventory levels over the past two years -- and a 12% decline in the past 12 months. The decline is slowing -- which might mean this inventory level can only go so low -- but this is what is causing so much frustration for buyers -- and oftentimes, so much delight for sellers! :-)  Faster and faster and faster, oh my! Indeed, homes are selling even more quickly now than they were a year ago. Half of the homes that sold in the past year were under contract within 30 days of hitting the market. If you are a buyer -- be ready to act FAST!  And finally, interest rates are on the rise. :-/ It costs more to finance a home purchase now than it did a year ago. I commented to a client today that today's interest rates are still ridiculously low compared to any longer-term historical perspective, but he was quick (and wise) to point out that this fact doesn't necessarily matter much for today's buyers. Why are they going to appreciate that today's interest rates are lower than they have been for most of the past 20 years -- all they care about is that they are going to be paying more to finance their home purchase now than if they had bought six months of a year ago. OK -- I'll stop there for now. Again, you can download the full report as a PDF, read the entire report with commentary online, or keep reading my blog in the coming days for further commentary. One last note for anyone thinking of buying or selling soon -- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

Buyers Buying Faster This May Than Last |

|

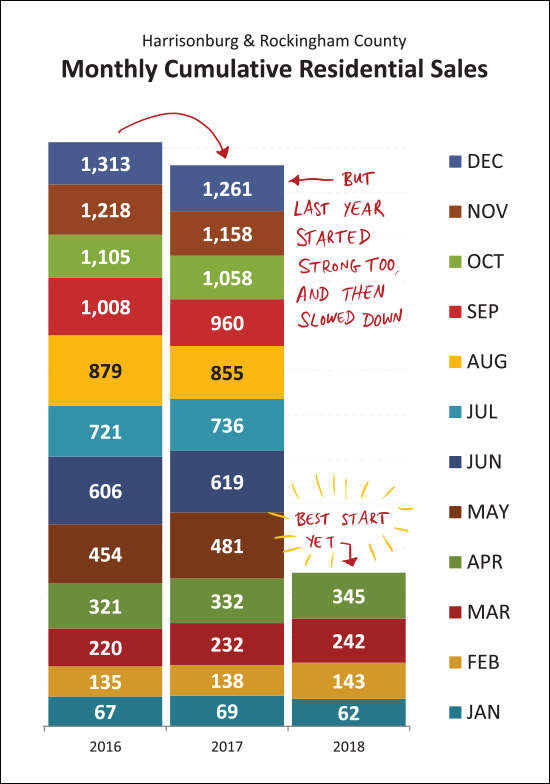

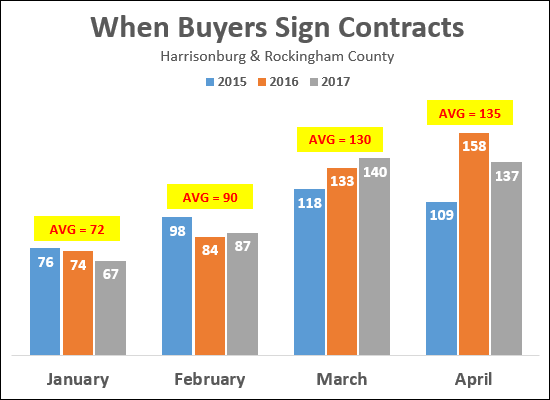

In the past 12 months there have been 1274 home sales -- compared to 1324 in the 12 months prior -- so, technically, the pace of home sales in our market has slowed by 4% over the past year. But -- home sales are POPPING so far this year... Closed sales last January through April = 332 Closed sales this January through April = 345 (4% increase) And -- as shown above, we've seen 120 buyers (and sellers, of course) sign contracts in the first 22 days of May -- as compared to only 101 last year. Hold onto your hat (?) everybody -- this could be a rather active year, yet again, in our local housing market. | |

Home Prices Edge Upward As Demand Exceeds Supply |

|

Find out about this newly listed custom home: 2550RamblewoodRoad.com. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market... Now, let's dive into some of the latest data from our local real estate market....  As shown above, it's been an interesting start to the year...

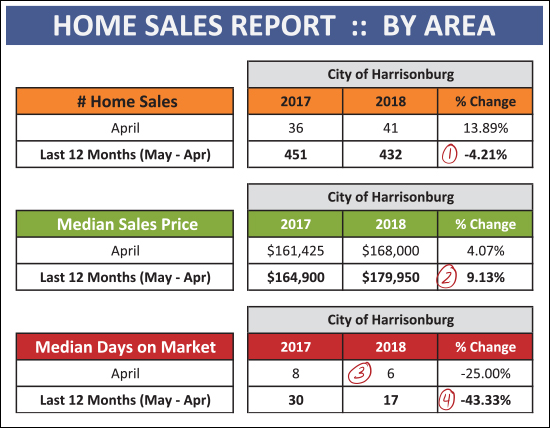

Shining a spotlight, briefly, on the City of Harrisonburg alone (not the County) we find...

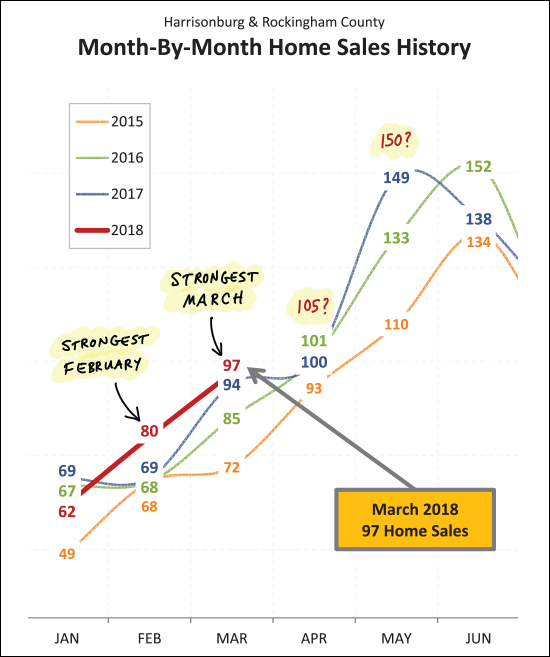

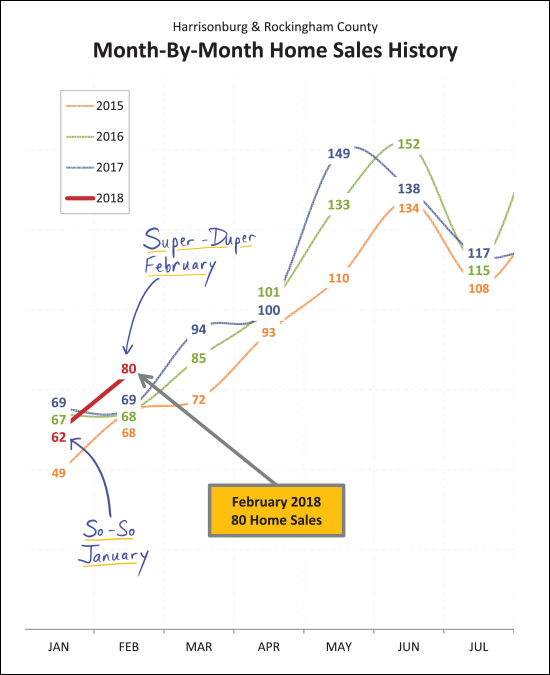

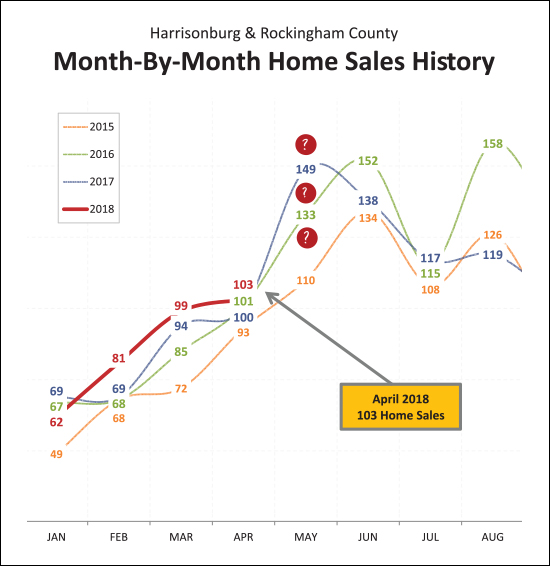

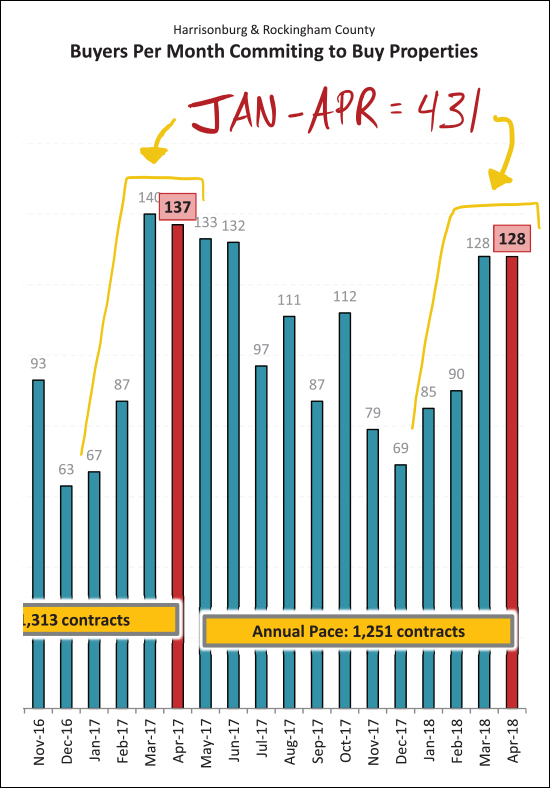

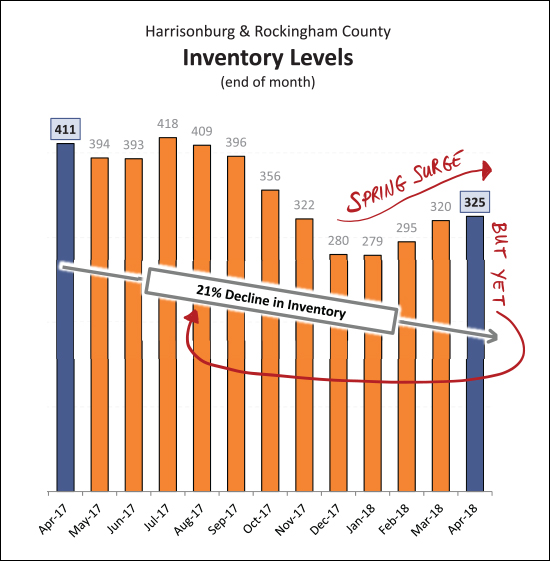

January 2018 was a tad slow -- but then February, March and April easily outpaced the same months last year. Wow! So -- where will we go in May? Could we really see a 50% increase (from April to May) as we saw last April (100) to May (149) or will the increase be a bit more tame?  Lest we get toooo overjoyed about the fantastical pace of home sales in the first four months of this year -- I will point out that the last four months of last year also looked QUITE promising, before sales slowed down during the rest of the year to actually show a net decline in the number of home sales in 2017 as compared to 2016. So -- get excited -- slowly? Cautiously?  Sellers seem to be able to hold firm on their price a bit more this year than -- oh, I don't know -- any of the past 10 years!? Yes, that is true. Sellers negotiated anywhere between 2% and 4% off of their last list price over the past 10 years -- but so far in 2018, they have only negotiated 1% off of their last list price!  What comes next, you might ask? Well -- we generally look at the pace of contracts to have an idea of what home sales might look like in the coming month or two. So -- what do we see now? Well, curiously, this January through April 431 properties went under contract -- and -- last January through April 431 properties went under contract. So -- yes -- it seems possible that the HOT months of home sales in May and June might be seen again this year.  One of the reasons why there has been an overall decline in home sales (when looking at the past 12 moths compared to the previous 12 months) is because of declining inventory levels. There are currently 21% fewer homes on the market as compared to one year ago -- EVEN THOUGH we have seen a mini Spring surge in listings over the past few months.  And finally -- those interest rates. They seem to be on the rise, woah, quite a bit! We have seen interest rates rise three quarters of one percent over the past nine-ish months. What's next? Will we push past 4.61% and start approaching 5%? Some say so. I don't think we will, but I have been wrong plenty of times over the past 5+ years about trends in mortgage interest rates. OK -- I'll stop there for now. Again, you can download the full report as a PDF, read the entire report with commentary online, or keep reading my blog in the coming days for further commentary. AND -- if you're thinking of buying or selling soon --- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

What homes are NOT being built? |

|

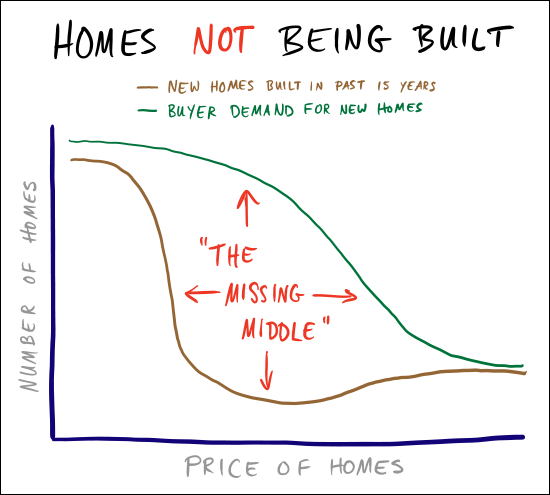

The graph above is not based on any actual data -- it's based on my experience of our local market, and conversations with a variety of buyers over the past few years. It seems that most of what has been built as new housing stock in this area over the past 15 years has either been townhouses -- or high end homes. This has left quite a gap in the middle of the market, where there is a LOT of buyer demand, but where there is NOT a lot of new housing stock to help meet this demand. How and when will this change? What will these buyers buy if they can't buy a home in that middle of the market price range? | |

Home Sales and Prices Rising, Time on Market Falling |

|

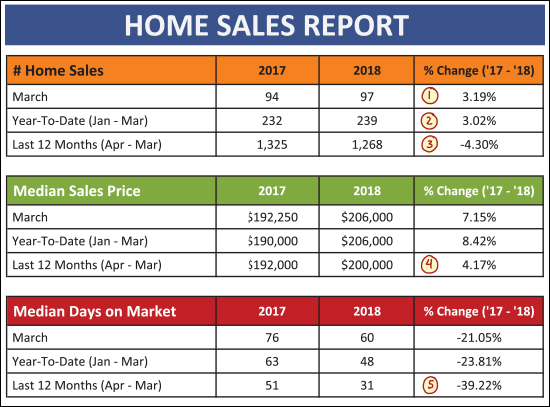

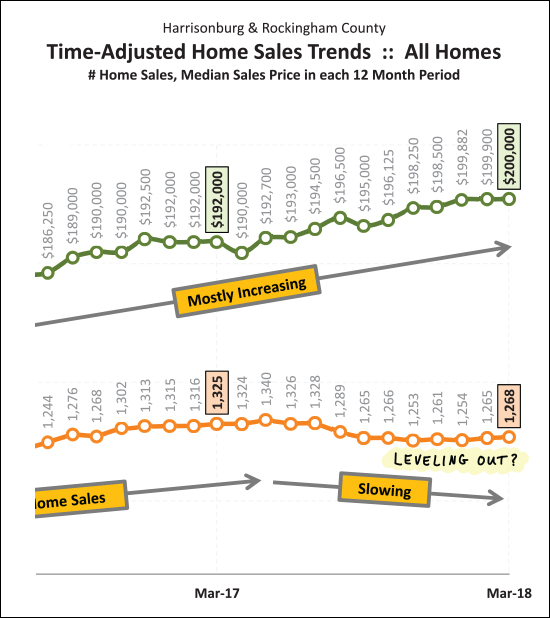

Find out about this newly listed custom-built home with amazing views: 973SmithAvenue.com. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market...  Now, let's dive into some of the latest data from our local real estate market....  As shown above, most market indicators are quite positive....

Two important items to note above....

One last tidbit....

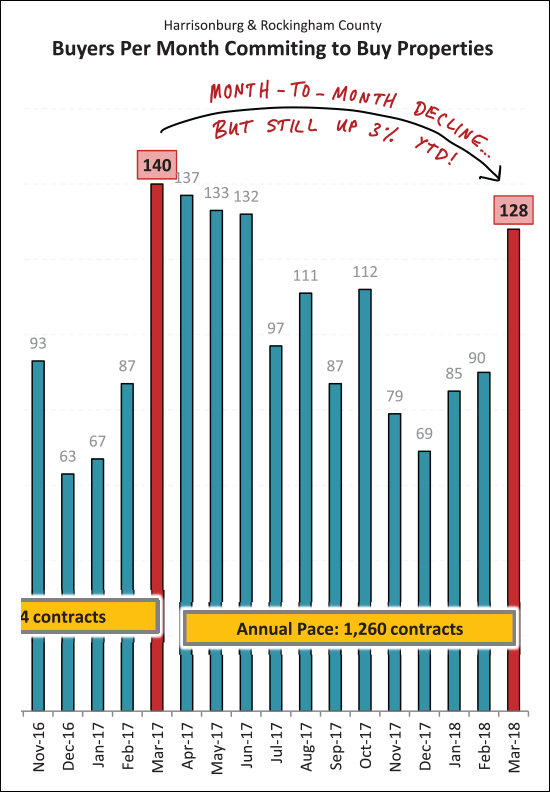

As shown above -- contract activity declined slightly in March 2018 -- but -- wait for it -- year-to-date (Jan-Mar) contract activity is still 3% higher than last year. So -- perhaps we will still have a reasonably strong month of closed sales in April and May after all. OK -- I'll stop there for now. Again, you can download the full report as a PDF, read the entire report with commentary online, or keep reading my blog in the coming days for further commentary. AND -- if you're thinking of buying or selling soon --- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... Enjoy this cold-again, hot-again month of April! | |

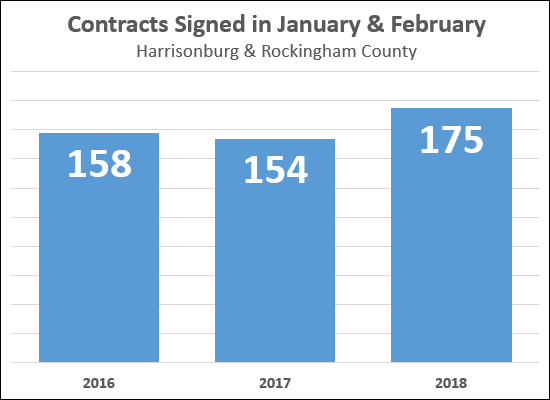

14% Increase in Home Buyers Signing Contracts in January and February |

|

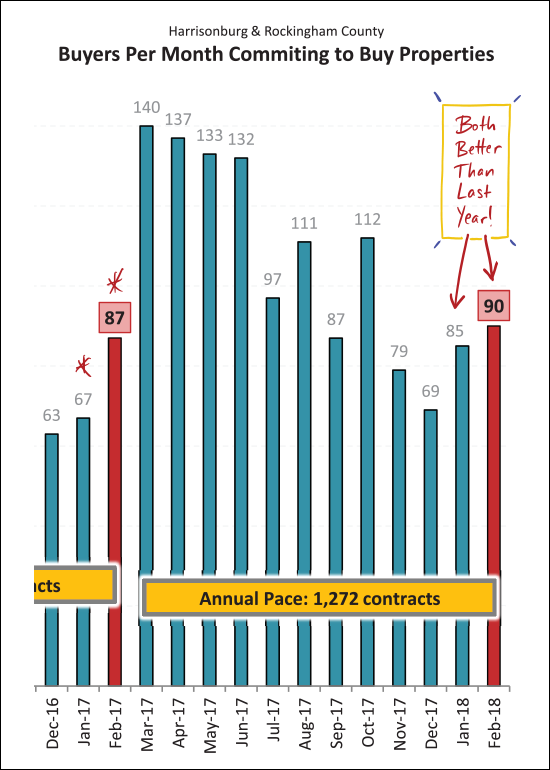

Mortgage interest rates are edging up again, as you may have heard. The average 30 year fixed rate at the end of February was 4.4% -- up from 3.9% just three months prior. Could this (slight) rise in the cost of financing your home be affecting the pace at which buyers are signing contracts? Possibly. It seems that 14% more buyers signed contracts this January and February as compared to last year during the same timeframe. This is a likely indicator that we'll see stronger months of closed sales in March and April. Then, the questions will be....

Let's hope for yes and no, in that order. | |

Local Real Estate Market Starts to Pop in February 2018 |

|

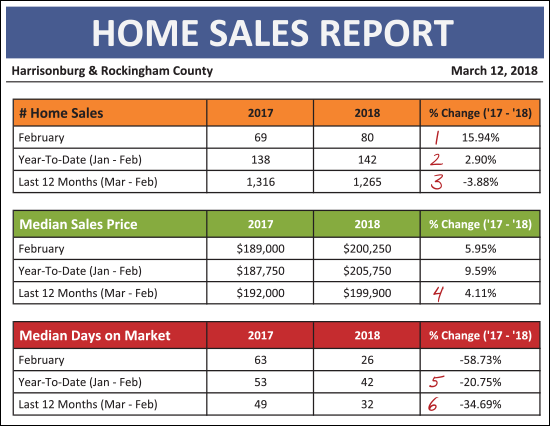

Find out about this newly listed (today!) City home at 1173PortlandDrive.com. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market...  OK -- now, let's dig into some of the main market metrics....  As shown above....

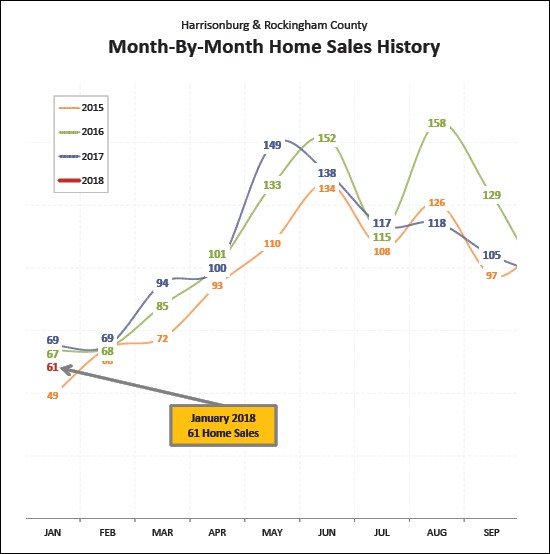

January 2018 wasn't the best January in the past few years, though it wasn't the worst either. It was in the middle of the pack, as shown above. February, however, was a strong month of sales -- jumping out ahead past the past three months of February. It seems likely we'll see between 90 and 100 home sales in March.

The graph above is actually a bit of a warning against too much exuberance over the BEST January-February combo we've seen in any recent year. Because, look carefully at last year -- you'll note that 2017 home sales were ahead of 2016 all the way through the end of July. So, for the first seven months of the year, it looked like we were poised to break even more records for the number of home sales in this area. And then in August and September of last year, we fell behind, and never caught back up. So -- it is exciting to see record numbers of sales in the combined first two months of this year -- but it in no way means that we'll see an actual increase in annual sales by the time December 31 rolls around.

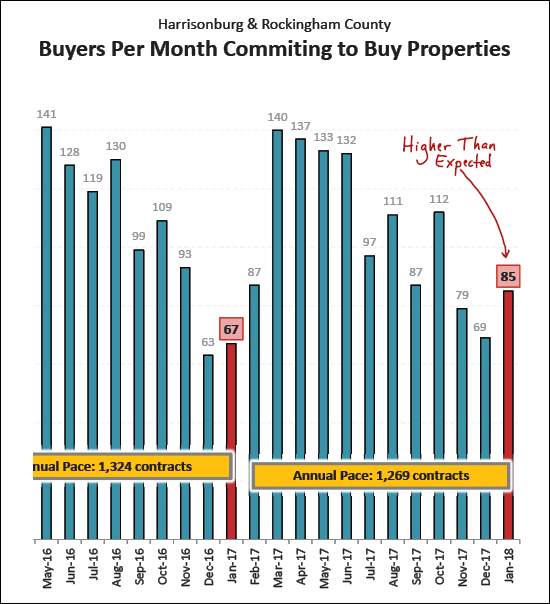

Having now brought you down to earth, I'll pump you up again. :-) The 85 and then 90 contracts seen in January/February of 2018 is a nice increase from last January/February when we saw 67 and then 87 contracts. So -- the faster (closed) sales pace may at least continue into March, and maybe April given the contracts signed to date.

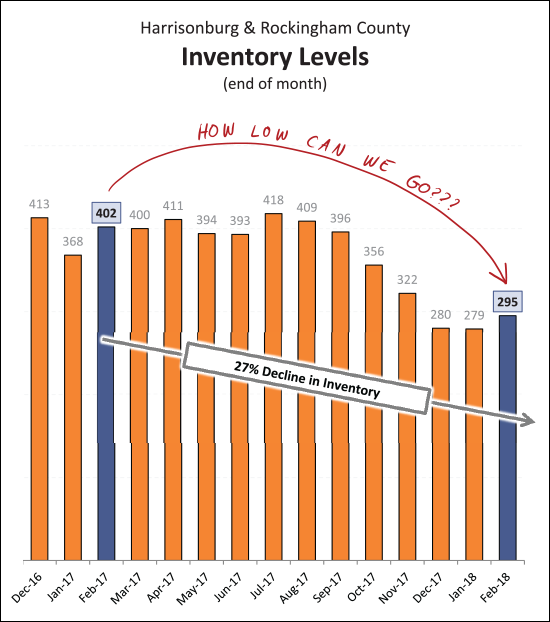

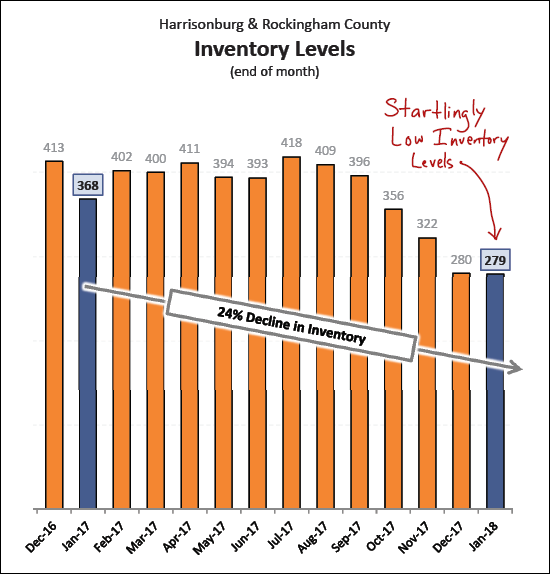

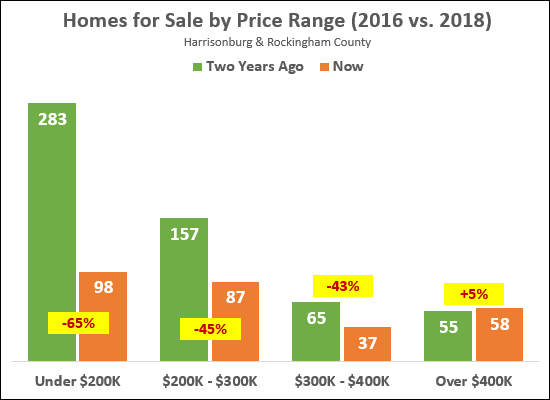

Oh yes, and don't forget about those sinking inventory levels. The decline in home sales we saw in our local market in 2017 is considered by many to have been at least partially caused by consistent declines in the number of homes listed for sale. We have seen inventory levels drop for the past few years -- and the 27% decline from 402 homes to 295 homes over the past 12 months certainly does not help provide enough homes for an increasing pool of buyers to purchase. We should (??!??) see an increase in these inventory levels as we get into the Spring market -- but that theoretical increase never substantially materialized last year.

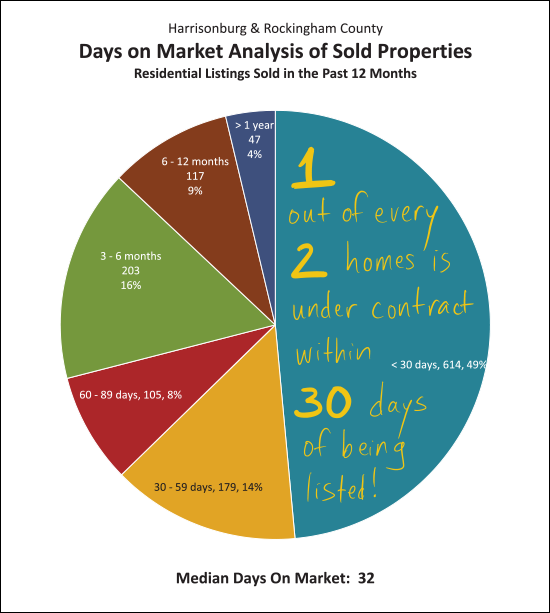

All of these market trends are tied up together, intertwined and interdependent upon each other. Here is another. One out of every two homes that sold in the past year (ok -- I rounded -- 49% if you need to know) went under contract within 30 days of being listed for sale. This low inventory environment is causing buyers to be extremely fast to view and then consider homes as they are listed for sale. OK -- I'll stop there for now. Again, you can download the full report as a PDF, read the entire report with commentary online, or keep reading my blog in the coming days for further commentary. AND -- if you're thinking of buying or selling soon --- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... Happy March! | |

Approaching March, A Different Look For Our Local Housing Market |

|

This is a bit of a different look for our local housing market. Ignoring last year, there have always been between 500 and 900 homes for sale in Harrisonburg and Rockingham County when entering into March -- the very early edge of the Spring real estate market. Last year -- that number felt low -- only 402 homes on the market in early March. This year -- low doesn't even describe it -- there are only 279 homes on the market right now. There is bound to be a surge of buyers hoping to contract on homes this March, April, May and June. What will they find as they enter into our local housing market? Very few houses for sale. And lots of competition from other buyers!!! | |

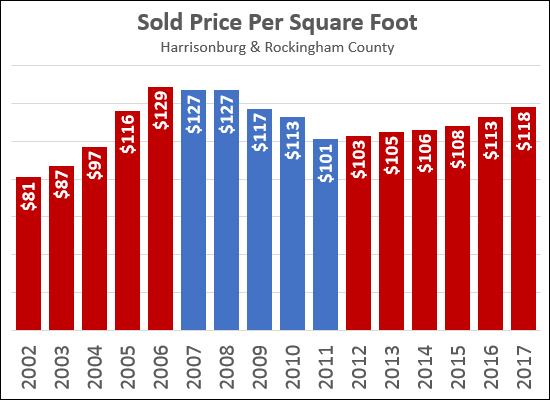

Median Price Per Square Foot Keeps On Rising |

|

In addition to watching how the median sales price changes over time, it can be quite insightful to see how the median price per square foot of sold homes changes over time. The graph above tracks the median price per square foot of single family homes (not townhouses, duplexes or condos) in Harrisonburg and Rockingham County over the past 15 years. Price per square foot increased 59% between 2002 and 2006 during the housing boom, but then fell 22% between 2006 and 2011 as the market cooled back off. Since that time, however, we have seen a slow and steady increase in this metric -- from $101/SF in 2011 to $118/SF last year -- which marks a 17% increase over the past six years. I do not expect that we will see any drastic increases in this metric in the next few years, though an increasing number of buyers (more demand) and significantly fewer sellers (less supply) does make you wonder if we will start to see more rapid increases in sales prices, and thus in price per square foot. ALSO OF NOTE -- this metric is most helpful in understanding value trends over time -- not in calculating the value of one particular property. This median price per square foot is the mid point of many very different homes -- new homes, old homes, homes with garages, homes without garages, homes with basements, homes without basements, homes with acreage, homes on small lots, etc. A median price per square foot can be more helpful in understanding the potential value (or value range) of a single property if we pull that median value based on a smaller data set of more properties more similar to the single property. | |

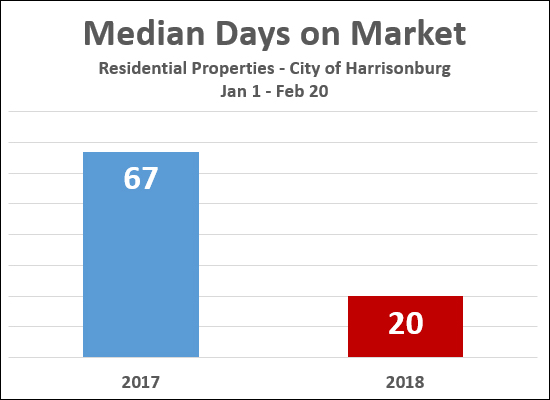

City Homes Selling Three Times Faster This Year Than Last |

|

Here is a somewhat startling statistic.... Looking at the start to last year (Jan 1 - Feb 20) the homes that sold (went under contract) in the City of Harrisonburg did so with a median "days on market" of 67 days. This year during the same timeframe (Jan 1 - Feb 20) the homes that sold (went under contract) in the City of Harrisonburg did so with a median "days on market" of 20 days. So -- homes are selling (more than!) three times faster than they were last year. Wow! And -- a few more homes are selling.... Contracts between Jan 1 and Feb 20:

Buckle up! It seems like it might be a fast paced market for much of 2018. Low inventory levels and rising interest rates certainly are contributing to this. | |

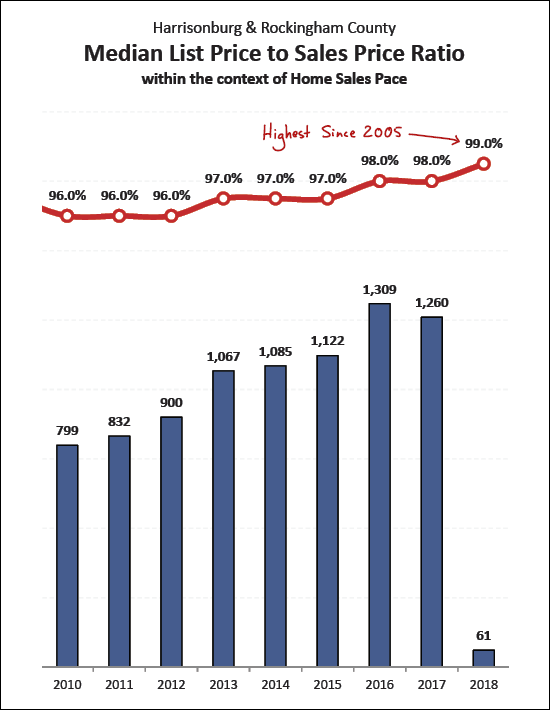

Are Sellers Negotiating Less On Price? |

|

This graph above shows the median list price to sales price ratio (red line) over the past 15 years as compared to the overall pace of home sales. At the peak of the housing boom (2004-2006) sellers were able to obtain a median of 99% of their asking price --- up from a median of 97.7% in 2001 before the pace of home sales started escalating. Then, when the pace of home sales slowed (through 2010) this metric dropped to 96%, where it stayed for three years. Sellers started selling for slightly more in 2013-2015 when they could obtain 97% of their list price. This increased to 98% in 2016, held steady in 2017, and is flirting with 99% in 2018. Of note -- the 99% figure in 2018 is based on only one month of data - January 2018. Stay tuned to see how this adjusts as we continue through 2018. | |

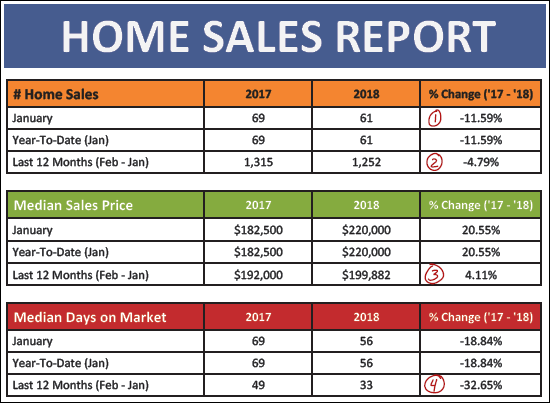

Local Home Sales Off To Slightly Slow Start In 2018 |

|

Find out more about this newly built home in Lakewood Estates at 1644CumberlandDrive.com. I just published my most recent monthly market report, and as usual, you can read on for an overview, download the full report as a PDF, read the entire report with commentary online, or tune in to my monthly video overview of our local housing market...  OK -- now, let's take a look a few of the main indicators for our local housing market....  As shown above....

As shown above, January 2018 home sales were right in the middle of the pack as contextualized by the previous three years. And in some ways, we should expect to see around 70 home sales next month -- however....

Contract activity in January 2018 was much stronger than could have been expected. Buyers (and sellers) signed 85 contracts in January -- as compared to only 67 last January. Thus, it is reasonable expect we'll probably see somewhat of a bump in home sales in February.

And perhaps that is why so many homes are selling so quickly. Almost half of the homes that have sold in the past year have gone under contract within 30 days of coming on the market! OK -- I'll stop there for now. Again, you can download the full report as a PDF, read the entire report with commentary online, or keep reading my blog in the coming days for further commentary. If you're thinking of buying or selling soon --- SELLERS -- even though it is a seller's market in many price ranges right now, you must still focus on price, condition and marketing. For further reading on buying or selling in this area, check out.... | |

Will Single Family Home Sales Ever Return to 2016 Peak? |

|

Apparently, 2016 was a special year for single family home sales in Harrisonburg and Rockingham County. After three years straight (2013, 2014, 2015) of seeing a very consistent number of single family homes in the City and County (813-819) there was a 20% increase in 2016 to 978 home sales! Then, in 2017 -- sales of single family homes fell 10% to 884 sales. Hmmm..... This was likely at least partially an inventory issue....

And inventory levels got even worse during 2017....

All that is to say that I would be shocked if we saw more than 978 home sales in 2018. I think we may have peaked in 2016 -- and we might not return to that peak for some time. Perhaps some home builders need to start creating new single family home supply in this area?? | |

When Will Home Buying Activity Start in Earnest? |

|

It is no surprise that buying activity (signing contracts, not closings) slows down over the Winter. As shown above -- an average of 72 buyers sign contracts in January, which then jumps up to 90 in February, and then an even larger jump in March to an average of 130/month. So, we're going to say the March is when we first seem a big jump in buyer activity. For that reason, many sellers wait until March (or even April) to put their homes on the market -- though the Spring market brings more competition from other sellers in addition to meaning that we'll start to see more buyers. Of note -- staying relatively true to form, there have been 75 contracts signed thus far in January 2018. Who knows, maybe we'll come out slightly ahead? | |

Which price range of homes have been hit the hardest with reduced inventory levels? |

|

Clearly, the under $200K market is extremely tight right now -- with a sharp (65%) decline over the past two years. Some of this is the lack of availability of this housing because more people want to buy these homes than sellers want to sell them -- and some is a result of increases in property values over the past two years, resulting in some "just under $200K" homes becoming "just over $200K" homes and falling into the next price bracket. As shown above, there has also been a significant (45%, 43%) drop in housing inventory levels between $200K-$300K and $300K-$400K. The only stable price range has been the "over $400K" price range where there are just about the same number of homes for sale now (58) as there were two years ago (55). I expect that inventory levels under $200K will drop even lower over the next 12 months You can find out more about the Harrisonburg and Rockingham County real estate market by visiting....  | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings