| Newer Posts | Older Posts |

If High Mortgage Interest Rates Having You Looking At Renting Instead Of Buying, Unfortunately You Will Also Find High Rental Rates!?! |

|

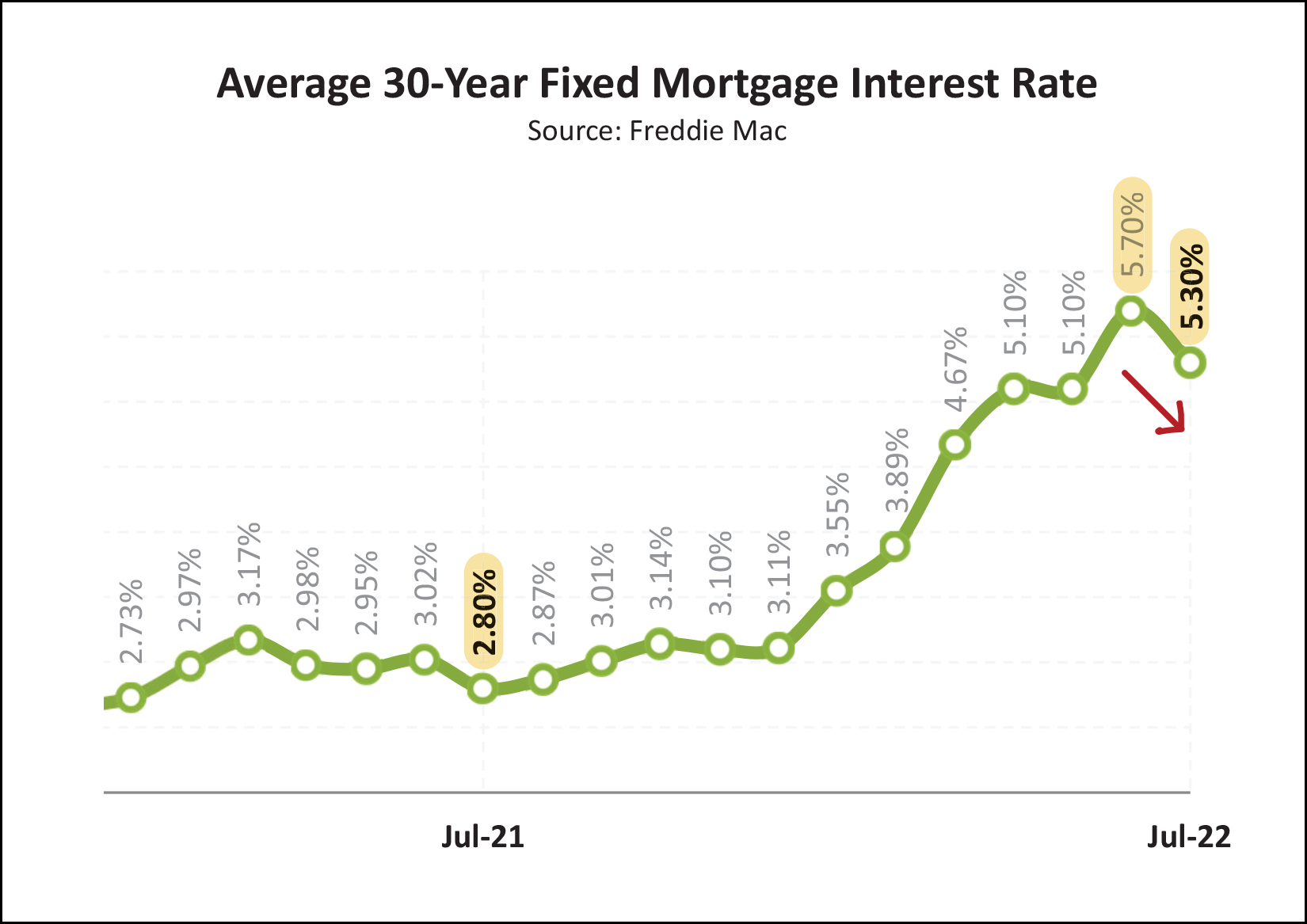

Some (many?) would be home buyers are discovering that mortgage interest rates are making their potential monthly housing costs much higher than anticipated. Just a year ago, the mortgage interest rate was 2.8% for a 30 year fixed rate mortgage and now it's 5.3%. Combine higher mortgage interest rates with higher home values and today's buyers find much higher mortgage payments... A Year Ago... $225,000 = 2021 Median Sales Price of Townhomes, Duplexes and Condos $1,038 = monthly payment assuming 10% downpayment, 2.8% mortgage interest rate Today... $241,767 = 2022 Median Sales Price of Townhomes, Duplexes and Condos $1,431 = monthly payment assuming 10% downpayment, 5.3% mortgage interest rate So, the potential monthly housing cost of buying a median priced townhouse has increased from $1,038 to $1,431 in the past year. This might cause some (many?) would be buyers to explore renting instead. But... rental rates have also increased significantly over the past year! I don't have a large data set to support this statement, but generally speaking, townhouses that might have rented for around $1,100 a year ago are now often renting for $1,350 or more. So, perhaps rental rates aren't increasing as quickly as monthly housing costs if you purchase a townhouse... but these higher rental rates mean that choosing to rent instead buy doesn't provide quite as much relief of your housing costs as you might imagine. | |

Median Price of Single Family Home in Harrisonburg and Rockingham County Rises 67% Over 10 Years, 140% Over 20 Years |

|

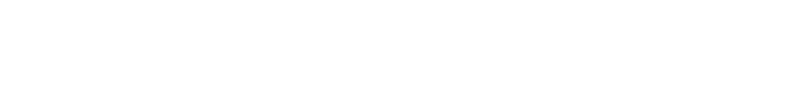

Single family home values have not always increased in Harrisonburg and Rockingham County over the past 20 years... but they have mostly increased, and they have significantly increased over a 10 year and 20 year time horizon. 10 Years Ago = Median Sales Price of $195,000 Now = Median Sales Price of $325,990 67% Increase over 10 Years 20 Years Ago = Median Sales Price of $136,000 Now = Median Sales Price of $325,990 140% Increase Over 20 Years Over these past 20 years, the median sales price increased during 12 years, decreased during four years and had a change (+/-) of less than 2% during four years. The average increase per year in the median sales price in Harrisonburg and Rockingham County was 4.5%. | |

33 Townhouses Proposed To Be Built In The City of Harrisonburg, At The Entrance To Cobblers Valley |

|

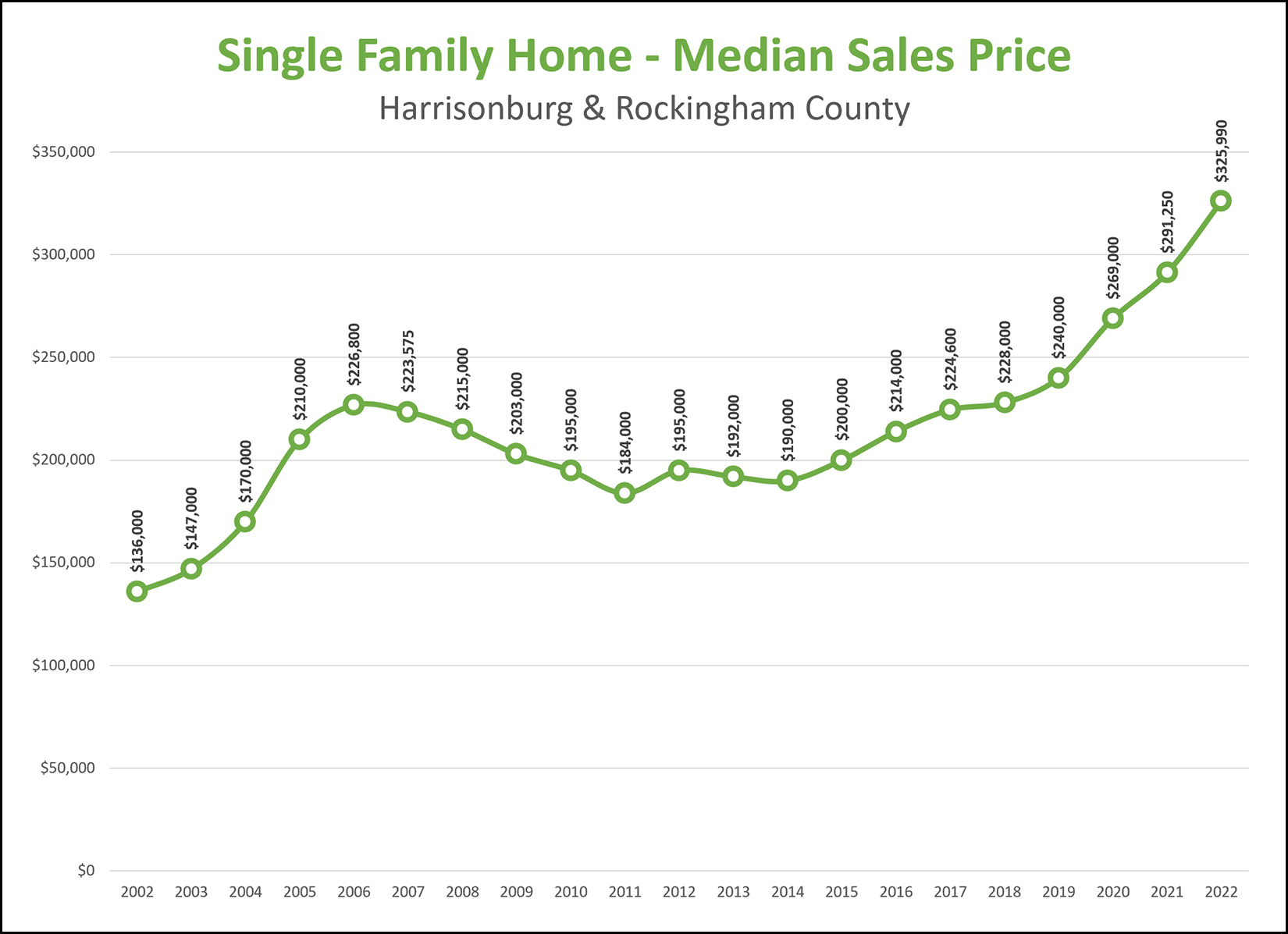

Ryan Homes is currently building a neighborhood called Cobblers Valley in Rockingham County now 33 townhomes are proposed to be built in the City, at the entrance to Cobblers Valley. The property is already zoned for townhouses but the developer is requesting a subdivision ordinance variance to allow the townhouse lots to be built on a private street instead of a public street. You can download the reference documents from the Planning Commission's summary of the request here. This is the proposed layout of this small section of townhouses in the City...  | |

Harrisonburg Housing Market Still Showing Strength Despite Some Signs Of Slowing |

|

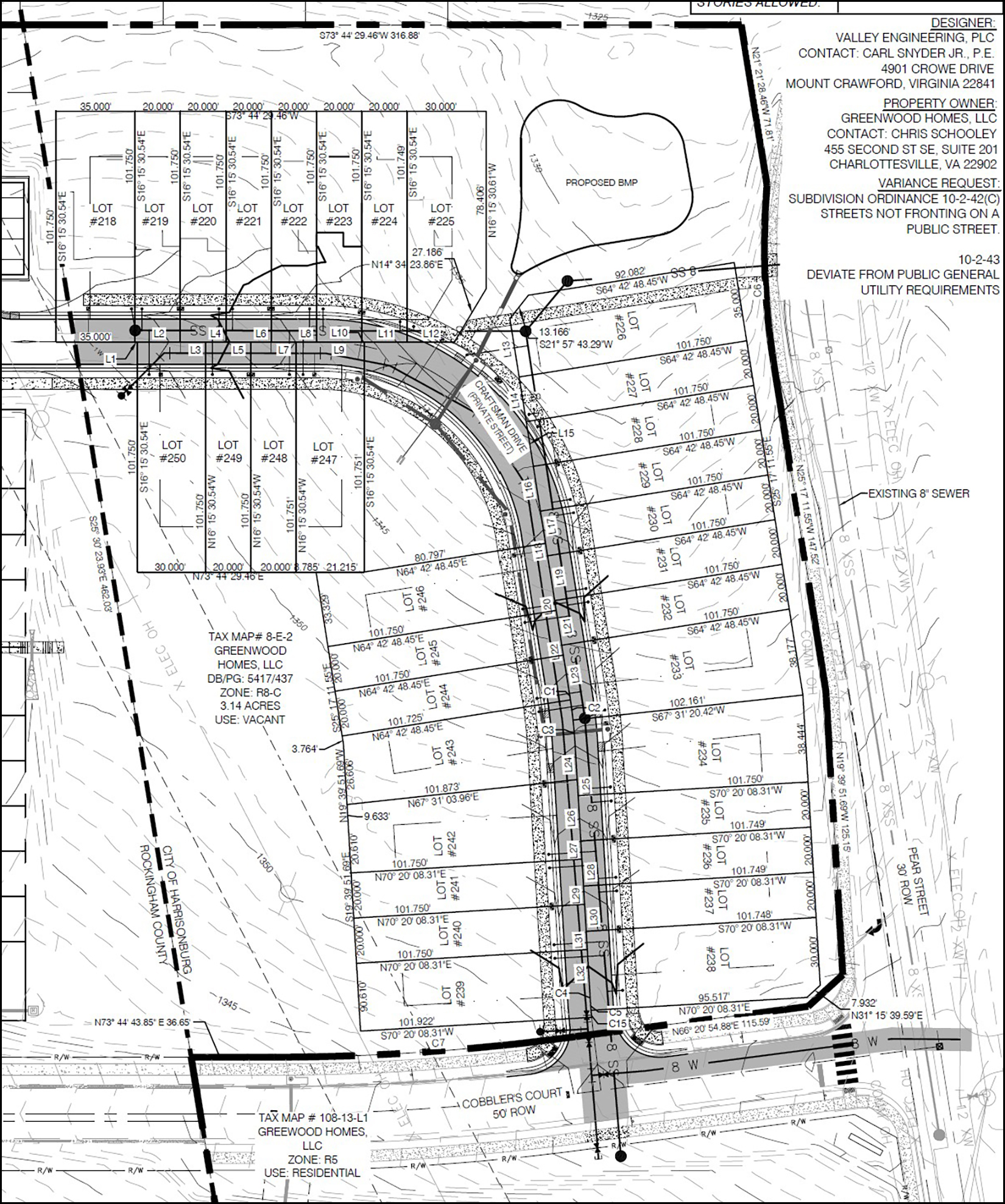

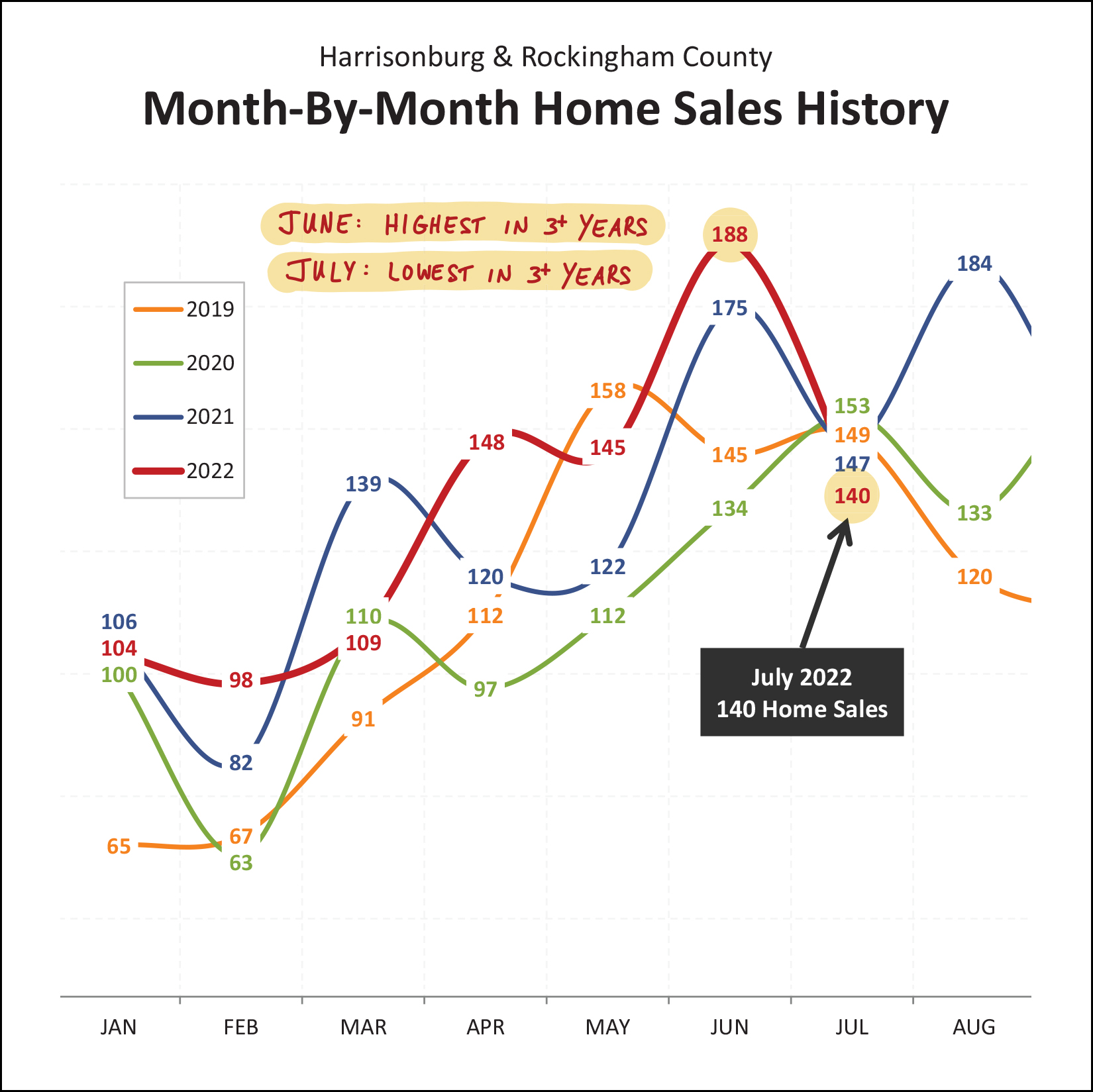

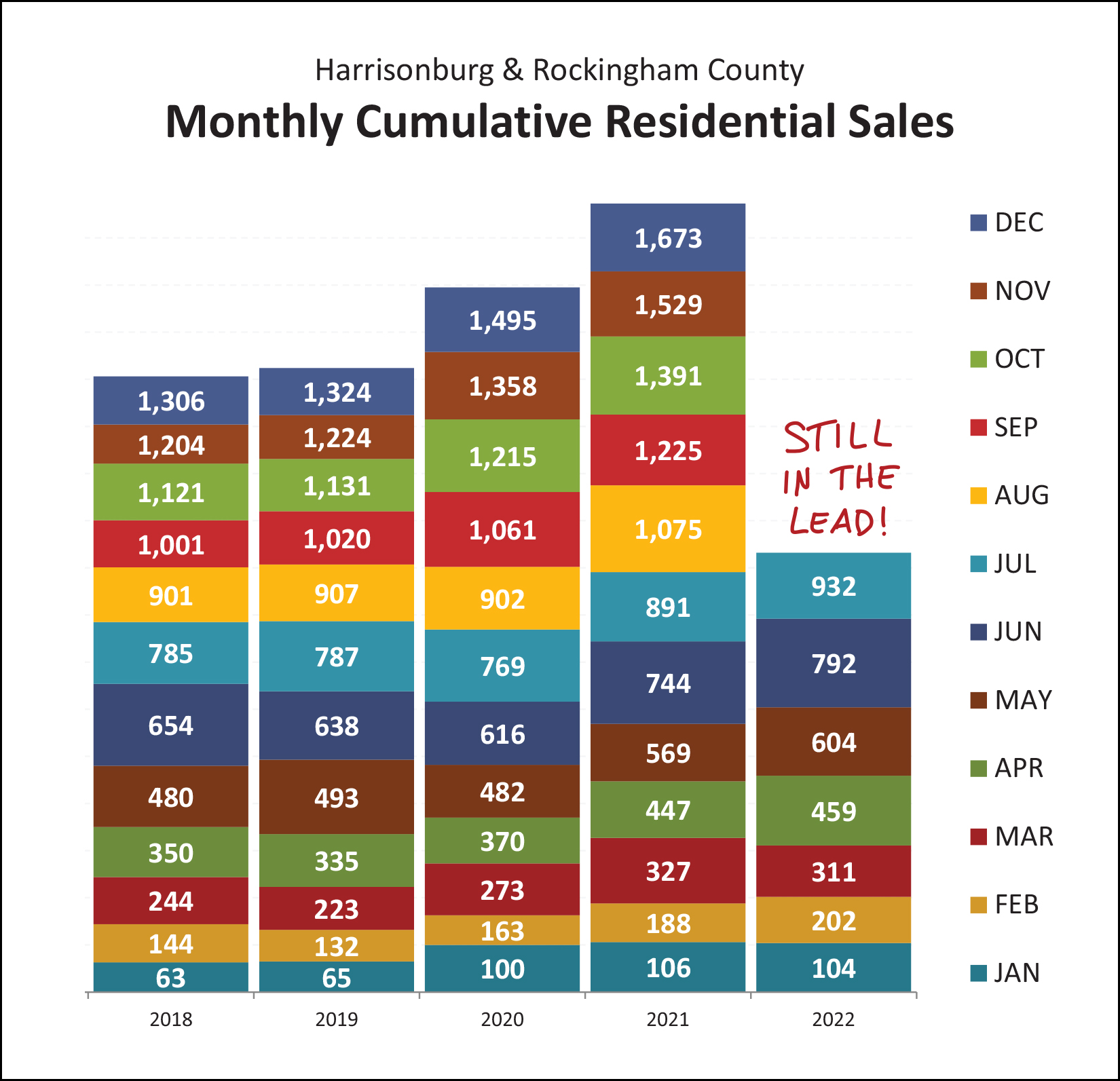

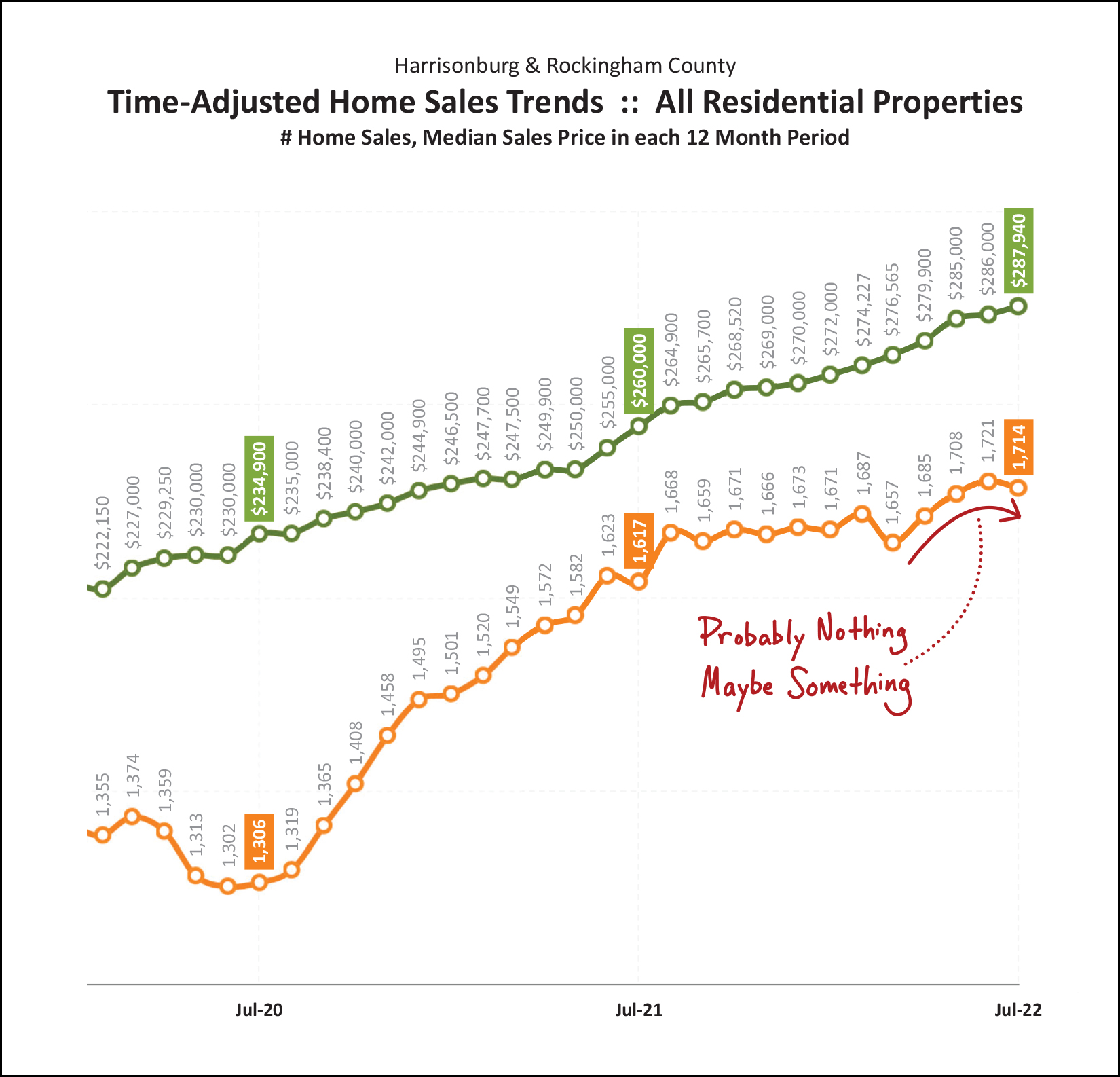

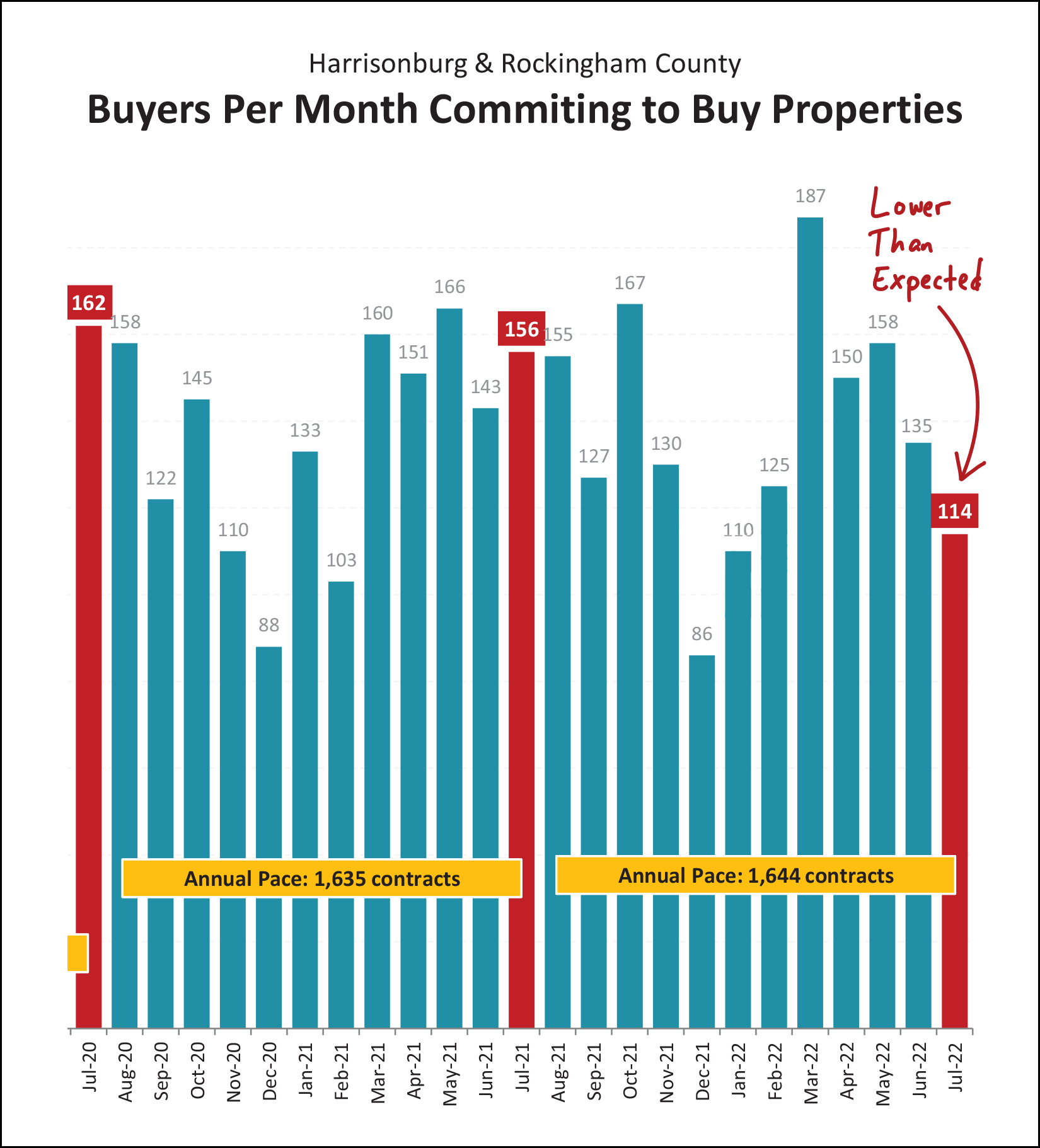

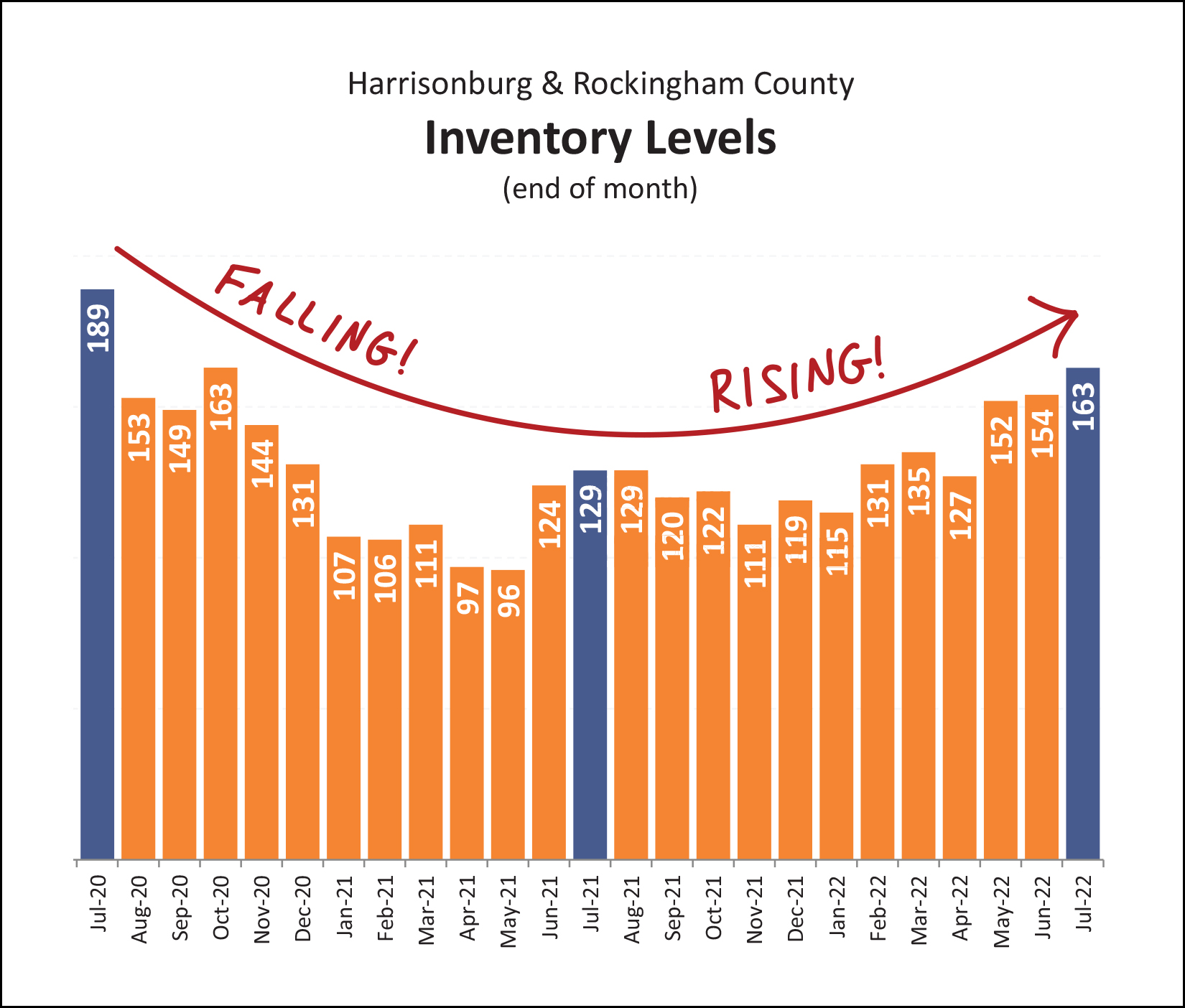

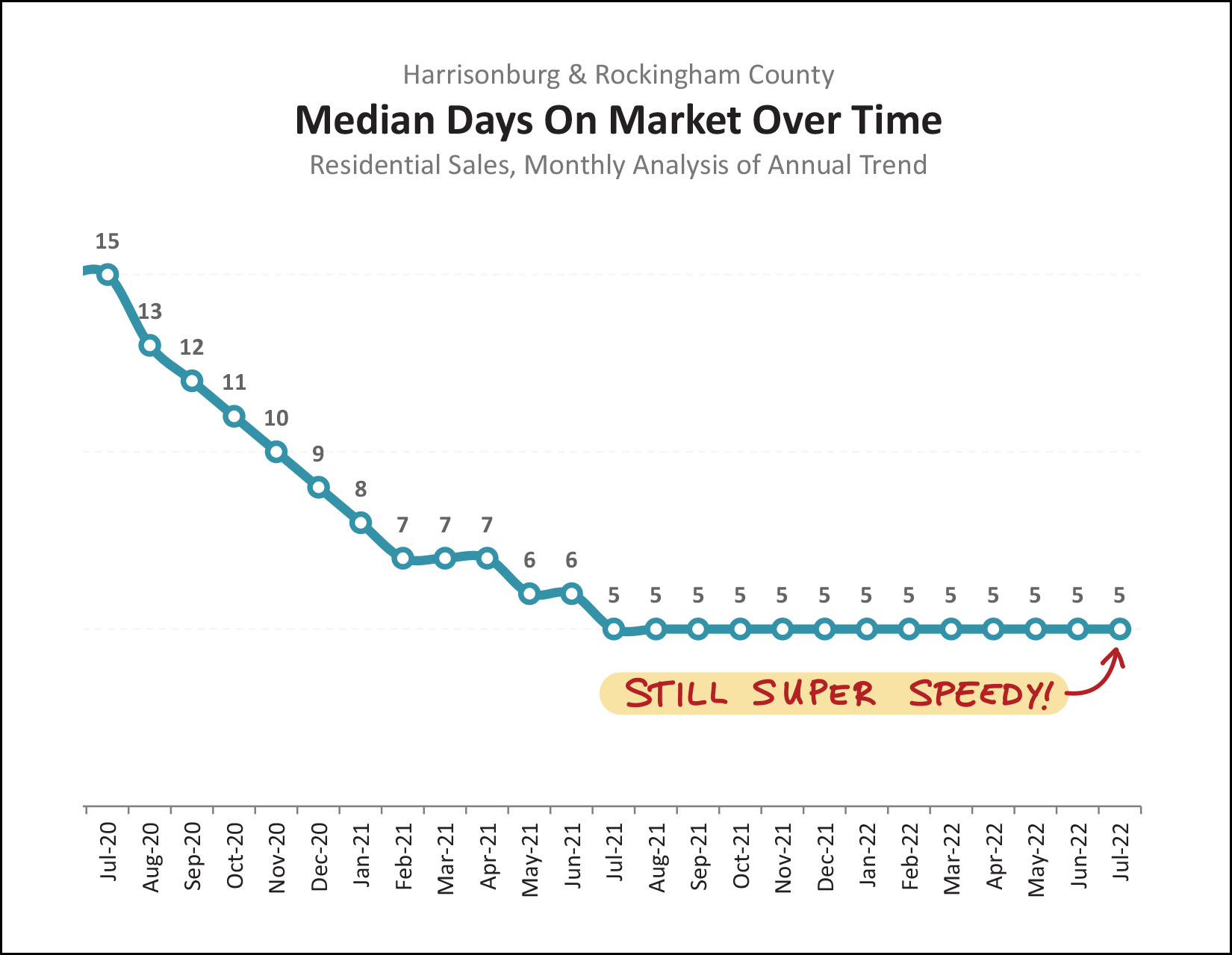

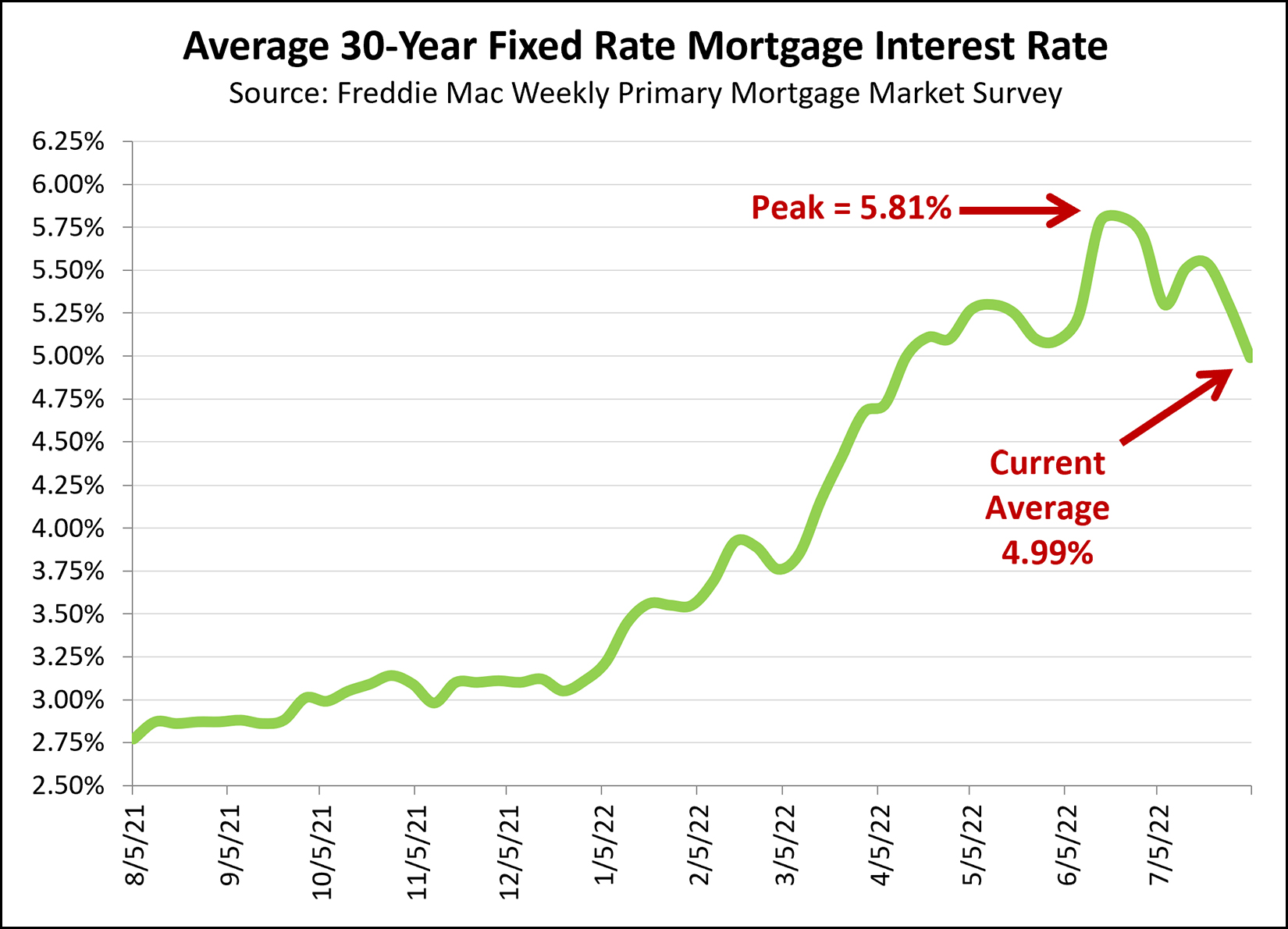

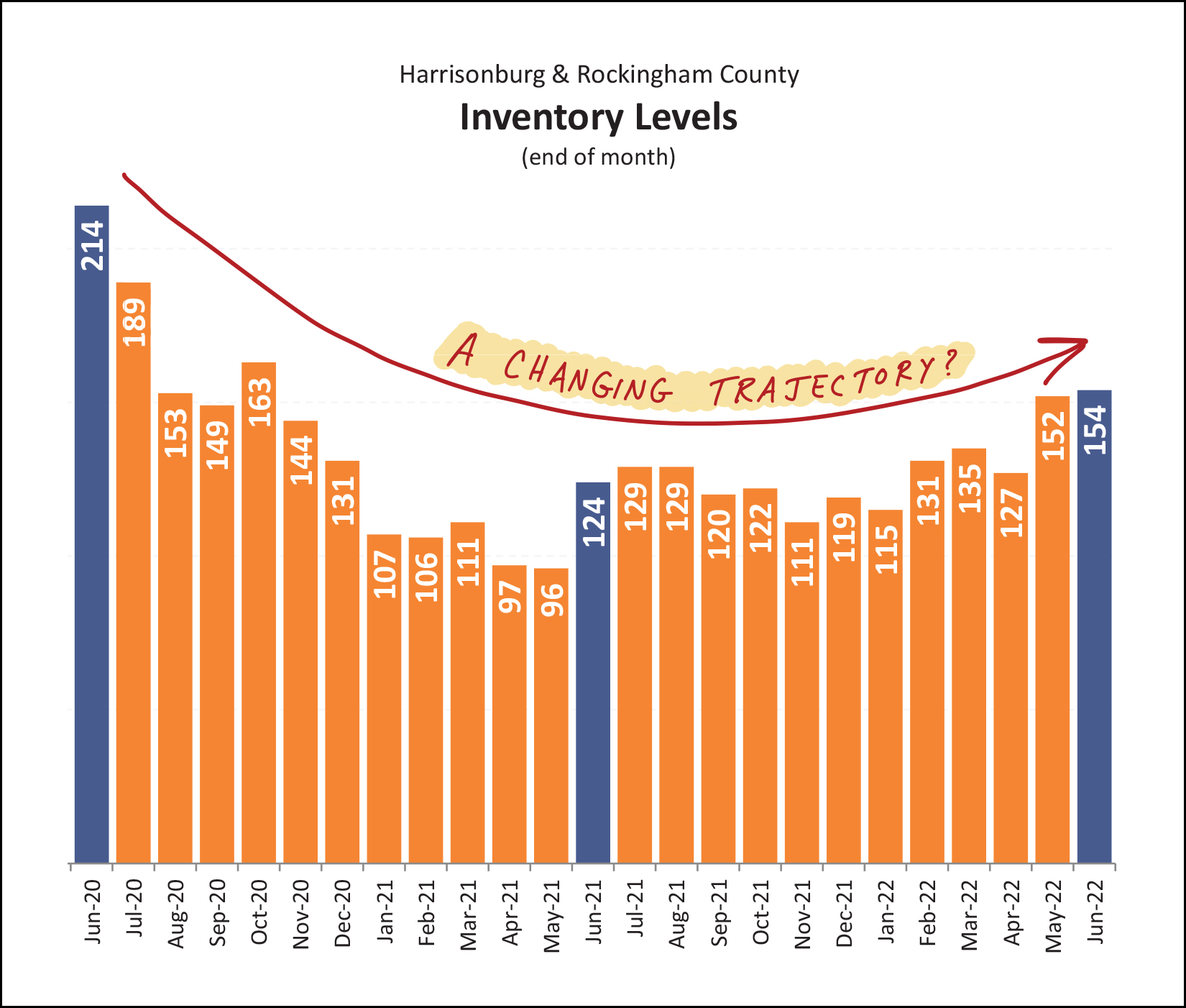

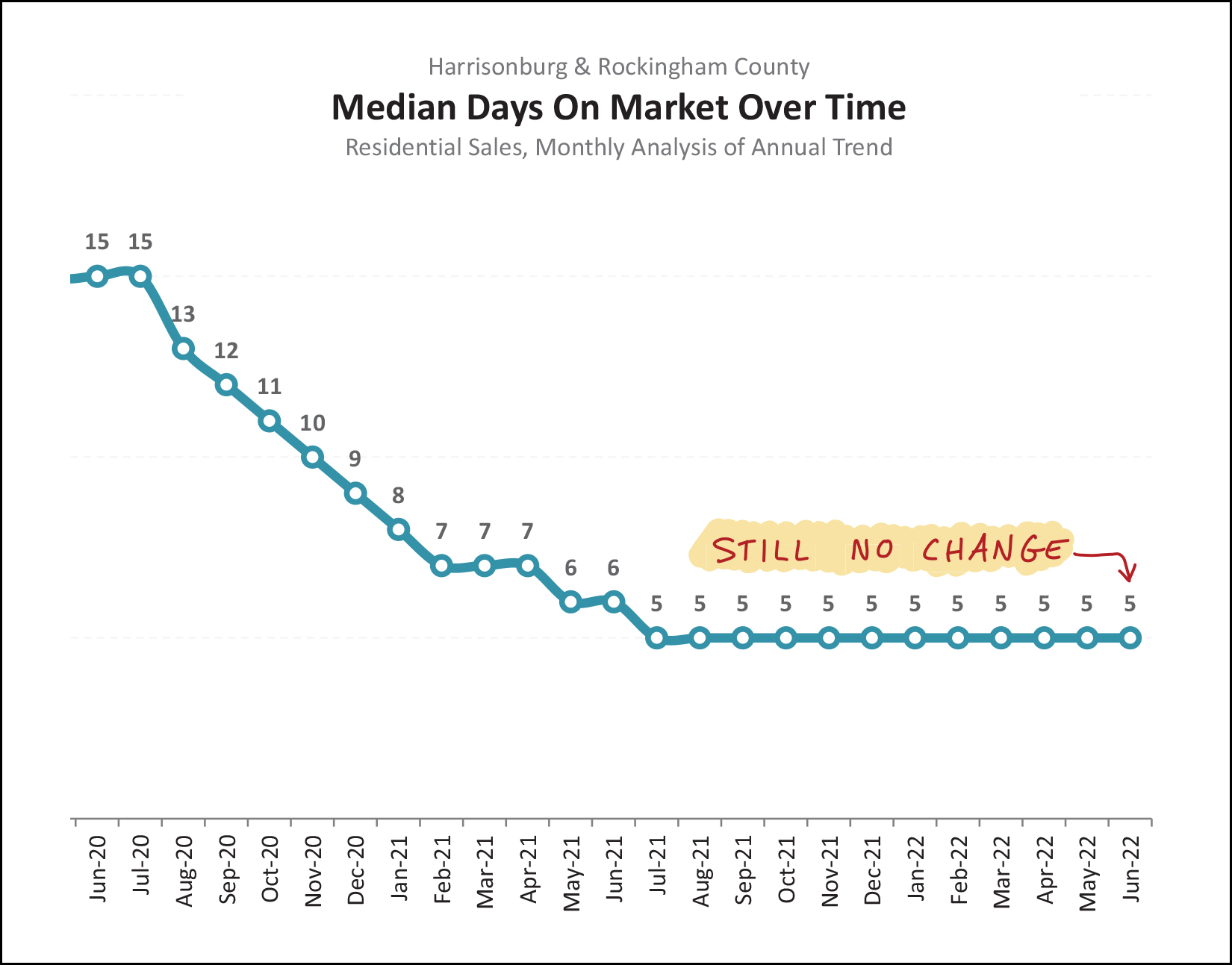

Happy Thursday afternoon, friends! As any student or teacher will tell you, summer is almost over! čśó I hope that you and your family had a wonderful summer and that you had at least one opportunity to sneak away... to the beach, the lake, a tropical island, a music festival, a rural AirBNB, a national forest, a campsite or a new city! One of my favorite spots to sneak away is Deep Creek Lake, MD...  But getting back to business... The beautiful house on the cover of this month's market report is located at 3161 Henry Grant Hill in Preston Lake and you can find out more about this spacious home here. Each month I have a giveaway, of sorts, for readers of this market report. This month's giveaway requires a special sort of market report reader... one who also likes to run... a lot. I enjoy running and frequently participate in races put on by VA Momentum, and thus I was excited to hear they are putting on a half marathon this fall. So... this month, you can enter for a chance to win a free registration to the Harrisonburg Half Marathon, to be held on October 15, 2022! Find out more about the half marathon here. Enter to win the free race registration here. Email me and tell me I'm crazy for thinking you'd run a half marathon here. čśë And now, after all that, let's dig in and see what is happening in our local housing market...  As noted in my headline above, there are some signs that our local real estate market might be slowing down a bit. This very well may mean, though, that it slows down from going 90 MPH in a 60 MPH zone to going 75 MPH in a 60 MPH zone. The latest numbers, as shown above, indicate that... [1] July home sales were slower (140) than last July. We'll see this again on a graph in a moment. [2] Thus far this year we have seen 932 home sales, which is 4.6% more than last year. We had a record number of home sales last year, so a further increase this year is... record breaking. [3] The median sales price in July was 5% higher than last July. [4] When looking at the first seven months of the year, the median sales price has risen 11.7% in Harrisonburg and Rockingham County. So... most of these indicators are quite positive, rosy, exuberant, except the slight slow down in July. This is seen a bit more clearly here...  Above, you'll note that in June 2022 we had an astronomical 188 home sales... higher than any of the past three months of June. But, then, July. In July 2022 we only saw 140 home sales, which is less than any of the past three months of July. Some might point out that looking at a single month of housing data, in a small-ish housing market, can make you think something is happening, when nothing is happening. I agree that can happen. If we smash the two months together, we find that there have been 328 home sales this June and July... compared to 322 home sales last June and July. So... maybe things are "just fine" right now, and maybe things are starting to slow, slightly.  As shown above, if things are starting to slow... they're only just starting to do so, and they're doing so verrrrry slowly. The 932 home sales seen thus far in 2022 is more than we have seen in the first seven months of any of the prior four years. Perhaps when we get another month or two into the year we will see things level out a bit in 2022?  Slicing and dicing the data once more, this graph (above) measures (each month) the number of sales in a 12 month period as shown with an orange line, and the 12-month median sales price (measured each month) shown with the green line. As you can see at the end of the orange line, it's possible that the overall pace of home sales is slowing a bit... but then again, maybe not. We'll need to watch this for a few more months to know for sure. Speaking of the future, our most reliable indicator of future sales is... current contracts...  This one surprised me a bit. We usually see around 150 to 160 contracts signed in any given month of July. But... not this July. There were only 114 contracts signed in July 2022, which is much lower than usual, and likely means we will see a lower than usual month of closed sales in August and/or September. This falls to the category of "things that make you say hmmmm...." and this will definitely be a trend we will need to continue to monitor. Somewhat fewer buyers signing contracts might mean that inventory levels would rise a bit...  Indeed, we are starting to see inventory levels creep up a bit. There are now 163 homes for sale in Harrisonburg and Rockingham County, which is a bit more than the 129 we saw at this time a year ago. It is important to note, though that these "slightly higher" inventory levels are really still VERY, VERY low. Many or most buyers in most price ranges and locations still have very few options of homes to buy right now. So, yes, inventory levels are creeping up a bit, but don't think that's necessarily giving buyers more choices... or giving buyers more leverage... at least not at this point. So... a few fewer sales... fewer contracts... slightly higher inventory levels... that probably means that homes aren't selling as quickly, right!? Well...  Looking at the 12 months of home sales prior to July 2021 (a year ago) the median "days on market" for those sales was only five days. That metric has remained constant for 13 months now... and today, when looking backwards by a year, the median "days on market" is still just five days. Narrowing the focus even more, to just the 114 properties that went under contract in July 2022, we might expect to see a higher "days on market" -- and we do -- but only barely. The median days on market during July 2022 was... six days. So, homes are still going under contract very, very quickly! Finally, maybe this (below) is a contributing factor to the slight slow down over the past 30 to 45 days?  A year ago, the mortgage interest rate was 2.8%. Six months ago it was 3.55%. During June and July it was as high as 5.81%, though it has started to decline now. It is quite possible that these higher mortgage rates have caused some buyers to not be able to buy any longer... or that it has at least partially dampened their enthusiasm. So, there you have it, friends. The housing market in Harrisonburg and Rockingham County is still showing great signs of strength with more sales than ever, at higher prices than ever. But... we might be seeing a slight slow down in home sales (from record high levels) and we might be seeing a slight increase in inventory levels (from record low levels). We'll have to give it a few more months to see how things continue to develop in the local market to know for sure. Until then... If selling a home is on your mind, let's talk sooner rather than later. Before you know it, we'll be halfway through fall and headed into winter. If you are planning to buy a home soon, let's start watching for new listings of interest and going to see them quickly when they hit the market. If I can be of any help with the above (selling, buying) please call/text me at 540-578-0102 or email me here so we can talk about working together to navigate your way through the ever changing Harrisonburg real estate market. | |

Anecdotally, A Smaller Percentage of Showings Seem To Be Resulting In Offers These Days |

|

I don't have any data to back this up, but it seems that a smaller percentage of showings are result in offers right now. A year ago, 20 showings might have resulted in 5 to 10 offers. Today, 20 showings seems to be resulting in 2 to 3 offers. It's hard to know what exactly is driving this change... [1] Home prices are certainly higher now than they were a year ago, and maybe it's harder for buyers who look at houses to get excited about paying today's prices as compared to the prices a year ago? Though, a year ago, prices seemed pretty high to most folks as well... [2] Mortgage interest rates are certainly higher now than they were a year ago, and maybe buyers are excited about Home X at Price Y but when they run the numbers and determine Mortgage Payment Z their excitement cools? Though, they could have known that before they decided to go see the house... [3] The housing market was on fire a year ago with no signs of cooling off, whereas now some markets are seeing sales and/or prices level off or decline slightly. So, maybe buyers are a touch more hesitant to act today as compared to a year ago because there is some small amount of doubt of whether home prices will continue to accelerate upwards over the next few years? Though, a year ago, there was some doubt about whether prices would keep accelerating upwards because they had been increasing so quickly up until that time... So, it's hard to say why, but a somewhat smaller portion of buyers who go to view homes seem to be deciding to make an offer on those homes right now. Does this matter to sellers? Not necessarily. [1] Homes are still selling very quickly. [2] Homes are still selling at prices that are very favorable to sellers. [3] Sellers are still often having more than one offer to consider, even if they don't have ten offers. So, changes are afoot, but they aren't necessarily changes that are affecting the pace of sales or sales prices in our local market. | |

Some Home Sellers Optimize For Speed, Convenience or Certainty Instead Of Price |

|

What are you optimizing for?

As a home seller, you are always optimizing for something. PRICE - Maybe you are willing to wait as long as it takes to get the price that you want for your house. Even if it takes months longer than you had hoped and even if it means that you aren't able to continue on with other life transitions that you had planned, at least you go the price you wanted. TIME - Maybe it's important to you that you wrap up your home sale (have the house under contract) within a few days or weeks. If so, you might be willing to price your home a bit lower to maximize the possibility that you accomplish your timing goals. CONVENIENCE - Maybe your strategy for when you list your home and your pricing strategy all revolve around making it a seamless transition to your next home. You're willing to be flexible on timing and on pricing so long as it lets you accomplish your goals of buying that perfect next home. CERTAINTY - Some sellers don't mind working their way through inspection contingencies, but some would opt for a slightly lower priced offer without an inspection if that meant they would have certainty that the sale would move forward. | |

Happy Mortgage Interest Rate News As Average Rate Falls Below 5% Again |

|

Mortgage interest rates have been steadily climbing for most of the past six months -- peaking at 5.81%. But... in a bit of good news for buyers in today's housing market... the average mortgage interest rate (for a 30 year fixed rate mortgage) has fallen below 5% again... barely... to 4.99%. Just over a month ago with rates nearing 6%, some were thinking we were going to see them continue to rise to 6%, 7% or beyond. This moderation in rates is certainly helpful for home buyers looking to buy a home right now! | |

If You Can Buy A Home Without Selling, Get Your Ducks In A Row Sooner Rather Than Later |

|

It's hard to get a home seller to consider a home sale contingency these days. The market is still moving quite briskly, so why would a seller tie up their home in a contract with a buyer... who then has to go and sell their home!? Sometimes, though, a buyer can buy their next home before selling their current home. This allows said buyer to make an offer without a home sale contingency, and thus, have a shot at securing a contract on the home they hope to purchase. But... sometimes... being able to buy a home without selling requires a bit of research or planning or both... RESEARCH - If you are pretty sure you can buy without selling, don't wait to talk to your lender to confirm that until a house of interest comes on the market for sale. Talk to them now! Submit documentation to your lender to get to having a firm understanding of whether you can or cannot buy without selling... and get a copy of your pre-approval letter! PLANNING - Perhaps you have quite a bit of equity in your home... or perhaps it is entirely paid off! One option may be to take out an equity line on your current home to allow you to use those funds for a downpayment on the new house... and then pay off the equity line when you sell your current home. If you're looking for a good lender for getting pre-qualified or for exploring equity line options, let me know... | |

The Developer of Preston Lake Would Like To Build 139 Townhouses Behind Turner Ashby High School |

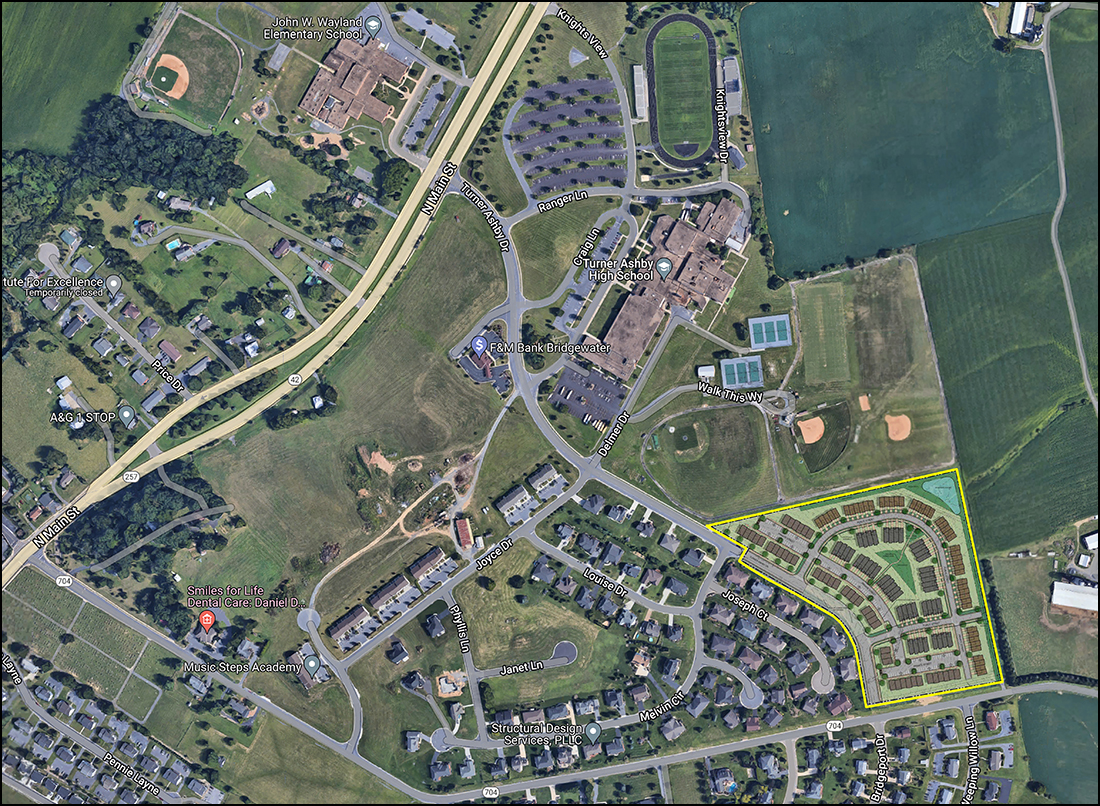

|

The developer of Preston Lake, Evergreen Homes, would like to build 139 townhouses behind Turner Ashby High School in the area outlined above. Bridgewater Town Council will review the proposal at their meeting in August. The potential townhouse development would be called The Glen at Cooks Creek and would be comprised of several different styles and sizes of townhouses. These townhouses would be built adjacent to Windsor West... and the land for these townhouses seems to currently be owned by the developer of Windsor West. Read a bit more this potential development over at the Daily News Record here. | |

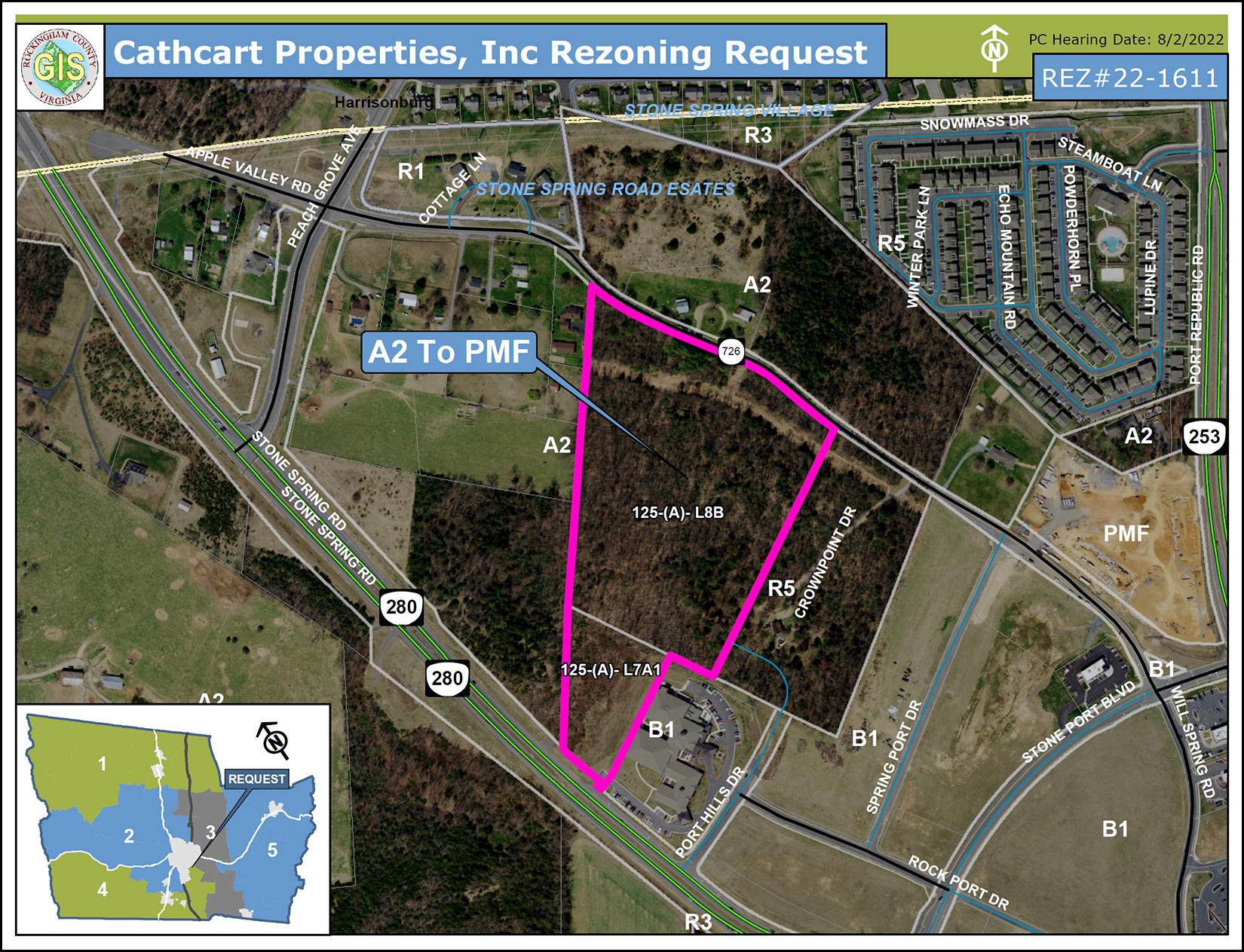

271 Apartments Proposed Between Stone Spring Road and Apple Valley Road |

|

Cathcart Properties Inc, a developer out of Charlottesville, is proposing a rezoning of 19.3 acres between Stone Spring Road and Apple Valley Road (as shown above) to allow for the development of up to 271 apartments in seven apartment buildings as shown below...  The potential unit breakdown per the site plan appears to include...

Per the developer's description of the proposed plan for The Wentworth we learn that the community will contain no more than 271 apartments and amenities are likely to include a clubhouse, pool, playground, dog park, multi-purpose court, bus stop, car wash and trash/recycling site. The Rockingham County Planning Commission will review this rezoning request at their meeting on August 2nd at 6:30 PM. Download the entire rezoning application packet here. | |

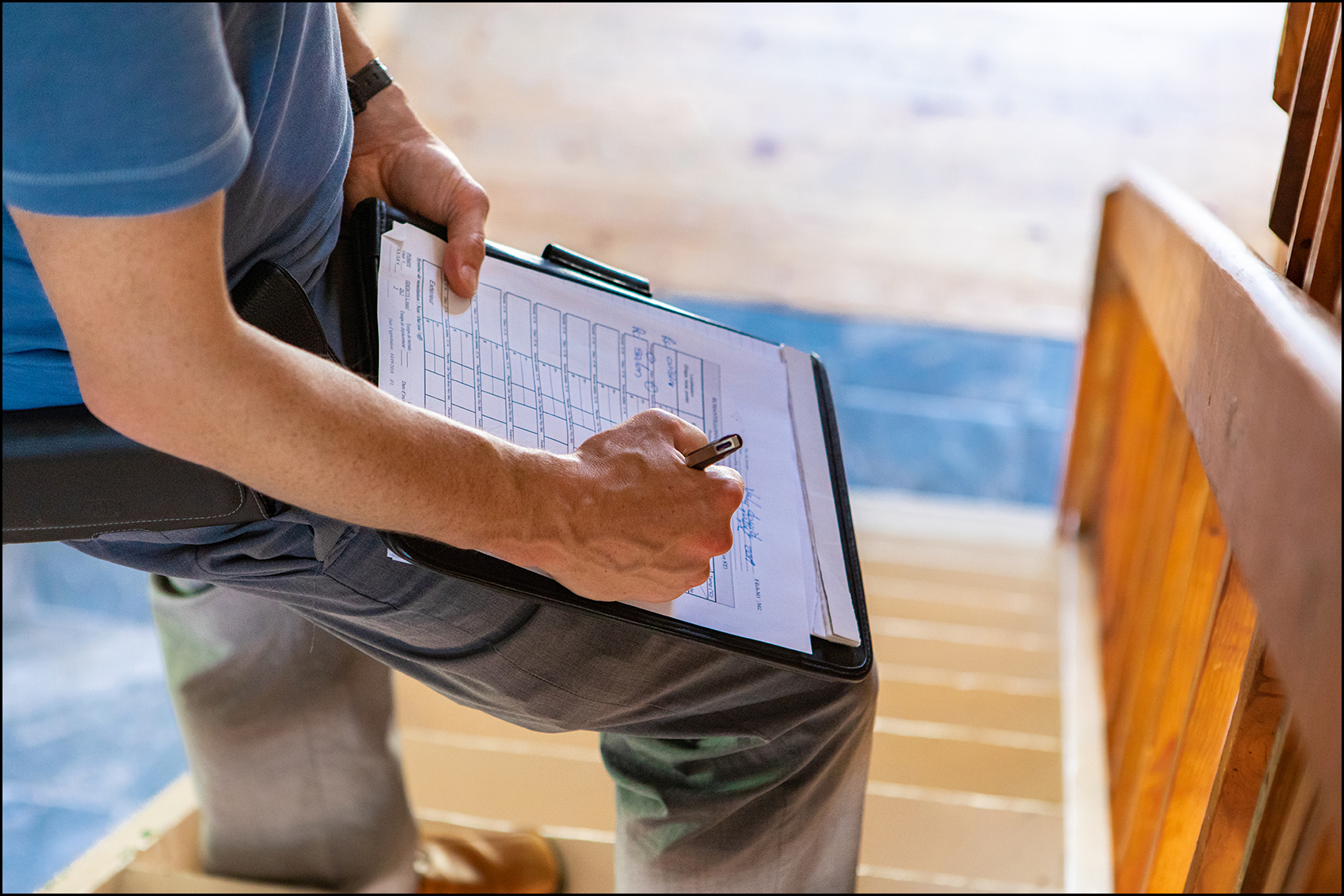

Home Inspections Are Likely To Become A Thing Again, And They Should |

|

Over the past two years I have told countless home sellers something along the following lines as they have made final preparations to sell their home... "That recent listing over in that neighborhood had five offers within the first week and none of those buyers included home inspection contingencies." "That townhouse just went under contract after receiving eight offers, and only one of the eight buyers was asking to be able to conduct a home inspection." As such, many home sellers over the past two years have not had to work their way through home inspection contingencies and the negotiations that sometimes take place after those inspections. And... my point today... most home buyers over the past two years have not had the option of conducting a home inspection during their purchase process. As our local real estate market starts transitioning into a market that is not quite as piping hot of a market as it has been for the past two years, we will very likely start to see more offers with home inspection contingencies. This is great news for buyers! A home purchase is a major financial decision both in the near term and the long term. You are paying a large amount of money for a home in which to live... but that home may very well need some items repaired or need some system maintenance or replacement in the near future. A home inspection allows a buyer to more clearly understand potential home maintenance costs over time by learning more about the condition of the components and systems of the house. As a side note, I am much more of a fan of home inspections being used by buyers to learn about a house and to propose slightly different contract terms if major issues are discovered -- more so than home inspections being used by buyers to try to renegotiate the deal just because they can threaten to walk away from the deal based on the inspection contingency. Home sellers today should be prepared for offers that may include inspection contingencies. Home buyers today should consider including inspection contingencies if they are not competing with multiple other buyers to secure a contract on a hot new listing. | |

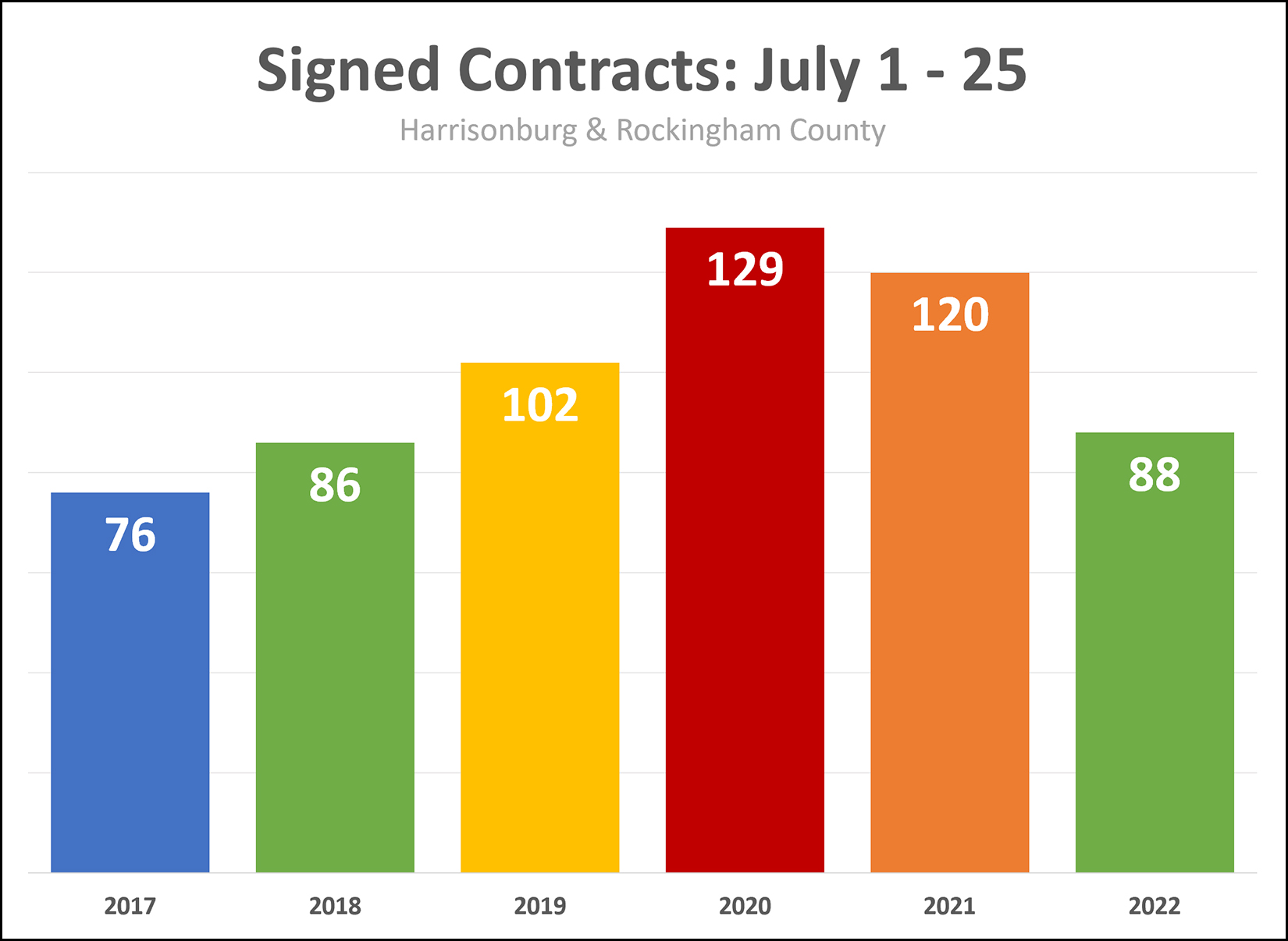

Contract Activity Slowing A Bit In July 2022? |

|

In the first 25 days of July 2022, we have seen 88 signed contracts. Some context and notes...

Is this a massive slow down or a one month anomaly? Only time will tell, but thus far, contract activity in July is certainly seeming slower that I would have expected. | |

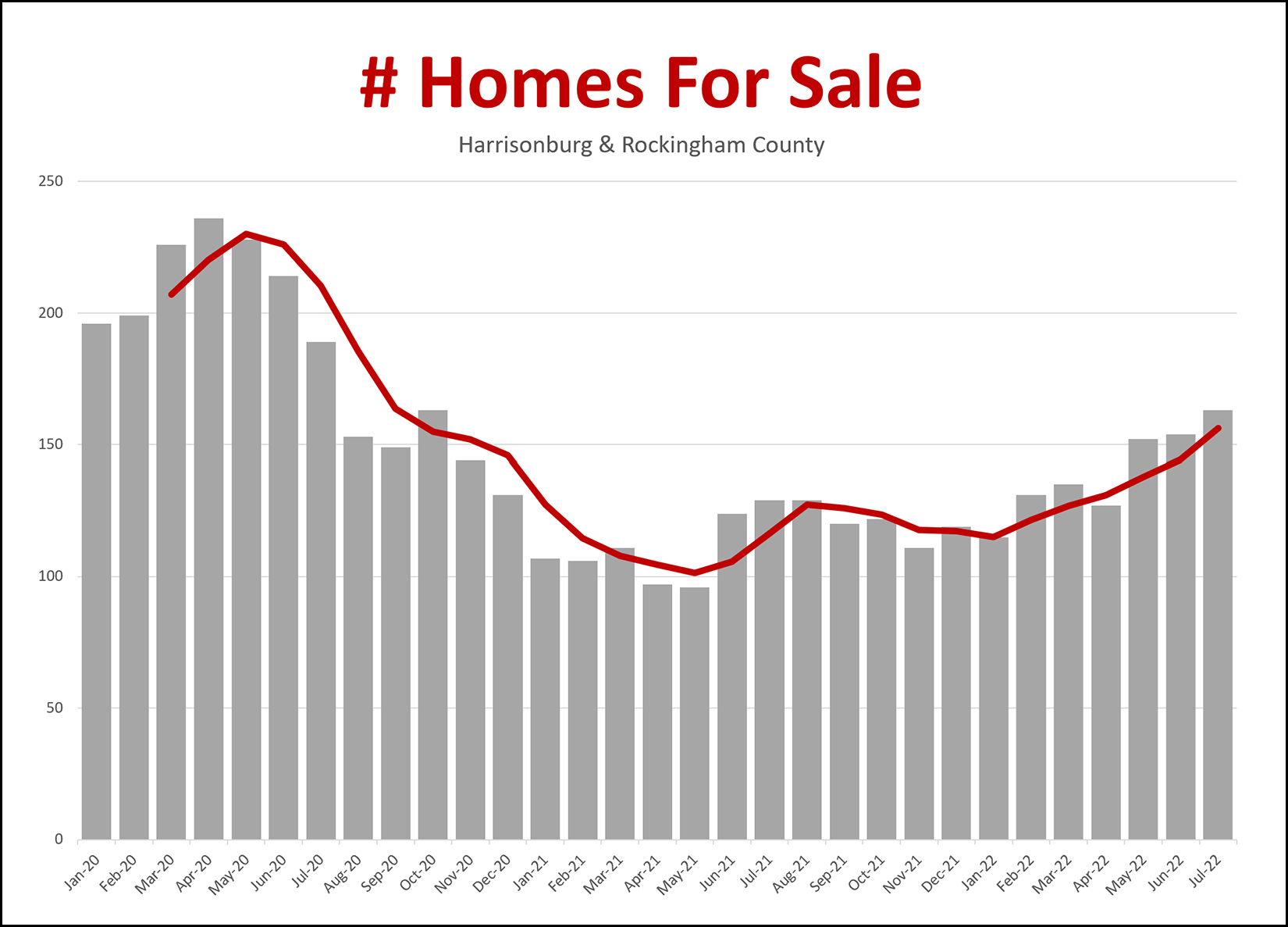

Inventory Levels Creeping Slowly Upward, To Higher Low Levels |

|

Inventory levels - the number of homes for sale at any given time - have been creeping upward for the past 6+ months. With 163 homes for sale, we are now seeing more homes for sale than we have seen at any time since late 2020. The gray bars above show the number of homes on the market at the end of each month. The red line above shows a moving three month average to show the overall trend more clearly. To put this in a bit of context though, these new highs are actually still pretty low... Homes for Sale In...

So, yes, July 2022 inventory levels are higher than a year ago... but are also much lower than any other recent July... | |

There Will Come A Time When Homes Will Not Sell Instantly, And That Is OK |

|

Over the past year, the median "days on market" has been five days in Harrisonburg and Rockingham County. That means that half of homes that sell are under contract in five or fewer days. That is fast. It's the fastest homes have ever sold in this market. Just three years ago, the median "days on market" was 23 days -- a bit over three weeks. That is also rather fast, but certainly not as fast as five days. And guess what folks, just as ridiculously low mortgage interest rates stuck around for a few years and then came to an end -- it is very likely that we will eventually see the time it takes to sell a home start to increase from this record median of five days. For example... in the past 30 days, the median days on market was seven days... yes, a full two days longer than that prolonged low of five days. If we do start to see the pace of homes selling starting to slow a bit... maybe from a median of five days on the market, to seven days, to (gasp!) a median of 10 days, here's what it might mean for our local market... [1] Home buyers will still need to look at homes quickly when they go on the market, but they might be able to sleep on the decision of whether or not to make an offer. [2] We might eventually see fewer multiple offer scenarios, at least in some price ranges. [3] Many homes (those in desirable locations, price ranges, etc.) will still sell very quickly, perhaps in five days, even if the overall market statistic increases. [4] Sellers will need to put up with showings for more than a few days. :-) One nice part about a fast moving market is that many home sellers only had to put up with home showings for a week or less - and that might start to change. There are plenty of additional *possible* implications of the pace of the market slowing. But rather than speculate as to what they will be, what they will mean, and when they will happen, I'll keep monitoring the data to see what is actually happening on the ground in our local market. Of note, related to median days on market (DOM) in our local market... Median DOM in the past 12 months = 5 days Median DOM in the past 30 days = 7 days Median DOM in the past 30 days for homes priced under $250K = 5 days So, even if the overall market slows down -- a smidge -- many segments of the overall market will likely still be moving quite quickly! | |

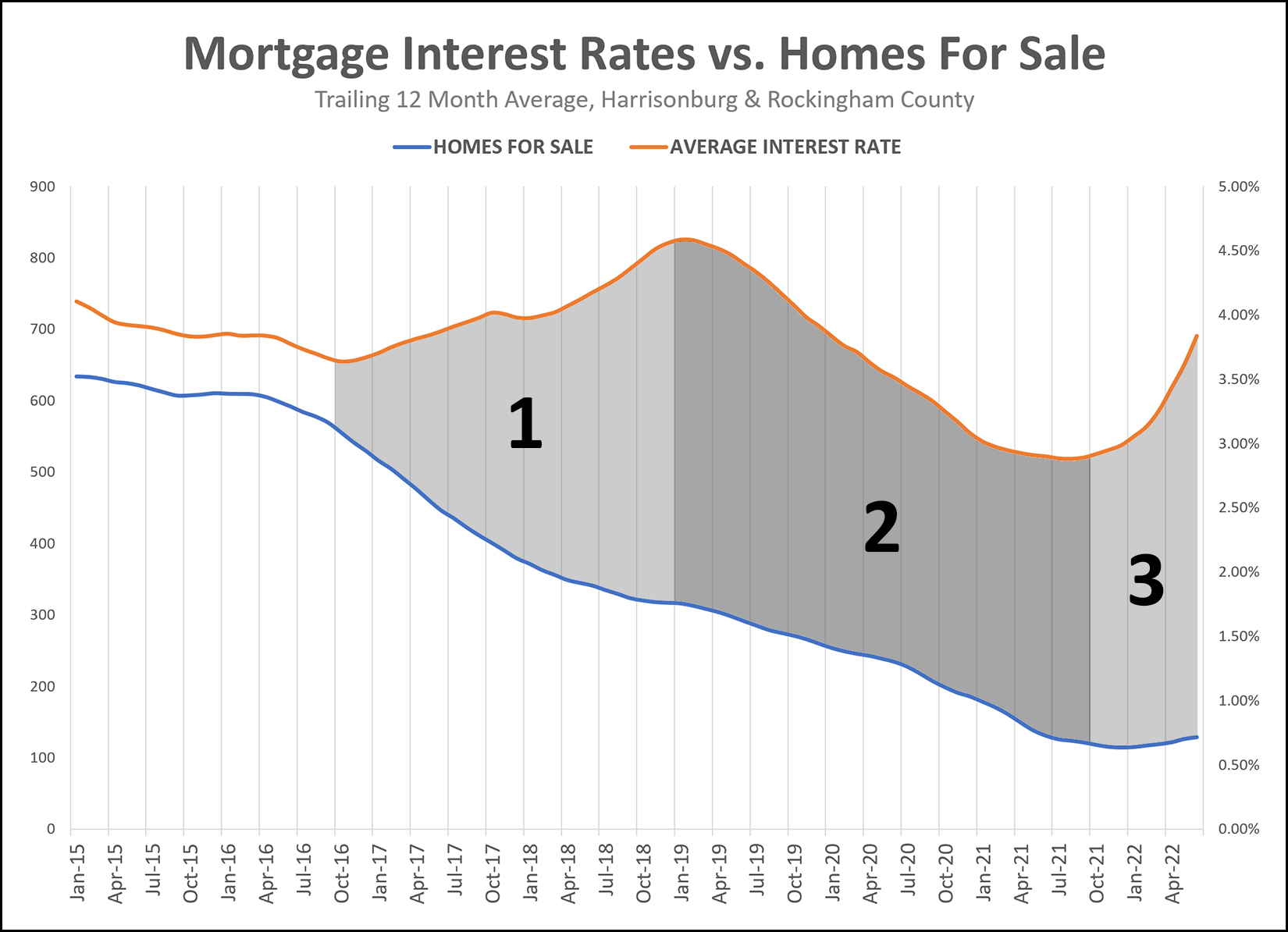

Do Inventory Levels Rise (and fall) With Mortgage Interest Rates? |

|

Q: Do Inventory Levels Rise (and fall) With Mortgage Interest Rates? A: Sometimes Interest rates are on the rise right now... and inventory levels are rising as well. Interest rates were falling for quite a few years just prior to 2021... and inventory levels also fell during that timeframe. So... do inventory levels just track right along with mortgage interest rates? Sometimes, but not always, it seems. Of note... The graph above shows a 12 month average of the number of homes for sale (blue line) and a 12 month average of a 30 year fixed rate mortgage interest rate (orange line). So, the last data point (June 2022) is showing the average number of homes for sale in the 12 months prior to and including June 2022... and the average mortgage interest rate in the 12 months prior to and including June 22. Looking back, then, to the beginning of 2015, we can see four general trends taking place, three of which I have labeled. [0] The unlabeled portion of the graph (2015-2016) showed very little upward or downward movement in inventory levels or interest rates. [1] Between 2016 and 2018 we saw interest rates rising, but inventory levels falling. This runs counter to the premise proposed above, that inventory levels rise and fall as interest rates do the same. [2] Between 2019 and 2021, indeed, interest rates declined, and inventory levels did as well. [3] Since late 2021 we have seen interest rates start to climb (and even faster and further in 2022) and inventory levels have started to climb as well. So... yes, there seems to be some connection between interest rates and inventory levels... at some times... but not always. The unspoken here, is the main connection between these two factors... which is home buyers. As interest rates decline, in theory there are more buyers, which would in theory, cause inventory levels to decline. As interest rates rise, in theory there are fewer buyers, which would in theory, cause inventory levels to rise. Beyond all of these theoretical connections and consequences, what does this mean for 2022 and 2023 in our local housing market? So long as interest rates are rising, there is a decent chance that inventory levels will rise somewhat as well, as some buyers won't be able to afford some houses any longer... or will choose to limit their home buying budget. The big question, of course, is whether it will be a four part chain reaction... [1] Interest Rates Rise [2] Fewer Buyers Buy Homes [3] Inventory Levels Rise [4] Prices Flatten Out or Fall Thus far in our local market, we are seeing... [1] Interest Rates Rising [2] More Buyers Buying (not fewer as predicted above) [3] Inventory Levels Rising (slightly, not significantly) [4] Prices Are Still Rising (not flattening out or falling as predicted above) Do keep in mind that every housing market trend you see in the national news may or may not actually be representative of what is happening in our local market. | |

The Local Real Estate Market Is Constantly Changing |

|

Over the past two years as home sales and home prices have rapidly accelerated upwards, we couldn't assume anything about pricing... We know - your neighbor's identical house sold three months ago for $350K. We assume - your house will sell for around $350K. And then - your house actually sells for $380K. Home prices were increasing so quickly that a recent sales price of $___ did not necessarily mean the next similar home would sell for that same price. And now, as the market seems to be slowing down a bit, we still can't assume anything about pricing... We know - your neighbor's identical house sold three months ago for $375K. We assume - your house will sell for around $375K. And then - your house might sell for $350K, $375K or $400K. These days... [1] There are certainly plenty of homes that are going on the market and selling very quickly, often with multiple offers. [2] There are some homes that are going on the market and sitting around for a bit before having an offer. [3] Some homes are still selling for more than we would have thought based on recent sales prices. [4] Some homes are selling for a bit less than we would have thought based on recent sales prices. I don't think we're seeing a wholesale shift at this point. We're still seeing more sales, at higher prices. But I don't think we can assume as reliably that home prices are steadily marching upwards at a rate of 10% per year right now. | |

Last Call For Sellers Hoping To Sell To Buyers Hoping To Move Before School Starts |

|

I don't want to mention... the school year... but... it's coming, sooner than we realize. :-) With the start to school only 40-ish days away (depending the school system) we're now approaching the end of a golden window for buyers and sellers, when... [1] Buyers can buy and still get moved in before school starts. [2] Sellers can sell and still get a buyer moved in before school starts. So, if you're hoping to sell your home to someone who wants to be in your house by the time the school year starts... you should be getting your house on the market sometime in the next week or two. OK... everyone may now return to focusing on summer and pretending that the coming school year is way off in the far distant future. ;-) | |

Price Your Home Reasonably And You Will Receive Reasonable Offers |

|

Now more than ever, appropriate pricing is the key to a successful sale of your home. TOO HIGH... If an identical home sold a month ago for $325K... we shouldn't price your home at $335K or $340K or $350K. If you price your home too far above other recent sales, buyers may come to see your home... but they likely will not make an offer. TOO LOW... Likewise, and equally important, if an identical home sold a month ago for $325K... we shouldn't price your home at $300K or $305K or $310K. If we price your home too far below other recent sales, we will likely have an offer or two, but we can't necessarily count on enough offers with escalation clauses to increase your "too low" list price up to the "just right" market value. JUST RIGHT... If an identical home sold a month ago for $325K, we should likely consider a list price of $319K, $325K or $329K. Not too high. Not too low. Just right. Disclaimer: I'm oversimplifying here. :-) Rarely is there an "identical" house that sold in the past month to provide such a straight forward guidance on pricing. But, despite my oversimplification, hopefully the general sentiment of my guidance is clear enough. ;-) | |

The Harrisonburg Housing Market Keeps Defying Expectations |

|

After A Worldwide Pandemic...

After Mortgage Interest Rates Almost Doubled...

When the pandemic began, I was convinced home sales would slow and prices might drop as well. The market defied my expectations. When interest rates skyrocketed, I was convinced home sales would slow and prices might drop as well. Thus far, the market has defied my expectations. As you can see, the Harrisonburg housing market doesn't always do what we might expect, even with significant external factors having the potential to make large impacts on our local market. So... don't assume our local housing market will do whatever you might read in national headlines... the local market seems to keep having some surprises for us! | |

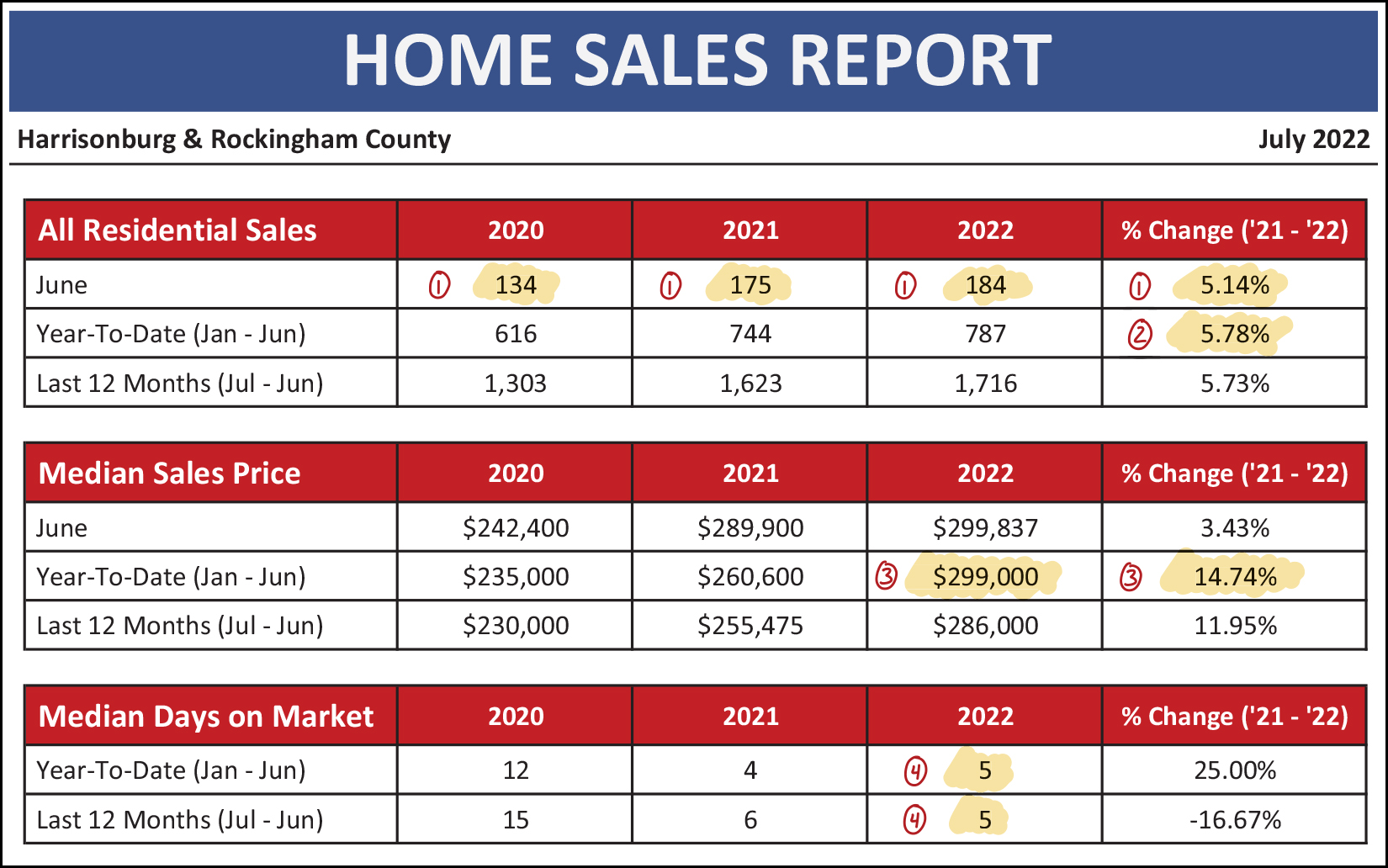

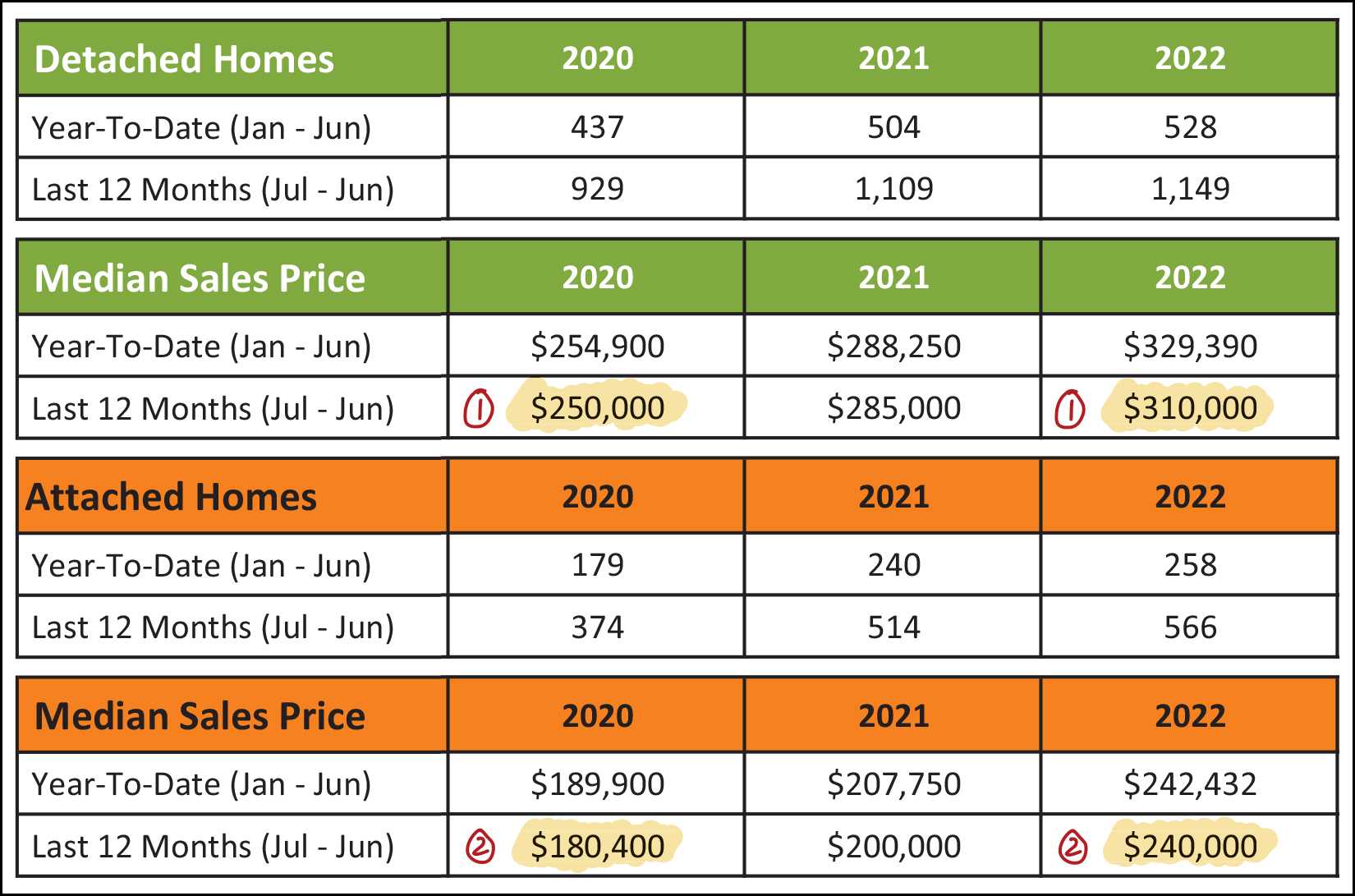

Harrisonburg Housing Market Still Speeding Right Along |

|

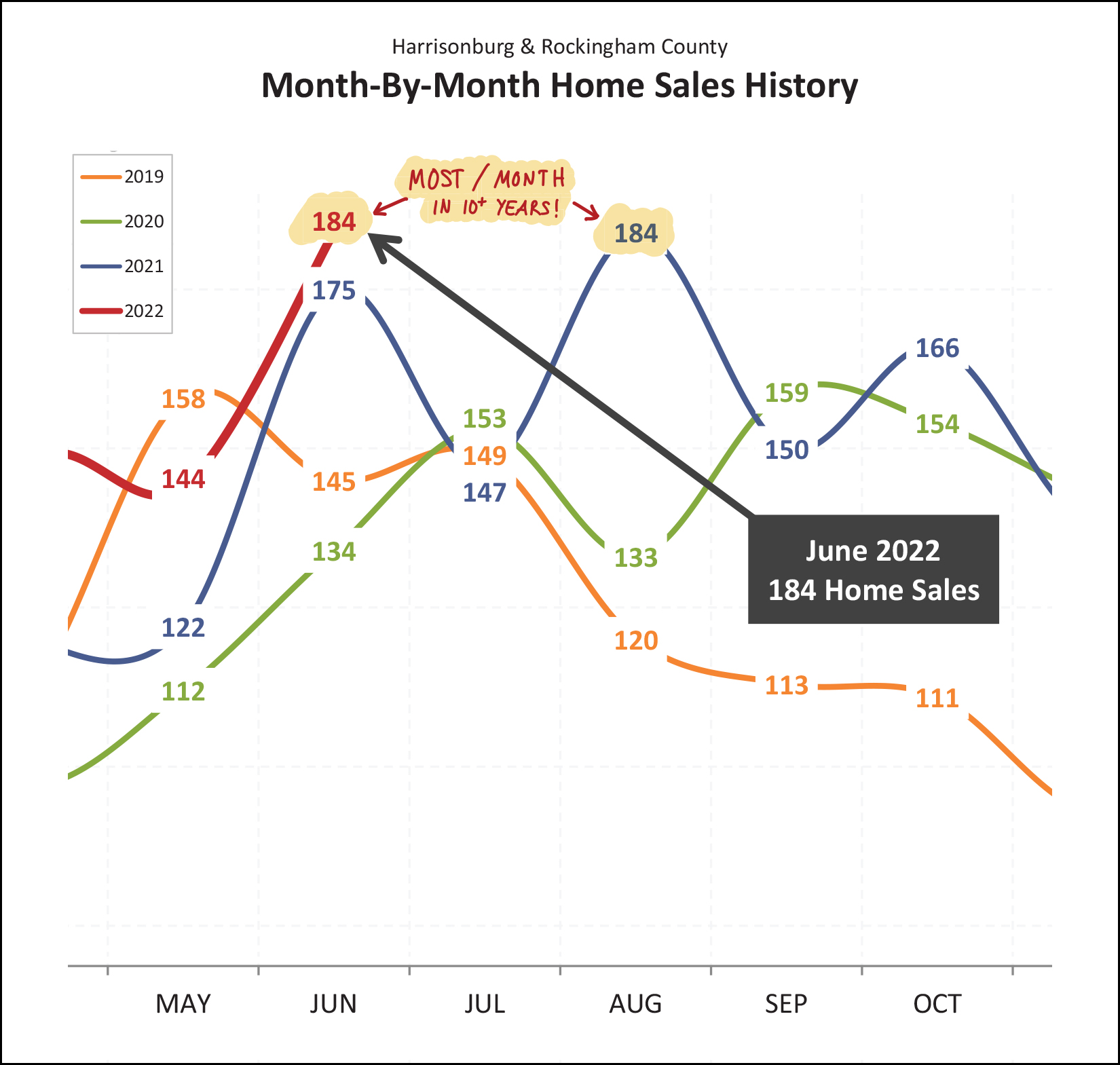

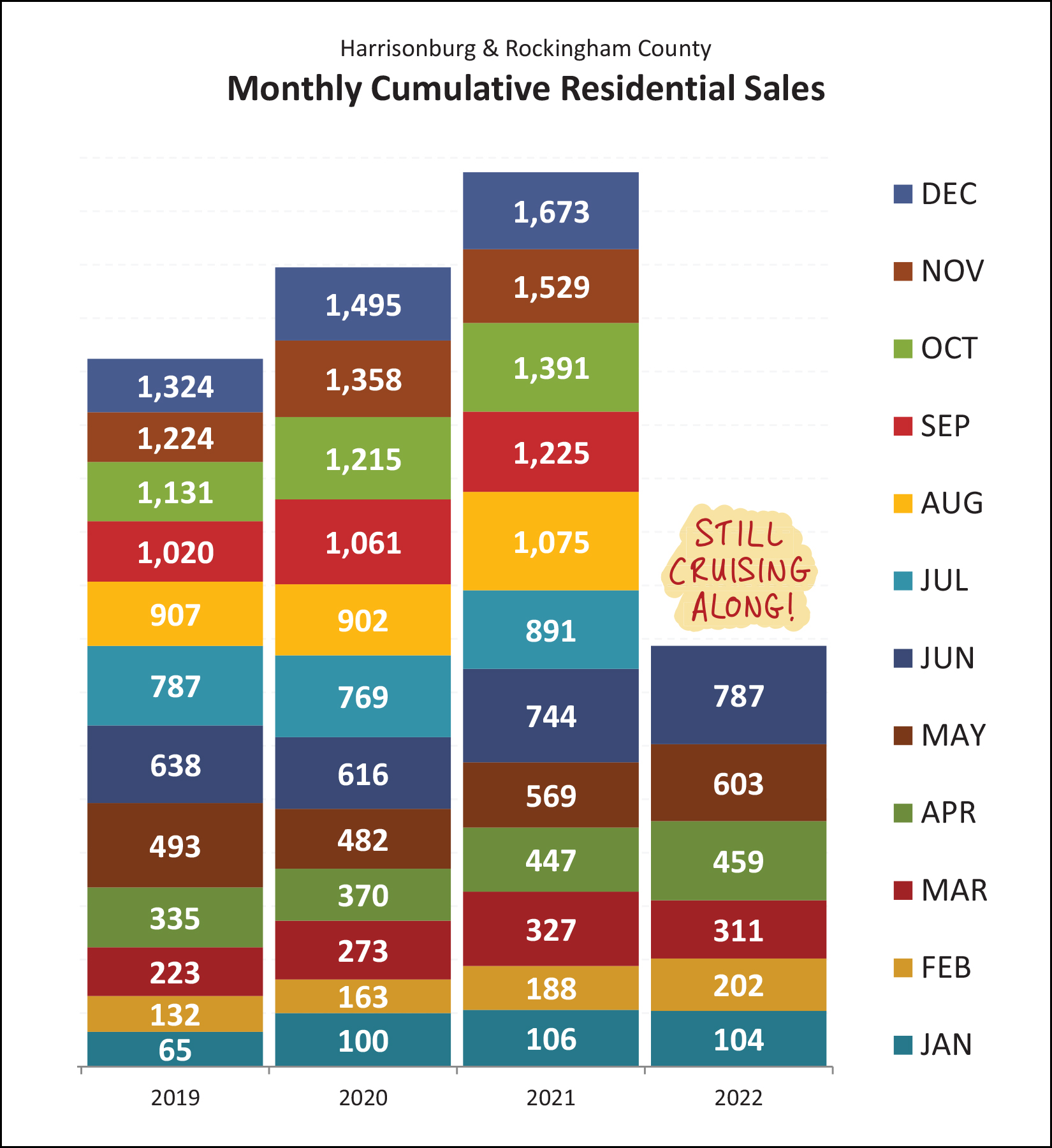

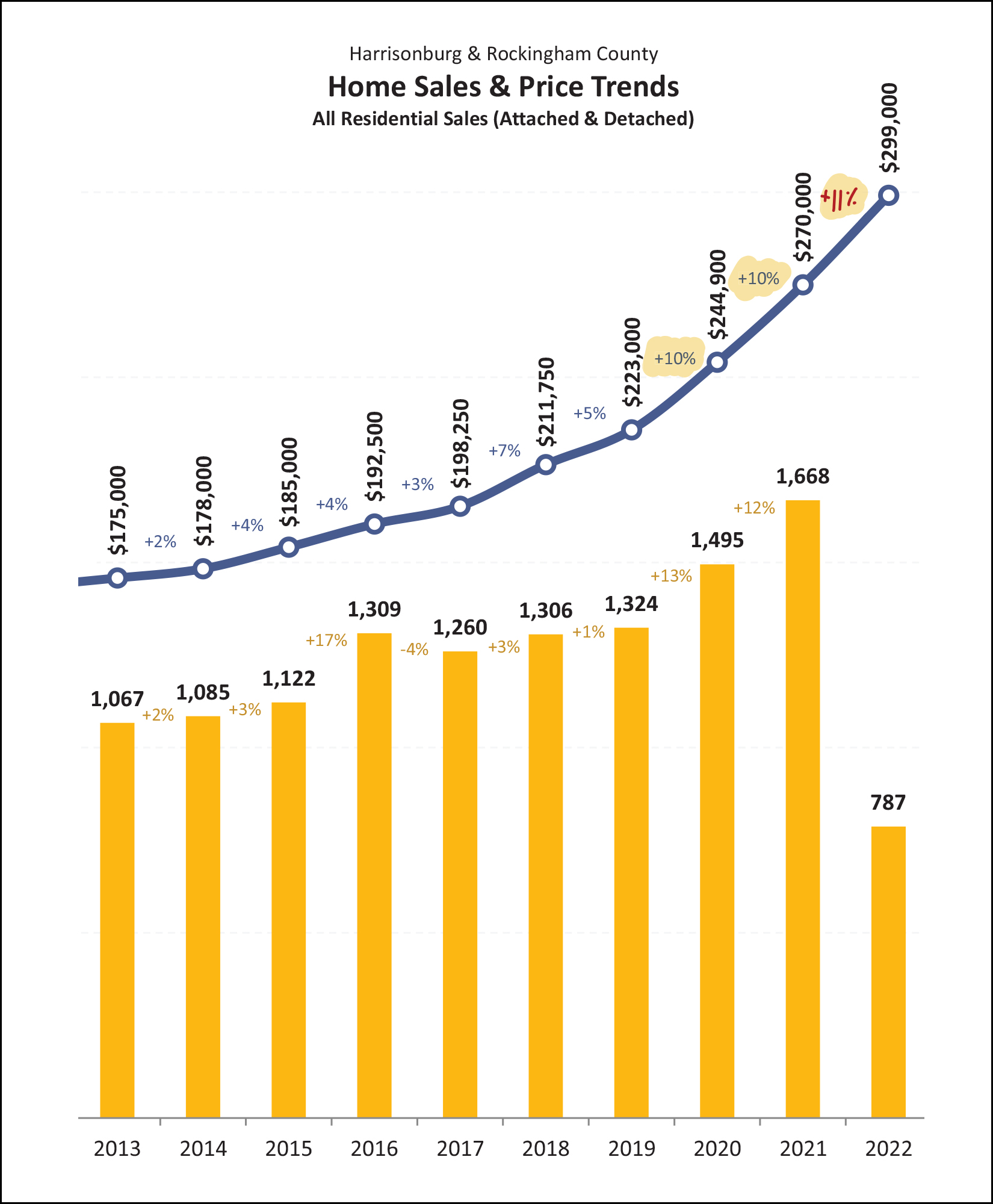

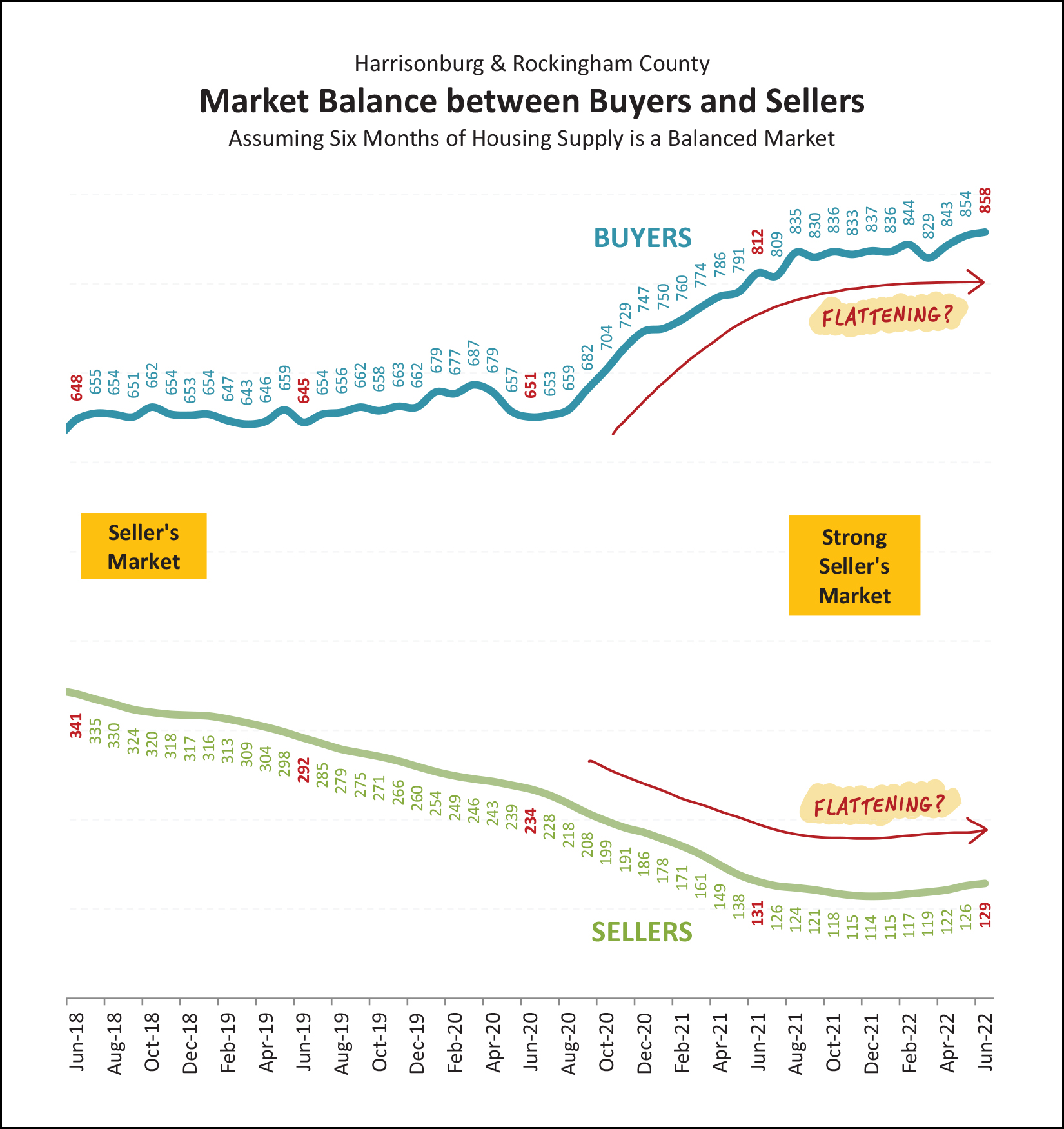

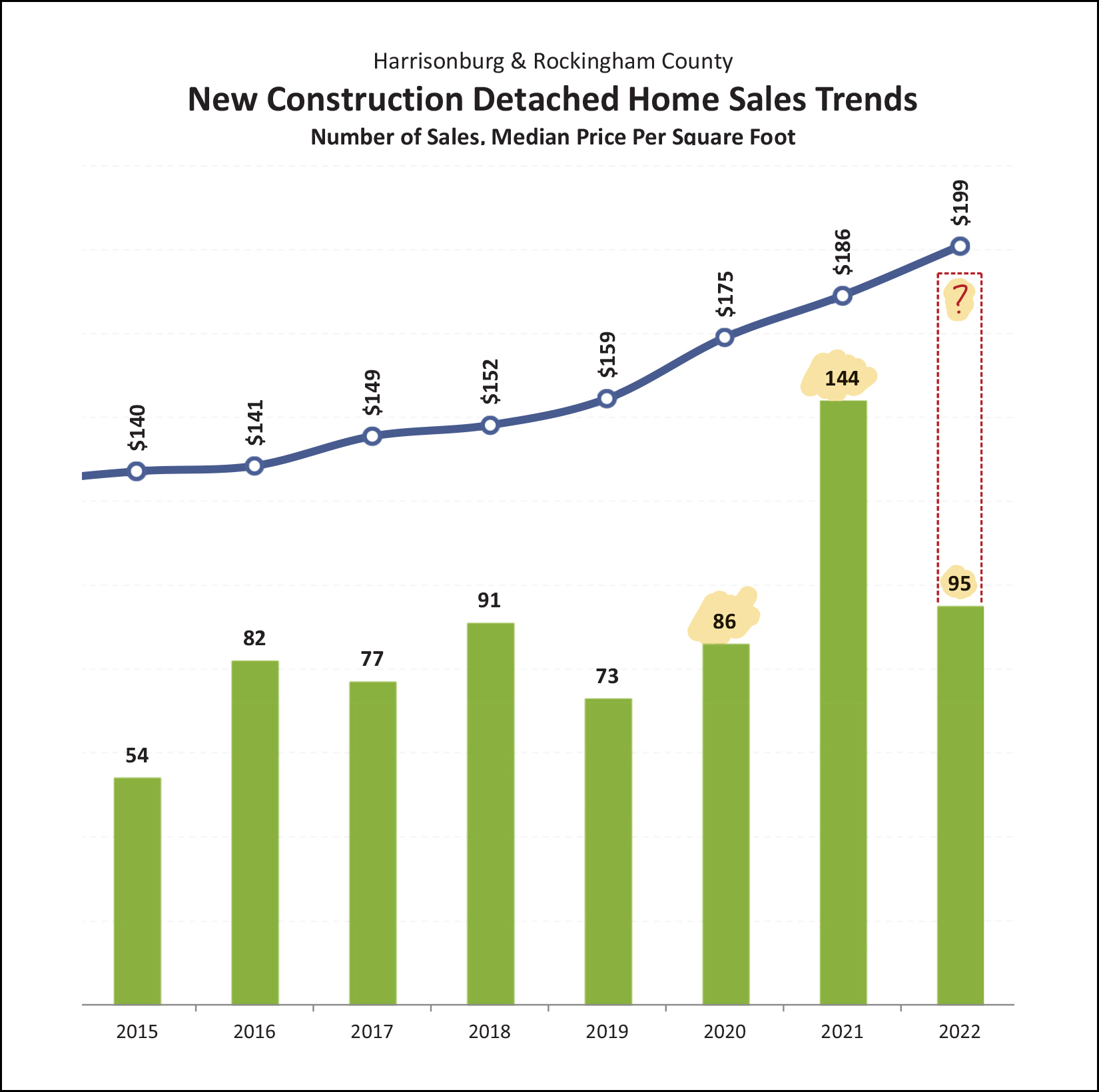

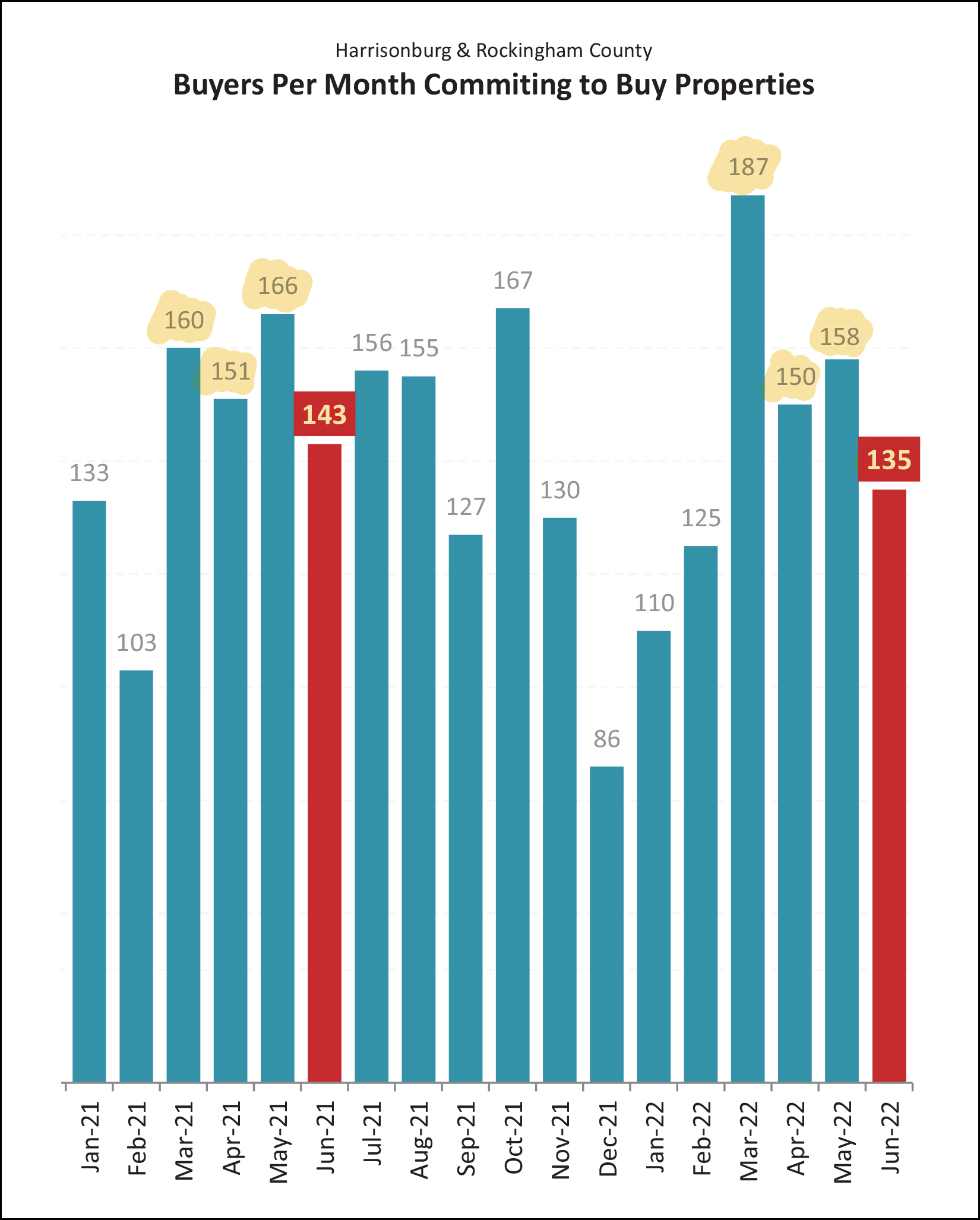

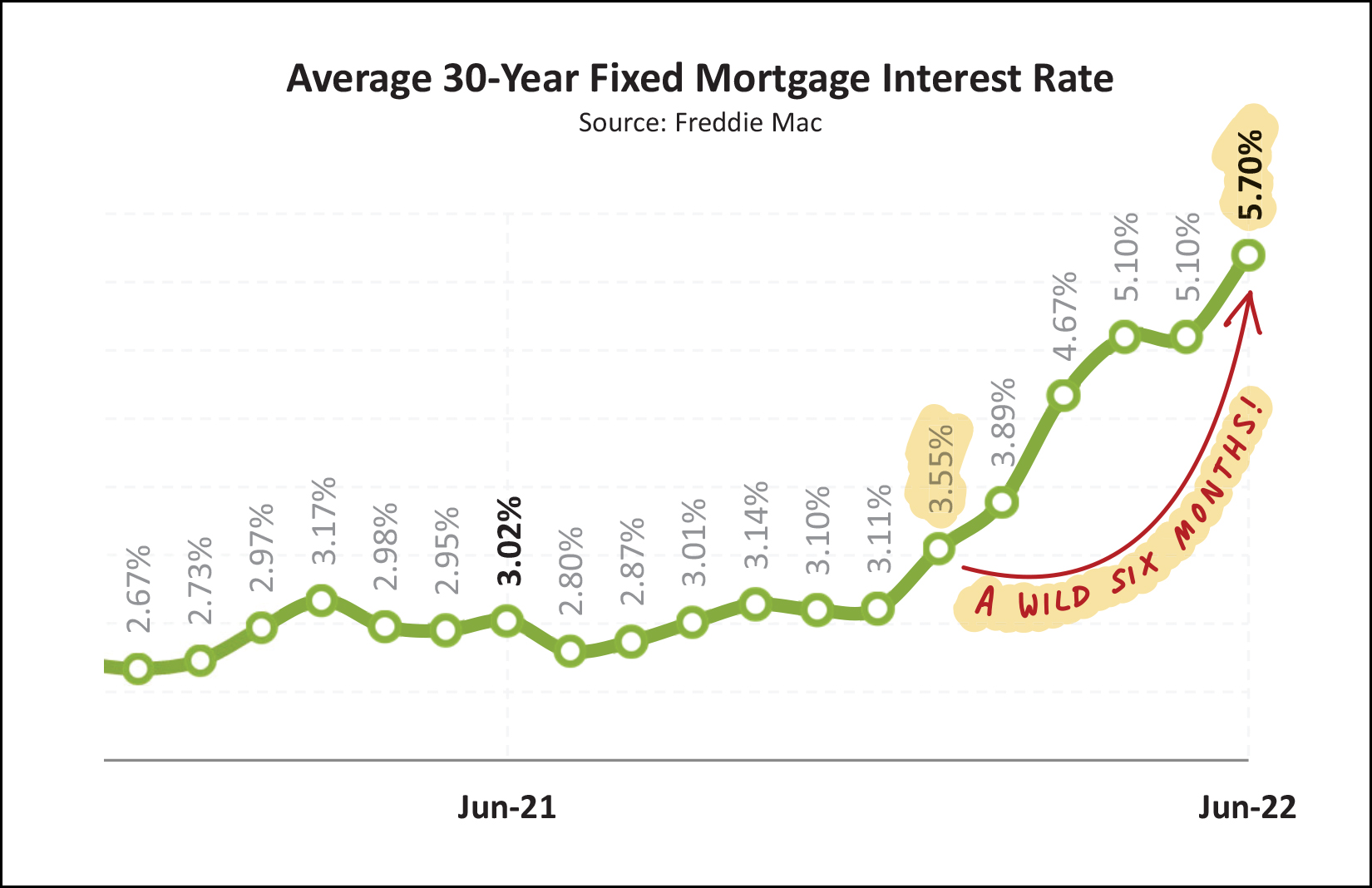

Happy Tuesday morning, friends! The starting and ending point of summer likely varies for many of us, but it seems like we're somewhere around the middle of summer. Gasp! As such, I hope the first half (or so) of the summer has treated you well, and that you still have some fun, adventures and relaxation in the works for the second half of summer. Before we get to the real estate news of the day, I'll mention that Red Wing was *fantastic* this year...  I enjoyed seeing many of you out at Natural Chimneys over that long (but not quite long enough) weekend and I hope the rest of you will consider checking it out next year! Sign up for Red Wing Updates here. Next, I should mention that the beautiful home on the cover of my market report is on the market, for sale, as of this morning! Find out more about 390 Callaway Circle here. Finally, if you're looking for a good cup of coffee (or a caramel latte) one of my favorite coffee spots in the 'burg is Black Sheep Coffee, tucked away over on West Bruce Street. Interested in checking out Black Sheep Coffee? I'm giving away a $50 gift certificate, which you can enter to win here! And now, let's spend a few minutes together exploring the latest news and happenings in our local housing market...  Right off the bat, we get to some rather fascinating updates just checking out the very basic metrics of our local market. As referenced in the tiny red numbers above... [1] A normal June might have around 135 or 145 home sales. Last June (2021) we saw an impressive 175 home sales. I did not think we would clear that high bar this June. But... we did. There were an astonishing 184 home sales in June 2022! [2] The median sales price in the first half of this year was $299,000! That is almost 15% higher than it was in the first half of last year, when it was $260,600. Even with *much* higher mortgage interest rates, homes keep selling at higher and higher prices! [3] Homes are still selling fassssssssst! The median days on the market in Harrisonburg and Rockingham County during the first six months of 2022 was... only five days, just as fast as when we look at the entire past 12 months of data. So... lots of sales, prices that are higher than ever, and homes are going under contract faster than ever. Hmmmm... things don't seem to really be slowing down thus far in 2022!? This fast moving market has been one contributor to the steady increases in home prices seen over the past two years. Take a look at these increases...  [1] The median sales price of detached homes was only $250,000 just two years ago... but over the past two years that median sales price has risen to $310,000! [2] The median sales price of attached homes (townhomes, duplexes, condos) was only $180,400 just two years ago... but over the past two years that median sales prices has risen to $240,000! Homeowners have been delighted with these increases. Sellers have also been big fans. Buyers... not so much. It can be tough for buyers to get excited about paying a *much* higher price alongside their *much* higher mortgage interest rate... but buyers still seem to be moving forward full steam with their home purchases thus far in 2022. Those home buyers are moving along so steadily that we're breaking (tying) some records...  Over the past ten years, the most home sales we have seen in a month has been 184 home sales... which took place last year, in August. Well, what do you know!? This June (last month) we saw... 184 home sales! Looking ahead, what should we expect for July? The past three months of July have been tightly clustered around that 145 - 155 range, so I'm going to play it safe and guess we'll see right around that many home sales in July 2022. Perhaps 150 on the nose!? As I have mentioned to many of you, I fully expected (and still expect) that we'll see a bit of a slow down in home sales activity in 2022 due to higher mortgage interest rates... but... the data just isn't agreeing with me thus far...  As shown above, the 787 home sales we've seen in the first half of 2022 exceed the number of home sales in the first half of each of the past three years! If I didn't know better, I'd think mortgage interest rates must be *lower* than ever in 2022 to spur on so much buyer activity!? But, no, not so much. More on that later. Looking at these big picture trends in a slightly different way, it's astonishing to see three years in a row of double digit growth in the median sales price in our market...  How much did our area's median sales price increase in 2020? 10% How much did our area's median sales price increase in 2021? 10% How much has our area's median sales price increased thus far in 2022? 11% It's been an astonishing few years in our local market to see home values escalating so quickly... without any signs of slowing down. But... to try to reel us back in a bit from cloud nine...  It's hard not to look at the graph above and think that things could be, might be, possibly be changing... [BLUE] The top, blue, line shows the number of buyers buying in a six month period as evaluated over the past four years. This metric has been steadily marching upward over the past two years... but... it seems that the number of buyers buying might be flattening out a bit. Again, not that the amount of buyers buying is decreasing, but buyer activity might not be continuing to increase as quickly as it has for most of the past two years. [GREEN] The bottom, green, line shows the numbers of sellers selling at any given time... the inventory levels at the end(ish) of each month. For most of the past four (plus) years we have seen fewer and fewer (and fewer and fewer) homes on the market, due largely to excessive amounts of buyer demand. But... over the past six months... we're starting to see some modest flattening out of inventory levels in our local area. Inventory levels seem to be steadying themselves. Bear in mind that it is still definitely a strong (strong!) seller's market, but we might be starting to see some early signs that the market might be slowing down a touch... perhaps cooling off from a strong-strong-strong seller's market to a strong-strong seller's market!? Changing gears, slightly, here's an interesting trend to make sure that we recognize...  After typically only seeing around 70 - 90 new (detached) home sales per year, we saw a remarkably high 144 such sales last year... and this year we seem to be on track to see around 180 new detached home sales in Harrisonburg and Rockingham County. These recent, steady increases in the number of new homes selling in our market is doing two things... one, allowing the overall number of home sales to increase without relying just on resale homes as inventory... and allowing the median sales price in our market to keep climbing, given that new homes are typically more expensive than resale homes. OK, shifting back to the overall sales market, here's a look at recent months of contract activity... measured by when contracts are signed...  Looking at the highlighted months... [2022] We have seen 630 signed contracts in the past four months. [2021] In the same months last year, we saw 620 signed contracts. So, yes, even with *much* higher mortgage interest rates, we are seeing more buyers sign contracts to buy homes now as compared to a year ago. Is this surprising? Yes, relative to interest rates. No, relative to what seems to be a significant number of buyers who wanted to buy homes in this area in the past two years who have not yet been able to do so. In other words, demand exceeds supply. There are still lots of buyers who want to buy... even if the interest rates are higher than they were previously and higher than they would prefer. So, demand is high. How about supply? Well...  It is possible that our local housing supply is increasing, slightly. After multiple years of constantly declining inventory levels, we now seem to be seeing inventory levels increasing a bit. Sadly, these *slightly* higher inventory levels aren't evenly spread across all property types, locations and prices... so many buyers will still find inventory levels to be *quite* low in their segment of our local market. Because inventory levels are still so low in most segments of the market, we are still seeing homes selling just as quickly has they have for the past year...  As shown above, the pace at which homes go under contract once listed (days on market) declined steadily through 2020 and 2021 until it seemed to bottom out at a median of five days on the market. That is to say that half of homes go under contract in five or fewer days... and half go under contract in five or more days. This metric hit a median of five days on the market back in July 2021 and has stayed there ever since. If or when the market starts to slow, soften or cool, we'll start to see this metric drift upward again. Finally, that one topic that isn't quite as exciting to talk about... mortgage interest rates...  Just six months ago... the average mortgage interest rate for a 30 year fixed rate mortgage was... 3.55%. Now, it has risen all the way up to 5.7% as of the end of June. This drastically affects the monthly payment for buyers in today's market as compared to just six (or twelve, etc.) months ago. I don't think we'll see interest rates rise above 6% but it is definitely possible. If there is one thing that could cool off our local housing market, it's this "cost of money" in the form of the mortgage interest rates. But, again, it hasn't happened yet despite drastic changes in interest rates. And here we find ourselves again, at the close of what seems to be another red hot month of real estate activity in Harrisonburg and Rockingham County. By the headlines... [1] More and more home sales are selling! [2] Homes are selling at higher and higher prices! [3] Homes are selling as fast as ever! [4] Inventory levels are increasing, slightly, in some pockets of the market. [5] Mortgage interest rates are higher than they have been in years! What will we see over the next few months in our local real estate market? Most likely, more of the same... but we won't know for sure until those next few months pass... and I'll pause each month to check the numbers and share some thoughts with you so that we can all have a good sense of where we have been, where we are and where we might be going next. Speaking of next... If you are planning to SELL a house in the next few months, sooner is likely better than later, and I'd be delighted to chat with you about how we might work together. If you are planning to BUY a home in the next few months, you ought to check in with your lender sooner rather than later to get proper expectations of your potential mortgage payments within the context of rising mortgage interest rates... and yes, I'd be delighted to help you with buying as well. Be in touch at any point if I can be of any help to you or your family or friends. You can call/text me at 540-578-0102 or email me here. Until next month... may your summer be as relaxing as this crazy real estate market can be stressful! ;-) | |

| Newer Posts | Older Posts |

Scott Rogers

Funkhouser Real

Estate Group

540-578-0102

scott@funkhousergroup.com

Licensed in the

Commonwealth of Virginia

Home Search

Housing Market Report

Harrisonburg Townhouses

Walk Through This Home

Investment Properties

Harrisonburg Foreclosures

Property Transfers

New Listings